Abstract

Demonetization is an act of divesting a currency unit from its legal tender. In a developing country, the act of demonetization will have a direct influence on various sectors. An event study is an empirical analysis to investigate the effect of such unforeseen events. In this study, we investigate the impact of demonetization on the Indian stock market. For the analysis, daily data from the NIFTY 50 Index during demonetization have been analyzed within the observation of different event windows. These event windows are framed as 0–7 days, 0–14 days, and 0–30 days to understand the impact of demonetization during the analysis period 8th November 2016–21st December 2016. The study concludes that the impact of events on the Indian stock market lasted for a short time-period and the market recovered within 1 month. More precisely, in the case of demonetization, though the stock market initially viewed the event as disruptive, Cumulative Abnormal Returns bounce back to indicate that the negative financial impact was not as severe as the industry perceived.

Similar content being viewed by others

1 Introduction

Demonetization is the process of taking away a currency unit from its legal tender status. It happens as national currency changes: the current form or money forms are taken out of circulation and withdrawn, often to be replaced by new notes or coins. It will create confusion or a severe economic slowdown if it goes wrong. Demonetization has been seen as a mechanism for stabilizing the currency and fighting inflation, promoting trade and consumer access, and moving informal economic activity towards greater openness and away from black and grey markets. One of the earliest known instances of demonetization was in the United States of America where the implementation of the Coinage Act of 1873 mandated the replacement of silver by adopting gold standards that led to an economic slowdown for 5 years (Reti, 1998). Further, in 1969, the United States of America went for demonetizing all bills above $100 which was the stepping stone for the development of the American banking system (Friedman, 1992). Reduction of market liquidity and tax evasion was the prime concern of Ghana in 1982. The government then took initiative by demonetizing its 50-cedi currency note which resulted in the public’s shift of interest towards physical assets and foreign currency (Kapasi, 2019). In 1984, the Nigerian government under the leadership of Muhammadu Buhari proposed the change of existing currency notes with new colored currency notes. This decision failed to achieve its aim of resolving the inflated and debt-ridden economy (Miyan, 2017). In 1987, Myanmar announced the demonetization of nearly 80% of the money in circulation to limit the black economy which led to the government crackdown the following year (Vashishat & Tyagi, 2017). In order to counter the parallel economy, the Soviet Union under the leadership of Mikhail Gorbachev removed 100 and 50-ruble currency notes from the market in 1991 which subsequently affected the economy of Soviet republics such as Kazakhstan and Ukraine (Dharanipriya & Karthikeyan, 2020). Small countries like Zaire also considered removing the obsolete currency from circulation in 1993. It caused several economic disruptions (Muthulakshmi & Kalaimani, 2017). In 1996, the Australian government replaced its paper-based currency with new long-lasting currency notes made up of polymer. This step successfully helped in mitigating the black money and increasing the security features (Singh, 2017). In 2002, the European Union demonetized its existing currencies in all 12 nations and introduced the new unified currency ‘Euro’. It turned out to be a successful implementation as the public was well aware of the unprecedented event beforehand (Kaur, 2017). In Zimbabwe in 2015, the government in order to stabilize its hyper-inflated economy replaced the Zimbabwe dollar with the American dollar and was unsuccessful as it led to the receding of accumulated savings of wealth holders (Warburton, 2017).

Several studies have been conducted in the past, examining the impact of a disruptive event on market response and shareholder wealth through a numerous methodologies and the event study is one of them. The event study was invented by Ball and Brown and can capture the impact of any event on the volatility and direction of the price fluctuations (Kim et al., 2020). An event study is commonly used in several fields such as finance, economics, marketing, and supply chain management. It is usually carried out by collecting the financial market data and analyzing it to find out the impact of any event. It is known that the security prices immediately reflect the impact of the event, as per its significance. Hence, by observing the security prices, the economic impact of an event could be measured (Kowalewski & Śpiewanowski, 2020).

In the Indian context, the demonetization episodes are not new. The first demonetization recorded was in 1946 during the British colonial government and the second was in 1978 in independent India to remove the higher order currency denominations to eliminate the spread of black money but the impacts of such currency bans were less significant (Fouillet et al., 2021). This was due to the reason that people during the demonetization were rarely using very high denominations of currency or a very small proportion of the money supply got affected. On 8th November 2016, the Indian government brought demonetization into effect unprecedentedly where ₹500 and ₹1000 banknotes were scraped off from the market (Fouillet et al., 2021). Further, new ₹500 and ₹2000 banknotes were issued in exchange for the old ones. Prime Minister Narendra Modi justified the move as a bold step of the government to uproot the financial scams in the form of black money and corruption (Sam et al., 2021) in the country by eliminating the circulation of illegal and counterfeit currency and tax evasion (Dharmapala & Khanna, 2019; Zhu et al., 2018). The impact of this demonetization attracted a mixed reaction in the literature. On the negative side, this unannounced demonetization resulted in cash shortages in subsequent weeks triggering a short-term structural break in the nation (Singh & Ghosh, 2021). The authors highlighted that the pre-demonetization period witnessed an increased economic activity with increased banking transaction which was halted temporarily post-demonetization period.

The impact of demonetization completely relies on the factors of demand and supply. Demonetization affects cash-dependent industries and consumers the most, rather than the cash-independent ones especially the heterogeneous consumers by creating a bigger liquidity shock to India’s macroeconomically stable output and welfare (Bajaj & Damodaran, 2022). Similarly, India’s large informal sectors that comprise of 80% of the labour force were affected adversely by the demonetization due to a shortage of cash (Karmakar & Narayanan, 2020). However, the findings by Fouillet et al (2021) is quite interesting, where the authors claim that the demonetization was executed mostly to promote the digital economy in the country rather than contending the financial corruption. It has also been stated by the researchers that the impact of demonetization is temporary; it can be reinstated upon the arrival of normal conditions (Zhu et al., 2018). On the positive side, researchers argued that demonetization promoted financial inclusion (Singh & Ghosh, 2021) through a cashless economy such as digital transactions, electronics payment, point of sales (POS), etc. (Fouillet et al., 2021; Sam et al., 2021; Singh & Ghosh, 2021; Zhu et al., 2018).

In this study, the impact of demonetization on the Indian stock market is set as the research objective. We have extended as well as differentiate the works of Dharmapala and Khanna (2019) by considering NIFTY 50 indices from National Stock Exchange (NSE) as our sample. Risk-Adjusted Return Model, Market Adjusted Return Model, and Mean Adjusted Return Model are employed as solution approaches. It is believed that the stock market is a good example of how shareholder expectations over this disruptive event remain grounded across various industries. The ideal indicator for analyzing this impact would be the financial performance of companies in any industry as it would be possible to interpret changes in sales and profits regarding how sectors were affected (Masood & Sergi, 2008). The current study helps to understand the impact of the announcement of demonetization on the stock market as a whole and the impact of demonetization on different sectors of the stocks that constitute the NIFTY index. For this study, the Nifty 50 index has been taken as a sample and used for event study methodology due to its large representation of the Indian economy. As per the report on the methodology of NIFTY 50 indices (NSE Indices Limited, 2019, 2022), there are more than 1600 companies trading routinely on the National Stock Exchange of India (NSE). Out of them, NIFTY 50 constituted those 50 blue-chip companies that approximately hold 66% (NSE Indices Limited, 2022) of float-adjusted market capitalization. Also, the NIFTY 50 indices cover major Indian economic sectors and offer helpful insights to investment bankers for benchmarking purposes through a single efficient portfolio. In addition, the speed of information adjustment (Prasanna & Menon, 2013) is well maintained in NIFTY 50 indices in the form of addition and deletion of companies, share changes, stock splits, etc. For these reasons NIFTY 50 indices are considered a strong representative of the Indian economy and hence we have used the data from NIFTY 50 for our study proposed in this paper. The date of the announcement, 8th November 2016 is considered as the event date (0) and the impact of the demonetization is analysed over the three-time period (event study windows) being 0–7, 0–14, and 0–30 days. The results of the above-mentioned models were observed at the end of the concerned event windows.

The structure of the article is as follows; Sect. 2 describes previous work in this domain, Sect. 3 highlights the methodology adopted in the study, Sect. 4 describes the results, and finally, Sect. 5 concludes the study along with the discussion on future directions.

2 Literature Review

In the literature, several studies assessed the impact of an event on market response and shareholder wealth. As the primary aim of our present study orients the impact of the demonetization on the Indian stock market, we present a brief review of research work conducted on stock markets that cause noteworthy reactions. Therefore, we have categorised the literature we have considered into three subsections namely (1) Methods to study stock markets, (2) Event Study Approach (3) Event study on Indian demonetization episode in 2016.

2.1 Methods to Study Stock Markets

From the pool of literature, it is identified that the volatility of the Indian stock market exhibits characteristics similar to those found in most of the major developed and emerging stock markets (Kaur, 2004) and the exchange rate in emerging markets fluctuates due to the local factors and co-movements from developed nations such as US and China (Liu et al., 2019). Also, several factors like economic policy uncertainty, geopolitical risk, and financial stress are heterogeneous in nature across different emerging markets and not the same across emerging markets (Das et al., 2019). For countries like India, market volatility is also very significant and is proportional to share price (Ma et al., 2018). As the volatility of the bull market is comparatively lower than the bear market negative news causes higher volatility than positive news (Sakthivel et al., 2014). The predictability of stock return volatility is also significantly affected by the stock market implied volatility (Dai et al., 2020). In the literature, it has been observed that several methods have been adopted by researchers to analyze the impact of an event on the stock market. Some of the popular methods are Artificial Neural Network (Vijh et al., 2020), Sentiment analysis (Bhardwaj et al., 2015), GARCH model (Fang et al., 2018), Hierarchical Structure (Zhang et al., 2020) Logistic Regression (Nayak et al., 2016) and Clustering Technique (Nanda et al., 2010). Besides the aforesaid literature, event-study analysis is also found to be an efficient methodology for the aforesaid purpose due to its simplicity and ability to reveal greater market trends or patterns.

2.2 Event Study Approach

In the literature of finance and economics, the event study is a widely used statistical method that studies the impact of a noticeable event on a firm’s value (Brown & Warner, 1980; Mackinlay, 1997). Among the plethora of literature on event study analysis, several studies are central to our study. To discuss a few, Chen et al. (2007) used an event study to highlight the adverse effect of the SARS outbreak on the hospitality industries in Taiwan. Their study inferred that this outbreak has a significant impact on the hospitality industry because of a significant negative Cumulative Mean Abnormal Return (CMAR) even after 10 days of the outbreak. This outbreak showed the fragility of the hotel business toward an epidemic and a new epidemic could likely depress stock markets in Taiwan and South-East Asia. Duso et al. (2010) considered the ability of event study analysis to capture mergers’ ex-post profitability in Austria. They showed that abnormal returns and the ex-post profitability of mergers are positively and significantly correlated for merging firms. Seo et al. (2013) adopted an event study to examine the impact of food safety events on the value of food-related firms in the United States of America. They concluded that it took nearly a year for the firms to recover from the impact of events. Also, firm-specific and situational factors were the most significant determinants of the impact of the event. To investigate the accident severity, Makino, (2016) used an event-study mechanism to examine whether severity is getting affected by variation in the Japanese chemical industry. The findings show that the accident risk has a significant negative return after severe accidents had occurred and it has the potential to motivate the TMT of the firms to reduce their firms’ accident risk because of monitoring by the investors in stock markets. Dutta et al., (2018) mentioned a standardized novel mechanism that shows abnormal returns in long-horizon event studies in Finland. Further, they also identified that Initial Public Offering (IPO), as well as Seasoned Equity Offering (SEO), returns successfully outperforms benchmarking organization. Tao et al. (2019) measured the short-term impact of the 2011 Tohoku earthquake on the whole market and individual stock for China through an event study. They concluded that the market turned positive in a relatively short span, despite the initial negative reaction. Lalwani et al. (2019) investigated the presence of post-event, over-or under-reaction in the stock markets for the top 10 countries by market capitalization. They indicated that the study shows that the UK and Japanese markets efficiently react toward all kinds of price information. Australia, Hong Kong, and USA markets have shown significant overreaction bias in negative price shocks while there is no such bias in positive price events. The Swiss and Indian markets have underreaction toward positive information and overreaction towards negative reactions. Canadian market under-reacts to negative information and the German market under-reacts toward positive information. An interesting study was conducted by Buigut and Kapar (2020), where a comparative study is carried out to analyze the impact of the Qatar blockade on seven stock markets in GCC countries through event study mechanisms. Their study helped in obtaining critical findings such as the Qatar market exhibits negative effects over shorter event windows, but it gradually gets eliminated as Qatar introduced new supply routes. Oman index shows a negative impact over longer event windows. This concludes that Qatar should continue its economic diversification so as not to be dependent on a single source. A similar interesting study was conducted by Bash and Alsaifi (2019) on the impact of Jamal Khashoggi’s disappearance on the stock market. This uncertain event had a strong negative impact on the stock market returns. Through further study, later it was found that the negative impact was mainly due to the local investors. A similar significant negative impact was reported by Law et al. (2020) when manufacturers were to be taxed according to the volume of products with added sugar they produced or imported by the UK Soft Drinks Industry. Kowalewski and Śpiewanowski (2020) examined the reaction of the stock market towards the disasters in potash mines. They observed a significant reaction only to accidents that may result in considerable economic losses, whereas we found that other factors do not influence the event effect. Kim et al. (2020) examined the influence of macroscopic and infectious epidemic disease outbreaks on the financial performance of the restaurant industry during 2004–2016. They show that the epidemic disease outbreaks had a negative impact on the firm's value.

2.3 Event Study on Indian Demonetization Episode in 2016

To our knowledge, the most comprehensive study on the impact of unprecedented and disruptive economic policy like demonetization on a country’s financial market has been conducted by Dharmapala and Khanna (2019) where the authors considered India’s demonetization episode of 2016 and evaluated the reactions from the Indian stock market through event study methodology. Interestingly the authors found no significant impact of demonetization to curb corruption and tax evasion as shown as a rationale by the Indian government behind such move. Instead, they argued that the demonetization positively affects the state-owned enterprises and largely the banks. However, they cautioned against any conclusions on the success and failure of the demonetization move as the stock market gives mixed reaction that are influenced by the other micro and macro-economic factors. Similarly, Jawed et al. (2019) also used the event study method by taking daily adjusted stock returns as their sample and found varying sectoral effects of demonetization on the Indian economy. Their findings show that the banking and other financial sectors were affected for a short period while sectors like IT, pharma, and consumer durables witnessed significant gain.

Based on the literature, we develop the relationship among the parameters such as the source of an event, the sector of study, and the impact of the event and risk factors. The relationship is shown in Table 1.

3 Methodology

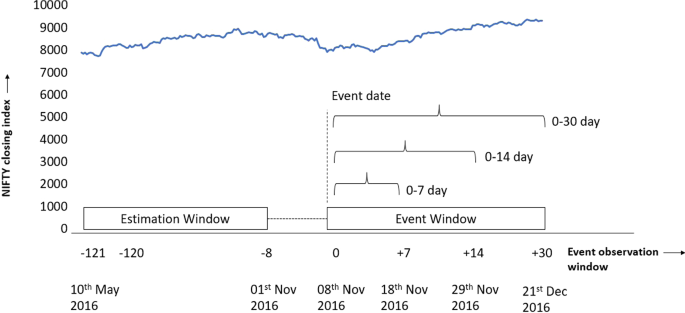

The event study methodology is selected to analyze the data. To find out the impact of demonetization on the stock market the daily data of 50 companies on the NIFTY 50 index is collected. This index is selected as it represents the 50 largest Indian companies that are listed on the National Stock Exchange. The daily data is adopted instead of monthly data as the latter comprises of a lot of changes (updates) that may occur during the month. Therefore, measuring the impact of the announcement using the smallest feasible period is important for measuring market effectiveness as the market reactions and sentiments are very sensitive. For our study, the daily data is collected over the period of 10th May 2016–21st December 2016. The data is collected from the website of NSE India (https://www.nseindia.com/market-data/live-market-indices). The estimation period for the event is taken from 10th May 2016 to 27th October 2016 (excluding market holidays) (− 121 to − 8) to specify the normal return of the security. The estimation window is the period over which we calculate the normal returns of security, which start from day − 121 and end on day − 8. The estimation window is mutually exclusive with the event window to avoid possible influence that occurs due to the estimation of the normal return of the event of interest. The event window is the period over which we study the market response to the event and starts on 8 November 2016. Apart from the date of the event, the event window includes days after the event to avoid the potential bias due to delays in the market reaction to the new information. It is also a common practice to include days before the event to account for the possibility that the market may anticipate the event. However, the chances of biases due to any confounding events cannot be ruled out and that may increase with the length of the event window. So, it is crucial that the event window should be considered for a shorter duration to minimize the effect of possible confounding events. In addition, there are many stocks available that are very thinly traded, and their impacts will have less significant if a long event window is considered. Therefore, the event window for our study is restricted to up to 30 days from the day of the announcement of the demonetization. Three event windows such as 0–7 days, 0–14 days, and 0–30 days are considered to understand the impact of the event over different time periods, where “0” represents the event date. Figure 1 indicates the estimation window, event window with dates and the closing indices of NIFTY 50.

3.1 Event Study

In the proposed study we have followed a similar event study methodology as proposed by Brown and Warner (1980, 1985), Mackinlay (1997). Event studies have numerous applications that can uncover significant insights about how security is probably going to respond to a given disruptive occasion. One of the major tools to carry out event study method is through computation of the abnormal returns that can estimate the impact of an event. The abnormal return is calculated by finding the difference between the actual return and the expected return of a security. It is the return generated by security or a portfolio that doesn’t match its benchmark or the return predicted by an equilibrium model. This deviation of the return of the security from its expected benchmark makes it to be called abnormal returns. An abnormal return can be either positive or negative. Abnormal return helps us in understanding the impact of an event (Lalwani et al., 2019; Mackinlay, 1997). While the actual returns can be empirically observed, the normal returns need to be estimated (Buigut & Kapar, 2020). For this, the event study methodology makes use of three expected return models, which are also common to other areas of Finance research. The notations of the models are given in Table 2.

3.2 Model Description

In this study, three general models namely (1) Risk-Adjusted Market Model, (2) Market Adjusted Return Model, and (3) Mean Adjusted Return Model are considered to analyze cumulative abnormal returns caused by demonetization in the Indian equity Market. These models are very frequently used in the event study literature and the main rationale behind adopting these models lies in the assumptions and explanations given in Brown and Warner (1980) and Dyckman et al. (1984). The Mean Adjusted Return Model assumes that the predicted expected return for security is equal to a constant and varies across the security while Market Adjusted Return Model is equal across the security and need not be constant always. Under the assumption of constant systematic risk both the Market Adjusted Return Model and Mean Adjusted Return Model agree with the Asset Pricing Model. Similarly, the Risk-Adjusted Market Model establishes a crucial relationship between realised returns of security as well as the market. Also, it can be anticipated that the abnormal performance of given security can be conditional to an event like demonetization and therefore, the Risk-Adjusted Market model can bring more insights into the event study. Therefore, incorporating all three models in our study will explore more information on the impact of the demonetization event on the Indian equity market. The models are described as follows.

3.2.1 Risk-Adjusted Market Model

This model works on the principle of variance reduction during the abnormal security return excluding the specific part of the return caused by variation in market return (Kowalewski and Śpiewanowski (2020)

where

\(R_{mt}\) = market (\(m\)) return calculated from Nifty 50 index between day \(t\) and day \(t - 1\).

Following Brown and Warner (1980) and Mackinlay (1997), the terms a and b are parameters for stock (i) are estimated using ordinary least squares (OLS) in the event window from the following equation.

where \(\varepsilon_{it}\) is the disturbance term with zero mean and constant variance i.e., \(E\left( {\varepsilon_{it} } \right) = 0\) and \(var\left( {\varepsilon_{it} } \right) = \sigma_{{\varepsilon_{t} }}^{2}\) with \(\sigma_{{\varepsilon_{t} }}^{2}\) as parameters of the market model. The term \(\varepsilon_{it}\) is also known as the abnormal return.

3.2.2 Market-Adjusted Return Model

Market-Adjusted Return Model excludes the impact caused by the variance in market return. The model is explained as follows.

3.2.3 Mean-Adjusted Return Model

This model excludes both the market influence and variance in market return while computing the abnormal return of the stock. It takes the mean of stock (i) as the expected return.

The CAR is given as the sum of abnormal returns for each day. This event window considers all the stocks and is calculated for all three models. This has been purposefully done so that the influence of any abnormal return on any specific stock can be rejected.

Therefore, \(CAR_{{i\left( {t_{1,} t_{2} } \right)}}\) can be defined as the cumulative abnormal return of the stock from a particular day (time period) \(t_{1}\) to the day \(t_{2}\), where \(t_{1} \le t \le t_{2}\).

(CAAR) which represents the average of the CAR of various stocks within a Further, in the current study, we expanded it by calculating the Cumulative Average Annual Return given period of time.

3.3 Hypothesis Development

The following null hypotheses are formulated to investigate the aim of the study.

H1

The means of the CAR before and after the implementation of demonetization of all INR 500 and INR 1000 notes are equal.

H2

The variances of the CAR before and after demonetization of all INR 500 and INR 1000 notes are equal.

H3

There is no significant CAAR during the event window caused by demonetization.

Acceptance of the null hypothesis shows that the impact of the announcement of demonetization is seized within the prices of the security immediately and accurately so that the investor doesn’t get any chance of receiving any abnormal returns from the security. This indicates a semi-strong level presence of efficient market pricing in the stock market.

3.4 Test Statistics

In this study, we use t-test statistics to know the significance level of CAAR. The results are calculated during the event window caused by the announcement of demonetization. The t-statistics of CAARt are computed as:

where \(S_{CAAR}\) is the standard deviation of the cumulative abnormal returns

4 Results and Discussions

In this section, we have stated the results in two phases. First, the statistical inferences have been established through testing three research hypotheses given in Sect. 3.3 by analyzing overall NIFTY 50 indices. Second, we have attempted to explain the possible differential effects of demonetization while grouping NIFTY 50 indices into different sectors and then computing the sector-wise CAR.

4.1 Statistical Inference from Research Hypotheses

In the present study, the impact of demonetization on CAR has been examined in three event window horizons namely (0–7) days; (0–14) days, and (0–30) days for those 50 companies present in the NIFTY 50. The test statistics used for research hypotheses \(H_{1} ,H_{2} ,\) and \(H_{3}\) are \(t\)-test for CAR, \(F\)-test for CAR, and \(t\)-test with CAAR, and the result summaries are shown in Tables 3, 4 and 5 respectively. The test statistic t-test is considered for hypotheses \(H_{1}\) and \(H_{3}\) to verify the presence of abnormal return and \(F\)-test is conducted for the hypothesis \(H_{2}\) to investigate possible variability in pre- and post-demonetization periods.

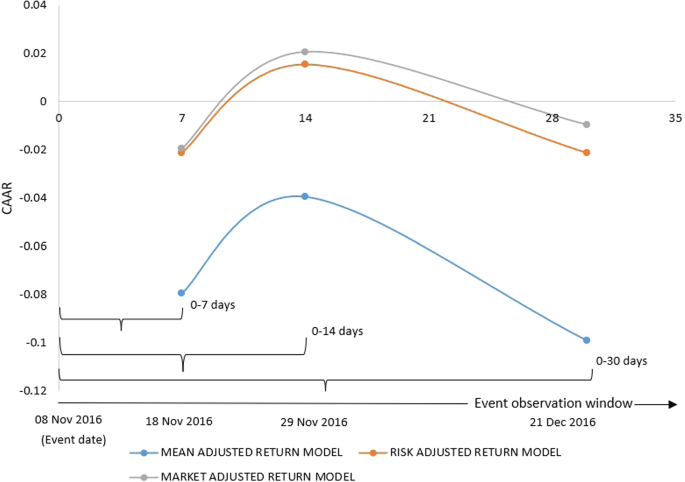

Table 3 reports the results of the t-test conducted to inspect the similarities of the means of the CAR of the demonetization announcement dating November 8, 2016. We could see a significant value in all event windows of 0–7-days of CAR (in all models) with results in rejecting the null hypothesis of the same mean before and after the demonetization. This explains that demonetization had an immediate impact on all NIFTY 50 indices during the first 7 days of implementation of the same. But 0–30 days event window CAR doesn’t continue the same. The t-test value of 30-day CAR in Risk-Adjusted and Market Adjusted return models lie below the critical value, thus resulting in the non-rejection of the null hypothesis (\(H_{1}\)). This leads to the conclusion that a significant impact of the announcement of demonetization in a short period (during the first 7 days) is observed but the impact doesn’t last till 30 days from the event. But interestingly we can see a mixed signal from all the three models even when the windows are chosen for 0–14 days. The Risk-Adjusted Return model shows sufficient evidence for not rejecting the null hypothesis while the Mean Adjusted Return model shows strong support to reject the same hypothesis. However, the Market Adjusted Return model weakly rejects the null hypothesis. We can perceive that the results from the Risk-Adjusted, and Market Adjusted return model show that the market is slowly recovering from the impact of the event during the cited event window. In this scenario, the Risk-Adjusted return model can be more relatable given the fact that the model measures the relationship between realized security returns and realized market returns as predicted by the ex-ante model. The Mean Adjusted Return Model gives a consistent result for all event windows. The reason may be because the model averages the difference between observed return and predicted return.

Again, the simultaneous and overall reaction of the market due to economic disruptive events like demonetization is hard to evaluate as there are other possible factors to influence the market (Dharmapala & Khanna, 2019). Therefore, we have segregated indices of the firms listed in NIFTY 50 into various sectors and made an effort to describe the possible differential factors through Table 6 and Fig. 3.

Table 4 reports the F-test conducted to inspect the similarities between the variance of the CAR. All the values of the F-test results are closely near zero and well under the critical value. The null hypothesis is rejected (\(H_{2}\)). Hence, it concludes that the variance of the CARs before and after the announcement of demonetization is not equal. This indicates that there is sufficient evidence available to consider that the equity market behavior during the estimation window (pre demonetization) and the event window (post demonetization) periods are not the same and significant changes are observed.

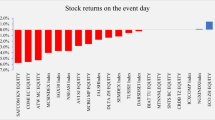

Table 5 and Fig. 2 represent the results of the event study to inspect the impact of demonetization on the value of securities. The CAAR values were observed at the end of the event windows from the event declaration day. For example, during the 0–7 days event window, the CAAR value reported in Table 5 as well as in the Fig. 2 is for the 7th day from the event declaration date. Similarly, for the event windows 0–14 days and 0–30 days, the CAAR values were observed on the 14th and 30th day respectively from the event declaration date. Thus, the horizontal axis in Fig. 2 represents the postevent observation timeline starting from the event date i.e., 08 November 2016 as the origin. The respective t-statistics conducted for \(H_{3}\) of all the three models used for three different event windows are also represented. The t-statistics value is found to be significant for 0–7 days window in all three models, for the 0–14 days window in two models (Risk Adjusted and Market Adjusted Return Model), and for 0–30 days window in one model (Mean Adjusted Return Model). This indicates a significant negative abnormal return for most of the models during the initial event window (0–7 days) reflecting a strong negative impact due to the demonetization on the value of the securities. The CAAR provides us an overall view of the impact of the announcement and the observation period of its presence in the market (shown in Fig. 2) over three event windows. The 0–7 days event window had a significant negative value and it turned positive in the next window. This shows the fast recovery of the market from the announcement of demonetization. From this, we could interpret that the impacts due to the announcement of demonetization have a significant negative impact on the short period. But the impact didn’t last for a long period of time and no significant impact could be detected over a period of 1 month.

4.2 Inference from Sector-Wise Average CAR

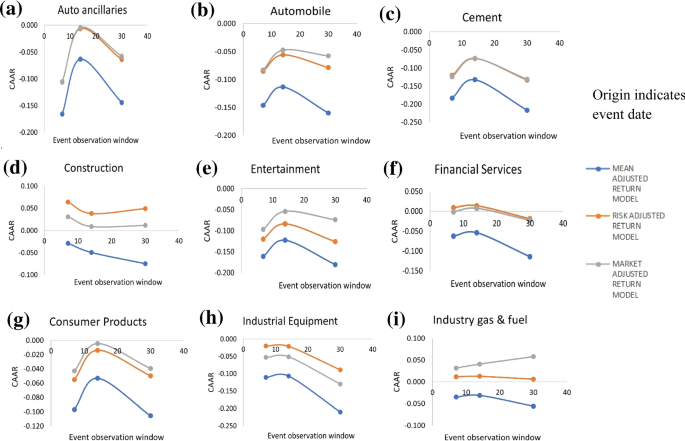

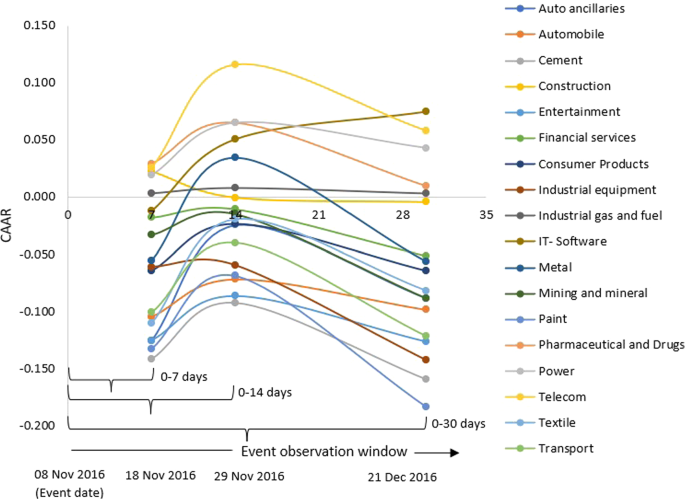

It is a fact that the differential impact of demonetization on NIFTY 50 indices may not be possible or not sufficient to explain through the tools such as Mean Adjusted, Risk Adjusted and Market Adjusted return models as the NIFTY 50 indices can be influenced by many other socio-economic factors. Therefore, we have computed the average CAAR with all three return models discussed in this study by classifying 18 different sectors that consist of indices of all 50 firms listed in NIFTY 50. Table 6 reflects the results computed through the average CAAR during the event windows. It is done by segregating the CARs of individual securities to analyze their consolidated reactions. For example, the automobile sector consists of firms namely Eicher, Maruti, Tata Motors, Mahindra and Mahindra, Hero Moto Cop, and Bajaj Auto. Similarly, banks namely Bank of Baroda, Kotak Bank, State Bank of India, Yes Bank, ICICI Bank, IndusInd Bank, HDFC Bank, Axis Bank, and HDFC are grouped in the financial service sector and so on. The detailed grouping is provided as an appendix. We found that the overall reaction of the market to demonetization reflects similar trends in various sectors. Then for a better understanding of the impact of the event, the values of all the three models are calculated and plotted in a graph for all sectors individually over three different time periods (Fig. 3). Also, a simultaneous pictorial representation of all sectors produced in Fig. 4 by averaging the return from all three models is presented.

4.2.1 Automobile and Auto Ancillaries Sector

It can be observed that the auto ancillaries’ and automobile sectors are strongly related and the Fig. 3a, b show that both the sectors follow similar patterns in the Risk-Adjusted and the Market Adjusted return models with significant negative impact due to the event during the first event window. It is understood that the money transaction slowed down during the first event period. But in the second event period, the market shows some improvement in CAAR. As it is very difficult at this point to analyze the differential impact of these improvements, there might be many possibilities. As per the reports of HDFC Bank Investment advisory group in December 2016, it can be assumed that the above positive spike in CAAR value could be due to positive information such as growth opportunity, FDI initiatives from the Government, and implementation of scrappage policy, etc. In addition to this, firm-wise positive performance in the auto sector should not be overlooked. Factors such as Tata Motor’s strong stock valuation and international presence, Bajaj Auto’s new lunches based on premium, price, and super sports segments, and the company’s increased stake in KTM Austria, surged demand in tractor segments on the back of labor shortage and normal monsoon could have possible positive impacts on the stock market in second event windows i.e., 0–14 days. However, there is a negative impact again observed during third event windows as CAAR values declined. We assume that it is due to the restricted money supply, the two-wheeler demands that mostly rural based decreased during the whole event duration as transactions were mainly done in physical currencies. Also, the huge inventory of BS-III vehicles by many companies has a negative contribution to CAAR value in the third event window. We observe that the negative shocks in all the above cases are short-term.

4.2.2 Financial Services Sector

It is interesting to observe that no significant negative impact of demonetization on the financial services sector in Fig. 3f. The financial sector in NIFTY 50 indices mostly consists of leading banks of India. During the first two event windows (0–7 and 0–14 days window) both Risk-Adjusted and Market Adjusted models report a positive average CAR that reflects the positive impact of demonetization on the financial services sector. The influencing factors that might be instrumental in such a reaction can be many. Some of them are a surge in bank deposits and equity, increased digital retail and banking transactions, positive public anticipation on curbing black money and tax invasion, vigilant on fake currency circulation, greater financial inclusions such as Pradhan Mantri Jandhan Yojna (PMJY), and increased mutual fund investments (Dharmapala & Khanna, 2019; Singh, 2017), etc. However, all three models outlined a slightly negative impact during the third event window. We assume that a stiff decline in currency circulation and withdrawal restriction were possible reasons for this decreased CAR during the third event window. In addition, some other possible reasons may include factors like excess liquidity in banks, weak credit demand, and low-cost Current Account and Saving Account (CASA) that forced banks to a large cut in their marginal cost of funds-based lending rates (MCLR). In all the models, the Mean Adjusted Return Model exhibited a negative impact on the event for all three windows though there was an improvement in the second event window due its naiveness towards accounting for various market and risk factors.

4.2.3 IT and Software Sector

It is noteworthy to state that the IT and Software sectors witnessed a significantly positive impact from demonetization during the event period. Figure 3j shows a steadily increasing average CAR value over the event windows in all three models. Although, Indian IT and Software sectors are mostly influenced by confounding factors like U.S geopolitical environments (Dharmapala & Khanna, 2019), economical disruptions like demonetization created a huge opportunity for IT sectors to boost the digital economy (Business Standard Report, 2016). Therefore, a strong positive impact of the demonetization as reported in this study is not uncommon under the strong establishment of the Indian technology sector.

4.2.4 Construction Sector

The construction sector listed only one firm from NIFTY 50 which is Larson and Turbo Ltd (L & T) which reflects a different impact pattern (Fig. 3d) than the previous sectors. The first event period has a positive impact and from there the CAAR tends to be negative. As the company construction business is largely migrant labor intensive and were mostly paid by cash, the CAAR might have been negatively affected due to a decline in high-value currency circulation. Apart from that low investment momentum, order backlogs, and slower outflow of funding from the banks might be other reasons for these negative CAAR values during the first to second event windows. The marginal improvements in the third event window are also observed which may be due to the company’s proactive approach towards reduction in working capital, cost optimization through supply chain effectiveness, and other initiatives as reported by Hindustan Times (Press Trust of India, 2017). The Market Adjusted and Risk Adjusted return models show similar patterns while the Mean Adjusted Return model is mostly in the negative CAAR range.

4.2.5 Pharmaceuticals-Drugs and Power Sectors

The pharmaceutical and power sectors exhibit similar trends in their CAAR values as shown in Fig. 3n, o. The pharmaceutical and drugs sector had no impact in the first event period. In the second event period, the CAAR turned positive which indicates a positive impact on the sector followed by a no significant impact in the third event period. Along the lines of arguments presented by Dharmapala and Khanna (2019), we also assume that this positive impact was owing to the high dependency on external finances which were sufficiently available in banks during the demonetization.

Similarly, the power sector (Fig. 3o) had no significant impact in the first event period. The CAAR turned positive in the second event period and slightly declined in value in the following event period. This shows the insignificant impact of demonetization on the power sector. As per the report published in The Economics Times (PTI, 2016), it is interesting to note that the power sector got benefitted in terms of collecting huge pending bills as the Government of India authorized paying the pending utility bills in demonetized currencies. Also, a high inflow in funds to banks during the event windows resulted in lending the fund to the power sector for better infrastructure could be another reason for this positive reaction.

4.2.6 Industry Gas and Fuel Sector

The impact on the industry gas and fuel sector could not be specified as the three models provide values different from each other (Fig. 3i). There is no similarity among the models. Also, financial news sources highlighted many differential factors such as declined two-wheeler sales, the overall decrease in oil demand, a rise in demands for domestic liquified petroleum gas (LPG) and increasing aviation demand in this sector. Hence, the impact of demonetization could not be analyzed for this sector properly.

4.2.7 Telecom and Metal sectors

Figure 3p shows that the telecom sector had no significant impact in the first event window though it started with a low CAAR value followed by a positive impact in the next window. During the third event window, there is a slight decline in CAAR, but no negative impact was observed for all three models. Relatively low CAAR is expected due to the withdrawal of denominations of Indian Rupees 500 and 1000 currency. It may be because of the increased online transactions, different and flexible packages, and wide adoption of online transactions that have been adopted by telecom industries before the demonetization episode. Similarly, the metal sector recorded no significant impact on their business during the three event windows in Risk-Adjusted and Market Adjusted Models. The metal sector is not directly related to household spending patterns which may be an explanation behind this non-significant reaction due to demonetization.

4.2.8 Other Sectors with Similar CAAR Trends

The sectors like cement, entertainment, consumer product, industrial equipment, mining & mineral, and paint have undergone similar impacts from the demonetization as their respective CAAR values have started with a significant negative impact in the first event window followed by marginal improvements in the second event window and after which further significant decrease in CAAR values in all three models is seen. Most of these sectors are hard cash-dependent industries with voluminous retail outlets throughout the country. With restrictions in withdrawal of higher order denominations, these sectors were affected heavily.

The textile and transport sectors have similar CAAR trends (Fig. 3q, r) as they face negative impact during the first event windows with almost no impact in the second event windows followed by significant negative impact during the third event window. The textile sectors are mostly labor-intensive and due to sudden demonetization, the inevitable situations like workforce layoff, closure or reduction of various operational activities, inability to pay daily wages of labors, and lack of sufficient working capital due to cash crouch (Choudhery et al., 2021) could be the main cause behind this negative impact. The transportation sector from the NIFTY 50 list considered for this study is Adani Ports and Special Economic Zone limited. The freight industries coming under this are mostly substantially transacted through hard cash for various activities like payment and expenses of truckers, fuel, local tolls, and taxes. These transactions were badly affected due to cash crouch and ban in high-value currencies and could be a differential factor for negative impact of demonetization transportation sector.

As the individual sectors are tedious to interpret separately, we consolidate the results by calculating their event-window-wise average and arrive at a mean value of all the three models in Fig. 4. From Fig. 4, we can see that most sectors have similar reactions due to demonetization. The sectors such as cement, paint, auto ancillaries, entertainment, textile, and transport had a significant negative impact much higher than other sectors due to the announcement in the shorter period. The sectors that had less impact are pharmaceutical and drugs, power, and telecom. The financial sector and the IT & Software sector remain advantageous during the event windows.

5 Conclusions

The study examines the impact of the announcement of demonetization on the Indian stock market. To evaluate the consequences of such a significant economic disruptive policy, an event study methodology is adopted, and the impact has been observed for a short period of 30 days from the announcement of the event. Using capital market data sampled from NIFTY 50 indices, the adopted methodology analyzes the financial impacts of such unforeseen events on 18 leading industrial sectors. The effectiveness of such a study comes from the idea that the outcome of an event would be reflected instantly in security prices, provided by the sagacity of the marketplace. This makes it possible the use abnormal returns in research on the day of the event.

The announcement of demonetization, which was intended to reduce the black money or counterfeit notes used for illegal and anti-social activities, invited numerous arguments and counterarguments from different sections of society. But this study intuitively deduces that this monetary policy has directly affected the liquidity in the system. It is because, in a country like India, where most of the transactions are hard cash-dependent, the shortage of cash flow within the country adversely affected many sectors. The sectors like manufacturing of goods, agriculture, and several other services were negatively impacted by demonetization, which led to a short-term economic slowdown and a decrease in the GDP growth rate.

From the findings of the study, we observe that the stock market initially viewed the announcement of demonetization to be disruptive to the entire market. However, CARs ‘bounce-back’ evidenced that the negative financial impact may not be as severe as the industries perceived for most of the cases. Therefore, the impact lasted only for a short period for most of the sectors, and the market recovered largely within 1 month. It is also noticed that sectors like financial services, IT, and Software gained from this event while Pharmaceuticals, Power, Telecom, and Metal sectors were least affected. We also found that most cash-dependent sectors like cement, entertainment, industrial equipment, mining & mineral sectors were negatively impacted by the demonetization. Methodologically, both the Risk-Adjusted return Model and Market Adjusted Return Model show similar inferences, while Mean Adjusted Return Model underestimated the positive impacts of the event.

The insight and values from this study could be utilized by managers and policymakers in the future under the circumstances of disruptive monetary policy or similar events that create an economic imbalance. The event study methodology is not limited to any sector or field and can be used in any such event. However, the current study has several limitations such as scenarios like extended event windows, larger NIFTY indices, the impact of possible differential and confounding factors, etc., which can invite the attention of future researchers on this topic. Further, for future studies, different methodologies, such as longitudinal analysis that includes frequent measurements of the same variables over several periods, can be utilized to analyze the financial impact of demonetization and other events that creates perturbative situation in a country’s economy.

References

Bajaj, A., & Damodaran, N. (2022). Consumer payment choice and the heterogeneous impact of India’s demonetization. Journal of Economic Dynamics and Control, 137, 104329.

Bash, A., & Alsaifi, K. (2019). Fear from uncertainty: An event study of Khashoggi and stock market returns. Journal of Behavioral and Experimental Finance, 23, 54–58.

Bhardwaj, A., Narayan, Y., Vanraj, P., & Dutta, M. (2015). Sentiment analysis for indian stock market prediction using sensex and nifty. Procedia Computer Science, 70, 85–91.

Blomberg, M., & Forell, L. (2019). The effects of monetary adjustment on the Swedish stock market.

Brown, S. J., & Warner, J. B. (1980). Measuring security price performance. Journal of Financial Economics, 8(3), 205–258.

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns. Journal of Financial Economics, 14(1), 3–31.

Buigut, S., & Kapar, B. (2020). Effect of Qatar diplomatic and economic isolation on GCC stock markets: An event study approach. Finance Research Letters, 37, 101352.

Business standard Report. (2016).

Chen, M. H., Jang, S. S., & Kim, W. G. (2007). The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management, 26(1), 200–212.

Choudhery, A., Choudhery, K., Kaur, V., Malhi, P. S., & Godara, S. K. (2021). Impact of demonetization on textile and apparel industry. In Recent Trends in Traditional and Technical Textiles (pp. 209–221). Springer.

Dai, Z., Zhou, H., Wen, F., & He, S. (2020). Efficient predictability of stock return volatility: The role of stock market implied volatility. North American Journal of Economics and Finance, 52(January), 101174.

Das, D., Kannadhasan, M., & Bhattacharyya, M. (2019). Do the emerging stock markets react to international economic policy uncertainty, geopolitical risk and financial stress alike? North American Journal of Economics and Finance, 48, 1–19.

Dev, S., & Mohapatra, P. (2019). The impact of demonetization on Indian stock market: A sectoral analysis of bombay stock exchange. IUP Journal of Applied Economics, 18(4), 71–88.

Dharanipriya, A., & Karthikeyan, C. (2020). Impact of demonetization on Indian farmers. International Journal of Development Extension, 10(2), 13–21.

Dharmapala, D., & Khanna, V. S. (2019). Stock market reactions to India’s 2016 demonetization. Journal of Empirical Legal Studies, 16(2), 281–317.

Duso, T., Gugler, K., & Yurtoglu, B. (2010). Is the event study methodology useful for merger analysis? A comparison of stock market and accounting data. International Review of Law and Economics, 30(2), 186–192.

Dutta, A., Knif, J., Kolari, J. W., & Pynnonen, S. (2018). A robust and powerful test of abnormal stock returns in long-horizon event studies. Journal of Empirical Finance, 47, 1–24.

Dyckman, T., Philbrick, D., & Stephan, J. (1984). A Comparison of event study methodologies using daily stock returns: A simulation approach. Journal of Accounting Research, 22, 1.

Fang, L., Qian, Y., Chen, Y., & Yu, H. (2018). How does stock market volatility react to NVIX? Evidence from developed countries. Physica a: Statistical Mechanics and Its Applications, 505, 490–499.

Fouillet, C., Guérin, I., & Servet, J. M. (2021). Demonetization and digitalization: The Indian government’s hidden agenda. Telecommunications Policy, 45(2), 1–12.

Friedman, M. (1992). Franklin D. Roosevelt, silver, and China. Journal of Political Economy, 100(1), 62–83.

Jawed, M. S., Dhaigude, A. S., & Tapar, A. V. (2019). The sectoral effect of demonetization on the economy: Evidence from early reaction of the Indian stock markets. Cogent Economics and Finance, 7(1), 1–18.

Kapasi, S. (2019). Impact of demonetization in India. International Journal of Research in Social Sciences, 9(1), 221–236.

Karmakar, S., & Narayanan, A. (2020). Do households care about cash? Exploring the heterogeneous effects of India’s demonetization. Journal of Asian Economics, 69, 101203.

Kaur, H. (2004). Time varying volatility in the Indian Stock Market. Vikalpa, 29(4), 25–42.

Kaur, J. (2017). Impact of demonetization on Indian economy. South Asian Journal of Marketing & Management Research, 7(6), 53–57.

Kim, J., Kim, J., Lee, S. K., & Tang, L. R. (2020). Effects of epidemic disease outbreaks on financial performance of restaurants: Event study method approach. Journal of Hospitality and Tourism Management, 43(January), 32–41.

Kowalewski, O., & Śpiewanowski, P. (2020). Stock market response to potash mine disasters. Journal of Commodity Markets, 20, 100124.

Lalwani, V., Sharma, U., & Chakraborty, M. (2019). Investor reaction to extreme price shocks in stock markets: A cross country examination. IIMB Management Review, 31(3), 258–267.

Law, C., Cornelsen, L., Adams, J., Penney, T., Rutter, H., White, M., & Smith, R. (2020). An analysis of the stock market reaction to the announcements of the UK soft drinks industry levy. Economics and Human Biology, 38, 100834.

Liu, C., Wang, B. Z., Wang, H., & Zhang, J. (2019). What drives fluctuations in exchange rate growth in emerging markets: A multi-level dynamic factor approach. Economic Systems, 43(2), 100696.

Ma, R., Anderson, H. D., & Marshall, B. R. (2018). Market volatility, liquidity shocks, and stock returns: Worldwide evidence. Pacific Basin Finance Journal, 49, 164–199.

Mackinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13–39.

Makino, R. (2016). Stock market responses to chemical accidents in Japan: An event study. Journal of Loss Prevention in the Process Industries, 44, 453–458.

Masood, O., & Sergi, B. S. (2008). How political risks and events have influenced Pakistan’s stock markets from 1947 to the present. International Journal of Economic Policy in Emerging Economies, 1(4), 427–444.

Memdani, L., & Shenoy, G. (2019). Impact of terrorism on stock markets across the world and stock returns: An event study of Taj attack in India. Journal of Financial Crime, 26(3), 793–807.

Miyan, M. (2017). Statistical review on the demonetization in India. International Journal of Advanced Research in Computer Science, 8(5).

Muthulakshmi, E. K., & Kalaimani, G. (2017). Impact of demonetization on Indian economy: A survey. IOSR Journal of Humanities and Social Science, 3(4), 50–54.

Nanda, S. R., Mahanty, B., & Tiwari, M. K. (2010). Clustering Indian stock market data for portfolio management. Expert Systems with Applications, 37(12), 8793–8798.

Nayak, A., Pai, M. M. M., & Pai, R. M. (2016). Prediction models for indian stock market. Procedia Computer Science, 89, 441–449.

NSE Indices Limited. (2019). Nifty 50, index methodology, October 2019 (Vol. 051, Issue October).

NSE Indices Limited. (2022). Methodology Document for equity indices (Issue April).

Pandey, D. K., & Kumari, V. (2021). An event study on the impacts of Covid-19 on the global stock markets. International Journal of Financial Markets and Derivatives, 8(2), 148–168.

Pérez-Rodríguez, J. V., & González López-Valcárcel, B. (2012). Does innovation in obesity drugs affect stock markets? An event study analysis. Gaceta Sanitaria, 26(4), 352–359.

Prasanna, P. K., & Menon, A. S. (2013). Speed of information adjustment in Indian stock indices. IIMB Management Review, 25(3), 150–159.

PTI. (2016). Demonetisation positive for power sector: Mercom. https://economictimes.indiatimes.com/industry/energy/power/demonetisation-positive-for-power-sector-mercom/articleshow/55811207.cms

Reti, S. P. (1998). Silver and gold: The political economy of international monetary conferences. Greenwood Publishing Group.

Sakthivel, P., VeeraKumar, K., Raghuram, G., Govindarajan, K., & Vijay Anand, V. (2014). Impact of global financial crisis on stock market volatility: Evidence from India. Asian Social Science, 10(10), 86–94.

Sam, J. S., Chakraborty, A., & Srinivasan, J. (2021). Cashlessness in India: Vision, policy and practices. Telecommunications Policy, 45(8), 1–6.

Seo, S., Jang, S. S., Miao, L., Almanza, B., & Behnke, C. (2013). The impact of food safety events on the value of food-related firms: An event study approach. International Journal of Hospitality Management, 33, 153–165.

Singh, B., Behera, H., Raut, D., & Roy, I. (2017). Impact of demonetisation on the financial sector.

Singh, V. K., & Ghosh, S. (2021). Financial inclusion and economic growth in India amid demonetization: A case study based on panel cointegration and causality. Economic Analysis and Policy, 71, 674–693.

Taneem, S., & Yuce, A. (2011). Information content of dividend announcements: An investigation of the Indian stock market. International Business & Economics Research Journal, 10(5), 49–57.

Tao, Z., Han, L., Song, Y., & Bai, K. (2019). Stock market reactions to the 2011 off the Pacific coast of Tohoku earthquake. International Journal of Disaster Risk Reduction, 41, 101294.

Press Trust of India. (2017).

Vashishat, T., & Tyagi, V. K. (2017). Assessing the impact of demonetization of 2016 on the Indian economy: An exploratory study. Asian Journal of Research in Business Economics and Management, 7(7), 135–150.

Vijh, M., Chandola, D., Tikkiwal, V. A., & Kumar, A. (2020). Stock closing price prediction using machine learning techniques. Procedia Computer Science, 167(2019), 599–606.

Warburton, C. E. (2017). The development of international monetary policy. Routledge.

Zhang, J. B., Gao, Y. C., & Cai, S. M. (2020). The hierarchical structure of stock market in times of global financial crisis. Physica a: Statistical Mechanics and Its Applications, 542, 123452.

Zhu, H., Gupta, A., Majumder, B., & Steinbach, S. (2018). Short-term effects of India’s demonetization on the rural poor. Economics Letters, 170, 117–121.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1

Appendix 1

Studied organizations along with their sectors.

Serial number | Sector | NIFTY 50 Indices considered between 10 May 2016 and 08 December 2016 |

|---|---|---|

1 | Auto ancillaries | Bosch ltd |

2 | Automobile | Bajaj Auto Ltd, Eicher Motors Ltd, Hero MotoCorp Ltd, Mahindra and Mahindra Ltd, Maruti Suzuki India Ltd |

3 | Cement | ACC Ltd, Ambuja Cement Ltd, Ultra Tech Cement Ltd |

4 | Construction | Larsen & Toubro Limited |

5 | Entertainment | Zee Entertainment Enterprises Limited |

6 | Financial services | Bank of Baroda Ltd, Kotak Mahindra Bank Ltd, State Bank of India, Yes Bank Limited, ICICI Bank Ltd, IndusInd Bank Ltd, HDFC Bank Limited, Axis Bank Ltd, Housing Development Finance Corp Ltd |

7 | Consumer Products | Hindustan Unilever Ltd, ITC Ltd |

8 | Industrial equipment | Bharat Heavy Electricals Limited |

9 | Industrial gas and fuel | Oil & Natural Gas Corporation Limited, Reliance Petroleum Ltd, GAIL (India) Limited, Bharat Petroleum Corp Ltd |

10 | IT and Software | Infosys Ltd, Wipro Limited, Tech Mahindra Ltd, Tata Consultancy Services Limited, HCL Technologies Ltd |

11 | Metal | Tata Steel Limited, Hindalco Industries Ltd, Vedanta Ltd |

12 | Mining and mineral | Coal India Ltd |

13 | Paint | Asian Paints Ltd |

14 | Pharmaceutical and Drugs | Lupin Limited, Cipla Ltd, Sun Pharmaceutical Industries Limited, Dr Reddy's Laboratories Ltd |

15 | Power | NTPC Limited, Power Grid Corporation of India Limited, Tata Power Company Limited |

16 | Telecom | Bharti Airtel Limited, Idea Cellular |

17 | Textile | Grasim Industries Ltd |

18 | Transport | Adani Ports and Special Economic Zone Limited |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sutar, G., Dhalmahapatra, K. & Chakraborty, S. Impact of India’s Demonetization Episode on its Equity Markets. Asia-Pac Financ Markets 30, 649–675 (2023). https://doi.org/10.1007/s10690-022-09392-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-022-09392-6