Abstract

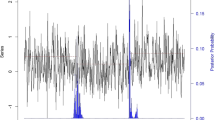

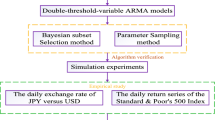

Bayesian analysis of threshold autoregressive (TAR) model with various possible thresholds is considered. A method of Bayesian stochastic search selection is introduced to identify a threshold-dependent sequence with highest probability. All model parameters are computed by a hybrid Markov chain Monte Carlo method, which combines Metropolis–Hastings algorithm and Gibbs sampler. The main innovation of the method introduced here is to estimate the TAR model without assuming the fixed number of threshold values, thus is more flexible and useful. Simulation experiments and a real data example lend further support to the proposed approach.

Similar content being viewed by others

References

Brooks C, Garrett I (2002) Can we explain the dynamics of the UK FTSE 100 stock and stock index futures markets. Appl Financ Econ 12:25–31

Chen CWS (1998) A Bayesian analysis of generalized threshold autoregressive models. Stat Probab Lett 40:15–22

Chen CWS, Gerlach R, So MKP (2008a) Bayesian model selection for heterroskedastic models. Adv Econom 25:567–594

Chen CWS, Lin EMH, Liu FC, Gerlach R (2008b) Bayesian estimation for parsimonious threshold autoregressive models in R. R J 8:26–33

Chen CWS, Gerlach R, Lin AMH (2010) Falling and explosive, dormant and rising markets via multiple-regime financial time series models. Appl Stoch Models Bus Ind 26:28–49

Chen CWS, Lee JC (1995) Bayesian inference of threshold autoregressive models. J Time Ser Anal 16:483–492

Chib S, Greenberg E (1995) Understanding the Metropolis–Hastings algorithm. Am Stat 49:327–335

Geweke J, Terui N (1993) Bayesian threshold autoregressive models for nonlinear time series. J Time Ser Anal 14:441–454

Hansen BE (2011) Threshold autoregression in economics. Stat Interface 4:123–127

Ismail MA, Charif HA (2003) Bayesian Inference for threshold moving average models. METRON 1:119–132

Lavielle M, Moulines E (2000) Least squares estimation of an unknown number of shifts in a time series. J Time Ser Anal 21(1):33–59

Mcculloch RE, Tsay RS (1993a) Bayesian analysis of threshold autoregressive processes with a random number of regimes. Computing science and statistics. In: Proceedings of the 25th symposium on the interface, Fairfax Station, VA: Interface Foundation of North America, pp 253–262

Mcculloch RE, Tsay RS (1993b) Bayesian inference and prediction for mean and variance shifts in autoregressive time series. J Am Stat Assoc 88:968–978

Sáfadi T, Morettin PA (2000) Bayesian analysis of threshold autoregressive moving average models. Sankyã 62:353–371

So MKP, Chen CWS, Chen MT (2005) A Bayesian threshold nonlinearity test in financial time series. J Forecast 24:61–75

Tong H (1978) On a threshold model. In: Chen CH (ed) Pattern recognition and signal processing. Sijthoff and Noordhoff, Amsterdam, pp 101–141

Tong H (1983) Threshold model in non-linear time series analysis. Lecture notes in statistics, vol 21. Springer, Berlin

Tong H (1990) Non-linear time series: a dynamical system approach. Oxford University Press, Oxford

Tong H, Lim KS (1980) Threshold autoregressions, limit cycles, and data. J R Stat Soc 42:245–292

Tsay RS (1989) Testing and modeling threshold autoregressive process. J Am Stat Assoc 84:231–240

Tsay RS (2005) Analysis of financial time series, 2nd edn. Wiley, Hoboken

Acknowledgments

The authors thank the editors and the referee for their constructive comments and valuable suggestions. This paper is partially supported by the EPSRC Bridging-the-Gaps project and the starter grant from the Faculty of Science, University of Strathclyde. The authors J. S. Liu and Q. Xia are supported by National Science Foundation of China (No. 11171117), National Science Foundations of Guangdong Province of China (Nos. 2016A030313414, S2011010002371) and National statistical plan for scientific research project of China (No. 2015LZ48).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: The proof of Theorem 1

The conditional posterior distribution of \((\gamma ,d)\) given \((Y,\sigma ^2)\) is

where \(L(\Theta ,\gamma ,\sigma ^2,d|Y)\) is defined by (2.4) and

Let \(\Theta _k^*,V_k^*\) and \(\hat{\Theta }_k\) be defined as before, then we have

where \(S_k^{*2}\) is defined by (2.12). Thus the conditional posterior distribution (5.1) reduces to

where

in which \(\omega _k\) and \(\beta \) are defined as in (2.14). The proof of Theorem 1 is completed.

Appendix 2: The proof of equation (2.17)

If \(\sigma _1^2=\cdots =\sigma _k^2=\sigma ^2\) and the prior distribution of \(\sigma ^2\) is \(IG(\upsilon /2,\upsilon \lambda /2)\), then conditional posterior distribution of \((\gamma ,d)\) given \((Y,\sigma ^2)\) is

where \(L(\Theta ,\gamma ,\sigma ^2,d|Y)\) is defined by (2.15), \(\pi (\Theta |\gamma ,d)\) is as before. Then it follows from (5.3) the conditional posterior distribution (5.5) reduces to

where

in which \(S_k^{*2}={1\over \sigma ^2}Y_k^{*'}Y_k^*-\Theta _k^{*'}V_k^*\Theta _k^*\), \(\omega _k\) is defined by (2.17) and \(\beta \) is defined as in (2.14). The proof is completed.

Rights and permissions

About this article

Cite this article

Pan, J., Xia, Q. & Liu, J. Bayesian analysis of multiple thresholds autoregressive model. Comput Stat 32, 219–237 (2017). https://doi.org/10.1007/s00180-016-0673-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-016-0673-3