Abstract

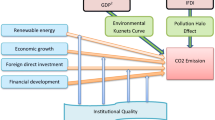

The paper empirically examines whether and how political institutions shape the nexus between finance and carbon dioxide (CO2) emissions. In a sample of developing and developed countries, it finds that financial development impedes green technology development and thus raises energy use and CO2 emissions, the effects that moderate with improvements in institutional quality. Despite so, there are differences between banks and stock markets, banking competition and concentration, and household and firm credit. Specifically, a more concentrated, less competitive bank-based financial system that lends more to households hinders green technology development and exaggerates energy use and CO2 emissions, and the impacts diminish when institutional quality enhances. Conversely, a more market-oriented financial system with a more competitive and less concentrated banking sector that lends more to private non-financial enterprises promotes green technology development and decreases energy use and CO2 emissions, the effects that weaken when the quality of political institutions betters.

Similar content being viewed by others

Notes

In Column (4) of Table 6, we evaluate the estimated value of \(\frac{{\partial y_{it} }}{\partial Lerner}\) and the associated standard deviation at different percentiles of \(\overline{free}\). We find a similar pattern.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Acemoglu D, Johnson S, Robinson J, Yared P (2008) Income and democracy. Am Econ Rev 98:808–842

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ https://doi.org/10.1016/j.eneco.2020.104768

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-component models. J Econ 68:29–52

Barrett S, Graddy K (2000) Freedom, growth, and the environment. Environ Dev Econ 5:433–456

Beck T, Levine R (2002) Industry growth and capital allocation: Does having a market- or bank-based system matter? J Financ Econ 64:147–180

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Bernauer T, Koubi V (2009) Effects of political institutions on air quality. Ecol Econ 68:1355–1365

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Boyd JH, Smith BD (1998) Capital market imperfections in a monetary growth model. Econ Theor 11:241–273

Brambor T, Clark WR, Golder M (2006) Understanding interaction models: improving empirical analyses. Polit Anal 14:63–82

Buonanno P, Carraro C, Galeotti M (2003) Endogenous induced technical change and the costs of Kyoto. Resour Energy Econ 25:11–34

Capelle-Blancard G, Laguna M-A (2010) How does the stock market respond to chemical disasters? J Environ Econ Manag 59:192–205

Carlitz RD, Povitkina M (2021) Local interest group activity and environmental degradation in authoritarian regimes. World Dev 142:105425

Congleton RD (1992) Political institutions and pollution control. Rev Econ Stat 74:412–421

Damania R, Fredriksson PG, List JA (2003) Trade liberalization, corruption, and environmental policy formation: theory and evidence. J Environ Econ Manag 46:490–512

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42:310–335

Demetriades P, Andrianova S (2004) Finance and growth: what we know and what we need to know. In: Goodhart C (ed) Financial development and growth: explaining the links, chapter 2. Palgrave Macmillan, Basingstoke, pp 38–65

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455

Farzin H, Bond CA (2006) Democracy and environmental quality. J Dev Econ 81:213–235

Fredriksson PG, Neumayer E (2013) Democracy and climate change policies: Is history important? Ecol Econ 95:11–19

Fredriksson PG, Neumayer E, Damania R, Gates S (2005) Environmentalism, democracy, and pollution control. J Environ Econ Manag 49:343–365

Fredriksson PG, Wollscheid RJ (2007) Democratic institutions versus autocratic regimes: The case of environmental policy. Public Choice 130:381–393

Gerlagh R, Lise W (2005) Carbon taxes: a drop in the ocean, or a drop that erodes the stone? The effect of carbon taxes on technological change. Ecol Econ 54:241–260

Girma S, Shortland A (2008) The political economy of financial development. Oxf Econ Pap 60:567–596

Goel R, Herrala R, Mazhar U (2013) Institutional quality and environmental pollution: MENA countries versus rest of the world. Econ Syst 37:508–521

Grossman GM, Krueger AB (1993) Environmental impacts of the North American free trade agreement. In: Garber P (ed) The US -Mexico free trade agreement. MIT Press, Cambridge, MA, pp 165–177

Grossman GM, Krueger AB (1995) Economic environment and the economic growth. Quart J Econ 110:353–377

Haber SH, North D, Weingast BR (2007) Political institutions and financial development. Stanford University Press, Stanford, CA

Halkos GE, Paizanos EA (2017) The channels of the effect of government expenditure on the environment: evidence using dynamic panel data. J Environ Plann Manage 60:135–157

Hansen LP (1982) Large sample properties of generalized method of moments estimators. Econometrica 50:1029–1054

Hellwig M (1991) Banking, financial intermediation and corporate finance. In: Giovanni A, Mayer C (eds) European financial integration. Cambridge University Press, Cambridge, pp 35–63

Huang Y (2010) Political institutions and financial development: an empirical study. World Dev 38:1667–1677

Iwińska K, Kampas A, Longhurst K (2019) Interactions between democracy and environmental quality: toward a more nuanced understanding. Sustainability 11:1728

Khalid U, Shafiullah M (2021) Financial development and governance: a panel data analysis incorporating cross-sectional dependence. Econ Syst 100855. https://doi.org/10.1016/j.ecosys.2021.100855

Kim D-H, Hsieh J, Lin S-C (2021) Financial liberalization, political institutions, and income inequality. Empir Econ 60:1245–1281

Kim DH, Wu YC, Lin SC (2020) Carbon dioxide emissions and the finance curse. Energy Econ 88:104788

Kirchgässner G, Schneider F (2003) On the political economy of environmental policy. Public Choice 115:369–396

Kumbaroglu G, Karali N, Arıkan Y (2008a) CO2, GDP and RET: an aggregate economic equilibrium analysis for Turkey. Energy Policy 36:2694–2708

Kumbaroglu G, Madlener R, Demirel M (2008b) A real options evaluation model for the diffusion prospects of new renewable power generation technologies. Energy Econ 30:1882–1908

La Porta R, Lopez-de-Silanes F, Shleifer A (2002) Government ownership of banks. J Finance 57:265–301

Lanoie P, Laplante B, Roy M (1998) Can capital markets create incentives for pollution control? Ecol Econ 26:31–41

Law SH, Azman-Saini WNW (2012) Institutional quality, governance and financial development. Econ Governance 13:217–236

Law SH, Azman-Saini WNW, Ibrahim MH (2013) Institutional quality thresholds and finance–growth nexus. J Bank Finance 37:5373–5381

Law SH, Kutan AM, Naseem NAM (2018) The role of institutions in finance curse: Evidence from international data. J Comp Econ 46:174–191

Law SH, Tan HB, Azman-Saini WNW (2014) Financial development and income inequality at different levels of institutional quality. Emerg Mark Financ Trade 50:21–33

Léon F (2018) The credit structure database. CREA Discussion Paper Series 18–07, Center for Research in Economic Analysis. University of Luxembourg

Levine R (2005) Finance and growth: theory and evidence. In: Aghion P, Durlauf S (eds) Handbook of economic growth 1, chapter 12. North-Holland, Amsterdam, pp 865–934

Li Q, Reuveny R (2006) Democracy and environmental degradation. Int Stud Quart 50:935–956

Lv C, Shao C, Lee CC (2021) Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ 98:105237

Midlarsky MI (1998) Democracy and the environment: an empirical assessment. J Peace Res 35:341–361

Murdoch JC, Sandler T (1997) The voluntary provision of a public good: the case of reduced CFC emissions and the Montreal Protocol. J Public Econ 63:331–349

Neumayer E (2002) Do democracies exhibit stronger international environmental commitment? A cross country analysis. J Peace Res 39:139–164

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371

Payne RA (1995) Freedom and the environment. J Democr 6:41–55

Policardo L (2016) Is democracy good for the environment? Quasi-experimental evidence from regime transitions. Environ Resour Econ 64:275–300

Porter ME, van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9:97–118

Povitkina M (2018) The limits of democracy in tackling climate change. Environ Polit 27:411–432

Raffin N (2014) Education and the political economy of environmental protection. Ann Econ Stat 115(116):379–407

Rajan RG (1992) Insiders and outsiders: the choice between informed and arm’s-length debt. J Financ 47:1367–1400

Ren Y, Liu L, Zhu H, Tang R (2020) The direct and indirect effects of democracy on carbon dioxide emissions in BRICS countries: Evidence from panel quantile regression. Environ Sci Pollut Res 27:33085–33102

Roberts JT, Parks BC (2007) A climate of injustice: global inequality, North-South politics, and climate policy. MIT Press, Cambridge, MA

Roe MJ, Siegel JI (2011) Political instability: effects on financial development, roots in the severity of economic inequality. J Comp Econ 39:279–309

Roodman D (2009) A note on the theme of too many instruments. Oxford Bull Econ Stat 71:135–158

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39:999–1006

Sadorsky P (2013) Do urbanization and industrialization affect energy intensity in developing countries? Energy Econ 37:52–59

Scruggs LA (1998) Political and economic inequality and the environment. Ecol Econ 26:259–275

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sustain Energy Rev 70:185–192

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Sinha A (2019) Environmental Kuznets curve for CO2 emissions: a literature survey. J Econ Stud 46:106–168

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32:137–145

Thoenig M, Verdier T (2003) A theory of defensive skill-biased innovation and globalization. Am Econ Rev 93:709–728

Torras M, Boyce JK (1998) Income, inequality, and pollution: A reassessment of the environmental Kuznets curve. Ecol Econ 25:147–160

You W-H, Zhu H-M, Yu K, Peng C (2015) Democracy, financial openness, and global carbon dioxide emissions: heterogeneity across existing emission levels. World Dev 66:189–207

Weinstein DE, Yafeh Y (1998) On the costs of a bank-centered financial system: Evidence from the changing main bank relations in Japan. J Financ 53:635–672

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econom 126:25–51

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26:7926–7937

Zeqiraj V, Sohag K, Soytas U (2020) Stock market development and low-carbon economy: the role of innovation and renewable energy. Energy Econ 91:104908

Zhao B, Yang W (2020) Does financial development influence CO2 emissions? A Chinese provincial-level study Does financial development influence CO2 emissions? Energy 200:117523

Acknowledgements

We are grateful to the editor G. Hondroyiannis and two anonymous referees for their constructive comments and suggestions that significantly improve the quality of our paper. This work was supported by a Korea University Grant. The usual disclaimer applies.

Author information

Authors and Affiliations

Contributions

YCW contributed to software, validation and investigation. DHK was involved in the visualization, writing–reviewing and editing. SCL was involved in the conceptualization, methodology, software and writing—original draft preparation.

Corresponding author

Ethics declarations

Conflicts of interest

The authors, Dong-Hyeon Kim, Yi-Chen Wu and Shu-Chin Lin, declare that they have no relevant or material financial interests that relate to the research described in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kim, DH., Wu, YC. & Lin, SC. Carbon dioxide emissions, financial development and political institutions. Econ Change Restruct 55, 837–874 (2022). https://doi.org/10.1007/s10644-021-09331-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-021-09331-x