Abstract

Purpose

This study empirically analyzes whether the rapid growth of loans and risk-taking behavior during the expansion of loans affected non-performing loans (NPLs) and the solvency of financial institutions in the Turkish banking system.

Design/methodology/approach

Using the GMM Generalized Method of Moments, this study used data on Turkish banks from 2011 to 2017 to test two hypotheses on the effects of loan growth on NPLs and solvency.

Findings

This study finds significant results for the effect of loan growth on NPLs and solvency. NPLs rose from the previous year’s loan growth, which tended to reduce solvency.

Research limitations/implications

Due to selected research methods, the results may lack generality. Therefore, future studies should test the propositions herein further.

Practical implications

The results indicate that careful allocation behavior is required when lending. Additionally, these findings may be helpful to financial managers and decision makers.

Originality/value

This study confirms the need to determine how to allocate loans during the loan boom periods.

Similar content being viewed by others

Introduction

As the International Monetary Fund, Ernst & Young1, and other agencies point out, the Turkish banking system has a relatively low proportion of non-performing loans (NPLs), despite the recent economic downturn and foreign exchange risk. Nevertheless, this ratio varies from bank to bank, and some banks are more sensitive than others are. Although NPLs are not high by regional standards (or compared to some Eurozone member states) and are well configured, analysts, and sector participants are increasingly aware of the risk of rising balance sheet ratios. After several years of rapid credit growth, several factors may lead to an increase in NPLs, including a slowdown in economic growth, a pullback in the economy, and a fall in investor sentiment.

NPLs gained research attention in recent years due to the increasing interest in understanding the variables that are vulnerable to a financial crisis. NPLs are one such indicator that is linked closely to weakness in the financial and banking system. We can confirm this by the close relationship between the surge in NPLs and solvency. Though Louzis et al. (2012) and Reinhart and Rogoff (2011) point out that the increase in NPLs marks the outbreak of the banking crisis, NPLs are also significant after the global crisis. Certainly, the global financial crisis led to a surge in NPLs, which also pose a risk to the profitability and liquidity of the banking system, as well as financial stability.

In the early 1980s, Turkey’s financial sector relaxed the process of neoliberalism. These provisions increase the efficiency of the Turkish banking system (Zaim 1995). Through these reforms, Islamic finance emerged, called Special Financial Houses2. Despite these reforms, Selcuk (2010) and Afsar (2011) argue that there was a prompt increase in NPLs after the global crisis. In addition, the global crisis challenged both the Turkish banking sector and the changes in NPLs after the crisis and ownership as key drivers of this change. According to Blejer (2006) and Shahzad et al. (2019), financial efficiency is an important issue because it improves financial stability. In rapidly changing global financial markets, bank managers, regulators, and investors pay more attention to converting their expensive inputs into more effective financial products and services.

Banking is the mainstay of the Turkish financial system. In particular, total banking assets account for about 87% of the Turkish financial system (CBRT, 2016). This is the main motivation for analyzing NPLs, which provided important feedback in financial stability. At the same time, the global crisis forced the Central Bank of the Republic of Turkey (CBRT) to supplement financial stability. Therefore, this analysis can also inform monetary policy related to macro-prudential issues (BASCI and Kara 2011).

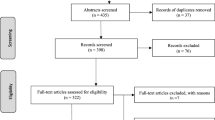

We specifically examine the relationship between loan growth and bank risk-taking behavior and discuss the impact of loan growth on financial health. To assess the different perspectives on the relationship between credit growth and bank risk-taking behavior, this study uses micro-level data from 59 Turkish banks3 between 2011 and 2017. To understand the effect of loan growth on the financial system, we use the two-step GMM (Generalized Method of Moments) estimation technique. Thus, this study contributes to the literature in two ways. First, it analyses 5 types of banks: commercial, corporate, real state, investment, and Islamic banks. Second, we also include additional variables such as political stability and the rule of law to check their impact on NPLs and solvency.

Literature review

We divide this section into three. First, we provide a brief summary of the studies on only the Turkish banking industry’s efficiency. Second, we discuss available research on NPLs in the bank literature. Finally, we focus on the gaps in the current literature.

Turkish banking industry background and research on efficiency

Background

As early as 2002, the Turkish banking system invested the capital of investing depositors in high yield government bonds. This is a profitable business. Inflation adjustments for government bonds between 2002 and 2005 have an “actual” yield rate of up to 15% on average. The profitability of this market does not apply to reasonable retail and SMEs. Banking business has a real appetite; of the total bank assets, 40% were invested in government securities, and the share of loans at the end of 2002 was as low as 23%. In short, bank loans are expensive, government bonds crowd out the financial market, and the average household disposable income leaves no room for great personal leverage (Selim Elhadef 2016; Wang and Wang 2019; Wang et al. 2019).

However, the implementation of the proposed reform aimed at restoring fiscal and monetary discipline was postponed, leading to complete market instability. The banking industry inevitably experienced a systemic crisis that peaked in November 2000, particularly due to a large number of bad loans. The crisis also led to a severe contraction in economic activity. The government, with support from the IMF, announced a comprehensive plan to reduce inflation and public sector debt, and to restructure the banking system in May 2000.

The Turkish economy, as well as its banking system, faced problems arising from a failed military coup attempt in July 2016, which led to a fall in the overall economy and banking sector. This event also had a negative impact on the Turkish Lira against the US Dollar exchange rate.

Review of studies of the efficiency of the Turkish banking sector

Fukuyama and Matousek (2011), Denizer et al. (2007), and Ozkan-Gunay and Tektas (2006) apply three-input and three-output Fourier flexible cost function specifications to investigate the efficiency, economies of scale, and technological advances in Turkish banks for 1988–1998. Their results confirm that the Turkish banking system has significant inefficiencies and economies of scale during sample period. These studies also focus on analyzing bank efficiency before and after the crisis. From 1990 to 2001, the sample batch included non-public commercial banks. The authors find that bank efficiency gradually declined during this period, and that the 1990 and 1994 crises had a negative impact on bank efficiency.

Berger and Humphrey (1997) report that most of the studies on bank efficiency (about 95%) focus on developed countries, of which 70% are on the United States. Many researchers believe that more studies should compare and measure the efficiency of banks in different countries to help ensure global financial stability (Beim and Calomiris 2001; Berger and Humphrey 1997; Eichengreen and Arteta 2002). Berger and Humphrey (1997) use a national database to assess the technical, configuration, and cost efficiency of conventional banks and participating banks.

Us (2017) and Jermias and Yigit (2018) suggest that analyzing traditional loans such as mortgage lending may also help policymakers directly identify loan types and the factors that result in NPLs. Isik and Hassan (2002) observe the efficiency of Turkish banks for 1988–1996. They apply nonparametric and parametric methods and find that the inefficiency of Turkish banks comes mainly from diseconomies of scale. They also show that foreign banks operate more efficiently than their domestic counterparts do.

NPL-related literature

Louzis et al. (2012) used nine Greek deposit banks for 2003 and the first quarter of 2009 for the third quarter, by following Blundell and Bond’s (1998) system GMM estimator to analyze the factors that affect the NPL ratio. They conclude that economic growth, unemployment, public debt, interest rates, and profitability measured by return on equity (ROE) have a considerable impact on the proportion of NPLs in Greek banks (commercial, consumer, and mortgage loans). Mester (1996) and Chao et al. (2019) use non-performing assets as a control variable in the cost function of a sample from the Bank of America. Their results show that bad loans have a significant negative impact on total costs.

Boudriga et al. (2010) and Li et al. (2016) use a randomized regression analysis to examine how bank-specific institutions, the business environment, and macroeconomic environmental indicators affect NPLs in the Middle East and North Africa (MENA) region rate using a sample of 46 banks from 12 countries for 2002–2006,. They find that the institutional environment, bank capital, loan loss provisions, credit growth, foreign participation, and problem loans are significantly related. Figure 1 showing our sample period of NPL of Turkey how this changes during the period.

Foos et al. (2010) use bank-scope data for 16,000 banks in 16 major countries from 1997 to 2007 and find that previous abnormal loan growth is directly related to overall levels and loan losses at the individual bank level. Additionally, excessive loan growth hurts bank interest income, which reduces profitability. On the surface, a large increase in loans reduces the capital ratio, which has a negative impact on solvency. Messai and Jouini (2013) study the determinants of NPLs in Spain, Italy, and Greece for 2004–2008, and find that banks increased their provisions for bad loans and bank assets for NPLs.

Cottarelli et al. (2005) and Kraft and Jankov (2005) provide evidence that loan losses are related to rapid loan growth and increased bank risk. Recently, academic researchers focusing on rapid expansion examined the changes in China’s banking industry. Much research focuses on banks in China in terms of their productivity and performance, and the overall effectiveness of the country’s banking system (Ariff and Luc 2008; Berger et al. 2009; Xiaoqing Maggie and Heffernan 2007).

Theoretical background

Stiglitz and Weiss (1981) provide theoretical support for moral hazard theory, also known as hazard and adverse selection in finance, which is defined as the likelihood that the success of an entrepreneur who borrows from a bank to finance a new business may depend on corporate efforts that the bank cannot directly monitor. Over time, to reward this hidden effort, the borrower must derive considerable profits from the success of his venture capital. This need allows borrowers to earn enough profit from their success to impose an upper limit on the rate that banks can charge. Therefore, even if qualified, enthusiastic borrowers cannot find funds and interest rates may not rise.

Literature gap

From this literature review, we can see several important gaps that we intend to address in this study. First, although many studies analyze NPLs by bank- and macro-specific variables, these studies did not consider political stability and the rule of law when measuring the macro variables. Second, we use a more extensive and recent data set here; our sample period also includes a failed military coup attempt, so our study differs from most prior related studies that mainly adopt shorter sample periods. Third, we use GMM system two-step estimates to examine NPLs with loan growth and GMM system two-step estimates to examine solvency with loan growth. This method avoids the endogeneity problem when testing the data.

Additionally, while this method is not unique to the literature on the solvency of Turkish banks, it contributes to the overall literature on bank solvency. The literature review shows that only a few studies include a bad output (i.e., bad loans) in their model. We also use the maximum number of related macro and micro control variables to help address the gap in the literature.

Hypotheses and theoretical framework

The first assumption examines how the growth in loans affects Turkish banks. Future loan defaults are related to expansion loans, which tend to increase credit loss preparation and may lead to a loan loss reserve. Studies of borrower behavior reveal that borrowers do not default instantly after getting bank credit (Berger and Udell 2004; Zhang et al. 2019). Therefore, we assume that prior loan growth is converted into an NPL increment.

H1: swift growth in loans raises the amount of NPLs

In the second assumption, we explore how loan growth influences solvency. Capital growth is a vital cause of shocks and the increase in a competitor’s position. Power of capital indications steady banks and large networks provide their business. Therefore, monitoring is crucial the whole organization’s operation. Consequently, common events will have a comprehensive effect on business risk. Furthermore, loan growth may increase as banks maximize capital, resulting in a decline in the capital ratio to risk-weighted assets.

H2: abnormal loan growth affects a bank’s solvency

Figure 2 illustrates the theoretical framework of this study.

Data and methodology

Data

We use annual balance sheet and income statement data from 2011 to 2017 collected from Bankscope’s bank-specific variables, namely NPLs, loan growth, bank assets (Total assets), solvency, leverage, and efficiency ratios. We collected data on macroeconomic variables such as the gross domestic product (GDP) growth rate, unemployment rate, the rule of law, and inflation rate from world development indicators. All data items are denominated in U.S. dollars.

When there is a direct or indirect nonlinear relationship between inflation, unemployment, GDP growth, the rule of law, and bank-specific variables, it is important to include macroeconomic effects in the model. Chadwick (2018) and Ari and Cergibozan (2018) suggest that macro-prudential tightening can effectively curb loan growth and loan growth volatility, and lower consumer price inflation. Additionally, this effect is more pronounced when macroprudential tools are coordinated with monetary policy. We thus include macro-level control variables in our analysis to control the macro-level consequences. The rise in inflation prevented companies from earning higher profits, thus reducing progress and impeding the potential for financial growth. Credit processing has a positive effect on real GDP (Tinoco-Zermeño et al. 2014; Shahzad 2019). Changes in the unemployment rate lead to the expansion or reduction in household repayment capacity; however, a rise in the unemployment rate weakens the ability to repay loans and increases the bad debt ratio. Governance plays a vital role in developing countries, and it is also an important indicator of financial health. Poor governance and the relaxation of the rule of law decrease investor confidence, profitability, and efficiency. The 1997–1998 Asian financial crises demonstrated the influence of corporate governance instability (Johnson et al. 2000).

Table 1 summarizes the notation and definition of the variables, as well as their expected signs.

Before conducting the empirical analysis, we check the correlation between the control variables and the independent variables. It seems to support the hypothesis that each independent variable has its own specific ability to interpret bank- and macro-economy-specific variables. Table 2 reports the descriptive statistics for the variables, including the mean, standard deviation, minimum, and maximum. Table 3 shows the 5% significance level in the correlation matrix.

Econometric estimations

We analyzed the effect of loan growth on NPLs during 2011–2017. In H1, we test whether the rapid growth of past loans is related to the gradual decline in the average credit quality of the loan portfolio of financial institutions. Therefore, we adopt the two-step generalized moment estimator (GMM) estimate established by Arellano and Bond (1991). We follow Foos et al.’s (2010) generalized moment method to estimate the impact of loan growth on bank risk. To determine the strength of over recognition constraints in the model, we use the Sargan test and the AR (1) and AR (2) tests (first- and second-order autocorrelation tests) to achieve zero correlation or no correlation. The number of observations in any given regression depends on the model-specific data requirements.

GMM estimation

Recent research on corporate finance, particularly on idiosyncratic and firm life cycles, reveals concerns about potential endogenous biases. Simple OLS can have considerable biases regarding endogeneity. However, other studies identify two other forms of endogeneity: dynamic endogeneity and simultaneity endogeneity (Nguyen et al. 2015; Wintoki et al. 2012). Dynamic endogeneity exists when the present value of an independent variable is the result of past performance or risk. In our case, a firm goes through different lifecycle stages, and past performance determines the firm’s life cycle stage. Although four FLCS (firm life cycle stages) variables are determined simultaneously, and each variable may affect other variables at the same time (Schultz et al. 2010; Tan and Ma 2016; Tan et al. 2018). Therefore, dynamic endogeneity and simultaneity endogeneity may lead to estimation bias. We cope with these biases using the GMM estimation method (Arellano and Bond 1991; Blundell and Bond 1998). One of the strengths of GMM estimation is that it uses internal instruments from the panel itself; that is, the post-lagged values of the variables. Thus, a GMM estimation is the most appropriate and robust model for corporate finance research.

Loan growth and NPLs

We test the effect of bank- and macro-economy-specific variables on NPLs using the following models.

Model 1

Model 2

Model 3

In Eq. 1, NPL refers to the ratio of NPLs to gross advances and LG refers to loan growth. The models incorporate various bank-specific variables (total assets, leverage ratio, and efficiency), and macro-economy-specific variables (GDP, inflation, rule of law, unemployment, and political stability). We used three models with different macroeconomic variables to check the robustness of the results.

Loan growth and bank solvency

We teste the effect of bank- and macro-economy-specific variables on solvency using the models below.

Model 4

Model 5

Model 6

In Eq. 5. SOL refers to solvency and LG refers to loan growth. These models also include bank-specific variables (total assets, leverage ratio, and efficiency) and macro-economy-specific variables (GDP, inflation, rule of law, unemployment, and political stability). We use three models with different macroeconomic variables to check the robustness of the results.

Results and discussion

This study confirms the findings on macro-economy-specific and bank-specific factors affecting NPLs and solvency empirically. Many empirical studies point out that an increase in loan activity will eventually lead to future NPLs (Foos et al. 2010; Kraft and Jankov 2005). These studies find that the competition for short-term profit enhances the strategies of bank managers under favorable economic conditions and is the main reason for the increase in NPLs.

Table 4 shows that loan growth has a highly significant positive relationship with NPLs in all three of our models at the 1% level. Our results are robust because we used three combinations of control variables. This result indicates that the increasing trend in future loan losses will lead to financial weakness. If a financial institution or multiple banks begin to issue unusual loans to earn short-term profits, then it will certainly lead to loan losses. When bank managers get targets from their senior managers, they may ignore lending policies. That is, they may aim to meet the targets assigned by senior managers by giving loans without the necessary documentation. We also find a highly significant negative relationship between size and NPLs in all three models. This result indicates that Turkish banks are trying to improve their assets through investment, and lending to households and different businesses. Such strategies might increase NPLs. Furthermore, adjusting producer and consumer plans during an expansionary lending period might increase the chance of issuing NPLs. Such activities also tend to decrease assets (Tinoco-Zermeño et al. 2014). On the contrary, compared with smaller institutions and banks, institutions have a more efficient team than most and can manage risks most effectively. Our study findings are in line with those of Kashif et al. (2016), who study Pakistan’s banking sector and also find that an increase in the previous year’s loan growth has a positive relationship with NPLs, which in turn decrease the bank’s solvency with a time lag of many years.

As we expected, there is a negative and significant relationship between leverage and NPLs, which creates direct obstacles to balance sheet expansion and a liquidity contraction due to the increase in this ratio. These results also seem to indicate the potential for future bad loans due to poor governance and the lack of information symmetry. However, we find that the efficiency ratio has a highly significant, positive relationship with NPLs. This seems to suggest that extensive advancing activities tend to increase the loan loss provisions.

We found a highly significant negative association between GDP and NPLs. These results indicate that high GDP growth helps reduce loan losses. It is clear that high GDP growth helps improve regional living standards, resulting in good financial conditions, ethical values, and a better ability to repay loans. The rapid growth in GPD increases the income of businesses and individuals. These results confirm the results in Foos et al. (2010) and Salas and Saurina (2002). Surprisingly, we found a negative relationship between NPLs and inflation. Our control macro variable unemployment has a positively significant relationship with NPLs; higher unemployment seems too increase NPLs.

Economic development is thoroughly related to political stability. Uncertainty due to an unstable political situation may diminish the rate of investment and economic development. On the other hand, poor economic performance may lead to the collapse of the government and political turmoil (Alesina et al. 1996). Political stability and the rule of law both have a negative relationship with NPLs.

The increase in loans results in an increase in NPLs, suggesting that financial institutions are at risk due to the abnormal growth in loans. We next test whether loan growth will precipitate the overall decline in bank solvency.

Table 5 reports the results of testing solvency using bank- and macro-economy-specific variables. Though a stable, active balance sheet can encourage managers to increase returns through investment and loans, growth in NPLs is bound to play a role in the bankruptcy of financial institutions. We found a highly significant negative relationship in all relevant models of loan growth and solvency. These results are robust and show that abnormal loan growth tends to decrease a bank’s solvency. We found a significant positive association between size (total assets) and solvency in all models. These positive results indicate that through effective adjustment and supervisory actions, financial institutions and commercial banks can increase their size to solve bankruptcy problems. Large banks have more capacity to bear risk and have more opportunity to invest in new business, which has a positive impact on solvency and can help the institution move solvency in a positive direction.

The efficiency ratio has a highly significant indirect relationship with solvency. Under favorable economic conditions, banks enjoy a healthy financial environment, despite increasing their returns and profits through extensive borrowing as compared with profits, a lower provision for losses and fixed costs, strong political stability, and reasonable legal rules, which create ideal scenarios for business expansion. Therefore, for both models 4 and 5, GDP shows a highly positive relationship at the 1% level, indicating that a stable economy can ensure that supporting financial institutions will have solvency in the future. Inflation and the unemployment ratio show the expected negative relationship.

The ROL (role of law) and political stability have significantly positive relationships with solvency, which indicates that strong law enforcement agencies and a stable political situation will have a positive impact on a bank’s solvency. Political stability plays an important role in economic growth, but in a growing economy, the financial sector is a pillar and makes a significant contribution.

Conclusions and policy implications

After the global economic crisis, researchers, regulators, and policymakers studied the influence of banks and macroeconomic factors on NPLs. In our study, we used advanced panel data analysis methods, specifically GMM system two-step estimates to investigate the factors that influence the NPL ratios of 59 banks in the Turkish banking industry from 2011 to 2017.

As the increase in NPLs is a significant feature of the financial crisis, many empirical studies focused on NPLs. To maintain the bank’s financial/loan stability, determining the increase in the NPL ratio in the banking system is a crucial issue. The last global financial crisis emphasized the importance of banking systems in most advanced and emerging market economies. Many banking systems had structural weaknesses such as bad loans, dangerous financial applications, and moral hazard, bad governance, skimping, and bad debts during the last few decades. This study’s results affirm the findings in the literature; that is, the rapid growth of loans has the most serious impact on a bank’s balance sheet.

Many studies show that debtors do not immediately go bankrupt after receiving prepayments, but generally require more than 3 years. Although prior studies show that the increase in abnormal debt in the previous year was positively correlated with the loss on bank and personal bank loans (Foos et al. 2010), our study contributes to the literature by confirming these results using a set of different micro and macro variables. Specifically, loan growth increased NPLs, which in turn affect a bank’s solvency. Nevertheless, abnormal loan growth during a loan boom tends to increase NPLs, which directly affect the decline in capital ratios and results in the bankruptcy of banks. This study contributes to the literature by including a robust set of macro variables (GDPt, INFt, UNEMPLt, ROLt, and POLSTt) in different models. Our finding clearly shows that due to the increase in NPLs, a sudden fall in the capital tends to decrease solvency. These problems may weaken the banking system and cause payment difficulties. NPLs decrease bank assets, which leads to bank insolvency. Macroeconomic variables also affect a bank’s financial stability. Therefore, these issues must be addressed to create sustainable macroeconomic conditions, rapid economic activity, high economic performance, new job creation, and financial stability. Otherwise, the potential risks in the banking system may decrease economic growth, and increase unemployment and prices, thereby leading to an economic and/or banking crisis.

Future research can adopt various macroeconomic and bank-specific variables and different estimators to explore the association between these variables and a bank’s bad loans. First, the impact of these factors on NPLs can be analyzed in deeper for the Turkish banking sector. Second, it may be worthwhile for Turkey to use different econometric methods to study credit risk. The results can be debated based on the results of previous banking studies and the related assumptions.

Availability of data and materials

Data collected for this paper is from Bankscope, data and material will be furnished on demand.

Abbreviations

- EY:

-

Ernst & Young

- GDP:

-

Gross domestic product

- GMM:

-

Generalized method of moments

- LG:

-

Loan growth

- NPLs:

-

Non-performing loans

- SFH:

-

Special Financial House

- SOL:

-

Solvency

References

Afsar M (2011) Küresel Kriz ve Türk Bankacılık Sektörüne Yansımaları. Eskişehir Osmangazi Üniversitesi İktisadi ve İdari Bilimler Dergisi 6(2):143

Alesina A, Özler S, Roubini N, Swagel P (1996) Political instability and economic growth. J Econ Growth 1(2):189–211

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Ari A, Cergibozan R (2018) Currency crises in Turkey: an empirical assessment. Res Int Bus Financ 46:281

Ariff M, Luc C (2008) Cost and profit efficiency of Chinese banks: a non-parametric analysis. China Econ Rev 19(2):260–273

BASCI E, Kara H (2011) Finansal istikrar ve para politikası. İktisat İşletme ve Finans 26(302):9–25

Beim D, Calomiris C (2001) Appendix to chapter 1. D. Beim and C. Calomiris. Emerging financial markets. McGraw-Hill/Irwin, New York

Berger AN, Hasan I, Zhou M (2009) Bank ownership and efficiency in China: what will happen in the world’s largest nation? J Bank Financ 33(1):113–130

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98(2):175–212

Berger AN, Udell GF (2004) The institutional memory hypothesis and the procyclicality of bank lending behavior. J Financ Intermed 13(4):458–495

Blejer MI (2006) Economic growth and the stability and efficiency of the financial sector. J Bank Financ 30(12):3429–3432

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Boudriga A, Taktak NB, Jellouli S (2010) Bank specific, business and institutional environment determinants of banks nonperforming loans: evidence from mena countries. In Economic Research Forum, Working Paper (Vol. 547). pp. 1-28.

Chadwick MG (2018) Effectiveness of monetary and macroprudential shocks on consumer credit growth and volatility in Turkey. Central Bank Review

Chao X, Kou G, Peng Y, Alsaadi FE (2019) Behavior monitoring methods for trade-based money laundering integrating macro and micro prudential regulation: A case from China. Technological and Economic Development of Economy. pp. 1-16.

Cottarelli C, Dell’Ariccia G, Vladkova-Hollar I (2005) Early birds, late risers, and sleeping beauties: Bank credit growth to the private sector in central and Eastern Europe and in the Balkans. J Bank Financ 29(1):83–104

Denizer CA, Dinc M, Tarimcilar M (2007) Financial liberalization and banking efficiency: evidence from Turkey. J Prod Anal 27(3):177–195

Eichengreen B, Arteta C (2002) Banking crises in emerging markets: presumptions and evidence. Financial policies in emerging markets, pp 47–94

Foos D, Norden L, Weber M (2010) Loan growth and riskiness of banks. J Bank Financ 34(12):2929–2940

Fukuyama H, Matousek R (2011) Efficiency of Turkish banking: two-stage network system. Variable returns to scale model. J Int Financ Mark Inst Money 21(1):75–91

Isik I, Hassan MK (2002) Technical, scale and allocative efficiencies of Turkish banking industry. J Bank Financ 26(4):719–766

Jermias J, Yigit F (2018) Factors affecting leverage during a financial crisis: evidence from Turkey. Borsa Istanbul Rev 19(2):171

Johnson S, Boone P, Breach A, Friedman E (2000) Corporate governance in the Asian financial crisis. J Financ Econ 58(1–2):141–186

Kashif M, Iftikhar SF, Iftikhar K (2016) Loan growth and bank solvency: evidence from the Pakistani banking sector. Financ Innovation 2(1):22

Kraft E, Jankov L (2005) Does speed kill? Lending booms and their consequences in Croatia. J Bank Financ 29(1):105–121

Li G, Kou G, Peng Y (2016) A group decision making model for integrating heterogeneous information. IEEE Trans Syst Man Cybern Syst Hum 48(6):982–992

Louzis DP, Vouldis AT, Metaxas VL (2012) Macroeconomic and bank-specific determinants of non-performing loans in Greece: a comparative study of mortgage, business and consumer loan portfolios. J Bank Financ 36(4):1012–1027

Messai AS, Jouini F (2013) Micro and macro determinants of non-performing loans. Int J Econ Financ Issues 3(4):852

Mester LJ (1996) A study of bank efficiency taking into account risk-preferences. J Bank Financ 20(6):1025–1045

Nguyen T, Locke S, Reddy K (2015) Ownership concentration and corporate performance from a dynamic perspective: does national governance quality matter? Int Rev Financ Anal 41:148–161

Ozkan-Gunay E, Tektas A (2006) Efficiency analysis of the Turkish banking sector in precrisis and crisis period: a DEA approach. Contemp Econ Policy 24(3):418–431

Reinhart CM, Rogoff KS (2011) From financial crash to debt crisis. Am Econ Rev 101(5):1676–1706

Salas V, Saurina J (2002) Credit risk in two institutional regimes: Spanish commercial and savings banks. J Financ Serv Res 22(3):203–224

Schultz EL, Tan DT, Walsh KD (2010) Endogeneity and the corporate governance-performance relation. Aust J Manag 35(2):145–163

Selcuk B (2010) Küresel Krizin Türk Finans Sektörü Üzerindeki Etkileri. Ekonomi Bilimleri Dergisi 2(2):21

Selim Elhadef, F. O. a. L. T. (2016). Turkish banking: current state and the way forward Internaional financial law review: EY, Global banking and financial policy review.

Shahzad F (2019) Does weather influence investor behavior, stock returns, and volatility? Evidence from the Greater China region. Physica A: Statistical Mechanics and its Applications 523:525–543

Shahzad F, Lu J, Fareed Z (2019) Does firm life cycle impact corporate risk taking and performance?. J Multinational Financ Manag.

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Tan W, Ma Z (2016) Ownership, internal capital market, and financing costs. Emerg Mark Financ Trade 52(5):1259–1278

Tan W, Yu S, Ma Z (2018) The impact of business groups on investment efficiency: does capital allocation matter? Emerg Mark Financ Trade 54(15):3539–3551

Tinoco-Zermeño MÁ, Venegas-Martínez F, Torres-Preciado VH (2014) Growth, bank credit, and inflation in Mexico: evidence from an ARDL-bounds testing approach. Latin American Economic Review 23(1):8

Us V (2017) Dynamics of non-performing loans in the Turkish banking sector by an ownership breakdown: the impact of the global crisis. Financ Res Lett 20:109–117

Wang Z, Wang Y (2019) Ownership, internal capital markets, and cash holdings. Emerg Mark Financ Trade 55(7):1656–1668

Wang Z, Zhang Z, Zhang H (2019) Can institutional investors improve voluntary management earnings forecasts? Emerg Mark Financ Trade:1–23

Wintoki MB, Linck JS, Netter JM (2012) Endogeneity and the dynamics of internal corporate governance. J Financ Econ 105(3):581–606

Xiaoqing Maggie F, Heffernan S (2007) Cost X-efficiency in China's banking sector. China Econ Rev 18(1):35–53

Zaim O (1995) The effect of financial liberalization on the efficiency of Turkish commercial banks. Appl Financ Econ 5(4):257–264

Zhang H, Kou G, Peng Y (2019) Soft consensus cost models for group decision making and economic interpretations. Eur J Oper Res 277(3):964

Acknowledgments

We greatly acknowledge the editor and anonymous reviewers of the Financial Innovation journal for their timely comments and proceedings on this paper. We also acknowledge Professor Jing Lu for his advice and encouragement while we were working on this paper.

Funding

Funding information is not applicable / No funding was received.

Author information

Authors and Affiliations

Contributions

FS carried out the idea of this paper and also the main author of this paper. ZF collected data and did statistical analysis. BZ contributed in methodology part. UH did help to revised manuscript. MI contributed in literature review part. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The findings, explanations, recommendations and conclusions of this paper are those of the authors and do not necessarily reflect the views of the central bank, commercial banks or any other policy-making body in the country. The authors of the paper understand the policy of “financial innovation” on the declaration of interest and declare that they have no financial and non-financial competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Shahzad, F., Fareed, Z., Zulfiqar, B. et al. Does abnormal lending behavior increase bank riskiness? Evidence from Turkey. Financ Innov 5, 37 (2019). https://doi.org/10.1186/s40854-019-0152-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-019-0152-2