Abstract

In this study, the conceptual process flowsheet was developed and the economic feasibility of woody biomass conversion to biofuel as feedstock was analysed by considering several promising experimental processes for lignin depolymerization, such as hydrodeoxygenation and hydrogenolysis, along with lignocellulosic biomass fractionation processes. The engineering simulation process toward the commercial production of bio-gasoline from lignocellulosic biomass using SuperPro Designer® was modeled. The compatibility of the end products with the current gasoline specifications was evaluated and various blending options were investigated to meet the octane number and Reid vapor pressure requirement of the product. The economic potential of the simulated engineering process was then evaluated from an economic perspective. The operating costs and capital investment of three scenario using three different catalytic systems were estimated and discussed to assess of the potential of commercializing of woody biomass valorization process. The main potential market segments were identified, including the process by-products such as xylose and cellulose pulp. From the economic evaluation study, it was found that selling the biomass fractionation products alone does have a greater profit than valorization of lignin to produce bio-gasoline, with net present value of RMB 22,653,000 and RMB 177,000, respectively at the same return on investment if the plant is set up in Hong Kong. It was also found that catalysts play a pivotal role in determination of the profitability in the valorization process, not only because of the price of the catalyst, but also the product distributions obtained with various types of it. To obtain the same gross profit, the sale price of bio-gasoline has to be set higher with platinum catalysts than with ruthenium catalysts (nearly 10 folds). Thus, catalyst development and process improvement are crucial in the establishment of bio-based circular economy.

Similar content being viewed by others

Background

Technological advancements in conventional and renewable energy production processes has changed people’s lifestyle. A growing global population coupled with higher purchasing power has driven global industries to adapt to higher energy demands and to explore emerging renewable and alternative energy. This applies to refinery industry and petrochemical manufacturing units which have been essential in supplying the world with chemicals and providing fuels for energy and transportation, since the exploration and use of renewable energy could sustain the ever-increasing energy needs. In Hong Kong, only a small amount of renewable energy is domestically produced [1], in which the major types of renewable energy are biodiesel and biogas from food wastes, wind energy and solar energy. In 2015, a total of 1899 TJ of renewable energy was produced and utilized by the consumers [1]. Over 80% of this energy was produced as biogas and only about 12% was sourced from biodiesel. Obviously, other types of renewable energy and resources could be explored, such as bio-gasoline and especially those can be derived from waste resources. Among the many different wastes in Hong Kong, lignocellulosic waste is probably is one of the less studied but is full of valuable resources. According to the “Monitoring of Solid Waste in Hong Kong” reports published by the Environmental Protection Department [2], the daily average of wood/rattan waste that ended up in landfills in 2017 was about 330 t, and it could reach up to 600 t due to the incomplete records on actual bulky waste flow [3]. There were used to be a few wood recycling and treatment companies in Hong Kong where old crates were refurbished for reuse and wood waste was shredded into wood chips for export overseas for further recycling operation. However, these wood recyclers ceased to operate due to financial reasons. In 2017, the waste wood recycling rate was less than 1%. Wood is composed of valuable resources including cellulose, hemicellulose and lignin. Therefore, successful recovery of these components can provide high economic returns if wood waste is properly recycled and reused, particularly if they can be chemically converted and valorised.

Valorization of lignocellulosic biomass to produce valuable chemicals and fuels, which is also known as the second-generation biorefinery, has been increasingly recognized as a sustainable and renewable solution to reduce dependence on fossil resources. One successful example is the development of cellulose to bioethanol using various biocatalysts, seemingly better alternative to the commercial corn and sugarcane to ethanol process due to direct competition for food consumption [4]. Commercial and demonstration plants that turn wood scraps into ethanol have been either established or are being constructed by several chemical companies [5,6,7,8,9,10]. According to a number of recent studies, enzymatic hydrolysis of lignocellulosic biomass to ethanol and fuels has found to be generally economically feasible [11,12,13,14,15,16,17,18,19,20,21,22,23]. However, its operability at full capacity has not yet been attained due to a number of technical and economical hurdles [24]. Stable supply of biomass feedstock, transport, pre-treatment/pre-processing [25] and enzyme cost [26] are issues that have yet to be addressed. While the first two issues can be rather regiospecific, the pre-treatment issue can be tackled by research and development efforts. Without good comparisons of the economic and technical performance of different processing options, pre-treatment at scale could still be the major hurdle towards commercialization [25].

Pyrolyzed oil is considered as one of the most abundant, globally available resource that exhibits itself as an alternative for production of a wide variety of liquid fuels and chemicals. While hydrogenolysis is useful in deploymerizing lignocellulosic biomass into phenolic monomers, hydrodeoxygenation (HDO) is particularly useful in upgrading and oxygen removal of lignocellulosic biomass feedstocks such as pyrolysis bio-oil which is derived from fast pyrolysis of biomass. During the upgrading process, HDO increases thermal stability, lowers oxygen contents and lowers viscosity of the products, which is why it is regarded as one of the most effective methods to convert lignin-derived bio-oil into renewable oxygen-free hydrocarbon fuels [27,28,29]. For example, lignin-derived diphenyl ether can be effectively hydrodeoxygenated over bifunctional catalyst Ru/H-Beta. Cyclohexane can be obtained in excellent yield by reacting phenolic monomers and dimeric model compounds with bifunctional catalyst Ru/HZSM-5. For HDO of real lignin macromolecules, Ru-based bimetallic catalysts supported on Zeolite Y such as Ru-Ni/HY exhibited > 80% of softwood lignin conversion yield to hydrocarbons [30], and Pt and Pd supported on Nb2O5 were also found to be excellent catalyst in the HDO of birch lignin to produce aromatics and naphthenes [31]. Although the HDO of lignocellulosic biomass had been extensively studied, the economic potential of such technology was relatively unexplored. We are aware of several thermochemical technologies to convert lignocellulosic biomass into biofuels that are in the process of commercialization, such as the Virent’s Bioreforming® [32,33,34,35,36] and the National Advanced Biofuels Consortium [37]. Although they utilize lignocellulosic biomass as the feedstock, the technology involves many multi-steps of conventional chemical processes such as distillations which may not be economically sound. We are particularly interested in the direct conversion of lignin [30, 38,39,40,41,42,43,44,45,46,47,48,49,50,51] and woody biomass [52,53,54] by HDO to blendstocks and then directly blending them as drop-in bio-fuels to minimize the process steps. Several researchers found on direct lignin conversion to blendstocks are promising [44, 54]. For example, Shao and co-works explored the direct lignin upgrading over Ru/Nb2O5 and an exceptional C7-C9 arenes selectivity of 71 wt.% was achieved. High conversion of woody biomass to paraffins and naphthenes could be achieved using Pt/NbOPO4 solid acid catalysts in cyclohexane at a pressure of 5 MPa. In such conditions, the aromatics were highly hydrogenated and not many aromatic products were retained, hence, the liquid alkanes will need to be blended with additional aromatics for gasoline productions. In this study, we have also devised another Pt catalytic system for the degradation of lignin with retention of aromatics contents for drop-in bio-fuel modelling study.

In our team’s effort to convert lignin to fuels in the gasoline range, we have developed a series of catalysts which can convert lignin and lignin-derived model chemicals into the gasoline fuel range [55,56,57,58,59]. The “drop-in biofuels” concept by fermentation of lignocellulosic biomass to bio-fuels with less oxygen contents and higher energy density is another attractive option compared to ethanol [60, 61], however the production cost and technical hurdles could be much higher. Catalytic depolymerization of biomass by metal catalysis is one of the mainstreams of study for biomass valorization and it is a potential technology for “drop-in biofuels”. Numerous studies have been done to study on the heterogeneous [62, 63] and homogeneous [64,65,66] catalyses to convert cellulosic and lignin compounds into high-value chemicals and fuels. An important aspect of these studies is the direct conversion of woody biomass into fuel components in the various fuel range [52,53,54], in which no chemical pre-treatment nor separation of raw woody biomass was necessary, and it should be of high potential for commercialization. Therefore, further economic evaluation in catalytic hydrodeoxygenation for biomass refinery is necessary. Recent studies on techno-economic analyses of biomass to fuels have been reported extensively. These include the biomass to bioethanol [11, 12, 14, 15, 17, 19, 21, 67,68,69], synthetic fuels from biomass-derived levulinic acid [70, 71], bio-jet fuel from biomass [16], biodiesel from biomass [20, 72,73,74], microalgae biorefinery [75], biomass gasification [76], biogas production [77] and biomass fractionation [78]. The aim of this study is to develop a process which converts the raw woody biomass into bio-blendstocks using catalytic depolymerization technology, which could be integrated as part of the conventional petroleum refinery processing, such as blending with reformate, or oxygenated chemicals to produce bio-gasoline. This offers a green and sustainable approach for current traditional petroleum refineries to incorporate renewable feedstocks into their existing plants and facilities, thus mitigating carbon emission and relying less on fossil fuels at the same time. Herein, a process for the conversion of wood to bio-gasoline which could be fit into the current conventional petroleum production plant to achieve the goal of sustainable development and carbon emission reduction is reported. Sensitivity analysis was performed to investigate the major parameters which could be critical to such technology development.

Results

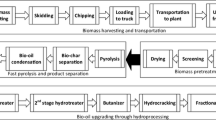

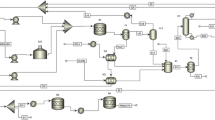

The process consists of pre-treatment and lignin extraction, hydrodeoxygenation/hydrogenolysis process and the final blending with butane, ethanol and reformate (RON = 95), etc. to produce a bio-gasoline that is compatible with the current uses of gasoline. The complete process flow sheet was shown in Fig. 1.

Proposed process flowsheet of the Ashwood conversion to bio-gasoline using Amberlyst-15/5wt%Pt/CNTs (Case IV in this study). For the cases using Ru/Nb2O5 and Ru/C, the flash drum operation unit was omitted (Please refer to the Additional file 1). The flowsheet was separated into five main sections: the woody biomass fractionation process; the cellulose pulp production; procedure for xylose production; the lignin isolation and hydrodeoxygenation process; and finally, the separation and blending procedures

SuperPro Designer® process simulator has been extensively used in modelling, evaluation and optimization of integrated biomass conversion process, especially for the first generation of biorefinery, such as bioethanol production [11, 14, 17, 19, 22, 67, 69], biodiesel production [72], food waste valorization [79], microalgae biorefinery [75], bio-jet fuel production [73, 74], biogas production [77], hydrogen production from bio-methane [80]. Most of these processes are biochemical or fermentation processes. It is handy to get an approximate cost of equipment and plant operating cost using this simulator. In this study, the economic viability of different scenarios using different catalysts can be quickly assessed. Sensitivity analysis was performed to assess which parameters, such as catalyst cost, prices of feedstocks and products, have a greater impact on the plant’s profitability (see Additional file 1 Section F for details).

The process design was estimated to run 22 batches per year. This simulation design analyses the production of bio-gasoline at a feed rate of 100,000 kg/batch woody biomass. Our simulation was entirely based on a batch process mode. This process design has been divided into five sections: 1) pre-treatment and fractionation of woody biomass cellulose; 2) pulp extraction; 3) lignin extraction and conversion process into liquid alkanes; 4) xylose recovery; 5) gasoline blending. By using SuperPro Designer® software for process engineering design, each portion of the processes were described in the following section. Detailed stream data were provided in the Additional file 1 section.

Process description

This simulation design analyses the production of bio-gasoline produced at a process rate of 10,000 kg/batch of woody biomass. Our simulation is based on a batch process mode. This process design has been divided into four sections:

-

Section 1: Pre-treatment and Fractionation of Woody Biomass

-

Section 2: Cellulose pulp extraction

-

Section 3: Hemicellulose isolation

-

Section 4: Lignin extraction and conversion process into liquid alkanes/aromatics

Section 1: pre-treatment and fractionation of Woody biomass

Wood chips were delivered to the plant primarily via trucks. As the trucks enter the plant they were conveyed (BC-101 and SC-101) at a rate of 10,000 kg/batch through a grinder (GR-101) for size reduction and a reactor (R-101) for fractionation of lignocellulosic biomass into hemicellulose, cellulose and aromatic polymer lignin. The fractionation section was based on the laboratory experiment conducted by Thorstein and co-workers [81]. Oxalic acid catalyst was used to selectively depolymerize the carbohydrate polymers, namely hemicellulose and cellulose together with the biphasic solvent (water and 2-methyltetrahydrofuran). The stoichiometry for this reaction is based on weight fraction. The stoichiometric coefficients are derived from calculation of mass of reactants and products involved together with 100% of extent of reaction assumed.

In this case, 100% of woody biomass was consumed for the conversion. Part of the oxalic acid crystal was originated from the crystallization of oxalic acid during the recycle.

The operation is heated at 150 °C and pressurised to 15 bar for 10 min at a working volume of 90%. This fractionation process yields an aqueous solution of hemicellulose sugars (in the form of xylose), a solid cellulose pulp, and a lignin fraction dissolved in the organic solvent. S-102, S-103, S-104, S-106, S-112 were involved in this part of the whole process.

Section 2: cellulose pulp extraction

The effluent of the fractionation reactor was separated into three streams, cellulose pulp stream, hemicellulose stream and lignin stream. For the lignin stream, process explanation will be provided in the third section, i.e. lignin extraction. In this section, the cellulose pulp extraction from the stream that comprises of water, solid residue of cellulose pulp, and 2-methyltetrahydrofuran. S-108, S-115, S-120 were involved in this part of the whole process. Since the stream was heated in the fractionation reactor, it needed to be cooled down before further drying. The cooling agent utilized in the process, calcium chloride (CaCl2), was used to control the effluent exit temperature at 25 °C. CaCl2 brine has a good heat transfer coefficient, which makes it an energy efficient option. The resultant stream is further processed in a drying drum to extract cellulose pulp from the filtrate, which contains water, oxygen, nitrogen and 2-methyltetrahydrofuran.

Section 3: hemicellulose isolation

In this section, we intended to extract the lignin composition with the purpose to transform it into bio-gasoline. The lignin stream after the fractionation process comprised of lignin dissolved in biphasic solvents (i.e. water and 2-methyltetrahydrofuran), oxalic acid and water-soluble xylose. The stream was sent to decanter tank (P-7/V-101) where two immiscible liquid phases were separated. The light phase stream comprises of the biphasic solvent, oxalic acid, water and xylose. A series of process units were assigned (i.e. evaporator, recrystallisation tank, Nutsche filtration tank) to recover the light phase stream which could then be reused in the fractionation process. An evaporator (P-8/EV-101), using steam as a heating agent evaporate the major part of the 2-methyltetrahydrofuran into vapor state in forward feed flow. Evaporated 2-methyltetrahydrofuran was recirculated to the mixing bowl (P-10/MX-101for reusing in the fractionation reactor (P-4/R-101). On the other side, the resultant liquor from the evaporator was first passed through a gate valve (P-12/GTV-101) to reduce the pressure of the flow followed by cooling unit (P-13/HX-101) to lower the temperature to 4 °C. It was then transferred to a vessel (P-14/R-102) for oxalic acid crystallization process. The crystallization process was set at 1 h with a final exiting temperature of 4 °C. Glycol was used as a cooling agent with a working volume of 90% and a pressure of 1.013 bar. Assuming that 98% of crystallization yield, a remaining 2% of aqueous oxalic acid was retained in the effluent, which was then transferred into a Nutsche Filtration Tank (P-15/NFD-101) for oxalic crystal filtering process that was set for 4 h with a loss of drying at 0.5%. Acetone was provided at a rate of 156 kg/batch for washing purpose. The resultant cake (i.e. crystalized oxalic acid and acetone) was directed into a drum dryer (P-17/DDR-104) to dry the oxalic acid crystals for reuse in the fractionation process. At the same time, another drum dryer (P-16/DDR-103) was employed to separate the xylose from organic biphasic solvent for further application.

Section 4: lignin extraction and conversion process into liquid alkanes

The organic heavy phase stream comprised of lignin and 2-methyltetrahydrofuran at a total flow rate of 493.5 metric ton/batch at 25 °C. A drum dryer (P-9/DDR-102) heated at 70 °C was applied to extract the lignin component from the organic phase of 2-Methyltetrahydrofuran with the use of steam. The resulting 2-methyltetrahydrofuran could be recycled and reused in the fractionation process, by redirecting it to the mixing tank (P-10/MX-101). The amount of lignin recovered directly after drying was assumed to be 100% in our case from an average woody biomass composition of 27% extracted lignin from an average ash wood. The lignin stream was cooled to 25 °C before it was conveyed using a pneumatic conveyor (P-20/PC-101) and ultimately blended with 1 wt.% of Ru/Nb2O5 catalyst in reactor (P-22/R-103). Ru/Nb2O5 catalyst had excellent performance in simultaneous depolymerization and hydrogenolysis of raw lignin via cleavage of C-O-C bonds in the lignin network and selectively cleavage of aromatic carbon-OH bonds in phenolic compounds [44]. The hydrodeoxygenation was conducted at 240 °C and pressurized to 7 bar with hydrogen. The simulated reaction was set at 30% extent of reaction and based on the stoichiometric equation (Eq. 1) below:

Here, the weight of the products was estimated on the basis of production of one mole of water per mole of organic molecule formed during hydrodeoxygenation. To be specific, the reaction over the Ru/Nb2O5 reached a total mass yield of 30.06 wt.% for liquid hydrocarbons. Due to the high durability of Ru/Nb2O5 catalyst, it could be reused for hydrodeoxygenation process. This could be done by skimming the top liquid hydrocarbon layer from the catalyst-dissolved water. Globe valve was opted to perform pressure drop on the stream to 1 bar. The rest of the liquid hydrocarbons is blended with reformate (RON = 95), butane, isopentane plus n-octane and methyl-t-butyl ether (MTBE) at 1537.9 kg/batch, 960 kg/batch, 2177.6 kg/batch and 1924 kg/batch, respectively in a batch reactor and cooled at − 1 °C upon exiting. Hydrocarbon composition of a reformate was chosen from the data reported by Karakuts and co-workers on their research of reformate fractionation [82]. One of the controlling gasoline blending specifications is Reid Vapor Pressure (RVP). We used butane and n-octane which can alter the RVP in order to attain an acceptable value. While MTBE was used as an oxygenate to regulate the octane number.

Blending and specification of biomass-based gasoline

Reformulated gasoline (RFG) under different considerations are evaluated in this section. Through a qualitative case study, these cases were examined to study the compatibility of the product with the regulations for transportation fuel in Hong Kong. Since Hong Kong has no refinery industry nor oil reserves, fuel supply is met by imports from multinational oil companies. The current selection of gasoline specifications in Hong Kong were shown in Table 1. For most of the cases, Hong Kong has adopted standards that are based on European Union V fuel quality specifications [83].

In Hong Kong, Euro IV standards of motor vehicle diesel and unleaded petrol was implemented in 2002 and 2005, respectively. To further reduce vehicle emissions, Euro V was implemented in July 2010 for all motor vehicle fuels. The major difference between Euro IV and Euro V motor vehicle fuels (i.e. for both diesel and petrol) is the tightening of the cap on sulphur content from 0.005 to 0.001%.

The aim of this study is to convert the lignin into gasoline with bio-based components of 40–45 wt.% and blended with gasoline additives necessary to meet the current gasoline specifications and meet the octane number of no lesser than 87 in order to resist premature ignition in the engine combustion chamber [84]. The main route for the biomass to hydrocarbon processes include OrganoCat® fractionation, lignin processing (hydrodeoxygenation/hydrogenolysis) and the ultimate blending with butane and ethanol to increase the octane number. Case I represents the baseline product from HDO as a result based on our simulation and reference articles. Case II represents the simulation without the HDO process. Case III illustrates the addition of ethanol, benzene, MTBE, butane, toluene and reformate (RON = 95) using Ru/C as a catalyst for the HDO process. Case IV represents the experimental data of biomass conversion using a Pt/CNTs with Amberlyst-15 catalyst for hydrogenolysis to evaluate the product compatibility.

Case I (HDO using Ru/Nb2O5 as catalyst)

The blending of the resultant HDO process of lignocellulosic biomass with butane would likely increase the RVP gasoline in order to meet the Hong Kong RVP requirement of 60 kPa. Based on the physical constants of paraffins, 372 kPa was used as the butane RVP, since it is the listed vapor pressure at 37.8 °C for n-butane. With these assumptions, the butane was blended at 0.22% with 9.45 psi gasoline (ethanol included), the resultant blend RVP was around 53.48 kPa. The octane number calculated in this case was 91.2 which falls into the Premium Gasoline category.

Oxygenate blending adds oxygen to the fuel in oxygen-bearing compounds such as MTBE, ETBE and ethanol with the purpose to increase the octane number and reduce the amount of carbon monoxide and unburned fuel in the exhaust gas, thus minimizing smog formation. In Hong Kong, the current gasoline selection for oxygen content is set at 2.7 wt.% in order to reduce smog and other airborne pollutants. The resulting fuel is often known as reformulated gasoline (RFG) or oxygenated gasoline.

Case II (without further lignin processing)

This case was conducted using Ru/Nb2O5 with the consideration of selling the fractionated biopolymers as raw materials for other chemical applications.

Case III (HDO using Ru/C as catalyst)

This case was simulated according to the report published by Shao and co-workers on the product yield of direct HDO [44]. Compared with the Ru/Nb2O5 case, this conversion using Ru/C only yielded exclusively alkylcyclohexanes, such as methylcyclohexanes, ethylcyclohexanes and propylcyclohexanes. The RVP and ON after blending were calculated as 48 kPa and 92.2 (premium grade gasoline), respectively.

Case IV (Hydrogenolysis using Pt/CNT catalyst with Amberlyst-15)

Several research teams reported the direct conversion of woody biomass with promising precious metal and layered catalysts without biomass pre-treatment. Xia et al. reported the one pot direct conversion of raw woody biomass into gasoline component in high yield using a type of Pt catalyst on solid acid support [54]. One promising aspect of this conversion was that the product components were quite clean, which consisted mostly of pentanes, hexanes and alkylcyclohexanes, in a maximum of 28.1 wt.% total liquid alkanes yield. Liu et al. developed a very promising biomass degradation and valorization process of raw woody biomass using Ru/C and layered LiTaMo6 catalysts under inorganic acid conditions for gasoline alkanes productions [52]. Apart from deoxygenation reaction to produce fuels, Ford and co-workers worked out a solution to convert woody biomass into alcohols using metal-based catalysts such as Cu [53]. In our effort for hydrogenation catalyst development, we have developed a series of Pt/CNTs for the efficient hydrogenation of alkenes and alkynes [85]. In this study, the Pt/CNTs was used with addition of polymeric solid acid Amberlyst-15 to convert organosolv lignin in 26–29 wt.% yield. For the product distribution and their corresponding composition, please refer to the Additional file 1. Interestingly, a large number of aromatics (26 vol%) was detected. It was also clearly observed that oxygenate (1.5%) components were among the products from our experiment and the result obtained was rather similar to the products yield reported by Kong and co-workers on their use of nickel-copper catalyst for alcoholysis of Kraft lignin [86]. Hence, adequate aromatics content in the products boosted the octane number thereby blending with reformate (RON = 95) was not necessary in this case. Details of the additives for blending for all the scenario were listed in Table 2. Table 3 summarizes the specifications of the blended bio-gasoline in all cases. In SPD modelling, the gasoline components were flashed off in the flash drum to produce gasoline component in the boiling point range of 50 - 220 °C as shown in Fig. 1. The products were further blended with pure naphthene, butane and ethanol to produce the final gasoline product.

Economic evaluation

In considering the economic value of this model, there are two types of situations: 1) the benefit of HDO/hydrogenolysis valorization; 2) the impact of using different catalysts. In the first instance, 2 scenarios are selected. We looked at the economic performance of the proposed Case I model as Scenario I and one with similar process but without the HDO/hydrogenolysis process that converts lignin into hydrocarbons as Scenario II, which means that the revenue would therefore merely come from the selling of the fractionation products, namely xylose, lignin and cellulose pulp. The aim of this comparison was to realize the benefit of lignin upgrading and valorization. On the other hand, three different catalysts, namely Ru/Nb2O5, Ru/C and Pt/CNTs/Amberlyst were compared for their effects to the plant’s economics with the consideration of additives to fulfill the requirement of the end product’s quality.

Capital cost estimation

The estimated capital cost consists of the fixed capital investment and working capital. Fixed capital refers to the investment made by the business for acquiring long term assets. This is the only cost that was not recovered at the end of project life time, other than the scrap value. The fixed capital investment (FCI) includes the costs of purchasing equipment, installation, piping, instrumentation and other related costs. For a preliminary economic analysis, the purchase cost of equipment estimated here is based on correlations provided by SPD (see Table 4). The item, “cost of uninstalled item”, accounts for the cost of secondary equipment that was not considered explicitly.

Installation cost of a piece of equipment included the cost of foundations, supports and services. Together with the other direct costs, these were estimated by multiplying the purchase cost of equipment with Lang factors of SPD. Working capital was used to deploy the financial resources in the day-to-day business operations. The corresponding working capital costs were calculated by multiplying the numbers of days by the corresponding unit costs per day. The detail of the parameters for this techno-economics study is described in Table 5.

Operation cost estimation

The operating cost to run a bio-gasoline production plant is the sum of all ongoing expenses including raw materials, labour, consumables, utilities, waste disposal and facility overhead. Unit production cost can be obtained by dividing the annual operation cost with the annual production yield. The costs of raw material were obtained from major chemical suppliers. The labour requirement was estimated based on the local basic wages at RMB 32.10 per hour [87].

The utilities usage was determined based on the material and energy balance in SPD and the costs were estimated from local utilities companies and online databases [88,89,90,91]. The wastewater and solid waste treatment costs were based on local regulations in Hong Kong [92] while transportation fixed cost and variable cost were set at RMB 24.3/m3·km and RMB 0.25/ m3·km, respectively with driving speed consideration of 64 km/hr. [93]. Flue gas (i.e. hydrogen gas, nitrogen and oxygen) was flared at high temperature according to requirements of safety and environmental management and the cost was set at RMB 60/MT of emission [94].

Revenue

The revenue was generated from sales of products, including the bio-gasoline, lignin, cellulose pulp and xylose. A market price for xylose, cellulose pulps, lignin and bio-gasoline were set at RMB 45,000/MT, RMB 13,000/MT, RMB 9000/MT and RMB 32,000/MT, respectively. The selling price of lignin residue used as combustion feedstock, which was due to incomplete depolymerization of lignin, was estimated to be RMB1,230/MT [95].

Profitability analysis

This study presented various economic indicators to evaluate the economic profitability of the two scenarios. The simplest indicator included gross profit, return on investment and payback time. They were defined in the following equations:

The annual gross profit was calculated by subtracting the annual operating cost (AOC) from total annual revenues whereas annual net profit was calculated as the annual gross profit minus the annual income taxes plus the depreciation. Other measures were also considered, such as net present value (NPV), return on investment (ROI) and internal rate of return (IRR). The average corporate tax in Hong Kong was 16.5% [96], while the depreciation of the fixed capital investment was calculated using straight line method on 10 years lifetime with 5% salvage value assumed. The NPV represents the total value of future net cash flows during the lifetime of the plant, discounted to reflect the time value of money. It was defined in Eq. (5).

The IRR is commonly used to indicate the efficiency of an investment. It was calculated based on cash flows before and after income taxes.

Discussion

The economic and technical assumptions described above outlined the base case scenario of the simulated organosolv process. Due to inherent uncertainties in simulation studies, sensitivity analyses were carried out in order to estimate the effect of changes for the major parameters upon the economic performance for the plant in both scenarios.

SuperPro Designer® enables users to modify the unit operations, material compositions, volume and equipment factors. The program also allows the user to key in the mass and economic factors (i.e. selling price, purchase price etc.) in order to determine the economic feasibility of the industrial-scale process in the current market. Apart from the process simulation as mentioned above, SPD could also generate an economic report, which is dependent on the capital costs, detailing the operating costs and the purchase and selling prices of chemicals. Some costs were not considered in this report, such as environmental abatement cost. The estimation of the capital and production costs for the production of biofuel from lignocellulosic biomass are conducted using the best available price for reagents, equipment and supplying materials. For the economic analysis, Case I will be evaluated for commercialization feasibility and to compare with a case where HDO was not anticipated. Furthermore, the effect on plant’s economics of Case III and Case IV were also compared in the sensitive analysis as a result of the use of different catalysts.

Capital investment

Table 4 presents the bare equipment cost for both scenarios. It was found that the bare equipment cost for Scenario I (RMB 37,794,000) was 27% higher than that of Scenario II (RMB 27,563,000) because equipment, such as stirred reactor and blending tank, was required for the bio-gasoline production where Scenario II did not require this equipment since the fractionated products can be directly put onto the market for sale. It should be pointed out that the cost of stirred reactors contributed the largest portion of bare equipment cost, with over 43% of the total equipment costs in both scenarios. Based on the process flow diagram, capital costs including both fixed capital investment (FCI) and working capital for Scenario I and Scenario II are summarized in Table 6.

Apart from the bare equipment cost, additional costs for building the pilot plant were anticipated and summarized in Table 6. Working capital was used to cover the expenses of the initialization of the plant in the start-up phase, such as the purchase of raw material, testing of equipment and training for labour, it was assumed to be 0.7% of the FCI. The total capital investment for Scenario I and Scenario II were RMB 180,993,000 and RMB 137,223,000, respectively.

The total FCI for a plant of this capacity is around RMB180 million (i.e. with a Lang factor of 6.5) for the total equipment cost. The quotations of the equipment were obtained from Zonta Electromechanical Technology in China (quoted as of April 2019). Since the actual costs of equipment were provided up to date, cost adjustment with Chemical Engineering Plant Cost Index was not necessary.

Operation cost

The project estimated annual operating costs for the Scenario I and II production facilities were shown in Table 7. It is worthwhile to note that the production cost of Scenario I RMB32,917,000 was 23% higer than that of Scenario II RMB25,224,000. In fact, the differences between the two cases were due to the additives during blending and equipment, labourers, and the amount of utilities as a result of additional steps for bio-gasoline production. More than 55% of the operating cost was attributed by the facility dependent cost in both Scenario I (RMB19,711,000) and Scenario II (RMB14,944,000). Facility dependent cost is associated with equipment maintenance, depreciation of the fixed capital cost, and miscellaneous costs such as insurance, factory expense and local taxes.

Revenue and profitability analysis

As shown in Table 8, the annual revenue generated in Scenario I and Scenario II were RMB 37,073,219 and RMB 31,458,000, respectively.

After the evaluation of capital cost, operation cost and the revenue generation discussed above, the profitability analysis was carried out to compare the profitability of Scenario I and Scenario II. Financial indicators such as gross profit, net profit, net present value (NPV), internal return rate (IRR), return on investment (ROI) and payback time of both scenarios are presented in Table 9.

It was found that both scenarios were economically feasible, in which Scenario II was being more economically favourable in term of the net present value, payback time and IRR. The bottom line of the financial analysis is the net profit, which is the leftover after paying all the expenses and taxes. Scenario I was 9.6% higher in net profit than Scenario II. The IRR, NPV and payback time for both scenarios were considered high, which indicates the profitability in the investment. Both scenarios have demonstrated positive level for the ROI, suggesting that in the long-run, their respective production could be profitable. Aside from this, a slightly longer payback time was observed when the bio-gasoline products were sold as a source of revenue. Results of the scenario analysis shows that the Scenario I was the most favourable solution to the current market, i.e. it can both satisfy the biorefineries’ economic growth and provide an alternative solution to the depleting fossil fuel resources.

Discount rate is the rate of return used in a discounted cash flow analysis to determine the present value of future cash flows. It was defined in Eq. (6):

By increasing the discount rate, the NPV of future earnings will shrink. It is of our interest to study the extent of the risk. The cumulative cash flow diagram as shown in Fig. 2 illustrated the effects of discount rate of the NPV of the two scenarios along the plant’s lifetime (i.e. 20 years).

As shown in Fig. 2, both scenarios were found to be rather similar, with the NPV remained positive at discount rate of 7% provided with 20 years of plants’ lifetime. In both cases, increasing discount rate resulted in lowered NPV and extended payback time. As long as the NPV remains positive, the process is still economically feasible. For Scenario I, it was expected that this result prevails, especially in the near future when bio-gasoline production becomes more efficient, such as higher depolymerization yield and more economical viable base metal catalysis. Despite the current capital, chemical and maintenance costs for Scenario I were above that of Scenario II, the projected net profit was higher. Assuming input prices remained the same, innovation and R&D on Scenario I could lead to lower capital and conversion costs, the resultant bio-gasoline production process could be considered as a rewarding investment for developed countries.

Sensitivity analysis

Sensitivity analysis was performed on the plant’s economic to assess the impact of various flow rate of woody biomass feedstock. In Scenario I, the projected cost of raw material for the bio-gasoline production was approximately RMB 1.5 million. Ru/Nb2O5 catalyst was the biggest contributing factor, attributing 20% of the material costs. Therefore, it is of our interest to perform a sensitivity analysis by varying cost of materials, price of products, income tax, utility cost, wastewater treatment cost and the cost of labour within ±50% at the beginning of the plant’s lifetime to evaluate the effects of these variables on the production economics. The impact of income tax variation was analysed in the case that the Hong Kong Government provides an incentive for this program. The results are shown in Fig. 3.

It was found that the selling price of the end product was the largest determinant of the NPV in both scenarios, with Scenario II having much greater influence to the plant’s economic future. Coproducts, such as xylose and cellulose pulp have been reported on following an upward trend towards the future market [97, 98]. The future rise of bio-gasoline demand due to the depletion of fossil-based gasoline was also expected. Therefore, falling of the bio-gasoline price is unlikely to occur in the near future and thus it was not expected to pose any risk to the economy of the plant. Lignin produced in Scenario II has been reported on its extensive uses in the animal feed additives industry, fine chemical productions, etc. According to the report by Reuter, Global Animal Feed Additives Industry is expected to grow at Compound Annual Growth Rate (CAGR) of around 4% during the forecast period 2016–2021. Also, lignin has been used in other products, including absorbents, emulsifiers, dispersants, and as chelating agents [99].

For both scenarios, utilities cost has high influence on the NPV, which implies that the cost of utilities may pose a certain risk on the plant’s economic future. In fact, it is in accordance with our expectation, since the cost of utilities in Scenario I and Scenario II are 26 and 33% of the AOC, respectively. The remaining variables, such as the cost of wastewater treatment, labour cost, income tax and material cost have little impact on the NPV in both scenarios, which implies that uncertainty of the scenario is limited.

The petroleum fuel price in Hong Kong as of May 2019 was RMB 15/l according to the Shell Co. Ltd. [100]. By assuming the gasoline density of 770 kg/m3, the gasoline cost was ranged at RMB 19.5/kg, which was lower than the cost of bio-gasoline production (RMB 32/kg) estimated in Scenario I. It is of our interest to determine another possible plant’s economics for using different catalysts for the HDO process. In this case, we referred to Case III and Case IV which utilized the Ru/C and Pt/CNT (5%) with Amberlyst-15 respectively. Table 10 showed the profitability of bio-gasoline using various catalysts and their economic indicators were all adjusted to a similar profitability result. By assuming the bio-based products of 40–45 wt.%, it was concluded that given the similar profitability result for three different catalysts, the selling price of bio-gasoline using Ru/C catalyst could be the most favourable in the current fuel market in Hong Kong. Fig. 4 indicates the types of catalyst add uncertainty to the plant economics, as this can be seen from their respective gradients.

It was found that the cost of 5 wt% Pt/CNT with Amberlyst-15 has the greatest impact on the plant’s economics future. The cost of Pt/CNT has to be reduced to half in order to become NPV neutral. It should be noted that other than the catalysts, additives such as ethanol, butane and reformate (RON = 95) were required for blending to meet the gasoline specifications and they were also part of the variables that determine the plant’s economics. Sensitivity analysis was performed on the plant’s economic to assess the impact of variations in terms of the type of catalyst. The results were shown in Fig. 5(a) Ru/Nb2O5 (b) Ru/C (c) Pt/CNT (5%) with Amberlyst-15.

As shown in Fig. 5, the product price for all cases was the largest determinant of the NPV in the corresponding cases. Despite poor economic performance for Case III, the NPV became positive with a 25% increase in selling price of products (see Fig. 5c). For all three cases, the market of these products was anticipated to follow an upward trend due to the depletion of fossil-based gasoline. This is followed by the cost of utilities which showed a slight influence in the plant’s economics. The material cost in the case of using Pt/CNT (5%) with Amberlyst-15 has the highest impact among the three cases, since the utilities and raw material using Pt/CNT (5%) with Amberlyst-15 catalyst are 30 and 23% of the AOC, respectively. The remaining variables, such as cost of transport, income tax, waste treatment and labour costs have little impact on the NPV in all cases.

Conclusions and future prospect

Although our research focus lies on the commercialization of biofuel production from lignocellulosic biomass, the conversion of lignocellulosic stream is very promising as it is seen as an influential aspect to minimize greenhouse gas emission. Both the scenarios examined in this study were economically feasible of which the production of bio-gasoline in Scenario II was the most profitable option in terms of the NPV (RMB 22,653,000), payback time (5.90 years) and IRR (9.14%). However, Scenario I with the use of relatively cheaper noble metal catalyst (i.e. Ru, Vs and Pt) also showed that lignocellulosic biomass has the potential to be introduced into the current market due to the potential production of co-products as part of the revenue so that the unit production cost of the bio-gasoline could be lowered. It should be pointed out that our studies considered the scenario where the coproducts were marketable. In fact, their potential of being upgraded into value-added products could be higher. On top of this, the economic feasibility studies were conducted on different types of catalysts to give an opportunity for the bio-gasoline to be introduced into the market and be able to compete with the fossil-based gasoline. It can be concluded that the development of economically viable catalysts was the key for the present blending process to compete with the current fossil-based gasoline prices.

To make the conversion process commercially viable and competitive against the existing energy, the following suggestions for future work are recommended in these areas: (a) the technical feasibility of using potentially lower feedstock cost, such as lower grade industrial lignin, especially the wood pulp by-product from the pulp and paper industry; (b) technical feasibility to regenerate the precious noble catalyst for longer time of use (since the shelf-life of the catalysts in this study was assumed to be 3 years only) (c) reduce solvent losses with the aim to improve recovery of solvent; and finally (d) development of non-precious base metal catalysis with high monomer yields and selectivities.

Methods

SuperPro Designer® (Intelligen Inc., Scotch Plains, NJ) was used to quantify the materials and energy requirements of the three processes being considered. The energy consumption was calculated with consideration of the electricity consumption of each equipment, the steam and the coolant consumption used in these processes. Thermophysical properties such as density, heat capacity, ideal gas heat capacity, Antoine constants of the raw material and chemical products, maximum volumes of various equipment, maximum areas of exchange coefficients of heat transfer, the amount of input streams, the amount of catalysts and raw materials, purchasing and selling prices of various materials, were entered into the simulator. Instead of developing heat exchanger operation units, heat recovery was performed to match the hot and cold streams to minimize the energy consumption. The process was operated as batch mode as a whole. Solvents and reagents were recycled wherever appropriate in order to minimize the consumption of materials and energy. Method of lignin extraction, lignin characterization, catalysts preparation, catalyst performance tests, catalysts cost estimation, thermophysical properties and parameters for simulation, stream data, and methods for estimating octane numbers and Reid Vapor pressures were all detailed in the supporting information.

Availability of data and materials

All data generated or analysed during this study are included in this published article.

Abbreviations

- AOC:

-

Annual operating cost

- CAGR:

-

Compound Annual Growth Rate

- CSTR:

-

Continuous stirred tank reactor

- FCI:

-

Fixed capital investment

- HDO:

-

Hydrodeoxygenation

- IRR:

-

Internal rate of return

- MON:

-

Motor octane number

- NPV:

-

Net present value

- OPEFB:

-

Oil palm empty fruit bunches

- ROI:

-

Return on investment

- RON:

-

Research octane number

- RVP:

-

Reid vapor pressure

- SPD:

-

SuperPro Designer®

References

New & Renewable Energy. In Energy Efficiency and Conservation. Hong Kong: Electrical and Mechanical Services Department. http://https://www.emsd.gov.hk/en/energy_efficiency/new_renewable_energy/ Accessed 13 Sept 2019.

Monitoring of solid waste in hong kong - waste statistics for 2017. Hong Kong: Statistics Unit - Environmental Protection Department; 2018. https://www.wastereduction.gov.hk/sites/default/files/msw2017.pdf. Accessed 13 Sept 2019.

Chung SS, Lau KY, Zhang C. Measuring bulky waste arisings in Hong Kong. Waste Manag. 2010;30:737–43.

Thompson P. The agricultural ethics of biofuels: the food vs. fuel debate. Agriculture. 2012;2:339–58.

Spencer T. Alabama plant to begin producing ethanol from waste wood. In: Institute for Agriculture & Trade Policy; 2008.

Abengoa celebrates grand opening of its first commercial-scale next generation biofuels plant. In: Abengoa Press Room. vol. 2014. United States. http://www.abengoa.com/web/en/novedades/hugoton/noticias/. Accessed 02 Dec 2019.

Bluefire renewable creates 52 jobs as site preparation continues on Fulton project; recovery act dollars at work. In: News from BlueFire Renewables Inc. vol. December 2, 2010. United States. https://bfreinc.com/. Accessed 02 Dec 2019.

Anaerobic organisms key to Coskata's rapid rise. In Ethanol Producers Magazine; 2008. http://biomassmagazine.com/articles/1736/anaerobic-organisms-key-to-coskata’s-rapid-rise. Accessed 13 Sept 2019.

DuPont breaks ground at 30 MMgy cellulosic ethanol facility. In Ethanol Producer Magazine; 2012. http://www.ethanolproducer.com/articles/9337/. Accessed 13 Sept 2019.

Schmidt S. Alabama town partners with Gulf Coast energy. In: Biomass Magazine; 2008.

Kim SB, Park C, Kim SW. Process design and evaluation of production of bioethanol and beta-lactam antibiotic from lignocellulosic biomass. Bioresour Technol. 2014;172:194–200.

Juneja A, Kumar D, Murthy GS. Economic feasibility and environmental life cycle assessment of ethanol production from lignocellulosic feedstock in Pacific northwest US. J Renew Sustain Ener. 2013;5:023142.

Jafari V, Labafzadeh SR, Jeihanipour A, Karimi K, Taherzadeh MJ. Construction and demolition lignocellulosic wastes to bioethanol. Renew Energ. 2011;36:2771–5.

Hasanly A, Khajeh Talkhoncheh M, Karimi AM. Techno-economic assessment of bioethanol production from wheat straw: a case study of Iran. Clean Technol Envir. 2017;20:357–77.

Gnansounou E, Dauriat A. Techno-economic analysis of lignocellulosic ethanol: a review. Bioresour Technol. 2010;101:4980–91.

Crawford JT, Shan CW, Budsberg E, Morgan H, Bura R, Gustafson R. Hydrocarbon bio-jet fuel from bioconversion of poplar biomass: techno-economic assessment. Biotechnol Biofuels. 2016;9:141.

Barrera I, Amezcua-Allieri MA, Estupiñan L, Martínez T, Aburto J. Technical and economical evaluation of bioethanol production from lignocellulosic residues in Mexico: case of sugarcane and blue agave bagasses. Chem Eng Res Des. 2016;107:91–101.

Baral NR, Shah A. Techno-economic analysis of utilization of stillage from a cellulosic biorefinery. Fuel Process Technol. 2017;166:59–68.

Kumar D, Murthy GS. Impact of pretreatment and downstream processing technologies on economics and energy in cellulosic ethanol production. Biotechnol Biofuels. 2011;4:27.

Michailos S. Process design, economic evaluation and life cycle assessment of jet fuel production from sugar cane residue. Environ Prog Sustain. 2018;37:1227–35.

van Rijn R, Nieves IU, Shanmugam KT, Ingram LO, Vermerris W. Techno-economic evaluation of cellulosic ethanol production based on pilot biorefinery data: a case study of sweet sorghum bagasse processed via L+SScF. Bioenergy Res. 2018;11:414–25.

Mupondwa E, Li X, Tabil L. Integrated bioethanol production from triticale grain and lignocellulosic straw in Western Canada. Ind Crop Prod. 2018;117:75–87.

Kumar D, Murthy GS. Life cycle assessment of energy and GHG emissions during ethanol production from grass straws using various pretreatment processes. Int J Life Cycle Ass. 2012;17:388–401.

Valdivia M, Galan JL, Laffarga J, Ramos JL. Biofuels 2020: biorefineries based on lignocellulosic materials. Microb Biotechnol. 2016;9:585–94.

Ragauskas AJ. Lignin ‘first’ pretreatments: research opportunities and challenges. Biofuels Bioprod Biorefin. 2018;12:515–7.

Klein-Marcuschamer D, Oleskowicz-Popiel P, Simmons BA, Blanch HW. The challenge of enzyme cost in the production of lignocellulosic biofuels. Biotechnol Bioeng. 2012;109:1083–7.

Feng J, Hse CY, Yang Z, Wang K, Jiang J, Xu J. Liquid phase in situ hydrodeoxygenation of biomass-derived phenolic compounds to hydrocarbons over bifunctional catalysts. Appl Catal A-Gen. 2017;542:163–73.

Yao G, Wu G, Dai W, Guan N, Li L. Hydrodeoxygenation of lignin-derived phenolic compounds over bi-functional Ru/H-Beta under mild conditions. Fuel. 2015;150:175–83.

Zhang X, Tang W, Zhang Q, Wang T, Ma L. Hydrodeoxygenation of lignin-derived phenoic compounds to hydrocarbon fuel over supported Ni-based catalysts. Appl Energy. 2018;227:73–9.

Wang H, Ruan H, Feng M, Qin Y, Job H, Luo L, et al. One-pot process for hydrodeoxygenation of lignin to alkanes using Ru-based bimetallic and bifunctional catalysts supported on zeolite Y. ChemSusChem. 2017;10:1846–56.

Dong L, Shao Y, Han X, Liu X, Xia Q, Parker SF, et al. Comparison of two multifunctional catalysts [M/Nb2O5 (M = Pd, Pt)] for one-pot hydrodeoxygenation of lignin. Catal Sci Technol. 2018;8:6129–36.

Blank B, Cortright R, Beck T, Woods E, Jehring M. Catalysts for hydrodeoxygenation of oxygenated hydrocarbons to alcohols and cyclic ethers. pp. 45 pp., Cont.-in-part of U.S. Ser. No. 586,499: Virent, Inc., USA . 2015:45 pp., Cont.-in-part of U.S. Ser. No. 586,499.

Blommel P, Cortright R. Hydrogenation of carboxylic acids to increase yield of aromatics. pp. 38pp.: Virent, Inc., USA . 2014:38pp.

Blommel P, Held A, Goodwin R, Cortright R. Process for converting biomass to aromatic hydrocarbons. pp. 62pp.: Virent, Inc., USA . 2014:62pp.

Blommel P, Price R. Production of alternative gasoline fuels. pp. 39 pp.: Virent, Inc., USA . 2017:39 pp.

Cortright RD, Vollendorf NW, Hornemann CC, McMahon SP. Catalysts and methods for reforming oxygenated compounds. pp. No pp. given: Virent, Inc., USA . 2012:No pp. given.

Holladay J. Toward the use of current refinery infrastructure to produce gasoline, diesel and jet fuel from biomass. In: American Chemical Society; 2010. NWRM-172.

Deuss PJ, Scott M, Tran F, Westwood NJ, de Vries JG, Barta K. Aromatic monomers by in situ conversion of reactive intermediates in the acid-catalyzed depolymerization of lignin. J Am Chem Soc. 2015;137:7456–67.

Hidajat MJ, Riaz A, Park J, Insyani R, Verma D, Kim J. Depolymerization of concentrated sulfuric acid hydrolysis lignin to high-yield aromatic monomers in basic sub- and supercritical fluids. Chem Eng J. 2017;317:9–19.

Kong J, He M, Lercher JA, Zhao C. Direct production of naphthenes and paraffins from lignin. Chem Comm (Camb). 2015;51:17580–3.

Li Q, López N. Chirality, rigidity, and conjugation: a first-principles study of the key molecular aspects of lignin Depolymerization on Ni-based catalysts. ACS Catal. 2018;8:4230–40.

Long J, Zhang Q, Wang T, Zhang X, Xu Y, Ma L. An efficient and economical process for lignin depolymerization in biomass-derived solvent tetrahydrofuran. Bioresour Technol. 2014;154:10–7.

Nandiwale KY, Danby AM, Ramanathan A, Chaudhari RV, Subramaniam B. Zirconium-incorporated mesoporous silicates show remarkable lignin depolymerization activity. ACS Sustain Chem Eng. 2017;5:7155–64.

Shao Y, Xia Q, Dong L, Liu X, Han X, Parker SF, et al. Selective production of arenes via direct lignin upgrading over a niobium-based catalyst. Nat Commun. 2017;8:16104.

Shu R, Xu Y, Ma L, Zhang Q, Wang C, Chen Y. Controllable production of guaiacols and phenols from lignin depolymerization using Pd/C catalyst cooperated with metal chloride. Chem Eng J. 2018;338:457–64.

Song Q, Wang F, Cai J, Wang Y, Zhang J, Yu W, et al. Lignin depolymerization (LDP) in alcohol over nickel-based catalysts via a fragmentation–hydrogenolysis process. Energy Environ Sci. 2013;6:994–1007.

Sturgeon MR, O'Brien MH, Ciesielski PN, Katahira R, Kruger JS, Chmely SC, et al. Lignin depolymerisation by nickel supported layered-double hydroxide catalysts. Green Chem. 2014;16:824–35.

Wang H, Zhang L, Deng T, Ruan H, Hou X, Cort JR, et al. ZnCl2 induced catalytic conversion of softwood lignin to aromatics and hydrocarbons. Green Chem. 2016;18:2802–10.

Wang X, Rinaldi R. Bifunctional Ni catalysts for the one-pot conversion of organosolv lignin into cycloalkanes. Catal Today. 2016;269:48–55.

Xu W, Miller SJ, Agrawal PK, Jones CW. Depolymerization and hydrodeoxygenation of switchgrass lignin with formic acid. ChemSusChem. 2012;5:667–75.

Ma X, Ma R, Hao W, Chen M, Yan F, Cui K, et al. Common pathways in Ethanolysis of Kraft lignin to platform chemicals over molybdenum-based catalysts. ACS Catal. 2015;5:4803–13.

Kang K, Gu X, Guo L, Liu P, Sheng X, Wu Y, et al. Efficient catalytic hydrolytic dehydrogenation of ammonia borane over surfactant-free bimetallic nanoparticles immobilized on amine-functionalized carbon nanotubes. Int J Hydrog Energy. 2015;40:12315–24.

Matson TD, Barta K, Iretskii AV, Ford PC. One-pot catalytic conversion of cellulose and of woody biomass solids to liquid fuels. J Am Chem Soc. 2011;133:14090–7.

Xia Q, Chen Z, Shao Y, Gong X, Wang H, Liu X, et al. Direct hydrodeoxygenation of raw woody biomass into liquid alkanes. Nat Commun. 2016;7:11162.

Jin S, Guan W, Tsang C-W, Yan DYS, Chan C-Y, Liang C. Enhanced Hydroconversion of lignin-derived oxygen-containing compounds over bulk nickel catalysts though Nb2O5 modification. Catal Lett. 2017;147:2215–24.

Jin S, Xiao Z, Chen X, Wang L, Guo J, Zhang M, et al. Cleavage of lignin-derived 4-O-5 aryl ethers over nickel nanoparticles supported on niobic acid-activated carbon composites. Ind Eng Chem Res. 2015;54:2302–10.

Jin S, Chen X, Li C, Tsang C-W, Lafaye G, Liang C. Hydrodeoxygenation of lignin-derived Diaryl ethers to aromatics and alkanes using nickel on Zr-doped niobium phosphate. ChemistrySelect. 2016;1:4949–56.

Li C, Jin S, Guan W, Tsang CW, Chu WK, Lau WK, Liang C: Chemical Precipitation Method for the Synthesis of Nb2O5 Modified Bulk Nickel Catalysts with High Specific Surface Area. J Vis Expt. 2018;132:e56987.

Guan W, Chen X, Jin S, Li C, Tsang C-W, Liang C. Highly stable Nb2O5–Al2O3 composites supported Pt catalysts for Hydrodeoxygenation of Diphenyl ether. Ind Eng Chem Res. 2017;56:14034–42.

Sergios Karatzos JDM, Jack N. Saddler. Summary of IEA Bioenergy Task 39 report: The potential and challenges of drop-in biofuels; 2014.

Jiang W, Gu P, Zhang F. Steps towards ‘drop-in’ biofuels: focusing on metabolic pathways. Curr Opin Biotechnol. 2017;53:26–32.

Pineda A, Lee AF. Heterogeneously catalyzed lignin depolymerization. App Pet Res. 2016;6:243–56.

Tudorache M, Opris C, Cojocaru B, Apostol NG, Tirsoaga A, Coman SM, et al. Highly efficient, easily recoverable, and recyclable re–SiO2–Fe3O4 catalyst for the fragmentation of lignin. ACS Sustain Chem Eng. 2018;6:9606–18.

Bender TA, Dabrowski JA, Gagné MR. Homogeneous catalysis for the production of low-volume, high-value chemicals from biomass. Nat Rev Chem. 2018;2:35–46.

Deuss PJ, Barta K, de Vries JG. Homogeneous catalysis for the conversion of biomass and biomass-derived platform chemicals. Catal Sci Technol. 2014;4:1174–96.

Karkas MD, Matsuura BS, Monos TM, Magallanes G, Stephenson CR. Transition-metal catalyzed valorization of lignin: the key to a sustainable carbon-neutral future. Org Biomol Chem. 2016;14:1853–914.

Ferrari MD, Guigou M, Lareo C. Energy consumption evaluation of fuel bioethanol production from sweet potato. Bioresour Technol. 2013;136:377–84.

Henao CA, Braden D, Maravelias CT, Dumesic JA. A Novel Catalytic Strategy for the Production of Liquid Fuels from Ligno-cellulosic Biomass. In: 21st European Symposium on Computer Aided Process Engineering; 2011. p. 1723–7.

Kwiatkowski JR, McAloon AJ, Taylor F, Johnston DB. Modeling the process and costs of fuel ethanol production by the corn dry-grind process. Ind Crop Prod. 2006;23:288–96.

Braden DJ, Henao CA, Heltzel J, Maravelias CC, Dumesic JA. Production of liquid hydrocarbon fuels by catalytic conversion of biomass-derived levulinic acid. Green Chem. 2011;13:1755–65.

Patel AD, Serrano-Ruiz JC, Dumesic JA, Anex RP. Techno-economic analysis of 5-nonanone production from levulinic acid. Chem Eng J. 2010;160:311–21.

De Pretto C, Tardioli PW, Costa CBB. Modelling and Analysis of a Soybean Biorefinery for the Production of Refined Oil, Biodiesel and Different Types of Flours. In: 26th European Symposium on Computer Aided Process Engineering; 2016. p. 925–30.

Li X, Mupondwa E, Tabil L. Technoeconomic analysis of biojet fuel production from camelina at commercial scale: case of Canadian prairies. Bioresour Technol. 2018;249:196–205.

Mupondwa E, Li X, Tabil L, Falk K, Gugel R. Technoeconomic analysis of camelina oil extraction as feedstock for biojet fuel in the Canadian prairies. Biomass Bioenergy. 2016;95:221–34.

Giwa A, Adeyemi I, Dindi A, Lopez CG-B, Lopresto CG, Curcio S, et al. Techno-economic assessment of the sustainability of an integrated biorefinery from microalgae and Jatropha: a review and case study. Renew Sustain Energ Rev. 2018;88:239–57.

Hunpinyo P, Narataruksa P, Tungkamani S, Pana-Suppamassadu K, Chollacoop N. Evaluation of techno-economic feasibility biomass-to-energy by using ASPEN plus®: a case study of Thailand. Energy Procedia. 2013;42:640–9.

Mel M, Yong AS, Ihsan SI, Setyobudi RH. Simulation study for economic analysis of biogas production from agricultural biomass. Energy Procedia. 2015;65:204–14.

Viell J, Harwardt A, Seiler J, Marquardt W. Is biomass fractionation by organosolv-like processes economically viable? A conceptual design study. Bioresour Technol. 2013;150:89–97.

Demichelis F, Fiore S, Pleissner D, Venus J. Technical and economic assessment of food waste valorization through a biorefinery chain. Renew Sustain Energ Rev. 2018;94:38–48.

Setyobudi RH, Mel M, Riyad Hussein Abdeen F, Mohd Salleh H, Izan Ihsan S, Adyani Ahmad Fuad F, Hendroko Setyobudi R, Alasaarela E, Pasila F, Chan G et al: Simulation Study of Bio-Methane Conversion into Hydrogen for Generating 500 kW of Power. MATEC Web Conf. 2018;164:01027.

vom Stein T, Grande PM, Kayser H, Sibilla F, Leitner W, Domínguez de María P. From biomass to feedstock: one-step fractionation of lignocellulose components by the selective organic acid-catalyzed depolymerization of hemicellulose in a biphasic system. Green Chem. 2011;13:1772–7.

Karakuts: Fractionation of Reformate. Chem Tech Fuels Oil+ 1994;30:11–12.

Hong kong. Strict fuel specs & emissions standards help improve air quality. In: Asian Clean Fuels Association News; 2010.

Adnan Dahadha NT, Barakat S. Study of the research octane number depression of domestic kerosene-doped automotive gasoline. Adv Appl Sci Res. 2013;4:129–34.

Jia Y, Wang C, Liang C, Qiu JS. Effect of CNT surface modification on catalytic performance of Pt/CNT for selective hydrogenation of o-Chloronitrobenzene. Chinese J Catal. 2009;30:1029–34.

Kong L. Efficient and controllable alcoholysis of Kraft lignin catalyzed by porous zeolite-supported nickel-copper catalyst. Bioresour Technol. 2019;276:310–7.

Statutory minimum wage. In Labor Department: Public Services. Hong Kong: Labor Department; 2019. https://www.labour.gov.hk/eng/news/mwo.htm. Accessed 13 Sept 2019.

Bulk Tariff. In China LIght and Power. Hong Kong; 2017. https://www.clp.com.hk/en/customer-service/tariff/business-and-other-customers/bulk-tariff. Accessed 13 Sept 2019.

Histroical steam price. In Intratec: Steam Price History and Forecast; 2017. https://www.intratec.us/chemical-markets/steam-price. Accessed 13 Sept 2019.

Calculating the Water Costs of Water-Cooled Air Compressors. In Industrial Utility Efficiency: Chiller & Cooling Best Practices: Air Technology Group Hitachi America, Ltd; https://coolingbestpractices.com/technology/chillers/calculating-water-costs-water-cooled-air-compressors. Accessed 13 Sept 2019.

Nixon WA. Economics of using calcium chloride vs. Sodium chloride for deicing/anti-icing IOWA; 2008.

Fees and charges for the disposal of chemical waste at the Chemical Waste Treatment Centre (CWTC). Hong Kong: Environmental Protection Department; 2015 https://www.epd.gov.hk/epd/english/news_events/press/press_070629a.html. Accessed 13 Sept 2019.

El M, Hernandez I. Truck versus pipeline transportation cost analysis of wastewater sludge; 2015.

Outlook of flares reduction in nigeria. In ISSUU: The French Development Agency; 2017. https://issuu.com/objectif-developpement/docs/nt-34-flare-reduction-nigeria. Accessed 13 Sept 2019.

Sun Z. Bright side of lignin depolymerization: toward new platform chemicals. Chem Rev. 2018;118:614–78.

Hong Kong corporate tax compliance and consulting. In PWC Tax Services: PWC Hong Kong; 2019.

Xylose market to reach a value of ~ US$ 2.9 bn by 2029. In. United States: Transparency market research; 26 Jul 2019. United States. https://www.transparencymarketresearch.com/pressrelease/xylose-market.htm. Accessed 02 Dec 2019.

Wood Pulp Market - Segmented by Geography - Growth, Trends, and Forecast (2019 - 2024). In: Mordor Intelligence. India; 2019. https://www.mordorintelligence.com/industry-reports/wood-pulp-market. Accessed 02 Dec 2019.

de Assis CA, Greca LG, Ago M, Balakshin MY, Jameel H, Gonzalez R, et al. Techno-economic assessment, scalability, and applications of aerosol lignin micro- and nanoparticles. ACS Sustain Chem. 2018;6:11853–68.

Price board gasoline. In Shell Fuels; 2019. https://www.shell.com.hk/en_hk/motorists/shell-fuels/price-board.html. Accessed 13 Sept 2019.

Acknowledgements

The authors would like to express their sincere thanks to Geetha Mohan for proofreading of the manuscripts.

Funding

The work described in this paper was fully supported by a grant from the Research Grants Council of the Hong Kong Special Administrative Region, China (UGC/FDS25/E09/17) and partially supported by (UGC/IDS25/15).

Author information

Authors and Affiliations

Contributions

SY Chua performed the economic evaluation. CW Tsang designed the process flowsheet and determined the process parameters. W Guan and X Chen designed the catalysts and performed the experiments on catalytic performance and assisted in performing the economic evaluations. Carol SK Lin provided advice on the execution of the simulation software package and revision of manuscript. RSW Fu have assisted in performing the economic evaluations. H Hu and C Liang provided general directions and perspectives. All authors read and approved the final manuscript.

Authors’ information

CW Tsang and RSW Fu are currently academic staff at the Technological and Higher Education Institute of Hong Kong. SY Chua are undergraduate students at the Technological and Higher Education Institute of Hong Kong. W Guan is PhD candidate and X Chen is Associate Professor at Dalian University of Technology, respectively. CSK Lin is Associate Professor at City University of Hong Kong. H Hu and C Liang are Professors at Dalian University of Technology.

Corresponding authors

Ethics declarations

Competing interests

I confirm that I have read BioMed Central’s guidance on competing interests and have included a statement in the manuscript indicating that none of the authors have any competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

To be submitted to: BMC Chemical Engineering

Supplementary information

Additional file 1:

Supplementary information of economic feasibility of gasoline production from lignocellulosic wastes in Hong Kong.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated.

About this article

Cite this article

Guan, W., Chua, SY., Tsang, CW. et al. Economic feasibility of gasoline production from lignocellulosic wastes in Hong Kong. BMC Chem Eng 1, 24 (2019). https://doi.org/10.1186/s42480-019-0024-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s42480-019-0024-6