Abstract

We experimentally study how receiving information about tax compliance of others affects individuals’ occupational choices and subsequent evading decisions. In one treatment individuals receive information about the highest tax evasion rates of others in past experimental sessions with no such social information; in another treatment they receive information about the lowest tax evasion rates observed in the past sessions with no such social information. We observe an asymmetric effect of social information on tax compliance. Whereas examples of high compliance do not have any disciplining effect, we find evidence that examples of low compliance significantly increase tax evasion for certain audit probabilities. No major differences are found across countries.

Similar content being viewed by others

Notes

This has been observed in various fields, such as schools achievements (Sacerdote 2001; Zimmerman 2003), recreational activities(Bramoullé et al. 2009), contribution to public goods (Fischbacher et al. 2001), consumption (Moretti 2011), labor supply (Aaronson et al. 1999), effort at work (Falk and Ichino 2006; Mas and Moretti 2009; Bandiera et al. 2009; Beugnot et al. 2013), quitting decisions (Rosaz et al. 2012), participation in retirement plans (Saez and Duflo 2003), or criminal activities (Glaeser et al. 1996; Keizer et al. 2008).

For an application of reference-dependent preferences to reporting behavior, see Heinemann and Kocher (2013) who study the impact of a regime shift from a progressive toward a proportionate tax tariff on tax evasion.

In Gerxhani and Schram (2006) the expected gross income is also higher in the salaried job than in the self-employed job.

This aims at capturing the fact that in salaried jobs tax evasion is made impossible by the fact that employers report the wage paid to the employees to the tax authorities.

Alternatively, we could have asked the players to choose the amount to be reported. For the sake of simplicity, we only offered a binary choice.

In our experiment, like in most experiments on tax evasion, audit probabilities are higher than in the field. We note, however, that we are mainly interested in identifying how behavior adjusts to variations in the audit probabilities and not so much in its precise values. Moreover, tax authorities are usually not revealing the true audit probabilities (Alm 1988). Hence, perceived audit probabilities are largely subjective and may be overweighed by individuals.

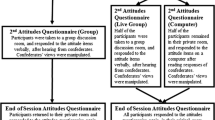

The instructions said: “You also receive information on the decisions of participants who in some previous experiments were in the same conditions as you are now.More precisely, before making your decision, you are informed on the proportion of participants who chose the salaried job and the proportion of those who chose the self-employed job in previous experiments for the same audit probability and the same fixed amount of the fine as you.” They also stated: “In these previous experiments the rules were the same as in this experiment, except that the participants did not have such information.” We have chosen this phrasing carefully in order to avoid deception. We did not inform subjects that they saw extreme values of previous sessions, but according to Hey (1998) and Hertwig and Ortman (2008) withholding information should not be considered as deception, whereas providing subjects with wrong information should be viewed as deception. Moreover, fully disclosing that the information contained extreme values would have confounded the comparison between the two conditions, because the informational contend would have been different. Our subjects received exactly the same instructions in both conditions of the social information treatment. Comparing the effect of explicit versus implicit social information is, however, an interesting question which could be explored in future research. See also Jamison et al. (2008) for an interesting study on the negative impact of using deception regarding the identity of interacting partners.

The two conditions are directly comparable, since we used the same instructions. Only the indicated proportions can possibly influence behavior. This would not have been possible if we had indicated that these proportions correspond to minimum or maximum values.

Subjects made ten successive choices between two paired lotteries, “option A” and “option B” (see online appendix). The payoffs for option A are either €2 or €1.60 and those for the riskier option B are either €3.85 or €0.10. In the first decision, the high payoff in both options has a probability of one tenth, and this probability increases by steps of one tenth as the number of the decision increases. Risk neutrality should lead subjects to cross-over from option A to option B at the fifth decision, while risk-loving individuals are expected to switch earlier and risk-averse individuals later.

In particular, we asked subjects to which extent they find a series of behaviors related to fraud acceptable or not using a ten-point Likert-type scale (see online appendix).

Subjects had to rate on a scale from 1 to 6 their feelings regarding the degree of acceptability of statements about tax fraud (see online appendix).

These predictions hold for any income level. Hence, learning one’s own actual income should not change the decision to report or not to report it. However, for the minimum gross income of 150 points, \(F\) = 75 and \(p=1/4\), the subjects should be indifferent between reporting or not, as the expected earnings are 112.50 in both cases.

In Lyon and Maastricht, we could use experimental labs. In Leuven and Liège, we used large lecture halls and a mobile lab, with enough space between participants to ensure confidentiality of decisions.

We used notions like income, tax, audit, and fine. The instructions did not include any loaded terms such as fraud, cheating, or tax evasion.

All Mann-Whitney non-parametric tests reported in this paper are two-tailed. The mean choice of each subject across periods is taken as one independent observation.

The difference between Wallonia and the Netherlands is no longer significant when we correct \(p\)-values for multiple testing.

We include random effects to control for the lack of independence between observations, because each individual is observed 30 times. The use of a panel method is justified, as confirmed by the significance of the \(\rho \) coefficient in table 4 which rejects the inexistence of unobserved individual level heterogeneity. Another way of correcting for the lack of independence of observations within individuals would be to consider our panel as a special case of clustered data such that errors are correlated over time for a given individual. This approach has, however, the disadvantage of being less efficient. In the appendix (Table 5) we provide estimation results of this approach and find that the results are similar to those presented here.

We do not use the actual proportions of those who have chosen the self-employment job or the proportions of evasion presented to the subjects, since they were absent in the No-Information treatment. Moreover information on past tax evasion was only presented to those who chose the self-employment occupation. By introducing dummy variables for the Info-Min and the Info-Max conditions, we directly control for the effect of receiving information on peers’ “good” and “bad” behavior.

Only ten subjects switched more than once between the two option choices in the Holt and Laury task. In case of multiple switches, the safety index has been calculated as the mean switching point. We have also performed the same estimation when withdrawing the observations from these ten individuals; the results are qualitatively the same.

We also tested for interaction effects between risk attitude (as given by the Holt and Laury test) and the social information conditions as well as for interaction effects between risk attitude, social information conditions, and the audit probability. The results showed that those who are more risk averse are less likely to evade when they are given good examples of compliance than those who are less risk averse. On the other hand, those who are more risk averse are more inclined to evade tax, when the audit probability is higher, and they receive information on low level of compliance. These regression results are available upon request.

This variable is coded 1 if the subject has agreed or strongly agreed with the following statement: “The rich have to pay too much taxes”, and 0 otherwise.

The three statements are “Almost every taxpayer would cheat to some extent if s/he thought s/he could get away with it” (labeled “Cheat if get away” hereafter); “Being paid in cash for a job and then not reporting it on your tax form” (labeled “Pay in cash” hereafter); “Someone evades taxes by not or only partially declaring income” (labeled “Tax evasion” hereafter). The first two statements are taken from the TOS survey and are rated on a scale from 1 (perfectly acceptable) to 6 (perfectly unacceptable). The last statement is taken from the Eurobarometer and is rated in the opposite direction from 1 (absolutely unacceptable) to 10 (absolutely acceptable).

We thank an anonymous reviewer for these suggestions.

References

Allingham, M., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(3–4), 323–338.

Alm, J. (1988). Uncertain tax policies, individual behavior, and welfare. American Economic Review, 78, 237–245.

Alm, J., Sanchez, I., & de Juan, A. (1995). Economic and non-economic factors in tax compliance. Kyklos, 48, 3–18.

Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology, 27, 224–246.

Alm, J. (2012). Measuring, explaining and controlling tax evasion: Lessons from theory, experiments, and field studies. International Tax and Public Finance, 19(1), 54–77.

Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36, 818–860.

Baldry, J. C. (1986). Tax evasion is not a gamble. Economics Letters, 22, 333–335.

Bandiera, O., Barankay, I., & Rasul, I. (2009). Social connections and incentives in the workplace: Evidence from personnel data. Econometrica, 77(4), 1047–1094.

Bellemare, C., Lepage, P., & Shearer, B. (2010). Peer pressure, incentives, and gender: An experimental analysis of motivation in the workplace. Labour Economics, 17(1), 276–283.

Beugnot, J., Fortin, B., Lacroix, G., Villeval, M. C. (2013). Social network and peer effects at work. IZA Discussion Paper 7521, Bonn.

Bramoullé, Y., Djebbari, H., & Fortin, B. (2009). Identification of peer effects through social networks. Journal of Econometrics, 150, 41–55.

Cohen, M., Jaffray, J.-Y., & Said, T. (1987). Experimental comparison of individual behavior under risk and under uncertainty for gains and losses. Organizational Behavior and Human Decision Processes, 39, 1–22.

Coricelli, G., Joffily, M., Montmarquette, C., & Villeval, M. C. (2010). Cheating, emotions and rationality: An experiment on tax evasion. Experimental Economics, 13, 226–247.

Cummings, R. G., Martinez-Vazquez, J., McKee, M., & Torgler, B. (2009). Tax morale affects tax compliance: Evidence from surveys and artefactual field experiments. Journal of Economic Behavior and Organization, 70(3), 447–457.

Dubin, J. A., Graetz, M. J., & Wilde, L. L. (1990). The effect of audit rates on the federal individual income tax, 1977–1986. National Tax Journal, 43(4), 395–409.

European Commission. (2007). Survey on undeclared work in the European Union, Eurobarometer special 284, Luxemburg.

Falk, A., & Ichino, A. (2006). Clean evidence on peer pressure. Journal of Labor Economics, 24(1), 39–57.

Fellner, G., Sausgruber, R., & Traxler, C. (2013). Testing enforcement strategies in the field: Threat, moral appeal and social information. Journal of the European Economic Association, 11(3), 634–660.

Fischbacher, U., Gächter, S., & Fehr, E. (2001). Are people condtionally cooperative? Evidenc from a public goods experiments. Economic Letters, 71(3), 397–404.

Fonseca, M.A., and G. Myles (2012). Experimental evidence on taxpayer compliance: Evidence from students and taxpayers. Research Report 198, University of Exeter.

Fortin, B., Lacroix, G., & Villeval, M. C. (2007). Tax evasion and social interactions. Journal of Public Economics, 91(11–12), 2089–2112.

Frederick, S. (2005). Cognitive reflection and decision making. Journal of Economic Perspectives, 19(4), 25–42.

Friedland, N., Maital, S., & Rutenberg, A. (1978). A simulation study of income tax evasion. Journal of Public Economics, 10, 107–116.

Galbiati, R., & Zanella, G. (2012). The tax evasion social multiplier: Evidence from Italy. Journal of Public Economics, 96(5–6), 485–494.

Gerxhani, K., & Schram, A. (2006). Tax evasion and income source: A comparative experimental study. Journal of Economic Psychology, 27(3), 402–422.

Glaeser, E., Sacerdote, B., & Scheinkman, J. (1996). Crime and social interaction. The Quarterly Journal of Economics, 111(2), 507–548.

Gordon, J. P. F. (1989). Individual morality and reputation costs of deterrents to tax evasion. European Economic Review, 33, 797–805.

Greiner, B. (2004). An Online Recruitment System for Economic Experiments. In K. Kremer, V. Macho (Eds.), Forschung und wissenschaftliches Rechnen 2003 (pp. 79–93). GWDG Bericht 63; Göttingen: Ges. für Wiss. Datenverarbeitung.

Halla, M., & Schneider, F. G. (2013). Taxes and benefits: Two options to cheat on the state. Oxford Bulletin of Economics and Statistics. doi:10.1111/obes.12024.

Heinemann, F., & Kocher, M. (2013). Tax compliance under tax regime changes. International Tax and Public Finance, 20(2), 225–246.

Hertwig, R., & Ortman, A. (2008). Deception in experiments: Revisiting the arguments in its defense. Ethics and Behavior, 18(1), 59–92.

Hey, J. D. (1998). Experimental economics and deception. A comment. Journal of Economic Psychology, 19, 397–401.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

Jamison, J., Karlan, D., & Schechter, L. (2008). To deceive or not to deceive: The effect of deception on behavior in future laboratory experiments. Journal of Economic Behavior & Organization, 68, 477–488.

Keizer, K., Lindenberg, S., & Steg, L. (2008). The spreading of disorder. Science, 322, 1681–1685.

Kim, Y. (2003). Income distribution and equilibrium multiplicity in a stigma-based model of tax evasion. Journal of Public Economics, 87, 1591–1616.

Kirchler, E. (2007). The economic psychology of tax behaviour. Cambridge: Cambridge University Press.

Lewis, A., Carrera, S., Cullis, J., & Jones, P. (2009). Individual, cognitive and cultural differences in tax compliance: UK and Italy compared. Journal of Economic Psychology, 30(3), 431–445.

Manski, C. F. (1993). Identification of endogenous social effects: The reflection problem. Review of Economic Studies, 60(3), 531–542.

Mas, A., & Moretti, E. (2009). Peers at work. American Economic Review, 99(1), 112–145.

Moretti, E. (2011). Social learning and peer effects in consumption: Evidence from movie sales. Review of Economic Studies, 78, 356–393.

Myles, G. D., & Naylor, R. A. (1996). A model of tax evasion with group conformity and social customs. European Journal of Political Economy, 12(1), 49–66.

Rosaz, J.,Slonim, R., Villeval, M. C. (2012). Quitting and peer effects at work. IZA Discussion Paper 6475, Bonn.

Sacerdote, B. (2001). Peer effects with random assignment: Results for Dartmouth roommates. The Quarterly Journal of Economics, 116(2), 681–704.

Saez, E., & Duflo, E. (2003). The role of information and social interactions in retirement plan decisions: Evidence from a randomized experiment. The Quarterly Journal of Economics, 118(2003), 815–842.

Schelling, T.C. (1978). Micromotives and Macrobehavior. New York: Norton.

Schmölders, G. (1960). Das irrationale in der öffentlichen finanzwissenschaft. Hamburg: Rowolt.

Schneider, F. (2007). Shadow economies of 145 countries all over the world: Estimation results over the period 1999 to 2003. Journal of Population Economics, 20(3), 495–526.

Slemrod, J. (2007). Cheating ourselves: The economics of tax evasion. Journal of Economic Perspectives, 21(1), 25–48.

Slemrod, J. B., Blumenthal, M., & Christian, C. (2001). Taxpayer response to an increased probability of audit: Evidence from a controlled experiment in Minnesota. Journal of Public Economics, 79, 455–483.

Spicer, M. W., & Becker, L. A. (1980). Fiscal inequity and tax evasion: An experimental approach. National Tax Journal, 33, 171–178.

Torgler, B. (2007). Tax compliance and tax morale. A theoretical and empirical analysis. Cheltenham: Edward Elgar.

Torgler, B., & Schneider, F. (2007). What shapes attitudes toward paying taxes? Evidence from multicultural European countries. Social Science Quarterly, 88, 443–470.

Traxler, C. (2009). Voting over taxes: The case of tax evasion. Public Choice, 140(1), 43–58.

United States Department of the Treasury. (1987). Taxpayer Opinion Survey (p. 8927). Internal Revenue Service, ICPSR.

Wilson, J. Q., & Kelling, G. L. (1982). Broken windows: The police and neighborhood safety. Atlantic Monthly, 249, 29–38.

Zeiliger, R. (2000). A presentation of regate, internet-based software for experimentalEconomics. http://www.gate.cnrs.fr/~zeiliger/regate/RegateIntro.ppt. Lyon: GATE.

Zimmerman, D. (2003). Peer effects in academic outcomes: Evidence from a natural experiment. Review of Economics and Statistics, 85(1), 9–23.

Acknowledgments

The authors are grateful to Sylvain Ferriol for programming the experiment. They wish to thank Frederic De Wispelaer, Jozef Pacolet, and Sergio Perelman for their help in the implementation of the experiments as well as two anonymous referees for their very helpful comments and suggestions. Financial support from Belgian Science Policy (SUBLEC AG/JJ/137) and from the Belgium’s French Community (ARC 05/10-332) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Supplementary regressions

Appendix: Supplementary regressions

See Table 5.

Rights and permissions

About this article

Cite this article

Lefebvre, M., Pestieau, P., Riedl, A. et al. Tax evasion and social information: an experiment in Belgium, France, and the Netherlands. Int Tax Public Finance 22, 401–425 (2015). https://doi.org/10.1007/s10797-014-9318-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-014-9318-z