Abstract

By specializing Montero’s (J Environ Econ Manag 44:23–44, 2002) model of environmental regulation under Cournot competition to an oligopoly with linear demand and quadratic abatement costs, we extend his comparison of firms incentives to invest in R&D under emission and performance standards by solving for a closed form solution of the underlying two-stage game. This allows for a full comparison of the two instruments in terms of their resulting propensity for R&D and equilibrium industry output. In addition, we incorporate an equilibrium welfare analysis. Finally, we investigate a three-stage game wherein a welfare-maximizing regulator sets a socially optimal emission cap under each policy instrument. For the latter game, while closed-form solutions for the subgame-perfect equilibrium are not possible, we establish numerically that the resulting welfare is always larger under a performance standard.

Similar content being viewed by others

Notes

Importantly, the questions of existence and uniqueness of a subgame-perfect equilibrium in pure strategies for the four different games analysed by Montero (2002) have not been addressed, and probably constitute very challenging issues in themselves. These issues can end up being crucial for the well-foundedness of the models at hand, e.g., for some of the properties of equilibria, including their comparative statics properties.

For further and more detailed discussion of the fact that the regulation of environmental risk is dominated by the use of standards, the reader is referred to Viscusi et al. (2000) and Harrington et al. (2004). Nevertheless, this state of affairs often does not reflect economists’ views on the normative merits of the two types of instruments.

One implication of this fact is that, even with our simple specification, a four-way comparison appears possible only via numerical simulations. The difference in structure across the two types of games also raises some issues as to the very meaning of some of the comparisons. Finally, the difference in model structure also means that the appropriate functional forms might not be the same.

There are multiple ways of modeling R&D in an environmental setting (see e.g., Amir et al. 2008). The main alternative to end of pipe technology is the use of cleaner technologies of production, which lead to a lower emissions-output ratio. Whether the conclusions of the present paper extend to this R&D technology is an interesting topic for future work, but beyond the scope of this paper.

Even for our simple specification, the basic three-stage model is not as analytically tractable as the two-stage games we investigate. For teh former model, this requires some reliance on numerical methods (Sect. 4).

We do not consider the extreme cases, in which \(h_{i}=0\) and \(h_{i}=1,\) since they imply that firm i does not emit, or \(y_{i}=q_{i}\), and that it does not abate, or \(y_{i}=0\), respectively.

Another common alternative way to introduce environmental R&D is to allow firms to use cleaner technologies to comply with environmental regulation. In this case, environmental R&D would aim at reducing the ratio of emissions per output. Whether the main results of the present paper extend to this type of environmental R&D is an open question of substantial interest. Recent results on some hitherto unknown differences between the two types of R&D indicate that the answer to this question requires some substantive analysis (see Amir et al. 2008; Bauman et al. 2008; Baker et al. 2008; Bréchet and Jouvet 2008, for more on this important point).

In addition, this assumption gets rid of potential technical difficulties and long computations (that a priori have no particular economic content of interest) associated with boundary equilibrium solutions.

There is some similarity with models investigating the effects of minimal environmental quality standards in vertically differentiated oligopolies (see e.g., Lambertini and Tampieri 2012).

The assumptions of this model imply that equilibrium does not depend on e in this stage, hence, we can simply write \(q_{i}(x_{i},x_{j})\) for \(i,j\in \left\{ 1,2\right\} \) and \(i\ne j\).

As in Proposition 1, we additionally require that \(0<e<\frac{ 3\gamma (a-c)}{9b\gamma -1},\) to ensure that\(\ 0<x(e)<c\) and \(0<e<q(e)\).

Under the conditions of Proposition 3 (a)(iii) and (b)(iii), it is useful to note that \(0<\overline{h}<1.\)

A convenient feature of the quadratic cost function is that firms will always choose to undertake strictly positive levels of R&D even when \( \gamma \) is very high. For an alternative, see e.g. Amir et al. (2017).

Here, environmental regulation is said to be stringent (mild) if h is small (large) within the interval (0, 1).

At \(h=0\), welfare under the emission and performance standards coincides, but the derivative of the welfare function with respect to h is higher under the performance standard. In particular, one obtaines \(W^{p\prime }(0)-W^{e\prime }(0)=\frac{2(a-c)\gamma (9bc\gamma -4a)}{(4-9b\gamma )^{2}} >0,\) where \(W^{p\prime }(0)\) and \(W^{e\prime }(0)\) denote the derivatives of the welfare function under the performance and emission standards, respectively.

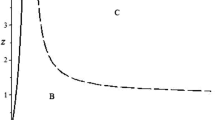

We find that the performance standard generates higher welfare than the emission standard for \(h<0.22\).

Notice that \(a<2\gamma s(a-c)\) in (A2) implies \(a>c\) in (A1), for the positive values of the parameters. Yet, we list \(a>c\) as a separate assumption because this weaker version is sufficient for some proofs (see the Appendix).

There are four roots in total, however, two of them are imaginary ones and one real root induces zero output. The restant root constitutes as the only relevant solution to the maximization problem of the regulator.

At \(a=3.375\), \(e^{*}=h^{*}=0\), \(x^{e}=x^{p}=c=1\), \(q^{e}=q^{p}=1.125\), and \(W^{e}=W^{p}=3.5625\).

\( s>0.957\) is required to satisfy (A2), given the parameter specification with \(a=2.3\).

\(s>0.55\) is required to satisfy (A2), given the parameter specification, with \(a=3.1\).

References

Amir R (2000) Modelling imperfectly appropriable R&D via spillovers. Int J Ind Organ 18:1013–1032

Amir R, Germain M, Van Steenberghe V (2008) On the impact of innovation on the marginal abatement cost curve. J Public Econ Theory 10:985–1010

Amir R, Halmenschlager C, Knauff M (2017) Does the cost paradox preclude technological progress under imperfect competition? J Public Econ Theory. doi:10.1111/jpet.12199

Baker E, Clarke L, Shittu E (2008) Technical change and the marginal cost of abatement. Energy Econ 30:2799–2816

Bauman Y, Lee M, Seeley K (2008) Does technological innovation really reduce marginal abatement costs? Some theory, algebraic evidence, and policy implications. Environ Resour Econ 40:507–527

Bréchet T, Jouvet P (2008) Environmental innovation and the cost of pollution abatement revisited. Ecol Econ 65:262–265

Benchekroun H, Van Long N (1998) Efficiency inducing taxation for polluting oligopolists. J Public Econ 70:325–342

Brander J, Spencer B (1983) Strategic commitment with R&D: the symmetric case. Bell J Econ 14:225–235

Bruneau JF (2004) A note on permits, standards, and technological innovation. J Environ Econ Manag 48:1192–1199

D’Aspremont C, Jacquemin A (1988) Cooperative and noncooperative R&D in duopoly with spillovers. Am Econ Rev 78:1133–1137

Downing PB, White LW (1986) Innovation in pollution control. J Environ Econ Manag 13:18–29

Harrington W, Morgenstern R, Sterner T (2004) Choosing environmental policy: comparing instruments and outcomes in the United States and Europe. RFF Press, Washington

Hueth B, Melkonyan T (2009) Standards and the regulation of environmental risk. J Regul Econ 36:219–246

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30:95–111

Lambertini L, Tampieri A (2012) Do minimum quality standards bite in polluting industries. Res Econ 66:184–194

McDonald S, Poyago-Theotoky J (2017) Green technology and optimal emissions taxation. J Public Econ Theory. doi:10.1111/jpet.12165

Malueg DA (1989) Emission credit trading and the incentive to adopt new pollution abatement technology. J Environ Econ Manag 16:52–57

Milliman SR, Prince R (1989) Firms incentives to promote technological change in pollution control. J Environ Econ Manag 17:247–265

Montero JP (2002) Permits, standards, and technology innovation. J Environ Econ Manag 44:23–44

Requate T (2005) Dynamic incentives by environmental policy instruments—survey. Ecol Econ 54:175–195

Viscusi WK, Vernon JM, Harrington JE (2000) Economics of regulation and antitrust. MIT Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank two referees of this journal and Hassan Benchekroun (as associate editor) for thorough and thoughtful reports, with many useful suggestions. We also gratefully acknowledge the wonderful hospitality at the Hausdorff Institute for Mathematics, University of Bonn, under the Trimester Program “Stochastic Dynamics in Economics and Finance” in the summer of 2013, where this work was initiated.

Appendix

Appendix

This section contains the proofs and computations for all the results of the paper.

Proof of Lemma 1

In the last stage, firm i solves the optimization problem (2), with first order condition (or FOC)

The reaction function of firm i is given by

The objective function is strictly concave, thus, a unique maximum is attained (the second-order condition (SOC) is \(-2b<0\)). Solving simultaneously the two non-zero reaction functions of the firms yields (for \(i\ne j\))

In the first stage, firm i chooses the level of R&D, \(x_{i}\), given \(x_{j}\), e and \({q}_{i}^{{}}(x_{i},x_{j})\) in Eq. (9).

The FOC of (3) is then given by

The first term in (10) vanishes by the FOC in (8). By (A1), \(9b\gamma >8\), the SOC holds. Plugging Eq. (9) into Eq. (10) and using the fact that the firms are symmetric and subject to the same standard e, we get that every firm invests

in R&D, yielding an output of

Since e is selected exogenously, we want to choose values that are economically meaningful. In particular, we want \(0<x(e)<c\) and \(0<e<q(e)\); we show that \(0<e<\frac{3\gamma (a-c)}{9b\gamma -1}\) is sufficient to guarantee that these two inequalities hold.

First notice that e, such that \(0<e<\frac{3\gamma (a-c)}{9b\gamma -1},\) implies that \(\frac{(a-c)}{9b\gamma -1}<{x}^{{}}(e)=\frac{4(a-c)-9be}{ 9b\gamma -4}<\frac{4(a-c)}{9b\gamma -4}\) by multiplying the first inequality by \(-9b\), adding \(4(a-c)\) and dividing by \(9b\gamma -4,\) which is positive by (A1). Assumption (A1) implies that the left hand side of the second inequality is strictly positive, hence, \(0<x(e)\). The proof of \(x(e)<c\) also follows from (A1); to see it rewrite \(9b\gamma c>4a\) as \(9b\gamma c-4c>4(a-c),\) which implies that \(\frac{4(a-c)}{9b\gamma -4}<c\), hence, that \({x}^{{}}(e)<c.\)

To show that \(e<q(e)\) (which immediately implies that \(0<q(e)\)) consider the following implications:

\(e<\frac{3\gamma (a-c)}{9b\gamma -1},\) hence, \((9b\gamma -1)e<3\gamma (a-c)\) by (A1) and, further, \(9b\gamma e-4e+3e<3\gamma (a-c)\), thus, \((9b\gamma -4)e<3\gamma (a-c)-3e,\) consequently leading to \(e<\frac{3\gamma (a-c)-3e}{ 9b\gamma -4}=q(e)\). This completes the proof of Lemma 1. \(\square \)

Proof of Lemma 2

In the last stage, firms solve problem (4), with FOC:

with SOC \(-2b<0\).

Solving simultaneously for the positive parts of the reaction curves of the firms, gives us

Using Eq. (14) in problem (5) helps derive the following FOC for the first stage:

with SOC \(8(1-h)^{2}/(9b)-\gamma <0\), which holds by (A1), \(8<9b\gamma \), and \(0<h<1\).

The first term in Eq. (15) vanishes by FOC (13). By the symmetry of the model, Eqs. (14) and (15) imply our result, \({x}(h)=\frac{4(1-h)[c(1-h)-a]}{4(1-h)^{2}-9b\gamma }\) and \({q}(h)=\frac{3\gamma [c(1-h)-a]}{4(1-h)^{2}-9b\gamma }.\)

Note that the following assumption:(A’) \(8(1-h)^{2}<9b\gamma \), \(a>c(1-h)\) and \(9bc\gamma >4a(1-h)\) for all \( 0<h<1\), guarantees that \(0<{x}^{{}}(h)<c\) and \({q}^{{}}(h)>0\). It is easy to verify that \(0<h<1\) and (A1) (\(8<9b\gamma \), \(a>c\) and \(9bc\gamma >4a\) ) imply (A’), since the lowest side of the (positive) inequalities is multiplied by a number between 0 and 1. This completes the proof of Lemma 2. \(\square \)

Proof of Proposition 3

To avoid confusion between the equilibrium variables, we add the superscript e for the equilibrium under the emission standard, and p for the equilibrium under the performance standard. Thus, \(x^{e}(e)\) and \(q^{e}(e)\) correspond to x(e) and q(e) in Lemma 1, respectively; and \(x^{p}(h)\) and \(q^{p}(h)\) correspond to x(h) and q(h) in Lemma 2, respectively.

Now, let us fix \(e=hq^{p}(h)\), so that both instruments generate the same level of emissions. Hence, e is a function of h and we can write \(x^{e}\) in terms of h, \(x^{e}(e)=x^{e}(hq^{p}(h))=x^{e}(h)\). Similarly, we can write \(q^{e}\) as a function of h (this feature will be used in part (c)).

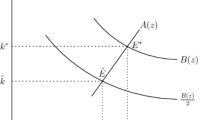

For parts (a) and (b), we find the values of h for which \( x^{e}(h)=x^{p}(h) \) holds. For these values, we can analyze the functions of interest to see which function takes a larger value on given intervals. It turns out that there are only two solutions: \(h_{1}=0\), which is trivial and implies zero level of emissions, and \(\overline{h}= \frac{5(9b\gamma )-(9b\gamma +16)a/c}{9b\gamma -16a/c}\), which is the threshold of interest. Since there are only two roots, we analyze the slopes of \(x^{e}(h)\) and \( x^{p}(h)\) around zero, to prove our result. We have to distinguish between two cases, which depend on the sign of \(9b\gamma -16a/c\).

-

(a)

Suppose that \(a/c<9b\gamma /16\) (i.e., \(9b\gamma -16a/c>0\)). Two possibilities arise; either \(\overline{h}>0 \) or \(\overline{h}<0\). First, let us assume that \(\overline{h}>0\). Since, by assumption, its denominator is positive, the numerator must be positive as well, i.e., \(5(9b\gamma )-(9b\gamma +16)a/c>0\). Further, it can be shown that \({x^{e}}^{\prime }(0)-{ x^{p}}^{\prime }(0)=-c\frac{5(9b\gamma )-(9b\gamma +16)a/c}{(4-9b\gamma )^{2} }\) is negative by the statement above, thus, \(x^{p}(h)\) is above \(x^{e}(h)\) for all \(0<h<\overline{h}\). A similar argument shows that \({x^{e}}^{\prime }(0)-{x^{p}}^{\prime }(0)>0\) when \(\overline{h}<0\), which implies that \( x^{e}(h)>x^{p}(h)\) for all \(0<h<1\). The reader can easily verify that (i) \( a/c<4\) implies \(\overline{h}>1\), (ii) \(a/c>5\frac{9b\gamma }{9b\gamma +16}\) implies \(\overline{h}<0\) and (iii) \(4<a/c<5\frac{9b\gamma }{9b\gamma +16}\) implies \(0<\overline{h}<1\); which clearly defines regions for where an instrument is superior that the other in terms of R&D. To complete our result, it suffices to show that \({x^{e}}^{\prime }( \overline{h})-{x^{p}}^{\prime }(\overline{h})\ne 0\), which holds by our assumptions, since \({x^{e}}^{\prime }(\overline{h})-{x^{p}}^{\prime }( \overline{h})=\frac{c(5(9b\gamma )-(9b\gamma +16)a/c)(16a-9bc\gamma )^{2}}{ 9b\gamma (-64+9b\gamma )(-4+9b\gamma )(-4a^{2}+9bc^{2}\gamma )}\).

-

(b)

Now suppose that \(a/c>9b\gamma /16\). The proof of this part is analogous to that in part a, and is therefore omitted.

-

(c)

This proof follows the same strategy as the one implemented in parts a and b. We look for h that satisfies the equality \(q^{e}(e)=q^{p}(h)\), with \(e=hq^{p}(h)\). Again two solutions are obtained; the trivial root \(h_{1}=0,\) and the root of interest, \(h_{0}= \frac{5a-9bc\gamma -c}{4a-c}\). Note that (A1) implies that \(h_{0}<1\), yet, it remains to establish whether its value is positive or negative. First, let us suppose that \(h_{0}>0\) and analyze the slopes of \(q^{e}(h)\) and \(q^{p}(h)\) at \(h_{1}=0\). If \(h_{0}>0\), then \( 5a-9bc\gamma -c>0\), by (A1), \(a>c\). Further rearrangements lead to \({q^{e}} ^{\prime }(0)-{q^{p}}^{\prime }(0)=\frac{3\gamma (5a-9bc\gamma -c)}{ (4-9b\gamma )^{2}}\), which is positive by the assumptions \(h_{0}>0\) and \( \gamma >0\). Hence, \(q^{e}(h)\) is always above \(q^{p}(h)\) (for all \(0<h<h_{0}\) ). If \(h_{0}<0\), then \(5a-9bc\gamma -c<0\) and \({q^{e}}^{\prime }(0)-{q^{p}} ^{\prime }(0)<0\); thus, \(q^{p}(h)\) is above \(q^{e}(h)\) for all \(0<h<1\). Notice that (i) \(a/c<(9b\gamma +1)/5\) implies \(h_0<0\) and (ii) \( a/c>(9b\gamma +1)/5\) implies \(0<h_0<1\). The fact that \({q^{e}}^{\prime }(h_{0})-{q^{p}}^{\prime }(h_{0})=\frac{3(-4a+c)^{2}\gamma (5a-9bc\gamma -c)}{ (-4+9b\gamma )(-1+36b\gamma )(-4a^{2}+9bc^{2}\gamma )}\) differs from zero (given our assumptions in any case), completes our proof.\(\square \)

Proof of Lemma 4

Given the results in Lemma 1, we solve the problem of the regulator presented in Eq. (6). Here, the FOC is given by the following equation:

The SOC of this problem is \(\frac{2(9b+8s-18b\gamma s)}{9b\gamma -4}\), which is negative by (A1) and (A2). Using the FOCs (8) and (10), Eq. (16) becomes

Combining Eqs. (11), (12) and (17), leads to the results outlined in Lemma 4. (A1) and (A2) guarantee that in equilibrium, \(0<x^{*}<c\) and \(0<e^{*}<q^{*}\). \(\square \)

Rights and permissions

About this article

Cite this article

Amir, R., Gama, A. & Werner, K. On Environmental Regulation of Oligopoly Markets: Emission versus Performance Standards. Environ Resource Econ 70, 147–167 (2018). https://doi.org/10.1007/s10640-017-0114-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0114-y