Abstract

We determine the optimal investment strategy for an ambiguity-averse investor in a setting with stochastic interest rates. The investor has access to stocks, bonds, and a bank account and he is ambiguous about the expected rate of return of both bonds and stocks. The investor can have different levels of ambiguity aversion about the two types of risky assets. We find that it is more important to take model uncertainty about the stock dynamics than model uncertainty about the bond dynamics into account. Furthermore, the investor’s ambiguity increases his hedging demand. Consequently, the bond/stock ratio increases with his ambiguity and implies less extreme positions in the bank account. Altogether, our model yields portfolio allocations which are more in line with what is implementable in practice. Finally, we demonstrate that neglecting model uncertainty implies significant losses for the investor.

Similar content being viewed by others

Notes

The impact of stochastic interest rates on optimal dynamic portfolios has been studied in e.g. Sørensen (1999), Brennan and Xia (2000, 2002), Campbell and Viceira (2001), Wachter (2003), Munk and Sørensen (2004, 2010), and Sangvinatsos and Wachter (2005). All of these studies assume that the model of the interest rate is known as well as the true set of parameter values.

Hansen et al. (1999, 2002) study discrete time asset pricing models in which the decision maker fears model misspecification. Anderson et al. (2003) extend this to a continuous-time setting. Alternative approaches to incorporating an investor’s concern about model uncertainty include a maximin specification of preferences proposed by Gilboa and Schmeidler (1989) and Epstein and Schneider (2003) and a smooth ambiguity aversion specification suggested by Klibanoff et al. (2005). Ma et al. (2008) consider robust portfolio choice with worst-case utility. The literature on ambiguity aversion has recently been surveyed by Epstein and Schneider (2010).

We assume that the stock pays no dividends. The analysis also goes through with dividends as long as the dividends are reinvested in the stock.

We assume \(\gamma \ge 1\) to avoid problems with infinite expected utility that may arise for \(0<\gamma <1\), cf. Kim and Omberg (1996) and Korn and Kraft (2004). For \(\gamma \rightarrow 1\) we get the log-utility case, i.e.

$$\begin{aligned} \tilde{V}(W,r,t) = \sup _{\pi } \inf _{u_1, u_2} \mathbb E _t^\mathbb{\tilde{P} } \left[ \ln W_T + \frac{1}{2}\int \limits _t^T \left( \frac{u_{1s}^2}{\varPsi _1(W_s,r_s,s)} + \frac{u_{2s}^2}{\varPsi _2(W_s,r_s,s)} \right) ds \right] . \end{aligned}$$This is in line with Uppal and Wang (2003), who allow for differences in the degree of ambiguity about the expected rate of return of different stocks.

Maenhout (2004) shows that if the preference parameter governing the ambiguity aversion is fixed and state independent as in Anderson et al. (2003), the preferences induced by the robust adjustment are not homothetic for a power utility investor. In particular, he shows that the optimal portfolio weight is not independent of wealth, and robustness wears off as wealth increases.

The term \(\text{ diag } \left( P_t \right) \) denotes the \(2 \times 2\) diagonal matrix with \(P_t\) down the diagonal.

The subscripts on \(\tilde{V}\) denote the partial derivatives, and we have suppressed the arguments of the indirect utility function and \(\varPsi \) for notational simplicity.

Similar results can be seen in papers with no ambiguity aversion and stochastic interest rates, for example Sørensen (1999).

The total weight in the hedge portfolio equals \(\pi ^{hdg} = \frac{\gamma -1+\theta _1}{\gamma + \theta _1}\). It is easy to see that the derivative wrt. \(\gamma \) is positive.

Our methodology is equivalent to the one in Maenhout (2006) and Liu (2010). However, our results are not identical. To see this, suppose that the investor cannot trade in a bond, but has access to two non-perfectly correlated stocks. Then the investor can still hedge the interest rate risk, but the two hedge terms in (3.16) would be time dependent. Moreover, the speculative term becomes constant.

In addition, traditional portfolio choice models induce a lot of trading. This is problematic if trading is subject to transaction costs. It can be shown that the instantaneous variance of the number of bonds and stocks decreases with the level of ambiguity aversion. Interestingly, the results from our dynamic setting are in line with the results in the static model by Garlappi et al. (2007).

We have also considered \(\theta _1 > 0\) together with \(\theta _2 \ne 0\). Since we get similar conclusions, we do not report detailed results.

This is due to the fact that the correlations and standard deviation of the stock indirectly enter in the market prices of risk.

For small values of \(\lambda _1\), the loss is decreasing in the level of \(\lambda _1\) if either the volatility of the interest rate or the speed of mean reversion is high. For larger values of \(\lambda _1\) the loss will still be increasing. Note that such a parametrization would not be in line with historical estimates about the short-term interest rate.

See for example Theorem 11.2.2 in Øksendal (2000).

The inflation-indexed long-term yield average yield is based on the unweighted average bid yields for all TIPS with remaining terms to maturity of more than 10 years.

References

Anderson, E.W., Hansen, L.P., Sargent, T.J.: A quartet of semigroups for model specification, robustness, prices of risk, and model detection. J Eur Econ Assoc 1(1), 68–123 (2003)

Anderson, E.W., Ghysels, E., Juergens, J.L.: The impact of risk and uncertainty on expected returns. J Financ Econ 94, 233–263 (2009)

Bossaerts, P., Ghirardato, P., Guarnaschelli, S., Zame, W.: Ambiguity in asset markets: theory and experiment. Rev Financ Stud 23, 1325–1359 (2010)

Brennan, M.J., Xia, Y.: Stochastic interest rates and the bond-stock mix. Eur Financ Rev 4(2), 197–210 (2000)

Brennan, M.J., Xia, Y.: Dynamic asset allocation under inflation. J Financ 57(3), 1201–1238 (2002)

Campbell, J.Y.: Asset prices, consumption, and the business cycle. In: Taylor, J., Woodford, M. (eds) Handbook of Macroeconomics 1(chap. 19). Amsterdam: North-Holland (1999)

Campbell, J.Y., Viceira, L.M.: Who should buy long-term bonds? Am Econ Rev 91(1), 99–127 (2001)

Duffie, D., Kan, R.: A yield-factor model of interest rates. Math Financ 6, 379–406 (1996)

Ellsberg, D.: Risk, ambiguity, and the savage axioms. Q J Econ 75(4), 643–669 (1961)

Epstein, L.G., Schneider, M.: Recursive multiple-priors. J Econ Theory 113, 1–11 (2003)

Epstein, L.G., Schneider, M.: Ambiguity and Asset Markets, nBER working paper series (2010)

Garlappi, L., Uppal, R., Wang, T.: Portfolio selection with parameter and model uncertainty: a multi-prior approach. Rev Financ Stud 20(1), 41–81 (2007)

Gilboa, I., Schmeidler, D.: Maximin expected utility with a non-unique prior. J Math Econ 18, 141–153 (1989)

Hansen, L.P., Sargent, T.J., Tallarini, T.J.: Robust permanet income pricing. Rev Econ Stud 66, 873–907 (1999)

Hansen, L.P., Sargent, T.J., Wang, N.: Robust permanet income pricing with filtering. Macroecono Dyn 6, 40–84 (2002)

Kim, T.S., Omberg, E.: Dynamic nonmyopic portfolio behavior. Rev Financ Stud 9(1), 141–161 (1996)

Klibanoff, P., Marinacci, M., Mukerji, S.: A smooth model of decision making under ambiguity. Econometrica 73(6), 1849–1892 (2005)

Korn, R., Kraft, H.: On the stability of continuous-time portfolio problems with stochastic opportunity set. Math Financ 14, 403–414 (2004)

Larsen, L.S., Munk, C.: The costs of suboptimal dynamic asset allocation: general results and applications to interest rate risk, stock volatility risk, and growth/value tilts. J Econ Dyn Control 36, 266–293 (2012)

Liu, H.: Robust consumption and portfolio choice for time varying investment opportunitie. Ann Financ 6, 435–454 (2010)

Liu, J., Pan, J., Wang, T.: An equilibrium model of rare-event premia and its implication for option smirks. Rev Financ Stud 18(1), 131–164 (2005)

Ma, X., Zhao, Q., Qu, J.: Robust portfolio optimization with a generalized expected utility model under ambiguity. Ann Financ 4, 431–444 (2008)

Maenhout, P.J.: Robust portfolio rules and asset pricing. Rev Financ Stud 17, 951–983 (2004)

Maenhout, P.J.: Robust portfolio rules and detection-error probabilities for a mean-reverting risk premium. J Econ Theory 128, 136–163 (2006)

Munk, C., Sørensen, C.: Optimal consumption and investment strategies with stochastic interest rates. J Bank Financ 28(8), 1987–2013 (2004)

Munk, C., Sørensen, C.: Dynamic asset allocation with stochastic income and interest rates. J Financ Econ 96(3), 433–462 (2010)

Øksendal, B.: Stochastic Differential Equations: An Introduction with Applications, 5th edn. New York: Springer (2000)

Sangvinatsos, A., Wachter, J.A.: Does the failure of the expectations hypothesis matter for long-term investors? J Financ 60(1), 179–230 (2005)

Sørensen, C.: Dynamic asset allocation and fixed income management. J Financ Quant Anal 34, 513–531 (1999)

Uppal, R., Wang, T.: Model misspecification and underdiversification. J Financ 58, 2465–2486 (2003)

Vasicek, O.: An equilibrium characterization of the term structure. J Financ Econ 5, 177–188 (1977)

Wachter, J.A.: Risk aversion and allocation to long-term bonds. J Econ Theory 112, 325–333 (2003)

Acknowledgments

We are grateful for comments from participants at the 19th Annual Meeting of the European Financial Management Association, participants at the 17th Annual Meeting of the German Finance Association (DGF), and participants at the Arne Ryde Workshop in Financial Economics 2012 (Lund University). In particular, we thank Claus Munk, Anne Villamil (the editor), and an anonymous referee.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Optimal investment strategy

Substituting \(u^*\) from (3.8) into the HJB Eq. (3.5) yields

The first-order condition with respect to \(\pi \) implies that a candidate for the optimal investment strategy is given by

Substituting \(\pi ^*\) into the HJB Eq. (6.1) yields a partial differential equation (PDE) for \(\tilde{V}\). If this PDE has a solution, \(\tilde{V}(W,r,t)\), such that the strategy \(\pi \) is well-defined, it follows from a verification theorem that the strategy is optimal and that the function \(\tilde{V}(W,r,t)\) equals the indirect utility function.Footnote 17 By using the linear homogeneity in wealth, which we have ensured by the choice of \(\varPsi \) given in (2.17), we make the following conjecture for the solution to the HJB equation in (6.1)

where \(A(\cdot )\) and \(B(\cdot )\) are deterministic functions. By substituting the relevant derivatives of \(\tilde{V}\) into the HJB equation it follows that our guess solves the equation if

The optimal investment strategy now follows from (6.2), and the worst-case measure accepted by the investor follows from (3.8).

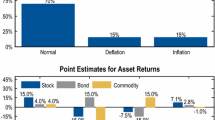

Appendix B: Calibration of parameters

We calibrate the model to historical estimates of mean returns, standard deviations, and correlations for the US market. We consider a time period of 15 years, which is the time period of data available on US TIPS, which we need to determine the real return on bonds. The real return on the stock is constructed using real stock prices on S&P 500 taken from the homepage of Robert Shiller.Footnote 18 The data period runs from January 1996 to January 2011. The annualized average real return on the stock approximately equals \(\mu _S = 0.06\) with a standard deviation of \(\sigma _S= 0.20\). As an approximation for the short-term interest rate we use the real 1-year interest rate also stated on Shiller’s homepage. The average real US short-term interest rate then equals \(\bar{r}^\mathbb{P }=0.014\) and has a volatility of \(\sigma _r = 0.022\). The correlation between the short-term interest rate and the stock index equals \(-0.09\), that is, the correlation between the stock and bond market equals \(\rho = 0.09\). If we know the standard deviation of the return on a bond, we can determine the speed of mean reversion in the short rate by solving

To get an estimate of the standard deviation we use US TIPS represented by Barclays US Govt Inflation-linked Bond Index for which data is available from January 1997 to January 2012 on Bloomberg. We get a standard deviation of \(\sigma _B = 0.06\). Hence, for a maturity of 10 years this gives us an estimate for the speed of mean reversion in the interest rate of \(\kappa =0.36\). To get an estimate of the market price of interest rate risk, \(\lambda _1\), we can use that

However, this implies that we need an estimate of the long-term real rate. As an approximation for the long-term real rate we use the inflation-indexed long-term average yield from the Federal Reserve H.15 Statistical Releases.Footnote 19 We use a time period of only 8 years (from 2003 to 2011) due to the availability of the data, and we get that the average inflation-indexed long-term average yield equals \(y_{\infty }=0.02\). It then follows that \(\lambda _1 = 0.12\). Finally, we need an estimate of the market price of risk factor \(\lambda _2\), which is given by

The Sharpe ratio follows from \(\psi = \frac{\mu _S-\bar{r}^\mathbb{P }}{\sigma _S} = 0.2\), from which we finally get that \(\lambda _2 = 0.22\). Our parameters are comparable to the estimated parameters given in Munk and Sørensen (2010). The parameter estimates are summarized in Table 1.

Rights and permissions

About this article

Cite this article

Flor, C.R., Larsen, L.S. Robust portfolio choice with stochastic interest rates. Ann Finance 10, 243–265 (2014). https://doi.org/10.1007/s10436-013-0234-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-013-0234-5