Abstract

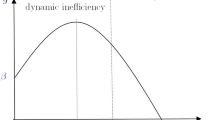

This article analyzes the consequences on capital accumulation and environmental quality of environmental policies financed by public debt. A public sector of pollution abatement is financed by a tax or by public debt. We show that if the initial capital stock is high enough, the economy monotonically converges to a long-run steady state. On the contrary, when the initial capital stock is low, the economy is relegated to an environmental poverty trap. We also explore the implications of public policies on the trap and on the long-run stable steady state. In particular, we find that government should decrease debt and increase pollution abatement to promote capital accumulation and environmental quality at the stable long-run steady state. Finally, a welfare analysis shows that there exists a level of public debt that allows a long run steady state to be optimal.

Similar content being viewed by others

Notes

In such swaps a non-governmental organization (NGO) purchases developing country debt on the secondary market at a discount from the face value of the debt title. The NGO redeems the acquired title with the debtor country in exchange for a domestic currency instrument used to finance environmental expenditures (see Hansen 1989; Jha and Schatan 2001; Sheikh 2008). The first agreement was signed between Conservation International and Bolivia in 1987. More recently, such a bilateral deal was signed between the United States and Indonesia, swapping nearly US$ 30 million of Indonesian government debt owed to the United States over the next 8 years against Indonesia’s commitment to spend this sum on NGO projects benefiting Sumatra’s tropical forests (see Cassimon et al. 2011). Finally, the total amount of recorded funds generated in the world during the last 20 years (1990–2010) by these swaps is about one billion US$.

Paris Club is a forum for negotiating debt restructurings between indebted developing countries and official bilateral creditors.

Nevertheless, there is a decline in the number of debt-for-nature swaps in recent years, likely results in part from the higher prices of commercial debt in secondary markets. Additionally, other agreements for debt restructuring and cancellation, such as the Heavily Indebted Poor Countries (HIPC) initiative, lower a developing country’s debt obligation by much more than the relatively small contribution debt-for-nature swaps make (Sheikh 2008).

How debt could help environmental protection programs? For instance, the Stern Review (2007) estimates that the short-term cost of reducing greenhouse gas emissions could be limited to 1 % of global GDP. This short-term cost would avoid the economic and social costs of long-term global warming, which are estimated at (at least) 5 % of global GDP. Could the present generations borrow 1 % of global GDP in order to finance the fight against the emission of greenhouse gas emissions? If the long-term costs of borrowing are lower than the costs of global warming, then public debt policy could be an efficient solution.

In particular, the probability with which young agents survive on to the second period depends on public health expenditures which are in turn funded by income taxes on labor income.

This is also the case in a companion paper, Fodha and Seegmuller (2012). However, in this contribution, there is also private abatement and the results mainly depend on the efficiencies of private versus public abatement.

Health impacts of pollution is one of the feedbacks of the environmental quality on the economy (other macroeconomic consequences could be for instance the limits to growth, the loss of productivity of workers and of agricultural resources...). Many studies shed light on these environmental feedbacks and insist on the necessity to take them into account when searching for global solutions (Carbone and Smith 2010; Smith 2012). Finally, all these impacts imply economic inefficiencies: public abatement is obviously a tool to correct them, whatever the funding scheme.

The World Health Organization estimates that a quarter of the World’s disease burden is due to the contamination of air, water, soil and food particularly from respiratory infections and diarrhoeal diseases. Human Development Report 2007 suggests that climate change poses major obstacles to progress in meeting Millennium Developing Goals and maintaining progress raising the Human Development Index. “There is a clear and present danger that climate change will roll back human development for a large section of humanity, undermining international cooperation aimed at achieving the Millennium Development Goals in the process.”

See “Appendix A” for an example of longevity function.

\(E_{t}\) may encompass both environmental conditions (quality of water, air and soils, etc.) and resources availability (fisheries, forestry, etc.). One interpretation of \(E\), is the quality of soil or groundwater, where contamination reduces \(E\), and environmental clean-up increases \(E\),. Another interpretation of \(E\) might be the inverse of the stock of greenhouse gases in the atmosphere; maintenance in this case could correspond to the planting of trees. Note that \(E\) is therefore simply an index of the amenity value of environmental quality that can take on positive or negative values. For instance, the Environmental Performance Index [Yale Center for Environmental Law & Policy, data available on-line at http://epi.yale.edu] could be a good approximation of this synthetic indicator.

We assume that \(\beta ^{\prime }\left( e\right) \) is upper-bounded and that this bound is not too large, for two main reasons. The first justification is an economic one: any shock in the environmental quality will hence not induce a too strong change in the demography. It also ensures the smoothing of the evolution of the individual saving rate with respect to changes in pollution. Otherwise, saving would be too sensitive to the environmental quality, which seems unrealistic and would artificially exaggerate the risk of poverty trap. The second reason is a biological one: among all the determinants of human longevity, epidemiological studies show that natural environment plays a significant but not major role, comparatively to other factors such that genetic and social environment, person’s individual characteristics and behaviors, and finally health care system (Dever 1976). More recently, applied studies find that reductions in air pollution accounted for as much as 15 % of the overall increase in life expectancy in the United States (Pope et al. 2009). Basically, according to the World Health Organization studies, this impact may be higher in Low Developed Countries but health problems are primarily due to factors related to poverty.

We assume complete depreciation of capital after one period of use.

We do not consider private pollution abatement. This is a non-neutral assumption and drives the results of the dynamics. This allows to have a negative relationship between environmental quality and capital accumulation, whereas one usually has the converse with private environmental maintenance. Moreover, the taking into account of private abatement (i.e. voluntary provision of public goods) would rise inefficiencies induced by agents’ coordination failures (free rider problem).

The quality of the environment has an autonomous level of zero. For \(m>0,\) in an economy undisturbed by human activity, \(E=0.\) Human activities could enhance this “natural” value by protecting the environment, or could damage this value by emitting pollution. If \(m=1,\) the environmental quality is supposed to be a flow.

For empirical evaluations of the debt-for-nature swaps policies, one can refer to Kahn and McDonald (1995) and Deacon and Murphy (1997). These two studies consider the deforestation case in developing countries and put lights on the conditions to be met in order to increase the efficiency of such environmental policy tool.

In this section, we only deal with long term horizon. Indeed, we look for a complete analytical solution. In the model we consider, this is not possible along a dynamic path. Following de la Croix and Michel (2002), the welfare analysis considers \(g\) constant. Hence, we can determine the level of debt that allows to have an optimal steady state for a given level of \(g\). As we explain, we need a unique instrument for decentralization.

For simplicity, we note \(H_{x_i}\equiv \partial H(x_1, x_2)/\partial x_i\) and \(H_{x_i x_j}\equiv \partial ^2 H(x_1, x_2)/\partial x_j\partial x_i\).

References

Blanchard OJ (1985) Debt, deficits and finite horizons. J Polit Econ 93:223–247

Bovenberg AL, Heijdra BJ (1998) Environmental tax policy and intergenerational distribution. J Public Econ 67:1–24

Carbone JC, Smith K (2010) Valuing ecosystem services in general equilibrium, NBER working papers 15844, National Bureau of Economic Research, Inc

Cassimon D, Prowse M, Essers D (2011) The pitfalls and potential of debt-for-nature swaps: a US-Indonesian case study. Glob Environ Change 21(1):93–102

Chakraborty S (2004) Endogenous lifetime and economic growth. J Econ Theory 116:119–137

Deacon RT, Murphy P (1997) The structure of an environmental transaction: the debt-for-nature swap. Land Econ 73:1–24

de la Croix D, Michel P (2002) A theory of economic growth: dynamics and policy in overlapping generations. Cambridge University Press, Cambridge

Dever GEA (1976) An epidemiological model for health policy analysis. Soc Indic Res 2(4):453–466

Diamond P (1965) National debt in a neoclassical growth model. Am Econ Rev 55:1126–1150

Fodha M, Seegmuller T (2012) A note on environmental policy and public debt stabilization. Macroecon Dyn 16(3):477–492

Hansen S (1989) Debt for nature swaps: overview and discussion of key issues. Ecol Econ 1:77–93

Heijdra BJ, Kooiman JP, Ligthart JE (2006) Environmental quality, the macroeconomy, and intergenerational distribution. Resour Energy Econ 28:74–104

Howarth R, Norgaard R (1992) Environmental valuation under sustainable development. Am Econ Rev 82:473–477

Jha R, Schatan C (2001) Debt for nature: a swap whose time has gone? Working paper, ECLAC, Santiago de Chile

John A, Pecchenino R (1994) An overlapping generations model of growth and the environment. Econ J 104:1393–1410

John A, Pecchenino R, Schimmelpfennig D, Schreft S (1995) Short-lived agents and the long-lived environment. J Public Econ 58:127–141

Jouvet PA, Pestieau P, Ponthière G (2010) Longevity and environmental quality in an OLG model. J Econ 100:191–216

Jouvet PA, Michel P, Vidal JP (2000) Intergenerational altruism and the environment. Scand J Econ 102:135–150

Kahn JR, McDonald JA (1995) Thirld-world debt and tropical deforestation. Ecol Econ 12:107–123

Kampa M, Castanas E (2008) Human health effects of air pollution. Environ Pollut 151(2):362–367

Mariani F, Barahona P, Raffin N (2010) Life expectancy and the environment. J Econ Dyn Control 34(4):798–815

Moye M (2003) Bilateral debt-for-environment swaps by creditor. WWF Center for Conservation Finance

Neuberg M, Rabczenko D, Moshammer H (2007) Extended effects of air pollution on cardiopulmonary mortality in Vienna. Atmos Environ 41(38):8549–8556

OECD (2008) Environmental outlook to 2030. Organization for Economic Cooperation and Development, Paris

Pautrel X (2008) Reconsidering the impact of pollution on long-run growth when pollution influences health and agents have a finite-lifetime. Environ Resour Econ 40(1):37–52

Pope CA, Ezzati M, Dockery DW (2009) Fine-particulate air pollution and life expectancy in the United States. N Engl J Med 360:376–386

Ruiz M (2007) Debt swaps for development: creative solution or smoke screen? EURODAD, Brussels

Sheikh PA (2008) Debt-for-nature initiatives and the tropical forest conservation act: status and implementation. Congressional Research Service report

Smith K (2012) Valuing nature in a general equilibrium. In: Keynote lecture, EAERE annual conference. http://eaere2012.org/programme/keynote-speakers

Stern N (2007) Stern review on the economics of climate change. Cambridge University Press, Cambridge

Tol RSJ (2011) Poverty traps and climate change. Working paper WP413. Economic and Social Research Institute (ESRI)

Varvarigos D (2010) Environmental degradation, longevity, and the dynamics of economic development. Environ Resour Econ 46:59–73

Yaari M (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32:137–150

Acknowledgments

The authors are indebted to Robert Cairns and three anonymous referees for their helpful suggestions and comments on an earlier version of this article. We are also grateful for the comments of the participants of the “Environment and Natural Resources Management in Developing and Transition Economies 2010” and “CREE 2011” conferences.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper benefits from the financial support of French National Research Agency Grant (ANR-09-BLAN-0350-01).

Appendices

Appendix A: An Example of Longevity Function

Assume \(\beta (e)=\frac{\alpha +x}{a+x}\) with \(x=e-\underline{e}\) and \(0<\alpha <a\). In our paper, we take the limit case where \(\underline{e}\) tends to \(-\infty \). This simplification allows to have that \(\beta (e)\) is defined for all \(e\in \mathbb{R }\). This function needs to satisfy: \(\underline{\beta }<\beta (e)<1\), \(0<\beta ^{\prime }(e)<\widetilde{\beta }\) and \(|\beta ^{\prime \prime }(e)/\beta ^{\prime }(e)|<\overline{\beta }\). We hence have:

which implies that:

We assume \(\left( i\right) a=\frac{2}{\overline{\beta }}; \left( ii\right) \alpha =\frac{2}{\overline{\beta }}\left( 1-\frac{2\widetilde{ \beta }}{\overline{\beta }}\right) \) and \(\left( iii\right) \underline{\beta }\) sufficiently low, such that \(\underline{\beta }<1-\frac{2\widetilde{ \beta }}{\overline{\beta }}.\) Of course, this requires \(\overline{\beta }>2\widetilde{\beta }\). We deduce that:

Appendix B: Proof of Proposition 2

We differentiate the dynamic system (13)–(14) in the neighborhood of a steady state:

The trace \(T\) and the determinant \(D\) of the associated characteristic polynomial \(P(\lambda )\equiv \lambda ^2 -T\lambda +D=0\) are given by:

Since \(T>0\) and \(D>0\), we have \(P(-1)=1+T+D>0\). We now determine \(P(1)=1-T+D\). After some computations, we get:

with \(\Omega ^{\prime }(k)=\frac{\alpha sk^{s-1}}{n-1+m}\frac{\beta ^{\prime }(e)}{\beta (e)^2}\) and \(\Phi ^{\prime }(k)=\frac{g-nb-h(k)}{n(k+b)^2} \). Therefore, at the steady state \(k_1\), we have \(P(1)<0\), because \(\Omega ^{\prime }(k)< \Phi ^{\prime }(k)\). This shows that this is a saddle. At the steady state \(k_2\), we have \(\Omega ^{\prime }(k)>\Phi ^{\prime }(k)\), implying that \(P(1)>0\). This steady state is stable or unstable, depending on the value of \(D\) with respect to \(1\).

Choose \({\widetilde{\beta }}\) sufficiently small. Since \(\beta ^{\prime }(e)<\widetilde{\beta }, D<1\) requires:

We can show that this is equivalent to \(\Phi ^{\prime }(k)<0\), which shows that the steady state \(k_2\) is stable. \(\square \)

Appendix C: Proof of Lemma 1

Using the definition of the matrix \(A\), we can compute:

One may easily see that this expression is equivalent to:

Recall that \(\Phi ^{\prime }(k_1)>\Omega ^{\prime }(k_1)\), while \(\Phi ^{\prime }(k_2)<\Omega ^{\prime }(k_2)\). We deduce that \(detA>0\) when the matrix \(A\) is evaluated at the steady state \(\left( k_{1},e_{1}\right) \), while \(detA<0\) when the matrix \(A\) is evaluated at the steady state \(\left( k_{2},e_{2}\right) \). \(\square \)

Appendix D: Second Order Conditions for the Optimal Solution

The social planner solves \(Max_{k,d} H(d, k)\), with:

The first order conditions are give byFootnote 17:

The Hessian matrix is given by:

with:

We deduce that

The second order conditions require \(H_{dd}<0\), \(H_{kk}<0\) and \(H_{dd}H_{kk}-H_{dk}^2>0\). They are satisfied for \(|\beta ^{\prime \prime }(e)/\beta ^{\prime }(e)|<\overline{\beta }\), with \(\overline{\beta }>0\) a constant sufficiently low. \(\square \)

Rights and permissions

About this article

Cite this article

Fodha, M., Seegmuller, T. Environmental Quality, Public Debt and Economic Development. Environ Resource Econ 57, 487–504 (2014). https://doi.org/10.1007/s10640-013-9639-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9639-x