Abstract

This paper provides a political economy analysis of (de)centralization when local public goods—with spillovers effects—can be substitutes or complements. Depending on the degree of complementarity between local public goods, median voters strategically delegate policy to either ‘conservative’ or to ‘liberal’ representatives under decentralized decision-making. In the first case, it accentuates the free-rider problem in public good provision, while it mitigates it in the second case. Under centralized decision-making, the process of strategic delegation results in either too low or too much public spending, with the outcome crucially depending on the sharing of the costs of local public spending relative to the size of the spillover effects. Hence, with a common financing rule, centralization is welfare improving if and only if both public good externalities and the degree of complementarity between local public goods are both relatively large.

Similar content being viewed by others

Notes

In fact, strategic delegation can nullify any element of cooperativeness within the legislature (see Cheikbossian 2000).

Interestingly, they state that “weaker-link public goods resemble strategic complements” (p. 497). For ‘better-shot’ public goods, they briefly refer to the cases of the development of a vaccine or public policies against international terrorism. They conclude that “ better-shot public goods are akin to strategic substitutes” (p. 497). However, they do not analyze the nature of strategic interactions between countries as a function of the type of public good. Instead, they analyze correlated strategies for specific numerical examples of ‘weaker-link’ and ‘better-shot’ transnational public goods.

Due to its convenience, this separability assumption has been extensively used in the political economy literature of (de)centralization to investigate a number of issues such as lobbying (see, e.g., Lockwood 2008), the popular support for centralization (see, e.g., Feld et al. 2008; Feidler and Staal 2012), or the endogenous choice of the degree of centralization (see, Lorz and Willmann 2005, 2013).

This corresponds to the standard alternative specification which has also been used to study, for example, the impact of voting rules, such as direct referendum or qualified majority, on the emergence and scope of centralized systems (see, e.g., Redoano and Scharf 2004; and Alesina et al. 2005); or the effect of lobbying on the performance of a decentralized system (see, e.g., Cheikbossian 2008).

In models à la Besley and Coate (2003) or Dur and Roelfsema (2005), which can be recovered as (two) cases of our framework, a SPNE always exists. We can also show that such an equilibrium exists under a decentralized system when local public investment are strategic complements (but not too complements). For more details, see the additional appendix, which is available upon request.

In this literature, most authors just assume the existence of a (general) Nash equilibrium and few of them have explicitly focused on the existence problem (see, e.g., Laussel and Le Breton 1998; Rothstein 2007). More closely related to the present analysis, Persson and Tabellini (1992) analyze tax competition between two countries and where the policy-maker, in each country, is elected by majority voting. It is thus a two-stage game with strategic delegation effects. However, they implicitly assume the existence of an equilibrium by focusing on the first-order conditions only. This practice is also common in the literature on strategic trade policy with governments choosing (non-cooperatively) their trade policies prior to the time that firms engage in market competition (see, e.g., Brander and Spencer 1985; Eaton and Grossma 1986).

Because of the spillover parameter, there are two levels of effective public good consumption—hence two different CES ‘social composition functions’ – one for each region. For this reason, our model does not belong to the class of “aggregative games”, where each player’s payoff depends on her own action and the same aggregate of all players’ actions (see, Corchón 1994; Cornes and Hartley 2007a, b; and Acemoglu and Jensen 2013).

The denomination of ‘perfect-substitutes’ for \(\sigma =0\) is actually abusive. Indeed, even in this case, one unit of investment abroad does not entail the same marginal benefit than when this unit is provided domestically because of the spillover parameter. So, the adjective ‘perfect’ must be understood as referring to an infinite elasticity of substitution between the two levels of public investments.

Note that (1) is also discontinuous at \(\sigma =1\). This case is excluded from our analysis.

This type of utility function (2), with F(.) being an isoelastic function and G(.) being a CES function, has been used by Ray et al. (2007) to analyze voluntary participation in a joint project with imperfect substitution between individual efforts (but without spillover effects). They focus on how (exogenous) share vectors affect joint surplus. Note also that to save on notations, we will work with the F(.) formulation throughout the text and the appendix.

The proofs of the lemma and propositions are given in the appendix.

See Bulow et al. (1985) for the definition of strategic complementarity or substitutability.

See the Appendix. Multiplicity is also possible for \(\sigma =0\) and \( \sigma \rightarrow +\infty \). In the first case, it happens when there are also ‘perfect spillovers’—i.e. \(\beta =1\)—and when the two representatives have identical preferences—i.e. \(\theta _{A}=\theta _{B}\): there is a continuum of equilibria with the same public good surplus. The latter case corresponds to the ‘weakest-link’ public good game: there is also a continuum of equilibria with varying public good surplus and in which the representatives’ decisions are matched each other.

I am very grateful to the reviewer for pointing out this difficulty.

Gary-Bobo (1989) develops the concept of a kth-order Locally Consistent Equilibrium (k-LCE), which is an imperfectly competitive equilibrium allocation at which firms perceive only a kth-order Taylor expansion of their true demand curves (and therefore of their true profit functions). A 2-LCE is thus a strategy profile for which the first derivative of each player’s payoff function vanishes and the second derivative is negative.

In the proofs of Proposition 1 (for a decentralized system) and 2 (for a centralized system), we assume the existence of a LNSPE and show that, if it the case, this equilibrium is unique and is characterized by the statements given in these two propositions. The proofs of the existence of a LNSPE under decentralization (and under the sufficient condition that \( \sigma \ge \bar{\sigma }\)) and under centralization are given in a separate appendix. In this second appendix, we also show that, in the case of a decentralized system, there exists a SPNE for \(\sigma =0\) and \(\sigma \in \left[ \mu , 1\right) \). This additional appendix is available upon request.

Let \(\Lambda \left( \sigma , \beta \right) \) the term in \(\left[ . \right] \) of (8). We have \(\partial \Lambda \left( \sigma ,\beta \right) /\partial \beta =\mu ^{2}/\left[ \mu \left( 1-\beta \right) +\sigma \beta \right] ^{2}>0\), and \(\partial \Lambda \left( \sigma , \beta \right) /\partial \sigma =-\mu \beta ^{2}/\left[ \mu \left( 1-\beta \right) +\sigma \beta \right] ^{2}\le 0\).

Besley and Coate (2003) first analyze the case where decisions are taken by a minimum coalition of representatives—in fact by one representative in their two-region model. Then, they consider the utilitarian solution, which can be motivated by the ‘universalism’ view in the political science literature on distributive politics. According to this view, the elected representatives develop a norm of reciprocity to overcome the problems associated with minimum coalitions (see, e.g., Weingast 1979; and Shepsle and Weingast 1981). Also, decisions in supranational bodies sometimes require unanimity, thus forcing legislators to cooperate. This is the case in the EU for policies falling under the heading of the second pillar—i.e. common foreign and security policy—and third pillar—i.e. police and judicial cooperation in criminal matters.

The Proof is the same as in Lemma 3. Equilibrium public good levels under centralization are implicitly defined by (13) for \(j=A,B\). Applying the implicit function theorem together with the fact that aggregate payoff given by (12) is strictly concave in \(e_{j}\) (see the Proof of Lemma 4), we have that \(e_{j}\) and \(G_{j}(\mathbf {e)}\) are both increasing in \(\theta _{j} \). It follows that the single-crossing property is satisfied (see the Proof of Lemma 3).

Again, in the proof of this Proposition, we assume the existence of a LNSPE. The proof of the existence of a LNSPE (under the sufficient condition that \(\mu \ge 0.5\)) is given in a separate appendix. In this second appendix, we also state than under a centralized system, there exists a SPNE \(\sigma =0\) and \(\sigma =\mu \). This additional appendix is available upon request.

The sign of \(\partial \tilde{\theta }/\partial \sigma \) is the same as the sign of its numerator, which is given by: \(4\beta \mu \left( 1-\beta \right) \left[ 2\beta -\lambda (1+\beta )\right] m\). This term is negative (respectively positive) for \(\lambda \) larger (respectively lower) than \( \tilde{\lambda }=2\beta /\left( 1+\beta \right) \). The sign of \(\partial \tilde{\theta }/\partial \beta \) is the same as the sign of its numerator, which is given by: \(-4\mu \left[ \mu (1-\lambda )(1-2\beta )+\sigma \lambda +\beta ^{2}\left[ \mu (1-\lambda )-\sigma \left( 2-\lambda \right) \right] \right] m\). This term can be positive or negative depending on the exact values of the triplet \(\left( \sigma , \beta , \lambda \right) \).

In Dur and Roelfsema (2005), the financing rule of a centralized system is summarized by three parameters: the weight of direct tax costs shared among regions through a common budget; the weight of an indirect utility cost; and the weight of the cross-subsidy from one region to the other. They show that the “optimal” cross-subsidy is increasing in the spillover parameter, which amounts to increase the budgetary externality. Since a linear cost-division rule is imposed, we believe that it is more transparent and clear to describe the financing rule of a centralized system by a unique parameter, as in the present framework.

This result is related to that obtained by Buchholz et al. (2005) who show that voters support candidates who are even less green than they are to represent them in the cooperative scenario compared to the isolationist scenario. They also show that in the extreme case of global pollution, elected politicians pay no attention at all to the environment in any scenario. This would correspond to \(\beta =1\) and \(\sigma =0\) in our setup, with no provision of public goods in equilibrium (as under decentralization in this case; see Eq. (10)).

This is consistent with the sufficient condition imposed for the existence of a LNSPE under centralization (see Proposition 2 and the separate appendix). The condition for the existence of a LNSPE is that \( \sigma \ge \bar{\sigma }=\sqrt{5}-2\), which is assumed to hold in this section.

The prevalence of this assumption in the literature is justified to some extent since most centralized systems of government operate (roughly) according to such a rule. Indeed, equal cost sharing is very often a constitutionally imposed arrangement. For example, in most European countries, uniform tax rules are at the core of budgeting institutions (see, e.g., Von Hagen 1992).

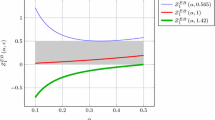

We can also compare the threshold value \(\tilde{\sigma }\) to the sufficient condition used for proving the existence of a LNSPE under a decentralized system (see Proposition 1). In fact, for \(\mu =0.5\), the condition in question is given by \(\sigma \ge \bar{\sigma }=(1/4)\left[ \sqrt{33}-5\right] \simeq 0.19\) (see the separate appendix). Numerically, we have that \(\tilde{\sigma }\le \) \(\bar{\sigma }\) for any \(\beta \gtrsim 0.42\), in which case centralization dominates decentralization under the sufficient (but not necessary) condition for the existence of a LNSPE in a decentralized system.

For example, the utility from public goods in Besley and Coate (2003) is given by (with our notations): \(\theta \left[ \left( 1-\beta \right) \ln (e_{j})+\beta \ln (e_{-j})\right] \). The cross-derivatives with respect to \( e_{j}\) and \(e_{-j}\) are equal to 0, which means that there are no strategic interactions. Again, this corresponds to the special case of \( \sigma =\mu \) in our framework.

With \(\sigma =0\), we indeed have that \(\partial \tilde{e}_{B}/\partial \theta _{A}\) and \(\partial \tilde{e}_{A}/\partial \theta _{A}\) are of opposite signs. This can be seen from equation (55) in the Appendix.

Notice also that \(\sigma \ge \tilde{\sigma }\)—and \(\beta \ge 3-2 \sqrt{2}\)—does not necessarily imply that local public investments must be strategic complements since these two conditions can be satisfied for \( \sigma \le \mu =0.5\).

Indeed, numerical simulations shows that the only exception is for \( \sigma <1\), with the welfare difference being increasing in \(\beta .\)

References

Acemoglu D, Jensen MK (2013) Aggregative comparative statics. Games Econ Behav 81:27–49

Alesina A, Ignazio A, Etro F (2005) International unions. Am Econ Rev 95:602–15

Arce MDG, Sandler T (2001) Transnational public goods: strategies and institutions. Eur J Political Econ 17:493–516

Baicker K (2005) The spillover effects of state spending. J Public Econ 89:529–544

Bayindir-Upmann T, Ziad A (2005) Existence of equilibria in a basic tax-competition model. Reg Sci Urban Econ 35:1–22

Bergstrom TC, Blume L, Varian H (1986) On the private provision of public goods. J Public Econ 29:25–49

Besley T, Coate S (2003) Centralized versus decentralized provision of local public goods: a political economy approach. J Public Econ 87:2611–2637

Bloch F, Zenginobuz U (2007) The effect of spillovers on the provision of local public goods. Rev Econ Des 11:199–216

Bonanno G (1988) Oligopoly equilibria when firms have local knowledge of demand. Int Econ Rev 29:45–55

Brander JA, Spencer B (1985) Export subsidies and international market share rivalry. J Int Econ 18:83–100

Buchholz W, Haupt A, Peters W (2005) International environmental agreements and strategic voting. Scand J Econ 107(1):175–195

Bucovetsky S, Smart M (2006) The efficiency consequences of local revenue equalization: tax competition and tax distortions. J Public Econ Theory 8:119–144

Bulow JL, Geanakoplos JD, Klemperer PD (1985) Multimarket oligopoly: strategic substitutes and complements. J Political Econ 93:488–511

Case AC, Rosen HS, Hines JR (1993) Budget spillovers and fiscal policy interdependence: evidence from the states. J Public Econ 52:285–307

Cheikbossian G (2000) Federalism, distributive politics and representative democracy. Econo Gov 1:105–122

Cheikbossian G (2008) Rent-seeking, spillovers and the benefits of decentralization. J Urban Econ 63:217–228

Corchón L (1994) Comparative statics for aggregative games. The strong concavity case. Math Soc Sci 28:151–165

Cornes RC (1993) Dyke maintenance and other stories: some neglected types of public goods. Q J Econ 107:259–271

Cornes R, Hartley R (2007a) Weak links, good shots and Other public good games: building on BBV. J Public Econ 91:1684–1707

Cornes R, Hartley R (2007b) Aggregative public good games. J Public Econ Theory 9:201–219

Duggan J (2000) Equilibrium equivalence under expected plurality and probability of winning maximization, Working Paper, University of Rochester

Dur R, Roelfsema H (2005) Why does centralization fail to internalize policy externalities. Public Choice 122:395–416

Eaton J, Grossma GM (1986) Optimal trade and industrial policy under oligopoly. Q J Econ 101(2):383–406

Feidler J, Staal K (2012) Centralized and decentralized provision of public goods. Econ Gov 13:73–93

Feld LP, Schaltegger CA, Schnellenbach J (2008) On government centralization and fiscal referendums. Eur Econ Rev 52(4):611–645

Figlio DN, Kolpin VW, Reid WE (1999) Do states play welfare games? J Urban Econ 46:437–454

Foucault M, Madies T, Paty S (2008) Public spending interactions and local politics. Empirical evidence from french municipalities. Public Choice 137:57–80

Gans JS, Smart M (1996) Majority-voting with single-crossing preferences. J Public Econ 59:219–237

Gary-Bobo RJ (1989) Cournot-walras and locally consistent equilibria. J Econ Theory 49:10–32

Hirshleifer J (1983) From weakest-link to best-shot: the voluntary provision of public goods. Public Choice 41:371–386

Laussel D, Le Breton M (1998) Existence of nash equilibria in fiscal competition models. Reg Sci Urban Econ 28:283–296

Lockwood B (2008) Voting, lobbying and the decentralization theorem. Econ Politics 20:416–461

Lorz O, Willmann G (2005) On the endogenous allocation of decision powers in federal structures. J Urban Econ 57:242–257

Lorz O, Willmann G (2013) Sizes versus scope: on the trade-off facing economic union. Int Tax Public Financ 20(2):247–267

Oates WE (1972) Fiscal federalism. Harcourt Bruce Jovanovich, New York

Patty JW (2005) Local equilibrium equivalence in probabilistic voting models. Games Econ Behav 51:523–536

Persson T, Tabellini G (2000) Political economics: explaining economic policy. The MIT Press, Cambridge

Persson T, Tabellini G (1992) The politics of 1992: fiscal policy and European economic integration. Rev Econ Stud 59:689–701

Ray D, Baland JM, Dagnelie O (2007) Inequality and inefficiency in joint projects. Econ J 117:922–935

Redoano M, Scharf KA (2004) The political economy of policy centralization: direct versus representative democracy. J Public Econ 88:799–817

Roelfsema H (2007) Strategic delegation and environmental policy-making. J Environ Econ Manag 53:270–275

Rothstein P (1990) Order restricted preferences and majority rules. Soc Choice Welf 7:331–342

Rothstein P (1991) Representative voter theorem. Public Choice 72:193–212

Rothstein P (2007) Discontinuous payoffs, pure strategy nash equilibrium. J Public Econ Theory 9(2):335–368

Sandler T (1997) Global challenges: an approach to environmental, political, and economic problems. Cambridge University Press, Cambridge

Sandler T (1998) Global and regional public goods: a prognosis for collective action. Fisc Stud 19:221–247

Schofield N (2004) Local political equilibria. In: Austen-Smith D, Duggan J (eds) Social choice and strategic decisions. Springer, Heidelberg

Shepsle K, Weingast B (1981) Political preferences for the pork barrel. Am J Political Sci 25:96–111

Von Hagen J (1992) Budgeting procedures and fiscal performance in the European communities. Commission of the European communities, DG II Economic Papers 96

Weingast B (1979) A rational choice perspective on congressional norms. Am J Political Sci 23:245–262

Author information

Authors and Affiliations

Corresponding author

Additional information

I thank Philippe Mahenc, Lena Panova, Maik Schneider, seminar participants in Montpellier, Strasbourg (BETA) and Zurich (ETH) as well as participants of the European Economic Association annual meeting in Toulouse (EEA 2014) and of the World Congress of the Econometric Society in Montreal (ESWC 2015). I am also very grateful to an anonymous reviewer for helping me to clarify some crucial points and for giving me detailed and very helpful comments on earlier versions.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

1.1 Proof of Lemma 1

The first derivative of \(v_{j}\left( \mathbf {e}\right) \) given by (3) with respect to \(e_{j}\) is given by

From (1), we have that \(\partial G_{j}\left( \mathbf {e}\right) /\partial e_{j}=\left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma }e_{j}^{-\sigma } \), and hence

Now, calculating the derivative of (20) with respect to \(e_{-j}\), we have

which can be rewritten as

Now, let \(\mu \equiv -[F^{^{\prime \prime }}\left( G_{j}\left( \mathbf {e} \right) \right) .G_{j}\left( \mathbf {e}\right) ]/F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \) be the elasticity of the marginal utility for public good consumption and factorizing by \(F^{\prime }\left( G_{j}\right) \), we obtain

We also have \(\partial G_{j}\left( \mathbf {e}\right) /\partial e_{-j}=\beta \left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma }e_{-j}^{-\sigma }\). Hence, (23) can be rewritten as

Therefore, \(\partial ^{2}v_{j}(\mathbf {e)/\partial }e_{j}\mathbf {\partial } e_{-j}\) is positive (respectively negative) and local public investments are strategic complements (respectively substitutes) for \(\sigma \) larger (respectively lower) than \(\mu \).

1.2 Proof of Lemma 2

(i) Existence We first show that the game of public good provision admits a pure strategy Nash equilibrium. First, each region’s representative can at most invest its private endowment, y, in the public good so that the strategy space of each representative is a compact interval, \(S=[0,y]\). We now show that the maximization problem of each representative is strictly concave. Using (19), the second derivative of \(v_{j}(\mathbf {e)}\) with respect to \(e_{j}\) is given by

The first term in \(\left\{ .\right\} \) is negative since \(F^{\prime \prime }\left( .\right) <0\). The sign of the second term is the same as the sign of \(\partial ^{2}G_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}\) since \( F^{\prime }\left( .\right) >0\). We have \(\partial G_{j}\left( \mathbf {e} \right) /\partial e_{j}=\left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma }e_{j}^{-\sigma }\) and hence

Again, \(\partial G_{j}\left( \mathbf {e}\right) /\partial e_{j}=\left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma }e_{j}^{-\sigma }\), so that (26) can be rewritten as follows

This (second) derivative is strictly negative since \(\left[ G_{j}\left( \mathbf {e}\right) \right] ^{1-\sigma }e_{j}^{-(1-\sigma )}=1+\beta (e_{-j}/e_{j})^{1-\sigma }>1\). It follows that \(\partial ^{2}v_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}\) given by (25) is strictly negative. Specifically (and for future use), substituting \(\partial ^{2}G_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}=-\sigma \beta \left[ G_{j}\left( \mathbf {e}\right) \right] ^{2\sigma -1}e_{j}^{-2\sigma }(e_{-j}/e_{j})^{1-\sigma }\) into (25) yields

Factorizing by \(F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \left[ G_{j}\left( \mathbf {e}\right) \right] ^{2\sigma -1}e_{j}^{-2\sigma }\) and using \(\mu =-[F^{^{\prime \prime }}\left( G_{j}\left( \mathbf {e}\right) \right) .G_{j}\left( \mathbf {e}\right) ]/F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \), (28) can be rewritten as

As a result \(v_{j}\left( \mathbf {e}\right) \) is strictly concave and continuous in \(e_{j}\) for \(\sigma \in \left[ 0,1\right) \) or \(\sigma \in (1,+\infty )\), which guarantees the existence of a pure strategy Nash equilibrium. In this equilibrium, the first-order condition given by (4) is both necessary and sufficient for characterizing the best-response function of region j’s representative.

(ii) Uniqueness We first observe that there does not exist an equilibrium in which for one region a corner solution at zero public investments is obtained while an interior solution holds for the other region for any \(\sigma \in \left\{ \left[ 0,1\right) \cup (1,+\infty )\right\} \). First, for \(\sigma \in \left[ 0,1\right) \), the first-order condition (4) cannot be satisfied for \(e_{j}=0\) and \(e_{-j}>0\) because in that case \(G_{j}\left( \mathbf {e}\right) >0\) and the left-hand term of (4) approaches infinity. Second, if \(\sigma \in (1,+\infty )\) and \(e_{j}=0\) then, as mentioned in the text, we take the limit of (1), i.e. \(G_{j}\left( \mathbf {e}\right) =0\) and \(G_{-j}\left( \mathbf {e}\right) =0\). Hence, \(v_{-j}\left( \mathbf {e}\right) \) is strictly decreasing in \(e_{-j}\), and so \(e_{j}=0\) and \(e_{-j}=0\) are mutually best responses.

Next, we show that there exists a unique equilibrium with \(e_{j}^{*}>0\), for \(j=A,B\), when local public investments are strategic substitutes—i.e. \(\sigma \in \left[ 0,\mu \right) \)—and when they are strategic complements—i.e. \(\sigma \in (\mu ,+\infty )\). For \(\sigma \in \left[ 0,\mu \right) \), the proof proceeds by contradiction (in the spirit of Bloch and Zenginobuz 2007). Suppose that there exists two distinct equilibria \( \mathbf {e\equiv }\left( e_{j},e_{-j}\right) \in \mathfrak {R}_{+}^{*2}\) and \( \mathbf {e}^{\prime }\mathbf {\equiv }\left( e_{j}^{\prime },e_{-j}^{\prime }\right) \in \mathfrak {R}_{+}^{*2}\). Suppose further, without loss of generality, that \(e_{j}^{\prime }<e_{j}\). We first show that this implies \( G_{j}\left( \mathbf {e}^{\prime }\right) >G_{j}\left( \mathbf {e}\right) \). From the first-order condition (4), we have \(\theta _{j}F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma }=e_{j}^{\sigma }\). The right-hand term (RHT) is lower with \(e_{j}^{\prime }\) than with \(e_{j}\), which implies that the left-hand term (LHT) must also be lower with \(e_{j}^{\prime }\). The derivative of this term with respect to \(G_{j}\left( \mathbf {e}\right) \) is given by \(\partial \left( LHT\right) /\partial G_{j}\left( \mathbf {e}\right) =\theta _{j}F^{\prime \prime }\left( G_{j}\left( \mathbf {e}\right) \right) \left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma }+\sigma \theta _{j}F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \left[ G_{j}\left( \mathbf {e} \right) \right] ^{\sigma -1}\). This can be rewritten as \(\partial \left( LHT\right) /\partial G_{j}\left( \mathbf {e}\right) =\theta _{j}\left[ G_{j}\left( \mathbf {e}\right) \right] ^{\sigma -1}F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \left[ \sigma -\mu \right] \), which is negative for \(\sigma <\mu \) (so that the LHT is decreasing in \(G_{j}\left( \mathbf {e}\right) \)). Hence, we must have \(G_{j}\left( \mathbf {e}^{\prime }\right) >G_{j}\left( \mathbf {e}\right) \) for satisfying the first-order condition in region j when \(e_{j}^{\prime }<e_{j}\). However, \(G_{j}\left( \mathbf {e}^{\prime }\right) >G_{j}\left( \mathbf {e}\right) \) and \( e_{j}^{\prime }<e_{j}\) necessarily imply \(e_{-j}^{\prime }>e_{-j}\) and \( G_{-j}\left( \mathbf {e}^{\prime }\right) >G_{-j}\left( \mathbf {e}\right) \). But for region \(-j\), the RHT of the first-order condition is (also) increasing in \(e_{-j}\) and the LHT is (also) decreasing \(G_{-j}\left( \mathbf {e}\right) \). Therefore, one cannot have another equilibrium \(\mathbf { e}^{\prime }\ne \mathbf {e}\), which satisfies the two first-order conditions. To summarize, there is a unique equilibrium which involves \( e_{A}^{*}>0\) and \(e_{B}^{*}>0\) for \(\sigma \in \left[ 0,\mu \right) \) .

Suppose now that \(\sigma \in (\mu ,+\infty )\). In an interior equilibrium, public good provision is still characterized by the first-order condition (4) with equality. This equation implicitly defines \(e_{j}=\varphi \left( \theta _{j},e_{-j}\right) \). By the implicit function theorem, \(\varphi (.)\) is continuous and furthermore \(\partial e_{j}/\partial e_{-j}=-\left[ \partial ^{2}v_{j}\left( \mathbf {e}\right) \mathbf {/}\partial e_{j}\partial e_{-j}\right] /[\partial ^{2}v_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}]\), with \(\partial ^{2}v_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}\) being strictly negative (from Lemma 2). Using (24) and (29), we have

which is positive for \(\sigma >\mu \) (and negative for \(\sigma <\mu \)). When \(\sigma >\mu \), one can also observe that \(\partial ^{2}e_{j}/\partial e_{-j}^{2}<0\), so that best-response functions are increasing at a decreasing rate. We also have that \(\left( \partial e_{j}/\partial e_{-j}\right) _{\left| e_{-j}\rightarrow 0\right. }=+\infty \), which means that near the origin, each best-response function must be on the upper side of the \(45{{}^\circ }\) line. At the other extreme, we have \(\left( \partial e_{j}/\partial e_{-j}\right) _{\left| e_{-j}\rightarrow +\infty \right. }=0\), so that each best-response function must cross the \(45{{}^\circ }\) line. Since its slope is always decreasing, each best-response function crosses the \(45{{}^\circ }\) line only once. There is thus a unique equilibrium which involves \( e_{A}^{*}>0\) and \(e_{B}^{*}>0\) for \(\sigma \in (\mu ,+\infty )\).

For \(\sigma =\mu \)—which corresponds to the analysis of Besley and Coate (2003)—there is a unique equilibrium in dominant strategies, and best-response functions are two straight lines with 0 slope.

1.3 Proof of Lemma 3

We first show that \(e_{j}\) and \(G_{j}\left( \mathbf {e}\right) \) are increasing in \(\theta _{j}\). Equilibrium public good provision is characterized by the first-order condition (4). Again, this equation implicitly defines \(e_{j}=\varphi \left( \theta _{j},e_{-j}\right) \). By the implicit function theorem, \(\partial e_{j}/\partial \theta _{j}=-\left[ \partial ^{2}v_{j}\left( \mathbf {e}\right) \mathbf {/}\partial e_{j}\mathbf { \partial }\theta _{j}\right] /[\partial ^{2}v_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}]\). Using (20), we have \(\partial ^{2}v_{j}\left( \mathbf { e}\right) \mathbf {/}\partial e_{j}\mathbf {\partial }\theta _{j}=F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \left[ G_{j}\left( \mathbf {e} \right) \right] ^{\sigma }e_{j}^{-\sigma }>0\). Again, we also have \(\partial ^{2}v_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}<0\) (Lemma 2). It follows that \(\partial e_{j}/\partial \theta _{j}>0\). This also implies that \(\partial G_{j}\left( \mathbf {e}\right) /\partial \theta _{j}>0\) since \( G_{j}\left( \mathbf {e}\right) \) is increasing in \(e_{j}\).

Next suppose that \(\theta ^{\prime }>\theta \) and \(\theta _{j}>\theta _{j}^{^{\prime }}\). The inequality \(w_{j}(\theta ,\theta _{j},\theta _{-j} \mathbf {)}\ge w_{j}(\theta ,\theta _{j}^{\prime },\theta _{-j}\mathbf {)}\) can be rewritten as \(\theta \left[ F\left( G_{j}\left( \theta _{j},\theta _{-j}\right) \right) -F(G_{j}(\theta _{j}^{\prime },\theta _{-j}))\right] \ge e_{j}\left( \theta _{j},\theta _{-j}\right) -e_{j}(\theta _{j}^{\prime },\theta _{-j})\). The right-hand term and the term in \(\left[ .\right] \) in the left-hand side are both strictly positive (since F(.) is also an increasing function). So, if this inequality is verified for a type \(\theta \) citizen in region j, it is also obviously verified for a type \(\theta ^{\prime }\) citizen with \(\theta ^{\prime }>\theta \), i.e., \(w_{j}(\theta ^{\prime },\theta _{j},\theta _{-j}\mathbf {)}\ge w_{j}(\theta ^{\prime },\theta _{j}^{\prime },\theta _{-j}\mathbf {)}\). Suppose now that \(\theta ^{\prime }<\theta \) and \(\theta _{j}<\theta _{j}^{^{\prime }}\). The inequality \(w_{j}(\theta ,\theta _{j},\theta _{-j}\mathbf {)}\ge w_{j}(\theta ,\theta _{j}^{\prime },\theta _{-j}\mathbf {)}\) can be rewritten as \(\theta \left[ F(G_{j}(\theta _{j}^{\prime },\theta _{-j}))-F\left( G_{j}\left( \theta _{j},\theta _{-j}\right) \right) \right] \le e_{j}(\theta _{j}^{\prime },\theta _{-j})-e_{j}(\theta _{j},\theta _{-j})\). Again, the right-hand term and the term in \(\left[ .\right] \) in the left-hand side are both strictly positive. So if this inequality is verified for a type \(\theta \) citizen in region j, it is also obviously verified for a type \(\theta ^{\prime }\) citizen with \(\theta ^{\prime }<\theta \), i.e., \(w_{j}(\theta ^{\prime },\theta _{j},\theta _{-j}\mathbf {)}\ge w_{j}(\theta ^{\prime },\theta _{j}^{\prime },\theta _{-j}\mathbf {)}\).

1.4 Proof of Proposition 1

Here, we just assume the existence of a LNSPE (under the sufficient condition that \(\sigma \ge \bar{\sigma }\)) and characterize the properties of this equilibrium. We also show that if a symmetric LNSPE exists, then this equilibrium is unique. The proof of the existence of such an equilibrium under decentralization is given in a separate appendix. In this second appendix, we also show that, in the case of a decentralized system, there exists a SPNE for \(\sigma =0\) and \(\sigma \in \left[ \mu ,1\right) \). This additional appendix is available upon request.

(i) in a LNSPE, the preferred representative of region j’s median voter is given by the first-order condition (6). We first derive the expression for \(\partial e_{-j}^{*}/\partial \theta _{j}\). For expositional convenience only let \(j\equiv A\) and \(-j\equiv B\), so that we first determine \(\partial e_{-B}^{*}/\partial \theta _{A}\). Using (4), \(e_{B}^{*}\) must satisfy

Differentiating this expression with respect to \(\theta _{A}\) yields

Factorizing by \(\theta _{B}e_{B}^{*-\sigma -1}\left[ G_{B}\left( \mathbf { e}^{*}\right) \right] ^{\sigma -1}\), the equality (32) reduces to

Now, factorizing by \(F^{\prime }\left( G_{B}\left( \mathbf {e}^{*}\right) \right) \) and use \(\mu =-[F^{^{\prime \prime }}\left( G_{j}\left( \mathbf {e} \right) \right) .G_{j}\left( \mathbf {e}\right) ]/F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \), then the equality (33) reduces to

We also have \(G_{B}\left( \mathbf {e}^{*}\right) =\left[ e_{B}^{*1-\sigma }+\beta e_{A}^{*1-\sigma }\right] ^{\frac{1}{1-\sigma }}\) and hence

Substituting this expression into (34), we have

Factorizing by \(\left[ G_{B}\left( \mathbf {e}^{*}\right) \right] ^{\sigma }\) and observing that \(\left[ G_{B}\left( \mathbf {e}^{*}\right) \right] ^{1-\sigma }=\left[ e_{B}^{*1-\sigma }+\beta e_{A}^{*1-\sigma }\right] \), the equality (36) reduces to

This implies

Now, assuming that the median voters in both regions have the same taste parameter m , this implies that \(\theta _{A}=\theta _{B}=\theta \) and \(e_{A}^{*}=e_{B}^{*}=e^{*}\). In a symmetric equilibrium, (38) then reduces to

Substituting into the first-order condition (6) then yields

The solution of this equation is thus given by (7) in Proposition 1.

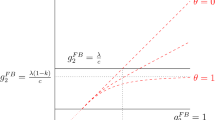

(ii) We have \(\theta ^{*}\gtreqqless m\), if \(\left( 1+\beta \right) \left[ \mu \left( 1-\beta \right) +\sigma \beta \right] \gtreqqless \mu +\sigma \beta \), which reduces to \(\beta ^{2}(\sigma -\mu )\gtreqqless 0\) or \(\sigma \gtreqqless \mu \).

1.5 Proof of Lemma 4

We show that aggregated payoff given by (12) is strictly concave, so that a unique solutions results. From Lemma 2—Equation (29)—we have that \(\partial ^{2}v_{j}\left( \mathbf {e}\right) /\partial e_{j}^{2}<0\). It is then sufficient to show that \(\partial ^{2}v_{-j}\left( \mathbf {e}\right) /\partial e_{j}^{2}<0\). We have

Now, calculating the second derivative of \(v_{-j}(\mathbf {e)}\) with respect to \(e_{j}\), we obtain

The first term in \(\left\{ .\right\} \) is negative since \(F^{\prime \prime }\left( .\right) <0\). The sign of the second term in \(\left\{ .\right\} \) is the same as the sign of \(\partial ^{2}G_{-j}\left( \mathbf {e}\right) /\partial e_{j}^{2}\) since \(F^{\prime }\left( .\right) >0\). We have \(\partial G_{-j}\left( \mathbf {e}\right) /\partial e_{j}=\beta \left[ G_{-j}\left( \mathbf {e}\right) \right] ^{\sigma }e_{j}^{-\sigma }\), and hence

Again, \(\partial G_{-j}\left( \mathbf {e}\right) /\partial e_{j}=\beta \left[ G_{-j}\left( \mathbf {e}\right) \right] ^{\sigma }e_{j}^{-\sigma }\) so that (43) can be rewritten as follows

which is strictly negative since \(\left[ G_{-j}\left( \mathbf {e}\right) \right] ^{1-\sigma }e_{j}^{-(1-\sigma )}=\beta +(e_{-j}/e_{j})^{1-\sigma }>\beta \). It follows that \(\partial ^{2}v_{-j}\left( \mathbf {e}\right) /\partial e_{j}^{2}<0\). Together with Lemma 2, we have that \(v_{j}\left( \mathbf {e}\right) +v_{-j}\left( \mathbf {e}\right) \) is strictly concave in \( e_{j}\). There is thus a unique solution which is given by the (necessary and sufficient) first-order condition (13).

1.6 Proof of Proposition 2

Again for this proof, we just assume the existence of a LNSPE (under the sufficient condition that \(\mu \ge 0.5\)) and characterize the properties of this equilibrium. The proof of existence of such an equilibrium under centralization is given in a separate appendix, which is available upon request.

In a LNSPE, the preferred representative of region j’s median voter is given by the first-order condition (14). We then need to derive the expression of \(\partial \tilde{e}_{-j}/\partial \theta _{j}\). Again, for expositional convenience only, we derive the outcome of the delegation stage for region A keeping in mind that the same reasoning will apply for region B. Hence, we first characterize \(\partial \tilde{e}_{B}/\partial \theta _{A}\).

Using (13), \(\tilde{e}_{A}\) and \(\tilde{e}_{B}\) are such that

We then obtain

Substituting into (13)—with \(j\equiv B\) and \(-j\equiv A\)—and simplifying, we have

Differentiating this expression with respect to \(\theta _{A}\) yields

We also have

Substituting into (48) and factorizing by \(\left[ G_{B}\left( {\tilde{\mathbf{e}}}\right) \right] ^{2\sigma -1}\), we have

Now, factorizing by \(F^{\prime }\left( G_{B}\left( {\tilde{\mathbf{e}}}\right) \right) \) and using \(\mu =-[F^{^{\prime \prime }}\left( G_{j}\left( \mathbf { e}\right) \right) .G_{j}\left( \mathbf {e}\right) ]/F^{\prime }\left( G_{j}\left( \mathbf {e}\right) \right) \) gives

Now, using (47), we have

Observing that \(\left[ G_{B}\left( {\tilde{\mathbf{e}}}\right) \right] ^{\sigma -1}=1/\left[ \tilde{e}_{B}^{1-\sigma }+\beta \tilde{e} _{A}^{1-\sigma }\right] \), we have

We then have

As for the decentralization system, we focus on a symmetric equilibrium i.e. \(m_{A}=m_{B}=m\), which implies \(\theta _{A}=\theta _{B}=\theta \) and \( \tilde{e}_{A}=\tilde{e}_{B}=\tilde{e}\). The above expression then reduces to

In addition, from (13), we also have in a symmetric equilibrium \(F^{\prime }\left( G\left( {\tilde{\mathbf{e}}}\right) \right) \left[ G\left( {\tilde{\mathbf{e}}}\right) \right] ^{\sigma }\tilde{e}^{-\sigma }=1/\left[ \theta \left( 1+\beta \right) \right] \). Substituting this last expression into (14) (with \(m_{j}=m\)) yields

Finally, substituting (55) into (56) yields

The solution of this equation in \(\theta \) is thus given by (15) in Proposition 2.

(ii) It is immediately verified that \(\tilde{\theta }\gtreqqless m\) if \( \lambda \gtreqqless \tilde{\lambda }\) with \(\tilde{\lambda }\equiv 2\beta /\left( 1+\beta \right) \).

1.7 Welfare under decentralization and centralization

From (4) with \(F(G)=G^{1-\mu }\), we can obtain the level of public investment in each region in the symmetric equilibrium of a decentralized system, that is \(e^{*}=\left[ \theta ^{*}\left( 1-\mu \right) \left( 1+\beta \right) ^{\frac{\sigma -\mu }{1-\sigma }}\right] ^{\frac{1}{\mu }}\). Substituting (7) into this expression, we then obtain

We then obtain the following level of welfare for the median voter under a decentralized system,

Assuming that \(\mu =0.5\), we obtain (17) in the text.

Using (13) with \(F(G)=G^{1-\mu }\), we obtain the level of public investment in each region in the symmetric equilibrium of a centralized system, that is \(\tilde{e}=\left[ \tilde{\theta }\left( 1-\mu \right) \left( 1+\beta \right) ^{\frac{1-\mu }{1-\sigma }}\right] ^{\frac{1}{\mu }}\). Using (15), we then have

We then obtain the following level of welfare for the median voter under a centralized system.

Assuming that \(\mu =0.5\), we obtain (18) in the text.

1.8 Proof of Proposition 3

(i) When \(\lambda =0\), we have under a centralized system

while for \(\lambda =1\), we have

The welfare of each region under a decentralized system is still given by (17).

Hence, when \(\lambda =0\), the welfare difference between a centralized and a decentralized system is given by

This expression is clearly positive for any \(\sigma \in \left\{ \left[ 0,1\right) \cup (1,+\infty )\right\} \) and \(\beta \in \left[ 0,1\right] \).

When \(\lambda =1\), the welfare difference between a centralized and a decentralized system is given by

The sign of \(\tilde{\upsilon }_{\left| \lambda =1\right. }-\upsilon ^{*}\) is the same as the sign of

which is quadratic in \(\sigma \). Thus \(\Gamma \left( \sigma ,\beta \right) =0 \) has two solutions given by

Clearly, \(\hat{\sigma }\) is negative while \(\tilde{\sigma }\) is positive if only if \(6\beta -\beta ^{2}-1\ge 0\) or \(\beta \ge 3-2\sqrt{2}\).

Furthermore, the second derivative of \(\Gamma \left( \sigma ,\beta \right) \) with respect to \(\sigma \) is also positive if \(\beta \ge 3-2\sqrt{2}\) and negative if \(\beta \le 3-2\sqrt{2}\). Then, for \(\beta \le 3-2\sqrt{2}\), \(\Gamma \left( \sigma ,\beta \right) \) reaches a global maximum and furthermore \(0\ge \tilde{\sigma }\ge \hat{\sigma }\), which necessarily implies that \(\Gamma \left( \sigma ,\beta \right) <0\) for any \(\sigma \ge 0 \). When \(\beta \ge 3-2\sqrt{2}\), \(\Gamma \left( \sigma ,\beta \right) \) reaches a global minimum and hence \(\Gamma \left( \sigma ,\beta \right) \) is positive only if \(\sigma \ge \tilde{\sigma }\ge 0\ge \hat{\sigma }\).

Rights and permissions

About this article

Cite this article

Cheikbossian, G. The political economy of (De)centralization with complementary public goods. Soc Choice Welf 47, 315–348 (2016). https://doi.org/10.1007/s00355-016-0962-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-016-0962-3