Abstract

The economic literature has shown that some countries may be trapped in what is called an ”environmental poverty trap”: poor longevity implies little maintenance of the environment, which leads to high levels of pollution that in turn keeps life expectancy low. Since life expectancy is an important determinant of saving, these economies may not be able to grow. This article aims to provide policy recommendations to improve both environmental quality and growth in the context of debt consolidation. Notably, it studies how public debt and public maintenance may be used to escape from the environmental poverty trap. A welfare analysis is then undertaken to show that public debt is an instrument which helps to solve the capital over-accumulation problem and to achieve environmental objectives.

Similar content being viewed by others

Notes

More details about the EPI may be found in [13].

It is significant at the 1 % level. See Appendix I for more details about the statistics.

There are a lot of economies constrained by ”budget balanced rules” or ”debt rules” that have been set in order to consolidates public finances. The interested reader could refer to the IMF Fiscal Rule Dataset [2].

It also simplifies the analysis since it allows an explosive debt path to be avoided.

A debt-for-nature swap is a mechanism that may be used by developing countries to finance an environmental policy. Broadly speaking, it consists in debt cancelation afforded in exchange for the commitment to invest in environmental maintenance. Further details may be found in Hansen [12] or Deacon and Murphy [6]. Cassimon et al. [3] propose a good case study of a US-Indonesian debt-for-nature swap.

In overlapping generations models, the first welfare theorem does not apply. The reader could refer to de la Croix and Michel [5] for further explanations.

This formulation is present in [19] in a different context.

If public maintenance’s productivity is not higher than the private one, there is no reason to consider public maintenance in this framework because its use will be inefficient. Indeed, government will take resources from households to perform what households perform better.

Here, both private and public maintenance are considered as curative actions.

Numerous papers consider John and Pecchenino’s [15] equation, which is nearly the same but without the constant \(\eta \tilde {e}\). Here their approach is not convenient due to the use of a log-linear utility function. Using this index solves for that difficulty.

Here, life expectancy is considered as depending only on the environmental quality and J, as given by nature. A more realistic approach would endogenize life expectancy .

For a deeper analysis of this point see Grossman and Krueger [11].

This assumption is a condition restricting the space of k. It is notable that this condition is equivalent to σ(w−τ)≥β k 𝜖 .

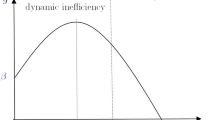

Depending on value of the parameters, the relative position of the curves may vary by a small amount. This potential variation does not change the conclusions of the present work.

There may exist a wide range of phase diagrams depending on the relative position of the curves and the steady states and on the level of J. We decided to present one of the most interesting cases. All other cases are similar to this case or to the one presented in Appendix II.

It was decided here arbitrarily to plot the path to see the dynamics. The arbitrary nature of the curve does not diminish the impact of the paper, because it is possible to obtain the actual curve as soon as the model is calibrated. But obtaining the curve is not the aim of the present work.

Proof: see Appendix III.

See Samuelson [24].

It should be remembered that \(g<\epsilon ^{\frac {\epsilon }{1-\epsilon }}(1-\epsilon )\).

References

Blanchard, O.J. (1984). Debt, deficits and finite horizons.

Budina, M.N., Kinda, M.T., Schaechter, M.A., & Weber, A. (2012). Fiscal rules at a glance: country details from a new dataset. 12-273, International Monetary Fund.

Cassimon, D., Prowse, M., & Essers, D. (2011). The pitfalls and potential of debt-for-nature swaps: a US-Indonesian case study. Global Environmental Change, 21(1), 93–102.

Chakraborty, S. (2004). Endogenous lifetime and economic growth. Journal of Economic Theory, 116(1), 119–137.

De La Croix, D., & Michel, P. (2002). A theory of economic growth: dynamics and policy in overlapping generations. Cambridge University Press.

Deacon, R.T., & Murphy, P. (1997). The structure of an environmental transaction: the debt-for-nature swap. Land economics, 1–24.

Diamond, P.A. (1965). National debt in a neoclassical growth model. The American Economic Review, 55(5), 1126–1150.

Escolano, M.J. (2010). A practical guide to public debt dynamics, fiscal sustainability, and cyclical adjustment of budgetary aggregates. International Monetary Fund.

Fodha, M., & Seegmuller, T. (2012). A note on environmental policy and public debt stabilization. Macroeconomic Dynamics, 16(03), 477–492.

Fodha, M., & Seegmuller, T. (2014). Environmental quality, public debt and economic development. Environmental and Resource Economics, 57(4), 487–504.

Grossman, G.M., & Krueger, A.B. (1994). Economic growth and the environment. Tech. rep., National Bureau of Economic Research.

Hansen, S. (1989). Debt for nature swaps – overview and discussion of key issues. Ecological Economics, 1(1), 77–93.

Hsu, A., Emerson, J., Levy, M., de Sherbinin, A., Johnson, L., Malik, O., Schwartz, J., & Jaiteh, M. (2014). The 2014 environmental performance index. New Haven, CT: Yale Center for Environmental Law and Policy, 4701–4735.

IMF (2014). World economic outlook database.

John, A., & Pecchenino, R. (1994). An overlapping generations model of growth and the environment. The Economic Journal, 1393–1410.

John, A., Pecchenino, R., Schimmelpfennig, D., & Schreft, S. (1995). Short-lived agents and the long-lived environment. Journal of Public Economics, 58(1), 127–141.

Jouvet, P.A., Pestieau, P., & Ponthiere, G. (2010). Longevity and environmental quality in an olg model. Journal of Economics, 100(3), 191–216.

Laden, F., Schwartz, J., Speizer, F.E., & Dockery, D.W. (2006). Reduction in fine particulate air pollution and mortality: extended follow-up of the harvard six cities study. American journal of respiratory and critical care medicine, 173(6), 667– 672.

Mariani, F., Pérez-Barahona, A., & Raffin, N. (2010). Life expectancy and the environment. Journal of Economic Dynamics and Control, 34(4), 798–815.

Minea, A., & Villieu, P. (2010). Dette publique, croissance et bien-être: une perspective de long terme. Economie et Prévision, 10(1-2), 33–55.

Minea, A., & Villieu, P. (2013). Debt policy rule, productive government spending, and multiple growth paths: A note. Macroeconomic Dynamics, 17(04), 947–954.

Ono, T., & Maeda, Y. (2001). Is aging harmful to the environment? Environmental and Resource Economics, 20(2), 113–127.

Ono, T., & Maeda, Y. (2002). Sustainable development in an aging economy. Environment and Development Economics, 7(01), 9– 22.

Samuelson, P.A. (1958). An exact consumption-loan model of interest with or without the social contrivance of money. The journal of political economy, 467–482.

Acknowledgments

I would like to thank two anonymous referees for their helpful comments. This research has been partly funded by the Labex VOLTAIRE (ANR-10-LABX-100-01).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix : A: Stylized fact: A negative correlation between public debt and the environmental quality

The correlation coefficient between the mean of the Net General Government Debt ratio and the mean of the EPI over the 2000-2010 period is −0.161. It is significant at the 1 percent level. The correlation is performed on a sample of 59 countries (see Table 2 (Fig. 2)) .

The EPI data come from the Yale Center for Environmental Law and Policy [13]. The Net General Government Debt data come from the IMF World Economic Outlook database [14].

Appendix : B: Dynamics when

\( \mathbf { \underline {e_{1}} \le \,J\,\le \, \underline {e_{2}} }\) As explained in Section 5, the present phase diagram is one of a wide range of possibilities. Indeed, our relative steady states may vary a little given the position of the curves. In fact, \(\overline {e}_{1}\) may be higher than \(\underline {e_{2}}\). That possibility does not change the policy recommendation because these points only represent the environmental trap’s situation. It may only improve or reduce the probability of falling into the trap when we give values are given to parameters.

Depending on where the J threshold is placed, the dynamics may vary somewhat. Section 5 presents the case in which there are three areas of convergence. If we decided to improve medical knowledge (i.e., impose a lower J), there are thus have two convergence areas. Indeed, the point \((\underline {k_{2}},\underline {e_{2}})\) is no longer an attraction point because \({\underline {e_{2}}}>J\). The convergence area toward the high equilibrium is thus larger. This is represented in Fig. 3.

It is also possible to look at the extreme case. If medical knowledge is very high, \(J<\overline {e_{1}}\), the curves that prevail for the analysis of dynamics are in red. If medical knowledge is very low, \(J>\overline {e_{2}}\), the curves that prevail are in green.

Nevertheless, failing to present an

Appendix C: Proof of proposition 1

1.1 Variation of dk with Respect to db

This is higher than zero for \(k\leq \frac {-1-\pi \gamma \eta }{\pi (1-\gamma )\epsilon }<0\), which is impossible. This expression is thus always negative. Given the sign of the determinant, we obtain the signs that we put in the corresponding cases in Table ??

1.2 Variation of dk with Respect to dg

Given assumption 1, this is always positive. Given the sign of the determinant, the signs that are put in the corresponding cases in Table 1 are obtained.Variation of de with Respect to db

This is higher than 0 if:

Thus, it can easily be confirmed that the sign will crucially depend on the \(\frac {b}{k}\) level.Variation of de with Respect to dg

Given assumption 1, this is always positive. Given the sign of the determinant, the signs are obtained that are put in the corresponding cases in Table 1.

Rights and permissions

About this article

Cite this article

Clootens, N. Public Debt, Life Expectancy, and the Environment. Environ Model Assess 22, 267–278 (2017). https://doi.org/10.1007/s10666-016-9535-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-016-9535-1