Abstract

In this paper, we consider a classical risk model with dividend payments and capital injections in the presence of both fixed and proportionals administration costs. Negative surplus or ruin is not allowed. We measure the value of a strategy by the discounted value of the dividends minus the costs. It turns out, capital injections are only made if the claim process falls below zero. Further, at the time of an injection the company may not only inject the deficit, but inject additional capital C ≥ 0 to prevent future capital injections. We derive the associated Hamilton–Jacobi–Bellman equation and show that the optimal strategy is of band type. By using Gerber–Shiu functions, we derive a method to determine numerically the solution to the integro-differential equation and the unknown value C.

Similar content being viewed by others

References

Albrecher H, Thonhauser S (2008) Optimal dividend strategies for a risk process under force of interest. Insur Math Econ 43(1):134–149

Albrecher H, Thonhauser S (2009) Optimality results for dividend problems in insurance. RACSAM Rev R Acad Cien Serie A Math 103(2):295–320

Asmussen S, Taksar M (1997) Controlled diffusion models for optimal dividend pay-out. Insur Math Econ 20(1):1–15

Avanzi B (2009) Strategies for dividend distribution: a review. North Am Actuar J 13(2):217–251

Avram F, Palmowski Z, Pistorius MR (2007) On the optimal dividend problem for a spectrally negative Lévy process. Ann Appl Prob 17(1):156–180

Azcue P, Muler N (2005) Optimal reinsurance and dividend distribution policies in the Cramér–Lundberg model. Math. Finance 15(2):261–308

Brémaud P (1981) Point processes and queues. Springer, New York

Dickson DCM, Waters HR (2004) Some optimal dividends problems. ASTIN Bull 34(1):49–74

de Finetti B (1957) Su un’impostazione alternativa della teoria collettiva del rischio. In: Transactions of the XVth international congress of actuaries, vol 2, pp 433–443

Evans LC (1998) Partial differential equations. AMS, Providence

Gerber HU (1969) Entscheidungskriterien für den zusammengesetzten Poisson-Prozess. Schweiz Verein Versicherungsmath Mitt 69:185–228

Gerber HU, Lin XS, Yang H (2006) A note on the dividends-penalty identity and the optimal dividend barrier. ASTIN Bull 36:489–503

Gerber HU, Shiu ESW (1998) On the time value of ruin. North Am Actuar J 8(1):1–20

Gerber HU, Shiu ESW, Smith N (2006) Maximizing dividends without bankruptcy. ASTIN Bull 36:5–23

He L, Liang Z (2009) Optimal financing and dividend control of the insurance company with fixed and proportional transaction costs. Insur Math Econ 44(1):88–94

Jeanblanc-Piqué M, Shiryaev AN (1995) Optimization of the flow of dividends. Uspekhi Mat Nauk 50(2(302)):25–46

Kulenko N, Schmidli H (2008) Optimal dividend strategies in a Cramér–Lundberg model with capital injections. Insur Math Econ 43(2):270–278

Lokka A, Zervos M (2008) Optimal dividend and insurance of equity policies in the presence of proportional costs. Insur Math Econ 42(3):954–961

Paulsen J (2008) Optimal dividend payments and reinvestments of diffusion processes with both fixed and proportional costs. SIAM J Control Optim 47(5):2201–2226

Schmidli H (2008) Stochastic control in insurance. Springer, London

Shreve SE, Lehoczky JP, Gaver DP (1984) Optimal consumption for general diffusions with absorbing and reflecting barriers. SIAM J Control Optim 22:55–75

Thonhauser S, Albrecher H (2007) Dividend maximization under consideration of the time value of ruin. Insur Math Econ 41(1):163–184

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

Let h > 0 and fix \(u\in [0,u_0].\) If x = 0 we suppose u ≤ c, if x > 0 we let h be small enough such that x + (c − u)h ≥ 0, i.e. the reserve process does not fall below zero because of the dividend payments. Let K > 0 be the Lipschitz-constant. Choose \(\varepsilon > 0\) and \({n\in\mathbb{N} }\) such that \(K (x+(c-u)h)/n<\varepsilon/2\) and let x k = k(x + (c − u)h)/n for 0 ≤ k ≤ n. For initial capital \(x^{\prime}\) where \(x_k\leq x^{\prime}< x_{k+1},\) we choose a strategy {U k t } with \(V^{U^k}(x_k)> V(x_k)-\varepsilon/2.\) Then, by the Lipschitz continuity of V(x), it holds that

Thus, for all \(x^{\prime}\in[0, x+(c-u)h]\) we can find a measurable strategy \(\tilde{U}\) such that \(V^{\tilde{U}}(x^{\prime})> V(x^{\prime})-\varepsilon.\)

Consider now the strategy

Conditioning on \({{\mathcal F}_{h\wedge T_1}}\) yields

The constant \(\varepsilon\) is arbitrary, thus, we let tend it to zero. If we rearrange the terms and divide them by h, then we get

Now we choose a strategy W(h) = {W t (h)} with V W(h)(x) ≥ V(x) − h 2. There exists w h such that \({{\mathbb{E}}[\int_0^{h\wedge T_1}(W_s(h)-w_h)e^{-\delta s}\;\hbox{d} s]=0}.\) Let \(w_t^{\prime}\) denote W t (h) conditioned on T 1 > t and \(a(t)=\int_0^t(c-w_s^{\prime})\;\hbox{d} s\). In the same way as above, we can derive

All terms with exception of the second and the forth one converge. We choose a sequence h n → 0 such that

This limit is finite by the local Lipschitz continuity. Without loss of generality, we can assume that \( w_{h_n} \) converges to some value \(\tilde{u}\). Then a(h n )/h n converges to \(c-\lim w_{h_n}^{\prime}=c-\lim w_{h_n}=c-\tilde{u}\) and

The sequence {\( w_{j_n} \)} fulfils (12), and so equality holds for \(u=\tilde{u}\).

We can repeat the above procedure for any subsequence \( w_{j_n} \) that converges to \(\hat{u},\) say. Then for the limit

we get

such that \(\tilde{u}=\hat{u}\) and the limit

is unique. If now \({x\in{\mathcal D},}\) the above limit is \((c-\tilde{u})V^{\prime}(x)\). Otherwise we have shown the differentiability at x from the right if \(c>\tilde{u}\) and the differentiability at x from the left if \(c<\tilde{u}\). We do not distinguish the notation first and write for both derivatives the Hamilton–Jacobi–Bellman equation

where we have

because of the property (1).

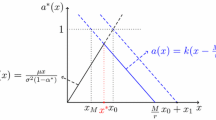

Equation 13 is linear in u, thus, the argument \(\tilde{u}=u(x)\) maximising the left-hand side of Eq. 13 is

Consider now the function

Since V(x − y) ≤ V(x) for y ≥ 0, it follows by the bounded convergence theorem and continuity of V(x) that H(x) is a continuous function on \({\mathbb{R}}.\) The HJB equation (13) reads

for any \({x\in {\mathcal D}}\) and \(\tilde{u}=u(x).\)

Let u 0 < c. Then we have shown the differentiability from the right with

Suppose, H(x) > c. Then, by continuity, there exist \(\varepsilon>0\) and an interval \({{\mathcal U}_\varepsilon(x)}\) such that H(z) > c for any \({z\in {\mathcal U}_\varepsilon(x)}.\) Let {x n } be a sequence in \({{\mathcal U}_\varepsilon(x)\cap {\mathcal D}}\) tending to x from left. For any x n Eq. 16 holds. Denote \(\tilde{u}_n= u(x_n)\). Then, H(x n ) > c and from Eq. 16 \(\tilde{u}_n=0\) follows. Therefore, \(u=\lim_{n\to\infty}\tilde{u}_n=0\) and we get that V is differentiable from the left with

If H(x) < c, in an analogous way we get \(H(x_n)<c, \tilde{u}_n=u_0\) and therefore u = u 0 such that \(V^{\prime}(x-)=V^{\prime}(x+)<1\).

If H(x) = c, differentiability follows because we can choose u arbitrarily.

Thus, for u 0 < c, we have proved that V is continuously differentiable and fulfils Eq. 13. We denote this solution by \( V_{u_0} (x) \).

We consider now the case u 0 = c. We can follow from Eq. 16 that

If H(x) > c, then, by similar arguments as above, we derive that V is differentiable at x with \( V^{\prime}(x)>1\) and HJB equation (13) is fulfilled with u = 0.

Let now H(x) = c. Then, H(z) ≥ c for any \({z\in {\mathcal U}_\varepsilon(x)}\). Suppose, \(V^{\prime}(x-)<1\). For a sequence x n ↓ x with H(x n ) > c we get that \(\tilde{u}_n=0\) and therefore V is differentiable from the right with \(V^{\prime}(x+)=1\). In this case (13) is again fulfilled. If there is a sequence with H(x n ) = c, then we get differentiability at x.

The last case to consider is u 0 > c. Then

If H(x) = c, then differentiability follows similarly to above.

Let H(x) > c. Suppose that \(V^{\prime}(x+)>1\) and \(\tilde{u}=0\). Let {x n } be a sequence in \({{\mathcal U}_\varepsilon(x)\cap{\mathcal D}}\) with x n ↑ x. If \(u=\lim_{n\to\infty}\tilde{u}_n=0,\) then we get differentiability with \(V^{\prime}(x)>1\). If u = u 0, then V is differentiable from the left with \(V^{\prime}(x-)<V^{\prime}(x+)\) and both derivatives solve Eq. 13.

Suppose that V′(x −) < 1 and \(\tilde{u}=u_0\). For a sequence x n ↓ x we again have to choose either u = 0 or u = u 0. The choice u = 0 shows that V is differentiable from the right with \(V^{\prime}(x+)>1\) and both derivatives solve Eq. 13. If u = u 0, then differentiability follows with \(V^{\prime}(x)<1\).

Proof of Lemma 6

The proof is based on Schmidli [20, Section 2.4.2].

-

1.

Since H is continuous, H(x) ≥ c for all \(x\in[0,\infty)\) and {c} is closed, the set \(\{x\in[0,\infty): H(x)=c\}\) is closed.

-

2.

Let \({x\in {\mathcal B}}\). Since \({{\mathcal A}}\) is closed, there must be \(\varepsilon>0\) such that \({(x-\varepsilon, x)\subset {\mathcal A}^c}\) because, otherwise, \({x\in {\mathcal A}}\). Since \({(x-\varepsilon, x)\subset{\mathcal C}^c,}\) we get \({(x-\varepsilon, x)\subset{\mathcal B}}\).

-

3.

Let \(\{x_n\}\subset (x_0, x]\) such that x n ↓ x 0. Then, \(V^{\prime}(x_n)=1\) and H(x n ) > c. By continuity, \(V^{\prime}(x_0)=1\) and H(x 0) = c, since, otherwise, \({x_0\in {\mathcal B}}\).

-

4.

If \({x\in{\mathcal C},}\) then, by the continuity of H, there must be a δ > 0 such that \({[x,x+\delta)\subset {\mathcal A}^c}\). If there would be some \({x_1\in {\mathcal B}}\) within this interval, we could follow the existence of an \({x_0\in {\mathcal A}}\) with x 0 < x 1 such that \({(x_0,x_1] \subset {\mathcal B}}\). Since \({x\notin {\mathcal B}}\) this x 0 has also to be in the interval [x, x + δ) which is a contradiction. Therefore, \({[x,x+\delta)\subset {\mathcal B}^c}\) and \({[x,x+\delta)\subset {\mathcal C}}\).

-

5.

Let C be chosen optimally. Since V(x) is strictly increasing, we get \(V(x)-\int\limits_0^x V(x-y)\;{\text{d}} G(y)\geq V(x)(1-G(x))\) and therefore

$$ \begin{aligned} & (\lambda+\delta)V(x)-\lambda\int\limits_0^x V(x-y)\hbox{d} G(y)\\ & \qquad -\lambda(V(C)-\phi C-L)(1-G(x))+\lambda\phi\int\limits_x^\infty (1-G(y))\hbox{d} y\\ & \quad \geq \lambda V(x)(1-G(x))+\delta V(x)-\lambda (V(C)-\phi C-L)(1-G(x))\\ & \quad = \delta V(x)+\lambda(1-G(x))(V(x)-V(C)+\phi C+L)\\ &\quad \geq \delta V(x). \end{aligned} $$The last inequality holds because obviously V(x) − V(C) ≥ 0 for x ≥ C. For x < C we have by Lemma 4 that V(x) − V(C) ≥ − ϕ(C − x) − L and thus V(x) − V(C) + ϕC + L ≥ ϕx ≥ 0.

From Lemma 4 we can follow that for any \(x>\lambda(\phi\mu+\phi C+L)/\delta\)

$$V(x)\geq x+ \frac{c- \lambda(\phi\mu+\phi C+L)}{\delta}>\frac{\lambda(\phi\mu+\phi C+L)}{\delta}+\frac{c- \lambda(\phi\mu+\phi C+L)}{\delta}=\frac{c}{\delta}$$holds. Assume now that there is \(x>\lambda(\phi\mu+\phi C+L)/\delta\) with \(V^\prime(x-)>1.\) Then \(V^\prime(z)>1\) for all z ≥ x. To prove this claim, we suppose that there is \(z={\text{inf}}\{y>x:V^\prime(y)=1\}<\infty.\) For this point we have

$$1=V^\prime(z)=\frac{(\lambda+\delta)V(x)-\lambda\int_0^\infty V (x-y) \text{d}G(y)}{c}\geq \frac{\delta V(z)}{c}\\>\frac{\delta V(x)}{c}>1,$$which is a contradiction. Thus,

$$V^\prime(z)\geq \frac{\delta}{c}V(z)$$for all z ≥ x, or equivalently, \(\log(V(z)/V(x))\geq (z-x)\delta/c, \) i.e. V(x) is exponentially increasing on \([x,\infty).\) This is a contradiction to Lemma 4. Thus, \(V^\prime(x-)=1.\)

-

6.

The assertion follows from the forth and fifth point.

Proof of Lemma 7

Let \(\varepsilon={\frac{c}{2(2\lambda+\delta)}}\) and denote by \(CI[x_0,x_0+\varepsilon)\) the set of all continuous and increasing functions \(u:[x_0,x_0+\varepsilon)\rightarrow [0,\infty)\). For a \(u\in CI[x_0,x_0+\varepsilon),\) let

By the continuity of u and \(v, \bar{u}\) is continuous for x ≥ 0. Define now for \(u\in CI[x_0,x_0+\varepsilon)\)

Because of the monotonicity of u and v and v(x 0) = u(x 0) we get

By the positivity of u and v, we get the upper bound for \(\bar{u}(x)\)

It follows that T u is increasing, positive and continuous for \(x\in [x_0, x_0+\varepsilon)\). For \(u_1, u_2\in CI[x_0,x_0+\varepsilon)\) holds

where \(\left\|\cdot\right\|\) is the supremum norm. It follows

Interchanging u 1 and u 2 yields \(\left\|T_{u_1}-T_{u_2}\right\|\leq {\frac{1} {2}}\left\|u_1-u_2\right\|,\) i.e. T is a contraction on \(CI[x_0,x_0+\varepsilon)\). This proves the existence of a \(u\in CI[x_0,x_0+\varepsilon)\) such that

This provides \(u^{\prime}(x)=\bar{u}(x)\) everywhere in \([x_0, x_0+\varepsilon)\). Thus we get the existence of a unique solution to Eq. 10 with the required properties on \([x_0, x_0+\varepsilon)\).

Since \(\varepsilon\) does not depend on x 0, we have shown the existence of a unique solution on \([x_0,\infty)\).

Rights and permissions

About this article

Cite this article

Scheer, N., Schmidli, H. Optimal dividend strategies in a Cramer–Lundberg model with capital injections and administration costs. Eur. Actuar. J. 1, 57–92 (2011). https://doi.org/10.1007/s13385-011-0007-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-011-0007-3