Abstract

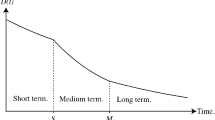

This study proposes a model of non-unitary time discounting and examines its welfare implications. A key feature of our model lies in the disparity of time discounting between multiple distinct goods, which induces an individual’s preference reversals even though she normally discounts her future utilities for each good. After characterizing the time-consistent decision-making by such an individual, we compare welfare achieved in the market economy and welfare in the planner’s allocation from the perspective of all selves across time. Under certain situations, the selves in early periods strictly prefer the social planner’s allocation, whereas the selves in future periods strictly prefer the market equilibrium. Therefore, the welfare implications of our model are quite different from those in the canonical discounting model and in models of other time-inconsistent preferences.

Similar content being viewed by others

Notes

For an excellent discussion on the inconsistency of intertemporal choices due to time discounting, see Frederick et al. (2002).

In Subsection 4.4 (p. 56) of their paper, Krusell et al. (2002) make the same argument.

Throughout the study, we focus on the case in which each self employs Markov strategies whereby she makes a decision based only on the state variables, in this case, her assets.

Using the definition of \(a_t\) and \(\lim _{T \rightarrow \infty } (\prod _{t=0}^{T} R_t)^{-1} a_{T+1}=0\), the intertemporal budget constraint is given by \(a_t = \sum _{t'=t}^\infty (\prod _{\nu =t}^{t'} R_\nu )^{-1} (c_{t'}+w_{t'}(1-l_{t'}))\) for all \(t =0, 1, 2\ldots\) Then, we obtain \(R_t a_t=a_{t+1}+c_t+w_t (1-l_t)\).

See Proposition 2 of their paper.

We thank an anonymous referee for pointing out this.

References

Banerjee, A., & Mullainthan, S. (2010). The shape of temptation: Implications for the economic lives of the poor. NBER Working Paper 15973.

Barro, R. J. (1999). Ramsey meets Laibson in the neoclassical growth model. Quarterly Journal of Economics, 114, 1125–1152.

Chapman, G. B. (1996). Temporal discounting and utility for health and money. Journal of Experimental Psychology: Learning, Memory, and Cognition, 22, 771–791.

Chapman, G. B., Nelson, R., & Hier, D. B. (1999). Familiarity and time preferences: Decision making about treatments for migrate headaches and Crohn’s disease. Journal of Experimental Psychology: Applied, 5, 17–34.

Chapman, G. B., Brewer, N. T., & Leventhal, E. A. (2001). Value for the future and preventive health behavior. Journal of Experimental Psychology: Applied, 7, 235–250.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40, 351–401.

Goldman, S. M. (1980). Consistent plans. Review of Economic Studies, 47, 533–537.

Gul, F., & Pesendorfer, W. (2001). Temptation and self-control. Econometrica, 69, 1403–1435.

Hiraguchi, R. (2014). On the neoclassical growth model with non-constant discounting. Economics Letters, 125, 175–178.

Hiraguchi, R. (2016). On a two-sector endogenous growth model with quasi-geometric discounting. Journal of Mathematical Economics, 65, 26–35.

Hori, T., & Futagami, K. (2019). A non-unitary discount rate model. Economica, 86, 139–165.

Krusell, P., Kuruşçu, B., & Smith, A. A. (2002). Equilibrium welfare and government policy with quasi-geometric discounting. Journal of Economic Theory, 105, 42–72.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. Quarterly Journal of Economics, 112, 443–477.

Peleg, B., & Yaari, M. E. (1973). On the existence of a consistent course of action when tastes are changing. Review of Economic Studies, 40, 391–401.

Phelps, E. S., & Pollak, R. A. (1968). On second-best national saving and game-equilibrium growth. Review of Economic Studies, 35, 185–199.

Pollak, R. A. (1968). Consistent planning. Review of Economic Studies, 35, 201–208.

Soman, D. (1998). The illusion of delayed incentives: Evaluating future effort-money transactions. Journal of Marketing Research, 35, 427–37.

Soman, D. (2004). The effect of time delay on multi-attribute choice. Journal of Economic Psychology, 25, 153–175.

Strotz, R. H. (1955). Myopia and inconsistency in dynamic utility maximization. Review of Economic Studies, 23, 165–180.

Ubfal, D. (2016). How general are time preferences? Eliciting good-specific discount rate. Journal of Development Economics, 118, 150–170.

Acknowledgements

This is a substantially revised version of the paper entitled “Welfare and Tax Policies in a Neoclassical Growth Model with Non-unitary Discounting”. We especially thank Takeo Hori for valuable discussions. We also thank an anonymous referee for helpful comments. Of course, all errors and shortcomings are our own. Ohdoi acknowledges financial support from JSPS KAKENHI Grant Number JP19K01646 as well as the program of the Joint Usage/Research Center at KIER, Kyoto University. Futagami acknowledges financial support from G-COE (Osaka University) “Human Behavior and Socioeconomic Dynamics.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proof of Proposition 1

We restate the optimization problem of the self in a period:

where \(V_c\) and \(V_x\) are recursively defined by the following functional equations:

The first-order conditions (FOCs) of the problem (A.1) are

Differentiating \(V_c(a)\) and \(V_x(a)\) in (A.2) with respect to a and adding these together, we obtain

Substituting (A.3) and (A.4) into the right-hand side of this equation, we obtain

Since g(a) is defined as \(g(a)\equiv Ra-\phi _c(a)-p\phi _x(a)\),

From (A.5) and (A.6), we obtain the following equation, which appears in the main body:

Substituting (A.7) into (A.4) and evaluating it in period t yields the following Euler equation:

Using (A.3) and (A.7), the above equation is also expressed as

Appendix B: Proof of Lemma 1

To show this lemma, we guess \(\phi _c(a, X)\) and \(V_l(a, X)\) as follows:

where \(\mu _c\), \(b_l(X)\), and \(d_l\) are the parameters that we have to solve for. From (7), we have

Using this result and the budget constraint (2) in the main body, we obtain

where

Using the above guesses and (B.3), we can rewrite the Euler equation (8) as follows:

which results in

At the same time, \(d_l\) (as well as \(b_l(X)\)) must satisfy the following functional equation:

Substituting (B.1)–(B.3) into the above equation yields

which results in \(d_l= \zeta /(1-\beta _l)\). Substituting this into (B.5),

From (B.4) and (B.7), we finally obtain

where

Appendix C: Derivation of Eq. (9)

When \(\delta =1\), human wealth in the main body is expressed as

From Eq. (3),

To simplify the expression of \(\prod _{\nu =t}^{t'-1} r_\nu\), we first calculate \(\sum _{\nu =t}^{t'-1} \ln r_\nu\).

Since we guess that \(X_{t+1}=s^{\mathrm{eqm}}A X_t^\alpha\) for all t,

Then,

where we use the fact that \(\ln X_{t'}\) satisfies Eq. (C.4) with \(\nu =t'\). Substituting this into the right-hand side of Eq. (C.3) yields

Since \(\prod _{\nu =t}^{t'-1} r_\nu = \exp \left[ \sum _{\nu =t}^{t'-1} \ln r_\nu \right]\), the above equation implies

Finally, substituting (C.2) and (C.5) into (C.1), we obtain

If \(s^{\mathrm{eqm}}\ge \alpha\), (C.6) implies that the human wealth of the household is infinity in any period, which should be excluded. Since we guess that \(s^{\mathrm{eqm}} <\alpha\) (and show that this inequality holds), Eq. (C.6) gives

Since \(X_t=k_t/l^{\mathrm{eqm}}\) from the market-clearing conditions for labor and assets, we obtain Eq. (9).

Appendix D: Proof of Lemma 2

We state the planner’s problem again here.

Assume that the planner in a period expects that if the value of capital is given by k, the next self’s decisions about savings and labor supply are

Then, functions \(V^\mathrm{{sp}}_c(k)\) and \(V^\mathrm{{sp}}_l(k)\) are given by the following functional equations:

The FOCs of the problem in (D.1) with respect to \(k'\) and l are given by

respectively. We make the following guess for \(V^\mathrm{{sp}}_i\) (\(i\in \{c, l \}\)):

From (D.4), we obtain

where \(\Psi\) is defined as

From (D.5) and (D.6), we obtain

Since the value of \(\Psi\) is still unknown, we substitute (D.6), (D.8), and the guess for \(V^\mathrm{{sp}}_j\) into (D.2) and (D.3):

Since the coefficients of both sides must be equal, we can show that

Then, \(d_l=0\) implies

Substituting this result into the definition of \(\Psi\), we have

Finally, substituting the obtained value of \(\Psi\) into (D.6) and (D.8), we obtain

and

Appendix E: Proof of Proposition 3

If the saving rate and labor supply are determined so that they are constant over time, we calculate the utility of a self in period t as follows.

From Eq. (12) in the main body, we have

where \(k_t\) is historically given for the self in period t. Substituting this result into the last term in (E.1) yields

Note that the following identity holds:

To obtain this proposition, we first show the following two lemmas.

Lemma E.1

There exists a unique pair \((s^*, l^*)\) that maximizes W(s, l, k).

Proof

Since this function is strictly concave in (s, l), the necessary and sufficient conditions for \((s^*, l^*)\) are given by the following FOCs:

which in turn yield

where \(\omega \equiv (1-\beta _c)/(1-\beta _l)\), which deviates from unity if and only if \(\beta _c\ne \beta _l\). \(\square\)

We next show the following lemma.

Lemma E.2

\(s^\mathrm{{sp}} ( \equiv s^*) \gtreqless s^\mathrm{{eqm}}\) and \(l^*\gtreqless l^\mathrm{{sp}} \gtreqless l^\mathrm{{eqm}}\) if and only if \(\beta _c \gtreqless \beta _l.\)

Proof

From their definitions, it follows that \((s^\mathrm{{eqm}}, l^\mathrm{{eqm}})=(s^\mathrm{{sp}}, l^\mathrm{{sp}})=(s^*, l^*)\) when \(\beta _c=\beta _l\). From the proof of Lemma 3 in the main body, we know that \(s^\mathrm{{eqm}}\) and \(l^\mathrm{{eqm}}\) are strictly increasing with respect to \(\beta _l\), whereas \(s^\mathrm{{sp}}\) and \(l^\mathrm{{sp}}\) are independent of \(\beta _l\). Finally, \(l^*\) is strictly decreasing with respect to \(\beta _l\). Then, we can show that

\(\square\)

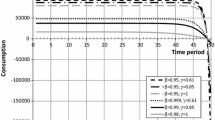

Having obtained Lemmas E.1 and E.2, we evaluate the ranking between \(V^\mathrm{{eqm}} (k)\) and \(V^\mathrm{{sp}} (k)\) by using the contours of W(s, l, k) in the s-l plane. In panels (a) and (b) of Fig. 1, \((s^*, l^*)\) is located at point O, and the closed curves represent the contours of W(s, l, k). The value of the welfare evaluation function W(s, l, k) increases as the curves approach O. At any point on the curve passing through point A (B), \(V^\mathrm{{eqm}}(k)\) (\(V^\mathrm{{sp}}(k)\)) is achieved. From Lemma E.2, the distance from points A to O is necessarily farther than that from points B to O, as long as \(\beta _c\ne \beta _l\). Furthermore, from this lemma, we can show that points A and B are located in the same quadrant of the coordinate plane, with its origin given by point O. This means that when \(\beta _c\ne \beta _l\), the indifference curve passing through point A is always located outside the curve passing through point B. Therefore, we show that this proposition holds.

Appendix F: Proof of Lemma 5

From the definitions of \(V^j(k)\) and W in (E.2), \(V^j(k)\) is expressed as

where \(B^j\) is a collection of other terms, independent of k. The above equation shows that \(V^j (k)\) is strictly increasing.

Appendix G: Proof of Proposition 5

When the saving rate and labor supply are constant over time, the steady state of capital is given by

Thus, the steady state of k in the market equilibrium is \(K_{ss}(s^\mathrm{{eqm}}, l^\mathrm{{eqm}})\), while that under social planning is \(K_{ss}(s^\mathrm{{sp}}, l^\mathrm{{sp}})\). We define the function \(W_{ss}(s, l)\) as follows:

We verify that \(V^j(K_{ss}(s^j, l^j))\equiv W_{ss}(s^j, l^j)\). By simple calculations, we find that \(W_{ss}(s, l)\) is maximized at \((s^*_{ss}, l^*_{ss})\), where

To obtain this proposition, we first show the following lemma.

Lemma E.3

Given \(\beta _c\), there exists a unique \({{\overline{\beta }}}_l \in (\beta _c, 1)\), such that \(s^\mathrm{{sp}}< s^\mathrm{{eqm}} < s^*_{ss}\) and \(l^\mathrm{{sp}}< l^\mathrm{{eqm}}< l^*_{ss}\) if and only if \(\beta _c<\beta _l < {{\overline{\beta }}}_l\).

Proof

From the proof of Lemma E.2, we show that

Then, our remaining task is to derive the condition under which \(s^\mathrm{{eqm}}<s^{*}_{ss}\) and \(l^\mathrm{{eqm}}<l^{*}_{ss}\) hold. From its definition, \(s^\mathrm{{eqm}}\) converges to \(\alpha (=s^*_{ss})\) as \(\beta _l \rightarrow 1\). Since \(s^\mathrm{{eqm}}\) is strictly increasing with respect to \(\beta _l\), we first find that

We next consider the ranking between \(l^\mathrm{{eqm}}\) and \(l^*_{ss}\).

From its definition, \(l^\mathrm{{eqm}}\) is strictly increasing with respect to \(\beta _l\) and converges to \(1/(1+\zeta )\) as \(\beta _l \rightarrow 1\). On the contrary, we can easily verify that \(l^{*}_{ss}\) is decreasing with respect to \(\beta _l\), and \(l^*_{ss}= 1/(1+\zeta )\) when \(\beta _l=\beta _c\), and \(l^{*}_{ss} \rightarrow 0\) as \(\beta _l \rightarrow 1\). There exists a unique \({{\overline{\beta }}}_l \in (\beta _c, 1)\) such that

These results show that this lemma holds. \(\square\)

Lemma E.3 shows that if \(\beta _c<\beta _l< {{\overline{\beta }}}_l\), \(V^\mathrm{{eqm}} (K_{ss}(s^\mathrm{{eqm}}, l^\mathrm{{eqm}}))>V^\mathrm{{sp}}(K_{ss}(s^\mathrm{{sp}}, l^\mathrm{{sp}}))\). If \(\beta _l>{{\overline{\beta }}}_l\), it is ambiguous which case yields higher welfare. Therefore, we focus on the former situation.

Since \(V^\mathrm{{eqm}} (k_0)<V^\mathrm{{sp}}(k_0)\), there is at least one period, denoted by T, such that \(V^\mathrm{{eqm}} (k^\mathrm{{eqm}}_t)> V^\mathrm{{sp}}(k^\mathrm{{sp}}_t)\) if \(t\ge T\). Then, we can complete the proof of this proposition by showing that such a period T is unique. To this end, let \(q_t\) denote \(q_t \equiv \ln k_t\). Then, we can rewrite (12) in the main body as follows:

where \(q^j_{ss} \equiv \ln \left[ (s^j A)^{1/(1-\alpha )} l^j \right] =\ln K_{ss}(s^j, l^j)\) from Eq. (G.1). Substituting (G.2) into \(V^j(k)\), we obtain \(V^j(k^j_t)\equiv {\mathcal {V}}^j(t)\), where \({\mathcal {V}}\) is given by

From Proposition 3, we know that \({\mathcal {V}}^\mathrm{{eqm}}(0)\equiv V^\mathrm{{eqm}} (k_0)< V^\mathrm{{sp}} (k_0)\equiv {\mathcal {V}}^\mathrm{{sp}}(0)\) always holds. Moreover, since we consider the case of \(\beta _c<\beta _l<{{\overline{\beta }}}_l\), \({\mathcal {V}}^\mathrm{{eqm}}(T)> {\mathcal {V}}^\mathrm{{sp}}(T)\) as \(T\rightarrow \infty\). Finally, subtracting \({\mathcal {V}}^\mathrm{{eqm}}(t)\) from \({\mathcal {V}}^\mathrm{{sp}}(t)\) yields

Since the value of \(\alpha ^t\) decreases as t increases, \({\mathcal {V}}^\mathrm{{eqm}}(t')-{\mathcal {V}}^\mathrm{{sp}}(t')>{\mathcal {V}}^\mathrm{{eqm}}(t)-{\mathcal {V}}^\mathrm{{sp}}(t)\), for all \(t'>t\), if \(q^\mathrm{{eqm}}_{ss}-q^\mathrm{{sp}}_{ss}>0\). Note that this condition is automatically satisfied for the case of \(\beta _l>\beta _c\). Thus, there exists a unique \(T^*>0\), such that \({\mathcal {V}}^\mathrm{{eqm}}(t)>{\mathcal {V}}^\mathrm{{sp}}(t)\) if and only if \(t\ge T^*\). This proves Proposition 5.

Appendix H: Analysis of tax policies

1.1 H. 1 Market equilibrium under the time-invariant tax policy

To obtain the time-consistent tax policy in Proposition 6, we first characterize the market equilibrium when the tax rates are constant over time: \(\varvec{\tau }_t =\varvec{\tau }\) for all t, which is necessary to show this proposition. Let us introduce the following new functions:

where r(X) and w(X) are given by (3), and the new variable:

The household’s budget constraint is then expressed as

Lemma H.1

In the market equilibrium with the constant tax policy, the saving rate, labor supply, and capital income tax rate are given by \(s^\mathrm{{eqm}}(\varvec{\tau })\), \(l^\mathrm{{eqm}}(\varvec{\tau })\), and \(\tau _r(\varvec{\tau })\), respectively, where

and

Proof

As in the case of the laissez-faire environment in Sect. 3, the self in period t rationally expects the law of motion for the aggregate state \(X_t\) as Eq. (5) in the main body. Then, the optimization problem of the self in a period is given by

subject to the budget constraint (H.1). Functions \(V_c\) and \(V_l\) here are defined as the following functional equations:

respectively, where \(\phi _c(\cdot )\) and \(\phi _l(\cdot )\) are the policy functions for c and l in this case, and \(g(\cdot )\) is given by \(g(\cdot )\equiv {{\hat{r}}}(\cdot ) k+{{\hat{w}}}(\cdot ) \phi _l(\cdot )-\phi _c(\cdot )\).

Hereafter, the arguments of the functions are omitted unless doing so would cause confusion. The FOCs of the problem (H.2) are

We derive the equilibrium in this case by use of “guess and verify.” We guess \(V_i\) (\(i\in \{c, l\}\)) and G are given by

Then, from (H.1), (H.5), and (H.6), we obtain

where the definition of \(\Psi\) is the same as (D.7):

and \(\Lambda\) is given by

Substituting (H.7)–(H.9) into (H.3) and (H.4), we obtain

implying that

Meanwhile, because \(\Lambda =\varphi\) holds, we have

Now, we derive the equilibrium saving rate \(s^\mathrm{{eqm}}\), labor supply \(l^\mathrm{{eqm}}\), and capital income tax rate \(\tau _r\). Since \(K_{t+1}=k_{t+1}\) in the equilibrium, the household’s saving behavior must be consistent with the law of motion of aggregate capital in the market equilibrium. Recalling that \(X_{t+1}=k_{t+1}/l_{t+1}\), this implies

Using the household’s condition (H.9), the guess \(G(k/l)=sA(k/l)^\alpha\), and the guess that labor supply is constant in the equilibrium, we can rewrite this consistency condition (H.11) as

which in turn yields

Since \(\tau _r\) is still to be determined, we use the government’s budget constraint (equation (14) in the main body) and \(X'=s AX^\alpha\) to obtain

Substituting (H.13) into (H.12), we obtain the equilibrium saving rate:

Then, substituting this result back into (H.10) and (H.13) yields

Finally, we obtain the equilibrium labor supply \(l^\mathrm{{eqm}}\) using the consistency condition \(l^\mathrm{{eqm}}=\phi _l(k, k/l^\mathrm{{eqm}})\). From (H.7), this condition is rewritten as

Then, substituting \(\varphi ^\mathrm{{eqm}}(\varvec{\tau })\) and \(\tau _r(\varvec{\tau })\) into this equation and rearranging the terms, we obtain

\(\square\)

1.2 H.2 Definition of the time-consistent policy

In this section, we formally define the time-consistent tax policy. Suppose that the government in period t sets \(\varvec{\tau }_t = \widetilde{\varvec{\tau }}\equiv ({{\widetilde{\tau }}}_w,{{\widetilde{\tau }}}_i)\). while the government in the other periods set the tax rates as \(\overline{\varvec{\tau }}=({{\overline{\tau }}}_w, {{\overline{\tau }}}_i)\). If \(\widetilde{\varvec{\tau }}\ne \overline{\varvec{\tau }}\), there is unilateral deviation of the government in period t. Let \({{\widetilde{G}}}(X, \widetilde{\varvec{\tau }})\) denote the law of motion of X, which differs from G(X) obtained in the previous section because of the current government’s one-period deviation. By definition, \({{\widetilde{G}}}(X, \overline{\varvec{\tau }})\equiv G(X)\) (i.e., if \(\widetilde{\varvec{\tau }}=\overline{\varvec{\tau }}\), they are the same function).

Then, the optimization problem of the household in period t (H.2) is replaced by

In Eq. (H.14), functions \(V_c\) and \(V_l\) are the same as (H.3) and (H.4), respectively, meaning that the household’s decision-making is qualitatively the same as that in the previous section. This is simply because each individual makes her decision taking the factor prices and taxes as given.

Next, we consider the government’s decision-making in period t. In contrast to the household’s behavior, the government recognizes that it can affect the equilibrium labor supply. In what follows, we let \(l_t={{\widetilde{l}}}^\mathrm{{eqm}}(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\) denote the equilibrium labor supply in period t. Owing to the current government’s deviation, \({{\widetilde{l}}}^\mathrm{{eqm}}(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\) can be a different function from \(l^\mathrm{{eqm}} (\overline{\varvec{\tau }})\).

We can now define the time-consistent tax policy.

Definition 1

The sequence \(\{\varvec{\tau }_t\}_{t=0}^\infty\), with \(\varvec{\tau }_t=\overline{\varvec{\tau }}\) \(\forall t=0, 1, 2 \ldots\), is the time-consistent tax policy if

In other words, the sequence of tax rates \(\{ \varvec{\tau }_t\}_{t=0}^\infty\), with \(\varvec{\tau }_t=\overline{\varvec{\tau }}\) \(\forall t=0, 1, 2 \ldots\) is the time-consistent tax policy if any selves of the government cannot obtain a strictly positive welfare gain by these selves’ unilateral one-shot deviation from \(\overline{\varvec{\tau }}\).

1.3 H.3 Proof of Proposition 6

We now show Proposition 6. Suppose that the government in period t deviates from \(\overline{\varvec{\tau }}\) and sets \(\varvec{\tau }_t= \widetilde{\varvec{\tau }}\). We guess that the law of motion of the aggregate state in this period is given by

where \({{\widetilde{s}}}_t\) is the equilibrium saving rate in period t, which can differ from \(s^\mathrm{{eqm}}(\overline{\varvec{\tau }})\) by the government’s deviation in this period. Since the pair of tax rates after this period is always given by \(\overline{\varvec{\tau }}\), the equilibrium labor supply \(l_{t+j}\) (\(j=1, 2, \ldots\)) is \(l^\mathrm{{eqm}}(\overline{\varvec{\tau }})\). Therefore, Eq. (H.11) now implies

where \({{\widetilde{\varphi }}}_t\) is the value of \(\varphi\) in period t. In addition, by imposing \(\varvec{\tau }=\widetilde{\varvec{\tau }}\) and \(l_{t+1}=l^\mathrm{{eqm}}(\overline{\varvec{\tau }})\) on the government budget constraint (14), we obtain

From (H.10), (H.15), (H.16), and the consistency condition, \(\phi _l(k_t, k_t/l_t)=l_t\), the equilibrium labor supply as well as the values of \({{\widetilde{s}}}_t\), \({{\widetilde{\varphi }}}_t\), and \({{\widetilde{\tau }}}_r\) are determined as the functions of both \(\widetilde{\varvec{\tau }}\) and \(\overline{\varvec{\tau }}\). Let their values be denoted by \({{\widetilde{s}}}^\mathrm{{eqm}}(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\), \({{\widetilde{\varphi }}}^\mathrm{{eqm}}(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\), and \({{\widetilde{\tau }}}_r(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\), respectively. Then,

Now, we derive the welfare in period t, \({{\widetilde{V}}}[k_t, k_t/{{\widetilde{l}}}^\mathrm{{eqm}}(\cdot ), \widetilde{\varvec{\tau }}]\). Since the value of \(\varphi\) is given by \(\varphi ^\mathrm{{eqm}}(\overline{\varvec{\tau }})\) in the subsequent periods, the following equation holds:

Substituting these results into Eq. (H.14) yields

where “other terms” represent the collection of all terms independent of \(\widetilde{\varvec{\tau }}\). Note that in the proof of Lemma H.1, the values of \(b_c\) and \(d_c\) are already given and \(b_l+d_l=0\) is already verified.

From the above equation, we find that \(\widetilde{\varvec{\tau }}\) affects \({{\widetilde{V}}}\) only through \({{\widetilde{s}}}^\mathrm{{eqm}}(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\) and \({{\widetilde{l}}}^\mathrm{{eqm}}(\widetilde{\varvec{\tau }}, \overline{\varvec{\tau }})\). This implies that obtaining \({{\widetilde{V}}}\) by choosing \(\widetilde{\varvec{\tau }}\) can also be achieved directly by choosing the values of \({{\widetilde{s}}}^\mathrm{{eqm}}\) and \({{\widetilde{l}}}^\mathrm{{eqm}}\). The FOCs are given by

respectively. Letting \(({{\overline{s}}}, {{\overline{l}}})\) denote the solutions, we explicitly obtain

The tax policy \(\overline{\varvec{\tau }}\) is then determined from

Since \({{\widetilde{s}}}^\mathrm{{eqm}}( \varvec{\tau }, \varvec{\tau })=s^\mathrm{{eqm}}(\varvec{\tau })\), and \({{\widetilde{l}}}^\mathrm{{eqm}}(\varvec{\tau }, \varvec{\tau })=l^\mathrm{{eqm}}(\varvec{\tau })\), for all \(\varvec{\tau }\), substituting \(s^\mathrm{{eqm}}(\varvec{\tau })\) and \(l^\mathrm{{eqm}}(\varvec{\tau })\) in Lemma H.1 into (H.17) yields the following two equations:

The former and latter equations yield

and

respectively. Then, from the above two equations, we have \({{\overline{\tau }}}_w=0\) and \({{\overline{\tau }}}_i=\dfrac{1-\beta _c}{(1+\zeta )\beta _c}\psi -1\). From the definition of \(\psi\), we then have

Finally, substituting \({{\overline{\tau }}}_w=0\) and \(s^\mathrm{{eqm}}(\overline{\varvec{\tau }})=\beta _c\alpha\) into (H.13), we obtain \({{\overline{\tau }}}_r=-\beta _c {{\overline{\tau }}}_i\).

Rights and permissions

About this article

Cite this article

Ohdoi, R., Futagami, K. Welfare implications of non-unitary time discounting. Theory Decis 90, 85–115 (2021). https://doi.org/10.1007/s11238-020-09766-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-020-09766-0