Abstract

Access-based consumption, a growing trend in today’s society, provides the consumer with an opportunity to have access to new and diverse products without the burden of ownership. As one form of access-based consumption in the fashion industry, fashion renting still lacks development and popularity. The purpose of this study is to identify how perceived risks and frugal shopping affect the attitudes, perceived enjoyment and further behavioral intention toward the adoption of fashion renting. An online survey was conducted with 452 participants in the United States. Structural equation modeling was employed to test the proposed hypotheses. The results confirmed the negative influences of three perceived risks (financial risk, performance risk, psychological risk) and the positive influences of frugal shopping on attitude toward and perceived enjoyment of fashion renting. Additionally, perceived enjoyment and attitudes were both found having positive influences on consumers’ intention toward fashion renting. This study contributes to existing literature by discovering the effects of perceived risks on attitude and perceived enjoyment of fashion renting and further fashion renting intentions. Managerial suggestions are also provided to promote fashion renting in the future.

Similar content being viewed by others

Introduction

Over-consumption has been identified as one of the major challenges facing sustainability in the fashion industry (Armstrong et al. 2015). Consumers keep purchasing fashion items more than is needed, which generate more wastes. This is especially true with the rising popularity of fast fashion. Consumers are now able to purchase more fashion products that are being used for a shorter period at a relatively lower cost. Although the fast fashion strategy makes it easier for consumers to purchase apparel products with a higher frequency, it also creates pressure for some consumers to follow the fast-changing trends. Because of trying to keep pace with the ever-changing fast fashion trends, many consumers continuously purchase the latest fashion products, which may exceed their needs or even their financial capacity and suffer ownership burdens.

Access-based consumption, defined as “transactions that can be market-mediated in which no transfer of ownership takes place” (Bardhi and Eckhardt 2012, p. 881), is a growing trend in today’s society. This new type of consumption provides the consumer with an opportunity to access new and diverse products without the burden of ownership (Bardhi and Eckhardt 2012). Renting has been identified as one typical form of access-based consumption (Moeller and Wittkowski 2010). Recently this trend has started to grow in the fashion industry. Some notable fashion rental companies such as Rent the Runway and The Ms. Collection have entered the market and provide fashion rentals to consumers for about 20% of the retail price (Gao 2017). In addition, this new trend has also been suggested as an alternative source of revenue for the fashion industry (WRAP 2011). Marketing research conducted by Allied Market Research (2017) reported that the global renting market was valued at $1013 million in 2017. The online clothing rental market size is estimated to reach $1856 million by 2023; North America accounted for a 40% share of the global clothing rental market in 2017.

Although access-based consumption may hold substantial benefits for businesses and societies and is continuing to expand and gain more attention, not all consumers have been engaged in the transactions (PwC 2015; The Nielsen Global Survey 2014). The idea of renting is still in its infancy and lacks popularity and development in the fashion industry (Demailly and Novel 2014; Pedersen and Netter 2015; Piscicelli et al. 2015). Marketing research conducted by The Nielsen Global Survey (2014) reports that only 22% of participants were willing to rent clothing items. A variety of concerns about fashion rental have been pointed out (Armstrong et al. 2015), such as financial issues and social concerns. Although some assumptions have been made, empirical evidence identifying barriers and motivations to clothing renting is lacking. Perceived risks, which are involved in all purchase decisions (Dholakia 2001), have been identified as key elements of buying behavior and significantly impact purchasing decisions (Kumar and Grisaffe 2004). In pursuit of sustainable apparel consumption, Kang and Kim (2013) also affirmed the negative effect of four potential risks, including financial risk, performance risk, psychological risk, and social risk. These risks may impede consumers renting behavior. In addition, enjoyment of the shopping process is another important concept in retailing. Perceived enjoyment of a certain behavior has also been found to significantly influence intention (Davis et al. 1992). Additionally, being frugal may motivate consumers to rent instead of buying some fashion products as renting is usually cheaper than buying.

However, to date, no study has examined the relationships between perceived risks and enjoyment of renting and consumers’ intention to rent fashion products. Therefore, the researcher aims to expand existing knowledge of access-based consumption behavior by identifying how perceived risks and frugality impact the attitude, perceived enjoyment and further behavioral intention toward fashion renting. To examine the influence of these factors on fashion renting would provide a better understanding of consumer profiles for those who more likely to rent fashion items. The results of this study are expected to contribute to the broader literature that focuses on access-based consumption in the fashion industry and to lay the foundations for the development of strategies that encourage fashion-renting business.

Though there are a number of research studies on renting, the majority of these studies have been conducted in Europe (Edbring et al. 2016; Leismann et al. 2013; Martin and Upham 2016; Pedersen and Netter 2015; Piscicelli et al. 2015) and none of these studies have been specifically focusing on fashion renting. Empirical research on consumers’ adoption of access-based consumption in the US is still lacking. On average, each US consumer spent $1141 to purchase 64 pieces of clothing in 2013 (American Apparel & Footwear Association 2015), the equivalent of 16 kg of new clothes, which is above the global average of 5 kg per person in 2014 (Cobbing 2016). High levels of apparel consumption lead to a high volume of landfill waste caused by the apparel industry in the US The fast-growing rate of apparel consumption in the US and its subsequent waste are fueling an environmental crisis. Therefore, this study was conducted in the United States. A quantitative research method with an online survey was employed in this study. Structural equation modeling was conducted to test the proposed hypotheses. The results confirmed the negative influences of three perceived risks and positive influences of frugal shopping on attitude toward and perceived enjoyment of fashion renting. Additionally, perceived enjoyment and attitudes were both found to have positive influences on consumers’ intention toward fashion renting.

Literature review

Access-based consumption and fashion renting

Access-based consumption allows consumers the access to usage of a product for a certain period of time by paying an access fee, while the legal ownership remains with the provider (Schaefers et al. 2016). Access-based consumption is also known as non-ownership consumption, which is considered one form of collaborative consumption (Leismann et al. 2013). Access-based consumption is based on the idea of sharing usage of product (Bardhi and Eckhardt 2012); but it is different from other types of sharing, such as swapping, in which a permanent transfer of ownership is involved (Belk 2010). Instead, in the process of access-based consumption consumers focus on the temporary use of a certain product, rather than obtaining the property right to the product (Gruen 2017; Moeller and Wittkowski 2010; Schaefers et al. 2016).

Access-based consumption brings environmental advantages because it encourages consumers to share-use products, which increase the use frequency of products that might be discarded after limited use otherwise (Armstrong et al. 2015; Botsman and Rogers 2010). Access-based consumption also brings benefits to consumers. It provides consumers with an opportunity to experience a variety of new products without the burden of ownership (Belk 2007), which they may not be able to afford otherwise. Especially in the fashion industry, access-based consumption enables consumers to achieve more variety in apparel choice and to have access to new fashions and special fashion products that would not be accessible otherwise (Balck and Cracau 2015). For example, an individual who cannot afford luxury fashion items can now consume them through access-based consumption. The services are also beneficial for consumers who are undergoing temporary body-shape changes, such as pregnant women; these services provide cost-effective solutions to these consumers (Allied Market Research 2017). Businesses will also generate revenue by providing usage of products (Durgee and O’Connor 1995) because the rental company maintains the permanent ownership of these products and are able to rent to multiple consumers at different times; therefore, generate profit.

Renting, one typical form of access-based consumption (Moeller and Wittkowski 2010), is defined as when “one party offers an item to another party for a fixed period of time in exchange for a fixed amount of money and in which there is no change of ownership” (Durgee and O’Connor 1995, p. 90). Renting is not a new concept and has been in effect through various products and services for some time, such as car renting programs (Bardhi and Eckhardt 2012), toys (Ozanne and Ballantine 2010), music and film (Botsman and Rogers 2010), furniture, musical instruments (Durgee and O’Connor 1995), and so on. Recently, this type of trend has started to grow in the fashion industry. Raised awareness concerning positive environmental impacts of access-based consumption is propelling the growth of the fashion rental market.

The fashion rental market also works to address the fashion needs of consumers who do not want to spend money on clothes that are to be worn for only one or two occasions, making it more affordable and convenient (Allied Market Research 2017). Renting encourages the consumer to enjoy the usage and function of products without the burdens of ownership, which includes not only the cost of purchasing, maintaining and storing the product, but also the risk of obsolescence and disposition (Philip et al. 2015). Especially in the fashion industry, fashion trends update frequently and fashion products are replaced by new styles quickly, which may bring financial burdens to consumers who always want to keep up with latest fashion trends. Fashion-conscious consumers with weak financial conditions often find clothing rental services preferable (Allied Market Research 2017). There are some notable fashion renting businesses exist in the market. For example, BagBorroworSteal.com provides consumers with short-term renting, where consumers can rent designers’ products for short periods. There are also some rental businesses that provide subscription-based renting, by which consumers can rent unlimited fashion items for 1 month with a monthly subscription fee. For instance, Rent the Runway provides designer dresses and accessory rentals through online services; The Ms. Collection provides consumers with an unlimited designer dresses and accessory rentals; Fashionhire.com provides consumers with designer bag rentals; Gwynnie Bee provides plus-size clothing rentals; Le Tote provides women’s clothes and accessory rentals for consumers’ everyday style; and Albright, a fashion library located in New York, offers an archive of classic pieces of high-end fashion products.

Previous research has examined motivations and barriers for access-based consumption (Edbring et al. 2016; Mohlmann 2015). In regard to the fashion renting, researchers mainly focus on consumer preferences and motivations in some exploratory qualitative studies. For example, Mun and Johnson (2014) conducted in-depth interviews to find out participants’ motivations and perceived benefits for collaborative consumption of apparel products, including online renting. Armstrong et al. (2015) conducted focus groups to identify consumers’ preferences and concerns in regards to apparel renting. Pedersen and Netter (2015) also performed semi-structured interviews to investigate the opportunities and barriers of fashion libraries. These researchers found similar motives for fashion renting participation, including having access to the latest fashion items at a lower cost and being more environmentally conscious. Challenges to adoption, such as hygiene risks with used clothing and lack of trust in the provider (Armstrong et al. 2015; Edbring et al. 2016), financial risks (Mun and Johnson 2014), have also been identified previously. However, to date, quantitative studies focusing on the role of perceived risks and perceived enjoyment of renting in consumers’ acceptance of fashion renting has not been investigated.

Financial risk

Financial risk refers to concerns about potential financial loss due to a purchase decision (Kang and Kim 2013). Schaefers et al. (2016) have found that the perceived financial risk of ownership positively influences consumers’ frequency of using access-based consumption in order to avoid the risk of ownership burden. However, Armstrong et al. (2015) point out that financial issues are major concerns for fashion rental. For example, consumers may have concerns about the financial loss if they pay the provider for renting up-dated fashion items, but do not get what they expect. Lack of trust in the provider has been identified as one of the barriers to fashion renting (Armstrong et al. 2015). In general, perceived risks may cause negative feelings, such as anxiety, discomfort, and uncertainty (Yüksel and Yüksel 2007). Specifically, with concerns of suffering a financial loss, consumers may not be able to perceive the process of renting as enjoyable. In addition, the negative influence of financial risk on attitude has also been confirmed (Kang and Kim 2013). Renting encourages consumers to focus on the temporary use of the product without transfer of permanent ownership (Bardhi and Eckhardt 2012), which may also cause concerns to some consumers who might think that it is a waste of money to rent clothing rather than owning it. Consumers’ positive attitude toward renting may also be influenced by concerns pertaining to not getting what they paid for. Therefore, the following hypothesis was proposed:

- H1::

-

The perceived financial risk of renting has a negative influence on (a) consumers’ attitude toward fashion renting; (b) perceived enjoyment of fashion renting.

Performance risk

Performance risk involves the uncertainty about whether or not the performance of the product will be as expected (Schaefers et al. 2016). Usually, rental clothes are shared and thus worn by multiple users, which raise concerns about hygiene issues of rental items (Armstrong et al. 2015; Gao 2017). A previous study conducted by Argo et al. (2006) has confirmed that consumers usually have concerns about contagion when they know that an object has been physically touched by someone else, especially a stranger. Not knowing if the item they rent is clean or not may impede consumers’ positive attitude toward renting fashion items, thus may not be able to enjoy the process of renting and the use of these rented items. Additionally, for some online fashion renting, consumers may also have worries regarding the quality of the rental items; whether or not the rental items will look good on them is also another concern since they are not able to try the clothing on before placing the order. For first-time renting consumers, a major concern is that information about the product from a certain renting company is lacking, thus, performance risk is expected to increase. In this sense, due to the potential negative consequences in regard to the uncertainty of product quality and cleanliness, perceived performance risk is also expected to cause negative attitudes and emotional feelings. Therefore, we hypothesize as below:

- H2::

-

The perceived performance risk of renting has a negative influence on (a) consumers’ attitude toward fashion renting; (b) perceived enjoyment of fashion renting.

Psychological risk

Psychological risk refers to the potential negative influence of a certain behavior on one’s self-image (Kang and Kim 2013). When considering psychological risk, consumers contemplate the potential loss of self-esteem or ego caused by engaging in a behavior. Perceived risk, which involves psychological risk, has been found to negatively influence the degree to which an individual’s feeling of joy and fun is experienced (Yüksel and Yüksel 2007). In addition, the negative influence of perceived psychological risk on attitude toward the consumption of environmentally sustainable apparel has been confirmed (Kang and Kim 2013). Fashion renting provides consumers with an opportunity to obtain the usage of new fashion items without the burden of ownership; however, to some consumers, ownership is a symbol of status. Ownership has been considered the ideal consumption type in many societies, which is associated with individuals’ prestigious status and a sense of security and independence (Gao 2017). Nonetheless, renting behavior has, in contrast, been considered to be related to low social status and low financial power (Bardhi and Eckhardt 2012). Some consumers may believe that renting instead of buying will not match their personal image; instead, they believe that it will ruin their personal style and cause them to lose self-esteem. They may also feel a lack of security brought about by not owning the products; thus, they would not be able to perceive the renting process as enjoyable. A negative attitude toward renting may develop as well. Therefore, the following hypothesis was proposed:

- H3::

-

The perceived psychological risk of renting has a negative influence on (a) consumers’ attitude toward fashion renting; (b) perceived enjoyment of fashion renting.

Social risk

Social risk refers to the negative outcomes that a purchase decision may have on one’s social standing and disapproval from one’s family members or friends (Schaefers et al. 2016). As opposed to psychological risk, social risk indicates that consumers consider how the use of products or the purchase decisions they make may damage or reduce their image in the eyes of others (Kang and Kim 2013). Social risk takes into account how society influences a consumer’s decision. Apparel consumption not only satisfies a basic need but also delivers a sense of belonging and reflects a consumer’s social status (Gonzalez and Bovone 2012). However, social concerns have been pointed out as a major concern for fashion rental (Armstrong et al. 2015). Having concerns about whether or not they are able to identify clothing items that would be reflective of their personal style might impede consumers to participate in fashion renting. In addition, when all the high-end fashion clothes are rented but not owned by the consumer, it becomes questionable for consumers to identify which status group they belong to (Gao 2017). Previous studies have confirmed the negative influences of perceived social risk on consumers’ attitude toward sustainable apparel consumption (Kang and Kim 2013) and perceived enjoyment (Yüksel and Yüksel 2007). Through renting, consumers are able to wear some fashion items that they are not able to afford otherwise, which may reflect that the individual is striving for a luxurious life that is not in accordance with their real social status. Consumers may also have concerns about how other people think of them when they wear the fashion items they rent and cannot afford to buy. Thus, having concerns that renting can damage their image in the eyes of others, consumers may not have a positive attitude toward fashion renting, thus, may not perceive renting as fun and enjoyable. Therefore, the following hypothesis was developed:

- H4::

-

The perceived social risk of renting has a negative influence on (a) consumers’ attitude toward fashion renting; (b) perceived enjoyment of fashion renting.

Frugal shopping

Frugality concerns two prominent aspects of consumer motivations: economizing monetary and material resources (Lastovicka et al. 1999). Frugal consumers are usually more conscious of the price and value of products (Kasser 2005); they prefer to take activities to avoid wasting money and resources (Evans 2011). Usually, through renting, consumers have access to fashion items at a relatively lower price compared to buying those items (Gao 2017), which might be attractive to frugal consumers. A qualitative research conducted by Moeller and Wittkowski (2010) has found that renting is usually cheaper than buying, and the price has been revealed as one of the most important factors determining consumers’ decision to rent or buy. Gao (2017) also argues that one of the major motivations for fashion renting is economic. The idea of fashion renting gives people the benefit of keeping up with new trends at reduced costs while avoiding ownership burdens and reducing expenditures on fashion items, as well as lowering negative environmental impacts by increasing use intensity and reducing waste (Botsman and Rogers 2010; Moeller and Wittkowski 2010). Frugal consumers might think renting is a more economical way to keep up with latest fashion trend and consume high-end fashion items. Economic benefit has been regarded as an important incentive in access-based consumption (Edbring et al. 2016) and positively influences attitude (Hamari et al. 2015). With the knowledge that renting fashion items would be a means to consume the latest fashion products at lower prices, a positive attitude toward the behavior of fashion renting will be developed. In addition, the process of shopping for favorable up-dated fashion items to rent may be perceived as enjoyable and fun, knowing that it also enables them to save money. Therefore, the hypothesis is proposed as below:

- H5::

-

Frugal shopping has a positive influence on (a) consumers’ attitude toward fashion renting; (b) perceived enjoyment of fashion renting; (c) consumers’ intention toward fashion renting.

Perceived enjoyment

Perceived enjoyment interprets the extent to which performing a certain activity is perceived to be enjoyable in itself, regardless of the performance consequences that are expected (Davis et al. 1992). As the intrinsic motivation, perceived enjoyment indicates the pleasure, fun, and satisfaction gained from performing a certain behavior (Teo et al. 1999). Perceived enjoyment is a salient factor affecting consumer attitudes and intentions toward the behavior (Davis et al. 1992). Individuals might be more likely to get involved in a particular behavior if it yields fun and pleasure. In addition, when a certain activity is perceived to be enjoyable, a positive attitude toward the behavior is also developed. The enjoyment of the shopping process is an important concept in retailing. Several studies have examined consumers’ shopping motivation and confirmed the importance of having fun during the shopping process (Arnold and Reynolds 2003; Kang and Park-Poaps 2010). Fashion renting requires consumers to share products that may have been used by other people. Not enjoying the idea of sharing may discourage consumers’ intention to rent. If renting is perceived to provide positive feelings and experiences, consumers will be more likely to accept it. The positive influence of perceived enjoyment on intentions toward a certain behavior has been confirmed by several studies, such as collaborative consumption (Hamari et al. 2015), apparel customization (Lang et al. 2018; Lee and Chang 2011), online shopping (Ramayah and Ignatius 2005), technology use (Teo and Noyes 2011), and so forth. Enjoyment has also been identified as an important factor in other sharing-related activities, such as online information sharing (Nov et al. 2010). Given that the shopping process of fashion products is a form of a hedonic system, perceived enjoyment is expected to have a salient influence on purchase intention toward fashion renting. Therefore, the following hypothesis was developed:

- H6::

-

Perceived enjoyment has a positive influence on consumers’ intention toward fashion renting.

Attitude

Attitude refers to “the degree to which a person has a favorable or unfavorable evaluation or appraisal of the behavior in question” (Ajzen 1991, p. 188). A positive attitude toward a given behavior indicates that an individual is more likely to participate in the behavior. Edbring et al. (2016) point out that people usually have a positive attitude towards temporary renting of products. Fashion trends change quickly, which brings financial pressure to follow the fast-changing trends for many consumers. Fashion renting provides an alternative to fashion consumption in a way that consumers can maintain access to new clothes for a temporary period of time without having to buy more in order to catch up with the new trends (Pedersen and Netter 2015). The benefit of reducing ownership burden may develop a positive attitude toward fashion renting among consumers. A previous study has confirmed the positive influence of attitude on collaborative consumption (Hamari et al. 2015). Recently, Johnson et al. (2016) have pointed out the positive influence of attitude on online apparel collaborative consumption, which includes renting. Therefore, the following hypothesis was developed:

- H7::

-

Consumers’ attitude has a positive influence on consumers’ intention toward fashion renting.

Methods

Sample and data collection

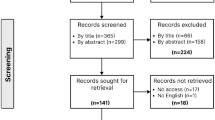

A purposive sampling strategy was employed with an online survey for data collection. To develop a representative sample, a consumer panel of the target population was purchased from an online research company, which solicited responses by sending the survey link to the targeted population in an email invitation. To ensure a balanced sample of each age group and gender, a quota was set on each of the age groups and genders. Each respondent was given a brief description of the study explaining Institutional Review Board approval and the implications of participation. Data cleaning generated 452 usable samples out of 607 returned responses, with an overall completion rate of 74.76%.

Measures and questionnaire

The questionnaire contained three sections. In the first section, multi-item scales were utilized to measure perceived risks, frugality, attitude and perceived enjoyment. All of these constructs were measured on 5-point Likert scales with “1 = strongly disagree, to 5 = strongly agree.” Perceived risks contained four dimensions (Kang and Kim 2013): financial risk, performance risk, psychological risk and social risk. Each dimension was measured by a multiple-item scale modified from Kang and Kim (2013). Frugal shopping behavior was measured by four items adapted from Kasser (2005). A semantic differential scale (Ajzen 2002) was employed to measure attitude towards fashion renting. An incomplete statement regarding fashion renting was developed, followed by five groups of semantic differential adjectives. Based on the 5-point scale, participants were requested to select the corresponding adjective from each group to complete the statement. Perceived enjoyment in sharing fashion products was also measured by a five-item scale, adapted from Hsu and Lin (2008) and Teo and Noyes (2011).

The second section of the questionnaire contains questions regarding consumers’ intention toward fashion renting. To provide a better idea of fashion renting, a hypothetical scenario statement was developed to gauge the participants’ overall outlook on fashion renting. Participants were requested to rate the level of willingness to adopt the fashion renting model by responding to the question, “I intend to rent clothing or consider renting fashion products in the next 12 months?” The item was measured utilizing a 5-point Likert scale 1 = “strongly disagree” to 5 = “strongly agree.” The scenario was described below:

A fashion retailer provides a rental service for consumers to rent a certain number of garments for a short time period (both online and physical store); consumers can rent a variety of designer dresses and accessories, as well as many options of the latest fashion products.

Applying a scenario to describe the renting business in the research design will give participants a visualized idea about the fashion renting process. The third section measures consumers’ demographics, including gender, ethnicity, education, and annual income.

Data analysis

Reliability and validity were both examined. A two-step approach was adopted (Anderson and Gerbing 1988). Confirmatory factor analysis (CFA) was first conducted to find a better model for the measurement of each latent variable (Jackson et al. 2009). Then, structural equation modeling (SEM) was employed to test the proposed hypotheses. The goodness-of-fit (GFI) indices used in this study include the Chi square normalized by degrees of freedom χ2/df < 3 for a good model fit (Kline 2010); the conventional cut off ≥ 0.90 for an acceptable fit for CFI and TIL, and ≥ 0.95 for a good fit (Hu and Bentler 1999). RMSEA and SRMR values between 0.05 and 0.08 represent an acceptable fit and values < 0.05 indicate a good fit (Hu and Bentler 1999; Kline 2010).

Results

Characteristics of participants

Of the total 452 participants, 43.6% were male and 56.4% were female. Caucasian/white made up 64.6% of the sample, Hispanic and African American/Black 14.2 and 13.5%, respectively. In addition, 33.6% of participants were age 18–35, 34.7% were 36–50, and 31.6% were 51–69. In regards to education, 38.7% of the sample had a college degree, 16.6% of them had a Masters/MBA degree. There were also 24.8% participants who reported having some college education. In regard to annual household income, 27.9% of participants reported annual income being more than US $100,000; participants with annual household income of US $40,000–US $59,999 and US $80,000–US $99,999 both made up 14.6% of the sample (see Table 1).

Estimation and validation

The result of the confirmatory factor analysis of the measurement model, including seven latent constructs with 28 items, exhibited an excellent model fit (\(\chi_{(df = 303)}^{2}\) = 714.193, p < 0.000, χ2/df = 2.36; RMSEA = 0.055; CFI = 0.959; TLI = 0.952; SRMR = 0.048) (Kline, 2010; Hu and Bentler 1999). Next, construct validity was also confirmed by assessing convergent validity and discriminant validity. All CFA loadings were higher than 0.5, which provided evidence for convergent validity (Kline 2010); and the average variance extracted (AVE) for each construct was greater than 0.5 (Anderson and Gerbing 1988), suggesting that each construct is well represented by its own indicators. In addition, discriminant validity between constructs was also established because all AVEs ranging from 0.501 to 0.849 exceeded squared correlations between the constructs, ranging from 0.001 to 0.516 (Fornell and Larcker 1981). Cronbach’s alpha estimates of all constructs ranged from 0.748 to 0.965, which exceeded the recommended 0.70 cut off point (Cortina 1993), confirming the reliability of measurement. Tables 2 and 3 present the results regarding convergent and discriminant validities and the reliability of the instruments.

Hypotheses test

Structural equation modeling was applied to examine the proposed hypotheses. The results revealed an acceptable model fit (\(\chi_{(df = 352)}^{2}\) = 843.665, p = 0.000, χ2/df = 2.39; RMSEA = 0.056; CFI = 0.955; TLI = 0.948; SRMR = 0.050) (Kline 2010; Hu & Bentler 1999). The individual paths of the model were examined. The large sample size of 452 is a possible reason for the poor fit indicated by the statistical significance test (Kline 2010; Sawyer and Page 1984). The Chi Square test is sensitive to sample size and large sample sizes tended to be rejected and it is no longer relied upon as a basis for acceptance or rejection (Schermelleh-Engel et al. 2003; Vandenberg 2006); therefore, multiple fit indexes were used for model fit evaluation.

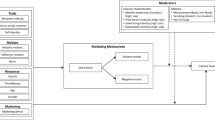

The negative effects of perceived financial risk on attitude (β = − 0.131, p < 0.002) and perceived enjoyment (β =− 0.222, p < 0.000) were both supported. Similarly, the performance risk was also found negatively affect attitude (β = − 0.354, p < 0.000) and perceived enjoyment (β = − 0.275, p < 0.000). In addition, the psychological risk was also found negatively affect attitude (β = − 0.324, p < 0.000) and perceived enjoyment (β = − 0.218, p < 0.000). Therefore, H1a, H1b, H2a, H2b, H3a, and H3b were all supported. However, the effects of social risk on attitude (β = − 0.078, p = 0.152) or perceived enjoyment (β = − 0.059, p = 0.100) were not significant. Thus, H4a and H4b were not supported. Next, the effects of frugal shopping on clothing attitude (β = 0.273, p < 0.012) and perceived enjoyment (β = 0.255, p < 0.009) were both supported. However, no significant effects were found between frugal shopping with fashion renting (β = 0.065, p < 0.108). Therefore, H5a and H5b were both supported, but H5c was not supported by this study. Finally, the positive effects of attitude (β = 0.133, p < 0.017) and perceived enjoyment (β = 0.502, p < 0.000) on fashion renting intention were both confirmed. Thus, H6 and H7 were both supported (Fig. 1).

Discussion and implications

The purpose of this study is to determine the barriers and motivations for consumers to pursue access-based consumption, specifically, fashion renting. Four perceived risks, as well as perceived enjoyment, frugal shopping and consumers’ attitude toward fashion renting were investigated. In addition, three open-ended questions were included in this study to identify the specific barriers and motivators for fashion renting. Evidence from the study indicates that consumer intentions to rent clothing is encouraged by their attitudes, perceived enjoyment, as well as frugal shopping; but impeded by the perceived financial, performance, and psychological risks.

Specifically, study results point out that the three perceived risks of financial risk, performance risk, and psychological risk all negatively influence both consumers’ attitude toward and perceived enjoyment of fashion renting. This result contributes to the current literature in that the relationships between perceived risks of fashion renting and perceived enjoyment have not been previously researched. However, the negative relationship between financial risk and attitude is consistent with a previous study on environmentally sustainable apparel consumption conducted by Kang and Kim (2013). Financial risk indicates the concerns about financial loss of a purchase decision (Kang and Kim 2013). Although renting provides consumers with more variety of new fashion items with a relatively lower cost compared to retail prices (Gao 2017), some consumers may still think it is not worth the money merely to temporarily use the product. To those consumers, paying for the use of fashion products may be perceived as a waste. In addition, because the rental provider maintains ownership of renting items, some consumers may have concerns about how to keep the items in like-new condition and what will happen if they damage the rented fashion items. Specifically, consumers are not sure about their responsibility when it comes to the maintenance of the rented items and if they would have to pay more if they damage the items or they are not able to keep those items in good shape. Retailers need to consider consumers’ concerns about the potential financial loss in their marketing strategy. For example, to relieve financial concerns, retailers can provide a clear policy regarding the maintenance or damaging of items.

As predicted, the psychological risk was found to negatively impact attitude, which is consistent with a previous research by Kang and Kim (2013). No previous research was found that has investigated the relationship between psychological risk and perceived enjoyment. The negative influences of psychological risk on attitude and perceived enjoyment indicate that being afraid that fashion renting is not in accordance with their self-image may cause consumers unable to enjoy the process of renting. Although fashion renting provides consumers with an opportunity to have access to new fashion items with low cost; however, to some consumers, ownership is a symbol of status. They may think renting some items that they actually are not able to afford will ruin their personal style. Fashion rental retailers could highlight that renting conveys a new lifestyle, more sustainable and environmental.

Similarly, having concerns about the performance of rented items will also negatively affect consumers’ attitude toward and perceived enjoyment of fashion renting. The negative influence of performance risk on attitude was different from a previous research (Kang and Kim 2013), in which no significant relationship was found between performance risk and attitude toward environmentally sustainable apparel. Many rental retailers only provide renting services online, like Rent the Runway, Le Tote, and Gwynnie Bee, thus, consumers may have concerns about whether or not they will get what they pay for. Not being able to try the items on before they rent them may also bring concerns about whether or not these products will look good on them. In addition, the permanent ownership of renting products remains with the provider (Schaefers et al. 2016) and they may rent the same items out multiple times to different consumers. Therefore, concerns about hygiene when renting items may also influence consumers’ attitude toward renting and their perception of enjoyment about fashion renting. To provide a clear policy and description of the procedure for the maintenance and cleaning of items to be returned is an important strategy for fashion rental retailers to keep in mind.

However, as opposed to a previous research (Kang and Kim 2013), no significant relationships were found between social risks and attitude. The hypothesized negative influence of social risk on perceived enjoyment was not confirmed, which was not as predicted. This result indicates that the possible negative outcomes of social standing resulting from fashion renting do not really affect consumers’ attitude toward and perception of fashion renting. Consumers in a collectivist culture are more influenced by social norms than those in an individualist culture. The data in this study were collected in the United States, which is an individualistic society (Hofstede 1980). People who live in an individualistic society put a great deal of stress on personal achievements and individual rights, instead of being concerned with social pressure from others. These cultural characteristics might explain the weak influence of social risk in this study.

The direct effect of frugal shopping on consumers’ intention toward fashion renting was not significant, which is consistent with previous research conducted by Moeller and Wittkowski (2010) on consumers’ preference for non-ownership consumption. However, the positive influences of frugal shopping on both attitude and perceived enjoyment were confirmed. Frugal consumers are usually more conscious of the price and the value of products (Kasser 2005). These consumers care more about whether or not they are able to get what they pay for. Although economy has been stated as a major motivator to rent fashion items for many participants in this study, they may also have concerns regarding the performance of the products and whether or not what they receive is worth what they pay. These concerns might explain the non-significant direct effect of frugality on consumers’ intention toward fashion renting. Nevertheless, the perception of renting as being able to provide an opportunity to gain access to more options and new fashion items without the need to pay the full price of these products may still stimulate positive attitudes of consumers toward renting. Fashion retailers who provide renting services should emphasize the economic benefits of rentals in their marketing strategy.

As predicted, the positive relationship between perceived enjoyment and intention toward fashion renting was confirmed, which indicates that consumers who enjoy the process and results of renting fashion items are more likely to pursue fashion renting in their daily lives. Feeling enjoyment is an important motivator for people to get involved in a certain behavior. Individuals may engage in a particular behavior if it yields fun and enjoyment. Not feeling comfortable wearing rented items or not enjoying the renting process may discourage consumers’ engagement in renting. In addition, the results also point out the positive influence of attitude on consumers’ intention toward fashion renting, which is consistent with previous research on collaborative consumption conducted by Johnson et al. (2016) and Hamari et al. (2015). The results suggest that the decision to get involved in fashion renting is a rational process wherein consumers take into account their attitudes and personal perception about renting. Shaping attitudes and reducing perceived risks of fashion renting are crucial strategies as they may help consumers develop a sense of personal obligation regarding fashion renting.

Based on the results, clothing rental businesses should put emphasis on addressing financial, performance, and psychological risks in the development of their marketing strategies. Renting companies should provide a clear policy and description of how rented items are to be cared for and cleaned, along with specific policy information pertaining to damage during usage. In addition, emphasis on the opportunity to take advantage of a very large selection of new-to-the-user and fashionable items will also attract some consumers who are interested in variety. With regard to theoretical applications, this research adds a unique contribution to the body of knowledge pertaining to fashion renting intention of consumers by identifying the role of perceived risks, frugal shopping, perceived enjoyment, and attitude. This is the first time that these individual perceived risks have been investigated in relation to fashion renting. This research is in the beginning and exploratory stage. This beginning then gives researchers a basis to justify looking at different barriers and motivations more deeply in future work.

Conclusion and limitations

Overall, this study successfully identified certain barriers and motivation for fashion renting. It contributes to existing literature by discovering the effects of perceived risks on attitude and perceived enjoyment of clothing renting and further clothing renting intentions. Through a structural equation estimation, financial risk, performance risk, psychological risk, and frugal behavior proved to play an important role in influencing consumer attitude and perceived enjoyment, thereby influencing consumers’ intention to fashion renting. The negative influences of perceived risks on consumers’ intention to rent fashion, as well as the perceived concerns that the consumer has not been provided with direction for the fashion renting process by retailers should be considered in future marketing strategies. In addition, the results also highlight the positive role that perceived enjoyment and attitude have on the relationships between shopping values and the intention to purchase customized apparel products.

This study has several limitations that may need more study in future research. Firstly, a self-administered online survey method was used to collect data, which might limit the generalizability of the results. Second, the retail concept of fashion renting was explained in one sentence; participants may have different interpretations as they pertain to understanding fashion renting and this interpretation may have an influence on their response to the willingness to adopt this retail concept and generate bias. Third, participants were not requested to have actual fashion renting experiences, which may limit their evaluation on the perception of risks, attitude, and perceived enjoyment of fashion rental services. Finally, although behavioral intention has been used to measure behavior, the results are based on consumers’ intention, rather than behavior. Longitudinal research, which traces the model in association with behavior, would complement the findings of this study.

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211.

Ajzen, I. (2002). Constructing a TpB questionnaire: Conceptual and methodological considerations. Retrieved from: http://www.uni-bielefeld.de/ikg/zick/ajzen%20construction%20a%20tpb%20questionnaire.pdf. Accessed 18 Jan 2014.

Allied Market Research (2017). Online clothing rental market by end-users (women, men, and kids) and clothing style (ethnic, western, and others) - Global opportunity analysis and industry forecast, 2017–2023. Retrieved from: https://www.alliedmarketresearch.com/online-clothing-rental-market. Accessed 3 Feb 2018.

American Apparel & Footwear Association (2015). Apparelstats 2014 and shoestats 2014 reports. Retrieved from: https://www.wewear.org/apparelstats-2014-and-shoestats-2014-reports/. Accessed 19 Nov 2016.

Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103(3), 411–423.

Argo, J. J., Dahl, D. W., & Morales, A. C. (2006). Consumer contamination: How consumers react to products touched by others. Journal of Marketing, 70, 81–94.

Armstrong, C. M., Niinimäki, K., Kujala, S., Karell, E., & Lang, C. (2015). Sustainable fashion product service systems: An exploration in consumer acceptance of new consumption models. Journal of Cleaner Production, 97(15), 30–39.

Arnold, M. J., & Reynolds, K. E. (2003). Hedonic shopping motivations. Journal of Retailing, 79(2), 77–95.

Balck, B., & Cracau, D. (2015). Empirical analysis of customer motives in the shareeconomy: A cross-sectoral comparison. Retrieved from: www.fww.ovgu.de/fww_media/femm/femm_2015/2015_02.pdf. 19 Nov 2016.

Bardhi, F., & Eckhardt, G. M. (2012). Access-based consumption: The case of car sharing. Journal of Consumer Research, 39, 881–898.

Belk, R. W. (2007). Why not share rather than own. The ANNALS of the American Academy of Political and Social Science, 611, 126–140.

Belk, R. (2010). Sharing. Journal of Consumer Research, 36, 715–734.

Botsman, R., & Rogers, R. (2010). What’s mine is yours: The rise of collaborative consumption. New York: Harper Business.

Cobbing, M., & Vicaire, Y. (2016). Timeout for fast fashion. Retrieved from: http://www.greenpeace.org/international/Global/international/briefings/toxics/2016/Fact-Sheet-Timeout-for-fast-fashion.pdf. Accessed 4 Feb 2017.

Cortina, J. M. (1993). What is coefficient alpha? An examination of theory and applications. Journal of Applied Psychology, 78(1), 98–104.

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1992). Extrinsic and intrinsic motivation to use computers in the workplace. Journal of Applied Social Psychology, 22(14), 1111–1132.

Demailly, D., & Novel, A.-S. (2014). The sharing economy: Make it sustainable. Studies N 03/14, IDDRI, p. 30. Retrieved from: http://www.iddri.org/Evenements/Interventions/ST0314_DD%20ASN_sharing%20economy.pdf. Accessed 19 Nov 2015.

Dholakia, U. M. (2001). A motivational process model of product involvement and consumer risk perception. European Journal of Marketing, 35(11/12), 1340–1362.

Durgee, J. F., & O’Connor, G. C. (1995). An exploration into renting as consumption behavior. Psychology & Marketing, 12(2), 89–104.

Edbring, E. G., Lehner, M., & Mont, O. (2016). Exploring consumer attitudes to alternative models of consumption: Motivations and barriers. Journal of Cleaner Production, 123(1), 5–15.

Evans, D. (2011). Thrifty, green or frugal: Reflections on sustainable consumption in a changing economic climate. Geoforum, 42, 550–557.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50.

Gao, S. L. (2017). Fashion rental-You are what you access? Retrieved from: http://www.brandba.se/blog/2017/2/2/fashionrental. Accessed 6 June 2017

Gonzalez, A. M., & Bovone, L. (2012). Identities through fashion: A multidisciplinary approach. Oxford: Berg Publishers.

Gruen, A. (2017). Design and the creation of meaningful consumption practices in access-based consumption. Journal of Marketing Management, 33(3–4), 226–243.

Hamari, J., Sjöklint, M., & Ukkonen, A. (2015). The sharing economy: Why people participate in collaborative consumption. Journal of the Association for Information Science and Technology, 67(9), 2047–2059.

Hofstede, G. (1980). Culture’s consequences. Beverly Hills: Sage.

Hsu, C.-L., & Lin, J. C.-C. (2008). Acceptance of blog usage: The roles of technology acceptance, social influence and knowledge sharing motivation. Information & Management, 45, 65–74.

Hu, L.-T., & Bentler, P. M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1–31.

Jackson, D. L., Gillaspy, J. A. J., & Purc-Stephenson, R. (2009). Reporting practices in confirmatory factor analysis: An overview and some recommendations. Psychological Methods, 14(1), 6–23.

Johnson, K. K. P., Mun, J. M., & Chae, Y. (2016). Antecedents to internet use to collaboratively consume apparel. Journal of Fashion Marketing & Management, 20(4), 370–382.

Kang, J., & Kim, S.-H. (2013). What are consumers afraid of? Understanding perceived risk toward the consumption of environmentally sustainable apparel. Family and Consumer Sciences Research Journal, 41(3), 267–283.

Kang, J., & Park-Poaps, H. (2010). Hedonic and utilitarian shopping motivations of fashion leadership. Journal of Fashion Marketing and Management, 14(2), 312–328.

Kasser, T. (2005). Frugality, generosity, and materialism in children and adolescents. In K. A. Moore & L. H. Lippman (Eds.), What do children need to flourish: Conceptualizing and measuring indicators of positive development (Vol. 3, pp. 357–373). US: Springer.

Kline, R. B. (2010). Principles and practice of structural equation modeling (3rd ed.). New York: The Guilford Press.

Kumar, A., & Grisaffe, D. B. (2004). Effects of extrinsic attributes on perceived quality, customer value, and behavioral intentions in B2B settings: A comparison across goods and service industries. Journal of Business to Business Marketing, 11(4), 43–74.

Lang, C., Zhang, R., & Zhao, L. (2018). Facing the rising consumer sophistication: Identifying the factors influencing Chinese consumers’ intention to purchase customized apparel. In Y. Xu, T. Chi, & J. Su (Eds.), Chinese Consumers and the Fashion Market (pp. 3–23). Singapore: Springer.

Lastovicka, J. L., Bettencourt, L. A., Hughner, R. S., & Kuntze, R. J. (1999). Lifestyle of the tight and frugal: Theory and measurement. Journal of Consumer Research, 26(1), 85–98.

Lee, H.-H., & Chang, E. (2011). Consumer attitudes toward online mass customization: An application of extended technology acceptance model. Journal of Computer-Mediated Communication, 16, 171–200.

Leismann, K., Schmitt, M., Rohn, H., & Baedeker, C. (2013). Collaborative consumption: Towards a resource-saving consumption culture. Resources, 2, 184–203.

Martin, C. J., & Upham, P. (2016). Grassroots social innovation and the mobilization of values in collaborative consumption: A conceptual model. Journal of Cleaner Production, 134, 204–213.

Moeller, S., & Wittkowski, K. (2010). The burdens of ownership: Reasons for preferring renting. Managing Service Quality: An International Journal, 20(2), 176–191.

Mohlmann, M. (2015). Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. Journal of Consumer Behavior, 14(3), 193–207.

Mun, J.M., & Johnson, K.K.P. (2014). Online collaborative consumption: Undercovering motives, costs and benefits. Paper presented at the annual conference of the American Collegiate Retail Association, Dallas.

Nov, O., Naaman, M., & Ye, C. (2010). Analysis of participation in an online photo-sharing community: A multidimensional perspective. Journal of the American Society for Information Science and Technology, 61(3), 555–566.

Ozanne, L. K., & Ballantine, P. W. (2010). Sharing as a form of anti-consumption? An examination of toy library users. Journal of Consumer Behavior, 9(6), 485–498.

Pedersen, E. R. G., & Netter, S. (2015). Collaborative consumption: Business model opportunities and barriers for fashion libraries. Journal of Fashion Marketing and Management, 19(3), 258–273.

Philip, H. E., Ozanne, L. K., & Ballantine, P. W. (2015). Examining temporary disposition and acquisition in peer-to-peer renting. Journal of Marketing Management, 31, 1310–1332.

Piscicelli, L., Cooper, T., & Fisher, T. (2015). The role of values in collaborative consumption: Insights from a product-service system for lending and borrowing in the UK. Journal of Cleaner Production, 97, 21–29.

PwC (2015). The sharing economy. Retrieved from: https://www.pwc.com/us/en/technology/publications/assets/pwc-consumer-intelligence-series-the-sharing-economy.pdf. Accessed 12 Feb 2016.

Ramayah, T., & Ignatius, J. (2005). Impact of perceived usefulness, perceived ease of use and perceived enjoyment on intention to shop online. ICFAI Journal of Systems Management, 3(3), 36–51.

Sawyer, A. G., & Page, T. J., Jr. (1984). The use of incremental goodness of fit indices in structural equation models in marketing research. Journal of Business Research, 12, 297–308.

Schaefers, T., Lawson, S. J., & Kukar-Kinney, M. (2016a). How the burdens of ownership promote consumer usage of access-based services. Marketing Letter, 27, 269–577.

Schaefers, T., Wittkowski, K., Benoit, S., & Ferraro, R. (2016b). Contagious effects of customer misbehavior in access-based services. Journal of Service Research, 19(1), 3–21.

Schermelleh-Engel, K., Moosbrugger, H., & Müller, H. (2003). Evaluating the fit of structural equation models: Tests of significance and descriptive goodness-of-fit measures. Methods of Psychological Research Online, 8(2), 23–74.

Teo, T. S. H., Lim, V. K. G., & Lai, R. Y. C. (1999). Intrinsic and extrinsic motivation in internet usage. International Journal of Management Science., 27, 25–37.

Teo, T., & Noyes, J. (2011). An assessment of the influence of perceived enjoyment and attitude on the intention to use technology among pre-service teachers: A structural equation modeling approach. Computers & Education, 57, 1645–1653.

The Nielsen Global Survey (2014). Is sharing the new buying? Reputation and trust are emerging as new currencies. Retrieved from: http://www.nielsen.com/content/dam/nielsenglobal/apac/docs/reports/2014/Nielsen-Global-Share-Community-Report.pdf. Accessed 19 Nov 2015.

Vandenberg, R. J. (2006). Statistical and methodological myths and urban legends. Organizational Research Methods, 9(2), 194–201.

WRAP (2011). Valuing our clothes. Retrieved from: http://www.wrap.org.uk/sites/files/wrap/VoC%20FINAL%20online%202012%2007%2011.pdf. Accessed 18 Dec 2013.

Yüksel, A., & Yüksel, F. (2007). Shopping risk perceptions: Effects on tourist’ emotion, satisfaction and expressed loyalty intentions. Tourism Management, 28(3), 703–713.

Authors' contributions

The author read and approved the final manuscript.

Competing interests

The author declares that she has no competing interests.

Ethics approval and consent to participate

This research was approved by IRB in Louisiana State University.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Lang, C. Perceived risks and enjoyment of access-based consumption: identifying barriers and motivations to fashion renting. Fash Text 5, 23 (2018). https://doi.org/10.1186/s40691-018-0139-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40691-018-0139-z