Abstract

This paper tests the hypothesis that democratisation is conducive to less environmental depletion due to human activity. Using interrupted time series design for a panel of 47 transition countries and two indexes of pollution, CO\(_{2}\) emissions and PM10 concentrations, I find that democracies and dictatorships have two different targets of environmental quality, with those of democracies higher than those of dictatorships. Income inequality may as well alter this targets, but with opposite effects in the two different regimes.

Similar content being viewed by others

Notes

for a systematisation of the argument, see Payne (1995).

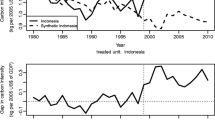

The average concentration of PM10 during democracy is 69.67906 and during dictatorship is 89.14407. GDP during democratic periods is, on average, 117,648.9 against 52,189.88 during dictatorship.

This average is computed over all the 53 years and over all the countries, conditioned to periods of democracy or dictatorship. The data for periods of democracy show an intensity of CO\(_{2}\) emissions (in Kg of carbon) per unit of income of 0.1269 against 0.1485 during periods of dictatorship.

All the results are also significant at 1 % level.

For a detailed presentation of the techniques used to construct such an index, visit the University of Texas’ website at http://utip.gov.utexas.edu/default.html.

It is indeed well known that many countries in Africa and the Caribbean suffer and have suffered from “kleptocratic” regimes (Acemoglu et al. 2004) run by individulas who use their power to transfer a large fraction of society’s resources to themselves. Two of the most “kleptocratic successes” are those of Mubutu Sese Seko in the Democratic Republic of Congo (Zaire) and Rafael Trujillo in the Dominican Republic. To have an idea of the numbers, in the 70’s, 15–20 % of Congo’s operating budget went directly to Mubutu, and in 1977 Mubutu’s family took $71 million from the National Bank for personal use and in the 80’s his personal fortune was estimated in $5 billion (Leslie 1987, p. 72). In the Dominican Republic, Trujillo became in power after he elected himself in a fraudulent election and at the end of his regime, the fortune of Trujillo’s family amounted to about 100 % of GDP at current prices and the family “controlled almost 80 % of the country’s industrial production” (Moya Pons 1995, p. 398). Other examples of “keptocratic regimes” include Haiti under the Duvaliers, Nicaragua under the Somozas, Uganda under Idi Amin, Liberia under Charles Taylor and the Philippines under Ferdinand Marcos, but the list can go on, if we include less extreme cases.

For a detailed description of these tests, the tests that will follow and results, refer to the “Appendix”.

Spurious regressions occur whenever one regresses a nonstationary variable over another nonstationary variable which are not cointegrated. In general, the estimated coefficients appear to be significant but they lack any real and plausible correlation, since what is correlated is just a common trend and nothing else. Under a spurious regression, the tendency of both series to be growing is picked up by the regression model, even though each series is growing for very different reasons and at a rates which are uncorrelated, and produce nonstationary residuals.

Since in my dataset there are only two nonstationary variables, it follows that at most one cointegrating relation may exist.

In performing these tests, it’s been assumed that there is no deterministic trend.

\(\hat{\epsilon }_{it-1}\) is computed as a residual of the long run relationship explaining percapita CO\(_{2}\) emissions.

This can be referred to Granger’s representation theorem for dynamic modelling, in Engle and Granger (1987)

Similar results are obtained for longer lags specifications, up to four.

Maddala and Wu use the results obtained by Fisher (1932).

In performing this test, it’s been assumed that there is no deterministic trend.

\(\Delta D^*\) and \(\Delta A^*\) are equal, respectively, to \(\Delta D \cdot Dem\) and \(\Delta A \cdot (1- Dem)\).

References

Acemoglu D, Robinson JA, Verdier T (2004) Kleptocracy and divide-and-rule: a model of personal rule. J Eur Econ Assoc 2(2/3). In: Papers and proceedings of the 18th annual congress of the European economic association, pp 162–192

Allison PD (1994) Using panel data to estimate the effects of events. Sociol Methods Res 23:174–199

Barro R (1996) Getting it right. MIT Press, Cambridge, MA

Barro R (1996b) Democracy and growth. J Econ Growth 1:1–27

Barro RJ (1999) Determinants of democracy. J Polit Econ 107:158–183

Bhattarai M, Hammig M (2001) Institutions and the environmental Kuznets curve for deforestation: a cross country analysis for Latin America, Africa and Asia. World Dev 29:995–1010

Bloom HS (2003) Using short interrupted time-series analysis to measure the impacts of whole school reform. Eval Rev 27:3–49

Campbell D, Stanley J (1966) Experimental and quasi-experimental designs for research. Rand McNally, Chicago, IL

Çíftçí S (2005) Treaties, collective responses and the determinants of aggregate support for European integration. Eur Union Polit 6:469–492

Cook TD, Campbell DT (1979) Quasi-experimentation: design and analysis for field settings. Rand McNally, Chicago, IL

Dasgupta P, Mäler KG (1995) Poverty, institutions, and the environmental resource-base, Chapt. 39. In: Behrman J, Srinivaan TN (eds) Handbook of development economics, vol 3A. Elsevier Science, Amsterdam

Desai U (1998) Environment, economic growth, and government, ecological policy and politics in developing countries. State University Press of New York Press, Albany, NY, pp 1–45

Engle RF, Granger CWJ (1987) Cointegration and error correction: representation, estimation and testing. Econometrica 55:251–276

Fisher RA (1932) Statistical methods for research workers, 4th edn. Oliver & Boyd, Edimburgh

Gallagher KP, Thacker SC (2008) Democracy, income and environmental quality, political economy research institute (PERI). Working Paper No. 164, University of Massachusetts, Amhrest

Gao H, Harrison D, Parry G, Daly K, Subbe C, Rowan K (2007) The impact of the introduction of critical care outreach services in England: a multicentre interrupted time series analysis. Crit care 11(5):R113

Gleditsch NP, Sverdrup B (2003) Democracy and the environment. In: Paper E, Redclift M (eds) Human security and the environment: international comparisons. Elgar, London

Hardin G (1968) The tragedy of the commons. Science 162:1243–1248

Hausman J (1979) Individual discount rates and the purchase and utilization of energy-using durables. Bell J Econ 10:33–54

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115:53–74

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90:1–44

Leslie WJ (1987) The world bank and structural transformationin developing countries: the case of Zaire. Lynne Rienner Publishers, Boulder, CO

Levin A, Lin CF, Chu C (2002) Unit root test in panel data: asymptotic and finite-sample properties. J Econom 108:1–24

Maddala GS, Shaowen Wu (1999) A comparative study of unit root test with panel data and a new simple test. Oxford Bull Econ Stat 61:631–652

Maddison A (2009) Statistics on world population, GDP and Per Capita GDP, 1–2006 AD, updated March 2009. http://www.ggdc.net/maddison/

Marland G, Boden TA, Andres RJ (2008) Global, regional, and national CO2 emissions. In: Trends: a compendium of data on global change. Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy, Oak Ridge, Tenn

Marland G, Rotty RM (1984) Carbon dioxide emissions from fossil fuels: a procedure for estimation and results for 1950–1982. Tellus 36(B):232–261

Milanovic B (2000) The median voter hypothesis, income inequality and income redistribution: an empirical test with the required data. Eur J Polit Econ 16(3):367–410

Payne RA (1995) Freedom and the environment. J Democr 6:41–55

Pons FM (1995) The Dominican Republic: a national history. Markus Weiner, Princeton, NJ

Przeworski A, Limongi F (1993) Political regimes and economic growth. J Econ Perspect 7:51–69

Rodrik D (1999) Democracies pay higher wages. Q J Econ 114:707–738

Schultz CB, Crockett TR (1990) Economic development, democratization, and environmental protection in Eastern Europe. Boston Coll Environ Aff Law Rev 18:53–84

Shadish WR, Cook TD, Campbell DT (2002) Experimental and quasiexperimental designs for generalized causal inference. Houghton Mifflin, Boston

Torras M, Boyce JK (1998) Income, inequality and pollution: a reassessment of the environmental Kuznets curve. Ecol Econ 25:147–160

United Nations (1992) Handbook of the international comparison program

Urbain JP (1992) On weak exogeneity in error correction models. Oxford Bull Econ Stat 54:187–207

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Diagnostic Tests

1.1.1 Panel Unit Root Test

The first step to decide the best way to estimate a relationship of interest, is to choose the appropriate econometric tool. In order to do so, it is necessary to verify the characteristics of the data generating processes: for each nondeterministic series (CO\(_{2}\) emissions, percapita GDP, PM10 concentrations and Inequality), I test whether they have stationary mean and variance. Available tests for unit root on panel data are based on the Dickey Fuller test (or its augmented version), so I test the following:

with \(i=1,\ldots ,N\) and \(t=1,\ldots ,T_i\). \(\rho _i\) represents the autoregressive coefficient for country \(i\), \(X_{it}\) is matrix representing the exogenous variables in the model, including any fixed effects and individual trends and \(\epsilon _{it}\) are the errors which are assumed i.i.d. If \(|\rho _i|=1\), then \(y_i\) contains a unit root. For practical purpose, the tests for unit root are performed using the following basic ADF specification:

with \(\alpha _i=\rho _i-1\).

Levin, Lin and Chu test assumes that the unit root process is common to all the cross sections so it assumes \(\alpha _i=\alpha \) for every \(i\). The test is performed by testing the null hypothesis \(H_0:\alpha =0\) against the alternative \(H_1:\alpha <0\) for all the cross section units. Their procedure derives estimates of \(\alpha \) from proxies for \(\Delta y_{it}\) and \(y_{it}\) that are standardised and free of autocorrelation and deterministic components. For a given set of lag orders \(p_i\), their procedure begins by estimating two additional sets of equations,

and denoting \((\hat{\beta },\hat{\delta })\) the estimated coefficients of Eq. 9 and \((\dot{\beta },\dot{\delta })\) those of Eq. 10. They define, then, \(\Delta \bar{y}_{it}\) and \(\bar{y}_{it-1}\) by taking, respectively, \(\Delta y_{it}\) and \(y_{it-1}\) and removing the autocorrelations and deterministic components using their respective auxiliary estimates

and standardise both \(\Delta \bar{y}_{it}\) and \(\bar{y}_{it-1}\) by dividing by the regression standard error

where \(s_i\) are the estimated standard errors from estimating each ADF in Eq. 8. The estimate of \(\alpha \) is then obtained from the pooled proxy equation

which, under the null, a modified \(t\) statistics for the resulting \(\hat{\alpha }\) is asymptotically normally distributed

where \(t_{\alpha }\) is the standard statistic for \(\hat{\alpha }=0\), \(\hat{\sigma }^2\) is the estimated variance of the error term \(\eta \), \(se(\hat{\alpha })\) is the standard error of \(\hat{\alpha }\), and

\(S_N\) is the mean of the ratios of the long run standard deviation for each individual, and it is estimated using kernel-based techniques, and \(\mu _{m\tilde{T}^*}\) and \(\sigma _{m\tilde{T}^*}\) are adjustment terms for the mean and standard deviation (for more details, refer to the original article of Levin et al. 2002). In order to perform this test, I include individual constant terms (fixed effects), and an individual trend, so my \(X_{it}\) matrix is a \(2NT \times 2N\) matrix, where the first \(NT \times N\) block is a matrix of dummy variables, each representing one single country, and the other block going from row \(NT+1\) to \(2NT\) and from column \(N+1\) to \(2N\) is a matrix of trends, one for each single countries. All the other terms in the matrix are equal to zero.

If the test for common unit root fails, it might be convenient to check whether individual unit root exists. Tests available for that are Im, Peasaran and Shin, Fisher AD and PP tests. Im, Pesaran and Shin test begin by specifying a separate ADF regression for each cross-section according to Eq. 8 with the null

and the alternative hypothesis is

That can be interpreted as a nonzero fraction of the individual processes is stationary. After having estimated the separate ADF regressions, the average of the \(t\) statistics for \(\alpha _i\) from the individual ADF regressions, \(t_{iT_i}(p_i)\),

is adjusted to arrive to the desired statistics. Critical values are provided in the Im, Pesaran and Shin’s paper (2003) for different number of cross sections and time periods when \(p_i=0\) for all \(i\), but in the general case when the lag order in Eq. 8 may be nonzero for some cross-sections, they show that a properly standardised \(\bar{t}_{NT}\) has an asymptotic standard normal distribution

and the expression for the expected mean and variance of the ADF regression \(t\) statistics, \(E(\bar{t}_{iT}(p_i))\) and \(Var(\bar{t}_{iT}(p_i))\) are provided by Im, Pesaran and Shin for various values of \(T\) and \(p\) and different test equation assumptions. I will use, in this paper, one lag and, as deterministic component, an individual constant, without introducing any trend term. Finally, there are other two tests for checking individual unit root: Fisher ADF and Fisher PP tests, which are based upon the idea by Maddala, Wu and Choi, and combine the \(p\) values from individual unit root tests. They work as follows: define \(\pi _i\) the \(p\) value from individual unit root test for cross-section \(i\), then under the null of unit root for all the \(N\) cross sections, we have the asymptotic result that

and also, Choi demonstrates that

where \(\Phi ^{-1}\) is the inverse of a standard normal cumulative distribution function. For both the Fisher tests, I specify as exogenous variables an individual constant (fixed effect) and an individual time trend.

Table 6 in “Appendix” shows the results of the tests for all the nondeterministic series. These tests accept the hypothesis of unit root only for two out of four series, percapita GDP and percapita CO\(_{2}\) emissions. Since the level of concentration of particulate matters (PM10) is stationary, it cannot be cointegrated with any other variable, while in principle CO\(_{2}\) and GDP could be. For what concerns the dependent variable PM10, then, a standard Least Squares Dummy Variables (LSDV) model for testing the effect of democracy on its level it is appropriate, as it should produce stationary (possibly normal) residuals. For what concerns the model for CO\(_{2}\) emissions, we cannot say a priori whether the same LSDV model is appropriate, and a test for cointegration is mandatory. If indeed the two series were cointegrated, that model would produce superconsistent estimates of the parameters, but if they were not, the model would suffer of the problem of the spurious regression with invalid inference of the parameters of interest. In this case, the tendency of both series to be growing leads to correlation which is picked up by the regression model, even though each series is growing for very different reasons and at a rates which are uncorrelated. Thus, in absence of cointegration (which will be tested in the next subsection) correlation between non-stationary series does not imply the kind of causal relationship that might be inferred from stationary series, so standard estimation techniques like OLS cannot be used.

1.1.2 Panel Cointegration Test

If two or more variables are nonstationary or I(1), if they are not cointegrated, the residual series obtained by regressing one I(1) variable over another I(1) variable is expected to be nonstationary, or I(1). This would lead to spurious regression since the estimated coefficients do not reflect a real relationship between those two variables, but simply correlated time trends. This however would be different if those two variables were cointegrated, and the coefficients would benefit from the “superconsistency” property. Since in my dataset there are only two nonstationary variables, namely, CO\(_{2}\) and GDP, it follows that at most one cointegrating relation may exist. In the Engle–Granger approach, cointegration is tested by verifying that the residual series generated by the regression of one I(1) variable over another I(1) variable is stationary. To verify whether percapita CO\(_{2}\) emissions and percapita GDP are cointegrated, I use the approach suggested by Kao (1999). Kao uses a two-step procedure to test for cointegration: in the first step, he regress the dependent variable [which is I(1)] over the independent [also I(1)] specifying cross-section specific intercepts and homogeneous coefficient: he basically regresses

where \(X_{it}\) is a matrix of dummy variables representing each single country and assuming \(\mathrm{{CO}_2}_{it}={\mathrm{CO}_2}_{it-1}+u_{it}\) and \(GDP_{it}=GDP_{it-1}+\epsilon _{it}\) for \(t=1,\ldots ,T\) and \(i=1,\ldots ,N\). Then Kao runs the pooled auxiliary regression

Assuming \(p=1\) Footnote 13, this augmented Dikey Fuller test for panel data reject at 1 % level the hypothesis that \(\rho =1\). The global ADF \(t\) statistic for Kao residual cointegration test with the null hypothesis of no cointegration shows a \(t\) stat of 3.499820 with a \(p\) value of 0.0002, so this test strongly suggests that those two series are cointegrated (detailed results of this test are in this Table 7 in “Appendix”).

Maddala and Shaowen (1999) combined test from individual cross-sectionsFootnote 14 is specified as follows: consider the following VAR representation for each cross-section unit:

where \(Y\) is a vector of I(1) variables (in my case, \(CO_{2}\) and GDP). Subtracting \(Y_{t-1}\) on the left and right hand side of equation 16 and adding and subtracting \(A_2Y_{t-1}\) from the right hand side, we get

with \(\Pi =(A_1+A_2-I)\) and \(\Gamma = - A_2\). Granger’s representation theorem asserts that if the coefficient matrix \(\Pi \) has a reduced rank \(r<k\), then there exists \(kxr\) matrices \(\alpha \) and \(\beta \) each with rank \(r\) such that \(\Pi =\alpha \cdot \beta '\) and \(\beta 'Y_t\) is I(0). \(r\) is the number of cointegrating relations and each column of \(\beta \) is the cointegrating vector, and the elements of \(\alpha \) are known as the adjustment parameters in the VEC model. Johansen’s method is to estimate the \(\Pi \) matrix from an unrestricted VAR and to test whether we can reject the restrictions implied by the reduced rank of \(\Pi \). In performing this test, I assume that the level data \(Y_t\) have no deterministic trends and the cointegrating equations have only interceipts, so

To determine the number of cointegrating relations \(r\) conditional on assumption 18, we proceed sequentially from \(r=0\) to \(r=k-1\) until we fail to reject. The trace statistic for the null hypothesis of \(r\) cointegrating relations is computed as

where \(\lambda _i\) is the largest eigenvalue of the \(\Pi \) matrix.

The maximum eigenvalue statistic tests the null hypothesis of \(r\) cointegrating relations against the alternative of \(r+1\) relations. The test statistics is computed

If the test statistics are continuous, the significance levels for each cross-section unit, denoted by \(\pi _i\) for \(i=1,2,\ldots ,N\), are independent uniform (0,1) variables, and \(-2 \log \pi _i\) has a \(\chi ^2\) distribution with two degrees of freedom. The approach proposed by Maddala and Wu to test cointegration in panel is to combine tests from individual cross sections to obtain a test statistic for the full panel, using the additive property of the \(\chi ^2\) variables: if \(\pi \) is the \(p\) value from an individual cointegration test for the cross-section \(i\), under the null hypothesis for the panel we have

Both trace and maximum eigenvalue tests reject the hypothesis of absence of cointegration at 1 % level, and accept the hypothesis that there exists one cointegrating relationFootnote 15. So, substantial evidence points out that a cointegrating relation between emissions and income exists, so the use of a procedure that takes into account this fact is justified.

1.1.3 Weak Exogeneity Test

In the model for the estimation of the of the effect of the regime on the level of CO\(_{2}\) emissions, I have only two non-stationary series, while the other variables are either deterministic or I(0). It follows that only one cointegrating relation can exist, so in principle it is possible to estimate this relationship using a single equation. However, estimating with a single equation is not free of drawbacks, as it is potentially inefficient, and so it does not lead to the smallest variance against alternative approaches. In general, information is lost unless the right-hand side variables in the cointegration vector are weakly exogenous. Weak exogeneity of these variables is indeed a prerequisite to assert that no useful information is lost when we condition on these variables without specifying their generating process. In practical terms, it must be the case that GDP is weakly exogenous with respect to the level of CO\(_{2}\) emissions. As pointed out by Urbain (1992), testing for weak exogeneity requires testing whether the error-correction term embedded in the short-run ECM (\(\hat{\epsilon }_{it-1}\) computed as a residual of the long run relationship equation) is significant in the equation determining \(\Delta GDP_{it}\). In particular, weak exogeneity requires that \(\Delta GDP_{it}\) does not depend on the disequilibrium changes represented by \(\hat{\epsilon }_{it-1}\).

Consider the following long run relationship for the dependent variable percapita \(CO_{2}\) emissions:

where the betas are combinations of parameters deriving from the ARDL model (for more details, please refer to the “Appendix”). Testing for weak exogeneity requires, in order:

-

1.

Estimating the coefficients of Eq. 22

-

2.

Computing the estimated residual series as

$$\begin{aligned} \hat{\epsilon }_{it}&= \mathrm{{CO}_2}_{it}-\hat{\beta }_{0i} - \hat{\beta }_1 GDP_{it} -\hat{\beta }_2 D_{it} - \hat{\beta }_3 A_{it} - \hat{\beta }_4 INEQ_{it} +\\&-\,\hat{\beta }_6 D_{it}\cdot INEQ_{it} -\hat{\beta }_7 A_{it}\cdot INEQ_{it} \end{aligned}$$ -

3.

Estimating the following equationFootnote 16:

$$\begin{aligned} \Delta GDP_{it}&= \gamma _1 \Delta \mathrm{{CO}_2}_{it} + \gamma _2 \Delta D_{it}^* + \gamma _3 \Delta A_{it}^* + \gamma _4 \Delta INEQ_{it}\nonumber \\&+ \,\gamma _5 W_{Dit} + \gamma _6 W_{Ait} - (1-\alpha )\hat{\eta }_{it-1} + \delta \hat{\epsilon }_{it-1} \end{aligned}$$(23)where the short-run interaction effects between the two trends and inequality are

$$\begin{aligned} W_{Dit}&= D_{it}\cdot \Delta INEQ_{it}+\Delta D_{it}^* \cdot INEQ_{it}-\Delta D_{it}^* \cdot \Delta INEQ_{it}\\ W_{Ait}&= A_{it}\cdot \Delta INEQ_{it}+\Delta A_{it}^* \cdot INEQ_{it}-\Delta A_{it}^* \cdot \Delta INEQ_{it} \end{aligned}$$and \(\hat{\eta }_{it}\) is the error correction term for the equation defining the relationship between \(GDP\) and \(CO_{2}\), and it is estimated from the long run relationship between GDP and \(\textit{CO}_{2}\), given by

$$\begin{aligned} \textit{GDP}_{it}&= \theta _{0i} + \theta _1 CO_{2} + \theta _2 D_{it} + \theta _3 A_{it} + \theta _4 INEQ_{it}\nonumber \\&+\,\theta _6 D_{it}\cdot INEQ_{it} +\theta _7 A_{it}\cdot INEQ_{it} +\eta _{it} \end{aligned}$$(24)and \(\hat{\epsilon }_{it-1}\) is already defined at point 2.

-

4.

Checking and testing the significancy of the coefficient attached to \(\hat{\epsilon }_{it-1}\), \(\delta \), in the equation defined at point 3. If \(\delta \) is significant in Eq. 23, then we cannot say that \(GDP\) is weakly exogenous and then a multivariate model for estimation is necessary. If instead \(\delta \) is found to be non-significant, a standard error correction model with one single equation is enough to estimate efficiently the relations of interest, so no loss of information occurs.

Results from the estimation of Eq. 23 for \(CO_{2}\) show that \(t\) test for \(\delta \) accepts the null of \(\delta =0\) at the standard level of 5 %. This coefficient amounts to \(-\)0.0382668, with a standard error of 0.1013909, a \(t\) statistic of \(-\)0.38 and a \(p\) value of 0.706, so GDP is shown to be weakly exogenous.

It is possible to conclude, then, that the estimation of the model for CO\(_{2}\) emissions using a single equation approach is appropriate, and there is no loss of information (and efficiency) (Tables 4, 5, 6, 7, 8, 9, 10).

1.2 The Econometric Model for the Estimation of the Unrestricted ECM for CO\(_{2}\) Emissions

Consider the following ARDL(1,1)

with \(j=1,\ldots ,4\) and

with some manipulations

and we end up with the usual ECM:

Rights and permissions

About this article

Cite this article

Policardo, L. Is Democracy Good for the Environment? Quasi-Experimental Evidence from Regime Transitions. Environ Resource Econ 64, 275–300 (2016). https://doi.org/10.1007/s10640-014-9870-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9870-0