Abstract

COVID-19 outbreak has heavily impacted the manufacturing industry, including Brazilian Automotive Industry. The effects of COVID-19 created restrictions in several industry processes as supply chain. On the other hand, several industry 4.0 technologies is able to support the industry supply chain activities in the COVID 19 scenarios, as well it may contributed for the automotive industry recovery and it will define the next steps of this industry. A supply chain is a network between a company and its suppliers to produce and distribute a specific product to the final buyer. Industry 4.0 is related to the technology development and the digitalization process that improve significantly productivity. Considering the automotive process, an important reference model is described in Advanced Product Quality Planning and Control Plan, that is a manual that communicate the guidelines of the product quality planning and control plan for internal and external suppliers. In this scenario, this paper evaluated the current situation and the future outlook for the adoption of Industry 4.0 technologies in the automotive OEM post-pandemic scenario on the point of view of automotive specialists. The results of this research provide an overview of the current situation and the future outlook for the usage of Industry 4.0 technologies by the Brazilian Northeast automotive OEM, from the perspective of manufacturing engineering experts on APQP.

Similar content being viewed by others

Introduction

Coronavirus disease 2019 (COVID-19) is an outbreak of respiratory illness caused by Sars-CoV-2 virus and firstly reported in China [1]. It was declared pandemic by the World Health Organization on March 11, 2020 [2]. Thenceforth COVID-19 outbreak has heavily impacted the manufacturing industry. Original Equipment Manufacturer (OEM) and parts suppliers have yet to return to full production capacity. For instance, Aston Martin Lagonda Global Holdings Plc plan to eliminate its workforce by 20% [3] and General Motors have slowed the manufacturing plants because of safety and lockdown protocols [4]. Brazilian automakers cancelled their quarantine and returned to manufacture vehicles, even with an ongoing outbreak, according to the Brazilian Association of Automotive Vehicle Manufacturers (ANFAVEA) guide protocols [5]. But considering COVID-19 contingency mode that creates restrictions to the manufacturing floor, manufacturing processes, review meetings and visits to suppliers to keep the social distance in order to avoid contamination, this may change the way that the OEM’s deals with the suppliers.

The automotive industry has a huge contribution in the economy of the country, contributing positively to the generation of jobs and whose financial results are used to measure the current wealth of the international economy [6]. For instance, it represents about 5% of the Brazilian gross domestic product (GDP) and approximately 20% of the GDP of the manufacturing industry [7], with 26 manufactures, 484 autoparts and 5279 car dealers employing more than 1.3 million workers around the country [8]. But the OEMs and their supply chain are currently working in a contingency mode. A slump in car sales were projected in 2020, predicting 64 million automobiles to be sold worldwide, against 80 million estimated pre-pandemic [9]. This scenario demands Supply Chain Resilience (SCR), defined as the ability to prevent and absorb changes, recovering initial performance after an unexpected disruption [10]. Following a disruptive event, key players in supply chain must predict, understand and to be prepared for the impact in this event. They need to define strategies to respond quickly and to adapt to the resulting effects, as well as rearrange your resources to strengthen skills [11].

COVID-19 is an unprecedented disruptive event in recent decades. In the current state, the lack of important information is creating a huge obstacle to respond to the interruption caused by this pandemic, which leads to a reactive and disorganized response to these interruptions, further compromising the SCR [12]. This outbreak clearly shows the need for improve the SCR research and practices [13].

The aim of this paper is to present a method to evaluate the current situation and the future outlook for the adoption of Industry 4.0 technologies in the automotive OEM post-pandemic scenario. A survey was applied to capture the perception of automotive manufacturing specialists regarding how the Industry 4.0 technologies supports the Advanced Product Quality Planning and Control Plan (APQP) phases. This proposed method may help the automotive supply chain to efficiently implement Industry 4.0 technologies to improve their SCR.

Industry 4.0

The term Industry 4.0 is related to the technology development and the digitalization process that brought significant productivity improvements. The term was first time introduced by the German government in Hannover Messe of 2011 and later it was declared as a strategic initiative to transform the manufacturing industry [14].

To support the flexibility of demand and personalized products in small batches that has been increasing considerably in the latest times, a combination of several digital technologies like; Artificial Intelligence, Cloud Computing, Autonomous Robots, Augmented Reality, Additive Manufacturing and Internet of Things (IoT) had to be introduced to allow the connectivity between suppliers, OEMs and costumers. All of this leads to efficiency and productivity improvements that are changing key business processes and increasing the competitive power of organizations [15].

A conceptual framework for Industry 4.0 was proposed based on three core and nine fundamental technologies that are transforming the industrial manufacturing: adaptive robotics, cyber physical infrastructure, sensors and actuators, additive manufacturing, cloud technologies, virtualization technologies (Virtual Reality (VR) and Augmented Reality (AR)), simulation, data analytics and Artificial Intelligence (AI), Real-time Locating Systems (RTLS) and Radio Frequency Identification (RFID) technologies, communication and networking, mobile technologies and cybersecurity [15].

Smart factories are the key feature for the Industry 4.0 and the main sub-processes to support it are listed below [16]:

-

Machine-to-Machine communication via IoT

-

Consistent communication from the sensor to the cloud

-

Integration of robotics and innovative drive technologies

-

RFID as the basis for parts tracking and intelligent products

These technologies support the three major advantages of Industry 4.0: vertical integration, horizontal integration and end-to-end engineering [17, 18]. While the vertical integration is related to the integration of information and communications technology systems in different hierarchical levels of an organization [18], the horizontal integration is the collaboration of resources and real time information exchange between enterprises, like supply chain, manufacturing and customer [19]. End-to-end engineering is the integration of engineering from product development to post-sales [18]. The vertical and horizontal integration shows the importance of Supply Chain to implement the Industry 4.0 framework technologies to collaborate and exchange information with the automotive OEM in real time.

Review of COVID-19 challenges that impact supply chain and industry 4.0 technologies to overcome them

The COVID-19 outbreak is the most serious disruption for the entire supply chain in recent history [12, 13]. Companies still seem to be unprepared in terms of supply chain mapping and visibility to deal with COVID-19 [12, 20]. According to [21], worldwide supply chains connecting the world to China and other manufacturing centers are expected to be seriously disrupted.

[22] identified the operational challenges confronted by retailers in providing efficient services and discussed some Industry 4.0 technologies to mitigate them. According to [22], theirs proposed framework may assist policymakers to develop an action plan for COVID-19. In our understanding, companies can take advantage of the roadmap proposed in this study for plan Industry 4.0 implementation also. Table 1 intend to summarize their findings. We added some other inputs from the available literature regarding the technologies or strategies that may mitigate supply chain issues caused by COVID-19 [13, 23–25].

In another study, [25] states that the best strategies to mitigate the risks attributed to COVID-19 in automobile industry is to develop localized sources of supply and to use advanced technologies of Industry 4.0, as Big Data Analytics that plays a significant role in providing real-time information on supply chain activities to overcome the challenges created by the pandemic. Moreover, [26] evaluated the impact of COVID-19 outbreak on employee performance of the service sector. They claim that the moderating role of Industry 4.0 technologies is more comprehensive in employee quality performance than delivery performance.

The COVID-19 pandemic is a recent event that needs further studies that seek to understand the main consequences that it has caused in the supply chain of each industrial sector. For instance, the automotive supply chain has more than 900 Tier 1 [27] and several hundred thousand Tier 2 and Tier 3 suppliers [28]. Although the literature reviewed here is not about in-depth studies on the challenges that COVID-19 brought to the supply chain in the automotive industry, we understand that the challenges presented in other sectors of the industry may be used as a basis to assess the future scenario of adoption of Industry 4.0 technologies in Tiers 1 and 2.

Advanced product quality plan phases

The APQP is a reference manual released by Ford, Chrysler and General Motors in July of 1994. The propose of this manual is to communicate the guidelines of the product quality planning and control plan for internal and external suppliers. Although designed for use in the automotive industry, as required in the QS-9000 manual, APQP is virtually suitable for any product quality planning [29].

The manual splits APQP in 5 phases [29, 30]:

-

Phase 1, Plan and Define Program. The decisions to be considered during the first step of the product development must be focused on the consumers expectations and needs based on quality and manufacturing standards. The goal of the first phase of the APQP is to assure that the product program is meeting customer needs while providing competitive value. The goal of any product program is meeting customer needs while providing competitive value. The initial step of the product quality planning process is to ensure that customer needs and expectations are clearly understood. In this phase, resource planning, process and product assumptions are made. A list of preliminary special characteristics and design / reliability goals are also established. Tools which typically provide great benefit in this section are Marketing Research, Historical Warranty and Quality Information, Team Experience, Business Plan, Product Product/Process Benchmark Data and Assumptions, Reliability Studies, Customer Inputs, Design Goals, Bill of Material, Flow Chart, Product Assurance Plan and others.

-

Phase 2, Product Design and Development. This phase focus on developing the design of the product. The product must be feasible and meet user expectations also. Some of the outputs in this phase are Design Failure Mode and Effects Analysis, Design Verification, Prototype Build and Control Plan, Engineering and Material Specifications. To explain this phase more clearly, we have split it into three subphases based on the Product Development Process (PDP) [31].

-

Phase 2.0, Informational Project. The quality and manufacturing requirements are considering assuring the feasibility of the manufacturing process attending the customers, government and engineering requirements according to its volumes. These information supports the economic and technical feasibility decisions. The goal of the informational phase is to develop a set of data based on the information raised during the planning and other sources, to drive the criteria to the decisions in the following phases of the product development.

-

Phase 2.1, Conceptual Project. During the conceptual phase the activities of the team are related to the research, creation, representation and define the solutions to the problems of the projects. The research for the solutions already in place can be done through benchmark studies. The creation of the solutions is free from restriction, since the specifications of the projects are being considered. The representation of the solutions cane be done through sketches and manual drawings, in parallel with the creation. The selected solutions are made based on properly methods supported by the requirements defined previously.

-

Phase 2.2, Detailed Project. The goal of this phase is to develop and deliver all project specifications based in the prior work. The project is detailed into engineering drawings and specifications documents.

-

-

Phase 3, Process Design and Development. The manufacturing process development phase defines how the product will be manufactured and assembled based on the technological point of view, this is the time to formalize the process and the additional activities related to the plan and control of the production. The tasks to be accomplished at this phase of the product quality planning process depend upon the successful completion of the prior stages contained in the first two phase. This next step is designed to ensure the comprehensive development of an effective manufacturing system. The manufacturing system must assure that customer requirements, needs and expectations are met. This phase explores manufacturing techniques and measurement methods that will be used to bring the design engineer’s vision into reality. Process Flow Charts, Process Failure Mode and Effects Analysis and Control Plan Methodology, Product/Process Quality System Review, Process Flow Chart, Floor Plan Layout, are examples of tools used in this section.

-

Phase 4, Product and process validation. Used to validate the manufacturing process through the production trial run and all the activities related to it. The main goal is to verify if the long-term production process is capable of meeting all the engineering requirements and specifications. Some examples of tools used in this phase are: Statistical Process Control, Measurement Systems Analysis, Process Capability Studies, Product Validation Testing, Packing Evaluation. In this phase, Product Part Approval Process (PPAP) is ready for submission and production begins upon approval. To explain it clearly, we have split it into two subphases based on the Product Development Process (PDP) [31].

-

Phase 4.0, Process validation. In order to validate the product and the process, a trial run is established according the product volumes. During the production of this batch, the manufacturing process and the product are evaluated according the quality and engineering requirements.

-

Phase 4.1, Product Launch. The goal of this phase is to launch the product in the market with the same results of the previous phase to ensure the acceptance of the product by the potential consumers.

-

-

Phase 5, Feedback, assessment, and corrective action. The focus is to guarantee the production of the product in mass production and statistics studies are established based on the customer and engineering requirements. When issues are raised, due either special or common-cause variation, containment and corrective actions are required. The manufacturing and development teams works together to solve the issues on time in order to protect the customers.

Table 2 shows a summary of the relationship between APQP and PDP, as well as the desired outputs in each APQP phase. Considering the phases and tools described in APQP and PDP, there is an perspective to integrate it to the Industry 4.0 technologies. This will be discussed in the following sections.

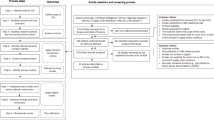

Method

A survey has been developed to show the perception of Industry 4.0 technologies current usage during the APQP phases and also the expert perspective in a scenario of 5 years up from now. The survey had questions regarding the usage level for nine technologies of Industry 4.0 framework [15] on the five phases of the APQP. The nine technologies of Industry 4.0 framework used in this study are listed bellow:

-

Adaptive Robotics

-

Cyber-Physical Systems

-

Additive Manufacturing

-

Cloud Technologies

-

VR and AR

-

AI and Data Analytics

-

Communication and Networking - IoT

-

RTLS and RFID

-

Cybersecurity

Sixteen manufacturing engineers in automotive industry, experts in manufacturing process, answered the survey between December of 2020 and January of 2021. 87.5% of this experts works in 2 automotive OEM from Brazilian Northeast and the same percentage reported that they have more than 10 years of experience in the automotive industry. All of them defined their knowledge in APQP between moderate to high. The knowledge in Industry 4.0 technologies were reported as moderate to high by 81.25% of the participants.

The survey presented five response categories for each question to be chosen by the specialist according to the current frequency of use of each Industry 4.0 technology from the perspective of manufacturing engineers in a new program. Moreover, the answers were applied into the results based in 3 categories, as shown in Fig. 1.

Results and discussion

We compiled the answers in graphs to evaluate the empirical results of this survey. We recall that these all results represent the current perceptions and future scenario expectations of some Brazilian Northeast automotive OEM manufacturing specialists for the use of Industry 4.0 technologies on APQP.

In terms of IoT (Fig. 2), the data gathered shows that the specialists believe that it is more utilized during the phases 2.2, 4.1 and 5, what can be understood through the necessity of getting the support of the connectivity between computers and machines to the preparation of the production of the product almost in its final design. For the perspective of 05 years ahead, the IoT will be highly used from the perspective of more than 60% of the interviewed, supporting the validation of the product and process throughout the whole APQP phases.

Communication and Networking - IoT. The current technology perception of medium to high use is less expressive at APQP phase 1 and this perception is higher for the next phases, reaching 50% in phases 4 and 5. The forecast shows the amount of experts that believe in the rise of technology use for all phases

Cloud Technologies are more required on the conceptual phase of the product development (phase 2.1). It is the phase that engineers and designers create sketches to develop engineering solutions for user requirements. More than 60% answered that this technology will be important to all phases of APQP over the next 5 years, highlighting high probability of use in phases 1, 2 and 3 (Fig. 3). Based on the survey, IoT and Cloud are the technologies of Industry 4.0 that are most used today in the automotive OEM industry.

It is almost unanimous that adaptive robots will be highly used in the next years in the phases 3 and 4, where product and process validation is carried out. In addition, adaptive robots use is also expected in corrective production actions to solve issues in phase 5 (Fig. 4).

VR and AR technologies are currently less used in phase 1 (Plan and Define Program) than the next phases of APQP. However, we expect a rise in theirs use over the next 5 years during this program definition phase. We emphasize that phase 3 can take advantage of these technologies, based on the usage ratio rise over the next 5 years (Fig. 5).

Despite not being widely used today by the OEMs, both Cybersecurity and AI plus Data Analytics had a expectation of use in the next 5 years. Between 60 and 80 percent of experts said that these two technologies will be heavily used in all phases of APQP (Figs. 6 and 7). This may mean that the specialists understand the quantity of data and the complexity of the technology will increase and it will be useful in all the phases. By the way, we highlight the huge gap between the current and future situation for the use of these technologies presented in the survey. According to [32], traditional cybersecurity approaches may not work to protect Big Data. For this reason, the growth in the use of the two technologies together may be important to keep the Supply Chain widely connected with the OEM.

It is expected that OEMs will see an increase in the use of Cyber-physical infrastructure (Fig. 8). But Cyber-Physical Systems usage rise is not as sharp as that seen in AI and Cybersecurity answers. Cyber-physical systems are the merge between embedded software-intensive syshtems and global networks [33]. As cyber-physical systems evolve through the network of existing infrastructures with embedded information technology [33], this technology may be more perceived in the APQP with the adoption of others Industry 4.0 technologies.

The use of RTLS and RFID technology does not appear to be widespread in the OEM (Fig. 9. But when supply chain visibility becomes a reality, RFID is likely to be adopted across the supply chain [34]. One of the RFID value is rendering the supply chain visible and as a strategic capability within supply networks [35].

Despite being considered little used today, additive manufacturing was considered important for the scenario of 5 years ahead, mainly for phases 3 and 4 when the engineering team design the process and validate the product and process, through PPAP (Fig. 10).

Figure 11 summarizes the results found for the current and future use of Industry 4.0 technologies by the Brazilian Northeast automotive OEM. First, Cybersecurity and AI with Data Analytics are the technologies with the potential of high adoption for the future scenario when compared to theirs current usage because they are located in the ‘A’ quadrant. Second, Cloud Technologies, IoT and Adaptive Robotics (quadrant ‘B’) are the most used technologies today and should present a rise in their use during the APQP in the 5 years. Despite being moderately used in practically all phases of APQP (Fig. 5), we do not foresee a rise in the use of VR and AR (quadrant ‘D’) as significant as the technologies found in quadrants ‘A’ and ‘B’. Lastly, Additive Manufacturing, Cyber-Physical Systems and RTLS plus RFID (quadrant ‘C’) were considered by specialists as the technologies less used today and that should not present a sharp rise of usage when compared with the technologies of the quadrant ‘A’. We highlight a sharp rise in the future adoption of additive manufacturing for the phases 3 and 4 of the APQP (Fig. 10) and for this reason it is closer to the quadrant ‘A’ limit when compared to the other technologies of quadrant ‘C’.

Scatter plot of the average current use versus average 5 years usage forecast of each Industry 4.0 Technology The limits of the quadrants (A, B, C and D) were defined based on the arithmetic mean of the responses related to the medium for high use of all technologies for all phases. They were used to group the technologies of Industry 4.0 in terms of the perception of their current use and the perspective of future adoption in the automotive OEM. The average values found were approximately 30% for the current use and 60% for the 5 years forecast

An association between the technologies that may mitigate the COVID-19 challenges presented in Table 1 and the technologies that should be most used for the next 5 years by Brazilian Northeast automotive OEM (Fig. 11, quadrants ‘A’ and ‘B’) may indicate the rise of resilience that the Brazilian Northeast supply chain would benefit from implementing the same technologies as the OEM. Lack of supply chain flexibility, lack of balance in supply and demand plus new consumer behaviors may be mitigated by the usage of AI and Data Analytics. Cloud technologies, IoT and Adaptive Robotics may be more present in solutions for communication issues, lack of security and poor infrastructure. Lastly, Cybersecurity may reduce the lack of access issue, considering the need for remote access to core systems.

Conclusion

In this paper we presented a new method to evaluate the current situation and the future outlook for the usage of Industry 4.0 technologies by the automotive OEMs, identifying the issues that may be mitigated by the implementation of these technologies in the supply chain.

The developed survey was applied to evaluate the Brazilian Northeast automotive OEMs scenario from the perspective of manufacturing engineering experts on APQP. Firstly, we identified the technologies most used today, among them IoT, Cloud, Adaptive Robotics, VR and AR. Second, our results demonstrate the perspective of a significant spike in the use of Cybersecurity and AI plus Data Analytics throughout the APQP. Lastly, we relate how these five technologies may mitigate some of the challenges that emerged with the COVID-19 pandemic.

This study may provide insights for Tiers 1 and 2 to plan actions with the aim of implementing the main Industry 4.0 technologies to improve the SCR. The presented discussion is limited to the COVID-19 outbreak, which restricts the conclusion for other outbreak or supply chain disruptions conditions. Although the method can be applied to assess the scenario of the automotive industry in any region or country, the results presented in this paper are also limited to the Brazilian Northeast automotive industry and they can not be considered a snapshot of the national scenario.

Future studies may evaluate the challenges and the adoption of Industry 4.0 technologies in other locations, to understand which technologies may rise the SCR worldwide. It should also be used to evaluate the perspectives of the design and release engineering experts or compare different OEMs results.

Availability of data and materials

The datasets used and analysed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- AI:

-

Artificial Intelligence

- ANFAVEA:

-

Brazilian Association of Automotive Vehicle Manufacturers

- APQP:

-

Advanced Product Quality Planning and Control Plan

- AR:

-

Augmented Reality

- OEM:

-

Original Equipment Manufacturer

- PDP:

-

Product Development Process

- RFID:

-

Radio Frequency Identification

- RTLS:

-

Real-time Locating Systems

- VR:

-

Virtual Reality

References

Cao X. Covid-19: immunopathology and its implications for therapy. Nat Rev Immunol. 2020; 20(5):269–270.

World Health Organization and others, et al.General’s opening remarks at the media briefing on COVID-19. Gen. Open. remarks media Brief. COVID-19. 2020.

Philip SV. U.K. Car Industry Joins European Jobs Wipeout to Battle Slump. 2020. https://www.bloomberg.com/news/articles/2020-06-04/aston-martin-to-cut-500-jobs-with-virus-stifling-demand-for-cars. Accessed 30 Jan 2021.

The bullish wave of plant construction hits a wall. Major factory projects delayed as States try to limit COVID-19 spread. 2020. https://www.autonews.com/manufacturing/bullish-wave-plant-construction-hits-wall. Accessed 7 Feb 2021.

ANFAVEA. Protocolo de Medidas Essenciais de Prevenção e Segurança Para Os Colaboradores da Industria Automobilística: Covid-19. 2020. https://anfavea.com.br/docs/acoes/ANFAVEA.PDF. Accessed 30 Jan 2021.

Gopal P, Thakkar J. Sustainable supply chain practices: an empirical investigation on indian automobile industry. Prod Plan Control. 2016; 27(1):49–64.

Puga FP, Castro LBd. Visão 2035: Brasil, país desenvolvido: agendas setoriais para alcance da meta. Rio de Janeiro: Banco Nacional de Desenvolvimento Econômico e Social; 2018.

Brazilian Automotive Industry Yearbook 2021. Brazil: ANFAVEA; 2021. https://anfavea.com.br/anuario2021/anuario.pdf. Accessed 5 Mar 2021.

Statista. Number of cars sold worldwide between 2010 and 2021 (in million units). 2021. https://www.statista.com/statistics/200002/international-car-sales-since-1990/. Accessed 5 Mar 2021.

Hendry L, Stevenson M, MacBryde J, Ball P, Sayed M, Liu L. Local food supply chain resilience to constitutional change: the brexit effect. Int J Oper Prod Manag. 2019; 39(3):429–453.

Ivanov D, Dolgui A, Sokolov B, Ivanova M. Literature review on disruption recovery in the supply chain. Int J Prod Res. 2017; 55(20):6158–6174.

Mubarik M, Naghavi N, Mubarik M, Kusi-Sarpong S, Khan S, Zaman I, Kazmi S. Resilience and cleaner production in industry 4.0: Role of supply chain mapping and visibility. J Clean Prod. 2021; 292:126058.

Ivanov D, Dolgui A. Viability of intertwined supply networks: extending the supply chain resilience angles towards survivability. a position paper motivated by covid-19 outbreak. Int J Prod Res. 2020; 58(10):2904–2915.

Rajput S, Singh S. Industry 4.0- challenges to implement circular economy. Benchmark An Int J. 2019; 28(5):1717–1739.

Salkin C, Oner M, Ustundag A, Cevikcan E. A conceptual framework for industry 4.0. In: Industry 4.0: Managing the Digital Transformation. Cham, Switzerland: Springer: 2018. p. 3–23.

Wang L, Wang G. Big data in cyber-physical systems, digital manufacturing and industry 4.0. Int J Eng Manuf (IJEM). 2016; 6(4):1–8.

Wang L, Törngren M, Onori M. Current status and advancement of cyber-physical systems in manufacturing. J Manuf Syst. 2015; 37:517–527.

Kagermann H, Helbig J, Hellinger A, Wahlster W. Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0: Securing the Future of German Manufacturing Industry; Final Report of the Industrie 4.0 Working Group. German: Forschungsunion; 2013.

Brettel M, Friederichsen N, Keller M, Rosenberg M. How virtualization, decentralization and network building change the manufacturing landscape: an industry 4.0 perspective. Intl J Inform Commun Eng. 2014; 8(1):37–44.

Choi T, Rogers D, Vakil B. Coronavirus is a wake-up call for supply chain management. Harv Bus Rev. 2020; 27:364–398.

Nakamura H, Managi S. Airport risk of importation and exportation of the covid-19 pandemic. Transp Policy. 2020; 96:40–47.

Kumar M, Raut R, Narwane V, Narkhede B. Applications of industry 4.0 to overcome the covid-19 operational challenges. Diabetes Metab Syndr Clin Res Rev. 2020; 14(5):1283–1289.

Ivanov D, Dolgui A. A digital supply chain twin for managing the disruption risks and resilience in the era of industry 4.0. Prod Plan Control. 2021; 32(9):775–778.

COVID-19: What It Means for Industrial Manufacturing. 2020. https://www.pwc.com/us/en/library/covid-19/coronavirus-impacts-industrial-manufacturing.html. Accessed 30 Jan 2021.

Belhadi A, Kamble S, Jabbour C, Gunasekaran A, Ndubisi N, Venkatesh M. Manufacturing and service supply chain resilience to the covid-19 outbreak: Lessons learned from the automobile and airline industries. Technol Forecast Soc Chang. 2021; 163:120447.

Narayanamurthy G, Tortorella G. Impact of covid-19 outbreak on employee performance–moderating role of industry 4.0 base technologies. Int J Prod Econ. 2021; 234:108075.

Burns K, Marx T. Crisis management planning among tier 2 automobile suppliers: Why suppliers fail to plan. J Conting Crisis Manag. 2014; 22(2):108–112.

Teresko J. The new race. Ind Week/IW. 1998; 247(18):40–44.

Thisse L. Advanced quality planning: A guide for any organization. Qual Prog. 1998; 31(2):73–77.

Stamatis DH. Advanced product quality planning: the road to success. Florida: CRC Press; 2018.

Rozenfeld H, Fernando A, Amaral DC, Toledo JC, da Silva SL, Alliprandini DH, Scalice RK. Gestão de projetos em desenvolvimento de produtos. Uma referência para a melhoria do processo. São Paulo: Saraiva; 2006.

Rawat DB, Doku R, Garuba M. Cybersecurity in big data era: From securing big data to data-driven security. IEEE Trans Serv Comput. 2019. https://doi.org/10.1109/TSC.2019.2907247.

Hellinger A, Seeger H. Cyber-physical systems. driving force for innovation in mobility, health, energy and production. Berlin: Springer-Verlag Berlin Heidelberg; 2011.

Tajima M. Strategic value of rfid in supply chain management. J Purch Supply Manag. 2007; 13(4):261–273.

Pfahl L, Moxham C. Achieving sustained competitive advantage by integrating ecr, rfid and visibility in retail supply chains: a conceptual framework. Prod Plan Control. 2014; 25(7):548–571. https://doi.org/10.1080/09537287.2012.729100.

Acknowledgements

Not applicable.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Authors’ contributions

All authors have contributed equally. All authors read and approved the final manuscript.

Authors’ information

Not applicable.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visithttp://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Soares, M.C., Ferreira, C.V. & Murari, T.B. Supply chain resilience and industry 4.0: a evaluation of the Brazilian northeast automotive OEM scenario post COVID-19. AI Perspect 3, 3 (2021). https://doi.org/10.1186/s42467-021-00010-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s42467-021-00010-1