Abstract

We use a combination of theory and experiment to study the incentives for firms to share knowledge when they engage in research and development (R&D) in an uncertain environment. We consider both symmetric and asymmetric starting points with regards to the amount of initial knowledge firms have before conducting R&D and look at how differences in starting positions affect the willingness of firms to share knowledge. We investigate when and if firms find R&D cooperation beneficial and how investment in R&D is affected by the outcome of the sharing decisions. The experimental evidence shows that overall subjects tend to behave consistently with theoretical predictions for the sharing of knowledge, although leaders who are not compensated by a side payment from laggards are more willing to share than predicted by the theory, and leaders who are compensated are less willing. The data on investment suggests less investment with sharing than without, consistent with theory. Compared to exact numerical predictions, there is overinvestment or underinvestment except for symmetric firms under no sharing. All cases of overinvestment and underinvestment, regardless of sharing or not and regardless of starting positions, are well explained by smoothed-out best (quantal) responses.

Similar content being viewed by others

Notes

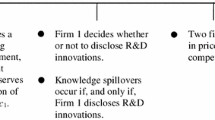

It is worth noting that by endogenizing the sharing decision in our experiment we create a situation in which sharing is a treatment by ‘choice’ as opposed to one made by ‘assignment.’ This design presents both opportunities and challenges. The primary opportunity is that because the scenario is richer and more realistic, there exists the potential for sharing decisions to affect investment choices, as well as the possibility that the anticipation of investment behavior could influence the initial decision to share. This endogenous structure does, however, present a challenge in the form of potential selection bias since the subjects who end up making investment decisions in a sharing environment are there because they made the decision to share.

The type of uncertainty typically studied in the tournament models is of a specific type. It often refers to uncertainty about how much time will pass until one of the firms innovates. In this framework it is not possible for more than one firm to innovate or for no one to innovate. The market is monopoly with certainty. Our model allows for variety in the resulting market structure depending on the number of successful innovators.

Examples of asymmetries mentioned include differences in size, assets, productive efficiency, R&D efficiency, absorptive capacity, and acquired knowledge.

The case with a common draw and sharing by assignment is analyzed in Østbye and Roelofs (2013).

This approach follows d’Asprémont and Jacquemin (1988) and many subsequent papers on R&D cooperation.

Additional knowledge sharing arrangements could include sharing of initial knowledge only or sharing of both initial and new knowledge. Another possibility considered in the literature is the coordination of R&D to maximize joint profit as in d’Asprémont and Jacquemin (1988), what Kamien et al. (1992) call cartelization and investigated experimentally by Suetens (2005).

This product market structure implies a possible emerging market (Porter 1980).

The limit case of \(a=1\) is not consistent with an interior equilibrium.

For innovation probabilities to be well defined, we need to impose the restriction \(F_{i} \equiv x_{i}+ \mu _{i} + \tau x_{j} \le 1\). This means \(x_{i}\) under NO can at most be equal to 1 for laggards and 0.9 for Symmetric, and at most 0.8 in all other cases.

Recall that the slope of the reaction function(s) is given by \(dx_{i} (x_{j})/dx_{j}=-a(1+\tau )/(1+2a\tau )<0\) which is equal to −0.7 when \(\tau = 0\).

Note that a TSC, as indicated in the second column, is formed only when both firms wish to share.

The matching of subjects was determined as follows. First, a random matching of subject numbers was generated for each of the 16 periods. Second, in treatments with an asymmetric starting point a coin flip determined the leader and laggard in each period until one subject was assigned leader status for the 8th time. At that point, the remaining periods that subject was assigned the role of laggard. This process guaranteed that each subject was a leader in eight periods and a laggard in eight periods. Finally, this same mapping of subjects into pairs along with leader / laggard status was repeated in each session so that any order effects would be consistent in making comparisons between treatments.

Besides simplicity, this may have the added advantage that behavior in previous stages will not be influenced by possible anticipations of deviations from equilibrium play in the product market stage. As noted by Halbheer et al. (2009), experimental evidence suggests that subjects in duopoly with strategic substitutes tend to supply more than predicted by Nash. This reason alone would suggest overinvestment in the previous stage.

Before proceeding it is worth taking the time to clarify the terminology we will use to describe our results. Recall that there are three treatments in the experiment (Symmetric, Asymmetric and Sidepayment). Subjects were placed in a treatment based on which session they attended (therefore this is treatment by assignment). In addition, in the asymmetric treatments (Asymmetric and Sidepayment) subjects played as both leader and laggard. We will refer to these differences as ‘roles.’ Finally, based on choices made during the first (sharing) stage, subjects find themselves in one of two possible sharing arrangements in the second stage. To distinguish these sharing arrangements (which are endogenous and therefore are treatments by choice) from the true treatments, we will refer to the sharing arrangements (NO and TSC) as sharing ‘regimes.’ Our analysis of the results includes comparisons across treatments, roles and sharing regimes. This analysis includes both between and within subjects comparisons depending on the exact variables under consideration.

Similarly, if we average the individual investment choices we would expect 200 observations given that all subjects play both roles (leader and laggard) in both regimes (TSC/NO). However, since sharing is endogenous a few subjects never participated in a TSC. This leaves us with 193 observations.

The estimates reported in Table 3 are based on the error correlation structure recommended by Cameron and Trivedi (2009, p. 249) for panel models with few periods. The panel is organized according to subsequent replications in the two roles when applicable and not subsequent time periods since roles are randomly assigned over periods.

More precisely, the p values are: Asymmetric leaders versus Symmetric p = 0.264, Sidepayment leaders versus Symmetric p = 0.261, Asymmetric versus Sidepayment leaders p = 0.047, Asymmetric laggards versus Symmetric p = 0.581, Sidepayment laggards vs Symmetric p = 0.491, Asymmetric vs Sidepayment laggards p = 0.883.

There is one case in TSC (leaders) where QRE predicts slight underinvestment for a very small range of parameter values. However, even in this case, for a vast majority of the parameter space the prediction is for overinvestment.

See the Appendix for a more detailed discussion of QRE as applied to our model.

We would like to thank the editor for this suggestion.

We could suspect that the difference also could be due to experience from playing both roles in the First Time Later dataset. However, symmetric subjects only play one role, and for asymmetric subjects a dummy in the regression that accounts for role switching is not significant.

We would like to thank one of the referees for suggesting these tests. The regression output is available from the authors upon request.

This type of strategy involves the laggard devoting most (or even all) of their resources in a high risk/high reward fashion. If successful, the laggard overtakes the leader, but if unsuccessful the laggard not only does not overtake the leader, but ends up with a large negative profit.

References

Amir, R. (2000). Modelling imperfectly appropriable R&D via spillovers. International Journal of Industrial Organization, 18, 1013–1032.

Anbarci, N., & Feltovich, N. (2013). How sensitive are bargaining outcomes to changes in disagreement payoffs? Experimental Economics, 16, 560–596.

Baumol, W. J. (1992). Horizontal collusion and innovation. The Economic Journal, 102, 129–137.

Baumol, W. J. (1993). Entrepreneurship, management and the structure of payoffs. Cambridge, MA: MIT Press.

Beath, J., Katsoulacos, Y., & Ulph, D. (1989). The game-teheoretic analysis of innovation: A survey. Bulletin of Economic Research, 41, 163–184.

Bohnet, I., & Huck, S. (2004). Repetition and reputation: Implications for trust and trustworthiness when institutions change. American Economic Review, 94, 362–366.

Brandenburger, A., & Nalebuff, B. (1995). The right game: Use game theory to shape strategy. Harvard Business Review, 73(4), 57–71.

Cameron, A. C., & Trivedi, P. K. (2009). MIcroeconometrics using Stata. College Station: Stata Press.

Cantner, U., & Guerzoni, M. (2011). Innovation and the evolution of industries: A tale of incentives, knowledge and needs. In D. B. Audretsch, O. Falck, S. Heblich, & A. Lederer (Eds.), Handbook of research on innovation and entrepreneurship. Cheltenham: Edward Elgar.

Cason, T. N., & Gangadharan, L. (2013). Cooperation spillovers and price competition in experimental markets. Economic Inquiry, 51, 1715–1730.

Clark, D. J., Østbye, S. E., & Roelofs, M. R. (2009). Should birds of a feather flock together? Theory and experiments on knowledge sharing in research and development. New York: Mimeo, University of Tromsø.

Cohen, W. M., & Levinthal, W. M. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99, 569–596.

Combs, K. L. (1993). The role of information sharing in cooperative research and development. International Journal of Industrial Organization, 11, 535–551.

Darai, D., Sacco, D., & Schmutzler, A. (2010). Competition and innovation: An experimental investigation. Experimental Economics, 13, 439–460.

Dasgupta, P. (1986). The theory of technological competition. In J. E. Stiglitz & G. F. Mathewson (Eds.), New developments in the analysis of market structure. London: MacMillan Press.

d’Asprémont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R&D in duopoly with spillovers. American Economic Review, 78, 1133–1137.

De Bondt, R. (1997). Spillovers and innovative activities. International Journal of Industrial Organization, 15, 1–28.

De Bondt, R., & Henriques, I. (1995). Strategic investment with asymmetric spillovers. Canadian Journal of Economics, 28, 656–674.

Deck, C., & Erkal, N. (2013). An experimental analysis of dynamic incentives to share knowledge. Economic Inquiry, 51, 1622–1639.

Dechenaux, E., Kovenock, D., & Sheremeta, R. M. (2015). A survey of experimental research on contests, all-pay auctions and tournaments. Experimental Economics, 18, 609–669.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Friedman, D., & Sunder, S. (1994). Experimental economics: A primer for economists. Cambridge, MA: Cambridge University Press.

Goeree, J. K., Holt, C., & Palfrey, T. R. (2005). Regular quantal response equilibrium. Experimental Economics, 8, 347–367.

Gürerk, Ö., & Selten, R. (2012). The effect of payoff tables on experimental oligopoly behavior. Experimental Economics, 15, 499–509.

Halbheer, D., Fehr, E., Goette, L., & Schmutzler, A. (2009). Self-reinforcing market dominance. Games and Economic Behavior, 67, 481–502.

Harrison, G. W. (2007). House money effects in public good experiments: Comment. Experimental Economics, 10, 429–437.

Hauenschild, N. (2003). On the role of input and output spillovers when R&D projects are risky. International Journal of Industrial Organization, 21, 1065–1089.

Henriques, I. (1990). Cooperative and noncooperative R&D with spillovers: Comment. American Economic Review, 80, 638–640.

Kamien, M., Muller, E., & Zang, I. (1992). Research joint ventures and R&D cartels. American Economic Review, 82, 1293–1306.

Katz, M. L., & Ordover, J. A. (1990). R&D cooperation and competition. Brookings papers on economic activity. Microeconomics. Washington, DC: Brookings Institution.

Konrad, K. A. (2009). Strategy and dynamics in contests. New York: Oxford University Press.

Kultti, K., & Takalo, T. (1998). R&D spillovers and information exchange. Economics Letters, 61, 121–123.

McKelvey, R. D., & Palfrey, T. R. (1995). Quantal response equilibria for normal form games. Games and Economic Behavior, 10, 6–38.

McKelvey, R. D., & Palfrey, T. R. (1998). Quantal response equilibria for extensive form games. Experimental Economics, 1, 9–41.

McKelvey, R. D., & Palfrey, T. R. (2015). Erratum to: Quantal response equilibria for extensive form games. Experimental Economics, 18, 762–763.

Miyagiwa, K., & Ohno, Y. (2002). Uncertainty, spillovers, and cooperative R&D. International Journal of Industrial Organization, 20, 855–876.

Østbye, S. E., & Roelofs, M. R. (2013). The competition-innovation relationship: Is R&D cooperation the answer? Economics of Innovation and New Technology, 22, 153–176.

Petit, M. L., & Tolwinski, B. (1999). R&D cooperation or competition? European Economic Review, 43, 185–208.

Porter, M. (1980). Competitive strategy: Techniques for analyzing industries and competitors. New York: The Free Press.

Potters, J., & Suetens, S. (2009). Cooperation in experimental games of strategic complements and substitutes. The Review of Economic Studies, 76, 1125–1147.

Poyago-Theotoky, J. (1996). R&D competition with asymmetric firms. Scottish Journal of Political Economy, 43, 334–342.

Sacco, D., & Scmutzler, A. (2011). Is there a u-shaped relation between competition and investment? International Journal of Industrial Organization, 29, 65–73.

Seade, J. (1980). On the effects of entry. Econometrica, 48, 479–489.

Sena, V. (2004). The return of the prince of Denmark: A survey on recent developments in the economics of innovation. The Economic Journal, 114, 312–332.

Silipo, D. B. (2005). The evolution of cooperation in patent races: Theory and experimental evidence. Journal of Economics, 85, 1–38.

Silipo, D. B. (2008). Incentives and forms of cooperation in research and development. Research in Economics, 62, 101–119.

Suetens, S. (2005). Cooperative and noncooperative R&D in experimental duopoly markets. International Journal of Industrial Organization, 23, 63–82.

Suetens, S. (2008). Does R&D cooperation facilitate price collusion? An experiment. Journal of Economic Behavior and Organization, 66, 822–836.

Veugelers, R. (1998). Collaboration in R&D: An assessment of theoretical and empirical findings. De Economist, 146, 419–443.

Wiethaus, L. (2005). Absorptive capacity and connectedness: Why competing firms also adopt identical R&D approaches. International Journal of Industrial Organization, 23, 467–481.

Acknowledgements

We would like to thank the editor of this journal and two anonymous referees for their constructive suggestions that greatly improved the paper. We would also like to thank Sigrid Suetens, Iván Barreda Tarrazona, Derek Clark and John Krieg, along with conference and seminar participants at Tilburg University, Universitat Jaume 1, the Nordic Behavioral and Experimental Economics Conference in Helsinki and the Economic Science Association meeting in Tokyo for helpful comments. The experiments in this paper were funded by the School of Business and Economics at UiT—The Arctic University of Norway and supported by equipment and staff at Western Washington University.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Regressions

The regression results reported in the main text are based on the raw results reported here as Table 7 (sharing), Table 8 (investment), and Table 9 (sensitivity). The same statistical panel data approach is used throughout and implemented using the software Stata/ MP 13.1 : the population-averaged approach (as recommended by Harrison 2007) with the unstructured correlation structure (recommended by Cameron and Trivedi 2009). It is worth emphasizing that to guard against the assumed correlation structure being misspecified, semi-robust standard errors adjusted for clustering on each subject are computed. This means that more efficient estimators may exist (see Cameron and Trivedi 2009, p. 248).

QRE analysis

Quantal Response Equilibrium (QRE) can be interpreted as an equilibrium concept based on smoothed best responses. Compared to Nash equilibrium, QRE allows deviations from best response but maintains mutual consistency. This method adds bounded rationality to subjects’ decisions by assuming that the subjects will choose high-payoff strategies more frequently than low-payoff strategies.

Following nearly all QRE analyses in the literature, we use the logit equilibrium version of QRE. Notice that players’ strategies depend on the parameter \(\lambda\), the precision or sensitivity parameter, that indexes the degree of rationality from 0 (naive play) to positive infinity (Nash best-response behavior). In addition, while in some situations it might be reasonable to allow the \(\lambda\) values to differ for different treatments when between-subjects comparisons are being made, when comparing roles in our experiment it is more reasonable to assume a common value for \(\lambda\) as subjects play as both leader and laggard.

In order to compute predictions for the QRE in our model which uses a continuous strategy space, we simplified by computing payoffs for 21 possible investment levels, from 0 to 1000 in increments of 50 (0, 50, 100, , 950, 1000), leading to a \(21\times 21\) payoff matrix (one for each player). This allows us to calculate the expected payoff for one player given both his and the other player’s investment level (see Anbarci and Feltovich 2013 for a similar approach).

The results of the QRE computation based on this simplified version of our game are given in Figs. 2 (NO) and 3 (TSC), and in Tables 10 (NO) and 11 (TSC). QRE implies a smooth and continuous graph that transitions from perfect noise at one extreme to the Nash equilibrium at the other. On the far left of the graphs, \(\lambda\) equals zero and shows random, naive behavior where subjects chose any of the possible strategies with equal probability. In our case this implies the same probability for all investment levels from 0 to 1000, giving the average investment of 500. As \(\lambda\) increases, the QRE prediction approaches the Nash equilibrium where subjects are assumed to be fully rational.

Based on Fig. 2, we observe that for the NO case, the investment level diverges as the level of rationality increases. Leaders’ investment increases while laggards’ investment decreases as each type moves towards the Nash prediction. For the TSC case (Fig. 3), investment drops as the level of rationality increases. In both pictures the horizontal lines indicate the predicted values under Nash / full rationality. In NO there are three separate values for Nash predictions (314 for laggards, 547 for Symmetry, 780 for leaders) and therefore three lines. In TSC there is one line since the Nash prediction is 226 regardless of role and treatment. Qualitatively, QRE picks up all deviations from Nash. This is clear from visual inspection of the figures which under NO show underinvestment for leaders and symmetric firms. Overinvestment is clearly the QRE prediction for laggards in NO and for symmetric firms, leaders and laggards in TSC. Note that in Fig. 3 (TSC) the QRE prediction does include a small range of \(\lambda\) for which the leader would slightly underinvest relative to Nash.

Visual inspection of the quantitative performance of QRE is more difficult. Here, the tables are more useful. In Tables 10 and 11 we have computed the \(\lambda\) values corresponding to the 95% interval estimates for investment levels based on data and the econometric model (point-estimates were presented in Table 5 in the main text). If the interval estimate covers the naive prediction (500), the lower \(\lambda\) takes the value zero. Picking different \(\lambda\) values for different cases to make QRE predictions fit the data would not be a reasonable way to assess the success of QRE. In particular, it would be difficult to argue that \(\lambda\) should be allowed to take different values when making within-subjects comparisons. However, we observe that a common \(\lambda\) value in the narrow interval [3.97, 4.10] allows the QRE predictions to fit the interval estimates in all cases.

Rights and permissions

About this article

Cite this article

Roelofs, M.R., Østbye, S.E. & Heen, E.E. Asymmetric firms, technology sharing and R&D investment. Exp Econ 20, 574–600 (2017). https://doi.org/10.1007/s10683-016-9500-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-016-9500-5