Abstract

In this paper, I study the nonparametric identification and estimation of multi-unit all-pay auctions of incomplete information. First, I consider the setting where multiple goods are allocated among several risk-neutral participants with independent private values (IPV). I prove the nonparametric identification of the model and derive two different consistent estimators of the distribution of bidder valuations. The first estimator is based on the classical structural approach similar to that of Guerre et al. (Econometrica 68(3):525–574, 2000). The second estimator, instead, allows estimation of the quantile function of the bidders’ valuations directly using the quantile density of the bids. Monte Carlo simulations show good small sample property under various assumptions of the number of players and goods. Next, I consider a variety of model extensions: the case of affiliated private values (APV), asymmetric players, the addition of random noise, as well as the case of risk-averse bidders. In contrast to all other scenarios, I prove that the general model with risk-averse bidders is not identified even in the semi-parametric case in which utility function is restricted to belong to the class of functions with constant absolute risk aversion (CARA). On the other hand, I show that the model with risk aversion can be identified if the distribution of valuations is restricted to having fixed support.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a wide range of real-world situations, competing agents spend resources (exert efforts, spend money, or time) to achieve a goal. In economics, all these situations can be described using a contest model, which is a natural model of costly competition. The distinctive feature of the contest is that effort is a sunk cost, since no matter whether a player wins or loses, the cost is always incurred. The contest framework has been applied to numerous scenarios including marketing and advertising by firms (Bell et al. 1975); litigation (Farmer and Pecorino 1999; Bernardo et al. 2000; Hirshleifer and Osborne 2001; Baye et al. 2005); research and development, patent race, procurement of innovative good, research contests (Taylor 1995; Che and Gale 2003; Dasgupta 1986); electoral competition (Snyder 1989; Baron 1994; Skaperdas and Grofman 1995); sport events, arms race and rent-seeking activity, such as lobbying (Hillman and Riley 1989; Tullock 1980; Moldovanu and Sela 2001; Krueger 1974; Baye et al. 1993; Kang 2015); as well as student competition for school seats (Bodoh-Creed and Hickman 2019).

An all-pay auction, or a perfectly discriminating contest, is a specific type of contest in which the player that exerts the highest effort wins with certainty. Due to the fact that it reflects the main property of any contest – the sunk cost of effort – without adding unnecessary complexity, an all-pay auction is one of the most widely used models of contests, and it is applied in a variety of the situations described above (see also Dechenaux et al. 2015 for a survey on experimental literature). One of the most relevant applications is the one of charitable fundraising. Moreover, an all-pay auction is an important auction format to study the case of a seller of an object engaging in an all-pay auction to maximize revenue. That is because an all-pay auction raises greater revenue than the first-price auction, as theoretical (see Krishna and Morgan 1997) and experimental (see Noussair and Silver 2006) results indicate. As a result, for example, an all-pay auction was proposed as a mechanism for crowdsourcing (see Luo et al. 2016).

In this paper, I study all-pay auctions of incomplete information with multiple identical goods. Each bidder has a valuation of the good, which is his private information and submits a bid in order to win one of the prizes, knowing his own valuation and the distribution of the valuations of the other players. That is in contrast to the complete information all-pay auction in which all players are assumed to know the valuations of the other players when they submit their bids. In many real-world situations, an economic agent likely has private information about his valuation of the prize, which makes the incomplete information model closer to the reality.Footnote 1

The theoretical literature on the all-pay auction of incomplete information is well-developed. The existence of equilibrium for the all-pay auction with one unit for sale is discussed, for example, by Hillman and Riley (1989), and by Krishna and Morgan (1997), whereas Moldovanu and Sela (2006), prove existence for the multi-unit case.Footnote 2 Amann and Leininger (1996) and Lizzeri and Persico (2000) examine the uniqueness of the equilibrium. Moreover, many papers consider variations of the model (see, for example, Kaplan et al. 2002; Minchuk and Sela 2014; Liu and Jingfeng 2017).

Instead, the literature on nonparametric identification and estimation of incomplete information auctions and contests is relatively scarce, especially when considered in relation to the wide and expanding literature on nonparametric models outside the domain of contests, and the increasing availability of big data. Exceptions include the well-established literature on the first-price auctions, originated with Guerre et al. (2000), and more recent contributions on different types of contest by Huang and He (2021) and Shakhgildyan (2019).

In this paper, I study the nonparametric identification and estimation of multi-unit all-pay auctions of incomplete information. First, I consider the setting where multiple goods are allocated among several risk-neutral participants with independent private values (IPV). I prove the nonparametric identification of the model and derive two different consistent estimators of the distribution of the bidder valuations. Both approaches allow the identification and estimation using the first-order condition without the need of solving for the equilibrium of the game. The first estimator is based on the classical structural approach similar to that of Guerre et al. (2000). The second estimator, instead, allows estimation of the quantile function of the bidder valuations directly using the estimator of the quantile density of the bids. Even thought it does not readily facilitate the density estimation, in applications in which the knowledge of the quantile function is enough, quantile-based estimation has a significant advantage as it is more robust and is not prone to a strong bias due to the compounding of boundary effects across both estimation stages of the estimator based on the bid densities. Extensive Monte Carlo simulations show good small sample property under various assumptions of the number of players and goods.

Next, I consider a variety of model extensions: the case of affiliated private values (APV), asymmetric players, the addition of random noise, as well as the case of risk-averse bidders. For the first three extensions, I derive the identifying equations and propose the estimation procedures. In contrast to these scenarios, I prove that the general model with risk-averse bidders is not identified even in the semi-parametric case where the utility function is restricted to belong to the class of functions with constant absolute risk aversion (CARA). On the other hand, I show that the model with risk aversion can be identified if the distribution of the valuations is restricted to having fixed support.

The rest of the paper is organized as follows. In Sect. 2, I introduce general notations and definitions used throughout the paper. Section 3 discusses the identification and estimation as well as the Monte Carlo simulations of the IPV model. Section 4 considers all of the extensions: the case of affiliated private values (APV), asymmetric players, the addition of random noise, as well as the case of risk-averse bidders. Section 5 concludes. All of the proofs are presented in the Appendix.

2 General notations and definitions

There exist multiple specifications of the auction models. The setting where each bidder’s expected utility depends only on his own private information, but not on the private information of the other players is called the private value model. Instead, bidders have common values if each bidder’s expected utility is strictly increasing in the private information of each of the players. Another important dimension is whether bidder information is independent or affiliated (see Athey and Haile 2002).

More formally, let us denote by \(v_i\) the bidder i’s private valuation (or type), \(v=(v_1, ... , v_N)\). N is the number of bidders. The payoff of each bidder if he obtains one unit is represented by \(U_i = u(v_i,V)\), where V is the common payoff component. It is further assumed that utility function \(u(\cdot )\) is continuous, non-negative, increasing in each argument, and common across bidders. Bidders might be risk-neutral or risk-averse. The cumulative distribution function of the valuations F, as well as N and u, are common knowledge. Thus bidders play the game of incomplete information.

Definition 1

Bidders have private values if

In the private values setting we can distinguish between two cases, namely independent and affiliated values.

Definition 2

The private values are independent if

where \(f(\cdot )\) is the marginal distribution of the private valuation.

Based on Milgrom and Weber (1982), the affiliation means the following:

Definition 3

For variables with densities it is said that they are affiliated if for all v and \(\hat{v}\)

where \(\vee \) denotes the component-wise maximum and \(\wedge \) denotes the component-wise minimum.

Affiliation means, that the bigger the realization of one’s value, the more likely it is that the other’s value is also big.

In this paper, I am going to consider the independent private values model as a baseline model, and the affiliated private values model as one of the extensions.

3 IPV all-pay auction with risk-neutral bidders

3.1 Model

I first focus on the IPV environment of the all-pay auction with N risk-neutral players and M, where \(M<N\), identical goods are the auction lots. In this case:

Assumption 1

\(u(v_i)=v_i\), \(i=1,...,N\).

Assumption 2

Each bidder draws a value \(v_i\) independently from a commonly known distribution F(v), which is assumed to be absolutely continuous and twice continuously differentiable on a compact support \([\underline{v}, \bar{v}]\), with density f and quantile function \(q = F^{-1}.\)

All the bidders are ex-ante symmetric. Here \(v_i\) is the private value of bidder i of possessing the good.

Assumption 3

The bidders submit the bids \(b_i\) simultaneously. At that moment bidder i knows N, M, \(v_i\) and F(v).

Thus the distribution function \(F(\cdot )\) is common knowledge, while the valuations of other players are not observed, which makes it the game of incomplete information.

Assumption 4

Each of N bidders pays \(b_i\), regardless of whether or not he obtains a good.

That assumption distinguishes the contest, an all-pay auction in particular, from the winner-pay auctions.

Assumption 5

N bids are ordered from highest to lowest and all M highest bidders receive a good. If there is a tie for the M-th object the lottery takes place and each of the bidders gets the object with equal probability.

Therefore the bidder i’s resulting payoff is \(v_i-b_i\) if he obtains a good, and \(-b_i\) otherwise. In expectation then the payoff to bidder i is:

where \(P[win|b_i, N, M, F(v)]\) is the probability that \(b_i\) is one of the M highest bids.

Following the literature, I consider the Bayesian equilibrium of this incomplete information game which is strictly monotonic and symmetric. For each valuation the corresponding bid is defined by the function \(s(v)=b\). Since s(v) is strictly monotonic it is invertible.

Given Assumptions 1-5, the win probability can be written as:

Given the winning probability, let us find the equation that characterizes the equilibrium.

Proposition 1

Given Assumptions 1-5, there exists the strictly increasing symmetric Bayesian equilibrium of the game described above:

The first-order condition of this game can be written as:

In particular,

Corollary 1

Given Assumptions 1-5 and M=1, there exists the strictly increasing symmetric Bayesian equilibrium of the game described above:

The first-order condition of this game can be written as:

Note that \(b_i=s({\underline{v}})=0.\)

Usually, valuations are unobserved for the econometrician, whereas bids are observed in the data. Let us denote by \(G(\cdot )\) the distribution of bids, with density \(g(\cdot )\) and quantile function \(r(\cdot )\). Next section discusses how to recover the distribution of \(v_i\) from the distribution of bids using Eq. (2).

3.2 Nonparametric identification

In this section, I prove the nonparametric identification of the IPV model.

In structural estimation, the first main question is whether the parameters of the economic model are identified from the available data or not. The distribution \(F(\cdot )\) of bidder valuations is the only unknown element for the econometrician. In turn, the number N of bidders, and the bids \(b_i\), \(i = 1,..., N\) themselves are observed. Therefore the question is whether there exists the distribution F that is uniquely determined from observed bids and win outcomes.

Note that the bids distribution \(G(\cdot )\) depends on \(F(\cdot )\) not only through \(v_i\) but also through the equilibrium strategy \(s(\cdot )\). Thus for the successful identification, both F, as well as the equilibrium strategy should be canceled out once the bid distribution and density are plugged into the first-order condition (2).

Let \(F \in \mathcal {F}\), the set of all admissible primitive distributions conforming to Assumption 2, and let \(\mathcal {G}\) denote the set of all bid distributions arising in a Bayes-Nash equilibrium from some \(F \in \mathcal {F}\). Let us call the mapping from the private information to bids \(\gamma \in \Gamma \), where \(\gamma : \mathcal {F} \rightarrow \mathcal {G}\). Then,

Definition 4

(Identification). A model \((\mathcal {F} , \Gamma )\) is identified if for every \((F, F') \in \mathcal {F}^2\) and \((\gamma , \gamma ') \in \Gamma ^2\) , \(\gamma (F)=\gamma '(F') \Rightarrow (F, \gamma )= (F', \gamma ')\).

Let \({\textbf {G}}(\cdot )\) denote the joint distribution of \((b_1,...,b_N)\).

For any \(b \in [\underline{b}, \bar{b}]=[s(\underline{v}), s(\bar{v})]\) it holds that \(G(b)=Pr(b_1 \le b)=Pr(v_1 \le s^{-1}(b)) = F(s^{-1}(b)) = F(v)\), where \(b = s(v)\). Thus the bids distribution \(G(\cdot )\) has support \([s(\underline{v}), s(\bar{v})]\) and its density is \(g(b) = \frac{f(v)}{s'(v)}\), where \(v = s^{-1}(b)\).

Moreover, let us denote \(t=F(v)\), equivalently \(v=q(t)\), where \(q(\cdot )\) is the quantile function of the distribution of valuations. As a result of monotonicity of the strategies, \(G(s(v))=F(v)\). Applying \(r(\cdot )\) to both sides of equality, where \(r(\cdot )\) is bid quantile function, we get: \(s(v)=r(F(v))=r(t)\) Moreover, \(s'(v)=r'(F(v))f(v)\). Thus,

Then the following proposition holds:Footnote 3

Proposition 2

Let \({\textbf {G}}(\cdot )\) belong to the set of absolutely continuous probability distributions with support \([\underline{b},\bar{b}]^N\). There exists an absolutely continuous distribution of bidder valuations \(F(\cdot )\) such that \({\textbf {G}}(\cdot )\) is the distribution of the equilibrium bids in the all-pay auction with independent private values if and only if:

-

1.

\({\textbf {G}}(b_1,...,b_N)=\prod _{i=1}^N G(b_i)\).

-

2.

The function \(\xi (\cdot ,N,G) \equiv \biggl (g(b_i)\sum \nolimits _{j=1}^{M} {N-1 \atopwithdelims ()j-1}(1-G(b_i))^{j-2}G^{N-j-1}(b_i)\biggl [ N-j-(N-1)G(b_i)\biggr ]\biggr )^{-1}\) is strictly increasing on \([\underline{b},\bar{b}]\) and its inverse is differentiable on \([\underline{v},\bar{v}]=[ \xi (\underline{b},N,G), \xi (\bar{b},N,G)].\)

When \(F(\cdot )\) exists, it is unique with support \([\underline{v},\bar{v}]\) and satisfies \(F(v) =G(\xi ^{-1}(v,N,G))\) for all \([\underline{v},\bar{v}]\). In addition, \(\xi (\cdot ,N,G)\) is the quasi inverse of the equilibrium strategy in the sense that \(\xi (b,N,G)= s^{-1}(b, N, F)\) for all \(b \in [\underline{b},\bar{b}]\). Thus for \(i=1,...,N\) in terms of the distribution of bids:

Moreover, the identifying equations can be rewritten in terms of quantile functions:

where \(r=G^{-1}\) is the bid quantile function, and \(t_i \in (0,1)\).

The next section discusses the estimation procedure.

3.3 Nonparametric estimation

In this section, I propose two consistent plug-in estimators for the distribution of bidder valuations. I assume that all bids and win outcomes are observed for the econometrician. The first estimator is based on Eq. (3) and the classical structural approach similar to that of Guerre et al. (2000). The second estimator, instead, is based on an alternative specification using quantile functions (4), and it allows to estimate the quantile function of the bidder valuations directly from the estimator of the quantile density of the bids. In the next section, I also analyse their performance using the Monte Carlo study.

3.3.1 Estimation based on bid density

Given Eq. (3), the plug-in estimator is constructed in two steps in the following way. First, the distribution of the bids \(G(\cdot )\) and density \(g(\cdot )\) are estimated from the observable bids and those estimates are used to find the corresponding pseudo-values. Second, pseudo-values are used to estimate the density function \(f(\cdot )\).

Step 1: Consider \(L_N\) - the number of N-bidders auctions. I index by l the l-th auction and use the observations \(\{b_{il}, i = 1,..., N, l = 1,..., L_N\}\) to find the nonparametric estimates of \(G(\cdot )\) and \(g(\cdot )\).

The marginal distribution of equilibrium bids can be estimated using the classical empirical CDF estimator:

Instead, the bid density g(b), can be estimated using kernel function:

where \(h_g\) denotes the bandwidth and K denotes the kernel function.

As a result, we can estimate \(v_i\) by plugging in the estimates \(\hat{G}\) and \(\hat{g}\) into Eq. (3).

Assumption 6

The data on \(\{b_i\}\) are i.i.d.

Assumption 7

The kernel function is of order \(\delta \), it has compact support and is continuously differentiable on its support.

Assumption 8

The density g(b) has compact support, is continuously differentiable of order \(m \ge \delta \) and \(m\ge 2\), and its derivatives are uniformly bounded.

Assumption 9

As \(L \rightarrow \infty \), \(h_g\rightarrow 0\), \(\sqrt{Lh_g}\rightarrow \infty \), \(\sqrt{Lh_g}h_g^{\delta }\rightarrow 0\), where \(L=L_N*N\).

Theorem 1

Given that Assumptions 1-5 about the model as well as Assumptions 6-9 are satisfied the following is the consistent estimator of the valuation of player i in auction l:

where:

These are the pseudo-values.

The issue with this simple methodology is that the classical estimator of density g is biased on the borders of the support. Moreover, as can be seen from the equilibrium strategy in Eq. (1), and from the Monte Carlo simulations in Sect. 3.4, in contrast to the first-price auction, in an all-pay auction there is almost no variation in bids for the low valuations once the ratio of M to N is large, and almost no variation in bids for the high valuations once the ratio of M to N is small. That also makes the estimation using classical kernel density estimation problematic since the bid density is bounded, and has bigger mass close to the boundaries.

To solve that issue, in empirical applications I propose to use an adaptive or “variable-bandwidth” kernel density estimation, which is state-of-the-art bid density estimation method. In particular, the estimator proposed by Botev et al. (2010). That estimator is a kernel estimator that does not use boundary transformation and yet is consistent at all boundaries, is nonnegative and integrates to one.

Step 2: In the second step, the density \(f(\cdot )\) can be estimated using the pseudo-sample \(\{\hat{v}_{il}, i = 1,..., N, l = 1,..., L_N\}\) and the kernel function:

Here \(h_f\) is the bandwidth and \(K_f\) - kernel function.

The valuation density estimation is also problematic within an \(h_f\)-neighborhood of the extremal pseudo values. Given that, in empirical applications, I propose to use instead of the classical kernel density estimator, the boundary-corrected kernel-density estimator following Hickman and Hubbard (2015).

3.3.2 Estimation based on the bid quantile density function

As an alternative estimate, I also propose an estimator of the quantile function of the valuations directly using Eq. (4). That estimator provides a method to avoid the two-step estimation procedure of the valuation density and is useful for the applications in which the econometrician’s question does not require information about the density of the valuations per se, but instead only requires information on the CDF.

On the right hand side of Eq. (4), the only function that requires estimation is the quantile density function of the bids.

Using the observations \(\{b_{il}, i = 1,..., N, l = 1,..., L_N\}\), the bid quantile density function, can be estimated consistently and asymptotically normally using the estimator proposed by Jones (1992):

where \(t\in (0,1)\), as before h denotes the bandwidth and K denotes the kernel function, \(L=L_N*N\), whereas \(X_{(i)}\), \(i=1,...,L\) are the order statistics of all the observed bids.Footnote 4 That is a natural direct kernel estimator of the quantile density, since the smooth estimator of the quantile function itself is given by:

Given Eq. (9), the plug-in estimator of the quantile function of bidder valuations does not require any additional steps, and thus the following theorem holds:

Theorem 2

Given that Assumptions 1–5 about the model as well as Assumptions 6–9 are satisfied, the following is the consistent estimator of the quantile function of the valuations:

where:

\(t\in (0,1)\).

The rate of convergence of this estimator is the same as for kernel density estimation per se. The advantage of this method is that it requires just one step, and as we will see from the Monte-Carlo results, estimates the quantile function of the valuaions very closely.

Note that the invertibility of the bid function is the key for identification as I relied heavily on the assumption that the bidders use a strictly increasing bid function.

3.4 Monte Carlo simulation

In this section, I conduct a Monte Carlo study.

Assume that the data on L auctions with M prizes and N players taking part in them is given. The number of auctions and players per se does not change the estimation procedure as the bidders are assumed to be ex-ante symmetric. What plays the role in estimation is the total number of observations which is given by \(L*N\), and the number of prizes M. In this study, the true distribution functions F of valuations is log-normal as in Guerre et al. (2000) with parameters zero and one, truncated at 0.055 and 2.5 that leads to leaving out approximately 20% of the original log-normal distribution. 1000 Monte Carlo replications are conducted. Next, each replication is described.

To start with, \(L*N\) observations of valuations are drawn randomly and the corresponding equilibrium strategies \(b_{il}\), \(i=1,...,N\), \(l = 1,..., L\) defined in Eq. (1) are calculated.

3.4.1 Monte Carlo based on the bid density function estimation

In this subsection, I consider the estimation based on the bid density function.

Step 1: Given the bids, the CDF is estimated using Eq. (5), whereas I estimate the bid density function using an adaptive or “variable-bandwidth” kernel density estimation. In particular, the estimator proposed by Botev et al. (2010).Footnote 5 Knowing the estimated distribution and density of the bids, I estimate the pseudo-valuations based on Eq. (7).

Step 2: The second and final step is the estimation of the density function of valuations \(\hat{f}(\cdot )\) using the boundary-corrected kernel-density estimator based on Hickman and Hubbard (2015). In each replication I estimate \(\hat{f}(\cdot )\) at 500 equally spaced points on [0.055, 2.5]. I use the triweight kernel:

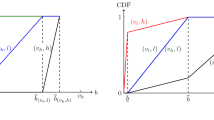

I start by considering the simple case of \(L=500\) auctions with \(M=1\) prize and \(N=2\) bidders. Figure 1 presents the true equilibrium strategy \(b=s(v)\) as well as for each \(b \in [s(0.055),s(2.5)]\) the mean of the 1000 estimates \(\hat{v}(b)=s^{-1}(b)\), together with the 5% quantile, and the 95% quantile.

The true quilibrium strategy is approximated by the mean of the 1000 Monte Carlo estimates very closely.

Figure 2 presents the true density of the truncated log-normal distribution, and for each value of v in the support, the mean of the 1000 estimates \(\hat{f}(v)\), together with the 5% quantile, and the 95% quantile.

Since the bid density has a big mass on the boarders of the support, even the adaptive kernel density estimator leads to the biased results closer to the borders.

Let us also consider the cases with more players and objects, in particul, the case of \(L=300\) auctions with \(M=2\) prizes and \(N=3\) bidders, as well as \(L=200\) auctions with \(M=2\) prizes and \(N=5\).

As we can see from in Fig. 3, the estimates of the equilibrium strategies are still approximated very closely.

On the other hand, the density estimators continue to suffer some bias on the boarders (see Fig. 4 below). Again, that is due to the fact that there is almost no variation in bids for the low valuations once the ratio of M to N is large, and almost no variation in bids for the high valuations once the ratio of M to N is small, and as a result, big masses at the boarders of bid density.

In comparison, results using the classical density estimators as well as valuation trimming, are presented in Appendix D. The drawbacks of those estimators are bigger biases on the boundaries, as well as non-integrability to one.

3.4.2 Monte Carlo based on the bid quantile density function estimation

In this subsection, I consider the estimation based on the bid quantile density function. It shows significant improvement compared to the more standard estimation method presented in the previous subsection. Given the bids, the derivative of the bid quantile density function is estimated using (9) and plugged into (11) to find the estimator of the quantile function of valuations. Specifically, as before, I use the triweight kernel and the bandwidth \(h=1.06\hat{\sigma _b}(NL)^{-1/5}\), where \(\hat{\sigma _b}\) is the estimated standard deviation of the bids.

I consider the cases of \(L=200\) auctions with \(N=5\) bidders and \(M=1,..,4\) prizes, such that the ratio of M to N varies from small to large. As I mentioned in the previous subsection depending on the ratio, the interval on which the bidding strategy is flat changes as well. That can be clearly seen from Fig. 5 below.

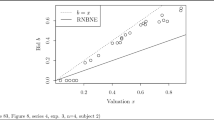

Figure 6 presents the true quantile function of the truncated log-normal distribution, as well as the mean of 1000 estimates \(\hat{q}(t)\) of quantile function, together with the 5% quantile, and the 95% quantile. of the estimates. Importantly, for all the ratios of N to M the true quantile function is approximated by the mean of the 1000 Monte Carlo estimates perfectly for almost all values accept the boundaries. With the increase of NM (and increase of the ratio of M to N), the confidence interval for the large values of quantile function becomes larger. At the same time, the confidence interval for the lower values of quantile function becomes smaller, which is consistent with intuition based on the equilibrium strategy behavior described before.

4 Extensions

4.1 Observed heterogeneity

The model can be extended to account for observed heterogeneity. Let \(N_l\) be the number of bidders in the l-th auction and \(X_l\) is the vector of observed characteristics. In this setting, the distribution of \(v_{il}\) for the l-th auction is the conditional distribution \(F(\cdot | X_l, N_l)\) of valuations given \((X_l, N_l)\). In turn, the distribution of observed bids in the l-th auction is \(G(\cdot | X_l, N_l)\). Thus,

where

These ratios can be estimated using observations \(\{(b_{il},X_l, N_l, i = 1,..., N_l, l = 1,..., L\}\)

where h denotes the bandwidth and K denotes the kernel function.

As a result, we are able to estimate:

Next, using the pseudo sample \(\{(\hat{v}_{il}, X_l), i = 1,..., N_l, l = 1,..., L\}\), we estimate nonparametrically the density f(v|x) by

where

where h denotes the bandwidth and K denotes the kernel function.

The procedure is very similar to the one before except for the fact that we condition on the observables and thus much more data is required.

4.2 Random noise

The model can be extended to account for additive random noise. Suppose that when bids \(b_i\) are submitted to the auctioneer, they are combined with a mean-zero iid shock to get \(\beta _i = b_i + \epsilon _i\), and then the winner is chosen as the top order statistic of the \(\beta \)’s, rather than the b’s. Let \(F_\epsilon (\cdot )\) be the CDF of \(\epsilon _j-\epsilon _i\), whereas \(f_\epsilon (\cdot )\) is the corresponding density function. Assumption 3 in that case becomes:

Assumption

3\('\) Bidders submit the bids \(b_i\) simultaneously. At that moment bidder i knows N, M, \(v_i\), F(v), and \(F_\epsilon (\cdot )\).

Thus, the win probability can be written as:

where

Given the winning probability let us find the equation that characterizes the equilibrium.

Proposition 3

Given Assumptions 1-3’ and 4-5, the first-order condition of this game can be written as:

where

Similar to the derivation in Sect. 3.2, the Eq. (12) above can be rewriten in terms of the distribution of bids:

where

and

The estimation, in that case, would consist of two steps. In the first step, assuming as before that all bids are observed in all auctions, the variance of random noise \(\epsilon _i\) could be estimated using the maximum likelihood from the win outcomes (we can focus on the winning probability of player 1, for example), and all the observed bids. In the second step, the distribution of random noise together with Eq. (13) is used for the identification of pseudo-values similar to the IPV case.

4.3 Asymmetric bidders

For the ease of exposition in this section, I maintain an assumption that \(M=1.\) When \(M>1\) the logic is similar, just the number of possible scenarios increases. The only difference with the benchmark IPV setting is that every bidder draws the valuation from the different distribution \(F_i(\cdot )\), \(i=1,...,N\).

Thus, the win probability for the case \(M=1\) can be written as:

Proposition 4

The first-order condition of this game can be written as:

Similar to the derivation in Sect. 3.2, the Eq. (14) above can be rewritten in terms of the distribution of bids:

The estimation is similar to the IPV case with the only exception that the distributions of bids need to be estimated separately for different players, and the same for the distributions of the pseudo-values.

4.4 APV all-pay auction with risk-neutral bidders

4.4.1 Model

In this section, I consider the same set-up with the affiliated private values (APV).

Assumption 10

Symmetric APV model is considered, thus all bidders are ex-ante identical. Each of the bidders knows the joint distribution of the valuations \({\textbf {F}}\).

The case of the first-price APV auction was considered in Li et al. (2002). In this section, I follow similar logic. As before, I only consider Bayesian Nash equilibrium that is strictly increasing, differentiable and symmetric. At first, I consider just one unit of indivisible good for sale, then the analysis will be extended to the case of M units in Sect. 4.4.4.

Each bidder i chooses a bid \(b_i\) to maximize his utility:

where \(B_i=s(y_i)\), \(y_i=\max \nolimits _{j \ne i} v_j\), and \(s(\cdot )\) is the equilibrium strategy.

Proposition 5

Given that Assumptions 1-5 and 11 are satisfied, as well as M=1, there exists the strictly increasing symmetric Bayesian equilibrium of the game described above:

where 1 is the index of any bidder as all of them are identical ex-ante. The first-order condition of this game can be written as:

Using the first-order condition we will be able to identify the model.

4.4.2 Nonparametric identification

In this section, I prove the nonparametric identification of the APV model.

As in the case of the IPV model, the APV model is identified whenever the distribution function F can be found by the econometrician uniquely given the data on the bids.

Let \(G_{B_1|b_1}(\cdot |\cdot )\) be the conditional distribution of \(B_1\) given \(b_1\) and \(g_{B_1|b_1}(\cdot |\cdot )\) be the corresponding density.

Then the following proposition holds:Footnote 6

Proposition 6

Let \(N \ge \) 2. Let \({\textbf {G}}(\cdot )\) belong to the set of absolutely continuous probability distributions with support \([\underline{b},\bar{b}]^N\). Then the symmetric APV model is identified. Moreover, distribution \({\textbf {G}}(\cdot )\) with support \([\underline{b},\bar{b}]^N\) can be rationalized by a symmetric APV model if and only if

-

1.

\({\textbf {G}}(\cdot )\) is symmetric and affiliated, and

-

2.

the function \(\xi (\cdot ,N,{\textbf {G}}) \equiv \bigl (g_{B_1|b_1}(b_i|b_i) \bigr )^{-1}\) is strictly increasing on \([\underline{b},\bar{b}].\)

Thus for \(i=1,...,N\) in terms of the distribution of bids:

The next section discusses the estimation procedure.

4.4.3 Nonparametric estimation

In this section, the consistent plug-in estimation for the bidder’s valuation is proposed.

Similar to the IPV case, the first step is the estimation of the conditional bid density \(g_{B_1|b_1}(\cdot |\cdot )\) using the data on bids. In the next step, the pseudo-values can be estimated using the Eq. (18). The last step is the estimation of the density of the valuations from the obtained pseudo-values using a kernel estimator.

Since

joint density should be estimated as well as the density of \(b_1\).

Let \(L_N\) be the number N-bidders auctions. I index by l the l-th auction and use the observations \(\{b_{il}, i = 1,..., N, l = 1,..., L_N\}\) to estimate nonparametrically \(g_{B_1,b_1}(\cdot ,\cdot )\) and \(g_{b_1}(\cdot )\).

where h, \(h_g\) denote the bandwidths and K, \(K_g\) denote the kernel functions.

Theorem 3

Given that Assumptions 1-11 are satisfied and M=1 the following is the consistent estimator of the valuation of player i in auction l:

where:

These are the pseudo-values.

To estimate the joint density \(f(\cdot ,...,\cdot )\) I use the pseudo-sample \(\{\hat{v}_{il}, i = 1,..., N, l = 1,..., L_N\}\)

for any value \((v_1,...,v_N)\).

In turn, to estimate the marginal density:

for any value \(v\in [0,1]\).

Similar to the IPV case, it is possible to account for the observed heterogeneity by conditioning on the unobservables.

4.4.4 Model with M units

The model could be extended to the case with M units for sale. In this case, instead of \(B_1\) I introduce \(B_m=s(y_m)\), \(y_m\) is the m-th largest bid among other bids. In this case

And as a result we get:

I use the estimates:

where h denotes the bandwidth and K denotes the kernel function.

Thus:

To estimate the joint density \(f(\cdot ,...,\cdot )\) the pseudo-sample \(\{\hat{v}_{il}, i = 1,..., N, l = 1,..., L_N\}\) is used as before.

4.5 IPV all-pay auction with risk-averse bidders

4.5.1 Model

As in previous sections assume that there are N bidders, \(i=1,...,N\). Each bidder draws a value \(v_i\) independently from a commonly known distribution F(v) with support \([\underline{v}, \bar{v}]\). \(v_i\) is the private value of bidder i of possessing the good. In contrast to the previous set-up, now each bidder is risk-averse, therefore he has utility function \(U(\cdot )\), such that: \(U(0)=0\), \(U'(\cdot )>0\) and \(U''(\cdot ) \le 0\), which are standard assumptions. Without loss of generality let us normalize \(U (1) = 1\).

Each bidder i knows the number of bidders N, his own value \(v_i\), as well as the distribution of the valuations of the other bidders F(v) and utility function \(U(\cdot )\). Again I consider the Bayesian equilibrium of this incomplete information game which is strictly monotonic and symmetric. The bid function is defined by \(s(v)=b\). As s(v) is strictly monotonic it is invertible, so \(s^{-1}(b)=v\). For ease of exposition, I consider the case with \(M=1\). In addition to these assumptions using the independence of the valuations, we can write the expected payoff to bidder i as:

Taking the first derivative with respect to the bid we get:

Substituting \(s^{-1}(b_i)=v_i\) and rearranging the terms we get the first-order differential equation which determines the bid function:

Using this equation I prove that the model is not identified.Footnote 7

4.5.2 Nonidentification result

I have shown in subsection 3.1 that \(F(v_i)=G(b_i)\) and \(\frac{f(v_i)}{s'(v_i)}=g(b_i)\), thus we can rewrite the Eq. (24) as

Let us call the model a set of structures [U, F].

A structure [U, F] is non-identified if there exists another structure \([U',F']\) within the model that leads to the same equilibrium bid distribution. If no such structure \([U',F']\) exists for any [U, F], the model is (globally) identified.

Theorem 4

The general IPV model with risk-averse bidders is not identified. Moreover, any structure [U, F] in \(U^{CARA} \times \mathcal {F}\) is not identified.

Formally, consider \(N=2\), \(U(x)=\frac{1-\exp (-ax)}{1-\exp (-a)}\), \(a>0\). Then any structure [U, F] with \(F(v)=\frac{2-Da-2 \exp (-av)}{(1-\exp (-av))(2 -a)D}\), \(v \in [-\frac{1}{a}\ln \Big ( \frac{2 - a}{2}\Big ), -\frac{1}{a}\ln \Big (1 - \frac{aD}{2\exp (-2d)+aD} \Big )]\), where \(a \in [1,2)\), d is a constant, \(D=1-\exp (-2d)\), leads to the truncated exponential distribution \(G(b)=(1-\exp (-2b))/D\) on [0, d].

As a result, it is shown that this model is not identified even in the semi-parametric case where the utility function of the bidders is restricted to belong to the class of functions with constant absolute risk aversion (CARA).

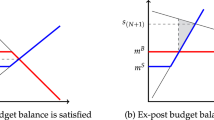

4.5.3 Identification result

The following proposition contrasts the previous non-identification result. It is similar to Theorem 1 in Donald and Paarsch (1996), even though the authors considered a different functional form of the utility in the case of first-price auctions. The main idea is that the source of non-identification lies in the fact that an increase in risk aversion can be compensated by a shrinkage in the private value distribution. That can be clearly seen in the example in Theorem 4 above. Instead, once the support of the distribution is fixed, the model becomes identified given the utility function satisfies CARA. The following Proposition 7 formally proves this result.

Assumption 11

The class of distributions \(\mathbf { F^r}\) contains distributions F(v) defined on \([\underline{v}, \bar{v}]\) that are strictly increasing, continuously differentiable with continuous density f(v) such that \(f(v) > 0\) on \((\underline{v}, \bar{v})\).

Proposition 7

Given Assumption 11, [u, F] is identified in \(U^{CARA} \times \mathbf { F^r}\).

As the rest of the proofs, the proof of this proposition is presented in the Appendix.

Additionally, an econometrician could use the idea behind the identification result in Guerre et al. (2009) and exploit the situations in which the bid distribution varies with the number of bidders or alternatively with the number of units for sale while the private value distribution does not. That would be the case in situations in which entry is exogenous, or alternatively in which there is an exogenous variation in the number of goods for sale. That is left for future research.

5 Conclusion

In this paper, I have proved the identification and derived two consistent estimators of a multi-unit perfectly discriminating contest, or an all-pay auction. The first estimator is based on the classical structural approach similar to that of Guerre et al. (2000). The second estimator, instead, allows estimation of the quantile function of the bidder valuations directly using the estimator of the quantile density of the bids. The important property of the estimation is that the determination of the equilibrium strategy could be avoided since I only use the first-order condition. This allows estimation of the distribution of valuations even in the case when the closed-form solution cannot be explicitly found. The perfectly discriminating contest model provides the framework that can be applied to the variety of real-life scenarios such as marketing and advertising by firms, litigation, research and development, patent race, procurement of innovative good, sports events, arms race, rent-seeking activity such as lobbying, as well as electoral competition. I considered a variety of model extensions: the case of affiliated private values (APV), asymmetric players, the addition of random noise, as well as the case of risk-averse bidders. For the first three extensions, I derived the identifying equations and proposed the estimation procedures. In contrast to these scenarios, I proved that the general model with risk-averse bidders is not identified even in the semi-parametric case where the utility function is restricted to belong to the class of functions with constant absolute risk aversion (CARA). On the other hand, I showed that the model with risk aversion can be identified if the distribution of the valuations is restricted to having fixed support.

Notes

Instead of considering players having different valuations of the good, the all-pay auction model can be equivalently applied to the situations in which the agents differ in terms of their types, such as costs of effort, strength, or ability, whereas the value of the good is normalized to one. To be more precise, in that case, expected payoff of player i is given by \(P(winning)-c_ib_i\), where \(c_i=1/v_i\) is the cost of effort, whereas \(v_i\) is the valuation.

Moldovanu and Sela (2006) consider the case of all-pay contests in which there are several prizes of fixed value, but the players differ in the effort efficiency. Importantly, this model is equivalent to the all-pay auction, as we have seen in Footnote 1.

I use the same notation as in Guerre et al. (2000).

A similar estimator can apply to winner-pay auctions as well, where equilibrium bid strategies are also strictly monotone.

The Matlab function akde1d is based on: Zdravko Botev (2022), “Adaptive kernel density estimation in one-dimension” (https://www.mathworks.com/matlabcentral/fileexchange/58309-adaptive-kernel-density-estimation-in-one-dimension).

I use the same notation as in Li et al. (2002) for convenience.

Campo et al. (2011) considered the case of the first-price auction.

Here R is the number of bounded continuous derivatives of \(f(\cdot )\), and \(c_g\) and \(c_f\) are constants.

Alternatively, other methods can be used to estimate the densities, such as, for example, the boundary correction proposed in Hickman and Hubbard (2015).

References

Amann E, Leininger W (1996) Asymmetric All-Pay Auctions with Incomplete Information: The Two-Player Case. Games Econom Behav 14(1):1–18

Athey S, Haile P (2002) Identification of Standard Auction Models. Econometrica 70(6):2107–2140

Baron DP (1994) Electoral Competition with Informed and Uninformed Voters. American Political Science Review 88(1):33–47

Baye MR, Kovenock D, de Vries CG (1993) Rigging the Lobbying Process: An Application of the All-Pay Auction. Am Econ Rev 83(1):289–294

Baye MR, Kovenock D, de Vries CG (2005) Comparative Analysis of Litigation Systems: An Auction-Theoretic Approach. Econ J 115(505):583–601

Bell DE, Keeney RL, Little JDC (1975) A Market Share Theorem,. J Mark Res 12(2):136–141

Bernardo AE, Talley E, Welch I (2000) A theory of legal presumptions. The Journal of Law, Economics, and Organization 16(1):1–49

Bodoh-Creed AL, Hickman BR (2019) Pre-College Human Capital Investment and Affirmative Action: A Structural Policy Analysis of US College Admissions

Botev ZI, Grotowski JF, Kroese DP (2010) Kernel density estimation via diffusion. Ann Stat 38(5):2916–2957

Campo S, Guerre E, Perrigne I, Vuong Q (2011) Semiparametric estimation of first-price auctions with risk-averse bidders. Rev Econ Stud 78(1):112–147

Che Y-K, Gale I (2003) Optimal Design of Research Contests. American Economic Review 93(3):646–671

Dasgupta P (1986) The Theory of Technological Competition. Palgrave Macmillan UK, London

Dechenaux E, Kovenock D, Sheremeta RM (2015) A survey of experimental research on contests, all-pay auctions and tournaments. Exp Econ 18(4):609–669

Donald SG, Paarsch HJ (1996) Identification, estimation, and testing in parametric empirical models of auctions within the independent private values paradigm. Economet Theor 12(3):517–567

Farmer A, Pecorino P (1999) Legal expenditure as a rent-seeking game. Public Choice 100(3):271–288

Guerre E, Perrigne I, Vuong Q (2000) Optimal Nonparametric Estimation of First-price Auctions. Econometrica 68(3):525–574

Guerre E, Perrigne I, Vuong Q (2009) Nonparametric Identification of Risk Aversion in First-Price Auctions under Exclusion Restrictions. Econometrica 77(4):1193–1227

He M, Huang Y (2021) Structural analysis of Tullock contests with an application to US house of representatives elections. Int Econ Rev 62(3):1011–1054

Hickman BR, Hubbard TP (2015) Replacing Sample Trimming with Boundary Correction in Nonparametric Estimation of First-Price Auctions. J Appl Economet 30(5):739–762

Hillman AL, Riley JG (1989) Politically contestable rents and transfers. Economics & Politics 1(1):17–39

Hirshleifer J, Osborne E (2001) Truth, Effort, and the Legal Battle. Public Choice 108(1):169–195

Jones MC (1992) Estimating densities, quantiles, quantile densities and density quantiles. Ann Inst Stat Math 44(4):721–727

Kang K (2015) Policy Influence and Private Returns from Lobbying in the Energy Sector. The Review of Economic Studies 07 83(1):269–305

Kaplan T, Luski I, Sela A, Wettstein D (2002) All-Pay Auctions with Variable Rewards. Journal of Industrial Economics 50(4):417–430

Krishna V, Morgan J (1997) An Analysis of the War of Attrition and the All-Pay Auction. Journal of Economic Theory 72(2):343–362

Krueger AO (1974) The Political Economy of the Rent-Seeking Society. Am Econ Rev 64(3):291–303

Li T, Perrigne I, Vuong Q (2002) Structural Estimation of the Affliated Private Value Auction Model. RAND Journal of Economics 33(2):171–193

Li Q, Racine JS (2006) Nonparametric Econometrics: Theory and Practice number 8355. In ‘Economics Books.’, Princeton University Press

Liu X, Lu L (2017) Optimal prize-rationing strategy in all-pay contests with incomplete information. Int J Ind Organ 50(C):57–90

Lizzeri A, Persico N (2000) Uniqueness and Existence of Equilibrium in Auctions with a Reserve Price. Games Econom Behav 30(1):83–114

Luo T, Das SK, Tan HP, Xia L (2016) Incentive mechanism design for crowdsourcing: An all-pay auction approach. ACM Transactions on Intelligent Systems and Technology (TIST) 7(3):1–26

Milgrom PR, Weber RJ (1982) A Theory of Auctions and Competitive Bidding. Econometrica 50(5):1089–1122

Minchuk Y, Sela A (2014) All-pay auctions with certain and uncertain prizes. Games Econom Behav 88(C):130–134

Moldovanu B, Sela A (2001) The Optimal Allocation of Prizes in Contests. American Economic Review 91(3):542–558

Moldovanu B, Sela A (2006) Contest architecture. Journal of Economic Theory 126(1):70–96

Noussair C, Silver J (2006) Behavior in all-pay auctions with incomplete information. Games Econom Behav 55(1):189–206

Shakhgildyan K (2019) Nonparametric Identification and Estimation of Contests with Uncertainty. University of California, Los Angeles, ProQuest Dissertations Publishing

Skaperdas S, Grofman B (1995) Modeling Negative Campaigning. American Political Science Review 89(1):49–61

Snyder JM (1989) Election Goals and the Allocation of Campaign Resources. Econometrica 57(3):637–660

Taylor CR (1995) Digging for Golden Carrots: An Analysis of Research Tournaments. Am Econ Rev 85(4):872–890

Tullock G (1980) Efficient Rent Seeking. In: Tollison RD, Buchanan JM, Tullock G (eds) Towards a Theory of the Rent-seeking Society. Texas A &M University Press, Austin, pp 3–15

Funding

Open access funding provided by Universitá Commerciale Luigi Bocconi within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I would like to thank my advisers John Asker, Francesco Decarolis and Rosa Liliana Matzkin for their support and encouragement, and the editors, two anonymous referees, and many seminar participants for helpful comments and suggestions.

Appendices

Appendices

Proof of Proposition 1

Proof

If the bid b corresponds to valuation v, \(b=s(v)\), the winning probability is

Therefore, expected utility of a bidder whose valuation is \(v_i\), but who bids as if his valuation was v is:

Using the First order condition (differentiating with respect to v and substituting \(v=v_i\)), we get:

Given that

we get the following equation for the valuation of player i:

It follows that the equilibrium strategy

In particular, for \(M=1\):

Therefore expected utility of a bidder whose valuation is \(v_i\), but who bids as if his valuation was v is:

Using the First order condition (differentiating with respect to v and substituting \(v=v_i\)), we get:

From this differential equation we obtain the value \(v_i\):

It follows that the equilibrium strategy

\(\square \)

Proof of Proposition 2

Proof

For any \(b \in [\underline{b}, \bar{b}]=[s(\underline{v}), s(\bar{v})]\) it holds that \(G(b)=Pr(b_1 \le b)=Pr(v_1 \le s^{-1}(b)) = F(s^{-1}(b)) = F(v)\), where \(b = s(v)\). Thus the bids distribution \(G(\cdot )\) has support \([s(\underline{v}), s(\bar{v})]\) and its density is \(g(b) = \frac{f(v)}{s'(v)}\), where \(v = s^{-1}(b)\).

This allows us to rewrite the Eq. (2) in terms of the distribution of bids, that is

As a result, we obtain the expression for private value \(v_i\) as a function of the bids \(b_i\), its distribution \(G(\cdot )\), its density \(g(\cdot )\), and the number of bidders N. The rest follows from the proof of Theorem 1 in Guerre et al. (2000).

In terms of quantile functions representation, let us denote \(t_i=F(v_i)\), equivalently \(v_i=q(t_i)\), where \(q(\cdot )\) is the quantile function of the distribution of valuations. As a result of monotonicity of the strategies \(G(s(v_i))=F(v_i)\). Applying \(r(\cdot )\) to both sides of equality, where \(r(\cdot )\) is bid quantile function, we get: \(s(v_i)=r(F(v_i))=r(t_i)\) Moreover, \(s'(v_i)=r'(F(v_i))f(v_i)\), thus

Using these equalities and changing variables we can rewrite (2) as:

where \(t_i \in (0,1)\). \(\square \)

Proof of Theorem 1

Proof

By Theorem 1.1 from Li and Racine (2006):

In its turn by the strong law of large numbers empirical CDF converges almost surely to the true CDF, thus also converges in probability.

Thus, by the properties of convergence in probability and continuous mapping theorem,

\(\square \)

Monte carlo simulation for the IPV model using classical kernel density and trimming

In this subsection, I consider the estimation based on the bid density function using classical kernel density and trimming for comparison. Given the bids, the CDF is estimated using (5) and the bid density function is estimated using (6). Specifically, I use the triweight kernel:

This is a kernel of order 2. The important property is that it has compact support and the kernel function is continuously differentiable on its support. Many other kernel functions satisfy the above properties. In it’s turn, \(h_g=1.06\hat{\sigma _b}(NL)^{-1/5}\), where \(\hat{\sigma _b}\) is the estimated standard deviation of the bids. The order is \(L^{-1/5}\) as when the valuations are not observed but should be estimated, by choosing the bandwidths \(h_g=c_g(logL/L)^{1/(2R+3)}\) and \(h_f=c_f(logL/L)^{1/(2R+3)}\), the optimal convergence rate can be reached.Footnote 8 That is according to the Theorem 3 in Guerre et al. (2000). In our case \(R=1\). Constant 1.06 is the result of the so-called rule of thumb.

Knowing the estimated distribution and density of the bids, I estimate the valuations. The issue here is that the estimator of density g is biased on the borders of the support. More precisely on \([\underline{b}, \underline{b}+\rho _g h_g/2)\) and on \((\bar{b}-\rho _g h_g/2, \bar{b}]\), where \(\rho _g\) is the length of the support of the kernel. In our case \(\rho _g=2\). If we consider \(b_{min}\) to be the minimum of the observed bids and \(b_{max}\) the maximum of the observed bids, then the \(\hat{g}\) is unbiased on \([b_{min}+\rho _g h_g/2 , b_{max}-\rho _g h_g/2]\). Thus, I trim the estimated valuations specified in (7):Footnote 9

The final step is the estimation of the density function of valuations \(\hat{f}(\cdot )\) using (8). Here \(h_f=1.06\hat{\sigma _v}(NL_T)^{-1/5}\), \(L_T\) is the number of auctions that are left after the trimming and \(\hat{\sigma _b}\) is the estimated standard deviation of \(\hat{v}_{il}\). In each replication I estimate \(\hat{f}(\cdot )\) at 500 equally spaced points on [0.055, 2.5].

I start by considering the simple case of \(L=500\) auctions with \(M=1\) prize and \(N=2\) bidders.

Figure 7 presents the true equilibrium strategy \(b=s(v)\) as well as for each \(b \in [s(0.055),s(2.5)]\) the mean of the 1000 estimates \(\hat{v}(b)=s^{-1}(b)\), together with the 5% quantile, and the 95% quantile. The important result is that inside the interval marked by the horizontal dashed lines defined by the average of \([b_{min}+h_g, b_{max}-h_g]\) the true equilibrium strategy is approximated by the mean of the 1000 Monte Carlo estimates almost perfectly. On the borders, the estimation is biased due to the bias of kernel estimators.

Figure 8 presents the true density of the truncated log-normal distribution, and for each value of v in the support, the mean of the 1000 estimates \(\hat{f}(v)\), together with the 5% quantile, and the 95% quantile. In this case, inside the interval marked by the vertical dashed lines defined by the average of \([s(b_{min}+h_g)+h_f, s(b_{max}-h_g)-h_f]\) the true density function is approximated by the mean of the 1000 Monte Carlo estimates almost perfectly. On the borders, the estimation is biased due to the bias of kernel estimators and trimming. Importantly, in comparison to the density estimation using adaptive and boundary-corrected kernels, the density estimator here does not integrate to one.

Since the pseudo-values are trimmed based on the support of the equilibrium bids, the bias is bigger on the borders of support where the equilibrium bid strategy is particularly flat. That issue becomes more prominent for the larger number of bidders and prizes.

Let us consider the cases of \(L=300\) auctions with \(M=2\) prizes and \(N=3\) bidders, as well as \(L=200\) auctions with \(M=2\) prizes and \(N=5\).

As we can see from in Fig. 9, the estimates of the equilibrium strategies are still approximated very closely.

On the other hand, the density estimators suffer significant bias, which is becoming more prominent for the larger number of bidders (see Fig. 10 below). That is due to the fact that there is almost no variation in bids for the low valuations once the ratio of M to N is large, and almost no variation in bids for the high valuations once the ratio of M to N is small.

Proof of Proposition 3

Proof

First, let’s derive the form of \(P(v_i)\): \(P(v_i)=P(b_i+\epsilon _i>b_j+\epsilon _j|b_i,N,M,F(v))=P(b_j+\epsilon<b_i)=\int \limits _{\underline{b}}^{\bar{b}}P(\epsilon <b_i-b_j)g(b_j)db_j=\int \limits _{\underline{b}}^{\bar{b}} \left( \int \limits _{-\infty }^{b_i-b_j}f_{\epsilon }(e)de \right) g(b_j)db_j=\int \limits _{\underline{v}}^{\bar{v}} \left[ \int \limits _{- \infty }^{s(v_i)-s(v)} f_ \epsilon (e)de \right] f(v)dv.\)

Then:

If the bid b corresponds to valuation v, \(b=s(v)\), the winning probability is

Therefore, expected utility of a bidder whose valuation is \(v_i\), but who bids as if his valuation was v is:

Using the First order condition (differentiating with respect to v and substituting \(v=v_i\)), we get:

Given that

we get the following equation for the valuation of player i:

\(\square \)

Proof of Proposition 4

Proof

First, let’s derive the form of winning probability:

Therefore, expected utility of a bidder whose valuation is \(v_i\), but who bids as if his valuation was v is:

Using the First order condition (differentiating with respect to v and substituting \(v=v_i\)), we get:

\(\square \)

Proof of Proposition 5

Proof

The expected utility of a bidder whose valuation is \(v_i\), but who bids as if his valuation was v is:

Using the First order condition (differentiating with respect to v and substituting \(v=v_i\)), we get:

for all \(v_i \in [\underline{v}, \bar{v}]\) such that \(s(\underline{v}) = \underline{v}\). \(f_{y_1|v_1}(\cdot |\cdot )\) is the notation for conditional density of \(y_1\) given \(v_1\). Here 1 is the index of any bidder as all of them are identical ex-ante. As a result, we get the following differential equation determining the bid function:

therefore

From the differential Eq. (26) we obtain the value \(v_i\):

This proves the proposition. \(\square \)

Proof of Proposition 6

Proof

Analogously to Li et al. (2002):

Thus

As a result, using the two equations above and condition \(v=s^{-1}(b)\), the first-order condition (17) can be rewritten as:

The rest follows from the proof of Proposition 1 in Li et al. (2002). \(\square \)

Proof of Theorem 3

Proof

By Theorem 1.1 from Li and Racine (2006):

Moreover, by Theorem 1.3 from Li and Racine (2006):

Thus, by the properties of convergence in probability and continuous mapping theorem,

\(\square \)

Monte Carlo Simulation for the APV Model

In this section, the estimation is described step by step by conducting a Monte Carlo study.

I consider the scenario when the data on \(L=500\) auctions each with \(N=2\) bidders is given. It could be easily generalized to account for the case when there is a different number of bidders. Following Li et al. (2002) I consider the simplest case of affiliated values distribution.

Private values are assumed to be the sum of the two uniform random variables \(v_i= \gamma +u_i\), where \(\gamma \) is U[0.25, 0.75], and the \(u_i\)’s are independently drawn from \(U[-0.25,0.25]\) so that they are correlated through \(\gamma \) and \(corr(v_i,v_j)=0.5\). Then \(f_{\gamma }(x)=2\), \(x \in [0.25,0.75]\), \(f_{u}(y)=2\), \(y \in [-0.25,0.25]\), thus

It follows that the marginal density of the valuations is triangular:

It can also be shown that

and

As a result,

Similarly, in general case, for any N it can also be shown that

Thus we can find the corresponding bids. In case when \(N=2\) using (16)

1000 Monte Carlo simulations are conducted. For each simulation 500 values of \(\gamma \), and 1000 values of \(u_i\) are drawn, and then \(v_i\) are calculated. Next, for each value draw the corresponding bid is calculated. Given the bids, similar to the IPV case, I estimate the bid density using the adaptive kernel, while the joint density is estimated using the Hickman and Hubbard (2015) method. In each replication, I estimate \(\hat{f}(\cdot )\) at 500 equally spaced points on [0, 1]. The Fig. 11 presents the true triangular marginal density, and for each value of \(v \in [0,1]\), the mean of the 1000 estimates \(\hat{f}(v)\), together with the 5% quantile, and the 95% quantile.

The Fig. 12 describes the situation when the model is estimated as IPV whereas in reality, it is the APV setting. It shows how much more prominent would have been the bias if the model were misspecified. When using an IPV model, some private values are overestimated, and some are underestimated.

Proof of Theorem 4

Proof

Let’s consider CARA utility function such that:

Thus \(U'(x)=\frac{a \exp (-ax)}{1-\exp (-a)}>0\) and \(U''(x)=\frac{-a^2\exp (-ax)}{1-\exp (-a)}<0\).

Let’s also fix N=2. In this case the differential equation becomes (I omit index i for simplicity):

which (after dividing both the numerator and denominator by \(\exp (ab)\)) is equivalent to

Let’s find v from this equation. \(1-\exp (-av)=\frac{a}{g(b)+aG(b)} ~\Rightarrow \)

Now let’s consider truncated exponential family of distributions \(G(b)=(1-\exp (-\lambda b))/D, ~b\in [0,d]\), \(D=1-\exp (-2d)\), \(g(b)=\lambda \exp (-\lambda b)/D\). Then \(g(b)+aG(b)=(\lambda \exp (-\lambda b)+a(1-\exp (-\lambda b)))/D\) and \(\frac{\partial [g(b)+aG(b)]}{\partial b}=(-\lambda ^2 \exp (-\lambda b)+a \lambda \exp (-\lambda b))/D=(\lambda \exp (-\lambda b)(a-\lambda ))/D<0\) when \(\lambda >a\). Thus in this case v is an increasing function of b.

Let’s find the bid function: \(g(b)+aG(b)=\frac{a}{1-\exp (-av)}\) \(\Rightarrow \) \((\lambda -a)\exp ^{-\lambda b}+a=\frac{Da}{1-\exp (-av)}\) \(\Rightarrow \)

In its turn

\(b \in [0; d]\), therefore v is well-defined, but has the moving support since \(v=-\frac{1}{a}\ln \Big ( \frac{\lambda - a}{\lambda }\Big )\) if \(b=0\) and \(v=-\frac{1}{a}\ln \Big ( 1-\frac{a}{\lambda \exp (-\lambda d)/D+a}\Big )\) if \(b=d\).

In particular, this is true if \(\lambda \)=2. This proves the proposition. \(\square \)

Proof of Proposition 7

Proof

Let’s consider CARA utility function \(U(x)=\frac{1-\exp (-ax)}{1-\exp (-a)}, ~~ a>0\), \(U'(x)=\frac{a \exp (-ax)}{1-\exp (-a)}\), and rewrite the FOC:

Thus,

Similar to Donald and Paarsch (1996), let’s consider the distribution of the winning bid:

Alternatively, under the pair \((F_0,a_0)\): \(P[W<k|F_0,a_0]=F_0(s_0^{-1}(k))^n.\) We need to show that if \((F_0,a_0)\ne (F,a)\), then there exist a k for which the distributions differ.

First, clearly if \(s(\bar{v}) \ne s_0(\bar{v})\), then we can set \(k=\min \{s(\bar{v}),s_0(\bar{v})\}\), and the distributions differ.

Second, suppose that \(a \ne a_0\), but \(s(\bar{v})= s_0(\bar{v})\). Let’s find the density of the winning bid:

If \(s^{-1}(k)=\bar{v}\):

Then \(h(\bar{v}|F,a) \ne h(\bar{v}|F_0,a_0)\) since \(h(\bar{v})\) is a decreasing function in a. Thus, for \(P[W<s(\bar{v})-\epsilon |F,a] \ne P[W<s(\bar{v})-\epsilon |F_0,a_0].\) That is a contradiction, so \(a=a_0\), and then since \(s(\bar{v}) = s_0(\bar{v}) \Rightarrow \) \(F=F_0\). \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Shakhgildyan, K. Nonparametric identification and estimation of all-pay auction and contest models. Rev Econ Design (2022). https://doi.org/10.1007/s10058-022-00309-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10058-022-00309-3