Abstract

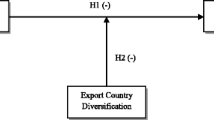

In this paper, we examine the impact of acquirer’s ownership identity on corporate diversification decisions of Chinese companies in their cross-border acquisitions. Few studies to date have looked at the effect of ownership on corporate decisions to diversify abroad, particularly in the emerging market context. We find that certain characteristics of acquirer’s ownership identity such as the government ownership, business group membership and being publicly traded will be negatively linked with industry diversification in international markets. Also, the effects of ownership identities are contingent upon the host country selection, and acquisitions into developed host countries are likely to be in unrelated industries. We observe that Chinese companies that buy in developed markets engage in global consolidation. These results support our arguments on domestic market protection strategies adopted by Chinese companies for mitigating competition from their developed market rivals.

Similar content being viewed by others

References

Alden, C., & Davies, M. 2006. Chinese multinational corporations in Africa. Africa Institute of South Africa, (3–4): 1–11.

Almeida, H. V., & Wolfenzon, D. 2006. A theory of pyramidal ownership and family business groups. Journal of Finance, 61(6): 2637–2680.

Bai, C. E., Lu, J., & Tao, Z. 2006. Property rights protection and access to bank loans. Economics of Transition, 14(4): 611–628.

Barai, P., & Mohanty, P. 2014. Role of industry relatedness in performance of Indian acquirers—Long and short run effects. Asia Pacific Journal of Management, 31(4): 1045–1073.

Berrill, J. 2015. Are the world’s largest firms regional or global?. Thunderbird International Business Review, 57(2): 87–101.

Berry, H., Guillén, M. F., & Zhou, N. 2010. An institutional approach to cross-national distance. Journal of International Business Studies, 41(9): 1460–1480.

Boisot, M., & Meyer, M. W. 2008. Which way through the open door? Reflections on the internationalization of Chinese firms. Management and Organization Review, 4(3): 349–365.

Boubakri, N., Cosset, J.-C., & Saffar, W. 2013. The role of state and foreign owners in corporate risk-taking: Evidence from privatization. Journal of Financial Economics, 108(3): 641–658.

Buckley, P. J., Forsans, N., & Munjal, S. 2012. Host-home country linkages and host-home country specific advantages as determinants of foreign acquisitions by Indian firms. International Business Review, 21(5): 878–890.

Buckley, P. J., Yu, P., Liu, Q., Munjal, S., & Tao, P. 2016. The institutional influence on the location strategies of multinational enterprises from emerging economies: Evidence from China’s cross-border mergers and acquisitions. Management and Organization Review, 12(3): 425–448.

Cai, K. G. 1999. Outward foreign direct investment: A novel dimension of China’s integration into the regional and global economy. China Quarterly, 160(4): 856–880.

Cai, Y. 2002. The resistance of Chinese laid-off workers in the reform period. China Quarterly, 170(6): 327–344.

Cartwright, S., & Schoenberg, R. 2006. Thirty years of mergers and acquisitions research: Recent advances and future opportunities. British Journal of Management, 17(S1): S1–S5.

Chen, C., & Findlay, C. 2003. A review of cross-border mergers and acquisitions in APEC. Asian-Pacific Economic Literature, 17(2): 14–38.

Chen, J. J. 2004. Determinants of capital structure of Chinese-listed companies. Journal of Business Research, 57(12): 1341–1351.

Chen, Y., & Young, M. 2010. Cross-border mergers and acquisitions by Chinese listed companies: A principal-principal perspective. Asia Pacific Journal of Management, 27(3): 523–539.

Child, J., & Marinova, S. 2014. The role of contextual combinations in the globalization of Chinese firms. Management and Organization Review, 10(3): 347–371.

Child, J., & Rodrigues, S. B. 2005. The internationalization of Chinese firms: A case for theoretical extension?. Management and Organization Review, 1(3): 381–410.

Choi, Y. R., Yoshikawa, T., Zahra, S. A., & Han, B. H. 2014. Market-oriented institutional change and R&D investments: Do business groups enhance advantage?. Journal of World Business, 49(4): 466–475.

Cui, L., & Jiang, F. 2012. State ownership effect on firms’ FDI ownership decisions under institutional pressure: A study of Chinese outward-investing firms. Journal of International Business Studies, 43(3): 264–284.

Datta, D. K., Pinches, G. E., & Narayanan, V. K. 1992. Factors influencing wealth creation from mergers and acquisitions: A meta-analysis. Strategic Management Journal, 13(1): 67–84.

De Beule, F., & Duanmu, J.-L. 2012. Locational determinants of internationalization: A firm-level analysis of Chinese and Indian acquisitions. European Management Journal, 30(3): 264–277.

Deng, P. 2007. Investing for strategic resources and its rationale: The case of outward FDI from Chinese companies. Business Horizons, 50(1): 71–81.

Deng, P. 2009. Why do Chinese firms tend to acquire strategic assets in international expansion?. Journal of World Business, 44(1): 74–84.

Denis, D., Denis, D., & Yost, K. 2002. Global diversification, industrial diversification, and firm value. Journal of Finance, 57(5): 1951–1979.

Dietz, M. C., Orr, G., & Xing, J. 2008. How Chinese companies can succeed abroad. McKinsey Quarterly, 3: 22.

Erdener, C., & Shapiro, D. M. 2005. The internationalization of Chinese family enterprises and Dunning’s eclectic MNE paradigm. Management and Organization Review, 1(3): 411–436.

Feng, E. 2017. China tightens rules on state groups’ foreign investments. Financial Times: August 3.

Gaur, A., & Delios, A., 2015. International diversification of emerging market firms: The role of ownership structure and group affiliation. Management International Review, 55(2): 235–253.

Gaur, A. S., Kumar, V., & Singh, D. 2014. Institutions, resources, and internationalization of emerging economy firms. Journal of World Business, 49(1): 12–20.

Ghemawat, P. 2001. Distance still matters. Harvard Business Review, 79(8): 137–147.

Gubbi, S., Aulakh, P., Ray, S., Sarkar, M., & Chittoor, R. 2010. Do international acquisitions by emerging-economy firms create shareholder value: The case of Indian firms. Journal of International Business Studies, 41(3): 397–418.

Hahn, D., & Lee, K. 2006. Chinese business groups: Their origins and development. In S.-j. Chang (Ed.). Business groups in East Asia: Financial crisis, restructuring, and new growth: 207–231. Oxford: Oxford University Press.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. 1998. Multivariate data analysis. Upper Saddle River: Prentice Hall.

Haleblian, J., & Finkelstein, S. 1999. The influence of organizational acquisition experience on acquisition performance: A behavioral learning perspective. Administrative Science Quarterly, 44(1): 29–56.

Hautz, J., Mayer, M. C., & Stadler, C. 2013. Ownership identity and concentration: A study of their joint impact on corporate diversification. British Journal of Management, 24(1): 102–126.

Hornby, L. 2017. China expands power of anti-corruption watchdog. Financial Times: October 19.

Huang, X., & Renyong, C. 2014. Chinese private firms’ outward foreign direct investment: Does firm ownership and size matter?. Thunderbird International Business Review, 56(5): 393–406.

Inoue, C. F., Lazzarini, S. G., & Musacchio, A. 2013. Leviathan as a minority shareholder: Firm-level implications of state equity purchases. Academy of Management Journal, 56(6): 1775–1801.

Jean, R.-J. B., Tan, D., & Sinkovics, R. R. 2011. Ethnic ties, location choice, and firm performance in foreign direct investment: A study of Taiwanese business groups FDI in China. International Business Review, 20(6): 627–635.

Khanna, T., & Palepu, K. 2000. The future of business groups in emerging markets: Long-run evidence from Chile. Academy of Management Journal, 43(3): 268–285.

Khanna, T., & Rivkin, J. W. 2001. Estimating the performance effects of business groups in emerging markets. Strategic Management Journal, 22(1): 45–74.

Khanna, T., & Yafeh, Y. 2007. Business groups in emerging markets: Paragons or parasites?. Journal of Economic Literature, 45(2): 331–372.

Kim, H., Hoskisson, R. E., Tihanyi, L., & Hong, J. 2004. The evolution and restructuring of diversified business groups in emerging markets: The lessons from chaebols in Korea. Asia Pacific Journal of Management, 21(1–2): 25–48.

Kumar, V., Gaur, A. S., & Pattnaik, C. 2012. Product diversification and international expansion of business groups. Management International Review, 52(2): 175–192.

Lane, P. J., Cannella, A. A., Jr., & Lubatkin, M. H. 1998. Agency problems as antecedents to unrelated mergers and diversification: Amihud and Lev reconsidered. Strategic Management Journal, 19(6): 555–578.

Lang, L. H. P., Stulz, R. M., & Walkling, R. A. 1991. A test of the free cash flow hypothesis: The case of bidder returns. Journal of Financial Economics, 29(2): 315–335.

Lee, K., & Woo, W. 2001. Business groups in China: Compared with Korean chaebols. In R. Hooley, & J. Yoo (Eds.). The post-financial crisis challenges for Asian industrialization: 721–747. Amsterdam: Elsevier Science.

Leff, N. H. 1978. Industrial organization and entrepreneurship in the developing countries: The economic groups. Economic Development and Cultural Change, 26(4): 661–675.

Lester, R. H., Hillman, A., Zardkoohi, A., & Cannella, A. A. 2008. Former government officials as outside directors: The role of human and social capital. Academy of Management Journal, 51(5): 999–1013.

Li, R., & Cheong, K.-C. 2017. Huawei and ZTE in Malaysia: The localisation of Chinese transnational enterprises. Journal of Contemporary Asia, 47(5): 752–773.

Li, W., He, A., Lan, H., & Yiu, D. 2012. Political connections and corporate diversification in emerging economies: Evidence from China. Asia Pacific Journal of Management, 29(3): 799–818.

Lin, C., & Su, D. 2008. Industrial diversification, partial privatization and firm valuation: Evidence from publicly listed firms in China. Journal of Corporate Finance, 14(4): 405–417.

Linn, S. C., & Switzer, J. A. 2001. Are cash acquisitions associated with better postcombination operating performance than stock acquisitions?. Journal of Banking & Finance, 25(6): 1113–1138.

Liou, R.-S., Chao, M. C.-H., & Yang, M. 2016. Emerging economies and institutional quality: Assessing the differential effects of institutional distances on ownership strategy. Journal of World Business, 51(4): 600–611.

Liou, R. S., Rao-Nicholson, R., & Sarpong, D. 2018. What is in a name? Cross-national distances and subsidiary’s corporate visual identity change in emerging-market firms’ cross-border acquisitions. International Marketing Review, 35(2), 301-319.

Liu, Q., & Lu, Z. J. 2007. Corporate governance and earnings management in the Chinese listed companies: A tunneling perspective. Journal of Corporate Finance, 13(5): 881–906.

Liu, Y., Li, Y., & Xue, J. 2011. Ownership, strategic orientation and internationalization in emerging markets. Journal of World Business, 46(3): 381–393.

Liu, Y., & Woywode, M. 2013. Light-touch integration of Chinese cross-border M&A: The influences of culture and absorptive capacity. Thunderbird International Business Review, 55(4): 469–483.

Lu, J., Liu, X., & Wang, H. 2011. Motives for outward FDI of Chinese private firms: Firm resources, industry dynamics, and government policies. Management and Organization Review, 7(2): 223–248.

Lu, J. W., & Beamish, P. W. 2004. International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal, 47(4): 598–609.

Lu, Y., & Yao, J. 2006. Impact of state ownership and control mechanisms on the performance of group affiliated companies in China. Asia Pacific Journal of Management, 23(4): 485–503.

Luo, Y., & Tung, R. 2007. International expansion of emerging market enterprises: A springboard perspective. Journal of International Business Studies, 38(4): 481–498.

Luo, Y., Xue, Q., & Han, B. 2010. How emerging market governments promote outward FDI: Experience from China. Journal of World Business, 45(1): 68–79.

Ma, X., Yao, X., & Xi, Y. 2006. Business group affiliation and firm performance in a transition economy: A focus on ownership voids. Asia Pacific Journal of Management, 23(4): 467–483.

Maman, D. 2002. The emergence of business groups: Israel and South Korea compared. Organization Studies, 23(5): 737–758.

Meyer, K. E., & Thaijongrak, O. 2013. The dynamics of emerging economy MNEs: How the internationalization process model can guide future research. Asia Pacific Journal of Management, 30(4): 1125–1153.

Milhaupt, C. J., & Zheng, W. 2014. Beyond ownership: State capitalism and the Chinese firm. Georgetown Law Journal, 103(655): 667–722.

Moeller, S. B., & Schlingemann, F. P. 2005. Global diversification and bidder gains: A comparison between cross-border and domestic acquisitions. Journal of Banking & Finance, 29(3): 533–564.

Neffke, F., Henning, M., & Boschma, R. 2011. How do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Economic Geography, 87(3): 237–265.

Nicholson, R. R., & Salaber, J. 2013. The motives and performance of cross-border acquirers from emerging economies: Comparison between Chinese and Indian firms. International Business Review, 22(6): 963–980.

Nocker, E., Bowen, H. P., Stadler, C., & Matzler, K. 2016. Capturing relatedness: Comprehensive measures based on secondary data. British Journal of Management, 27(1): 197–213.

Nolan, P. 2001. China and the global economy. Basingstoke: Palgrave.

Nolan, P. 2002. China and the global business revolution. Cambridge Journal of Economics, 26(1): 119–137.

Oesterle, M.-J., Richta, H. N., & Fisch, J. H. 2013. The influence of ownership structure on internationalization. International Business Review, 22(1): 187–201.

Peng, M. W. 2005. Perspectives—From China strategy to global strategy. Asia Pacific Journal of Management, 22(2): 123–141.

Pistor, K., & Xu, C. 2005. Governing stock markets in transition economies: Lessons from China. American Law and Economics Review, 7(1): 184–210.

Qian, Y. 1996. Enterprise reform in China: Agency problems and political control. Economics of Transition, 4(2): 427–447.

Ralston, D. A., Terpstra-Tong, J., Terpstra, R. H., Wang, X., & Egri, C. 2006. Today’s state-owned enterprises of China: Are they dying dinosaurs or dynamic dynamos?. Strategic Management Journal, 27(9): 825–843.

Ramamurti, R. 2008. What have we learned about emerging-market MNEs? In R. Ramamurti & J. V. Singh (Eds.). Emerging multinationals in emerging markets. Cambridge: Cambridge University Press.

Ramasamy, B., Yeung, M., & Laforet, S. 2010. China’s outward foreign direct investment: Location choice and firm ownership. Journal of World Business, 47(1): 17–25.

Ramaswamy, K., Li, M., & Veliyath, R. 2002. Variations in ownership behavior and propensity to diversify: A study of the Indian corporate context. Strategic Management Journal, 23(4): 345–358.

Rui, H., & Yip, G. S. 2008. Foreign acquisitions by Chinese firms: A strategic intent perspective. Journal of World Business, 43(2): 213–226.

Rumelt, R. P. 1974. Strategy, structure, and economic performance. Cambridge: Harvard University Press.

Shleifer, A., & Vishny, R. W. 2003. Stock market driven acquisitions. Journal of Financial Economics, 70(3): 295–311.

Singh, D. A. 2009. Export performance of emerging market firms. International Business Review, 18(4): 321–330.

Singh, D. A., & Gaur, A. S. 2013. Governance structure, innovation and internationalization: Evidence from India. Journal of International Management, 19(3): 300–309.

Sun, S. L., Peng, M. W., Ren, B., & Yan, D. 2012. A comparative ownership advantage framework for cross-border M&As: The rise of Chinese and Indian MNEs. Journal of World Business, 47(1): 4–16.

Sun, S. L., Peng, M. W., & Tan, W. 2017. Institutional relatedness behind product diversification and international diversification. Asia Pacific Journal of Management, 34(2): 339–366.

Tallman, S., & Li, J. 1996. Effects of international diversity and product diversity on the performance of multinational firms. Academy of Management Journal, 39(1): 179–196.

Tan, J. 2001. Innovation and risk-taking in a transitional economy: A comparative study of chinese managers and entrepreneurs. Journal of Business Venturing, 16(4): 359–376.

Tihanyi, L., Johnson, R. A., Hoskisson, R. E., & Hitt, M. A. 2003. Institutional ownership differences and international diversification: The effects of boards of directors and technological opportunity. Academy of Management Journal, 46(2): 195–211.

Toplensky, R. 2017. Syngenta and ChemChina deal to complete by summer, says chief. Financial Times..

Wang, C., Hong, J., Kafouros, M., & Boateng, A. 2012. What drives outward FDI of Chinese firms? Testing the explanatory power of three theoretical frameworks. International Business Review, 21(3): 425–438.

Xu, D., Zhou, C., & Phan, P. H. 2010. A real options perspective on sequential acquisitions in China. Journal of International Business Studies, 41(1): 166–174.

Xu, N., Xu, X., & Yuan, Q. 2013. Political connections, financing friction, and corporate investment: Evidence from Chinese listed family firms. European Financial Management, 19(4): 675–702.

Yiu, D. W. 2011. Multinational advantages of Chinese business groups: A theoretical exploration. Management and Organization Review, 7(2): 249–277.

Zaheer, S., Lamin, A., & Subramani, M. 2009. Cluster capabilities or ethnic ties? Location choice by foreign and domestic entrants in the services offshoring industry in India. Journal of International Business Studies, 40(6): 944–968.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Rao-Nicholson, R., Cai, C. The effects of ownership identity on corporate diversification strategy of Chinese companies in foreign markets. Asia Pac J Manag 37, 91–126 (2020). https://doi.org/10.1007/s10490-018-9578-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10490-018-9578-8