Abstract

In a polluting Cournot duopoly with homogeneous goods, this work compares the environmental, public finance and welfare impacts of three policies: an emissions tax, an abatement subsidy, and a policy mix. A subsidy, alone or coupled with a tax, always increases abatement; however, taxation disincentivises production, leading to decreased environmental damage, which positively affects welfare. Except for a rather inefficient technology, the emissions tax produces the lowest environmental damage; this positive effect, jointly with the tax revenues the government collects, more than offsets the negative impact on profits and consumer surplus due to output contraction, leading to the highest welfare. Only when societal awareness is negligible and technology is inefficient does the government design a policy providing a subsidy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change has become an imperative issue in the political agenda of several countries (see, for instance, The Economist 2019, 2021, 2023b). This phenomenon predominantly stems from greenhouse gas (GHG) emissions, produced during the process of combustion of fossil fuels for manufacturing and services production, both in industrial powers and developing countries. According to the latest available data, global GHG emissions have increased by 44% in the period 1990–2021 (ourworldindata.org 2023).

The worldwide concern about climate change has induced many countries to implement environmental policies that reduce environmental damage (or degradation; i.e., the deterioration of the environment) due to increased global temperature induced by GHG emissions generated by highly polluting industries. As part of the Paris Agreement, adopted by 196 countries at the United Nations Climate Change Conference (COP21) in December 2015, many countries submitted contributions based on their national conditions and environmental policies, unilaterally undertaking efforts to cut emissions related to their industrial activities.

The adoption of cleaner technologies for environmental protection is relevant in several productive sectors, often characterized by oligopolistic structures in which strategic interactions among firms and between firms and government/regulators play a crucial role. The market-based mechanisms implemented to “decarbonize” economies can be divided into quantity-based (quantity regulation) policies,Footnote 1 such as transferable emissions quotas and emission standards, and price-based (price regulation) policies, such as emissions taxes and abatement subsidies. This paper contributes to the longstanding debate on instrument choice (e.g., price vs. quantity; taxes vs. regulation) in climate/environmental policy focusing in detail on price-based mechanisms.

The design of environmental/emissions taxes is based on the following simple basic principle: using these tools, regulators assign a price to the pollution that economic agents produce, particularly firms. As pollution becomes costly, firms are incentivised to change their behaviours and reduce emissions. Other viable options include the subsidisation of abatement activities to reduce the cost of “green” investments to cut emissions as well as a policy mix of emissions tax and abatement subsidies.

This paper focuses on the environmental policies a government can design to incentivise firms' activities related to the abatement (i.e., reduction) of polluting emissions in the form of end-of-pipe technologies. In a framework in which the government/regulator has set the objective of improving the well-being of the overall society, this work aims to compare the impact on the environment, public finances, and social welfare of the aforesaid policies (emissions tax, abatement subsidy, policy mix). This simple analysis provides some insights into the design of environmental policies to cut GHG emissions and ease the transition from a polluted environment to a more sustainable one.

The theoretical literature in environmental economics has devoted significant efforts to assess various price-based policy initiatives intended to reduce emissions. On the one hand, since the 1990s, many economists have explored the effects of emissions taxes in polluting markets. The pioneering works analysing optimal emissions tax/subsidy in the Cournot oligopoly (duopoly) markets include Requate (1993, 2006), Simpson (1995), Carlsson (2000), Poyago-Theotoky and Teerasuwannajak (2002), David (2005), and Moner-Colonques and Rubio (2015). More recently, Ouchida et al. (2019) and Buccella et al. (2021) explore the subject, and Xu et al. (2022) and Xu and Lee (2022) address firms engaging in environmental corporate social responsibility. On the other hand, scholars have investigated the impact of subsidies on "green" technology (i.e., emissions-reducing) investments as an alternative policy to reduce the environmental damage of industrial production and improve welfare (see e.g., Poyago-Theotoky 2007, 2010; Ouchida and Goto 2014). Most of those contributions directly compare the welfare effects of “green” subsidies with the presence of emissions taxes in oligopolies to conceive and design appropriate policies for a sustainable economy, see inter alia Poyago-Theotoky (2003, 2007), David and Sinclair-Desgagné (2010), Ben Youssef and Dinar (2011), and Gautier (2015). However, the literature lacks in-depth comparison among different environmental policies and their effects on single components as well as the overall social welfare. Exceptions are the works of Conrad and Wang (1993), Ben Youssef and Dinar (2011), Gautier (2015), and the recent works of Bian and Zhao (2020) and Lee and Park (2021).

Conrad and Wang (1993) quantify the impact of emissions taxes and abatement subsidies on firms and industry output and the number of firms in the industry. They analyse three market structures, i.e., perfect competition, oligopoly, and a dominant firm with a competitive fringe, and find that those environmental policies affect the structure of the polluting sector in various ways. Though the policies are qualitatively similar, the effects on the industry's emissions are quantitatively different. Ben Youssef and Dinar (2011) use a three-stage game in which, at the first stage, the government chooses both a tax per unit of pollution and a subsidy per unit of R&D level to incentivise the abatement activities of firms producing homogeneous goods. R&D activities do not generate spillovers. The authors find that, if the marginal damage cost of pollution is sufficiently low, then the regulator subsidizes pollution to correct the output reduction distortion of oligopoly. If they are adequately high, then the regulator taxes the R&D investment, because firms may be tempted to overinvest in research.

Gautier (2015) studies the role of product differentiation on optimal policy and industry emissions in a Cournot oligopoly in which abatement subsidies and emission taxes are present. As products become more differentiated, the government can increase the tax rate, because the available abatement technology can make subsidies too costly. Moreover, industries with highly differentiated products may experience a rapid increase in emissions. To tackle this issue, policies to incentivise environmental R&D may be required. As industries become more or less pollution-intensive, the government accordingly adjusts the optimal policy, and its fine-tuning varies across industries depending on the different degrees of product differentiation.

Bian and Zhao (2020) study the impact of abatement subsidy and emissions tax on a supply chain in which the manufacturer distributes products through competitive retailers and invests in emissions abatement technology. The subsidy policy incentivises the manufacturer to abate pollution, leading to higher profits for the distribution channel. However, when emissions abatement is costly and emissions are highly damaging, the tax policy should be implemented, because it generates better environmental performance and social welfare. Moreover, the manufacturer has no incentive to improve abatement efficiency if the environmental damage of production is high under the subsidy policy or low under the tax policy.

Lee and Park (2021) compare emissions taxes and green R&D subsidies in private and mixed-duopoly markets in the presence of R&D spillovers; this is perhaps the paper closest to our analysis. The authors focus on the interaction of R&D spillovers and technology efficiency to determine the degrees of social awareness that ensure both policy tools can be implemented. They show that, in both private and mixed duopoly markets characterized by decreasing returns in production and linear environmental damage, a green R&D subsidy leads to a higher (lower) welfare level than an emissions tax when the green R&D is efficient (inefficient). This occurs regardless of R&D spillovers because it has lower social costs; thus, an R&D subsidy induces more R&D investment. Consequently, a higher spillover rate requires lower R&D efficiency for an abatement subsidy policy to be advantageous. However, when a publicly owned firm operates in the market, the government can consider a privatization policy. The results suggest that, in the presence of inefficient green R&D and a low (high) spillover rate, the government should opt for an emissions tax and (not) privatize the state-owned firm. With efficient green R&D, a subsidy is better; however, irrespective of spillovers, privatization is welfare detrimental.

The main elements of the present work (Cournot duopoly with homogeneous goods, linear production technology, and a convex environmental damage function) are based on Buccella et al. (2021); nonetheless, this paper further develops a two-stage game. In the first stage, a social welfare maximising government, which commits to the adoption of the environmental policy, optimally chooses the rates of the price-based regulatory tools, i.e., emissions tax only, abatement subsidy only, and a policy mix of the two previous tools, for the polluting industry. In the second stage, private firms that have invested in end-of-pipe technologies simultaneously decide the output and abatement levels. Unlike Lee and Park (2021), this article analyses only private markets (therefore, there is no room for the privatization policy). It does not consider the presence of technological spillovers concerning the investment in “green” technology and differs about the production technology (convex) and environmental damage function (linear). Unlike Bian and Zhao (2020), this work abstracts from the supply chain; that is, it does not consider vertical relations between manufacturers and retailers and how those relations may affect the government’s environmental policy. Moreover, this work differs from Buccella et al. (2021) because it does not consider the firms’ strategic (and therefore endogenous) choice of whether to invest in abatement activities in the presence of an environmental policy, but it compares the exogenously given symmetric equilibrium outcomes when firms have all adopted the abatement technology. This work, like Lee and Park (2021), stresses the role played by the interaction of societal awareness and technology in the choice of the optimal environmental policy; however, it carries out an in-depth analysis of the impact of those policies on environmental quality, public finances, and overall social welfare.

The key results are as follows. The provision of an abatement subsidy, alone or combined with a tax in the policy mix, always increases the levels of abatement. However, an emissions tax, increasing the firms’ marginal cost of production, tends to shrink production. Given that the environmental damage is linked to output, production levels in the presence of subsidies are higher than those with an emission tax only, and this negatively affects social welfare. Except for the case when the available abatement technology is inefficient, i.e., to abate emissions is expensive, an emissions tax leads to the lowest environmental damage. This positive effect on welfare, jointly with the tax revenues the government collects, more than counterbalances the negative impact on profits and consumer surplus due to the output contraction induced by taxation. Consequently, differently from Lee and Park (2021), this study asserts that an emissions tax always leads to the highest welfare among the three considered environmental policies, provided that the societal awareness toward the environment, i.e. the weight the government attributes to the environmental damage, is adequately high. Moreover, in contrast to Lee and Park (2021), when the technology is inefficient with negligible societal awareness, the government must design an abatement subsidy policy to cut emissions because the emissions tax policy is (technically) unfeasible.

The remainder of the paper is organised as follows. Section 2 illustrates some real-world examples of industrial sectors predominantly influenced by environmental policies. Section 3 describes the model, derives the relevant outcomes, and finally compares the environmental, public finance, and overall welfare impacts of the three environmental policies. Moreover, it presents a historical-political projection exercise and discusses some extensions. Section 4 closes the paper with an outline of the future research agenda.

2 Environmental Policies and Industrial Sectors: Europe as an Example

The EU is a leading political institution in the process of the “decarbonisation” of the economy, focusing on cutting GHG emissions from industrial activities. The sectors mainly targeted in the EU’s environmental policies seem to be more characteristically similar to the case in which capacity is difficult to adjust. Kreps and Scheinkman (1983) (also mentioned in Shy 1996, p. 113) build a two-period dynamic game in which, at the first stage, when long-term decisions are taken, firms choose their capacities, and in the second stage, when short-term decisions are taken, with fixed quantities, firms decide prices (i.e. quantity is more difficult to adjust than prices). They show that, in such a framework, the supply of a firm is at the intersection of Cournot’s reaction functions. Thus, the output and prices in equilibrium are identical to those of the standard one-shot Cournot model. This provides a rationale for the theoretical adoption of the Cournot model.

The main environmental policy instrument the EU uses to incentivise decarbonisation is the Emission Trading System (EU ETS), a quantity-based regulation policy created in 2005. It works on the “cap and trade” principle: the European institutions fix a cap on the total amount of GHGs emitted by the installations the system covers. Over time, the cap decreases: thus, total emissions fall.Footnote 2

The EU ETS covers the emissions of GHG from specific activities, focusing on those that can be accurately measured, reported, and verified. These are (1) carbon dioxide from (a) electricity and heat generation and energy-intensive industry sectors, including oil refineries, steel works, and production of iron, aluminium, metals, cement, lime, glass, ceramics, pulp, paper, cardboard, acids and bulk organic chemicals and from (b) transport, particularly aviation and, since 2024, maritime transport, with some specificities for those sectors; (2) nitrous oxide from the production of nitric, adipic, and glyoxylic acids, and glyoxal; and (3) perfluorocarbons from the production of aluminium.

In addition to the EU ETS, the adoption of price-based policies such as emissions taxes, e.g., carbon taxes, and abatement subsidies further incentivise investment in green (abatement) technologies. Concerning emissions taxes, in 1990, Finland was the first country in the world to introduce a carbon tax. From then on, in recent years, 20 other European countries, among them 14 EU Member states, have implemented such taxes which are levied on all direct and indirect production of GHG emissions, irrespective of the industrial sector. In EU countries, the carbon tax ranges from less than 1 euro per metric ton of carbon dioxide emitted in Poland to over 110 euros in Sweden. Carbon taxes are also levied in the four European Free Trade Association countries. In addition to country-specific levies, the EU carbon dioxide taxes also cover government revenue from the auctions of emission permits under the EU ETS. Excluding Switzerland, Ukraine, and the United Kingdom, all European countries that levy a carbon tax are also included in the EU ETS (Tax Foundation 2023; Eurostat 2023a).

Regarding environmental subsidies and other payments whose purpose is to protect the environment, such as for installing cleaner energy, keeping nature reserves, or conducting research on environmental issues, the use of this policy tool seems to lag. Public subsidies and other environmental-related transfers in EU countries are in place only in 11 member states, plus Switzerland and Norway (Eurostat 2023b). Moreover, for the 13 countries reporting 2020 data to Eurostat, environmental transfers range from 1.2% of GDP in Malta to 0.8% in Romania and Bulgaria, down to 0.3% in Sweden, Portugal, Ireland, and Luxembourg. The general government contributes to more than 80% of the environmental transfers received in the countries of Denmark, Ireland, Spain, Malta, and Sweden. In other countries, the percentage is still above 50%. The industrial sectors, which mostly received environmental transfers from the general government in most countries in 2020, were “agriculture, forestry and fishing” and “electricity, gas, steam and air conditioning supply.”Footnote 3

3 The Model

In a polluting duopoly industry, firm 1 and firm 2 produce homogeneous goods, \(q_{1}\) and \(q_{2}\), and compete à la Cournot. Firm \(i\) (\(i = 1,2\)) uses a linear technology to produce \(q_{i}\) units of the goods, leading to constant (marginal) cost, \(c\), which for analytical tractability and without loss of generality is set equal to zero. Each unit of production generates one unit of pollutant. However, due to abatement activities, the emissions released (pollution), \(e_{i}\), are given by \(e_{i} = q_{i} - k_{i}\) (Ulph 1996), with \(k_{i}\) as the abatement level to reduce the environmental impact. Abatement is derived from the adoption of an end-of-pipe cleaning technology: the pollutant is treated/filtered at the last stage of the process, prior to its release into the environment. One can refer to exhaust-gas cleaning equipment such as “filters in a refinery's pipe for CO2 reduction” or scrubbers on smokestacks “to remove SO2 from a fuel gas coal fired electric plant” (Asproudis and Gil-Moltó, 2015, p. 169), which are not directly linked to output. Each firm active in the market has knowledge of this common, universally accessible technology, e.g., provided by firms operating in a perfectly competitive eco-industry market. However, ki ϵ[0, qi): the current state of the technology does not facilitate complete emissions elimination.Footnote 4

The emissions abatement technology cost function faced by firm \(i\) is \(CA_{i} (k_{i} ) = \frac{z}{2}k_{i}^{2}\). Once firms have decided their abatement levels, the amount of the investment in the end-of-pipe technology is determined and becomes fixed. Parameter z > 0 scales up/down the total abatement cost; it can be interpreted as an exogenous index of the technological progress which measures the arrival of a cost-effective cleaning innovation. A reduction in the value of \(z\) reflects an improvement of the abatement technology, so that the pollution abatement process is less costly. The adoption of a clean technology to abate emissions requires that firms sustain costs with decreasing returns to investment: firms always incur some costs. As \(k_{i}\) is the pollutant abated per \(q_{i}\) units of output, a smaller (resp. larger) value of \(z\) coincides with, ceteris paribus, a more (resp. less) efficient abatement.

The index \(ED = \frac{g}{2}(e_{1} + e_{2} )^{2}\) assesses the environmental damage that industrial production generates. This damage function is common in the environmental economics literature and assumes that: 1) the environmental damage is a convex function of total pollution and 2) consumers take the damage as exogenous (see, for example, van der Ploeg and de Zeeuw 1992; Ulph 1996). The (exogenous) parameter g > 0 is the weight the government attributes to the environmental damage, i.e., the society and general public’s awareness of the environment, perceived risk, and perceived human cause of climate change (Knight 2016; see also Calculli et al. 2021). An increase in the values of parameter \(g\) implies, ceteris paribus, that the society is more concerned about environmental issues; the current work focuses on climate change. The (inverse) market demand is linear, whose expression is \(p = \alpha - \beta Q\),Footnote 5 where \(\alpha \ge 0\) is a positive parameter measuring the market size,\(\beta > 0\) is its slope, and \(Q = q_{1} + q_{2}\) is total supply. To make notation less burdensome, we normalize the demand parameters \(\alpha = 1\), \(\beta = 1\).Footnote 6

To evaluate the impact of each environmental policy (i.e., emissions taxes, abatement subsidy, and a combination of the two instruments), we build a two-stage non-cooperative game in which, at stage one (the regulator stage), a social-welfare-maximising government commits to set optimally the rate of the environmental instrument(s). At stage two (the market stage), firms simultaneously choose output and how much pollution to abate through a cleaning technology, taking as given the government’s choice. As usual, per each environmental policy scenario, the game is solved using backward induction.Footnote 7

3.1 Environmental Policy 1: Emissions Tax

Consider the case in which the government, to incentivise firms to cut emissions, levies an optimal emissions tax per each unit of output with the aim of maximising social welfare (see, for instance, Buccella et al. 2021). Consequently, the tax base of firm \(i\) is \(q_{i} - k_{i}\) (i.e., the remaining pollution), and the government’s tax revenue per firm is \(t(q_{i} - k_{i} )\).

Therefore, firm \(i\) profit function is:

where the superscript ET stands for emissions tax. At stage two of the game, firms simultaneously choose output and the abatement level. By cutting emissions, firms lessen their production costs of an amount equal to the reduced tax burden. Maximisation of (1) with respect to \(q_{i}\) and \(k_{i}\) leads to the following first-order conditions:

From the Hessian matrix, the successive principal minors \(\left| {H_{1} } \right| < 0,{\text{ and}}\;\;\left| {H_{2} } \right| > 0\) reveal that \(H\) is negative definite, i.e., the stationary point is a maximum. Solving the system of reaction functions (i) in (2), one gets output in equilibrium as

with \(t \in (0,1)\) to ensure qi > 0.Footnote 8 Note that an emissions tax per unit of output increases the firms’ marginal cost of production, and therefore an increase in the tax rate reduces output, i.e. \(\frac{{\partial q_{i} }}{\partial t} < 0\). Therefore, by cutting emissions, firms reduce both the fixed cost of the end-of-pipe technology and the per-unit marginal cost. Moreover, note that parameter \(z\) affects only the cost-effectiveness of the end-of-pipe technology, while it does not lead to a process innovation that reduces the marginal cost of production; therefore, the output decision does not depend directly on it. Making use of (3) and condition (ii) in (2), one obtains the next expressions for the producer surplus \((PS)\), consumer surplus \((CS)\), the government’s budget \((GB)\), and the environmental damage under ET:

Therefore, social welfare is:

At stage one, the government sets the emissions tax that maximises (8), that is:

The second-order condition for a maximum \(\frac{{\partial^{2} SW^{ET} }}{{\partial t^{2} }} < 0\) is satisfied. Equation (9) implies that a positive optimal emissions tax exists (i.e., \(t^{*ET} > 0\)) if and only if the social awareness of the environmental damage is adequately large, that is, \(g > \frac{z}{2(3 + z)}: = g^{ET} (z)\). Using the optimal tax in (9), one can verify that if \(g > g^{ET} (z)\) then the conditions \(q_{i}^{ET} > 0\), \(k_{i}^{ET} > 0\), and \(e_{i}^{ET} = q_{i}^{ET} - k_{i}^{ET} > 0\) are always satisfied.

Making use of the optimal tax in (9), the equilibrium profits of firm \(i\), its abatement level, the government’s budget, the environmental damage, and social welfare under ET are obtained, summarized in Table 1.

3.2 Environmental Policy 2: Emissions Abatement Subsidy

Let us now study the case in which the government incentivises emissions reduction, providing firms a subsidy per each unit of pollution abatement, \(s \in (0,1]\), and aiming at maximising social welfare (see, e.g., Lee and Park 2021). Therefore, the government does not raise revenues; instead, it incurs an expenditure per firm of \(sk_{i}\).

The profit function of firm \(i\) is now:

where the superscript AS stands for abatement subsidy. As before, at stage two of the game, firms choose output and the abatement level at the same time. By cutting emissions, firms decrease their costs reducing the cost of the cleaning technology. Maximising (10) with respect to \(q_{i}\) and \(k_{i}\) yields the following first-order conditions:

From the Hessian matrix, the successive principal minors \(\left| {H_{1} } \right| < 0,{\text{ and}}\;\;\left| {H_{2} } \right| > 0\) show that \(H\) is negative definite, i.e., the stationary point is a maximum. The system of reaction functions (i) in (11) leads to the following output in equilibrium:

Note that the provision of an abatement subsidy induces firms to cut emissions, which reduces the fixed cost of the end-of-pipe technology while unaffecting the per unit marginal cost of production. Consequently, the firms’ output choice does not depend on the subsidy. Making use of (12) and condition (ii) in (11), the next expressions for the producer surplus, consumer surplus, the government’s budget, and the environmental damage under AS are obtained:

The expression of social welfare is now:

At stage one, the government fixes the subsidy to maximise (17), that is:

The second-order condition for a maximum \(\frac{{\partial^{2} SW^{AS} }}{{\partial s^{2} }} < 0\) is satisfied. Equation (18) implies that an optimal feasible abatement subsidy exists (i.e., \(s^{*AS} \le 1\)) if and only if the social responsiveness of the environmental damage is not excessively large, that is, \(g < - \frac{3z}{{2(3 - z)}}: = g^{AS} (z)\). More in detail, one can easily obtain that, for \(z \in [0,4.5]\) and \(g \in [0,4.5]\), \(s^{*AS} \le 1\) always occurs. Analytical inspection of (18) reveals that, if \(g < g^{AS} (z)\), then the conditions \(q_{i}^{AS} > 0\), \(k_{i}^{AS} > 0\), and \(e_{i}^{AS} = q_{i}^{AS} - k_{i}^{AS} > 0\) are always satisfied.

Given the optimal subsidy in (18), the equilibrium profits of firm \(i\), abatement level, government budget, environmental damage, and social welfare under AS are derived, reported in Table 1.Footnote 9

3.3 Environmental Policy 3: Policy Mix

Finally, let us analyse the case in which the social welfare maximising government adopts a policy mix of emissions tax and abatement subsidy to incentivise firms’ emissions cut. On the one hand, the government collects tax revenues; on the other hand, it incurs in subsidy expenditures as well.

The profit function of firm \(i\) now reads:

where the superscript PM stands for policy mix. As in the previous cases, at stage two, firms simultaneously choose output and the abatement level. By cutting emissions, firms decrease their costs, lowering the burden of taxation as well as reducing the cost of the abatement technology. Maximising (19) with respect to \(q_{i}\) and \(k_{i}\), the following first-order conditions hold:

The Hessian matrix of (19) yields the principal minors \(\left| {H_{1} } \right| < 0,{\text{ and}}\;\;\left| {H_{2} } \right| > 0\): \(H\) is negative definite, and the stationary point is a maximum. The system of reaction functions (i) in (20) leads to the equilibrium output as in (3), and using it together with condition (ii) in (20), the expressions for the producer surplus, consumer surplus, the government’s budget, and the environmental damage under PM are:

The expression of social welfare is now:

At stage one, the government sets both the tax and the subsidy to maximise (25), that is:

The Hessian matrix of (25) with the sequence of principal minors \(\left| {H_{1} } \right| < 0,{\text{ and}}\;\;\left| {H_{2} } \right| > 0\), show that \(H\) is negative definite, and therefore the stationary point is a maximum.

Analytical inspection of (26) also reveals that \(\frac{{\partial t(s)^{PM} }}{\partial s} < 0\) and \(\frac{{\partial s(t)^{PM} }}{\partial t} < 0\): the two policy instruments are strategic substitutes. Solving the system of the first-order conditions leads to the following optimal values of the two instruments:

Therefore, the government implements the policy mix assigning a different share of emissions tax and abatement subsidy on the final public budget which, depending on the values of the parameters, can lead either to a surplus or a deficit. Moreover, Eq. (27) implies that: 1) a positive optimal emissions tax under policy mix exists if and only if the social awareness of the environmental damage is sufficiently large, that is, \(t^{*PM} > 0\) if \(g > - \frac{z}{2(1 - z)}: = g_{{}}^{PM} (z)\) and 2) an optimal feasible abatement subsidy always exists, that is, \(s^{*PM} \le 1\)\(\forall z,g \ge 0\).

Analytical inspection of (27) shows that, if the condition \(g > g_{{}}^{PM} (z)\), then the conditions \(q_{i}^{PM} > 0\), \(k_{i}^{PM} > 0\), and \(e_{i}^{PM} = q_{i}^{PM} - k_{i}^{PM} > 0\) are always satisfied. Given the optimal tax and subsidy in (27), the equilibrium profits of firm \(i\), its abatement level, the government’s budget, the environmental damage, and social welfare under PM are derived, summarized in Table 1.

3.4 Environmental Policies, Comparison and Discussion

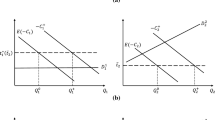

This section compares the outcomes under the three environmental policies described to analyse their impact on firms’ pollution abatement decisions and profitability, emissions and environmental damage, government’s budget, and overall social welfare. To begin, let us identify the parametric regions of feasibility of the three policies the threshold values generate. Figure 1 gives a graphical representation.

Lemma 1

(1) For \(g < g^{ET} (z)\) (Region A in Fig. 1), the subsidy is the only feasible environmental policy. (2) For \(g^{ET} (z) \le g < g_{{}}^{PM} (z)\) (Region B in Fig. 1), abatement subsidy and emissions tax are the feasible environmental policies. (3) For \(g_{{}}^{PM} (z) \le g < g^{AS} (z)\) (Region C in Fig. 1), the government can implement all three environmental policies. (4) For \(g \ge g^{AS} (z)\) (Region D in Fig. 1), the environmental tax and the policy mix are the feasible policies.

Proof

The proof is straightforward; it suffices to summarize the information in the previous sections. In fact, 1) for \(g < g^{ET} (z)\), \(t^{*ET} < 0\), \(s^{*AS} \le 1\) and \(t^{*PM} < 0\); 2) for \(g^{ET} (z) \le g < g_{{}}^{PM} (z),\) \(t^{*ET} > 0\), \(s^{*AS} \le 1\), and \(t^{*PM} < 0\); 3) for \(g_{{}}^{PM} (z) \le g < g^{AS} (z)\), \(t^{*ET} > 0\), \(s^{*AS} \le 1\), \(t^{*PM} > 0\), and \(s^{*PM} \le 1\); 4) for \(g \ge g^{AS} (z)\), \(t^{*ET} > 0\), \(s^{*AS} > 1\), \(t^{*PM} > 0\), and \(s^{*PM} \le 1\).

It is worth noting that, in region A, only the abatement subsidy is the feasible policy to cut emissions. The rationale for this result is that, with a lower environmental awareness, society is more worried about the negative impact on output due to taxation than on the environmental damage, and the subsidy does not affect output decisions.

Let us now further evaluate the impact of the public opinion awareness on the optimal environmental policy tools.

Lemma 2

In the function of the policy parameter evaluating the environmental quality, \(g\), the optimal environmental policy tool is: (1) monotonically increasing when an emissions tax or an abatement subsidy are separately implemented and (2) monotonically increasing in the emissions tax and decreasing in the abatement subsidy in the case of policy mix.

Proof

Simple analytical inspection reveals that (1) \(\frac{{\partial t^{*ET} }}{\partial g} > 0\) and \(\frac{{\partial s^{*AS} }}{\partial g} > 0\) and (2) \(\frac{{\partial t^{*PM} }}{\partial g} > 0\) and \(\frac{{\partial s^{*PM} }}{\partial g} < 0\).

Intuitively, the higher the weight the government assigns to the environmental quality, the higher the optimal emissions tax and subsidy rates the government is willing to set when it uses only one environmental policy tool, mostly to cut emissions. On the other hand, in the case of policy mix, it is also intuitive that the government opts for an increasing tax and decreasing subsidy because the former tool positively impacts the public budget (higher revenues) while the latter worsens it (higher spending).

Having identified the area of feasibility of the proposed environmental policies, it is now possible to investigate their impact on environmental as well as on welfare components and its general level. First, we analyse the effect of the environmental policies on abatement levels.

Lemma 3

The equilibrium abatement levels under the three environmental policies (\(k^{*} (s^{*AS} ) \equiv \sum\limits_{i = 1}^{2} {k_{i}^{*} } (s^{*AS} )\), \(k^{*} (t^{*ET} ) \equiv \sum\limits_{i = 1}^{2} {k_{i}^{*} } (t^{*ET} )\), and \(k^{*} (t^{*PM} ,s^{*PM} ) \equiv \sum\limits_{i = 1}^{2} {k_{i}^{*} } (t^{*PM} ,s^{*PM} )\), are such that: 1) in region A, \(k^{*} (s^{*AS} )\); 2) in region B, \(k^{*} (s^{*AS} ) > k^{*} (t^{*ET} )\); 3) in region C, \(k^{*} (s^{*AS} ) > k^{*} (t^{*PM} ,s^{*PM} ) > k^{*} (t^{*ET} )\); and 4) in region D, \(k^{*} (t^{*PM} ,s^{*PM} ) > k^{*} (t^{*ET} )\).

Proof

Taking into consideration the parametric areas of feasibility of each policy, the results straightforwardly derive from the comparison of the expressions of the abatement levels in Table 1.

The intuition behind those results is as follows. In region A, as already seen, the subsidy policy is the only available environmental policy to reduce emissions. However, despite in regions B and C other policies are now feasible, the abatement activities are more incentivised through only abatement subsidy. The rationale for this is that abatement levels are directly linked to production, and production decisions are independent of subsidies while negatively distorted by taxation. In region D, the abatement subsidy alone becomes too expensive; therefore, a combination of tax and subsidy is required. As a general observation, one can derive that at least some subsidisation is needed to maintain higher levels of abatement activities. The results on abatement activities bring the analysis directly to the next point concerning the overall environmental damage, leading to the following lemma.

Lemma 4

The ranking of the equilibrium environmental damages under the three policies are (see Fig. 2): 1) in region A, \(ED^{*AS}\); 2) in region B, for \(g^{ET} (z) \le g < g_{ET/AS}^{ED} (z),\)\(ED^{*ET} > ED^{*AS}\), while for \(g_{ET/AS}^{ED} (z) \le g < g_{{}}^{PM} (z),\) \(ED^{*AS} > ED^{*ET}\) where \(g_{ET/AS}^{ED} (z) \equiv \frac{z(3 + z)}{{z^{2} + 3z - 3}}\); 3) in region C, \(ED^{*AS} > ED^{*PM} > ED^{*ET}\); 4) in region D, \(ED^{*PM} > ED^{*ET}\).

Proof

Considering the parametric areas of feasibility of each policy, the results are directly obtained through comparison of the expressions of the environmental damages in Table 1.

Lemma 4 substantially mirrors Lemma 3, except for region B in which the environmental damage under emissions tax can be higher than under abatement subsidy: in fact, \(g_{ED|AS}^{ET} (z)\) in Fig. 2 represents the locus of \((g,z)\) pairs such that the environmental damage under the two policies is equivalent. The rationale for this result to occur is that, on the one hand, under emissions tax, the abatement levels of the firms are lower than under abatement subsidy; on the other hand, however, when (1) the societal awareness is adequately low, for whichever technological level and (2) the technology is quite inefficient, irrespective of the environmental concern, the output contraction is modest because the emissions tax rate is still not too high. Therefore, the overall effect is that emissions increase, as does the environmental damage.

Now, let us analyse the policy points. First, let us consider the implementation impact of the optimal environmental policies on public finances (government budget). An optimal emissions tax generates a budget surplus through the tax revenue. An optimal abatement subsidy generates a budget deficit, and to get a balanced deficit, the government can finance the environmental policy through a lump-sum tax transfer (e.g., from consumers).

More interesting is the case of the policy mix. Analytical inspection leads to the following Lemma.

Lemma 5

The optimal environmental policy mix generates: (1) a budget deficit for \(g^{PM} (z) \le g < g^{BB} (z)\) that can be financed via a lump-sum transfer and (2) a budget surplus for \(g^{BB} (z) < g\) where \(g_{BB}^{PM} (z) \equiv - \frac{2g(1 + \sqrt 2 \sqrt g )}{{1 - 2g}}\).

Proof

The result directly follows from the analysis of the numerator of the expression \(GB^{*PM}\) in Table 1.

The intuition behind this finding is as follows. In Fig. 3, \(g_{BB}^{PM} (z)\) represents the locus (threshold) of \((g,z)\) pairs such that the government achieves a balanced budget; i.e., the share of the two policy tools on the final budget is identical. If the state of the abatement technology available is rather inefficient, the cost of the green investment is quite expensive. On the one hand, subsidising emissions abatement can incentivise production and therefore further emissions, leading to an increasing environmental damage. On the other hand, subsidisation can be increasingly costly for the government, which indeed decides to assign a higher weight to the emissions tax in the policy mix.

It is possible now to compare the different optimal environmental policies in terms of the social welfare outcomes and derive which ones can emerge as the most preferred for a social welfare maximising government and their impact on public finances. Making use of Lemmas 1, 4, and 5, the next proposition holds.

Proposition 1

A social welfare maximising government implements: (1) an abatement subsidy policy with a budget deficit financed via a lump-sum transfer in region A; (2) an emissions tax policy with tax revenues in region B; and (3) the policy mix in regions C and D, with a budget deficit financed via a lump-sum transfer in sub-regions C1 and D1, and with a budget surplus in sub-regions C2 and D2 (see Fig. 4).

Proof

(1) The result is derived because, in region A, the abatement subsidy policy is the only feasible environmental policy. (2) In region B, the feasible policies are the abatement subsidy and the emissions tax. Analytical inspection reveals that \(SW(t^{*ET} ) > SW(s^{*AS} )\). In region C, all policies are feasible. The social welfare ranking is \(SW(t^{*PM}, s^{*PM} ) > SW(t^{*ET} ) > SW(s^{*AS} )\). Finally, in region D, the emissions tax and the policy mix are feasible, and the social welfare ranking is \(SW(t^{*PM}, s^{*PM} ) > SW(t^{*ET} )\).

Lemma 1 states that, if the societal awareness is extremely low (a fortiori when combined with an inefficient available technology), the government can nudge abatement activities only via subsidisation. Therefore, we may derive from Proposition 1 the following insight for the policy makers: except for the case of extremely low social awareness of the environmental damage (in which only the abatement subsidy is the feasible policy), the welfare-preferred environmental policy tool includes the taxation of emissions. The rationale for this result is as follows. Introducing an emission tax leads firms to contract production; consequently, this tends to lower the environmental damage, with a positive impact on the overall welfare. The combined effect of the benefits due to lower environmental damage and tax revenues collection overcomes the negative impact on profits and consumer surplus due to output contraction. Nonetheless, analytical inspection of the equilibrium social welfare under taxation reveals the following result.

Proposition 2

In the presence of an optimal emissions tax policy (region B), the higher is the societal awareness toward the environment, the lower is the social welfare.

Proof

The result directly follows from \(\frac{{\partial SW(t^{*ET} )}}{\partial g} < 0\).

Indeed, with increasing concern toward the environment, the emissions tax rate society is willing to pay rises as well. Therefore, even if the tax policy produces the lowest environmental damage, this beneficial effect decreases societal awareness, while the negative impact on profits and consumer surplus because of lower production increases.

3.5 Speculation on the Potential Future Evolution of Environmental Policy-Making

As in Buccella et al. (2021), this section conjectures potential historical-political trajectories the previous analysis can generate. To begin with, a methodological premise is in order. One must make a clear distinction between the logical time (order of moves) of the static (timeless) one-shot, non-cooperative market game two profit-maximising firms play in the presence of different environmental policies, and the historical timing of the events (past, present, and future) that contributes to create a chronological structure of sequences.

In the model, the logical structure of sequences (first, the regulator stage in which the government commits to set the optimal environmental policy and then the market stage in which firms choose output and abatement levels) represents the link of variables having a causal relationship among them and moving in the same logical (and not necessarily chronological) direction.

Because of the timeless structure of the model, the chronological linkage among the variables in terms of involvement in the analysis is absent. To give a historical interpretation of our results, one must abstract from the previous logical narrative of the model following the conjecture that the timeline of the index of technological progress, \(z\), is decreasing (as time goes by, the technology becomes more efficient) and that the societal ecological awareness timeline, \(g\), is increasing (the society becomes increasingly sensitive to environmental issues).

Our speculation focuses on the possible trajectories of the adoption of optimal environmental policies, depending on the relative magnitude of the parameters \(g\) and \(z\). To this purpose, Fig. 5 depicts a timeline of events in which different environmental policy paths are generated following trajectories with simultaneous improvements of abatement technologies and public awareness towards the environment, i.e., moving from North-West to South-East. This path seems to be consistent with the observed experience, especially in recent decades. The historical trend of technology (among them, abatement technologies) is toward advancements and, therefore, increasing efficiency. Early environmental concerns (and consequent political consciousness) appeared during the Industrial Revolution; nonetheless, the birth of modern environmentalism is commonly associated with intellectuals such as John Ruskin (1819–1900). Today, also due to the development of media, environmental awareness is universally widespread and evolving to face up to contemporary threats such as global warming (with massive involvement of young generations, Generation Z, one of whose best known representatives is Greta Thunberg with her Skolstrejk för klimatet action) and plastic pollution.

As discussed in Sect. 2, looking at the EU and other advanced economies, there are several countries where emission taxes are in force to incentivise the adoption of abatement technologies. However, even if abatement activities all around the world are increasing, this is happening at a too-slow pace to avoid the limit increase of the global temperature at the level of 1.5 C as fixed in the Paris Agreement. On the other hand, to “decarbonise” economies, green innovation can be crucial. To foster the development of green technologies, subsidies to green research and development (R&D) may be a valid alternative. Those subsidies can support firms’ innovation to reduce the costs of cutting emission technologies such as end-of-pipe technologies. Recent estimates show that investment in green R&D technologies makes carbon emissions reduction cheaper. Therefore, this method seems to be the most effective climate policy, with a return of $11 climate benefits per dollar spent (Lomborg 2020). Notwithstanding, up to the current stage, measures related to green R&D lag behind. In OECD countries, green R&D subsidies represent 9.4% of the resources devoted to policies with positive environmental implications (OECD 2021). As Sect. 2 reports, environmental subsidies as a percentage of GDP in the EU are currently limited. However, the EU in 2023 has discussed the launch of a Green Deal industrial plan, which aims to relax temporarily European competition rules to allow for expanded subsidies to clean-tech firms. The European Commission considers the use of public and private investments between 2021 and 2030 to meet the EU’s 2030 emission-reduction goals (IMF 2023).

These observations seem to suggest that, at present, mankind lives in a moment in which industrial production still adopts non-efficient abatement technologies, and societal awareness towards environmental damage is relatively low yet. The starting point for the use of optimal environmental policy to “nudge” firms in oligopoly contexts to adopt cleaning technologies is the provision of subsidies per unit of pollution abated, as Fig. 5 shows. Now, let us study two (among the many) potential trajectories to speculate potential evolutionary paths in the adoption of optimal environmental policies.

Consider first (the rather concave) Trajectory 1, characterised by an initial relatively slow pace of technological progress and fast increase in societal awareness because (perceived) damages to the environment generate individual incentives for sustaining abatement costs. The cost-inefficient (expensive) cleaning technology requires a public stimulus in the form of a subsidy to push firms in adopting the green technology. However, as seen in the previous section, the provision of a subsidy does not affect production, and pollution can be still high.

As environmental sensitivity increases, the society, and particularly consumers, through their political representatives, may accept lower production levels to live in a safer environment (because of lower pollution); therefore, it can support the design of an environmental tax and the government will optimally switch to this tool. However, given the relatively high cost of the abatement technology, the use of the environmental tax alone may restrain the further adoption of green technologies. Thus, to sustain abatement activities, the government can behave optimally by adopting an environmental policy mix, reducing taxation (it can be easily verified that \(t^{*ET} > t^{*PM}\)) and subsidising green innovation. Eventually, when the technology becomes extraordinarily cost-efficient so that the investment in abatement technology is particularly economical, the government no longer needs to stimulate emissions-cutting behaviours via the subsidy, leaving firms to abate pollution to reduce the tax base.

Consider now (the rather convex) Trajectory 2, characterised by an initial relatively fast pace of technological progress and slow improvements in environmental consciousness. The starting point is the same as in Trajectory 1, with the same rationale. As before, when environmental sensitivity increases, society can accept lower production levels to create a safer environment. However, increasing the cost-efficiency of the technology by lowering the cost of the green investment may induce the government to keep the environmental tax as a unique tool. If the technology remains for a long time at an insufficient cost-effective level, the further adoption of green technologies requires the re-introduction of subsidies for abatement activities and the adoption of a policy mix for a long-lasting period.

Notice that a more convex trajectory (a slow environmental sensitiveness and fast technological development at the beginning and eventually, when the technology is efficient, increasing societal awareness), can lead to a different path/history. In fact, after subsidisation, the government sets the environmental tax, and technological progress alone is sufficient to sustain the adoption of green technologies. However, if environmental awareness increase after technology reaches a cost-efficient technological level, the government can optimally continue to use the environmental tax alone. Society can accept that firms produce lower output via environmental taxes for a more sustainable environment (as conceptualised by the “degrowth” movement), but technology is adequately developed to let firms invest economically in abatement activities that allow them to reduce the tax burden. In such a case, a green-oriented policymaker can use the revenues collected to foster the public education system, making \(g\) endogenous.

3.6 Extensions

In two extensions, whose details are available upon request from the authors, the robustness of our basic model has been checked to the introduction of elements that affect the degree of market competition. The first extension has introduced horizontal product differentiation, in which more product differentiation characterises less competitive markets (defined by the parameter \(d \in [0,1]\)). The qualitative results are all confirmed, with the three policies and budgetary characteristics following the identical pattern in Fig. 4. From a quantitative perspective, more differentiated products tend to expand both the parametric area in which only subsidisation can be implemented (slightly) and the area of optimal policy mix (more consistently). Other results worth noting are as follows: (1) \(\frac{{\partial t^{ET} }}{\partial d} > 0\), less differentiated products induce the government to increase the emission tax. The rationale for the result is intuitive: the more homogeneous the goods are, the more firms expand production, increasing pollution and environmental damage. Concerning social welfare, \(\frac{{\partial SW^{ET} }}{\partial d} < 0\): with more differentiated products, industry output decreases. The positive effects of reduced environmental damage and tax revenues more than counter-balance the loss in terms of consumer surplus; (2) \(\frac{{\partial s^{AS} }}{\partial d} < 0\), less differentiated products, induce the government to decrease the subsidy rate: reduction of environmental damage can be too costly. Concerning social welfare, \(\frac{{\partial SW^{AS} }}{\partial d} > 0\): with less differentiated products, industry output increases; however, now, the positive effect of output expansion on consumer surplus is dominant with respect to the effects on the environmental damage and public finances; and (3) \(\frac{{\partial t^{ET} }}{\partial d} < 0\) and \(\frac{{\partial s^{AS} }}{\partial d} > 0\): with two policy tools to correct two distortions (the market and the environmental ones), the government needs to calibrate properly the tax/subsidy rates to guarantee the right balance. However, \(\frac{{\partial SW^{PM} }}{\partial d} < 0\): the impact of the environmental damage on overall welfare is the dominant one.

In the second extension, a conjectural variation (CV) model has been analysed to check the effects of more/less competitive market structures. In essence, the CV parameter (defined by the Greek letter \(\phi \in ( - 1,1)\)) covers the full range of market competition levels, from Bertrand competition to joint profit maximisation. Also in this case, the qualitative results are confirmed: the three policies and budgetary characteristics follow the pattern as in Fig. 4. Quantitatively, less competitive markets tend to enlarge both the parametric areas in which only abatement subsidies and only taxation can be implemented, while more competitive markets reduce the area of exclusive subsidisation and enlarge the parametric area of optimal policy mix. Comparative statics mimic those of the model with product differentiation according to the principle of the lower/higher degree of competition in the product market. Therefore, our results are robust to a large variety of product market structures.

4 Conclusions

In a polluting Cournot duopoly with homogeneous goods, this paper has analysed and compared the environmental, public finance, and overall welfare impacts of three policies a social welfare maximising government can implement: an emissions tax, an abatement subsidy, and a policy mix of the previous instruments. The key results are as follows. A subsidy, alone or coupled with a tax, always increases abatement levels. However, taxation shrinks production, leading to decreasing levels of environmental damage, which positively impacts social welfare. Indeed, excluding a parametric region characterised by a relatively inefficient abatement technology, environmental taxation tends to reduce the environmental damage which, together with the tax revenues the government collects, more than counterbalances the negative impact on profits and consumer surplus due to output contraction. Only low societal awareness combined with inefficient technology leads the government to incentivise more abatement via the provision of only a subsidy.

A cautionary note is in order here. The current framework considers a situation in which firms have already invested in abatement technologies. A more extended version of the game which considers the endogenous choice of firms regarding whether to invest in green technologies is a further suitable development of this work. Moreover, the relevant real-world cases of managerial firms which delegate output and, recently, green investment decisions as well to managers should be considered. Furthermore, from a policy perspective, it would be interesting to analyse (1) the different objectives for the government (maximisation of tax revenues, minimisation of environmental damage) and (2) the time consistency of environmental policies. In fact, this work assumes that the government/regulator commits/announces a policy choice before firms maximise profits. In the present framework, firms choose their abatement and output levels simultaneously. However, if these decisions are sequential, with the choice of abatement levels done at the first stage of the game, the regulator can have incentives to readjust the initial policy announcement after observing the firms’ abatement levels. Those questions are left for future research.

Notes

The subject of emissions standards in oligopoly markets is discussed, inter alias, by Besanko (1987), Ebert (1999), Montero (2002), Moraga-Gonzalez and Padron-Fumero (2002), Farzin (2003), Bruneau (2004), Kayalica and Lahiri (2005), Amir and Nannerup (2005), Requate (2006), Lahiri and Ono (2007), Carrión-Flores and Innes (2010), Heuson (2010), Perino and Requate (2012), Bárcena-Ruiz and Campo (2017). Amir et al. (2018), and Garella and Trentinaglia (2019); instead, tradeable emissions permits are the subject of research in Mørch von der Fehr (1993), Sartzetakis (1997, 2004), Carraro (2002), Liski and Montero (2005), David and Sinclair-Desgagné (2005), Requate (2006), Meunier (2011), Tanaka (2012), Hepburn et al. (2013), Garcia et al. (2018).

The US has also implemented permits trading systems, such as the sulphur dioxide trading program, in which allowances are voluntarily allocated under the Clean Air Act and the carbon dioxide cap-and-trade program in place in California.

On August 7, 2022, the US Senate passed the Inflation Reduction Act, which became effective on January 1, 2023. This act provides $369bn funds in terms of investments to clean energy, with the goal of substantially lowering carbon emissions over a decade. Those funds will be delivered through a mix of subsidies, grants, loan guarantees, and tax incentives (tax credits) on renewable energy and electric vehicles, hydrogen hubs, carbon capture and storage, and more, representing the largest package of climate spending in the US history (The Economist 2022, 2023a).

See Buccella et al. (2021, Appendix A) for analytical details supporting the assumption of an abatement technology that does not facilitate complete pollution elimination, e.g., \(0 \le k_{i} \le q_{i}\). This assumption follows Ulph (1996) and differs from Asproudis and Gil-Moltó (2015), in which emissions are \(e_{i} = q_{i} k_{i}\), with \(k_{i} \in [0,1)\) as a fraction of total production.

This demand structure is originated by the usual specification of quadratic utility for consumers’ preferences; that is, \(U(q_{1} ,q_{2} ) = \alpha (q_{1} + q_{2} ) - \frac{{\beta (q_{1}^{{}} + q_{2}^{{}} )^{2} }}{2} = \alpha Q - \frac{{\beta Q^{2} }}{2}\), as first proposed by Dixit (1979) and subsequently used by Singh and Vives (1984) and many others.

Indeed, neither the market size nor the slope of the market demand and the average and marginal costs affect the feasibility thresholds, profit differentials, environmental damage, and social welfare functions in our quantity-setting duopoly.

An alternative timing that can be of particular interest to study in the context of end-of-pipe abatements is to consider at the first stage the abatement choice, at the second stage the government policy, and at the third stage the firms’ output choice. One reason for this is that end-of-pipe abatements lead to endogenous sunk costs, and each firm can behave as a Stackelberg leader when it decides on abatement by anticipating the subsequent rival’s output best response. Moreover, due to the time-consistency of the government’s policy, the socially optimal values of emission taxes and abatement subsidies are likely to be affected. This is left for future research.

However, important contributions show that negative taxes (i.e., output subsidies) can be relevant as well. For instance, in an influential paper, Benchekroun and Long (1998) show that a tax must correct two market failures associated with production: (1) the damage from emissions, which are proportional to output, and (2) the inefficient output level arising from imperfect competition. On the one hand, emissions alone require a positive tax to increase the effective marginal cost of the firms and thus reduce the output that leads to those emissions. On the other hand, imperfect competition alone requires a negative tax (subsidy) to reduce the effective marginal cost and thus increase the output level to approach the competitive outcome. This paper neglects the second aspect by assumption because the focus is on parameter values that ensure positive Pigouvian taxes that incentivise abatement activities to reduce environmental damage.

Analytical inspection reveals that \(SW^{*AS} \ge 0\) if \(g(z) \le - \frac{2z}{{4 - z}}\). However, this non-negativity condition is not binding because the constraint \(g < g^{AS} (z)\) is more restrictive.

References

Amir R, Nannerup N (2005) Asymmetric regulation of identical polluters in oligopoly models. Environ Resour Econ 30(1):35–48

Amir R, Gama A, Werner K (2018) On environmental regulation of oligopoly markets: emission versus performance standards. Environ Resour Econ 70(1):147–167

Asproudis E, Gil-Moltó MJ (2015) Green trade unions: structure, wages, and environmental technology. Environ Resour Econ 60(2):165–189

Bárcena-Ruiz JC, Campo ML (2017) Taxes versus standards under cross-ownership. Resour Energy Econ 50:36–50

Ben Youssef S, Dinar Z (2011) Regulation of a duopoly and environmental R&D. Environ Econ 2(3):47–51

Benchekroun H, Long N (1998) Efficiency-inducing taxation for polluting oligopolists. J Public Econ 70(2):325–342

Besanko D (1987) Performance versus design standards in the regulation of pollution. J Public Econ 34(1):19–44

Bian J, Zhao X (2020) Tax or subsidy? An analysis of environmental policies in supply chains with retail competition. Eur J Oper Res 283(3):901–914

Bruneau JF (2004) A note on permits, standards, and technological innovation. J Environ Econ Manag 48(3):1192–1199

Buccella D, Fanti L, Gori L (2021) To abate, or not to abate? A strategic approach on green production in Cournot and Bertrand duopolies. Energy Econ 96:105164

Calculli C, D’Uggento AM, Labarile A, Ribecco N (2021) Evaluating people’s awareness about climate changes and environmental issues: a case study. J Clean Prod 324:129244

Carlsson F (2000) Environmental taxation and strategic commitment in duopoly models. Environ Resour Econ 15(3):243–256

Carraro C (2002) Imperfect markets, technological innovation, and environmental policy instruments. In: Van den Bergh JCJM (Ed) Handbook of environmental and resource economics. Edward Elgar Publishing Limited, Cheltenam, pp 235–248

Carrión-Flores CE, Innes R (2010) Environmental innovation and environmental performance. J Environ Econ Manag 59(1):27–42

Conrad K, Wang J (1993) The effect of emission taxes and abatement subsidies on market structure. Int J Ind Organ 11(4):499–518

David M (2005) Regulating a polluting oligopoly: emission tax or voluntary agreement? Rev Dev Econ 9(4):514–529

David M, Sinclair-Desgagné B (2005) Environmental regulation and the eco-industry. J Regul Econ 28(2):141–155

David M, Sinclair-Desgagné B (2010) Pollution abatement subsidies and the eco-industry. Environ Resour Econ 45(2):271–282

Dixit AK (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10(1):20–32

Ebert U (1999) Relative standards as strategic instruments in open economies. in: petrakis e, sartzetakis e, xepapadeas a (eds) environmental regulation and market power, competition, time consistency and international trade. Edward Elgar Cheltenham.

Eurostat (2023a) Environmental tax statistics—detailed analysis. Available online at https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Environmental_tax_statistics_-_detailed_analysis

Eurostat (2023b) Environmental subsidies and similar transfers statistics – detailed analysis. Available online at http://ec.europa.eu/eurostat/statistics-explained/index.php/Article_name

Farzin YH (2003) The effects of emissions standards on industry. J Regul Econ 24(3):315–327

Garcia A, Leal M, Lee SH (2018) Time-inconsistent environmental policies with a consumer-friendly firm: tradable permits versus emission tax. Int Rev Econ Financ 58:523–537

Garella PG, Trentinaglia MT (2019) Carbon tax, emission standards, and carbon leak under price competition. Environ Resour Econ 72(4):941–964

Gautier L (2015) Horizontal product differentiation and policy adjustment in the presence of abatement subsidies and emission taxes. J Environ Econ Policy 4(1):64–81

Hepburn CJ, Quah JKH, Ritz RA (2013) Emissions trading with profit-neutral permit allocations. J Public Econ 98:85–99

Heuson C (2010) Weitzman revisited: emission standards versus taxes with uncertain abatement costs and market power of polluting firms. Environ Resour Econ 47(3):349–369

IMF (2023) Europe, and the world, should use green subsidies cooperatively. Available online at https://www.imf.org/en/Blogs/Articles/2023/05/11/europe-and-the-world-should-use-green-subsidies-cooperatively

Kayalica MÖ, Lahiri S (2005) Strategic environmental policies in the presence of foreign direct investment. Environ Resour Econ 30(1):1–21

Knight KW (2016) Public awareness and perception of climate change: a quantitative cross-national study. Environ Sociol 2(1):101–113

Kreps DM, Scheinkman JA (1983) Quantity precommitment and Bertrand competition yield Cournot outcomes. Bell J Econ 14(2):326–337

Lahiri S, Ono Y (2007) Relative emission standard versus tax under oligopoly: the role of free entry. J Econ 91(2):107–128

Lee SH, Park CH (2021) Environmental regulations in private and mixed duopolies: taxes on emissions versus green R&D subsidies. Econ Syst 45(1):100852

Liski M, Montero JP (2005) A note on market power in an emission permits market with banking. Environ Resour Econ 31(2):159–173

Lomborg B (2020) Welfare in the 21st century: increasing development, reducing inequality, the impact of climate change, and the cost of climate policies. Technol Forecast Soc Chang 156:119981

Meunier G (2011) Emission permit trading between imperfectly competitive product markets. Environ Resour Econ 50(3):347–364

Moner-Colonques R, Rubio S (2015) The timing of environmental policy in a duopolistic market. Economía Agraria y Recursos Naturales-Agricultural and Resource Economics 15(1):11–40

Montero JP (2002) Permits, standards, and technology innovation. J Environ Econ Manag 44(1):23–44

Moraga-Gonzalez JL, Padron-Fumero N (2002) Environmental policy in a green market. Environ Resource Econ 22(3):419–447

Mørch von der Fehr NH (1993) Tradable emission rights and strategic interaction. Environ Resour Econ 3(2):129–151

OECD (2021) The OECD green recovery database: examining the environmental implications of COVID-19 recovery policies. Available online at https://read.oecd-ilibrary.org/view/?ref=1092_1092145-fqx3tx0r1q&title=The-OECD-Green-Recovery-Database

Ouchida Y, Goto D (2014) Do emission subsidies reduce emission? In the context of environmental R&D organization. Econ Model 36:511–516

Ouchida Y, Okamura M, Orito Y (2019) Emission taxation and investment in cleaner production: the case of differentiated duopoly. In: Theoretical and Empirical Analysis in Environmental Economics (pp. 35–48). Springer, Singapore

Ourworldindata.org (2023) Greenhouse gas emissions. Available at https://ourworldindata.org/greenhouse-gas-emissions (Accessed 01/09/2023).

Perino G, Requate T (2012) Does more stringent environmental regulation induce or reduce technology adoption? When the rate of technology adoption is inverted U-shaped. J Environ Econ Manag 64(3):456–467

Poyago-Theotoky JA (2003) Optimal environmental taxation, R&D subsidization and the role of market conduct. Finn Econ Pap 16(1):15–26

Poyago-Theotoky JA (2007) The organization of R&D and environmental policy. J Econ Behav Organ 62(1):63–75

Poyago-Theotoky JA (2010) Corrigendum to “The organization of R&D and environmental policy” [J. Econ. Behav. Org. 62 (2007) 63–75]. J Econ Behav Organ 76(2): 449–449

Poyago-Theotoky J, Teerasuwannajak K (2002) The timing of environmental policy: a note on the role of product differentiation. J Regul Econ 21(3):305–316

Requate T (1993) Pollution control in a Cournot duopoly via taxes or permits. J Econ 58(3):255–291

Requate T (2006) Environmental policy under imperfect competition. Int Yearb Environ Resour Econ 2006(2007):120–207

Sartzetakis ES (1997) Tradeable emission permits regulations in the presence of imperfectly competitive product markets: welfare implications. Environ Resour Econ 9(1):65–81

Sartzetakis ES (2004) On the efficiency of competitive markets for emission permits. Environ Resour Econ 27(1):1–19

Shy O (1996) Industrial organization: theory and applications. MIT press.

Simpson RD (1995) Optimal pollution taxation in a Cournot duopoly. Environ Resource Econ 6(4):359–369

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15(4):546–554

Tanaka M (2012) Multi-sector model of tradable emission permits. Environ Resource Econ 51(1):61–77

Tax Foundation (2023) Carbon Taxes in Europe. September 5, 2023. Available online at https://taxfoundation.org/data/all/eu/carbon-taxes-in-europe-2023/

The Economist (2019) The climate issue. September 21–27, 2019

The Economist (2021) COP-out. October 30, 2021

The Economist (2022) Joe Biden’s signature legislation passes the Senate, at last. August 9, 2022.

The Economist (2023a) What the inflation reduction act has achieved in its first year. August 17, 2023

The Economist (2023b) Some progress, must do better. November 23, 2023.

Ulph A (1996) Environmental policy and international trade when governments and producers act strategically. J Environ Econ Manag 30(3):265–281

van der Ploeg F, de Zeeuw AJ (1992) International aspects of pollution control. Environ Resource Econ 2(2):117–139

Xu L, Lee SH (2022) Non-cooperative and cooperative environmental corporate social responsibility with emission taxes. Manag Decis Econ 43(7):2849–2862

Xu L, Chen Y, Lee SH (2022) Emission tax and strategic environmental corporate social responsibility in a Cournot–Bertrand comparison. Energy Econ 107:105846

Funding

The authors declare that this study was not funded.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Buccella, D., Fanti, L. & Gori, L. Environmental Policies in a Polluting Duopoly: A Simple Comparison. Ital Econ J (2024). https://doi.org/10.1007/s40797-024-00277-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40797-024-00277-3