Abstract

In one of the most historic decisions in the Indian economy, the Government of India demonetized its two highest currency notes (Rs. 500 and Rs. 1000) on November 8, 2016. The Indian stock market does not only consist of domestic investors; however, it does attract a large pool of foreign investors. The present study, considering the significance of demonetization in Indian economy, attempted to examine the association between foreign institutional investment (FII), domestic institutional investment (DII) and stock market returns taking into account a period of 686 days from June 11, 2015, to March 27, 2018, i.e., 343 days pre- and post-demonetization. The study made use of various statistical techniques such as summary statistics, augmented Dickey–Fuller test, correlation analysis and regression analysis. The results indicate a negative relationship of FIIs and DIIs with Nifty 50 Index Returns prior to demonetization; however, such a relationship was noticed to be positive post-demonetization. The present study did not evidence a significant impact of demonetization on FIIs and DIIs, but a significant negative impact was noticed in the case of Nifty 50 Index and various sectoral indices post-demonetization. Nifty Realty sector was found to be severely affected because of demonetization. The study will help the government in understanding the impact of demonetization on foreign and domestic institutional investors, various sectoral indices and evaluate market sentiment post-demonetization and therefore frame necessary policies. Also, the information provided in present study will help various stock market participants.

Similar content being viewed by others

Introduction

On November 8, 2016, the Government of India in consultation with Reserve Bank of India (RBI) demonetized its two highest currency notes in the denomination of Rs. 500 and Rs. 1000 which was one of the most historical decisions. This decision was a surprise for the entire nation; however, the government was seemed to be preparing for the same for a couple of months. The announcement of demonetization did raise the eyebrows of various economists within India and across the globe. It soon became the most prominent topic of debate in media with various analysts and subject experts putting forth their opinions on the pros and cons of the decision. The general public did face some hardships in depositing the old currency in their bank accounts or exchanging old currency with the new ones, but in general scenario, people seemed to be pleased with the government’s decision of demonetization. As a general belief, we say everything gets discounted in the stock market. This suggests, by acting as an economic barometer, the stock market reflects and absorbs any news which is related to the economy. As a result, technical analysts were on toes post-demonetization to evidence the tremors generated on account of such news. The Indian stock market does not only consist of domestic investors; however, it does attract a large pool of foreign investors who invest their corpus and hope for the best returns. The foreign investors also analyze all events which occur in the country where they have invested their corpus. Such events happening in the economy are in fact the main reasons for the entry and withdrawal of foreign investors. A favourable news will attract foreign institutional investors in the country and subsequent withdrawal if the news is negative. We find Bhanu Murthy and Singh [3] conducting a study whereby the researchers attempted to find out whether foreign institutional investors really drive the Indian stock market. The researchers evaluated the role of foreign institutional investors, domestic institutional investors and mutual funds in the Indian stock market. The results clearly indicated the influence of FIIs and DIIs on the Indian stock market and mutual funds were found to be passive players. In a similar study, Mehla and Goyal [9] examined the long-term and short-term causal relationships between FIIs and the Indian stock market. The study found a long-term relationship between the said variables and the existence of unidirectional causality from FIIs to stock returns. Also, share prices were found to be influenced by the innovations in FIIs to a very large extent which signifies the information dissemination role of FIIs in the Indian stock market. More insight into the existing literature highlighting the relationship between foreign institutional investment, domestic institutional investment and stock market returns is discussed further. The present study aims to evaluate the relationship between foreign institutional investment, domestic institutional investment and stock market returns pre- and post-demonetization and also to examine the impact of demonetization on foreign institutional investment, domestic institutional investment and stock market returns.

Literature review

Siddiqui and Azad [13] analyzed the relationship between market indices and FIIs in the Indian context for the period 2000 to 2010. The results revealed a significant impact of FIIs on stock returns with respect to the Auto Index, Metal Index and IT Index. A mild significant impact was noticed in the case of SENSEX, BSE 500, BSE 100, BSE Capital Index, BSE Consumer Durables Index and PSU Index. However, the study evidenced an insignificant impact in the case of BANKEX, Realty Index, FMCG Index, Oil and Gas Index and Power Index. Loomba [8] investigated the dynamics of FIIs trading behavior and its impact on the Indian stock market. The researcher considered daily data on FIIs and SENSEX for a period of 10 years, i.e., 2001–2011. The results provided evidence of a positive association between the Indian stock market and FII activity. Lakshman et al. [7] conducted a study to identify the market-wide herding presence in the Indian stock market and the impact of FIIs on such herding. The researcher indicated that herding exists in the Indian stock market, but its impact is not very severe. Further, results revealed that FII flows do not significantly influence the herding behavior. An interesting finding from the study also suggested that mutual funds significantly increase the tendency of herding. Patel [12] analyzed the impact of FIIs on Indian stock market returns using monthly data for the period 1993–2012. The researcher applied various econometric techniques such as Johansen co-integration test, augmented Dickey–Fuller test, Granger causality test and vector error correction model (VECM). The study witnessed a positive association between FII and stock returns. The results also revealed the existence of the causation effect between FII and stock returns to be bidirectional.

Syamala et al. [15] evaluated the relation between stock liquidity and institutional ownership using the data relating to Indian firms for the period 2001–2012. The two liquidity measures, HL-Spread and Amihud illiquidity, were estimated. The researchers found a negative relationship between stock liquidity and institutional ownership and it is driven by Bank Ownership and Foreign Institutional Investors. The study also noticed a positive relationship between stock liquidity and retail ownership and thus concludes that liquid stocks are mostly held by the FIIs. Joo and Mir [6], using time series data of 15 years, i.e., 1999–2013 on SENSEX, Nifty and FIIs, conducted a study to examine the impact of FIIs on stock market volatility. The researchers used the augmented Dickey–Fuller test to check for stationarity and the GARCH model to evaluate volatility. The study noticed a significant relationship between the volatility of the stock market and FIIs. Also, the influence of FIIs on volatility of SENSEX and Nifty was witnessed. Also, Waqas et al. [17] examined the association between foreign portfolio investment (FPI) and macroeconomic factors using 12 years of monthly data pertaining to India, China, Sri Lanka and Pakistan. The researchers used GARCH (1,1) model to measure the volatility in FPI. The results provided evidence of a significant association between FPI and macroeconomic factors. The study also concluded that the focus of foreign portfolio investors is on a stable macroeconomic environment of a particular country. Srinivasan and Kalaivani [14] in their study explored the determinants of FIIs in India using the ARDL (auto-regressive distributed lag) approach for the period 2004–2011. The results showed that, in the short run as well as in the long run, a significant negative impact of exchange rates on FIIs can be noticed. For Indian equity stock market returns, a negative impact on FIIs was found in the short run and a significant positive impact in the long run. However, for US equity stock market returns, a positive impact on FIIs was noticed both in the short run and in the long run, but such influence was insignificant in the short run. This suggested that when the risk associated with the US stock market is high, the FIIs tend to invest more in the Indian stock market. Naik and Padhi [10] examined the interaction of the volatility of stock returns and institutional investment flows. The researchers used vector auto-regressive model to consider FIIs as well as net investment of mutual funds. The findings of the study revealed the evidence of FIIs and mutual funds influencing the volatility of the stock market. Such an impact was found to be positive with mutual funds and negative with FIIs. Also, the researchers found interrelation of FIIs and mutual funds and evidenced bidirectional causality from FIIs to stock market volatility.

Dhingra et al. [5] investigated the interactions of FII with the stock returns and volatility of the market using dynamic and static models. The evidence of FIIs destabilizing the markets was found using vector auto-regression. Arora [2] studied the trading behavior and relationship of FIIs and DIIs with stock returns. The results showed that opposite trading patterns are followed by DIIs and FIIs. The study also indicated that DIIs act as negative feedback traders and FIIs as positive feedback traders. The researchers found weak evidence of a negative association between future stock returns and FII investment. Vardhan and Sinha [16] examined the influence of FIIs on the Indian stock market and how it is integrated with the US stock market. The researchers employed vector auto-regression (VAR) models to prove the results. The results revealed that inflows and outflows of FII are influenced by the domestic stock market. The study did not notice any effect of the exchange rate on FII inflows, but outflows are affected by its change. Also, the study did not witness any significant influence of the US stock market on FII inflows; however, marginal influence on FII outflows was noticed.

Agarwal [1] attempted to find out how FIIs augment financial development and the extent to which FII investment and real investment are considered close in the primary market. The study was conducted for the period 2006–2011. The study found the predictive ability of GDP to be more dominant as compared to FII investments in the primary market. Pandey [11] conducted a study to examine the patterns of FII investments and their relationship with the Indian stock market. The results revealed that the SENSEX movement is influenced by the FIIS to a great extent. The study also evidenced a positive relationship between the SENSEX movement and foreign institutional investment. Zou et al. [18] investigated the characteristics and preferences of foreign institutional and domestic institutional holdings in China. The researchers considered data for the period 2003–2014. The findings of the study indicate that domestic institutional investors have stock-picking skills better than foreign institutional investors. Also as compared to the previous period, the firms with institutional holdings perform superior in the following period. Chen et al. [4] evaluated the influence of index risk-neutral skewness on stock returns and examined whether this influence will differ with sentiments of various institutional investors. The researchers used index futures returns as proxy to the stock market returns. The results revealed a significant negative effect of index risk-neutral skewness on index future returns and such an effect varies with sentiments of various institutional investors.

Research gap

The scrutiny of the existing literature reveals that a considerable amount of research has been done examining the association between foreign institutional investment, domestic institutional investment and stock market returns. Also, we noticed sector-wise analysis evidenced from the Bombay Stock Exchange. The present study is one of its kinds which will examine the relationship between foreign institutional investment, domestic institutional investment and stock returns pre- and post-demonetization in India. The study will reveal as to what extent foreign institutional investment and domestic institutional investment activities have been influenced by the demonetization decision of the government. That is, the study will investigate the impact of demonetization on FIIs, DIIs and stock market returns. The present study will also perform sector-wise analysis taking evidence from National Stock Exchange.

Objectives of the study

The present study attempts to answer the following research questions:

-

Did the relationship between foreign institutional investment, domestic institutional investment and stock market returns changed after demonetization?

-

What is the impact of demonetization on foreign institutional investment, domestic institutional investment and stock market returns?

Considering the above research questions, the following objectives were framed:

-

(a)

To evaluate the relationship between foreign institutional investment, domestic institutional investment and stock market returns pre- and post-demonetization.

-

(b)

To examine the impact of demonetization on foreign institutional investment, domestic institutional investment and stock market returns pre- and post-demonetization.

Methods

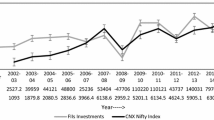

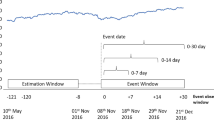

The present study considers the demonetization on November 8, 2016, by the Government of India as a significant event in the history of the Indian economy. Hence, the required analyses have been performed considering pre- and post-data of such an event. The main motive behind conducting this study is to examine the relationship of foreign institutional investments (FIIs) and domestic institutional investments (DIIs) with the stock market returns. For the purpose of analyses, the foreign institutional investments (FIIs) are represented by FII Gross Purchase and FII Gross Sales. The domestic institutional investments (DIIs) are represented as DII Gross Purchase and DII Gross Sales. Moreover, Nifty 50 Index Returns and sector-wise index returns are used as a proxy to stock market returns. The sectoral indices considered for analyses include Nifty Auto Index, Nifty FMCG Index, Nifty Financial Services Index, Nifty IT Index, Nifty Metal Index, Nifty Media Index, Nifty Pharma Index, Nifty Private Bank Index, Nifty PSU Bank Index and Nifty Realty Index.

The stock returns have been computed using the following formula:

where P0 is the current period price and P1 is the price of the previous period. The returns are converted into log-normal form to maintain the normality of data. The variables of FII and DII are also computed as growth for better analyses. The study considers a period of 686 days, i.e., from June 11, 2015, to March 27, 2018, considering the demonetization date as November 8, 2016. This implies 343 days pre- and 343 days post-demonetization. The data pertaining to FII and DII have been extracted from the official website of the Securities Exchange Board of India (SEBI) and moneycontrol.com. The closing prices of various indices have been obtained from the official website of the National Stock Exchange. The study made use of various statistical techniques such as summary statistics, correlation analysis and regression analysis. Also, the entire data were tested for stationarity, serial correlation and heteroscedasticity using the augmented Dickey–Fuller (ADF) test, Breusch–Godfrey Serial Correlation LM Test and Breusch–Pagan–Godfrey Heteroscedasticity Test, respectively.

The impact of demonetization on FIIs, DIIs and stock market returns was evaluated using regression analysis. For this purpose, study involved creation of dummy variables. Following were the sets of equations framed (Eqs. 1–15) for the purpose of such analyses where FIIs, DIIs and stock market returns have been assigned as endogenous variables and their dummies as regressors:

where

-

FII Gross Purchase, FII Gross Sales, DII Gross Purchase, DII Gross Sales, Nifty 50 Index Returns, Nifty Auto Index Returns, Nifty Financial Services Index Returns, Nifty FMCG Index Returns, Nifty IT Index Returns, Nifty Media Index Returns, Nifty Metal Index Returns, Nifty Pharma Index Returns, Nifty PSU Bank Index Returns, Nifty Private Bank Index Returns and Nifty Realty Index Returns are represented as Dependent Variables.

-

α1, α2, α3, α4, α5, α6, α7, α8, α9, α10, α11, α12, α13, α14 and α15 are intercept terms.

-

β1, β2, β3, β4, β5, β6, β7, β8, β9, β10, β11, β12, β13, β14 and β15 are slope coefficients.

-

Dummy FII Gross Purchase, Dummy FII Gross Sales, Dummy DII Gross Purchase, Dummy DII Gross Sales, Dummy Nifty 50 Index Returns, Dummy Nifty Auto Index Returns, Dummy Nifty Financial Services Index Returns, Dummy Nifty FMCG Index Returns, Dummy Nifty IT Index Returns, Dummy Nifty Media Index Returns, Dummy Nifty Metal Index Returns, Dummy Nifty Pharma Index Returns, Dummy Nifty PSU Bank Index Returns, Dummy Nifty Private Bank Index Returns and Dummy Nifty Realty Index Returns are represented as Independent Variables.

-

ε1, ε2, ε3, ε4, ε5, ε6, ε7, ε8, ε9, ε10, ε11, ε12, ε13, ε14 and ε15 are errors terms which are assumed to be 0.

The study used pre-dummy variables, as well as post-dummy variables and ordinary least square (OLS) method, which have been utilized for regression analysis. The required statistical and econometric analyses have been performed using econometric software E-views and sorted using Microsoft Excel.

The necessary hypotheses framed to boost the regression analyses were as follows:

-

Hypothesis 1 H0: There exists no significant impact of demonetization on FII Gross Purchase.

-

Hypothesis 2 H0: There exists no significant impact of demonetization on FII Gross Sales.

-

Hypothesis 3 H0: There exists no significant impact of demonetization on DII Gross Purchase.

-

Hypothesis 4 H0: There exists no significant impact of demonetization on DII Gross Sales.

-

Hypothesis 5 H0: There exists no significant impact of demonetization on Nifty 50 Index Returns.

-

Hypothesis 6 H0: There exists no significant impact of demonetization on Nifty Auto Index Returns.

-

Hypothesis 7 H0: There exists no significant impact of demonetization on Nifty Financial Services Index Returns.

-

Hypothesis 8 H0: There exists no significant impact of demonetization on Nifty FMCG Index Returns.

-

Hypothesis 9 H0: There exists no significant impact of demonetization on Nifty IT Index Returns.

-

Hypothesis 10 H0: There exists no significant impact of demonetization on Nifty Media Index Returns.

-

Hypothesis 11 H0: There exists no significant impact of demonetization on Nifty Metal Index Returns.

-

Hypothesis 12 H0: There exists no significant impact of demonetization on Nifty Pharma Index Returns.

-

Hypothesis 13 H0: There exists no significant impact of demonetization on Nifty PSU Bank Index Returns.

-

Hypothesis 14 H0: There exists no significant impact of demonetization on Nifty Private Bank Index Returns.

-

Hypothesis 15 H0: There exists no significant impact of demonetization on Nifty Realty Index Returns.

The hypotheses framed for the purpose of the augmented Dickey–Fuller test were as follows:

-

Hypothesis 1 H0: The data pertaining to FII Gross Purchase have a Unit Root.

-

Hypothesis 2 H0: The data pertaining to FII Gross Sales have a Unit Root.

-

Hypothesis 3 H0: The data pertaining to DII Gross Purchase have a Unit Root.

-

Hypothesis 4 H0: The data pertaining to DII Gross Sales have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty 50 Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Auto Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Financial Services Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty FMCG Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty IT Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Media Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Metal Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Pharma Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty PSU Bank Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Private Bank Index Returns have a Unit Root.

-

Hypothesis 5 H0: The data pertaining to Nifty Realty Index Returns have a Unit Root.

Results and discussion

Summary statistics

The summary statistics results are presented to understand the nature of data. The study used mean which is a performance measure, SD which signifies variations, skewness which indicates symmetry of data and kurtosis which reflect flatness of data. Table 1 shows that post-demonetization the average growth in FII Gross Purchase, FII Gross Sales and DII Gross Purchase has considerably increased. However, average growth in DII Gross Sales has shown a marginal decline. The study also observed the Nifty Media Index generating the highest average returns and Nifty IT Index generating lowest average returns before demonetization. But the average returns of the Nifty Realty Index were found to be maximum and Nifty Pharma Index to be minimum post-demonetization. These returns are based on averages computed considering 343 days prior and post-demonetization. Hence, it is not feasible yet to conclude the impact of demonetization. As such, the above summary statistics results are important to understand the nature of data before proceeding further analysis.

Augmented Dickey–Fuller test

Table 2 indicates the results of stationarity using the augmented Dickey–Fuller test. The present study tests the existence of unit root in the case of FII Gross Purchase, FII Gross Sales, DII Gross Purchase and DII Gross Sales. Also, the presence of unit root is tested in case of Nifty 50 Index Returns, Nifty Auto Index Returns, Nifty Fin Services Index Returns, Nifty FMCG Index Returns, Nifty IT Index Returns, Nifty Media Index Returns, Nifty Metal Index Returns, Nifty Pharma Index Returns, Nifty PSU Bank Index Returns, Nifty Private Bank Index Returns and Nifty Realty Index Returns. The results reveal the rejection of the null hypothesis at 1% level of significance for FIIs, DIIs and stock market returns. Hence, the data selected for the purpose of the study are stationary and thus considered to be suitable in the context of the current study.

Correlation analysis

The results highlighting the dynamic relationship of FIIs and DIIs with stock market returns are presented in Table 3. The results indicate a negative relationship of FII Gross Purchase, FII Gross Sales, DII Gross Purchase and DII Gross Sales with Nifty 50 Index Returns prior to demonetization. However, such a relationship was noticed to be a positive post-demonetization. Similar results were obtained in the case of the Nifty IT Index, Nifty PSU Bank Index and Nifty Private Bank Index. The relationship of FIIs and DIIs with stock market returns was found to be negative and did not change significantly post-demonetization in the case of Nifty FMCG Index, Nifty Media Index, Nifty Pharma Index and Nifty Realty Index.

Regression analysis

Table 4 indicates the results showing the impact of demonetization on FIIs, DIIs and stock market returns. The present study did not evidence a significant impact of demonetization on FII Gross Purchase, FII Gross Sales, DII Gross Purchase and DII Gross Sales. However, a significant impact was noticed in the case of the Nifty 50 Index and various sectoral indices post-demonetization. In the case of Nifty 50 Index Returns, the impact was found to be negative and significant at 1% level. Also, in the case of sectoral indices, the impact of demonetization was revealed to be significantly negative. Such an impact was severe in the case of the Nifty Reality Index. The decision of demonetization was a surprise for the entire nation including stock market participants. The major stock indices saw the reactions in the form of sell-offs. The stock market witnessed a correction that prolonged for a couple of months. The major sector which got affected because of demonetization is realty sector as per the findings of the present study.

Model diagnosis

The present study used the Breusch–Godfrey Serial Correlation LM Test to examine the presence of serial correlation and Breusch–Pagan–Godfrey Heteroscedasticity Test to check the presence of heteroscedasticity in the data, and the results are presented in Table 5. The results reveal the presence of serial correlation in the case of FII Gross Purchase, FII Gross Sales, DII Gross Purchase and DII Gross Sales pre- and post-demonetization. However, no serial correlation was noticed in the case of stock market returns except for the Nifty FMCG Index. In Table 4, the study found the impact of demonetization on stock market returns, but did not evidence any such impact on FIIs and DIIs. This may be due to the presence of serial correlation in the data pertaining to FIIs and DIIs. The Breusch–Pagan–Godfrey Heteroscedasticity Test reveals minor evidence of heteroscedasticity in the case of the Nifty Auto Index, Nifty IT Index, Nifty Media Index, Nifty Metal Index, Nifty Private Bank Index and Nifty Realty Index post-demonetization and in case of DII Gross Sales and Nifty Pharma Index prior to demonetization. However, Nifty 50 Index returns were found to be homoscedastic which is favorable in the context of present study.

Conclusion

The Indian economy witnessed demonetization on November 8, 2016, where the Government of India demonetized its two highest currency notes in the denomination of Rs. 500 and Rs. 1000. The decision was a surprise for the entire nation including stock market participants. The present study aimed to evaluate the relationship between foreign institutional investment, domestic institutional investment and stock market returns pre- and post-demonetization and also to examine the impact of demonetization on foreign institutional investment, domestic institutional investment and stock market returns. The study made use of various statistical and econometric techniques such as summary statistics, correlation analysis, regression analysis and augmented Dickey–Fuller (ADF) test. The results indicated a negative relationship of FIIs and DIIs with Nifty 50 Index Returns prior to demonetization; however, such a relationship was noticed to be positive post-demonetization. The present study did not evidence a significant impact of demonetization on FIIs and DIIs, but a significant negative impact was noticed in the case of the Nifty 50 Index and various sectoral indices post-demonetization. The study found the Nifty Realty sector to be severely affected because of demonetization.

The present study is also bound with certain limitations. As the period of study is limited and the demonetization decision of the Government of India is of very recent, more clear evidence regarding the relationship and impact of demonetization on FIIs, DIIs and stock market returns will be available in the near future. There exists a scope for further research. The period of the study can be enhanced in the near future to provide a wide outlook to examine the relationship and impact of demonetization on FIIs, DIIs and stock market returns. Also, stock returns volatility can be investigated post-demonetization using models like EGARCH, GARCH and so on. The present study will help the government in understanding the impact of demonetization on FIIs and DIIs, various sectoral indices and evaluate market sentiment post-demonetization and therefore frame necessary policies. Also, the information provided in the current study will help various stock market participants.

Availability of data and materials

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- FIIs:

-

Foreign institutional investments

- DIIs:

-

Domestic institutional investments

- ADF:

-

Augmented Dickey–Fuller test

- RBI:

-

Reserve Bank of India

- BSE:

-

Bombay Stock Exchange

- SENSEX:

-

Sensitive index

- IT:

-

Information technology

- PSU:

-

Public sector undertaking

- BANKEX:

-

Bank index (BSE)

- FMCG:

-

Fast-moving consumer goods

- VECM:

-

Vector error correction model

- HL-Spread:

-

High–low spread

- GARCH:

-

Generalized auto-regressive conditional heteroscedasticity

- FPI:

-

Foreign portfolio investment

- ARDL:

-

Auto-regressive distributed lag

- US:

-

United States

- VAR:

-

Vector auto-regression

- GDP:

-

Gross domestic product

- LM:

-

Lagrange multiplier

- LFIIGP:

-

Log of FII Gross Purchases

- LFIIGS:

-

Log of FII Gross Sales

- LDIIGP:

-

Log of DII Gross Purchases

- LDIIGS:

-

Log of DII Gross Sales

- LNIR:

-

Log of Nifty Index Returns

- LNAIR:

-

Log of Nifty Auto Index Returns

- LNFSIR:

-

Log of Nifty Financial Services Index Returns

- LNFMCGIR:

-

Log of Nifty FMCG Index Returns

- LNITIR:

-

Log of Nifty IT Index Returns

- LNMEDIR:

-

Log of Nifty Media Index Returns

- LNMETIR:

-

Log of Nifty Metal Index Returns

- LNPHIR:

-

Log of Nifty Pharma Index Returns

- LNPSUBIR:

-

Log of Nifty PSU Bank Index Returns

- LNPVTBIR:

-

Log of Nifty Private Bank Index Returns

- LNRIR:

-

Log of Nifty Realty Index Returns

- EGARCH:

-

Exponential generalized auto-regressive conditional heteroscedasticity

References

Agarwal B (2016) FII inflows into Indian IPOs and its impact on the Indian stock market. Emerg Econ Stud 2(1):129–144

Arora RK (2016) The relation between investment of domestic and foreign institutional investors and stock returns in India. Glob Bus Rev 17(3):654–664

Bhanu Murthy KV, Singh AK (2013) Do foreign institutional investors really drive the Indian stock market? Asia-Pac J Manag Res Innov 9(1):45–53

Chen C, Lee HC, Liao TH (2016) Risk-neutral skewness and market returns: the role of institutional investor sentiment in the futures market. N Am J Econ Finance 35:203–225

Dhingra VS, Gandhi S, Bulsara HP (2016) Foreign institutional investments in India: an empirical analysis of dynamic interaction with stock market return and volatility. IIMB Manag Rev 28:212–224

Joo BA, Mir ZA (2014) Impact of FIIs investment on volatility of indian stock market: an empirical investigation. J Bus Econ Policy 1(2):106–114

Lakshman MV, Basu S, Vaidyanathan R (2013) Market-wide herding and the impact of institutional investors in the Indian capital market. J Emerg Mark Finance 12(2):197–237

Loomba J (2012) Do FIIs impact volatility of Indian stock market? Int J Mark Financ Serv Manag Res 1(7):80–93

Mehla S, Goyal SK (2013) Impact of foreign institutional investment on Indian stock market: a cause and effect relationship. Asia-Pac J Manag Res Innov 9(3):329–335

Naik PK, Padhi P (2015) Interaction of institutional investment activity and stock market volatility: evidence from India. Asia-Pac J Manag Res Innov 11(3):219–229

Pandey R (2016) FII investments and its impact on Indian stock market. Asian J Manag Res 6(3):487–496

Patel SA (2013) Foreign institutional investment and stock market returns: evidence from Indian capital market. IIMS J Manag Sci 4(2):143–151

Siddiqui AA, Azad NA (2012) Foreign institutional investment flows and Indian financial market: relationship and way forward. Vision 16(3):175–185

Srinivasan P, Kalaivani M (2015) Determinants of foreign institutional investment in India: an empirical analysis. Glob Bus Rev 16(3):364–376

Syamala SR, Chauhan Y, Wadhwa K (2014) Institutional investors and stock liquidity: evidence from Indian stock market. Glob Bus Rev 15(3):461–476

Vardhan H, Sinha P (2016) Influence of foreign institutional investments (FIIs) on the Indian stock market: an insight by VAR models. J Emerg Mark Finance 15(1):49–83

Waqas Y, Hashmi SH, Nazir MI (2015) Macroeconomic factors and foreign portfolio investment volatility: a case of South Asian countries. Future Bus J 1:65–74

Zou L, Tang T, Li X (2016) The stock preferences of domestic versus foreign investors: evidence from qualified foreign institutional investors (QFIIs) in China. J Multinatl Financ Manag 37:12–28

Acknowledgements

Not applicable.

Funding

The study received no external funding.

Author information

Authors and Affiliations

Contributions

NP analyzed the data, and YVR interpreted the data. All authors had contributed equally in other sections of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Parab, N., Reddy, Y.V. A cause and effect relationship between FIIs, DIIs and stock market returns in India: pre- and post-demonetization analysis. Futur Bus J 6, 25 (2020). https://doi.org/10.1186/s43093-020-00029-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-020-00029-6