Abstract

This paper studies the evolutionary dynamics of a market regulated by an auctioned emission trading system with a price floor in which there exist three populations of firms that interact strategically: (i) non-polluting, (ii) polluting and compliant, (iii) polluting but non-compliant. Firms that adopt a non-polluting technology need no permits to operate, while firms that use a polluting technology can either buy the required permits (and be compliant) or not (being non-compliant). The latter do not buy emission permits and face the risk to be sanctioned if discovered. From the analysis of the model emerges that all three types of firms coexist at the equilibrium only under specific parameter values. More precisely, it can generically be excluded the coexistence between non-polluting firms and non-compliant polluting ones. The regulatory authority can favor the extinction of non-compliant firms by increasing their probability of being discovered and/or the sanction level. Moreover, the regulatory authority can favor the diffusion of innovation by increasing the permits price floor since polluting-compliant firms exit the market and new non-polluting firms enter the market. However, this policy instrument should be used with caution because it tends to increase also the number of non-compliant firms.

Similar content being viewed by others

Notes

Free allowances can be allocated to an installation either ex-ante, that is before emissions are produced, based on historical emissions or output (what is generally known as “grandfathering”), or ex-post proportionally to the emissions generated or to the corresponding output (often called “output-based allocation”).

For instance, the European Union Emission Trading System aims at reducing GHG emissions of the covered sectors by 43% in 2030 compared to their emission levels in 2005, when the system was introduced (Borghesi et al. 2016).

More precisely, Milliman and Prince (1989) and Jung et al. (1996) show that an auctioned ETS is a preferable policy instrument respect to, in descending welfare order, emission taxes and subsides, grandfathered permits, emissions standards. The debate on which is the best environmental policy instrument to spread innovation is beyond of the scope of the paper. See Requate 2005 for a theoretically literature review on the effects of environmental policy instruments on innovation.

It can be argued that using permits received for free implies an opportunity cost, therefore in principle the allocation method should not influence the firms’ operational decision. However, the allocation method modifies firms’ behavior in practice since receiving permits for free or not changes the relative convenience of alternative investments ex-ante (Marcantonini et al. 2017).

Parameter d captures how “dirty” is the polluting technology adopted by P-firms: for any given level of \(q_{P}\), the dirtier is the technology being adopted, the higher the demand of permits and thus also their price, ceteris paribus. It can obviously be influenced by many factors, including the kind and number of alternative clean technologies at disposal, as well as the supply-side policies of the Public Administration. As will be shown (cf. equation 8 below), an increase in d lowers the amount \(q_{P}\) just like an increase in the price floor. Differently from the price floor, however, parameter d is not directly influenced by the regulator.

Based on system (6), the planes are invariant, namely \({\dot{s}}=0\) and \({\dot{m}}=0\) hold if \(s=0\) and \(m=0\), respectively.

References

Arguedas, C., Camacho, E., & Zofío, J. L. (2010). Environmental policy instruments: Technology adoption incentives with imperfect compliance. Environmental and Resource Economics, 47, 261–274.

Borghesi, S. (2014). Water tradable permits: A review of theoretical and case studies. Journal of Environmental Planning and Management, 57(9), 1305–1332.

Borghesi, S., Montini, M., & Barreca, A. (2016). The European Emission Trading System and Its Followers. Springer Briefs in Environmental Science. Cham: Springer International Publishing.

Coase, R. H. (1960). The problem of social cost. The Journal of Law and Economics, 3(1), 1–44.

Crocker, T. D. (1966). The structuring of atmospheric pollution control systems. In H. Wolozing (Ed.), The Economics of Air Pollution (pp. 61–86). New York: W.W. Norton.

Dales, J. (1968). Pollution, Property, and Prices. Toronto: University of Toronto Press.

Downing, P. B., & White, L. J. (1986). Innovation in pollution control. Journal of Environmental Economics and Management, 13, 18–29.

Ellerman, A. D., Convery, F. J., & De Perthuis, C. (2010). Pricing carbon: The European Union emissions trading scheme. Cambridge: Cambridge University Press.

Fischer, C., Parry, I. W., & Pizer, W. A. (2003). Instrument choice for environmental protection when technological innovation is endogenous. Journal of Environmental Economics and Management, 45, 523–545.

Hofbauer, J., & Sigmund, K. (1988). The Theory of Evolution and Dynamical Systems. Cambridge: Cambridge University Press.

Jung, C., Krutilla, K., & Boyd, R. (1996). Incentives for advanced pollution abatement technology at the industry level: An evaluation of policy alternatives. Journal of Environmental Economics and Management, 30, 95–111.

Keeler, A. G. (1991). Noncompliant firms in transferable discharge permit markets: Some extensions. Journal of Environmental Economics and Management, 21, 180–189.

Malik, A. S. (1990). Markets for pollution control when firms are noncompliant. Journal of Environmental Economics and Management, 18, 97–106.

Malueg, D. (1989). Emission credit trading and the incentive to adopt new pollution abatement technology. Journal of Environmental Economics and Management, 18, 52–57.

Marcantonini, C., Teixido-Figueras, J., Verde, S. F., & Labandeira, X. (2017). Low-carbon innovation and investment in the EU ETS. Policy Brief 2017/22, RSCAS, European University Institute. Forence, Italy.

Milliman, S. R., & Prince, R. (1989). Firm incentives to promote technological change in pollution control. Journal of Environmental Economics and Management, 17, 247–265.

Montgomery, W. D. (1972). Markets in licenses and efficient pollution control programs. Journal of Economic Theory, 5(3), 395–418.

Requate, T. (2005). Dynamic incentives by environmental policy instruments—a survey. Ecological Economics, 54, 175–195.

Stranlund, J. K. (2017). The economics of enforcing emissions markets. Review of Environmental Economics and Policy, 11(2)

Villegas-Palacio, C., & Coria, J. (2010). On the interaction between imperfect compliance and technology adoption: Taxes versus tradable emissions permits. Journal of Regulatory Economics, 38, 274–291.

Weibull, J. W. (1995). Evolutionary Game Theory. Cambridge: MIT Press.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Mathematical appendix

Mathematical appendix

1.1 First order conditions

By imposing non negativity constraints \(q_{P}\geqslant 0\), \(q_{PP}\geqslant 0\), \(q_{NP}\geqslant 0\), and applying Khun-Tucker conditions, we obtain that given the values of the variables m, n, s the quantities \( q_{NP},q_{P},q_{PP}\) are chosen according to the first order conditions:

Remark 1

From (14) and (15) it follows that \(q_{P}\leqslant q_{PP}\) always holds.

Remark 2

Consider the case in which there exist values of \(q_{NP}>0\) and \(q_{PP}>0\) that satisfy conditions (15), (16) and, therefore, equations:

From such equations, it follows:

and then:

From Eq. (17) it results that if \(q_{PP}\) becomes equal to zero, then also \(q_{NP}\) becomes equal to zero, and vice-versa; moreover, from Remark 1, it occurs also to \(q_{P}\). Consequently, taking into account that \(p=Q-a\cdot \left( m\cdot q_{NP}+n\cdot q_{P}+s\cdot q_{PP}\right) >0\) when the quantities \(q_{NP}\), \(q_{P}\), \(q_{PP}\) are sufficiently low, it occurs that PP-firms and NP-firms never choose \(q_{PP}=0\) and \(q_{NP}=0\), respectively.Footnote 7 This implies that NP-firms and PP-firms always produce strictly positive quantities, regardless of the values of variables m, n, s.

1.2 Proof of Proposition 1

Taking into account Remark 2 and Eq. (17), in order to determine the values \(q_{NP}\), \(q_{P}\), \(q_{PP}\), it is sufficient to analyze only conditions (14), (15). Differently from (15), (16), condition (14) can be satisfied also for \(q_{P}=0\). Therefore, P-firms, which buy emission permits, could choose to produce a zero output, given m, n, s; such an event can occur only if \(\overline{p_{T}}>0\), and, therefore, \(p_{T}>0\) also for \(q_{P}=0\).

Consider first the case in which (14) is satisfied for \(q_{P}>0\). In such a context, conditions (14), (15) become:

from which:

Substituting (5) in (20), it becomes:

from which we obtain:

Finally, substituting (4) and (21) in (18), and taking account of (17), we obtain:

Equation (22) determines the equilibrium value of \(q_{P}\). Once determined \(q_{P}^{*}\), the equilibrium values of \(q_{PP}\) and \(q_{NP}\) are respectively determined by Eqs. (21) and (17). This completes the proof of Proposition 1.

1.3 The separatrix between the regimes with \(q_{P}>0\) and with \(q_{P}=0\)

Setting \(q_{P}=0\), Eq. (22) becomes:

Equation (23) represents the plane (in the space (m, n, s)) that separates the region in which \(q_{P}>0\) (below the plane) from that in which \(q_{P}=0\) (above the plane). If the values of m and/or s are sufficiently high to satisfy conditions \(\left( C_{P}^{V}/C_{NP}^{V}\right) \cdot m+s\geqslant \left( C_{P}^{V}/a\cdot \overline{ p_{T}}\right) \cdot \left( Q-\overline{p_{T}}\right) \), then the polluting-compliant firms choose \(q_{P}=0\).

1.4 Proof of Proposition 2

To prove Proposition 2, notice that when \(q_{P}=0\), the equilibrium values of \(q_{PP}\) and \(q_{NP}\) are determined by (19), taking into account Eq. (17), and that the demand function can be rewritten as \(p=Q-a\cdot \left( \frac{C_{P}^{V}}{C_{NP}^{V}}\cdot m+s\right) \cdot q_{PP}\).

1.5 Proof of Proposition 3

Below the plane represented by Eq. (23), that is in the region where \(q_{P}>0\), we have \(\dot{s}=0\) and \(\dot{m}=0\) if the following equations are respectively satisfied:

Using condition (17), Eq. (25) can be rewritten as:

Multiplying both sides for \(C_{NP}^{V}/C_{P}^{V}\), we obtain:

from which:

Notice that in Eqs. (25), (26), the coefficients of \( q_{PP}^{2} \) and \(q_{PP}\) coincide, therefore a value of \(q_{PP}\) such that \( \overset{\cdot }{s}=\overset{\cdot }{m}=0\) can exist only in the case in which the following equality

holds. This proves Proposition 3.

1.6 Stability and phase planes

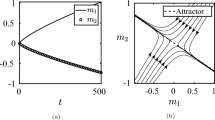

Figure 8 shows three numerical examples where only one stationary state is attractive, \(P_{2}\) in Fig. 8a, \(P_{4} \) in Fig. 8b, and \(P_{6}\) in Fig. 8c. In the figures, an empty dot “\(\circ \)” indicates a non attractive stationary state (that is, with at least one eigenvalue with positive real part), while a full dot “\(\bullet \)” denotes a locally attractive stationary state (that is, with 3 eigenvalues with negative real part).

The phase space corresponding to the numerical example in which \(P_{6}\) (where PP-firms are not present) is attractive is shown in Fig. 9. Differently, Fig. 10 illustrates a non generic case (the equality condition (13) is satisfied) in which all three types of firms coexist and there exists a segment (the black line that links \(P_{4}\) to \(P_{6}\)) constituted by (Lyapunov) stable stationary states. Conversely, the red line that links \(P_{2}\) to \(P_{5}\) is constituted by unstable stationary states located in the invariant plane \(n=0\) where there are not P-firms.

Rights and permissions

About this article

Cite this article

Antoci, A., Borghesi, S., Iannucci, G. et al. Emission permits, innovation and sanction in an evolutionary game. Econ Polit 37, 525–546 (2020). https://doi.org/10.1007/s40888-020-00179-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-020-00179-4