Abstract

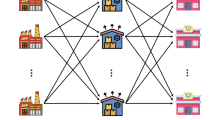

This paper investigates a newsvendor problem for fresh produce with put option contracts, in which the stochastic demand is price sensitive. The newsvendor can obtain products by ordering from a firm and return unsold products by purchasing and exercising put options. The fresh produce incurs a circulation loss in quantity during its transportation. The optimal joint order and pricing decisions for the newsvendor are analytically derived in the presence of put option contracts and circulation loss. Moreover, combined with numerical analysis, the optimal order quantity and selling price of the newsvendor are found to decrease with option price, but increase with exercise price and circulation loss, whereas the maximum expected profit is found to decrease with option price and circulation loss, but increase with exercise price. Furthermore, the newsvendor with put option contracts can deal with the risks that caused by demand uncertainty and high circulation loss of fresh produce.

Similar content being viewed by others

References

Akkerman R, Farahani P and Grunow M (2010). Quality, safety and sustainability in food distribution: a review of quantitative operations management approaches and challenges. OR Spectrum 32(4):863–904.

Bagnoli M and Bergstrom T (2005). Log-concave probability and its applications. Economic Theory 26(2):445–469.

Bai R, Burke EK and Kendall G (2008). Heuristic, meta-heuristic and hyper-heuristic approaches for fresh produce inventory control and shelf space allocation. Journal of the Operational Research Society 59(10):1387–1397.

Barnes-Schuster D, Bassok Y and Anupindi R (2002). Coordination and flexibility in supply contracts with options. Manufacturing & Service Operations Management 4(3):171–207.

Cachon GP (2003). Supply chain coordination with contracts. Handbooks in Operations Research and Management Science 11(1):227–339.

Cai X, Chen J, Xiao Y and Xu X (2010). Optimization and coordination of fresh product supply chains with freshness-keeping effort. Production and Operations Management 19(3):261–278.

Chen F and Parlar M (2007). Value of a put option to the risk-averse newsvendor. IIE Transactions 39(5):481–500.

Chen X, Hao G and Li L (2014). Channel coordination with a loss-averse newsvendor and option contracts. International Journal of Production Economics 150(1):52–57.

Chen X and Shen ZJ (2012). An analysis of a supply chain with options contracts and service requirements. IIE Transactions 44(10):805–819.

Chen X and Wang X (2015). Free or bundled: channel selection decisions under different power structures. Omega-International Journal of Management Science 53(1):11–20.

Chen X, Wang X and Jiang X (2016). The impact of power structure on the retail service supply chain with an O2O mixed channel. Journal of the Operational Research Society 67(2):294–301.

Fu Q, Zhou SX, Chao X and Lee CY (2012). Combined pricing and portfolio option procurement. Production and Operations Management 21(2):361–377.

Hu F, Lim CC and Lu Z (2014). Optimal production and procurement decisions in a supply chain with an option contract and partial backordering under uncertainties. Applied Mathematics and Computation 232(1), 1225–1234.

Hua Z, Li S and Liang L (2006). Impact of demand uncertainty on supply chain cooperation of single-period products. International Journal of Production Economics 100(2):268–284.

Lee CY, Li X and Xie Y (2013). Procurement risk management using capacitated option contracts with fixed ordering costs. IIE Transactions 45(8):845–864.

Liang L, Wang X and Gao J (2012). An option contract pricing model of relief material supply chain. Omega-International Journal of Management Science 40(5):594–600.

Liu C, Jiang Z, Liu L and Geng N (2013). Solutions for flexible container leasing contracts with options under capacity and order constraints. International Journal of Production Economics 141(1):403–413.

Liu G, Zhang J and Tang W (2015). Joint dynamic pricing and investment strategy for perishable foods with price-quality dependent demand. Annals of Operations Research 226(1):397–416.

Lowe TJ and Preckel PV (2004). Decision technologies for agribusiness problems: A brief review of selected literature and a call for research. Manufacturing & Service Operations Management 6(3):201–208.

Luo J and Chen X (2015). Risk hedging via option contracts in a random yield supply chain. Annals of Operations Research. doi:10.1007/s10479-015-1964-8.

Marzban S, Mahootchi M and Khamseh AA (2015). Developing a multi-period robust optimization model considering American style options. Annals of Operations Research 233(1):305–320.

Merzifonluoglu Y (2017). Integrated demand and procurement portfolio management with spot market volatility and option contracts. European Journal of Operational Research 258(1):181–192.

Mills ES (1959). Uncertainty and price theory. The Quarterly Journal of Economics 73(1):116–130.

Milner JM and Rosenblatt MJ (2002). Flexible supply contracts for short life-cycle goods: The buyer’s perspective. Naval Research Logistics 49(1):25–45.

Nagali V, Hwang J, Sanghera D, Gaskins M, Pridgen M, Thurston T, Mackenroth P, Branvold D, Scholler P and Shoemaker G (2008). Procurement risk management (PRM) at Hewlett-Packard company. Interfaces 38(1):51–60.

National Bureau of Statistics of China (2014). National data 2013. Available at: http://data.stats.gov.cn/english/easyquery.htm?cn=C01.

Nosoohi I and Nookabadi AS (2014). Designing a supply contract to coordinate supplier’s production, considering customer oriented production. Computers & Industrial Engineering 74(1):26–36.

Nosoohi I and Nookabadi AS (2016). Outsource planning through option contracts with demand and cost uncertainty. European Journal of Operational Research 250(1):131–142.

Petruzzi NC and Dada M (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research 47(2):183–194.

Qin Y, Wang J and Wei C (2014). Joint pricing and inventory control for fresh produce and foods with quality and physical quantity deteriorating simultaneously. International Journal of Production Economics 152(1):42–48.

Shukla M and Jharkharia S (2013). Agri-fresh produce supply chain management: A state-of-the-art literature review. International Journal of Operations and Production Management 33(2):114–158.

Soto-Silva WE, Nadal-Roig E, González-Araya MC and Pla-Aragones LM (2016). Operational research models applied to the fresh fruit supply chain. European Journal of Operational Research 251(2):345–355.

Treville S, Schürhoff N, Trigeorgis L and Avanzi B (2014). Optimal sourcing and lead‐time reduction under evolutionary demand risk. Production and Operations Management 23(12):2103–2117.

Wang C and Chen X (2013). Option contracts in fresh produce supply chain with circulation loss. Journal of Industrial Engineering and Management 6(1):104–112.

Wang C and Chen X (2015). Optimal ordering policy for a price-setting newsvendor with option contracts under demand uncertainty. International Journal of Production Research 53(20):6279–6293.

Wang C and Chen X (2017). Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Annals of Operations Research 248(1):471–491.

Wang Q and Tsao DB (2006). Supply contract with bidirectional options: the buyer’s perspective. International Journal of Production Economics 101(1):30–52.

Wu DJ and Kleindorfer PR (2005). Competitive options, supply contracting, and electronic markets. Management Science 51(3):452–466.

Wu Q, Mu Y and Feng Y (2015). Coordinating contracts for fresh product outsourcing logistics channels with power structures. International Journal of Production Economics 160(1):94–105.

Xiao Y and Chen J (2012). Supply chain management of fresh products with producer transportation. Decision Sciences 43(5):785–815.

Xue W, Ma L and Shen H (2015). Optimal inventory and hedging decisions with CVaR consideration. International Journal of Production Economics 162(1):70–82.

Acknowledgements

The authors are supported by the National Natural Science Foundation of China (Nos. 71272128, 71432003, 71602134, 91646109) and the National Social Science Foundation of China (No. 15ZDB169).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix: Proof of Lemma 1

When \( p_{0} \) is given, \( E\left[ {\pi \left( {z_{0} } \right)} \right] = \left[ {p_{0} \left( {1 - \beta } \right) - w_{1} } \right]\frac{{y\left( {p_{0} } \right) + \mu }}{1 - \beta } - w_{1} \frac{{\varLambda \left( {z_{0} } \right)}}{1 - \beta } - \left[ {\left( {p_{0} + g} \right)\left( {1 - \beta } \right) - w_{1} } \right]\frac{{\varTheta \left( {z_{0} } \right)}}{1 - \beta } \). As \( \frac{{{\text{d}}E\left[ {\pi \left( {z_{0} } \right)} \right]}}{{{\text{d}}z_{0} }} = - w_{1} + (p_{0} + g)\left( {1 - \beta } \right)\left\{ {1 - F\left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\} \) and \( \frac{{{\text{d}}^{2} E\left[ {\pi \left( {z_{0} } \right)} \right]}}{{{\text{d}}z_{0}^{2} }} = - \left( {p_{0} + g} \right)\left( {1 - \beta } \right)^{2} f\left[ {z_{0} \left( {1 - \beta } \right)} \right] < 0 \), \( E\left[ {\pi \left( {z_{0} } \right)} \right] \) is concave in \( z_{0} \). Thus, the unique optimal \( z_{0}^{*} \) is set by \( \frac{{{\text{d}}E\left[ {\pi \left( {z_{0} } \right)} \right]}}{{{\text{d}}z_{0} }} = 0 \), that is, \( z_{0}^{*} \) is the unique \( z_{0} \) in the region \( \left[ {A,B} \right] \) that satisfies \( \left( {p_{0} + g} \right)\left( {1 - \beta } \right)\left\{ {1 - F\left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\} = w_{1} \), and \( q_{0}^{*} = \frac{{y\left( {p_{0} } \right)}}{1 - \beta } + z_{0}^{*} \).

When \( z_{0} \) is given, \( E\left[ {\pi \left( {p_{0} } \right)} \right] = \left[ {p_{0} \left( {1 - \beta } \right) - w_{1} } \right]\frac{{y\left( {p_{0} } \right) + \mu }}{1 - \beta } - w_{1} \frac{{\varLambda \left( {z_{0} } \right)}}{1 - \beta } - \left[ {\left( {p_{0} + g} \right)\left( {1 - \beta } \right) - w_{1} } \right]\frac{{\varTheta \left( {z_{0} } \right)}}{1 - \beta } \). As \( \frac{{{\text{d}}E\left[ {\pi \left( {p_{0} } \right)} \right]}}{{{\text{d}}p_{0} }} = 2b\left( {\bar{p}_{0} - p_{0} } \right) - \varTheta \left( {z_{0} } \right) \) and \( \frac{{{\text{d}}^{2} E\left[ {\pi \left( {p_{0} } \right)} \right]}}{{{\text{d}}p_{0}^{2} }} = - 2b < 0 \), \( E\left[ {\pi \left( {p_{0} } \right)} \right] \) is concave in \( p_{0} \). Thus, the optimal \( p_{0}^{*} \) is set by \( \frac{{{\text{d}}E\left[ {\pi \left( {p_{0} } \right)} \right]}}{{{\text{d}}p_{0} }} = 0 \). We then have \( p_{0}^{*} = \bar{p}_{0} - \frac{{\varTheta \left( {z_{0} } \right)}}{2b} \), where \( \bar{p}_{0} = \frac{{a + \frac{{bw_{1} }}{1 - \beta } + \mu }}{2b} \).

Proof of Proposition 1

We obtain \( \frac{{{\text{dE}}\left[ {\pi (z_{0} ,p_{0} (z_{0} ))} \right]}}{{{\text{d}}z_{0} }} = - w_{1} + \left( {\bar{p}_{0} - \frac{{\varTheta \left( {z_{0} } \right)}}{2b} + g} \right)\left( {1 - \beta } \right)\left\{ {1 - F\left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\} \) by substituting \( p_{0}^{*} \equiv p_{0} \left( {z_{0} } \right) \) into \( E\left[ {\pi (z_{0} ,p_{0} )} \right] \). Let \( R\left( {z_{0} } \right) = \frac{{{\text{dE}}\left[ {\pi (z_{0} ,p_{0} (z_{0} ))} \right]}}{{{\text{d}}z_{0} }} \). Then, \( \frac{{{\text{d}}R\left( {z_{0} } \right)}}{{{\text{d}}z_{0} }} = - \left( {1 - \beta } \right)^{2} \frac{{f\left[ {z_{0} \left( {1 - \beta } \right)} \right]}}{2b}\left\{ {2b\left( {\bar{p}_{0} + g} \right) - \varTheta \left( {z_{0} } \right) - \frac{{1 - F\left[ {z_{0} \left( {1 - \beta } \right)} \right]}}{{r\left[ {z_{0} \left( {1 - \beta } \right)} \right]}}} \right\} \) and \( \frac{{{\text{d}}^{2} R\left( {z_{0} } \right)}}{{{\text{d}}z_{0}^{2} }} = \frac{{{\text{d}}R\left( {z_{0} } \right)/{\text{d}}z_{0} }}{{f\left[ {z_{0} \left( {1 - \beta } \right)} \right]}} \cdot \frac{{{\text{d}}f\left[ {z_{0} \left( {1 - \beta } \right)} \right]}}{{{\text{d}}z_{0} }} - \left( {1 - \beta } \right)^{3} \frac{{f\left[ {z_{0} \left( {1 - \beta } \right)} \right]\left\{ {1 - F\left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\}}}{{2br\left[ {z_{0} \left( {1 - \beta } \right)} \right]^{2} }}\left\{ {2r\left[ {z_{0} \left( {1 - \beta } \right)} \right]^{2} + r^{'} \left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\} \). Thus, we have \( \left. {\frac{{{\text{d}}^{2} R\left( {z_{0} } \right)}}{{{\text{d}}z_{0}^{2} }}} \right|_{{\frac{{{\text{d}}R\left( {z_{0} } \right)}}{{{\text{d}}z_{0} }} = 0}} = - \left( {1 - \beta } \right)^{3} \frac{{f\left[ {z_{0} \left( {1 - \beta } \right)} \right]\left\{ {1 - F\left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\}}}{{2br\left[ {z_{0} \left( {1 - \beta } \right)} \right]^{2} }}\left\{ {2r\left[ {z_{0} \left( {1 - \beta } \right)} \right]^{2} + r^{'} \left[ {z_{0} \left( {1 - \beta } \right)} \right]} \right\} \).

As \( F\left( \cdot \right) \) has an increasing failure rate, \( 2r\left[ {z_{0} \left( {1 - \beta } \right)} \right]^{2} + r^{'} \left[ {z_{0} \left( {1 - \beta } \right)} \right] > 0 \); then, \( \left. {\frac{{{\text{d}}^{2} R\left( {z_{0} } \right)}}{{{\text{d}}z_{0}^{2} }}} \right|_{{\frac{{{\text{d}}R\left( {z_{0} } \right)}}{{{\text{d}}z_{0} }} = 0}} < 0 \). Therefore, \( R\left( {z_{0} } \right) \) obtains its maximum when \( \frac{{{\text{d}}R\left( {z_{0} } \right)}}{{{\text{d}}z_{0} }} = 0 \). Thus, \( R\left( {z_{0} } \right) \) either is monotone or unimodal. Then, \( R\left( {z_{0} } \right) = 0 \) has at most two roots. Furthermore, \( R\left( B \right) = - w_{1} < 0 \). Thus, \( R\left( {z_{0} } \right) = 0 \) has only one root if \( R\left( A \right) > 0 \), which indicates \( a - b\left( {\frac{{w_{1} }}{1 - \beta } - 2g} \right) + A\left( {1 - \beta } \right) > 0 \).

Proof of Proposition 2

Following the implicit function rule, \( \frac{{{\text{d}}z_{0}^{*} }}{{{\text{d}}w_{1} }} = - \left( {\frac{{\partial R\left( {z_{0}^{*} } \right)}}{{\partial w_{1} }}} \right)/\left( {\frac{{\partial R\left( {z_{0}^{*} } \right)}}{{\partial z_{0}^{*} }}} \right) \). We obtain \( \frac{{\partial R\left( {z_{0}^{*} } \right)}}{{\partial w_{1} }} = - \frac{1}{2}\left\{ {1 + F\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right]} \right\} < 0 \). As \( z_{0}^{*} \) is the largest \( z_{0} \) in the region \( \left[ {A,B} \right] \) that satisfies \( \frac{{{\text{d}}E\left[ {\pi (z_{0} ,p_{0} (z_{0} ))} \right]}}{{{\text{d}}z_{0} }} = 0 \), and \( R\left( B \right) < 0 \), we obtain \( \frac{{\partial R\left( {z_{0}^{*} } \right)}}{{\partial z_{0}^{*} }} < 0 \). Thus, \( \frac{{{\text{d}}z_{0}^{*} }}{{{\text{d}}w_{1} }} < 0 \). The first part of the proof is completed.

Next, \( \frac{{{\text{d}}p_{0}^{*} }}{{{\text{d}}w_{1} }} = \frac{{\partial p_{0}^{*} }}{{\partial w_{1} }} + \frac{{\partial p_{0}^{*} }}{{\partial z_{0}^{*} }}\frac{{{\text{d}}z_{0}^{*} }}{{{\text{d}}w_{1} }} = \frac{{1 - br\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right]\left[ {\bar{p}_{0} - \frac{{\varTheta \left( {z_{0}^{*} } \right)}}{2b} + g} \right]}}{{\left( {1 - \beta } \right)\left\{ {1 - F\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right] - 2br\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right]\left( {\bar{p}_{0} - \frac{{\varTheta \left( {z_{0}^{*} } \right)}}{2b} + g} \right)} \right\}}} \). Given that \( \frac{{\partial R\left( {z_{0}^{*} } \right)}}{{\partial z_{0}^{*} }} < 0 \), we have \( 1 - F\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right] - 2br\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right]\left( {\bar{p}_{0} - \frac{{\varTheta \left( {z_{0}^{*} } \right)}}{2b} + g} \right) < 0 \). Thus, if \( br\left[ {z_{0}^{*} \left( {1 - \beta } \right)} \right]\left[ {\bar{p}_{0} - \frac{{\varTheta \left( {z_{0}^{*} } \right)}}{2b} + g} \right] \le 1 \), \( \frac{{{\text{d}}p_{0}^{*} }}{{{\text{d}}w_{1} }} \le 0 \); otherwise, \( \frac{{{\text{d}}p_{0}^{*} }}{{{\text{d}}w_{1} }} > 0 \).

Proof of Lemma 2

When \( p \) is given, \( \begin{aligned} E\left[ {\pi \left( {q_{2} ,z} \right)} \right] & = \left[ {p\left( {1 - \beta } \right) - w_{1} } \right]\frac{y\left( p \right) + \mu }{1 - \beta } - w_{1} \frac{{\Lambda \left( {q_{2} ,z} \right)}}{1 - \beta } \\ & \quad - \left[ {w_{2} \left( {1 - \beta } \right) - w_{1} } \right]\frac{{\Omega \left( {q_{2} ,z} \right)}}{1 - \beta } - \left[ {\left( {p + g} \right)\left( {1 - \beta } \right) - w_{1} } \right]\frac{{\Theta \left( z \right)}}{1 - \beta } \\ & \quad - \left[ {w_{0} + w_{1} - w_{2} \left( {1 - \beta } \right)} \right]q_{2} \mathop \smallint \limits_{A}^{{z\left( {1 - \beta } \right)}} f\left( x \right){\text{d}}x - w_{0} q_{2} \mathop \smallint \limits_{{z\left( {1 - \beta } \right)}}^{B} f\left( x \right){\text{d}}x \\ \end{aligned} \). \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2} }} = w_{2} \left( {1 - \beta } \right)F\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] - w_{0} \), \( \frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2}^{2} }} = - w_{2} \left( {1 - \beta } \right)^{2} f\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] \), \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{\partial z} = \left[ {\left( {p + g} \right)\left( {1 - \beta } \right) - w_{1} } \right] - w_{2} \left( {1 - \beta } \right)F\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] - \left( {p + g - w_{2} } \right)\left( {1 - \beta } \right)F\left[ {z\left( {1 - \beta } \right)} \right] \), \( \frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial z^{2} }} = - w_{2} \left( {1 - \beta } \right)^{2} f\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] - \left( {p + g - w_{2} } \right)\left( {1 - \beta } \right)^{2} f\left[ {z\left( {1 - \beta } \right)} \right] \), and \( \frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2} \partial z}} = \frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial z\partial q_{2} }} = w_{2} \left( {1 - \beta } \right)^{2} f\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] \). As \( \frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2}^{2} }} = - w_{2} \left( {1 - \beta } \right)^{2} f\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] < 0 \) and \( \left| {\begin{array}{*{20}c} {\frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2}^{2} }}} & {\frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2} \partial z}}} \\ {\frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial z\partial q_{2} }}} & {\frac{{\partial^{2} E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial z^{2} }}} \\ \end{array} } \right| = \left( {p + g - w_{2} } \right)w_{2} \left( {1 - \beta } \right)^{4} f\left[ {z\left( {1 - \beta } \right)} \right]f\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] > 0, \) the Hessian matrix of \( E\left[ {\pi \left( {q_{2} ,z} \right)} \right] \) is negative definite. Thus, \( E\left[ {\pi \left( {q_{2} ,z} \right)} \right] \) is jointly concave in \( q_{2} \) and \( z \), that is, the unique optimal \( q_{2}^{*} \) and unique optimal \( z^{*} \) are set by \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{{\partial q_{2} }} = 0 \) and \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z} \right)} \right]}}{\partial z} = 0 \), respectively.

When \( q_{2} \) and \( z \) are given, \( \begin{aligned} E\left[ {\pi \left( p \right)} \right] & = \left[ {p\left( {1 - \beta } \right) - w_{1} } \right]\frac{y\left( p \right) + \mu }{1 - \beta } - w_{1} \frac{{\Lambda \left( {q_{2} ,z} \right)}}{1 - \beta } - \left[ {w_{2} \left( {1 - \beta } \right) - w_{1} } \right]\frac{{\Omega \left( {q_{2} ,z} \right)}}{1 - \beta } \\ & \quad - \left[ {\left( {p + g} \right)\left( {1 - \beta } \right) - w_{1} } \right]\frac{{\Theta \left( z \right)}}{1 - \beta } - \left[ {w_{0} + w_{1} - w_{2} \left( {1 - \beta } \right)} \right]q_{2} \mathop \smallint \limits_{A}^{{z\left( {1 - \beta } \right)}} f\left( x \right)dx \\ & \quad - w_{0} q_{2} \mathop \smallint \limits_{z(1 - \beta )}^{B} f\left( x \right)dx \\ \end{aligned} \). As \( \frac{{{\text{d}}E\left[ {\pi \left( p \right)} \right]}}{{{\text{d}}p}} = 2b\left( {\bar{p} - p} \right) - \varTheta \left( z \right) \) and \( \frac{{{\text{d}}^{2} E\left[ {\pi \left( p \right)} \right]}}{{{\text{d}}p^{2} }} = - 2b < 0 \), \( E\left[ {\pi \left( p \right)} \right] \) is concave in \( p \). Thus, the unique optimal \( p^{*} \) is set by \( \frac{{{\text{d}}E\left[ {\pi \left( p \right)} \right]}}{{{\text{d}}p}} = 0 \).

Proof of Proposition 3

By substituting \( p^{*} = p\left( z \right) \) into \( E\left[ {\pi \left( {q_{2} ,z,p} \right)} \right] \), we obtain \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z,p(z)} \right)} \right]}}{{\partial q_{2} }} = w_{2} \left( {1 - \beta } \right)F\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] - w_{0} \) and \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z,p(z)} \right)} \right]}}{\partial z} = w_{2} \left( {1 - \beta } \right) - w_{1} - w_{2} \left( {1 - \beta } \right)F\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] + \left[ {\bar{p} - \frac{\varTheta \left( z \right)}{2b} + g - w_{2} } \right]\left( {1 - \beta } \right)\left\{ {1 - F\left[ {z\left( {1 - \beta } \right)} \right]} \right\} \). From Lemma 2, let \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z,p(z)} \right)} \right]}}{{\partial q_{2} }} = 0 \), we obtain \( F\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] = \frac{{w_{0} }}{{w_{2} \left( {1 - \beta } \right)}} \). Let \( \frac{{\partial E\left[ {\pi \left( {q_{2} ,z,p(z)} \right)} \right]}}{\partial z} = 0 \), we derive \( \left[ {\bar{p} - \frac{\varTheta \left( z \right)}{2b} + g - w_{2} } \right] \cdot \left\{ {1 - F\left[ {z\left( {1 - \beta } \right)} \right]} \right\} = \frac{{w_{0} + w_{1} }}{1 - \beta } - w_{2} \). Therefore, \( z^{*} \) is the unique \( z \) in the region \( \left[ {A,B} \right] \) that satisfies \( \left[ {\bar{p} - \frac{\varTheta \left( z \right)}{2b} + g - w_{2} } \right] \cdot \left\{ {1 - F\left[ {z\left( {1 - \beta } \right)} \right]} \right\} = \frac{{w_{0} + w_{1} }}{1 - \beta } - w_{2} \). Given that \( F\left[ {\left( {z - q_{2} } \right)\left( {1 - \beta } \right)} \right] = \frac{{w_{0} }}{{w_{2} \left( {1 - \beta } \right)}} \), \( q_{2}^{*} = z^{*} - \frac{1}{1 - \beta }F^{ - 1} \left[ {\frac{{w_{0} }}{{w_{{2}} \left( {1 - \beta } \right)}}} \right] \).

Proof of Proposition 4

Let \( R\left( z \right) = \frac{{{\text{d}}E\left[ {\pi \left( {q_{2} ,z,p(z)} \right)} \right]}}{{{\text{d}}z}} \). Similar to the proof of Proposition 2, \( \frac{{{\text{d}}z^{*} }}{{{\text{d}}w_{0} }} = - \left( {\frac{{\partial R\left( {z^{*} } \right)}}{{\partial w_{0} }}} \right)/\left( {\frac{{\partial R\left( {z^{*} } \right)}}{{\partial z^{*} }}} \right) \). We obtain \( \frac{{\partial R\left( {z^{*} } \right)}}{{\partial w_{0} }} = - 1 < 0 \). As \( z^{*} \) is the largest \( z \) in the region [A, B] that satisfies \( \frac{{dE\left[ {\pi \left( {q_{2} ,z,p(z)} \right)} \right]}}{dz} = 0 \), and \( R\left( B \right) = - \left[ {w_{0} + w_{1} - w_{2} \left( {1 - \beta } \right)} \right] < 0 \), we derive \( \frac{{\partial R\left( {z^{*} } \right)}}{{\partial z^{*} }} < 0 \). Thus, \( \frac{{dz^{*} }}{{dw_{0} }} < 0 \). Similarly, we obtain \( \frac{{\partial R\left( {z^{*} } \right)}}{{\partial w_{2} }} = F\left[ {z^{*} \left( {1 - \beta } \right)} \right]\left( {1 - \beta } \right) > 0 \), and \( \frac{{{\text{d}}z^{*} }}{{{\text{d}}w_{2} }} = - \left( {\frac{{\partial R\left( {z^{*} } \right)}}{{\partial w_{2} }}} \right)/\left( {\frac{{\partial R\left( {z^{*} } \right)}}{{\partial z^{*} }}} \right) > 0 \).

Next, we have \( \frac{{dp^{*} }}{{dw_{0} }} = \frac{{\partial p^{*} }}{{\partial z^{*} }}\frac{{{\text{d}}z^{*} }}{{{\text{d}}w_{0} }} \). Given that \( \frac{{\partial p^{*} }}{{\partial z^{*} }} = \frac{{\left( {1 - \beta } \right)\left\{ {1 - F\left[ {z^{*} \left( {1 - \beta } \right)} \right]} \right\}}}{2b} > 0 \) combined with \( \frac{{{\text{d}}z^{*} }}{{{\text{d}}w_{0} }} < 0 \), we obtain \( \frac{{{\text{d}}p^{*} }}{{{\text{d}}w_{0} }} < 0 \). Similarly, we have \( \frac{{{\text{d}}p^{*} }}{{{\text{d}}w_{2} }} = \frac{{\partial p^{*} }}{{\partial z^{*} }}\frac{{{\text{d}}z^{*} }}{{{\text{d}}w_{2} }} \). As \( \frac{{\partial p^{*} }}{{\partial z^{*} }} > 0 \), combined with \( \frac{{{\text{d}}z^{*} }}{{{\text{d}}w_{2} }} > 0 \), we obtain \( \frac{{{\text{d}}p^{*} }}{{{\text{d}}w_{2} }} > 0 \).

Proof of Proposition 5

From Proposition 3, we have \( q_{2}^{*} = z^{*} - \frac{1}{1 - \beta }F^{ - 1} \left[ {\frac{{w_{0} }}{{w_{{2}}\left( {1 - \beta } \right) }}} \right] \). Let \( x = \frac{{w_{0} }}{{w_{{2}}\left( {1 - \beta } \right) }} \). Thus, \( x \) increases with \( w_{0} \). Given that \( F^{ - 1} \left[ x \right] \) increases with \( x \), \( F^{ - 1} \left[ x \right] \) increases with \( w_{0} \). In Proposition 4, \( z^{*} \) decreases with \( w_{0} \). Thus, \( q_{2}^{*} \) decreases with \( w_{0} \). Similarly, \( x \) decreases with \( w_{2} \). Given that \( F^{ - 1} \left[ x \right] \) increases with \( x \), \( F^{ - 1} \left[ x \right] \) decreases with \( w_{2} \). In Proposition 4, \( z^{*} \) increases with \( w_{2} \). Thus, \( q_{2}^{*} \) increases with \( w_{2} \).

Rights and permissions

About this article

Cite this article

Wang, C., Chen, X. Joint order and pricing decisions for fresh produce with put option contracts. J Oper Res Soc (2017). https://doi.org/10.1057/s41274-017-0228-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41274-017-0228-1