Abstract

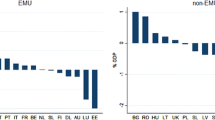

Eurozone members are supposedly constrained by the fiscal caps of the Stability and Growth Pact. Yet ever since the birth of the euro, members have postponed painful adjustment. Wishful thinking has played an important role in this failure. We find that governments’ forecasts are biased in the optimistic direction, especially during booms. Eurozone governments are especially over-optimistic when the budget deficit is over the 3 % of GDP ceiling at the time the forecasts are made. Those exceeding this cap systematically but falsely forecast a rapid future improvement. The new fiscal compact among the euro countries is supposed to make budget rules more binding by putting them into laws and constitutions at the national level. But biased forecasts can defeat budget rules. What is the record in Europe with national rules? The bias is less among eurozone countries that have adopted certain rules at the national level, particularly creating an independent fiscal institution that provides independent forecasts.

Similar content being viewed by others

Notes

The averages are the unweighted averages of each of the country means. Each country mean receives the same weight, even if some countries have more observations.

These findings are documented by Frankel (2011b) and other authors cited in the literature review below.

Indeed, Sweden’s strategy for staying out could have been to feign fiscal imprudence!

He proposes delegating the macroeconomic forecasting to supranational authorities, such as the European Commission or the IMF.

A list of country coverage can be found in Table A1 of the Online Appendix.

Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

Australia, Canada, Chile, Mexico, New Zealand, South Africa, and the United States.

In this paper, we use the revised versions of macroeconomic statistics rather than the statistics that were contemporaneously available because of data availability. For analysis of budget forecast errors using real-time data see Beetsma et al. (2009).

Because the output gap is constructed using the HP filter, future data is used in constructing the contemporary output gap so these are not true predictive regressions. However, these results are generally robust to replacing the output gap with recent GDP growth.

We also perform the same exercise for two different subsamples: euro area countries and non-euro area countries. Larger current budget deficits are associated with significantly more over-optimistic budget forecasts at all horizons over both the 1999–2007 and 1999–2011 time periods for euro area countries. So the crises of 2008–2011 are not driving these results (Larger budget deficits are only a predictors of over-optimism at the 2-year horizon from 1999 to 2011 for non-euro area countries). The current output gap is a robust predictor of over-optimistic budget forecasts for both euro area and non-euro area countries, over either period. These results are available as Table A6 in NBER WP 18283.

Because the large majority of the 3-year horizon forecast data we have comes from Stability and Convergence Programs, in this section we only look at forecast errors at the 1- and 2-year horizon to ensure we have sufficient observations from countries outside the euro area.

We thank an anonymous referee for this helpful suggestion.

Because the variable EDPGap is highly collinear with several of the other variables, we prefer the dummy variable EDP and will use it in place of EDPGap throughout the rest of the paper.

Available at http://ec.europa.eu/economy_finance/db_indicators/fiscal_governance/fiscal_rules/index_en.htm. The data on national fiscal rules in Europe were also applied to this problem by Zlatinova and Otto (2012).

The FRSI indices use the random weights method as in Sutherland et al. (2005).

Each rule is classified by the government sector that it covers: the central government, regional governments, local governments and social security. A rule can also be classified as covering multiple sectors or the general government. If one rule covers the general government sector and a second rule covers only certain sectors, the rule covering the individual sector is discounted as if it were the second rule covering that specific sector.

The weighted rules are (rule weight) × (coverage of general government finances) × (FRSI).

The so-called “Golden Rule” restricted the general government to borrow only to finance investment rather than current spending.

As in the previous sections, we require at least 10 budgets.

Available at http://ec.europa.eu/economy_finance/db_indicators/fiscal_governance/independent_institutions/index_en.htm. The European Commission defines independent fiscal institutions as “non partisan public bodies, other than the central bank, government or parliament that prepare macroeconomic forecasts for the budget, monitor fiscal performance and/or advise the government on fiscal policy matters.” The EC notes that one of the benefits of these institutions is that they “can provide macroeconomic forecasts for the budget preparation that do not suffer from the optimistic biases often found in official government forecasts”.

Other than through the dates the independent fiscal institutions were founded, the database does not include whether the tasks performed by the institution or its legal position has changed since its inception. Therefore, we assume that these characteristics are unchanged since the institutions were created.

In Austria, the government needs to justify publicly deviations from the forecasts of the Austrian Institute of Economic Research.

In constructing this variable, we assume that if the independent fiscal institution provides independent forecasts, as of 2010, it provided these forecasts since the institution’s creation.

References

Alesina, A., Hausmann, R., Hommes, R., & Stein, E. (1999). Budget institutions and fiscal performance in Latin America. Journal of Development Economics, 59(2), 253–273.

Anderson, B., & Minarik, J. (2006). Design choices for fiscal policy rules. OECD Journal on Budgeting, 5(4), 159–208.

Ashiya, M. (2005). Twenty-two years of Japanese institutional forecasts. Applied Financial Economics Letters, 1(2), 79–84.

Ashiya, M. (2007). Forecast accuracy of the Japanese government: Its year-ahead GDP forecast is too optimistic. Japan and the World Economy, 19(1), 68–85.

Auerbach, A. (1994). The U.S. Fiscal Problem: Where we are, how we got here and where we’re going. NBER Macroeconomics Annual, 9, 141–186.

Auerbach, A. (1999). On the performance and use of government revenue forecasts. National Tax Journal, 52(4), 765–782.

Beetsma, R., Bluhm, B., Giuliodori, M., & Wierts, P. (2011). From first-release to ex-post fiscal data: Exploring the sources of revision errors in the EU. (CEPR Discussion Paper 8413). London: Centre for Economic Policy Research.

Beetsma, R., Giuliodori, M., & Wierts, P. (2009). Planning to Cheat: EU fiscal policy in real time. Economic Policy, 24(60), 753–804.

Brück, T., & Stephan, A. (2006). Do eurozone countries cheat with their budget deficit forecasts? Kyklos, 59(1), 3–15.

Buti, M., Franco, D., & Ongena, H. (1998). Fiscal discipline and flexibility in EMU: The implementation of the stability and growth pact. Oxford Review of Economic Policy, 14(3), 81–97.

Debrun, X., Moulin, L., Turrini, A., Ayuso-i-Casals, J., & Kumar, M. (2008). Tied to the mast? National fiscal rules in the European Union. Economic Policy, 23(54), 297–362.

Forni, L., & Sandro M. (2004). Cyclical sensitivity of fiscal policies based on real-time data. (Economic Working Papers 540). Rome: Bank of Italy, Economic Research and International Relations Area.

Frankel, J. (2011a). Over-optimism in forecasts by Official Budget Agencies and Its Implications. Oxford Review of Economic Policy, 4(27), 536–562.

Frankel, J. (2011b). A solution to fiscal procyclicality: The structural budget institutions pioneered by Chile. Journal Economía Chilena (The Chilean Economy), 14(2), 39–78.

Frendreis, J., & Tatalovich, R. (2000). Accuracy and bias in macroeconomic forecasting by the administration, the CBO, and the Federal Reserve Board. Polity, 32(4), 623–632.

International Monetary Fund. (2009). Fiscal rules--Anchoring expectations for sustainable public finances. (IMF Working Paper). Washington, DC: International Monetary Fund.

Jonung, L., & Larch, M. (2006). Improving fiscal policy in the EU: The case for independent forecasts. Economic Policy, 21(47), 491–534.

Kopits, G. (2001). Fiscal rules: Useful policy framework or unnecessary ornament? (IMF Working Paper No. 01/145). Washington, DC: International Monetary Fund.

Kopits, G., & Symansky, S. (1998). Fiscal policy rules. (IMF Occasional Paper 162).

Marinheiro, C. (2010). The stability and growth pact, fiscal policy institutions and stabilization in Europe. International Economics and Economic Policy, 5(1), 189–207.

McNab, R. M., Rider, M., & Wall, K. (April, 2007). Are errors in official US budget receipts forecasts just noise? Andrew Young School (Research Paper Series Working Paper 07-22).

McNees, S. (1995). An assessment of the “official” economic forecasts,” New England Economic Review, available at http://www.bos.frb.org/economic/neer/neer1995/neer495b.htm.

Milesi-Ferretti, G. M. (2004). Good, bad or ugly? On the effects of fiscal rules with creative accounting. Journal of Public Economics, 88(1–2), 377–394.

Mühleisen, M., Stephan, D., David, H., Kornélia, K., & Bennett, S. (April, 2005). How do Canadian budget forecasts compare with those of other industrial countries? (IMF Working Paper 05/66).

O’Neill, T. (2005). Review of Canadian fiscal forecasting: Processes and system, available at http://www.fin.gc.ca/toc/2005/oneil_-eng.asp.

Persson, T., & Tabellini, G. (2004). Constitutional rules and fiscal policy outcomes. American Economic Review, 94(1), 25–45.

Poterba, J. (1997). Do budget rules work? In A. Auerbach (Ed.), Fiscal policy: Lessons from empirical research (pp. 53–86). Cambridge: MIT Press.

Schaechter, A., Tidiane, K., Nina, B., & Anke, W. (2012). Fiscal rules in response to the crisis-toward the ‘next-generation’ rules. A new dataset. (IMF Working Paper 12/187). Washington, DC: International Monetary Fund.

Strauch, R., Mark, H., & von Hagen, J. (2009). How forms of fiscal governance affect fiscal performance. In M. Hallerberg, S. Rolf, & J. von Hagen (Eds.), Fiscal governance in Europe. Cambridge: Cambridge University Press.

Sutherland, D., Robert, P., & Isabelle, J. (2005). Fiscal rules for sub-central governments: Design and impact. (OECD Working Paper 52). Paris: Organisation for Economic Co-operation and Development.

Wyplosz, C. (2005). Fiscal policy: Institutions versus rules. National Institute Economic Review, 191(1), 64–78.

Zlatinova, S., & Otto, M. (March, 2012). Fixing budget deficits in the EU: An evaluation of key issues and proposed modifications for fiscal rules in the eurozone. Second year policy analysis, MPA/ID Program, Harvard Kennedy School.

Acknowledgments

The authors acknowledge support from the Smith Richardson Foundation, though views and findings are ours alone. We thank Raul Galicia Duran for capable research assistance, Roel Beetsma and Martin Muhleisen for sharing their data, Max Otto and Snezhana Zlatinova for suggesting the use of EU data on national fiscal rules, and an anonymous referee for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

Frankel, J., Schreger, J. Over-optimistic official forecasts and fiscal rules in the eurozone. Rev World Econ 149, 247–272 (2013). https://doi.org/10.1007/s10290-013-0150-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-013-0150-9

Keywords

- Budget

- Discipline

- Euro

- Europe

- Eurozone

- Fiscal

- Fiscal compact

- Forecast

- Independent

- Institutions

- Maastricht criteria

- Optimism

- Procyclical

- Rule

- Stability and Growth Pact

- Wishful thinking