Abstract

We study how home-country factors can alter the impact of host-country conditions on the location decisions of state-owned enterprises (SOEs). Specifically, we examine the role of home-country pro-market reforms in facilitating SOEs’ entry into host countries with a free-market logic. We consider two types of home-country pro-market reforms: market liberalization and privatization. We propose that home market liberalization mainly mitigates SOEs’ market legitimacy deficit and facilitates their entry into host countries with a prominent free-market logic. In such contexts, businesses perceive SOEs from more liberalized home markets as more accustomed to market competition and thus are less likely to exert pressure on the host government against them. We also argue that furthering SOEs’ privatization mitigates SOEs’ political legitimacy deficit in host countries with a free-market logic, thus facilitating entry. In these contexts, host governments perceive more privatized SOEs as more independent from their home state due to reduced political connections. We find support for our arguments in a dataset of 97 telecom SOEs from 97 countries over the period 1990–2010. Our study advances research on SOEs’ internationalization and research on pro-market reforms and has relevant implications for managers and policymakers.

Résumé

Notre recherche vise à étudier comment les facteurs liés au pays d'origine peuvent modifier l'impact des conditions du pays d'accueil sur les décisions de localisation des entreprises publiques (State-Owned Enterprises – SOEs). Plus précisément, nous examinons le rôle des réformes du pays d'origine en faveur du marché dans la facilitation de l'entrée des SOEs dans les pays d'accueil ayant une logique de marché libre. Nous considérons deux types de réformes favorables au marché dans le pays d'origine : la libéralisation du marché et la privatisation. Nous proposons que la libéralisation du marché intérieur atténue principalement le déficit de légitimité des SOEs sur le marché et facilite leur entrée dans les pays d'accueil où la logique de marché libre est prédominante. Dans de tels contextes, les entreprises perçoivent les SOEs des marchés d'origine plus libéralisés comme étant plus habituées à la concurrence commerciale et sont donc moins susceptibles d'exercer des pressions sur le gouvernement du pays d'accueil à leur encontre. Nous argumentons également que la poursuite de la privatisation des SOEs atténue leur déficit de légitimité politique dans les pays d'accueil ayant une logique de marché libre, facilitant ainsi leur entrée sur le marché. Dans ces contextes, les gouvernements d'accueil perçoivent les SOEs plus privatisées comme plus indépendantes de leur État d'origine en raison de la réduction de leurs liens politiques. Nos arguments sont confirmés par un ensemble de données de 97 SOEs de télécommunications de 97 pays au cours de la période 1990–2010. Notre recherche fait progresser les recherches sur l'internationalisation des SOEs et les réformes favorables au marché. Elle a des implications importantes pour les managers ainsi que pour les décideurs politiques.

Resumen

Estudiamos como los factores del país de origen pueden alterar el impacto de las condiciones del país anfitrión en las decisiones de ubicación de las empresas de propiedad estatal (SOEs por sus iniciales en inglés). Específicamente, examinamos el papel de las reformas a favor del mercado en el país de origen en facilitar la entrada de las empresas estatales a los países anfitriones con una lógica de libre mercado. Consideramos dos tipos de reformas pro-mercado en los países de origen: liberalización del mercado y privatización. Proponemos que la liberalización principalmente mitiga el déficit de legitimidad del mercado de las empresas estatales y facilita su entrada a países anfitriones con una lógica prominente de libre mercado. En estos contextos, los negocios perciben a las empresas estatales de mercados de origen más liberalizados como más acostumbradas a la competencia de mercados, y debido a esto, menos propensas a ejercer presión en el gobierno anfitrión en contra de estas. También argumentamos que avanzar en la privatización de las empresas estatales mitiga el déficit de legitimidad política de las empresas estatales en países con una lógica de libre mercado, con esto facilitando la entrada. En estos contextos, los gobiernos anfitriones perciben las empresas estatales más privatizadas como más independientes del estado de su país de origen debido a conexiones políticas atenuadas. Encontramos apoyo a nuestros argumentos en una base de datos de 97 empresas estatales de telecomunicación de 97 países en el periodo 1990–2010. Nuestro estudio avanza la investigación sobre la internacionalización de las empresas estatales y la investigación en reformas pro-mercado y tiene implicaciones relevantes para gerentes y formuladores de política.

Resumo

Estudamos como fatores do país de origem podem alterar o impacto de condições do país de acolhimento nas decisões de localização de empresas estatais (SOEs). Especificamente, examinamos o papel das reformas pró-mercado do país de origem na facilitação da entrada de empresas estatais em países de acolhimento com uma lógica de livre mercado. Consideramos dois tipos de reformas pró-mercado no país de origem: liberalização de mercado e privatização. Propomos que a liberalização do mercado no país de origem atenue principalmente o déficit de legitimidade de mercado de SOEs e facilite sua entrada em países de acolhimento com uma lógica proeminente de mercado livre. Em tais contextos, empresas consideram que SOEs de mercados mais liberalizados estão mais habituadas à concorrência de mercado e, portanto, são menos propensas a exercer pressão sobre o governo anfitrião contra elas. Também argumentamos que o avanço da privatização de SOEs atenue o déficit de legitimidade política de SOEs nos países de acolhimento com uma lógica de mercado livre, dessa forma facilitando a entrada. Nestes contextos, governos anfitriões consideram SOEs mais privatizadas mais independentes do seu Estado de origem devido à redução de conexões políticas. Encontramos apoio para nossos argumentos num conjunto de dados de 97 SOEs de telecomunicações de 97 países durante o período 1990–2010. Nosso estudo avança a pesquisa sobre a internacionalização de SOEs, bem como reformas pró-mercado, e tem implicações relevantes para gestores e formuladores de políticas públicas.

摘要

我们研究了母国因素如何改变东道国的国情对国有企业(SOE)选址决策的影响。具体而言, 我们考察了母国的亲市场改革在促进SOE以自由市场逻辑进入东道国的作用。我们考虑了两类母国亲市场改革: 市场自由化和私有化。我们提出, 母国市场自由化主要缓解SOE市场合法性赤字, 并促进其进入具有明显自由市场逻辑的东道国。在这种情境下, 企业认为来自更自由化的母国市场的SOE更习惯于市场竞争, 因此它们不太可能向反对它们的东道国政府施加压力。我们还认为, 进一步推进SOE私有化缓解了SOE在有自由市场逻辑的东道国的政治合法性赤字, 从而促进了进入。在这种情境下, 东道国政府认为, 由于政治关系的减少, 更多私有化的SOE更独立于其母国。我们在1990–2010年间来自97个国家的97家电信SOE数据集中找到了对我们论点的支持。我们的研究推进了SOE国际化研究和亲市场改革研究, 并对管理者和决策者具有相关启示。

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

State ownership confers an “advantage of stateness” in foreign markets (Cuervo-Cazurra & Li, 2021). It also exposes SOEs to a legitimacy deficit in institutional contexts where a free-market logic prevails (Knutsen et al., 2011; Ding et al., 2014). In these countries, host businesses and governments perceive SOEs negatively because SOEs can adopt anti-competitive practices thanks to their home country’s government support and are politically connected to their governments. These legitimacy challenges deter SOEs’ entry into these countries.

While extant research has enlightened the role of the host-country context in SOEs’ internationalization, it has remained disconnected from the conversation on the role that the home-country context plays (Estrin et al., 2016; Grogaard et al., 2019; Li et al., 2018; Li et al., 2014; Mariotti & Marzano, 2019). Specifically, how the home institutional context alters the perceived legitimacy deficit an SOE faces in host countries with a prominent free-market logic is an open question (Meyer et al., 2014).

To answer this question, we draw on research on SOEs’ internationalization (Cuervo-Cazurra et al., 2014; Estrin et al., 2016; Mariotti & Marzano, 2019; Meyer et al., 2014; Musacchio et al., 2015) and consider how home institutions alter the perception of SOEs and, therefore, their legitimacy in specific hosts (Cuervo-Cazurra, 2011; Grogaard et al., 2019; Li et al., 2014). We build on the argument that organizational legitimacy is conferred by social actors (Deephouse, 1996) and distinguish between the market and political legitimacy deficits SOEs face in host countries with free-market logic because of their state ownership. SOEs’ market legitimacy deficit refers to the negative perceptions of host businesses regarding the anti-competitive practices SOEs adopt thanks to their home government’s support (Cuervo-Cazurra et al., 2014; Mariotti & Marzano, 2019). SOEs’ political legitimacy deficit refers to host governments’ negative perceptions regarding the lack of transparency and independence of SOEs from their home governments due to SOEs’ political connections (Aharoni, 2018; Duanmu, 2014; Meyer et al., 2014). We relate these legitimacy deficits to home-country pro-market reforms: market liberalization and SOE privatization (Cuervo-Cazurr et al., 2019). Liberalization changes the market structure, whereas privatization targets the company structure.

We argue that higher home pro-market reforms ease SOEs’ entry into more liberalized host countries. First, SOEs from more liberalized home markets confront a lower market legitimacy deficit in host liberalized countries because host businesses perceive these SOEs as more accustomed to a free-market logic at home. Second, furthering SOE privatization reduces political legitimacy in host liberalized countries because host governments perceive these foreign investors as more transparent and independent from their home governments.

We used the global telecommunications industry between 1990 and 2010 as a “laboratory.” We relied on the reports of the International Telecommunications Union (ITU) to build a longitudinal sample of 97 former monopoly telecommunications firms, each from a different country. For these firms, we retrieved data from annual reports, company and government websites, home- and host-country data on the adoption of pro-market reforms from the ITU’s World Telecommunications/ICT Indicators database, and additional secondary data from different sources. Our findings support our arguments and are robust to additional estimations testing alternative explanations and sensitivity checks.

Our study contributes to a more systematic understanding of the role of institutions in SOEs’ foreign expansion by offering theoretical arguments on how home-country conditions can alter the effects of host-country factors in SOEs’ location decisions, which are critical to their competitiveness (Florida & Adler, 2022). It also adds to international business research on pro-market reforms by examining strategic decisions related to internationalization in response to the adoption of pro-market reforms both in the home and host country in a multi-country empirical setting. Finally, our operationalization of SOE privatization offers a methodological contribution.

Home-country institutions and SOEs’ entry decisions

SOEs are legally independent companies where the state has percentage ownership. Their existence is informed by a market and a political logic (Cuervo-Cazurra et al., 2014; Musacchio et al., 2015) because they can address market inefficiencies and imperfections and facilitate the protection of nascent industries and strategic sectors. The same logics inform SOEs’ internationalization (Clegg et al., 2018; Cuervo-Cazurra & Li, 2021), reflecting the desire of governments to increase national economic growth and strengthen the country’s prestige and power in the international arena.

While state ownership confers an “advantage of stateness” to SOEs expanding abroad, SOEs suffer a liability of stateness in foreign countries where institutions promote a free-market economy (Cuervo-Cazurra et al., 2014; Meyer et al., 2014). They lack “fit” with local cognitive, normative, and regulatory institutions and thus face legitimacy challenges (Cuervo-Cazurra et al., 2014; Musacchio et al., 2015).

First, the negative perceptions of host businesses regarding SOEs’ non-competitive behavior create a market legitimacy deficit. Second, the negative perceptions of host governments regarding SOEs’ home political connections create a political legitimacy deficit. Building on these arguments, research on SOEs’ internationalization has established that the higher the promotion of market economy in the host, the more likely state ownership deters entry (Cuervo-Cazurra et al., 2014; Knutsen et al., 2011; Meyer et al., 2014).

However, home-country pro-market reforms alter the market structure and the government’s participation in an SOE’s ownership, thus influencing the SOE’s home-country reputation and how the SOE is perceived abroad (Cuervo-Cazurra, 2011; Li et al., 2014). Specifically, market liberalization introduces competition into a sector by allowing domestic and foreign companies to set up new businesses, restricting government intervention and privileged market positions to particular actors. In these markets, SOEs must comply with conditions of fair competition without necessarily leveraging their state ownership. Instead, privatization refers to transferring any percentage of ownership in SOEs to the private sector and results in hybrid organizations characterized by public–private partnerships where the state may hold majority or minority shares.

High levels of home market liberalization are expected to mitigate the market legitimacy deficit of SOEs in more liberalized markets. In home countries with high levels of market liberalization, market mechanisms inform the state’s resource allocation and distribution systems (Peng & Heath, 1996). SOEs must rely on the market to access financial, human, and technology capital through competitive mechanisms, focus on financial performance, and adopt profit-maximizing strategies. They must confront domestic and foreign competitors in their home market and engage in competitive battles (Cuervo-Cazurra et al., 2014). Thus, SOEs have to become more accustomed to operating in competitive conditions. Consequently, businesses in more liberalized foreign countries will perceive SOEs from more liberalized home markets as competitors aligned with a free-market logic. As a result, they are less likely to pressure the host government against these entrants.

The political legitimacy deficit SOEs face in host countries with liberalized markets is expected to decline as privatization intensifies. SOEs with private ownership adopt corporate governance models that make them hybrid firms where independent directors and professional managers with (international) experience in the industry sit on the board (Bruton et al., 2015; Musacchio et al., 2015). These improved governance practices aim for greater transparency and independence of the decision-making process from government interference. They involve analysts and rating agencies who monitor managers’ actions (Cui & Jiang, 2012). Thus, managers of these hybrid firms become less inclined to pursue projects for political gains. The effect of SOEs’ privatization on their organizational culture and strategies becomes more evident the longer the time since the initial release of home state ownership and the more significant the reduction in state ownership. SOEs’ privatization is a dynamic process that leads to organizational and behavioral changes with some time lag (Ramamurti, 2000). Over time, including independent directors and professional managers on their board to avoid government interference and the pursuit of political goals becomes standard practice. Independent monitoring also becomes gradually routinized once private ownership is introduced, requiring the adjustment of organizational practices to greater transparency in business relationships. The adjustment becomes more compelling the more significant the reduction in state ownership. SOEs with higher private ownership provide greater insurance of independence from their governments’ political goals.

Taken together, these arguments suggest:

Hypothesis: The higher the level of home pro-market reforms, the lower the likelihood that state ownership will deter entry into countries with higher levels of market liberalization.

Method

Empirical context

We test our arguments in the context of the telecom industry over the period 1990–2010. The industry in this time window is an excellent laboratory for several reasons.

First, we can observe the internationalization of telecom SOEs since their inception. The industry was traditionally a monopoly, with a single national SOE offering the entirety of telecommunications services in each country. In the early 1990s, each national market began transforming into a competitive environment (Henisz et al., 2005), allowing foreign and local companies to enter.Footnote 1

Second, our focus on telecoms between the 1990s and 2010 allows us to follow the adoption and evolution of home pro-market reforms. In the early 1990s, the World Trade Organization (WTO) members committed to structural reforms to liberalize their telecommunications sector.Footnote 2 In this period, we can also observe host countries with varying levels of telecom market liberalization. Our decision to end the analysis in 2010 is motivated by global technological developments that came into full force after the first decade of the 2000s. The development of new technologies, such as voice over IP, and the convergence of different technologies (e.g., broadcasting, telecommunications, and imaging technology) downplayed the role of the institutional context in telecom SOEs’ internationalization, thus facilitating non-traditional entry modes (Brouthers et al., 2022; Meyer et al., 2023). Communications were increasingly occurring in cyberspace, and the traditional location-based notions underlying telecommunications operations, policies, and regulatory jurisdiction broke down. Companies could run cross-country operations without requiring a presence and a license to operate in the host, thereby limiting the role of home and host institutions in SOEs’ internationalization.

Third, SOEs’ market and political legitimacy in foreign markets are highly relevant in telecommunications, which has historically been considered a strategic sector for national security. The spreading adoption of pro-market reforms in the period under analysis raised concerns about the entry of foreign SOEs into host liberalized markets (Luo & Wang, 2012).

Fourth, the telecom industry has general relevance and potential for the broader applicability of our arguments. The industry shares many attributes with other industries (e.g., banking, electricity, and energy) where state ownership is relevant (Mariotti & Marzano, 2019). It has been at the forefront of the worldwide movement toward pro-market reforms in non-manufacturing (Henisz et al., 2005) and manufacturing industries (Nicoletti et al., 2003). Pro-market reforms in telecommunications have been associated with economy-wide pro-market reforms (Megginson & Netter, 2001; Nicoletti et al., 2003), productivity growth (Nicoletti et al., 2003), per-capita income growth (Ostry et al., 2009), investment, employment, and output (Bouis et al., 2020).

Sample and data

We developed our sample from the global universe of 196 countries reported by ITU. For every country, we identified the national state-owned monopoly in 1990 and collected yearly firm-level data for 1990–2010. We collected company annual report information and financial statements from companies’ websites, independent sources and depositories, and national regulatory authorities. We relied on multilingual coders and translation tools to translate material from a different language to English. We reverse-translated the data for accuracy and cross-checked them with the ITU’s World Telecommunication/ICT Indicators database. Our checks did not flag any potential concerns.

Data availability resulted in an initial sample of 97 firms, each from a different country worldwide. The remaining countries’ SOEs did not publish annual reports. Therefore, no information on their financial accounts and internationalization was available. Of 97 SOEs in our sample, 37 engaged in internationalization (38%). The other 60 remained domestic throughout the analysis (see Online Appendix A for sample countries).Footnote 3 During our sample period, the 37 SOEs showed varying state ownership and engaged in 313 entries in 136 countries.

We supplement firm-level data with home and host countries data from the World Bank’s World Development Indicators (WDI) and World Governance Indicators (WGI) databases, ITU’s World Telecommunications/ICT Indicators database, and the Centre d’Etudes Prospective et Information (CEPII). Due to missing observations, the sample was reduced to 120 total countries. Of these, 28 were home, 113 were host, and 21 were both home and host.

Measures

Dependent variable. Entry is equal to 1 for all host countries j where a firm i enters in a given year t from the pool of 113 alternative destination countries in our sample, 0 for non-entries.

Independent variables. We use percentage ownership to capture State ownership (Benito et al., 2016; Wang et al., 2012).

For Host liberalization, we use the ITU’s annual regulatory survey on competition policy and regulatory policy. We developed our variables by considering information related to (a) the opening of the different telecommunications market segments and (b) the establishment of independent regulatory authorities in each home and host country in our sample. We proceeded into three steps. First, in each host country for each year in our sample, we considered the opening of the market to competition in each of the 17 market segments reported in the survey (i.e., satellite TV, cable TV, cable modem, DSL, domestic fixed long distance, fixed satellite services, fixed wireless broadband, international fixed long distance, international gateways, internet services, leased lines, local fixed line services, mobile satellite services, mobile cellular, VSAT, wireless local loop, and mobile broadband). We assigned 1 to each of these if the market segment opened to competition, 0 otherwise. We computed the sum of these measures for each country in each year to count the number of open market segments. Second, for each host country in each year in our sample, we considered (1) the establishment of six separate authorities (i.e., competition, data protection, consumer protection, broadcasting and media, internet issues, telecom/ICT), (2) whether the ICT regulator was autonomous, and (3) whether significant market power was recognized in law. To each of these, we assigned 1 if it applied, 0 otherwise. We computed the sum of these measures for each country yearly to measure the overall regulatory and competition scrutiny. Third, for each host country, we calculated Host liberalization as the yearly average value of the two measures built in the previous steps. The variable captures the multidimensionality of liberalization and the temporal developments of pro-market reform.

To measure Home pro-market reforms, we followed prior literature (Giuliano et al., 2013; Ostry et al., 2009) and developed a combined index ranging between 0 and 1, with higher values indicating more significant reforms. The index is the arithmetic mean of the normalized measures of Home liberalization, which we built as the parallel host-country measure, and Home privatization, which we built using the information on state ownership releases derived from company annual reports. We proceeded into four steps. First, we resorted to the corporate governance literature (Lazzarini et al., 2020) and identified six percentage thresholds of released state ownership that describe specific ownership types, as illustrated in Online Appendix B. Second, we assigned an increasing value to each of the six ownership types, ranging from 0 denoting wholly state ownership to 5 denoting full privatization. Third, for each firm in each year, we considered the percentage of released state ownership and associated value and discounted the value by multiplying it by the inverse of the firm’s age, calculated as the difference between the current year and the year of the firm’s establishment. The rationale is that the older the firm is when it reaches a threshold of state equity release, the less the impact of the release on its political independence. This is because the embeddedness of the state in the firm’s organizational culture is stronger. In the fourth step, for each firm in each year, we calculated Home privatization as the yearly cumulative sum of the discounted values. The variable allows us to capture the furthering of privatization by accounting for the time it takes for a focal firm to move toward lower percentages of state ownership since privatization was initiated. It penalizes firms that move along this path more slowly. It also considers the differential impact of state ownership release across firms of different ages.

Firm-level controls. We resort to information from company annual reports to compute firm-level controls. Foreign shareholding control can provide the firm with foreign industry-specific knowledge and/or act as a third-party signal (Gregorič et al., 2021), thus facilitating SOEs’ entry for reasons other than a reduced legitimacy deficit. Thus, we include Foreign investor, which equals 1 if a foreign telecoms company owns a minority shareholding in the capital of the focal firm that exceeds 25%, 0 otherwise (Mariotti & Marzano, 2019).Footnote 4 To account for firm internationalization experience and overall firm experience, we use the firm’s number of foreign entries (FDI experience) (Delios et al., 2008) and the firm’s age (Firm age) (Duanmu, 2014), respectively. We control for Firm size using the logarithm of total assets (Estrin et al., 2016). We include Home market share calculated as the firm market share averaged across the segments of fixed-voice and mobile telephony (Ros, 1999).Footnote 5 We also include Leverage, calculated as the total debt to shareholders’ equity, to account for the ability of the firm to finance internationalization and Technological ability using the yearly cumulative number of patents published by the firm (source: Clarivate Analytics’ Derwent Innovations Index). Finally, we control for the firm’s preferred choice of entry mode using its cumulative percentage of joint venture entries over its total entries (JVs percentage). Entry modes entailing more significant equity, such as greenfield investments and acquisitions, are associated with higher control and higher market legitimacy deficit than entry modes entailing lower equity, such as JVs (Yiu & Makino, 2002).

Host-country level controls. To rule out that firm entry may have resulted from political reciprocity between home and host, we include Host incumbent already in home, which equals 1 if a company entered a host country whose incumbent company previously entered the home country, 0 otherwise. To disentangle the effects of host market liberalization from those of the country’s overall quality of institutions, we control for Host institutional quality using the mean value of the six World Bank WGI (Santangelo, 2018). To account for the overall host market potential, we use the logarithmic transformation of the Host population (source: WDI). We use a binary control for whether private investors participate in the host country’s incumbent operator’s shareholding (Private investor in host incumbent) and control for Host market share, calculated akin to Home market share.Footnote 6 We include host-country fixed effects to account for unobserved host-country factors.

Home-country level controls. To single out the effect of pro-market reforms in telecoms, we account for macro-level Home institutional quality, measured as the corresponding variable for the host. We also control for the home country’s propensity to internationalize using the ratio of outward FDI to GDP (Home country percentage of FDI to GDP) (source: WDI). In countries with higher FDI outflows, firms may benefit from their domestic business network in their internationalization process (Johanson & Vahlne, 2009).

Home–host dyad controls. We account for Institutional distance using the home and host-country WGI in the Kogut and Singh (1988) index. We control for the Geographic distance (in kilometers) between home and host capital cities (Duanmu, 2014) (source: CEPII). We use binary measures to account for Linguistic distance and Colonial ties between home and host (source: CEPII). To rule out that SOEs’ entry might be attributed to their ability to capitalize on political connections (Benito et al., 2016), we use the “Idealpoint” measure by Bailey et al. (2017) that captures the convergence of nations’ foreign political preferences. We take the absolute value of the difference between a home and a host Idealpoint values to measure Political distance. Table 1 reports descriptive statistics and the correlations matrix.

Empirical strategy

To model firm location decisions, we use a conditional logit analysis (McFadden, 1984), which estimates the decision of firm i to locate its operations in country j in year t with j= 1, 2, …, 113 and t = 1990, …, 2010. We clustered the standard errors to account for multiple entries by the same firm. We lagged all independent variables by 1 year to account for simultaneity issues.

Not all sample firms internationalize during the period under analysis. To deal with a potential self-selection endogeneity issue in internationalization, we estimate a two-step Heckman selection model (Heckman, 1979) and use host GDP per capita as an exclusion restriction. The underlying logic is that larger economies have a larger domestic market size for firms to explore business opportunities. Thus, firms originating in smaller economies are more likely to internationalize than firms from larger economies (He & Cui, 2012). However, the size of the economy does not influence which country these firms will enter. We use a probit model in the first step to estimate the likelihood of internationalization during the sample period (see Table 2). Based on the results of this estimation, we calculate the Inverse Mills’ ratio and include it as an additional control in the conditional logit model. As host-country covariates are not included in the first estimation, we avoid perfect linearity between the two steps.

Results

Table 2 reports the results of the conditional logit estimations. Model 1 includes the controls. Model 2 adds State ownership, and Model 3 the interaction between Host liberalization and State ownership. Model 4 adds the interactions State ownership × Host liberalization, State ownership × Home pro-market reforms, and Host liberalization × Home pro-market reforms, and the three-way interaction State ownership × Host liberalization × Home pro-market reforms to test our hypothesis.

Model 3 confirms the baseline argument that state ownership deters entry into liberalized host markets because of the perceived market and political legitimacy deficits. The coefficient of State ownership × Host liberalization is negative and statistically significant (β = – 0.002; se = 0.001; p = 0.005), suggesting that firms are less likely to enter countries with higher market liberalization levels as state ownership increases. We discuss this result in Online Appendix C.

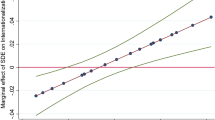

Model 4 tests our hypothesis. The interaction State ownership × Host liberalization × Home pro-market reforms is positive and statistically significant (β = 0.019; se = 0.006; p = 0.004), suggesting that Home pro-market reforms mitigates the negative impact of State ownership on the probability of entry into more liberalized countries. This evidence supports our hypothesis. We graph the effects of the interaction term considering hypothetical cases of “Low” (1 SD below the sample mean) and “High” (1 SD above the sample mean) State ownership in Fig. 1a, b, respectively. We illustrate how Home pro-market reforms alter the effect of Host liberalization on the location decisions of firms with a low vis-à-vis high State ownership. The confidence intervals suggest that the interaction effects are, in their majority, statistically significant.

Figure 1a considers the location decisions of firms with “Low” State ownership. A “Low” State ownership firm from a country with “High” Home pro-market reforms exhibits an increasing probability of entry as Host liberalization increases (i.e., from 0.53% to 0.59%). A comparable firm from a country with “Low” Home pro-market reforms exhibits, too, an increasing probability of entry as Host liberalization increases (i.e., from 0.56% to 0.1%). Figure 1b considers the location decisions of firms with “High” State ownership. A “High” State ownership firm from a country with “High” Home pro-market reforms exhibits an increasing probability of entry as Host liberalization increases (i.e., from 0.1% to 0.3%). Conversely, a comparable firm from a country with “Low” Home pro-market reforms exhibits a decreasing probability of entry as Host liberalization increases (i.e., from 0.5 to 0.3%). These findings are consistent with our hypothesis.

Different home pro-market reforms and identification of the mechanisms

Countries may commit to liberalization and privatization independently, affecting the market and political legitimacy deficits that SOEs face in foreign countries differently.

First, we disentangled these effects by running separate analyses for home liberalization and privatization. The results and relative graphs are reported in Online Appendix D. They confirm that both home pro-market reforms mitigate the negative effect of high state ownership on the likelihood of entry into host countries with a more liberalized market.

Second, we run additional estimations to identify the market and political legitimacy deficit mechanisms related to home liberalization and privatization, respectively. We discuss our identification strategy and show support for our mechanisms in Online Appendix E.

Robustness and sensitivity tests

We assess the sensitivity of our results to alternative estimation methods, samples, measures, and additional controls. All alternative estimations confirm our baseline results (see Online Appendix F).

Rare events. The small number of entry decisions reported in our data might cause a rare event bias. To rule out this bias, we re-estimated our models following King and Zeng (2001) and Firth (1993).

Alternative sample. Chinese SOEs arguably score high in both market and political legitimacy deficits (Meyer et al., 2014). We excluded China Telecom from our sample to rule out that outliers did not drive our findings.

Alternative measures. We replaced our Political distance measure with the political distance variable developed by Berry et al. (2010).

Additional controls. We account for additional host and home controls, such as the POLCON index of political constraints (Henisz, 2002) and the Economic Freedom Index of the Heritage Foundation (Clegg et al., 2018). We also control for the psychic distance between home and host (source: Dow & Karunaratna, 2006).

Discussion

We study how home-country factors can alter the effects of host-country conditions on SOEs’ location decisions. We argue and empirically show in the context of the global telecom industry that the higher the level of home pro-market reforms, the lower the likelihood that state ownership will deter entry into countries with higher levels of market liberalization. Our study contributes to the literature on SOE internationalization and international business research on pro-market reforms.

We offer a more systematic understanding of the phenomenon of SOE internationalization by connecting the work that has studied SOEs’ entry into countries with free-market logic (Knutsen et al., 2011; Li et al., 2014; Meyer et al., 2014) with the stream that has investigated the role of home-country institutions in SOEs’ foreign expansion (Estrin et al., 2016; Grogaard et al., 2019; Li et al., 2018; Mariotti & Marzano, 2019, 2020). Each of these streams has assumed homogeneity of home and host-country institutions. By jointly considering heterogeneous home and host institutions, our study spells out theoretically relevant boundary conditions of SOEs’ internationalization in countries with a prevailing free-market logic. In these countries, SOEs suffer from distinctive legitimacy deficits deriving from negative perceptions of host businesses and governments. The type of legitimacy deficit that is more or less relevant when SOEs enter host countries with distinctive institutional logic depends on SOEs’ home institutions. Thus, the ease of internationalization of SOEs in specific institutional contexts is contingent on home institutional conditions that can mitigate host-country actors’ negative perceptions of state ownership.

We contribute to international business research on pro-market reforms (Cuervo-Cazurra et al., 2019) that has primarily considered home-country pro-market reforms’ influence on firm strategy in a single country or region. Our study illuminates the relevance of host-country diversity in adopting home pro-market reforms. We argue and empirically show that home-country pro-market reforms may facilitate firm internationalization in specific hosts depending on the market liberalization of these countries. The principal theoretical implication of our study is that origin and destination countries are instrumental in building a theory about the role of pro-market reforms in the international context. Our cross-country analysis allows the applicability of our arguments beyond specific countries or regions, thus contributing to systematic theorizing of the role of home and host reforms in a firm’s international expansion. Finally, we offer a methodological contribution by developing a measure of SOE privatization that accounts for SOEs’ ownership type and temporal ownership release.

Future research can build on our study. Our analysis is framed within the telecom industry that serves the purpose of the study, and shares several similarities with other sectors where SOEs dominate. Our time window ended in 2010 due to the global technological development that occurred in the industry afterward. There is scope to explore more recent years by considering the role of institutions in connection to the development of new technologies.

Moreover, we included a comprehensive set of controls in our model, assessed the robustness and sensitivity of our results, accounted for potential sample selection bias, and graphically presented the (somewhat small) economic significance of the effects. However, we cannot rule out omitted variable bias entirely. For example, we cannot fully exclude that home market liberalization triggers SOE competitiveness, thus facilitating entry into more liberalized host countries. Future research could explore this channel. Notwithstanding these limitations, we are confident that our study will stimulate research that deepens our knowledge of this phenomenon along several dimensions.

Our study has practical implications. It suggests to policymakers that specific home pro-market reforms influence host-country stakeholders’ perceptions, and comprehensive pro-market reforms are required to sustain SOEs’ internationalization in the long term. Likewise, managers need to address the concerns of relevant host stakeholders by signaling an ability to play by the rules of a liberalized market and independence from their government.

Notes

Entry in low liberalized telecom markets was an option over the entire period considered. In these markets, governments allowed the acquisition of percentages of shareholding of the national SOE by foreign firms to capitalize on the SOE profit streams and raise immediate revenues to cover national debt. To account for these instances, in our empirical analysis we control for entry mode.

https://www.wto.org/english/news_e/pres97_e/data3.htm, accessed on 01/08/2022.

We account for potential self-selection issues using a two-step Heckman selection model as illustrated in our empirical strategy.

We use a binary variable to control for Foreign ownership because of the high correlation between the percentage of foreign ownership and SOE (r = 0.75). When we re-estimate our main model with the continuous variable, our results are confirmed.

To measure market shares, we use the number of customers served rather than revenue. Our choice is motivated by data limitations and by the fact that incumbents’ revenues have historically been regulated or subsidized, thus making cross-country comparisons unreliable.

Information is not available for all host countries in our sample. Thus, we filled missing values using the yearly average market share of the overall sample. The distribution of the variable shows a trend of a decreasing market share of former monopolies over time that is consistent with the expectation of market share decrease for incumbents as pro-market reforms further. To rule out that the inclusion of this variable may drive our results, we exclude it and re-run the model. Our findings are confirmed.

References

Aharoni, Y. (2018). The evolution of state-owned multinational enterprise theory. In A. Cuervo-Cazurra (Ed.), State-owned multinationals: Governments in global business. Palgrave MacMillan.

Bailey, M. A., Strezhnev, A., & Voeten, E. (2017). Estimating dynamic state preferences from united nations voting data. Journal of Conflict Resolution, 61(2), 430–456.

Benito, G. R., Rygh, A., & Lunnan, R. (2016). The benefits of internationalization for state-owned enterprises. Global Strategy Journal, 6(4), 269–288.

Berry, H., Guillén, M. F., & Zhou, N. (2010). An institutional approach to cross-national distance. Journal of International Business Studies, 41(9), 1460–1480.

Bouis, R., Duval, R., & Eugster, J. (2020). How fast does product market reform pay off? New evidence from non-manufacturing industry deregulation in advanced economies. Journal of Comparative Economics, 48(1), 198–217.

Brouthers, K. D., Chen, L., Li, S., & Shaheer, N. (2022). Charting new courses to enter foreign markets: Conceptualization, theoretical framework, and research directions on non-traditional entry modes. Journal of International Business Studies, 53(9), 2088–2115.

Bruton, G. D., Peng, M. W., Ahlstrom, D., Stan, C., & Xu, K. H. (2015). State-owned enterprises around the world as hybrid organizations. Academy of Management Perspectives, 29(1), 92–114.

Clegg, L. J., Voss, H., & Tardios, J. A. (2018). The autocratic advantage: Internationalization of state-owned multinationals. Journal of World Business, 53(5), 668–681.

Cuervo-Cazurra, A. (2011). Global strategy and global business environment: The direct and indirect influences of the home country on a firm’s global strategy. Global Strategy Journal, 1(3–4), 382–386.

Cuervo-Cazurra, A., Gaur, A., & Singh, D. (2019). Pro-market institutions and global strategy: The pendulum of pro-market reforms and reversals. Journal of International Business Studies, 50(4), 598–632.

Cuervo-Cazurra, A., Inkpen, A., Musacchio, A., & Ramaswamy, K. (2014). Governments as owners: State-owned multinational companies. Journal of International Business Studies, 45(8), 919–942.

Cuervo-Cazurra, A., & Li, C. (2021). State ownership and internationalization: The advantage and disadvantage of stateness. Journal of World Business, 56(1), 101112.

Cui, L., & Jiang, F. M. (2012). State ownership effect on firms’ FDI ownership decisions under institutional pressure: a study of Chinese outward-investing firms. Journal of International Business Studies, 43(3), 264–284.

Deephouse, D. L. (1996). Does isomorphism legitimate? Academy of Management Journal, 39(4), 1024–1039.

Delios, A., Gaur, A. S., & Makino, S. (2008). The timing of international expansion: Information, rivalry and imitation among Japanese firms, 1980–2002. Journal of Management Studies, 45(1), 169–195.

Dow, D., & Karunaratna, A. (2006). Developing a multidimensional instrument to measure psychic distance stimuli. Journal of International Business Studies, 37(5), 578–602.

Duanmu, J. L. (2014). State-owned MNCs and host country expropriation risk: The role of home state soft power and economic gunboat diplomacy. Journal of International Business Studies, 45(8), 1044–1060.

Estrin, S., Meyer, K. E., Nielsen, B. B., & Nielsen, S. (2016). Home country institutions and the internationalization of state-owned enterprises: A cross-country analysis. Journal of World Business, 51(2), 294–307.

Firth, D. (1993). Bias reduction of maximum-likelihood-estimates. Biometrika, 80(1), 27–38.

Florida, R., & Adler, P. (2022). Locational strategy: Understanding location in economic geography and corporate strategy. Global Strategy Journal, 12(3), 472–487.

Giuliano, P., Mishra, P., & Spilimbergo, A. (2013). Democracy and reforms: Evidence from a new dataset. American Economic Journal-Macroeconomics, 5(4), 179–204.

Gregorič, A., Rabbiosi, L., & Santangelo, G. D. (2021). Diaspora ownership and international technology licensing by emerging market firms. Journal of International Business Studies, 52(4), 671–691.

Grogaard, B., Rygh, A., & Benito, G. R. G. (2019). Bringing corporate governance into internalization theory: State ownership and foreign entry strategies. Journal of International Business Studies, 50(8), 1310–1337.

He, X., & Cui, L. (2012). Can strong home country institutions foster the internationalization of MNEs? Multinational Business Review, 20(4), 352–375.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Henisz, W. J. (2002). The institutional environment for infrastructure investment. Industrial and Corporate Change, 11(2), 355–389.

Henisz, W. J., Zelner, B. A., & Guillén, M. F. (2005). The worldwide diffusion of market-oriented infrastructure reform, 1977–1999. American Sociological Review, 70(6), 871–897.

Johanson, J., & Vahlne, J.-E. (2009). The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership. Journal of International Business Studies, 40(9), 1411–1431.

King, G., & Zeng, L. (2001). Logistic regression in rare events data. Political Analysis, 9(2), 137–163.

Knutsen, C. H., Rygh, A., & Hveem, H. (2011). Does state ownership matter? Institutions’ effect on foreign direct investment revisited. Business and Politics, 13(1), 1–31.

Kogut, B., & Singh, H. (1988). The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19(3), 411–432.

Lazzarini, S. G., Mesquita, L. F., Monteiro, F., & Musacchio, A. (2020). Leviathan as an inventor: An extended agency model of state-owned versus private firm invention in emerging and developed economies. Journal of International Business Studies, 52(4), 560–594.

Li, J., Xia, J., Shapiro, D., & Lin, Z. Y. (2018). Institutional compatibility and the internationalization of Chinese SOEs: The moderating role of home subnational institutions. Journal of World Business, 53(5), 641–652.

Li, M. H., Cui, L., & Lu, J. Y. (2014). Varieties in state capitalism: Outward FDI strategies of central and local state-owned enterprises from emerging economy countries. Journal of International Business Studies, 45(8), 980–1004.

Luo, Y., & Wang, S. L. (2012). Foreign direct investment strategies by developing country multinationals: A diagnostic model for home country effects. Global Strategy Journal, 2(3), 244–261.

Mariotti, S., & Marzano, R. (2020). Relational ownership, institutional context, and internationalization of state-owned enterprises: When and how are multinational co-owners a plus? Global Strategy Journal, 10(4), 779–812.

Mariotti, S., & Marzano, R. (2019). Varieties of capitalism and the internationalization of state-owned enterprises. Journal of International Business Studies, 50(5), 669–691.

McFadden, D. L. (1984). Econometric analysis of qualitative response models. Handbook of Econometrics, 2, 1395–1457.

Megginson, W. L., & Netter, J. R. (2001). From state to market: A survey of empirical studies on privatization. Journal of Economic Literature, 39(2), 321–389.

Meyer, K. E., Ding, Y., Li, J., & Zhang, H. (2014). Overcoming distrust: How state-owned enterprises adapt their foreign entries to institutional pressures abroad. Journal of International Business Studies, 45(8), 1005–1028.

Meyer, K. E., Li, J., Brouthers, K. D., & Jean, R. (2023). International business in the digital age: Global strategies in a world of national institutions. Journal of International Business Studies, 54(4), 577–598.

Musacchio, A., Lazzarini, S. G., & Aguilera, R. V. (2015). New varieties of state capitalism: Strategic and governance implications. Academy of Management Perspectives, 29(1), 115–131.

Nicoletti, G., Scarpetta, S., & Lane, P. R. (2003). Regulation, productivity and growth – OECD evidence. Economic Policy, 18(36), 9–72.

Ostry, M. J. D., Prati, M. A., & Spilimbergo, M. A. (2009). Structural reforms and economic performance in advanced and developing countries. International Monetary Fund.

Peng, M. W., & Heath, P. S. (1996). The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Academy of Management Review, 21(2), 492–528.

Ramamurti, R. (2000). A multilevel model of privatization in emerging economies. Academy of Management Review, 25(3), 525–550.

Ros, A. J. (1999). Does ownership or competition matter? The effects of telecommunications reform on network expansion and efficiency. Journal of Regulatory Economics, 15(1), 65–92.

Santangelo, G. D. (2018). The impact of FDI in land in agriculture in developing countries on host country food security. Journal of World Business, 53(1), 75–84.

Wang, C. Q., Hong, J., Kafouros, M., & Wright, M. (2012). Exploring the role of government involvement in outward FDI from emerging economies. Journal of International Business Studies, 43(7), 655–676.

Yiu, D., & Makino, S. (2002). The choice between joint venture and wholly owned subsidiary: An institutional perspective. Organization Science, 13(6), 667–683.

Acknowledgements

The authors are grateful to the Consulting Editor, Ajai Gaur, and three anonymous reviewers for their valuable guidance and constructive feedback during the review process. Earlier versions of the manuscript benefited from feedback from participants at the EIBA 2019 conference in Leeds and the AIB 2021 online conference. Any errors are our own.

Funding

Open access funding provided by the Cyprus Libraries Consortium (CLC).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Accepted by Ajai Gaur, Consulting Editor, October 12, 2023. This article has been with the authors for three revisions.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Santangelo, G.D., Symeou, P.C. The internationalization of state-owned enterprises in liberalized markets: the role of home-country pro-market reforms. J Int Bus Stud 55, 638–651 (2024). https://doi.org/10.1057/s41267-023-00668-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41267-023-00668-1