Abstract

Existing models of intertemporal choice such as discounted utility (also known as constant or exponential discounting), quasi-hyperbolic discounting and generalized hyperbolic discounting are not monotone: A decision maker with a concave utility function generally prefers receiving $1 m today plus $1 m tomorrow over receiving $2 m today. This paper proposes a new model of intertemporal choice. In this model, a decision maker cannot increase his/her satisfaction when a larger payoff is split into two smaller payoffs, one of which is slightly delayed in time. The model can rationalize several behavioral regularities such as a greater impatience for immediate outcomes. An application of the model to intertemporal consumption/saving reveals that consumers may exhibit dynamic inconsistency. Initially, they commit to saving for future consumption, but, as time passes, they prefer to renegotiate such a contract for an advance payment. Behavioral characterization (axiomatization) of the model is presented. The model allows for intertemporal wealth, complementarity and substitution effects (utility is not separable across time periods).

Similar content being viewed by others

Notes

This example is also given in Blavatskyy (2015, p. 143).

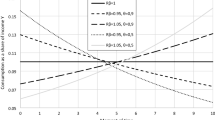

It seems that an inverse S-shaped weighting function rather than a concave utility function is the main driving force behind an apparent “hyperbolic” discounting. For example, consider discount factors implicitly defined by Eq. (25) with a weighting function (24) with parameter \(\gamma =0.56\) and a linear utility function. In this case, a quarterly discount factor would be 0.7115 for payoffs in one quarter, 0.6559 for payoffs in 1 year, and 0.7855 for payoffs in 3 years.

Alternatively, we can make an additional assumption that utility function is differentiable and investigate when the first derivative of the objective function in (32) is strictly positive for all \(C_{T-1}\in [0, Y_{T-1}]\).

When \(t=T-1\), recursive Eq. (35) becomes \(C_{T-1} =\frac{1}{d}\ln \left( {e^{C_T d}+\frac{R-1}{1-w\left( \beta \right) }w\left( {\beta ^{2}} \right) \left[ {e^{-C_T d}-1} \right] } \right) \).

If undesirable payoffs occur, then it is possible that \({{\mathbf {f}}}({{\mathbf {t}}})\succcurlyeq {{\mathbf {f}}} ({{\mathbf {s}}})\) even though a moment of time \(t\in S\) precedes a moment of time \(s\in S\). In this case, we need to assume explicitly that all step programs are comonotonic.

Rank-dependent utility with a linear utility function is also known as Yaari’s dual modal (Yaari 1987).

Typical parameterizations of rank-dependent utility also cannot resolve the classical St. Petersburg paradox (Blavatskyy 2005).

A similar example is also given in Rubinstein (2003, experiment 1, section 3.1, p. 1211).

References

Abdellaoui, M.: Parameter-free elicitation of utility and probability weighting functions. Manag. Sci. 46, 1497–1512 (2000)

Allais, M.: Le Comportement de l’Homme Rationnel devant le Risque: Critique des Postulates et Axiomes de l’Ecole Américaine. Econometrica 21, 503–546 (1953)

Bernasconi, M.: Nonlineal preference and two-stage lotteries: theories and evidence. Econ. J. 104, 54–70 (1994)

Blaschke, W., Bol, G.: Geometrie der Gewebe: Topologische Fragen der Differentialgeometrie. Springer, Berlin (1938)

Blavatskyy, P.: Back to the St. Petersburg paradox? Manag. Sci. 51(4), 677–678 (2005)

Blavatskyy, P.: Reverse common ratio effect. J. Risk Uncertain. 40, 219–241 (2010)

Blavatskyy, P.: Troika paradox. Econ. Lett. 115(2), 236–239 (2012)

Blavatskyy, P.: Reverse Allais paradox. Econ. Lett. 119(1), 60–64 (2013a)

Blavatskyy, P.: A simple behavioral characterization of subjective expected utility. Oper. Res. 61(4), 932–940 (2013b)

Blavatskyy, P.: Two examples of ambiguity aversion. Econ. Lett. 118(1), 206–208 (2013c)

Blavatskyy, P.: A Probability Weighting Function for Cumulative Prospect Theory and Mean-Gini Approach to Optimal Portfolio Investment” working paper available at http://ssrn.com/abstract=2380484 (2014)

Blavatskyy, P.: Intertemporal choice with different short-term and long-term discount factors. J. Math. Econ. 61, 139–143 (2015)

Bleichrodt, H., Rohde, K., Wakker, P.: Koopmans’ constant discounting for intertemporal choice: a simplification and a generalization. J. Math. Psychol. 52, 341–347 (2008)

Camerer, C., Ho, T.: Violations of the betweenness axiom and nonlinearity in probability. J. Risk Uncertain. 8, 167–196 (1994)

Debreu, G.: Representation of a preference ordering by a numerical function. In: Thrall, R.M., Coombs, C.H., Davis, R.L. (eds.) Decision Processes, pp. 159–165. Wiley, New York, NY (1954)

Frederick, S., Loewenstein, G., O’Donoghue, T.: Time discounting and time preference: a critical review. J. Econ. Lit. 40, 351–401 (2002)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 47, 263–291 (1979)

Koopmans, T.: Stationary ordinal utility and impatience. Econometrica 28, 287–309 (1960)

Köbberling, V., Wakker, P.P.: Preference foundations for nonexpected utility: a generalized and simplified technique. Math. Oper. Res. 28, 395–423 (2003)

Krantz, D.H., Luce, R.D., Suppes, P., Tversky, A.: Foundations of Measurement (Additive and Polynomial Representations), vol. 1. Academic Press, New York, NY (1971)

Loewenstein, G., Prelec, D.: Anomalies in intertemporal choice: evidence and an interpretation. Q. J. Econ. 107, 573–597 (1992)

Loewenstein, G., Prelec, D.: Preferences for sequences of outcomes. Psychol. Rev. 100, 91–108 (1993)

Machina, M.: Risk, ambiguity, and the rank-dependence Axioms. Am. Econ. Rev. 99(1), 385–392 (2009)

Phelps, E., Pollak, R.: On second-best national saving and game-equilibrium growth. Rev. Econ. Stud. 35, 185–199 (1968)

Quiggin, J.: Risk perception and risk aversion among Australian farmers. Aust. J. Agric. Recourse Econ. 25, 160–169 (1981)

Rubinstein, A.: Economics and psychology? The case of hyperbolic discounting. Int. Econ. Rev. 44, 1204–1216 (2003)

Samuelson, P.: A note on measurement of utility. Rev. Econ. Stud. 4, 155–161 (1937)

Scholten, M., Read, D.: The psychology of intertemporal tradeoffs. Psychol. Rev. 117(3), 925–944 (2010)

Starmer, C.: Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk. J. Econ. Lit. 38, 332–382 (2000)

Thaler, R.H.: Some empirical evidence on dynamic inconsistency. Econ. Lett. 8, 201–207 (1981)

Tversky, A., Kahneman, D.: Advances in prospect theory: cumulative representation of uncertainty. J. Risk Uncertain. 5, 297–323 (1992)

Wakker, P.P.: Cardinal coordinate independence for expected utility. J. Math. Psychol. 28, 110–117 (1984)

Wakker, P.P.: The algebraic versus the topological approach to additive representations. J. Math. Psychol. 32, 421–435 (1988)

Wakker, P.P.: Additive Representation of Preferences, a New Foundation of Decision Analysis. Kluwer, Dordrecht (1989)

Wakker, P.P.: Unbounded utility for Savage’s foundations of statistics, and other models. Math. Oper. Res. 18, 446–485 (1993)

Yaari, M.: The dual theory of choice under risk. Econometrica 55, 95–115 (1987)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Blavatskyy, P.R. A monotone model of intertemporal choice. Econ Theory 62, 785–812 (2016). https://doi.org/10.1007/s00199-015-0931-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-015-0931-6

Keywords

- Intertemporal choice

- Discounted utility

- Time preference

- Dynamic inconsistency

- Expected utility theory

- Rank-dependent utility