Abstract

Changes in stock location may affect the stability of international fisheries agreements. This paper offers a theoretical analysis of the stability of regional fisheries management organisations (RFMOs) in a non-cooperative, coalition formation game based on the classic Gordon–Schaefer model. We employ a new stability concept which modifies Farsighted Stability (Chwe, J Econ Theory 63:299–325, 1994). We call this concept farsighted downwards stability (FDS). We also employ the internal stability (IS) concept for comparison. Analytical results regarding FDS for symmetric players without changing stock location show stable Grand Coalitions for \(n\le 4\) player games and the possibility for partial cooperation. Sensitivity analysis deals with changing stock location and cost asymmetry. Stability decreases in \(n\), increases when costs are asymmetric and increases when FDS is employed. Farsighted conjectures on behalf of RFMO members can thus help to maintain cooperation as stock location changes. However, FDS is more sensitive to changes in stock location than IS.

Similar content being viewed by others

1 Introduction

There is a general recognition that cooperation is needed for the management of international fisheries to ensure the sustainability of stocks. With this in mind, regional fisheries management organisations (RFMOs) were set up to facilitate cooperation. The need for cooperation has sparked a recent literature concerned with the potential for, and the stability of, such agreements (e.g., Kaitala and Lindroos 1998; Bjørndal et al. 2000; Lindroos 2008; Pintassilgo and Lindroos 2008; Pintassilgo et al. 2010; Breton and Keoula 2012; Rettieva 2012; Punt et al. 2012; Bjørndal and Lindroos 2012). Such research is especially important because RFMO agreements are not binding or enforceable (Bjørndal et al. 2000). Much of the literature rightfully focuses on the potential for cooperation and the new-member problem (for a summary see Bailey et al. 2010).

In addition to these established research lines, recent research has begun to focus on the issue of changes in stock location which is likely due to climate change (Cheung et al. 2009). For example, mackerel stocks in the North East Atlantic have recently shifted northwards (Jansen and Gislason 2011). This has led to unilateral setting of national fishing quotas which constitute a violation of the existing RFMO agreement (Arnason 2012 and Haraldsson and Carey 2011). Ellefsen (2012) studies this specific problem with a calibrated model to assess the effects on the stability of the RFMO after the entrance of Iceland into the game. In general, uncertainty regarding the effects of climate change on stocks and the inflexibility of agreements to changes in stock locations have also been shown to be a significant barrier to maintaining cooperative agreements (Miller and Munro 2004). Further motivation is provided by Munro (2008) who calls for more applied game theoretic research on this issue.

In addition to Ellefsen (2012), three other studies address changes in stock location. Ekerhovd (2010) is concerned with both the area which is under RFMO management and the Exclusive Economic Zones (EEZs) of given countries, wherein those countries have exclusive fishing rights. Ekerhovd (2010) considers changes in the shares of stock of blue whiting distributed between the high seas and EEZs and shows whether or not coalitions are stable. The scenarios of changes in stock location have a strong impact on the stability of coalitions. Further, Brandt and Kronbak (2010) consider the case of cod in the Baltic under IPCC climate change scenarios. They analyse the size of the possible set of cooperative agreements under changes to recruitment and size of the stock. They conclude that cooperative solutions are less likely under changes in stock location. The most recent work, by Ishimura et al. (2012) has been concerned with the Pacific sardine under climate variability and its exploitation by Mexico, Canada and the USA. Different cooperative and non-cooperative regimes are analysed. They conclude that unilateral efforts to maximise conservation and management benefits would not be successful under climate change. The stability of the different cooperative and non-cooperative regimes is, however, not analysed.

This paper conceptualises the stability of cooperation under changes in stock location and hence adopts a different approach from Brandt and Kronbak (2010), Ekerhovd (2010), Ishimura et al. (2012) and Ellefsen (2012). Cooperation is most beneficial when the RFMO is a “Grand Coalition” consisting of all nations with a genuine interest in a given stock. Accordingly, we examine the stability of Grand Coalitions for a fixed number of players under changes in stock location.

Changes in stock location can be included in a model by allowing for changes in the “catchability” (usually denoted by \(q\) in the standard Gordon–Schaefer model). Catchability is normally considered to represent the fishing technology and thus the productivity of fishing effort. As a stock of a constant size changes its position relative to the fishing harbours of different countries, we can consider their productivity of effort as changing. This would be due to changing sailing time before reaching fishing grounds or an increased concentration of fish in proximity to the harbour. We assume that the productivity of fishing effort is determined only by the stock location and therefore that fishing technology is identical across states. This approach is most suitable for high seas fisheries where changing stock location does not affect the spatial distribution of stock across EEZs. We also assume that climate change, while it affects location, does not affect other aspects of the biology of the stock.

In addition to addressing the theory of changes in stock location, and in order to address the question of how fully cooperative agreements can be stabilised, we use two solution concepts. First, we employ a variant of the farsightedness concept which is based on farsighted conjectures (Chwe 1994). Farsighted conjectures are used in the context of a Great Fish War by Breton and Keoula (2012). In comparison to Nash conjectures, farsighted conjectures do not restrict players to remain in the coalition structure resulting from the deviation of another player. Farsighted conjectures therefore allow players to respond to deviations by making further deviations. Second, we employ the internal stability (IS) solution concept. This is based on Nash conjectures and is used most frequently in the literature. Nash conjectures do restrict players to remain in the coalition structure resulting from the deviation of another player.

This paper analyses implications of changes in stock location for the stability of Grand Coalitions under these different solution concepts. Comparing results under different solution concepts allows us to analyse the degree to which the (credible) responses to deviations, as conjectured by farsighted players, can affect the stability of Grand Coalitions under changing stock location.

Our study uses analytics to explore the characteristics of a farsighted solution concept in the symmetric setting and to derive some basic results in the asymmetric setting. A more detailed analysis of the asymmetric case is achieved via sensitivity analyses, which allow us to draw conclusions about the effects of asymmetry and changes in stock location on internal and farsighted stability in 3- and 4-player games.

This article makes three contributions to the literature. Firstly, we broaden the literature on asymmetric fishing games by comprehensively analysing the effects of asymmetric catchability. This builds on work by Pintassilgo et al. (2010). In turn, and secondly, this allows us to produce a theoretical framework to analyse the effects of changes in stock location on the stability of cooperation. Thirdly, and as will become clear later in this article, we develop a modified solution concept based on farsighted stability which addresses the problem of myopia while also being applicable in asymmetric coalition formation games which use sharing rules. We now continue into our model and analysis.

2 The Bio-economic Model

The set of \(N\) players represents \(n\) different fishing nations \(i\) who choose effort \(e_i;\,E=({e_1, \ldots ,e_n})\). We restrict effort such that \(e_i \in {\mathbb {R}}_{0}^{+}\). Efforts affect harvests \(h_i\) and, in turn, profits \(\Pi _i\). We employ the Gordon–Schaefer model of fisheries which has a long tradition in the literature. A single commercial fish stock is given as \(x\). Stock grows according to

Here, \(r>0\) refers to the intrinsic growth rate of the stock and \(k\) is the carrying capacity of the ecosystem. The production function (harvest) is given by

Here, \(0<q_i \le 1\) is the catchability coefficient which we use to represent changes in stock location. Unlike most studies, we allow catchability to vary between players and therefore become a source of potential asymmetry in the model.

This paper analyses the steady state where growth (Eq. 1) is equal to total harvest, \(\sum \nolimits _{i=1}^{N} h_{i}\). This allows us to determine the steady state stock as a function of efforts and obtain

Fish is sold on a common market and profit is given by

where \(p\) is price and \(c_i\) is \(i\)’s unit cost of effort. Costs may differ between players. This bio-economic model is used to calculate profits for any vector of efforts \(({e_1,\ldots ,e_n})\).

3 The Fisheries Game

Because there can only be one RFMO for a given fish stock, we model RFMO stability as a cartel game. We examine the incentives to participate in an RFMO in a two stage game. In the first stage, players’ strategy space is \(\{{\textit{join},\, \textit{not}\,\textit{join}}\}\) and this determines their RFMO membership. A coalition structure is denoted by the set \(S\) of players who join where \(|S|=s\). The set \(N\backslash S\) contains \(n-s\) singletons who do not join the RFMO. We have a Grand Coalition when \(S=N\), i.e. where all players are in the RFMO. Given a coalition structure, players choose their effort levels in the second stage.

3.1 Choosing Effort Levels

Effort levels are chosen to maximise profits in a strategic setting. Coalition members cooperate by choosing effort levels to maximise joint profits. Effort is a function of the efficiency of players. We define inverse efficiency as \(b_i \equiv \frac{c_i}{pq_i k}\). Further, we define \(\gamma _i \equiv \frac{c_i}{q_i}\), which we term the cost-catchability ratio of a given player. The term \(\gamma _i\) thus denotes the cost of fishing effort adjusted for the catchability and contains all the terms of \(b_i\) which we allow to be asymmetric. Furthermore, let \(l\in S\) be the member with the lowest cost-catchability ratio such that \(\gamma _l \equiv \min _{i\in S} \gamma _i\). Under these definitions, the following holds:

Lemma 1

Under a common market, the only coalition member whose effort is non-zero is the member with the lowest cost-catchability ratio, \(\gamma _l \equiv \min _{i\in S} \gamma _i\,\forall S\subseteq N\).

Players can only have a relative advantage via the individual parameters, \(c_i\) and \(q_i\). Therefore, the player with the lowest cost-catchability ratio must be the most efficient fisher. Coalition members cooperate to maximise joint profits and therefore the most efficient fisher will assume the task of fishing for the coalition. In this way, it is always efficient for player \(l\) in a coalition to fish since we have assumed, for simplicity, that cost is linear in effort and therefore marginal and average costs are also constant. Non-linear costs would usually merit multiple active fishers in the coalition and Lemma 1 would no longer apply.

We introduce transfers between coalition members to compensate members with zero fishing effort under Lemma 1 and thus incentivising membership. Transfers allow the profit of player \(l\) to be shared among the members. Transfers (or “side” payments) have met much resistance in the policy world and are not implemented in direct financial terms (Munro 2008). However, transfers are implicit in various policy instruments. Transfers can be made through bargaining over catch shares for other commercial species within an RFMO or with Individual Tradable Quotas (ITQs). Selling ITQs to the most effective member constitutes a transfer.

Given Lemma 1 and the choices of each player to join or not join, we can, via reaction functions, provide equilibrium effort strategies for coalition members and non-members. The reaction function and equilibrium strategy for the All Singletons structure is derived in “Appendix 1”. Because Lemma 1 holds for all coalition structures, the effort levels determined in the second stage for a game with coalition \(S\) will be the same as the efforts levels seen in an All Singletons structure consisting of \(n-s+1\) players.

The reaction function of a singleton in the All Singletons and partial cooperative structures is given by

The reaction function for the coalition in partially cooperative and Grand Coalition structures is given by

The equilibrium strategies for the Grand Coalition and both the coalition and singletons in partial cooperation structures can be expressed in one equation, namely,

and

Equation (7) also represents the equilibrium strategy for the All Singletons structure in the special case that the coalition consists of only one player, i.e. \(S=\{l\}\) such that \(\left( {\left( {N\backslash S} \right) \cup \{l\}} \right) =N.\)

Even before searching for solutions to the game, the equilibrium strategies permit insights into the presence and nature of the externalities in the model. Equations (2) and (3) show how harvest is a function of stock and therefore the harvest of 1 player will negatively affect other players because less fish can be caught with the same effort. This negative externality offers scope for beneficial cooperation. There is no competition when only one player in a Grand Coalition fishes. This allows the player with the lowest cost-catchability ratio to maximise the profit for the whole coalition by fishing from a large stock.

Equilibrium efforts, calculated in Eq. (7), can then be substituted into the profit function (Eq. 4) to obtain the partition function \(V(S)\) which gives payoffs as a function of the coalition structure. The partition function is the basis for the following section where we introduce two stability concepts.

3.2 Stability, Solution Concepts and Sharing Rules

Coalition stability depends on how much profit a coalition generates and how that profit is shared. A cartel partition function gives the profit of the coalition and every singleton. The coalition profit is then shared between coalition members via a sharing rule, which determines the payoffs. We will first provide a general definition of a sharing rule and then the particulars of the sharing rule for the two solution concepts.

We use a sharing rule which maximises potential for cooperation, namely the “almost ideal sharing scheme” proposed by Eyckmans and Finus (2004), McGinty (2007) and Weikard (2009). This sharing scheme uses “outside options” to determine how surplus is shared. Outside options are defined as the payoff that a player will receive when he leaves a coalition. The sharing scheme demands that every player receives the value of his outside option \(\omega _i\) plus a share \(\lambda _i (S)\) of the surplus that the coalition generates in excess the sum of the values of the outside options \(V_S (S)- \sum \nolimits _{i\in S} \omega _i\) such that the payoff \(V_i (S)\) of a coalition member in \(S\) is given by:

where \(\sum \nolimits _{i\in N} \lambda _i (S)=1\) and \(\lambda _i (S)\ge 0\).

In our numerical analysis, we will use coalition surplus as a measure of coalition stability. A positive (negative) surplus implies a stable (unstable) coalition. Our measure of stability is therefore defined as

How the outside option is defined depends on the stability concept used. We consider two stability concepts: Nash stability and a modified farsighted stability concept. A stability concept stipulates whether or not a player will deviate from a given coalition. A player’s decision regarding deviation depends on the type of “conjecture” which is employed.

The first type of conjectures are Nash conjectures. This assumes that all players will remain in the coalition structure which directly results from a deviation. Other players may adjust their efforts but no player will enact further deviations. Therefore, for Nash stability, \(\omega _i =V_i (S\backslash \{i\})\). The following inequality is a necessary condition for the Nash stability of a coalition:

The general formulation for Nash stability is that both IS (where no member wants to leave) and external stability (where no singleton wants to join) must hold. Here, we are concerned with the Nash stability of the Grand Coalition which cannot be enlarged and hence cannot be externally unstable. IS is therefore a sufficient condition for a stable Grand Coalition.

The second type of conjecture is based on farsightedness. Farsighted conjectures do not assume that players will remain in structures imposed upon them by a deviation. Should further deviation from such structures be beneficial, then players will deviate. Whether further deviations are beneficial is based on farsighted conjectures developed by Chwe (1994).

Farsighted conjectures require a different definition of the outside option. Specifically, we introduce the farsighted downwards stability (FDS) concept. This concept is a restricted version of Farsighted Equilibrium (Chwe 1994). FDS is a pragmatic solution concept which restricts Farsighted Equilibrium such that it can be operationalized in a game with transfers and asymmetric players. We now define FDS via the concepts of ordered sequences and credible induction.

Definition 1

A strictly ordered sequence is defined as a vector of coalition structures \(({S_1, S_2,\ldots S_k})\) which are ordered such that \(S_1 \supset S_2 \supset \cdots \supset S_k\) where \(|{S_j}|=|{S_{j+1}}|+1\,\,\forall \,\,j<k\).

Definition 2

A coalition \(S_k\) can be credibly induced via an ordered sequence iff \(\forall \,S_j \in ({S_1, S_2,\ldots S_{k-1}})\), there exists a player \(i\in S_j\) such that \(V_i ({S_k})\ge V_i ({S_j})\) and \(\forall \,S_m \subset S_k\), there does not exist an ordered sequence \((S_k, \ldots ,S_m)\) such that \(\forall \,S_j \in (S_k ,\ldots , S_m)\) there is an \(i\in \,S_j\) such that \(V_i ({S_m })\ge V_i ({S_j})\).

Definition 3

A coalition S satisfies FDS iff there does not exist a coalition \(S_k \subset S\) which can be credibly induced from S.

Intuitively then, we consider sequences of deviations from a coalition where one player after another deviates. Deviations by particular players are credible only if the payoff in the structure at the end of the sequence of deviations provides a greater payoff for every deviator. Therefore, by construction, the All Singletons structure always satisfies FDS. Structures satisfying FDS are those from which outside options are derived. These are used to calculate coalition stability as in Eq. (9).

Definition 1 refers to sequences of deviations. Sequences allow players to “induce” certain structures (Definition 2). If a player deviates from a Grand Coalition, the payoff which results directly from that deviation alone may be very large. However, if the new coalition does not satisfy FDS, the initial deviation would induce further deviations by the remaining coalition members until a structure satisfying FDS is reached. In the FDS structure, the player who deviated first may receive a payoff lower than what he received in the Grand Coalition. As such, FDS addresses the problem of myopia in Nash conjectures (Harsanyi 1974) and, can potentially result in a larger set of stable coalitions than under IS.

Although the FDS concept may not be behaviourally convincing in all settings, we would argue that it applies in our case where the main concern is the stability of the Grand Coalition. Implicitly, the FDS concept implies a punishment strategy whereby players who have deviated from the Grand Coalition are not allowed to benefit from re-joining. The FDS concept thus reflects a plausible restriction on the action space of players.

The FDS solution concept also has several pragmatic advantages in games with transfers and asymmetric players. These advantages result directly from the exclusion of external stability considerations. If coalitions in asymmetric games can be externally unstable, then a stable structure from which to draw the outside option may not exist. Furthermore, one of the structures that could be reached is the Grand Coalition itself. This is due to the potential for cycles in coalition structures.

To illustrate how cycles can occur, consider \(n=3\) and the Grand Coalition \(\{1, 2, 3\}\). Player 1 considers what structure his deviation from the Grand Coalition would eventually induce in order to decide if his initial deviation is worthwhile. His initial deviation would lead to coalition \(\{2,3\}\). Suppose he knows that partial coalition \(\{2,3\}\) is internally unstable and that player 2 will deviate, resulting in All Singletons. He also knows that player 3 prefers \(\{1,3\}\) to All Singletons (it is externally unstable) so he knows that coalition structure \(\{1,3\}\) will form. Finally, he knows too that \(\{1,3\}\) is externally unstable so 2 will join the coalition. This brings us back to the Grand Coalition, and thus results in a cycle. This process is summarised in Fig. 1. Note also that cycles cannot occur if players are symmetric. The presence of cycles mean that there is no stable structure from which player 1 can draw his outside option to decide whether his deviation from the Grand Coalition is beneficial. A further practical implication is that if outside options are not calculable, then optimal sharing cannot be implemented.Footnote 1

The issue of external stability, asymmetric players and farsightedness has been addressed by Caparrós and Giraud-Heraud (2011). They suggest an alternative definition of external stability such that a coalition is externally stable if the addition of a player to that coalition would lead to an internally unstable coalition. Such an approach combined with optimal sharing rules would, however, not preclude the possibility of cycles.

The problem of cycles and the need to define outside options is avoided if there are no transfers in the game. Transfers are not used in IEA analyses such as Zeeuw (2008), Osmani and Tol (2009) and Biancardi and Liddo (2010). In these examples, players receive the benefits of cooperation directly. In our game, a requirement for stable coalitions is that benefits are realised by the most efficient player and then distributed to coalition members.

In our specific circumstances, one option for dealing with this problem is to limit the information required for the sharing rule for a given structure to that which can be provided purely by the imputation for that particular structure. Various methods to achieve this such as the nucleolus and the Shapley value are found in cooperative game theory. However, optimal sharing rules perform best to stabilize coalitions for the provision of public goods (McGinty et al. 2012). Therefore, employing methods such as the Shapley value under any solution concept would lead to a reduction in the stability of Grand Coalitions (McGinty et al. 2012). Hannesson (2011) argues that non-cooperative approaches are too pessimistic regarding the potential for collaboration. Sharing rules which are not “optimal” are therefore undesirable.

In games with asymmetric players and transfer, the FDS concept therefore represents a plausible restriction in the action space of players, prevents possible cycles and permits a consistent application of optimal sharing rules. Additionally, if Grand Coalition stability under changing stock location is improved when the FDS solution concept is employed, we can suggest that restricting the action space of players as implied by the FDS concept could be beneficial for ensuring stability. Later, we will return to the FDS concept in order to show how it can be applied to asymmetric players using computational methods.

3.3 Some Established Results

Before we continue with our analysis, we briefly review some established results using IS. Increasing the number of players leads to reduced IS of the Grand Coalition (Pintassilgo and Lindroos 2008). IS of the Grand Coalition can however be achieved by introducing cost asymmetry into the model (Lindroos 2008). Cost asymmetry increases the relative efficiency at which a coalition can fish. In coalitions, the most efficient player fishes. Should this most efficient player have a sufficiently large advantage, the removal of externalities resulting from coalition formation allows the most efficient player to fully exploit his advantage to the extent that he can compensate those in the coalition enough to prevent them from deviating.

4 Analysing FDS Coalitions with \(n\) Symmetric Players

For a given \(n\) and symmetric players, coalition structures are sufficiently described by the number of coalition members \(s\). For different numbers of symmetric players, structures can be described by a pair \((n,s)\). In this section, we characterise the set of structures satisfying FDS in a symmetric setting.

First note that, by construction, All Singleton structures \((n,1)\) satisfy FDS. Next, a larger coalition \(s>1\) cannot satisfy FDS if members’ payoffs are less than what they get in All Singletons. Hence, it is a necessary condition for a structure to satisfy FDS that

The right-hand side of Inequality (11) represents a player’s payoff in the All Singletons structure. The left-hand side represents a member’s payoff in a coalition of size \(s\). If this inequality holds, then members (weakly) prefer to remain in structure \((n,s)\) rather than induce \((n,1)\).

Inequality (11) can be simplified by cancelling out the economic and biological parameters. This is shown in “Appendix 2a”. We obtain the following inequality which only contains \(n\) and \(s\).

Inequality (12) trivially holds for \(s=1\). Solving for \(s\) shows that for \(s>1\), the inequality holds when.

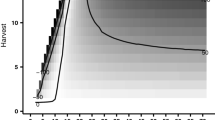

Using Inequality (13) we can, for a given \(n\), identify the smallest integer \(s\) for which (13) holds. This gives us a set of coalition structures from which no player would deviate because any deviation would induce \((n,1)\), which gives a smaller payoff. This set of coalition structures thus satisfies FDS. In Fig. 2, all structures that satisfy FDS are marked by \(\blacksquare \). Structures satisfying FDS where \(s=1\), display trivial FDS and those where \(s>1\) display non-trivial FDS.

Coalition structures satisfying FDS. Pairs \((n,s)\) marked by filled square satisfy FDS. Coalition structures marked by \(\alpha \) and \(\beta \) do not satisfy FDS. From structures marked by \(\alpha \), the structure \((n,1)\) will be induced. From structures marked by \(\beta \), structures displaying non-trivial FDS will be induced

For a given \(n\), coalitions for which \(s\) is too small to satisfy Inequality (13) therefore do not satisfy FDS. Such structures are marked by \(\alpha \). To complete the characterisation of structures satisfying FDS, note that Inequality (13) is only a necessary condition for FDS. While all structures satisfying FDS must satisfy (13), satisfying (13) is not sufficient for FDS. For example, consider a Grand Coalition with 15 players. While \((15,15)\) satisfies Inequality (13), we have not yet shown that this structure does not satisfy FDS because, as we will show, \((15,13)\) is credibly inducible from \((15,15)\). Hence, our final step is to prove that structures marked by \(\beta \) in Fig. 2 do not satisfy FDS.

Consider the incentives to leave the Grand Coalition. A player would deviate if his payoff in the structure which is induced by his deviation (and hence satisfies FDS) provides a larger payoff than his Grand Coalition payoff:

Similar to the derivations in “Appendix 2a”, when substituting the payoffs into (14), again, economic and biological parameters cancel and we obtain

We compare the conditions for \(s\) in (13) and (15) in “Appendix 2b”. The comparison shows that the minimum coalition size required for positive incentives to deviate from the Grand Coalition (15) is always smaller than the minimum size of a coalition satisfying FDS, determined by (13). Hence, there are incentives to deviate from Grand Coalitions marked by \(\beta \) because structures displaying non-trivial FDS satisfy (15). Furthermore, member payoffs in any coalition \(s<n\) in structures marked by \(\beta \) are lower than the Grand Coalition member payoff. Therefore members of these partial coalitions also have an incentive to deviate. We have thus fully characterised the set of structures satisfying FDS in our symmetric fisheries game.

5 Analytics of Asymmetry and Changing Stock Location

We will now begin to analyse the role of asymmetry in the model. This section presents analytical results on the effects of changes in stock location. These results will allow us to understand the results to be presented in the sensitivity analysis to follow. Asymmetry in the Gordon–Shaefer model has been studied by Pintassilgo et al. (2010) who consider cost-asymmetry. It turns out that there are important differences between the effects of cost-asymmetry and catchability-asymmetry in the model. Understanding these differences allows us to understand and compare results.

Firstly, let us consider the equilibrium effort strategy given in Eq. (7). It is immediately obvious that effort is decreasing \(c_i\). However, taking the first derivative of Eq. (7) with respect to \(q_i\) shows us that a threshold value of \(b_i\) exists which determines whether changes in \(q_i\) have a positive or negative effect on the equilibrium effort strategy. The threshold, where changes in \(q_i\) have no effect on the equilibrium effort strategy, is given by

where \(l\) refers to the coalition member with the lowest cost-catchability ratio. If \(b_i\) is greater than the threshold value, equilibrium effort is increasing in \(q_i\). Given that \(b_i\) is the inverse efficiency parameter, players who are inefficient in terms of \(b_i\) respond to increases in \(q_i\) by increasing their effort, whereas those who are efficient in terms of \(b_i\) respond to increases in \(q_i\) by decreasing their effort. Because effort is always decreasing in \(c_i\), we can see that different asymmetries may have very different effects.

Intuitively, cost reductions or catchability increases for a given player relative to other players will increase the harvest of that player. The key difference between the marginal effects of \(c_i\) and \(q_i\) is that increases in harvests due to decreases in \(c_i\) will be achieved by increasing effort, whereas, from the derivation of (16), we know that increases in harvest due to increases in \(q_i\) can be achieved with a reduction in effort. Therefore, increases in catchability allow efficient players to reduce effort and costs while simultaneously increasing harvests. On the other hand, reductions in cost can only be exploited by increasing effort, which is costly, if albeit at a lower unit rate. This suggests that favourable marginal changes in \(q_i\) may be more profitable to a player than favourable marginal changes in \(c_i\). We examine this proposition for the \(n\) player case, and find that

Therefore, marginal increases in \(q_i\) are more beneficial than marginal reductions in \(c_i\) as long as \(q_i\) is less than \(c_i\). We provide more details on the derivation of condition (17) in “Appendix 3”.

6 Numerical and Sensitivity Analyses

The purpose of this section is to expand our analysis to include asymmetric players in order to analyse the effects of changing stock location. Accordingly, we must operationalize the FDS solution concept to deal with asymmetric players in a numerical setting. The main challenge in doing so is in defining players’ outside options.

By construction, FDS allows us to exclude the possibility of cycles. However, introducing asymmetry requires us to deal with two additional problems in order to identify outside options and calculate stability. The root of these problems is in Definition 2, which requires that for a coalition to be unstable, at least one player must have an incentive to deviate. If a coalition does not generate enough profit to satisfy outside options (i.e. there is a negative surplus), all players have an incentive to deviate because the negative surplus is shared among players. Therefore, the payoff of coalition membership will be less than the outside option. Accordingly, there may be many ordered sequences which end with credibly inducible structures. In order to calculate the outside option for player \(i\), we need to know which structures satisfying FDS could result from a deviation by player \(i\) from the Grand Coalition. We label this set of structures as the feasible set.

Definition 4

The feasible set of player i, \(f_i\), is defined as the set of all \(S_k\) which can be reached from the Grand Coalition via ordered sequences resulting in credibly inducible structures.

An example of the feasible set for player 1 is shown in Fig. 3. Figure 3 illustrates a 4-player example where all coalition members have an incentive to deviate from the \(\{2,3,4\}\) structure. The structures \(\{3,4\}\) and \(\{2,4\}\) are stable such that the payoffs to player 1 in these structures are included in player 1’s feasible set. \(\{2,3\}\) is however, not stable but the All Singletons structure is. The payoff to player 1 in the All Singletons is therefore included and those in the \(\{2,3\}\) structure are excluded. In this case then, \(f_1 \) has three elements because there are three structures which can be credibly induced via ordered sequences. We now need to use the elements of a player’s feasible set to define the outside option of that player.

Definition 5

The outside option is defined as \(\omega _i =\max _{S\in f_i} V_i (S)\)

Definition 5 assumes that players will always deviate if there is at least one structure in the feasible set which provides a higher payoff. This reflects a cautious approach because it is less likely to lead to stable Grand Coalitions than, for example, taking the mean. In this way, stability can only be underestimated.

Finally, the FDS concept is based on static conjectures. Players foresee the eventual result of other players’ actions and do not hesitate by waiting for the next period to deviate.

Having fully defined our FDS concept and illustrated how it is applied in practise, we can now continue the analysis. In reality, fisheries games are characterised by asymmetries in catchability and costs. We work on the assumption that fishing nations are asymmetric in their catchability and we wish to see how stability of Grand Coalitions is affected by changes in catchability.

6.1 Changes in Stock Location with 3 Players

To begin, we consider the 3-player case with a specific scenario for changing stock location whereby catchability shifts entirely from player 1 to player 2. For simplicity, let us assume that Player 3 is not affected by the changing stock location. In this way, the sum of the catchability of the three players remains constant. Following the illustrative example, we carry out a sensitivity analysis to obtain more general results.

We define the vector \(Q=({q_1,q_2,q_3})\) to denote position of the fish stock relative to the three players. In our illustrative example, we consider 80 different values of \(Q\), which are ordered to represent gradual stock change as shown in Fig. 4.

We limit our analysis to values of \(q_i\) which ensure that players are always efficient enough to choose positive fishing effort. This allows us to isolate the effect of catchability change from changes in the number of players who are actively fishing. Therefore, we never consider values of \(q_i\) lower than 0.6. Figure 5 shows stability results for our illustrative example using the following parameterisations; \(p=1;\,k=10;\,c_1 =c_2 =c_3 =1.5\). We do not specify a value for the parameter \(r\) because \(r\) has no effect on the stability of coalitions. This is proven in “Appendix 4”.We choose this parameterisation because it allows us to fully illustrate the potential differences between the IS and FDS solution concepts.

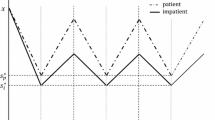

Stability values for a 3-player Grand Coalition with cost symmetry for the different parameterisations indicated in Fig. 4. a Internal stability which is always negative, indicating an unstable Grand Coalition across all parameterisations. b FDS. Different parameterisations result in varying FDS of partial coalitions, which in turn affects the outside options for players in the Grand Coalition and thus the stability of the Grand Coalition. For example, at parameterisation 10, the partial coalition \(\{1,2\}\) satisfies FDS. This means that the outside option of Player 3 leaving the Grand Coalition is determined in the structure given by coalition \(\{1,2\}\)

Here, the Grand Coalition is internally unstable under all parameterisations of catchability. Precisely the opposite is true when the FDS is considered. The Grand Coalition satisfies FDS under all parameterisations of catchability.

To explain these results, note that under IS, the outside options are always drawn from the remaining 2-player coalition (regardless of its stability). Note also, that under FDS, the set of stable partial coalitions changes and hence the set of coalition structures from which outside options are drawn changes also. Figure 5a shows how, as symmetry increases (perfect symmetry exists where \(Q=40\)), internal instability becomes more severe. This conforms with previously established results. Similarly, for a given set of stable partial coalitions, FDS of the Grand Coalition also decreases as symmetry increases. However, under FDS, the set of stable partial coalitions changes. These changes result in discontinuous jumps in stability. Increasing asymmetry increases the size of the set of stable partial coalitions and this decreases FDS while, for a given set of stable partial coalitions, increasing asymmetry increases FDS.

In order to make more general comparisons between the effects on changing stock location under the two solution concepts, we carry out a sensitivity analysis. We use bold type face to denote sets of values of a given parameter used in the analysis. The analysis tests over a discrete parameter space given by \(\uptheta \times Q\) where \(\uptheta =(\mathbf{p},\mathbf{c}_1,\mathbf{c}_2,\mathbf{c}_3,\mathbf{k})\). Our approach is to determine appropriate values for the set \(\uptheta \) and analyse the properties of each element of \(\uptheta \) as stock location changes.

Appropriate values of \(\uptheta \) need to allow for comparison of results with Pintassilgo et al. (2010). As such, we require a uniform distribution of \(b_i\) over a suitable range. However, the asymmetric \(q_{i}\) in our case precludes collecting terms \(p,\,c_i,\,q_i\) and \(k\) into the single parameter \(b_i\) in the profit function a la Pintassilgo et al. (2010). We therefore require a procedure which tests a uniform distribution of \(b_i\) but also specifies parameters for \(p,\,c_i\) and \(k\), thus determining the set \(\uptheta \).

In determining \(\uptheta \), we note that the variables \(p,\,c_i\) and \(k\) have no upper bound. However, a necessary condition for positive effort of player \(i\) is that \(b_i\) must be in the interval \(0\le b_i <1\). Therefore, we choose the values \(p,\,c_i\) and \(k\) such that \(b_i\) does not exceed its bounds for any tested value of \(q_i\). Additionally, we select values for \(p,\,c_i\) and \(k\) such that the values of \(b_i\) are uniformly distributed in the interval \([0,\,1)\). Values for \(p,\,c_i\) and \(k\) are chosen from sets of random draws from uniform distributions in the following intervals; \(0<c_i <2,\,0<p<2\) and \(1<k<100\). We select these intervals because they are reasonable and allow for a full range of \(b_i\). In addition, due to the result given in (17), it is appropriate to allow \(c_i\) to be less and greater than \(q_i\).

We retain our assumption that changes in stock location occur in the range \(0.6\le q_i \le 1\). Elements of \(Q\) are drawn from a uniform distribution in the interval of \([{0.6,1}]\) and obey the criterion that \(q_1 +q_2 +q_3 =2.4\). The summation criterion ensures that total catchability is always constant and thus represents the case where catchability is redistributed between players.Footnote 2

The parameter space \(\uptheta \times Q\) has approximately 100,000 elements which provides sufficient confidence in the results. For the cost-symmetric and cost-asymmetric case and for each element of \(\uptheta \times Q\), we test for FDS and IS. The sensitivity analysis is programmed in Matlab to classify each element of \(\uptheta \) into certain categories (see Table 1) depending on the stability of the Grand Coalition as stock location changes.

The results of the sensitivity analysis in Table 1 demonstrate that outcomes similar to those in Fig. 5a occur for 34.1 % (Never IS) of parameterisations for \(\uptheta \). Outcomes similar to those in Fig. 5b occur for 18.8 % (Always FDS) of parameterisations of \(\uptheta \). Further analysing the cost-symmetric case, the results also show that Sometimes FDS and Sometimes IS are the most common outcomes. However, Always IS never occurs but Always FDS occurs for 18.8 % of parameterisations of \(\uptheta \) in the cost-symmetric case. Additionally, Sometimes IS is less common than Sometimes FDS. Within our range of catchability changes, the use of the FDS solution concept offers significant stability improvements compared to IS.

Table 1 also shows that cost-asymmetry increases stability for both solution concepts. When cost asymmetry is introduced, the potential range of the cost-catchability ratio for the three players is greater when costs are asymmetric and thus, it is more likely that the most efficient member of the coalition can satisfy outside option requirements. We therefore see an increase in stability for both the FDS and IS solution concepts. Cost-asymmetry has a greater effect under the IS solution concept, as evidenced by the larger increase in Always IS. This indicates that the FDS solution concept is less reliant on cost-asymmetry to improve stability than IS.

In general then, stability increases under the FDS solution concept and in asymmetry. An interesting aspect of the results is that the FDS solution concept results in more frequent occurrences of “Sometimes FDS” in both the cost-symmetric and asymmetric cases. This means that, under the FDS solution concept, changing stock location is more likely to render a stable Grand Coalition unstable (or vice versa). Therefore, while the FDS concept results in more stability in general, it also shows more sensitivity to changing stock location. Sensitivity to changing stock location increases for FDS relative to IS because of the different way that the outside option is calculated. Using the 3-player game as an example, under IS, the outside options are always drawn from the payoffs of free-riders playing against partial coalitions. Under FDS, each outside option is calculated according to the stability of the partial coalitions. Changes in stock location can change the stability of partial coalitions and thus lead to greater variation in the outside options as stock location changes. In turn, this increases the sensitivity of stability to changing stock location.

6.2 Changes in Stock Location with 4 Players

We now examine the effect of a unit increase in the number of players. In order to do so, we employ the same sensitivity analysis procedure as in the previous subsection. The only changes are that \(\uptheta =(\mathbf{p},\mathbf{c}_1,\mathbf{c}_2,\mathbf{c}_3,\mathbf{c}_4,\mathbf{k})\), the random draws for catchability must now obey the criterion that \(q_1 +q_2 +q_3 +q_4 =3.2\) and the increased number of players increases the number of elements in \(\uptheta \times Q\).

The results in Table 2, in comparison to Table 1, show that, as expected, increasing the number of players from 3 to 4 decreases stability for both solution concepts and in both the cost-symmetric and asymmetric cases. Cost-asymmetry increases IS and FDS. Again, FDS offers improvements in stability overall, but also increases the frequency of “Sometimes FDS” in both cost-symmetric and asymmetric cases and thus increases the sensitivity of Grand Coalition stability to changing stock location. Comparison of Tables 1 and 2 shows that the problem of sensitivity with FDS becomes more severe as the number of players increases. There are two reasons for this. Firstly, in general, stability decreases in \(n\). Secondly, in the 3-player case there are only 4 structures (3 partial coalitions and All Singletons) from which the outside options can be drawn. In the 4-player case, there are 11 structures. Thus, changes in stock location can change the stability of a greater number partial coalitions and thus lead to greater variation in the outside option.

In addition to analysing the stability properties of each element of \(\uptheta \), we can also analyse each element of \(\uptheta \times Q\) individually. This allows for direct comparison to Pintassilgo et al. (2010). For 4-player games, considering asymmetry in \(c_i\) (which is represented by asymmetry in \(b_i\)), Pintassilgo et al. (2010) find that the Grand Coalition will be Internally Stable in 5.1 % of cases. In our cost-symmetric case, the percentage of elements of \(\uptheta \times Q\) for which the Grand Coalition is internally stable is 22 % (not shown in Table 2). This shows that asymmetry in \(q_i\) is more likely to lead to stability than asymmetry in \(c_i\).

The reason for this difference has already been partially explained in Sect. 5, where we established that marginal increases in \(q_i\) lead to a greater increase in profit than marginal reductions in \(c_i\) if and only if \(q_i < c_i\). Therefore, when \(q_i <c_i\) holds, a given degree of asymmetry in \(q_i\) can lead to greater differences in payoffs between players than the same degree of asymmetry in \(c_i\). In our sensitivity analysis, due to our selection of parameter ranges, \(q_i < c_i\) may or may not hold. When it does hold, a given degree of asymmetry in \(q_i\) can allow the most efficient coalition member to be more profitable than for a given degree of asymmetry in \(c_i\). Thus, the most efficient coalition member is more likely to be able to satisfy outside options. This explains the increased stability in our case relative to Pintassilgo et al. (2010).

Of course, the selection of intervals for \(q_i\) and \(c_i\) in the sensitivity analysis affects this result. For example, if \(c_i\) is always greater than \(q_i\) then the Grand Coalition will be stable for more elements of \(\uptheta \times Q\). In general, it holds that increases in \(q_i\) which reinforce existing cost advantages of the most efficient coalition member will increase stability. However, the relative magnitudes of \(c_i\) and \(q_i\) are important in determining the marginal effect of changes in \(q_i\) on coalition stability.

The results show that the FDS solution concept offers consistently more Grand Coalition stability under stock location changes in both 3- and 4-player games. Although, the improvements in stability due to the FDS solution concept are accompanied by an increase in the sensitivity of stability to changing stock location.

7 Discussion and Conclusion

The results of this study contribute to an improved understanding of the impacts of changing stock location on the potential for full cooperation regarding fish stocks. When players are symmetric and changes in stock location affect all players equally, the Grand Coalition satisfies FDS for \(n\le 4\). For \(n>4\), large partial coalitions can also satisfy FDS. When considering cost-symmetry and cost-asymmetry combined with changing stock location, we find that FDS leads to an increase in stability relative to IS. However, while stable Grand Coalitions are more likely under the FDS solution concept, changes in whether a Grand Coalition is stable due to changing stock location are also more likely. In this way, the use of the FDS solution concept increases stability, but also increases the sensitivity of stability to changes in stock location.

Finally, we discuss some important issues highlighted by our results. We need to consider the positivist aspect of which solution concept best reflects reality and the normative aspect of which behaviours implied by the solution concept are preferable. The normative aspect is clear. Should policy makers wish to increase the stability of Grand Coalitions under changes in stock location, then mechanisms could be put into place to encourage further deviation, thereby forcing players who are considering a deviation to make farsighted conjectures about the effects of their deviation. In doing so, policy makers should consider that such farsighted conjectures may lead to more frequent switches been stable and unstable Grand Coalitions as a consequence of the increase in sensitivity to changing stock location associated with FDS.

The positivist question is less clear cut. In the simplest, symmetric case, Grand Coalitions are unstable for more than 4 players. In reality, there have been examples of both success and failure of fisheries agreements for various numbers of fishing states (see Munro 2008). This offers some support for the notion that fishing countries are posing credible threats to deviation and that this facilitates stable coalitions.

There are also other approaches which could be employed to analyse the issue of changes in stock location. For example, Long and Flaaten (2011) use a Stackelberg game to analyse the potential for cooperation to manage straddling fish stocks and have found more optimistic results than in the literature based on Cournot games. Breton and Keoula (2012) employ a dynamic farsightedness concept as well as a static version. A dynamic structure has the potential to increase the stability of the Grand Coalitions when stable coalition structures are reached after a large number of deviations (for example, the All Singletons structure) and the discount rate is sufficiently low. Higher payoffs from deviations will therefore be reduced through discounting and this will help to stabilise Grand Coalitions.

Notes

Consider also that in this example, the set of imputations whose values could be considered to inform the outside option includes the Grand Coalition itself. Needing to know \(V_i\) when we need to know \(V_i\) in order to know \(V_i\) is a paradox best avoided.

In this way, we lose the ordering of \(Q\) as seen in Fig. 4. Given our method of statistical analysis, loosing ordering does not affect the interpretation of the results. If the random draws were ordered to represent a changing stock location scenario over time, as in Fig. 4, the results would be the same as without ordering. Further, this method benefits from not presenting scenarios as in Fig. 4 because imposing such a scenario is restrictive, particularly in the case of the four player game.

Abbreviations

- EEZ:

-

Exclusive economic zone

- FDS:

-

Farsighted downwards stability

- ITQs:

-

Individual transferable quotas

- RFMO:

-

Regional fisheries management organisation

References

Arnason R (2012) Global warming: new challenges for the common fisheries policy? Ocean Coast Manag 70:4–9

Bailey M, Rashid Sumaila U, Lindroos M (2010) Application of game theory to fisheries over three decades. Fish Res 102:1–8

Biancardi M, Di Liddo A (2010) The size of farsighted stable coalitions in a game of pollution abatement. Nat Resour Model 23:467–493

Bjørndal T, Kaitala V, Lindroos M, Munro GM (2000) The management of high seas fisheries. Ann Oper Res 94:183–196

Bjørndal T, Lindroos M (2012) Cooperative and non-cooperative management of the Northeast Atlantic cod fishery. J Bioecon 14:41–60

Brandt US, Kronbak LG (2010) On the stability of fishery agreements under exogenous change: an example of agreements under climate change. Fish Res 101:11–19

Breton M, Keoula M (2012) Farsightedness in a coalitional great fish war. Environ Resour Econ 51:297–315

Caparrós A, Giraud-Heraud E (2011) Coalition stability with heterogenous agents. Econ Bull 31:286–296

Cheung WWL, Lam VWY, Sarmiento JL, Kearney K, Watson R, Pauly D (2009) Projecting global marine biodiversity impacts under climate change scenarios. Fish Fish 10:235–251

Chwe MS-Y (1994) Farsighted coalitional stability. J Econ Theory 63:299–325

de Zeeuw A (2008) Dynamic effects on the stability of international environmental agreements. J Environ Econ Manag 55:163–174

Ekerhovd N-A (2010) The stability and resilience of management agreements on climate-sensitive straddling fishery resources: the blue whiting (Micromesistius poutassou) coastal state agreement. Can J Fish Aquat Sci 67:534–552

Ellefsen H (2012) The stability of fishing agreements with entry: the North East Atlantic mackerel. Strateg Behav Environ 3:1–24

Eyckmans J, Finus M (2004) An almost ideal sharing scheme for coalition games with externalities, working paper. Katholieke Universiteit Lueven, Center for Economic Studies

Hannesson R (2011) Game theory and fisheries. Ann Rev Resour Econ 3:181–202

Haraldsson G, Carey D (2011) Ensuring a sustainable and efficient fishery in Iceland, OECD Economics Department working papers. http://www.oecd-ilibrary.org/economics/ensuring-a-sustainable-and-efficient-fishery-in-iceland_5kg566jfrpzr-en. Cited 28 Sept. 2012

Harsanyi JC (1974) An equilibrium-point interpretation of stable sets and a proposed alternative definition. Manag Sci 20:1472–1495

Ishimura G, Herrick S, Sumaila U (2012) Fishing games under climate variability: transboundary management of Pacific sardine in the California Current System. Environ Econ Policy Stud 15:189–209

Jansen T, Gislason H (2011) Temperature affects the timing of spawning and migration of North Sea mackerel. Cont Shelf Res 31:64–72

Kaitala VT, Lindroos M (1998) Sharing the benefits of cooperation in high seas fisheries: a characteristic function game approach. Nat Resour Model 11:275–299

Lindroos M (2008) Coalitions in international fisheries management. Nat Resour Model 21:366–384

Long LK, Flaaten O (2011) A Stackelberg analysis of the potential for cooperation in straddling stock fisheries. Mar Resour Econ 26:119–139

McGinty M (2007) International environmental agreements among asymmetric nations. Oxf Econ Pap 59:45–62

McGinty M, Milam G, Gelves A (2012) Coalition stability in public goods provision: testing an optimal allocation rule. Environ Resour Econ 52:327–345

Miller KA, Munro GR (2004) Climate and Cooperation: a new perspective on the management of shared fish stocks. Marine Resource Economics 19:367–393

Munro GR (2008) Game theory and the development of resource management policy: the case of international fisheries. Environ Dev Econ 14:7–27

Osmani D, Tol R (2009) Toward farsightedly stable international environmental agreement. J Public Econ Theory 11:455–492

Pintassilgo P, Finus M, Lindroos M, Munro G (2010) Stability and success of regional fisheries management organizations. Environ Resour Econ 46:377–402

Pintassilgo P, Lindroos M (2008) Coalition formation in straddling stock fisheries: a partition function approach. Int Game Theory Rev 10:303–317

Punt MJ, Weikard H-P, Van Ierland EC (2012) Marine protected areas in the high seas and the impact on international fishing agreements. Nat Resour Model 26:164–193

Rettieva AN (2012) Stable coalition structure in bioresource management problem. Ecol Model 235–236:102–118

Weikard H-P (2009) Cartel stability under an optimal sharing rule. Manch School 77:575–593

Acknowledgments

We would like to acknowledge the helpful comments of Ekko van Ierland, Maarten Punt and Andries Richter. We are grateful to Pierre von Mouche for his help with the proof in “Appendix 1”. We thank the co-editor and reviewers, especially in relation to Sects. 6.1 and 6.2, which greatly improved during the review process. The research leading to these results has received funding from the European Community’s Seventh Framework Programme (FP7/2007–2013) under Grant Agreement No. 266445 for the project Vectors of Change in Oceans and Seas Marine Life, Impact on Economic Sectors (VECTORS).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Reaction Function and Equilibrium Strategy for the All Singletons Structure

Individual profits are given by

Using the steady state condition, solving for \(x\) and substituting the value for \(x\) gives us

The first order condition is

Solving for effort gives the reaction function

where \(b_i =\frac{c_i }{pq_i k}\).

We manipulate the reaction function to obtain the following two identities;

Substituting the second identity into the first gives us the equilibrium strategy

the RHS of which can be manipulated so that \(e_i\) is a function of the inverse efficiency parameters of all other players such that,

Appendix 2a: Derivation of Inequality (12)

Cancelling terms outside the square brackets and dividing both sides by \(pk\) yields

Removing \((1-b)\) from inside the brackets and cancelling yields

Which simplifies to \(\frac{1}{\left( {n+1} \right) ^{2}}\le \frac{1}{s\left( {n-s+2} \right) ^{2}}.\) Solving for \(s\) gives the result in (12).

Appendix 2b: Comparison of (13) and (15)

We examine the difference between the right hand sides of (13) and (15).

Hence, the difference is positive (and increasing) for all \(n>2\).

Appendix 3: The Relative Advantage of Cost Versus Catchability Asymmetries

Beginning by substituting Eqs. (3) and (7) into Eq. (4) and simplifying, we have equilibrium profit

where \(B_i \equiv 1-b_i \,\forall i,\, a\equiv n-s+1,\,\sum _j\) sums over all \(j\in N\backslash i\) and \(\sum _k\) sums over all \(k\in N\backslash j\).

The first differentials of the profit function are given below,

Appendix 4: The Independence of Coalition Stability from \(r\)

We will demonstrate that the parameter \(r\) has no effect on stability. In order to do so, we prove that the ordering of any two profit functions, regardless of coalition size or membership, does not depend on \(r\). The subscript \(j\) and \(k\) are used to denote the steady state stock size and effort under different coalition sizes or membership choices and hold their usual meaning for \(c_i\) and \(q_i\).

Consider the ordering

Equations (3) and (7) from the main text are repeated below.

Substitution of (7) into (3) shows that \(x\) is not a function of \(r\) because the \(r\) terms cancel. Effort \(e_i\) is linear in \(r\) and can thus be entirely cancelled from the ordering. Given that the equality of any two profits does not depend on \(r\), it holds also that the payoff of a given coalition member (Eq. 7) also does not depend on \(r\). To see this, note that given Eq. (9), \(V_{S}(S)>\sum \nolimits _{j\in S}\omega _j\) is a sufficient condition for stability. The argument for the independence of the ordering of any two profit functions from \(r\) thus holds also for payoffs.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

About this article

Cite this article

Walker, A.N., Weikard, HP. Farsightedness, Changing Stock Location and the Stability of International Fisheries Agreements. Environ Resource Econ 63, 591–611 (2016). https://doi.org/10.1007/s10640-014-9853-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9853-1