Abstract

The Oil and Gas (O&G) industry has been subjected to stringent environmental regulations and increasing stakeholders’ criticisms because of its devastating negative environmental impacts. Consequently, firms operating in the industry’s supply chain are increasingly facing intense pressures to develop the strategic capabilities for implementing green practices to reduce the environmental impacts of operations. From a theoretical perspective, the Natural Resource-Based View (NRBV) suggests that the strategic environmental capabilities of pollution prevention (PPC), product stewardship (PSC) and clean technology (CTC) can generate sustained competitive advantage for firms. However, the extant empirical research investigating the impact of the three NRBV strategic environmental capabilities (PPC, PWC and CTC) on firms’ competitive performance has yielded inconsistent results. Therefore, this paper adopts the theoretical lens of NRBV to develop and empirically assess an integrated framework of strategic environmental management capabilities (SEMC) and competitiveness in the context of the Nigerian O&G industry. Using a multiple regression technique to analyse the responses of 214 managers across the supply chain of the Nigerian O&G industry, this study examines the impact of the three NRBV-based SEMC (PPC, PWC and CTC) on the economic and environmental competitiveness of the firms operating in the supply chain of the Nigerian O&G industry. First, the results indicate that the three SEMCs have positive impacts on the environmental competitiveness of the O&G firms. However, while PPC and PSC are positively related to the economic competitiveness of firms, CTC has no statistically significant impact on economic competitiveness. These findings suggest that O&G firms in developing nations need to channel efforts to build their SEMCs for implementing green practices to enhance their economic and environmental competitiveness. The results further highlight the need for policymakers in petroleum-producing nations to promote policies that foster the adoption of green practices by O&G firms.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

23.1 Introduction

The O&G industry continually experiences stakeholders’ pressures to rethink operations towards sustainability due to the devastating negative impacts of the O&G operations and products on the environment [1]. Recently, various countries such as the Republic of Ireland and New Zealand have announced their commitment to divestment from fossil fuels (including O&G) [2]. Also, more stringent regulations are increasingly targeted at the O&G industry globally to manage climate change issues linked with the GHG emissions traceable to the industry [3, 4]. O&G firms can minimise operation and product environmental impact and improve economic performance by activating their strategic environmental management capabilities (SEMCs) [5].

The Natural Resource Based-View (NRBV) proposes pollution prevention (PPC), product stewardship (PSC) and clean technology (CTC) as SEMCs that may help firms attain sustained competitive advantage [6, 7]. Recently, O&G practitioners are showcasing their sustainability strategies to earn legitimacy against stakeholder pressures. For instance, Royal Dutch Shell has continually popularised its environmental management capabilities through its drive toward huge investment in cleaner energy [8]. While these strategies mostly align with the NRBV-SEMC of PPC, PSC and CTC, there is no empirical evidence that these SEMCs positively impact the competitiveness of O&G firms in line with NRBV’s postulations. Considering that such evidence may justify petroleum managers’ investment in green practices while influencing the O&G policy framework toward sustainability; the current paper sets out to answer the following research question (RQ):

Do strategic environmental capabilities (SEMCs) enhance the competitiveness of firms in the oil and gas supply chain?

For this purpose, this paper proposed an integrated SEMC-competitiveness model that links the three NRBV-based SEMCs (PPC, PSC and CTC) with firms’ environmental and economic competitiveness. The proposed model was assessed with data from selected managers in the Nigerian O&G supply chain. The remainder of this paper covers various sections, which include: Theoretical Background and Hypothesis development (Sect. 23.2), Methodology (Sect. 23.3), Results and Discussion (Sect. 23.4) and Conclusion and Recommendations (Sect. 23.5).

23.2 Theoretical Background and Hypotheses Development

23.2.1 Natural Resource-Based View (NRBV)

NRBV integrates the ‘voice of the environment’ into the Resource-Based View theory and argues that the future competitive advantage would be attained by firms’ ability to manage their natural environment effectively [6]. Accordingly, firms must channel their valuable, rare, inimitable and non-substitutable resources to activate the SEMCs of pollution prevention, product stewardship, clean technology and Base of the pyramid to attain sustained competitive advantage [7]. Empirical studies have validated the existence of PPC, PST and CTC in a supply chain context [7, 9]. However, the presence of the Base of the Pyramid strategies was not empirically validated in the UK Agrofood industry’s supply chain [9]. Few studies examining NRBV in the O&G industries have also sparingly focused on PPC and PSC [5, 10]. Therefore, the current research conceptualises PPC, PSC and CTC as the SEMCs that may enhance the competitiveness of O&G firms.

Pollution prevention is a process-based approach to eliminating unnecessary pollution within internal operations. One of its key objectives is proactively and effectively minimising emissions, effluents and waste from operations. In contrast, product stewardship capabilities enable firms to adopt a lifecycle approach to tackling social and environmental concerns at every stage of a product and production process to improve an organisation’s product sustainability [7]. A firm’s product stewardship capabilities transcend internal frameworks but depend mainly on stakeholder integration [6, 11]. Finally, Clean technology capabilities result in firms adopting a radical approach to pollution prevention and environmental management practices [12]. Generally, acquiring clean technology capabilities usually requires considerable investment [13]. Nevertheless, clean technology capabilities can enhance a company’s environmental reputation. The relationships among the constructs of this research are hereafter discussed.

23.2.2 Strategic Environmental Management Capabilities (SEMC) and Competitiveness

According to [6], the ability of firms to adopt pollution prevention strategies instead of end-of-the-pipe pollution control can help firms attain a higher level of economic performance. This is because pollution control methods such as waste disposal result in substantial financial costs and waste of managerial time, which could be saved through a proactive pollution prevention strategy. According to [5], O&G firms that integrate pollution prevention strategies into their operations achieve higher performance levels. Furthermore, firms may attain a higher level of competitive performance by applying a product stewardship strategy [6]. This is because firms pursuing product stewardship strategies can integrate environmental management strategies into a product lifecycle in collaboration with stakeholders [6, 7]. This improves firms’ ability to minimise the environmental impacts of products, leading to a good reputation among stakeholders and consumers.

Many leading O&G companies are gradually investing in clean technology to foster the energy transition in response to stakeholder pressures against climate change. For example, Shell increased its original annual clean energy budget in 2016 from $200 million to $1.2 billion in 2017 [14]. Although a clean technology strategy requires substantial financial capital, available subsidies and tax credits can ameliorate attributable financial requirements. Companies pursuing a clean technology strategy can also benefit from green financing. Based on the above, this research hypothesises that:

-

H1a: Pollution prevention capabilities positively impact firms’ environmental competitiveness in the O&G industry.

-

H1b: Pollution prevention capabilities positively impact firms’ economic competitiveness in the O&G industry.

-

H2a: Product stewardship capabilities positively impact firms’ environmental competitiveness in the O&G industry.

-

H2b: Product stewardship capabilities positively impact firms’ economic competitiveness in the O&G industry.

-

H3a: Clean Technology capabilities positively impact the environmental competitiveness of firms in the O&G industry.

-

H3b: Clean Technology capabilities positively impact firms’ economic competitiveness in the O&G industry.

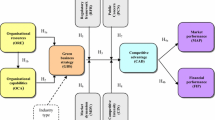

Following the hypotheses stipulated in this paper, the theoretical model of this research is presented in Fig. 23.1.

Our model consists of five constructs made up of three SEMC constructs (PPC, PSC and CTC) and two competitiveness constructs (EcoCom and EnvCom). The model specifies a causal impact of each of the SEMC constructs on the competitiveness constructs. The definition of each construct is provided in Table 23.1.

23.3 Methodology

23.3.1 Survey Development

Latent constructs are operationalised either by developing measurement scales or adapting existing indicators from the literature [15]. The five latent constructs in this research are measured with items adapted from the extant literature. PPC is measured with five items adapted from [16], initially tested in the Canadian O&G industry. PSC is operationalised with five indicators adapted from [17]. These items were also verified in the O&G industry. Measuring CTC is attained with the adaptability of combined items from [16, 18]. Finally, the competitiveness constructs (EcoCom and EnvCom) are operationalised with combined items modified from [19, 20]. To forestall the risk of measurement errors, the definitions of constructs and the measurement items were given to five academicians and five managers across the supply chain of the Nigerian O&G industry, who provided feedback that eventually refined the questionnaire items. The details of the questionnaire items are presented in Appendix 1.

23.3.2 Samples

The respondents in this research are top and middle-level managers across the supply chain of the Nigerian O&G industry. The Nigerian O&G industry is considered a relevant case study in this research because of its history of unsustainable operations across the supply chain, as documented in the literature. Also, strategic management staff across the Nigerian O&G industry are targeted in this research because they are considered knowledgeable in organisational strategies, including sustainability. A list of 2750 firms operating in the upstream and downstream sectors of the Nigerian O&G industry was obtained from the Department of Petroleum Resources (DPR), the regulator of the Nigerian O&G industry. The list contains the address and contact information of the relevant officers of the companies. Using a stratified random sampling technique, the list was classified into two groups: upstream (1100) and downstream (1650). Based on the sample size, 728 and 1092 questionnaires were respectively sent to the upstream and downstream firms using Qualtrics online survey platform. Between May and June 2019, 214 responses were received from various managers across the Nigerian O&G supply chain. The details of the respondents are provided in Table 23.2.

As per the view of [21] that sample sizes between 100 to 400 are sufficient for path analysis methodology based on regression analysis, the sample size of 214 is considered suitable for this research. Whereas this research records a low response rate of 12%, previous studies in operations management have also identified low response rates as a challenge in operations management research.

To ensure a higher ethical standard in this research, respondents were assured of anonymity to protect their identities. Also, informed consent was sought before completing the questionnaire, evidencing that respondents willfully volunteered the information analysed in this research. Furthermore, the informed consent emphasised the respondents’ right to withdraw their responses anytime before publication, without any reason.

23.4 Results and Discussion

23.4.1 Measurement Model Assessment

The measurement items were first assessed for reliability using Cronbach’s alpha. As shown in Table 23.2, all results are sufficiently above the recommended value of 0.70 [15], indicating that the reliability of the questionnaire items is satisfactory. Further reliability and validity assessments were carried out within the context of Confirmatory factor Analysis (CFA) using AMOS software. Items were assessed in a complete measurement model using CFA. As the modification indices in AMOS suggested, three measurement items (PPC5, CTC 4 and CTC5) were deleted from the respective constructs due to poor loadings [22]. The final results of the measurement model assessment are presented in Table 23.2.

The relative Chi-square of 1.336 is less than the recommended maximum value of 3.00 [21]. Also, other model fit indices (RMSEA, 0.40, TLI = 0.966, CFI = 0.970, IFI = 0.971, NFI = 0.903) are higher than the 0.90 recommended minimum value [22], providing evidence of good fit of the research model. Furthermore, all the t-values are above the recommended value of 2.575 and are significant at 0.01. level, indicating satisfactory convergent validity.

23.4.2 Hypotheses Testing and Results

Upon validating the measurement model, the constructs were classified into independent and dependent variables with causal relationships specified in line with the research model hypotheses. For this purpose, PPC, PSC and CTC are independent variables that impact EcoCom and EnvCom as dependent variables. The results of the individual hypotheses based on AMOS output are presented in (Table 23.4).

All hypotheses are positive and statistically significant except for H3a (CTC → EcoCom), which is not significant, thus mostly confirming the proposed research model. Therefore oil and gas firms that develop the strategic environmental management capabilities (SEMC) of pollution prevention and product stewardship are likely to derive the benefits of a higher level of economic and environmental competitiveness, in line with the NRBV logic [6, 7]. In contrast, while O&G firm’s capabilities for clean technology may enhance environmental competitiveness, it may not necessarily result in higher economic competitiveness. With these results, the current research has answered the proposed research question.

23.5 Conclusion

This research examined whether O&G firms that channel efforts into activating their strategic environmental capabilities of pollution prevention, product stewardship and clean technology can derive a higher level of competitiveness as proposed in the NRBV [6, 7]. While there is a positive association between the three SEMCs and environmental competitiveness, clean technology has no statistically significant effect on economic competitiveness, unlike pollution prevention and product stewardship strategies that positively and significantly impact economic competitiveness. The findings of our study have important implications for theory and managerial practice. From an academic perspective, our study has attempted to bring empiricism to the NRBV, which has hitherto been considered a mere theoretical lens in GSCM literature. The research has also deepened the application of theory in O&G-focused GSCM research. From the managerial perspective, the findings of this research justify O&G firms’ investment in the examined green practices as they all yielded positive impacts on environmental and economic competitiveness (except for CTC, which has no significant effect on economic competitiveness). Policymakers may also promote sustainability policies for the O&G industry because of the validated environmental benefits. Incentives such as subsidies can motivate O&G firms’ investment in clean technology to lessen the financial burden. Future studies may address this research’s limitations which include non-inclusion of participants from other O&G countries, expungement of other SEMCs from the research model and deemphasising the antecedents of SEMCs.

References

T.F. Cojoianu, F. Ascui, G.L. Clark, A.G. Hoepner, D. Wójcik, Does the fossil fuel divestment movement impact new oil and gas fundraising? Journal of Economic Geography 21(1), 141–164 (2021)

J. McKenzie, A.V. Carter, Stepping stones to keep fossil fuels in the ground: Insights for a global wind down from Ireland. The Extractive Industries and Society 8(4), 101002 (2021)

N.K.W. Ahmad, M.P. de Brito, J. Rezaei, L.A. Tavasszy, An integrative framework for sustainable supply chain management practices in the oil and gas industry. J. Environ. Planning Manage. 60(4), 577–601 (2017)

Y.Y. Yusuf, A. Gunasekaran, A. Musa, N.M. El-Berishy, T. Abubakar, H.M. Ambursa, The UK oil and gas supply chains: an empirical analysis of the adoption of sustainable measures and performance outcomes. Int. J. Prod. Econ. 146(2), 501–514 (2013)

M. Hastings, A new operational paradigm for oil operations in sensitive environments: an analysis of social pressure, corporate capabilities and competitive advantage. Bus. Strateg. Environ. 8(5), 267–280 (1999)

S.L. Hart, A natural-resource-based view of the firm. Acad. Manag. Rev. 20(4), 986–1014 (1995)

S.L. Hart, G. Dowell, Invited editorial: a natural-resource-based view of the firm: fifteen years after. J. Manag. 37(5), 1464–1479 (2011)

Sheppard, D. (2018). Oil producers face their ‘life or death’ question.

N. McDougall, B. Wagner, J. MacBryde, An empirical explanation of the natural-resource-based view of the firm. Production Planning & Control 30(16), 1366–1382 (2019)

M. Michalisin, B. Stinchfield, Climate change strategies and firm performance: an empirical investigation of the natural resource-based view of the firm. Journal of Business Strategies 27(2), 123–149 (2010)

Y.S. Chen, C.H. Chang, Enhance environmental commitments and green intangible assets toward green competitive advantages: an analysis of structural equation modelling (SEM). Qual. Quant. 47(1), 529–543 (2013)

P. del Río González, Analysing the factors influencing clean technology adoption: a study of the Spanish pulp and paper industry. Bus. Strateg. Environ. 14(1), 20–37 (2005)

X. Shi, C. Dong, C. Zhang, X. Zhang, Who should invest in clean technologies in a supply chain with competition? J. Clean. Prod. 215, 689–700 (2019)

IPIECA, Mapping oil and gas industry to sustainable development goals: an atlas, in International Petroleum Industry Environmental Conservation Association (2017). Available: http://www.ipieca.org/resources/awareness-briefing/mapping-the-oil-and-gas-industry-to-the-sustainable-development-goals-an-atlas/

J.F. Hair, W.C. Black, B.J. Babin, R.E. Anderson, Multivariate Data Analysis, 7th edn. (Pearson Prentice Hall, 2009)

S. Sharma, H. Vredenburg, Proactive corporate environmental strategy and the development of competitively valuable organisational capabilities. Strateg. Manag. J. 19(8), 729–753 (1998)

W.N.K.W. Ahmad, M.P. de Brito, L.A. Tavasszy, Sustainable supply chain management in the oil and gas industry: a review of corporate sustainability reporting practices. Benchmarking Int J. (2016)

K.V. Bhupendra, S. Sangle, What drives the successful implementation of the product stewardship strategy? The role of absorptive capability. Corp. Soc. Responsib. Environ. Manag. 24(3), 186–198 (2017)

Q. Zhu, J. Sarkis, K.H. Lai, Institutional-based antecedents and performance outcomes of internal and external green supply chain management practices. J. Purch. Supply Manag. 19(2), 106–117 (2013)

C.E. Moreno, J.F. Reyes, The value of proactive environmental strategy: an empirical evaluation of the contingent approach to dynamic capabilities. Cuadernos de Administración 26(47), 87–118 (2013)

R.B. Kline, in Principles and practice of structural equation modelling. Guilford publications (2015)

B.M. Byrne, Structural equation modelling with Mplus: basic concepts, applications, and programming (Routledge, 2013)

Acknowledgements

The researchers hereby acknowledge the Federal Republic of Nigeria for funding this research through the Petroleum Technology Development Fund (PTDF).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this paper

Cite this paper

Olajide, O., Kamal, M.M., Kwak, DW., He, Q., Lim, M. (2023). The Impact of Strategic Environmental Management Capabilities on the Competitiveness of an Oil and Gas Industry’s Supply Chain: An Empirical Evaluation of the Natural Resource-Based View of Firms. In: Nixon, J.D., Al-Habaibeh, A., Vukovic, V., Asthana, A. (eds) Energy and Sustainable Futures: Proceedings of the 3rd ICESF, 2022. ICESF 2022. Springer Proceedings in Energy. Springer, Cham. https://doi.org/10.1007/978-3-031-30960-1_23

Download citation

DOI: https://doi.org/10.1007/978-3-031-30960-1_23

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-30959-5

Online ISBN: 978-3-031-30960-1

eBook Packages: EnergyEnergy (R0)