Abstract

The risk profiles of investors play an important role in the success of derivative products investments. It is also necessary to determine the appropriate investor profile according to the conditions of a country. This protects investors from major losses. Therefore, there is a strong need for a new study that analyzes the risk profiles of derivative products in emerging economies. This study aims to identify the most appropriate investor risk profile for derivative instruments in emerging economies. It constructs a novel decision-making model. In this model, the facial action coding system, quantum theory, spherical fuzzy sets, and multi-stepwise weight assessment ratio analysis (M-SWARA) methodology are integrated to minimize uncertainty in this process. First, three main participants of derivatives for financial technology investors are evaluated using the quantum spherical fuzzy M-SWARA technique. After that, seven emerging economies are ranked based on this performance using quantum spherical fuzzy technique for order of preference by similarity to ideal solution. The main contribution is that an appropriate investor profile is identified for financial derivative investments in emerging economies. One of the important originalities of this study is the development of a new technique called M-SWARA by making some improvements to the classical stepwise weight assessment ratio analysis method. It is concluded that hedging is the most appropriate purpose for making investments in derivative products in emerging economies. It is also identified that China has the greatest performance among the seven emerging economies regarding the appropriate purpose for making derivative investments. For the effective management of this problem in these countries, it is recommended to prevent the speculative use of derivative products with legal regulations.

Similar content being viewed by others

Introduction

Financial derivatives can be used for hedging, speculation, and arbitrage purposes. In derivatives markets, the risk profiles of investors play an important role in the success of the market (Ospina-Forero and Granados 2023). Therefore, it is important for investors who want to trade in derivatives markets to have an accurate knowledge of their risk tolerances and risk management strategies. Derivatives are instruments used to manage risks arising from price changes (Gluhov et al. 2021). However, the use of derivatives should be consistent with the risk profiles of investors. Using derivative products for speculative purposes may be suitable for investors who prefer to take high risks (Ghazani and Jafari 2021). However, it may not be suitable for investors who prefer low risks. Investors’ risk tolerance determines how much risk they can take when trading in derivatives markets. Therefore, investors must determine their risk tolerance and develop risk management strategies accordingly (Abraham 2022). Before investing in a high-risk derivative product, investors should have a good understanding of the markets and risks and make decisions while considering their risk tolerance level.

To be successful in derivatives markets, it is also necessary to determine the appropriate investor profile according to the conditions of a country (Baker 2022). As these suitable investor profiles may differ according to country types, studies are needed for different country groups. The investor profile in derivative products may differ between developed and emerging economies (Depren et al. 2021). For investors to make effective and informed investment decisions in derivatives markets, they must understand these differences and develop strategies that are suitable for their situations. For example, economic conditions in developed countries are quite stable. Thus, in these countries, economic fragility is less, so derivative investments are unlikely to cause huge losses (Emm et al. 2022). On the other hand, volatility is very high in emerging economies. Therefore, it would be appropriate not to take excessive risks when investing in derivative products; otherwise, investors might face very high financial losses.

Hence, it is important to determine the most appropriate risk profile for derivative products, especially in emerging economies (Lin et al. 2022). This would help protect investors from major losses. Therefore, there is a strong need for a new study that analyzes the risk profiles of derivative products in emerging economies (Jin et al. 2022). The purpose of this article is to identify the most appropriate investor risk profile for derivative instruments in emerging economies. For this purpose, a novel decision-making model is constructed. In this model, the facial action coding system, quantum theory, spherical fuzzy sets, and multi-stepwise weight assessment ratio analysis (M-SWARA) methodology are integrated to minimize uncertainty in this process. First, three main participants of derivatives for financial technology (fintech) investors are evaluated with the quantum spherical fuzzy M-SWARA technique. Then, seven emerging (E7) economies are ranked based on this performance using the quantum spherical fuzzy technique for order of preference by similarity to ideal solution (TOPSIS).

The main research question of this study is “Which investor profile is more appropriate for derivative product investments in emerging economies?” The main contributions of this study to the literature are as follows:

-

(i)

An appropriate investor profile is identified for financial derivative investments in emerging economies. Derivatives can be considered for different purposes such as risk management and speculation. However, to be successful in these markets, the conditions in the target countries should be considered. The research results will guide investors who intend to invest in E7 economies.

-

(ii)

Experts may hesitate between several options while answering some questions. The hesitation experienced in this process can be taken into account by considering the facial expressions of the experts. This increases the consistency of the results obtained.

-

(iii)

One of the important originalities of this study is the development of a new technique called M-SWARA by making some improvements to the classical SWARA) method (Dinçer et al. 2022; Wu et al. 2022). Although the classical SWARA approach has some advantages, the causality relationship between the variables cannot be considered in this technique (Xu et al. 2023; Li et al. 2022). Different investor risk profiles in derivatives markets can have an impact on each other. In this framework, the causality relationship should be considered in the analysis to determine the most accurate risk profile (Sun et al. 2022; Yüksel and Dinçer 2023). These points reveal that the M-SWARA method is more suitable than other techniques for analyzing this issue (Kafka et al. 2022; Martínez et al. 2023).

The following section presents a “Literature review”. The “Methodology” is explained in the third section. The “Analysis results” are presented in the fourth section. The “Discussion” and “Conclusion” are given in the final sections.

Literature review

Speculative risk profile is the name given to the risk profile of investors who prefer to take high risks and follow aggressive investment strategies. Speculative investors take risks to earn high returns and often employ short-term investment strategies (Aslan et al. 2023). There are some advantages for speculative investors in financial markets. Adekoya et al. (2022) found that speculative investors can often find opportunities in financial markets as they prefer to take high risks. Due to these opportunities, they can earn high returns. Moreover, Hirota et al. (2022) claimed that speculative investors can be flexible about the asset class they will invest in. Thus, they can diversify their portfolios by investing in different asset classes. Furthermore, Guo et al. (2022a, b) stated that speculative investors can generate high returns in a short time by taking advantage of fluctuations in financial markets. On the other hand, speculative investors also experience some risks in these markets. Niu et al. (2022) concluded that speculative investors can experience equally high losses because they prefer to take high risks. Therefore, it is important to implement risk management strategies correctly. According to Long and Guo (2022), because speculative investors are flexible about the asset class they invest in, their losses would increase if they do not have enough variety in their portfolios. Moreover, Schmitt et al. (2022) highlighted that speculative investors invest with high return expectations and may experience disappointment when these expectations are not met.

Hedger risk profile is the name given to the risk profile of investors who use derivative products to hedge against possible risks and focus their investment strategies on hedging. Hedging is a risk management strategy, and it aims to prevent or limit possible losses (Mensi et al. 2023). Hedgers have a number of advantages in financial markets. Karim et al. (2022) stated that hedgers can limit their risks by using derivatives. They can minimize their losses by providing protection in an environment of uncertainty. Additionally, Corbet et al. (2022) demonstrated that hedgers can follow a specific investment strategy through derivatives products. Thus, they can limit their investment strategy to certain risks. Wang et al. (2022) demonstrated that, due to derivative products, hedgers can diversify their portfolios in order not to miss other investment opportunities while following a certain investment strategy. However, Nkrumah-Boadu et al. (2022) highlighted that hedgers may also experience some risks. According to Almeida and Gonçalves (2022), hedgers can make losses due to fluctuations in the prices of derivatives. Furthermore, Naeem et al. (2023) claimed that hedgers may miss out on profit opportunities due to price fluctuations of derivatives. Therefore, it is important to choose the right derivatives and use them at the right time.

Arbitrage is a strategy of making risk-free profits by taking advantage of price differences in financial markets. Arbitrageur risk profile is the name given to the risk profile of investors who monitor different markets and financial instruments to profit from price differences and perform arbitrage transactions by detecting these differences (Avdjiev et al. 2022). According to Draganidis (2023), the most important advantage arbitrageur investors have in financial markets is that they make risk-free profits by taking advantage of price differences in financial markets. Stádník (2022) claimed that these investors can balance the markets by using price differences in financial markets. However, arbitrageurs can make losses as a result of wrong determinations as price differences need to be determined correctly. Furthermore, Lin and Tan (2023) found that arbitrageurs may run the risk of not being able to close their positions due to market fluctuations. Additionally, arbitrageurs may face liquidity risk. Zhan et al. (2022) identified that arbitrage positions may not be liquidated when price differences in the markets are not closed on time. In addition, Bäuerle and Göll (2023) stated that arbitrage transactions require high technology and the ability to perform fast transactions. Therefore, arbitrageurs may not be very successful in markets with little technological infrastructure (Carta et al. 2022).

According to many researchers, behavioral finance rules play a very important role when investing in derivatives. In traditional finance, it is assumed that investors are rational (Mundi and Vashisht 2023). Thus, at least, investors consider emotional and psychological aspects when making investment decisions (Alhenawi et al. 2022). However, Xiao and Wu (2022) stated that, in behavioral finance theory, these considerations play a very important role in investment decisions. Derivatives are considerably affected by uncertainty in the market. Gavrilakis and Floros (2022) identified that investors may be affected by emotions, such as fear and panic, while investing in these products. On the other hand, Kumar and Kozhikode (2022) concluded that behavioral finance is concerned with how investors respond to market trends. This plays a very important role in determining the prices of derivative products accurately. As some derivative products have a very complex structure, it is not easy to understand (Tayeh and Kallinterakis 2022). Investors who act with behavioral finance rules in this process may make great losses (Baker et al. 2023). For example, if an investor who does not clearly understand the details of the derivative product buys this product only with the guidance of a person whom he trusts, there is a risk of very high losses due to this investment (Boussaidi et al. 2022).

Financial derivatives markets are an important tool for emerging economies. The main reason for this is that these markets can help countries manage their financial risks and support the development of financial markets. Emerging economies face many financial risks that investors must manage. Exchange rate risk, interest rate risk, and fluctuations in commodity prices are examples of this process (Guo et al. 2022a, b). Derivatives are designed to manage these risks and provide investors with the opportunity to reduce or manage their risks (Feregrino et al. 2022). The development of financial derivatives markets in emerging economies can help investors manage their financial risks, which may increase their inclination to invest in these countries (Eichengreen et al. 2023). In addition, these markets can support the development of financial systems of emerging economies and the formation of a better risk management culture (Reus and Sepúlveda-Hurtado 2023). Another importance of financial derivatives markets for emerging economies is that they help companies meet their financing needs (Geyikçi and Özyıldırım, 2023). Derivatives traded in these markets can provide companies with lower-cost sources of financing and help them better manage their cash flows (Martínez 2022).

While making this comprehensive literature review, the following results and key points are identified. Derivative markets play a crucial role in the improvement of financial markets. To succeed in derivative markets, the investor risk profile should be considered. Most of the studies highlighted that to be successful in derivatives markets, it is necessary to determine the appropriate investor profile according to the conditions of the countries. However, some scholars have identified that as a suitable investor profile may differ according to country types, studies are needed for different country groups. The existing studies mainly focused on the importance of these conditions. However, there are limited studies on identifying the most essential investor profile for derivative markets in emerging economies. To fill this gap in the literature, this study aims to evaluate derivatives of financial instruments as a method of optimizing sanctioned portfolios for fintech indices and gold. To be successful in financial derivatives markets in E7, the most appropriate investor risk profiles have to be determined.

Hybrid neuro-fuzzy decision-making model

In this study, a novel model is presented (the details are presented below, but all equations are in Table 4 in the Appendix). The Facial Action Coding System (FACS) considers the emotions of the people in the analysis process. In this study, it is applied to the fuzzy decision-making methodology. Using this approach, the facial expressions of decision-makers while answering the questions are considered. This helps to consider hesitancy more effectively to increase the appropriateness of the findings (Friesen and Ekman 1983).

Quantum mechanics consider different probabilities in the evaluation process. This helps to conduct a more effective analysis. Equations (1) and (2) give more information about this process. Spherical fuzzy sets (\({\widetilde{A}}_{S}\)) are a generalization of classical fuzzy sets. These sets consider different degrees, as in Eqs. (3) and (4). The quantum theory is integrated with spherical fuzzy sets, as in Eqs. (5)–(7). The golden ratio is used to compute the degrees in this process (Eqs. (8)–(12)). Equations (13)–(16) explain the operational process.

In this model, some enhancements are made to the SWARA method. As a result, the M-SWARA methodology is created (Dinçer et al. 2022; Wu et al. 2022).

-

Step 1: Evaluations are made.

-

Step 2: Relation matrix is created in Eq. (17).

-

Aggregated values are defined in Eq. (18).

-

Step 3: The defuzzified values are identified in Eq. (19).

-

Step 4: \({s}_{j}\), \({k}_{j}\), \({q}_{j}\), and \({w}_{j}\) are computed using Eqs. (20)–(22).

-

Step 5: The relation matrix is transformed and limited to the matrix to the power of 2t + 1.

-

Step 6: Causal directions are identified.

The TOPSIS method is also used in this study to rank alternatives (Yoon 1980; Hwang and Yoon 1981). The details are as follows:

-

Step 1: Evaluations are taken.

-

Step 2: Relation matrix is constructed using Eq. (23).

-

Step 3: The defuzzified values are defined in Eq. (19).

-

Step 4: Normalized values are calculated with Eq. (24).

-

Step 5: Weighted values are identified using Eq. (25).

-

Step 6: Positive \({A}^{+}\) and negative \({A}^{-}\) ideal solutions are defined with Eqs. (26) and (27).

-

Step 7: Distances to the best \({D}_{i}^{+}\) and worst \({D}_{i}^{-}\) alternatives are determined using Eqs. (28) and (29).

Relative closeness to the ideal solutions is computed with Eq. (30).

Analysis results

In this study, a hybrid fuzzy decision-making approach based on facial recognition and quantum spherical fuzzy sets with a golden cut is considered to evaluate the participants in derivatives for fintech investors in emerging economies. The details of the results are presented in the following subsections.

Impact-relation directions of the participants are measured for fintech investors

-

Step 1: A dataset is collected by observing the experts’ facial expressions. This first step entails the collection of a dataset through observation of the facial expressions of experts. This dataset includes a set of emotions, action units with their corresponding pairs, linguistic scales, and possibility degrees. This information is gathered by utilizing QSFNs, as presented in Table 5. The assessment of the emotional expressions of the decision-makers is carried out through the application of the FACS. After the procedure, three primary emotions were selected, namely contempt, surprise, and happiness, with each characterized by distinct action units. These action units serve as a means of quantifying the evaluations made by the decision-makers. An expert in the field of FACS observed the facial expressions of the decision-makers while they were reviewing the pairwise comparison and decision matrices and documented their emotional responses to the criteria and alternatives. The selected action units include 7, 10, 14, and 15 for contempt as the lowest scale; 1, 2, 5, and 27 for surprise as the medium scale; and 6, 12, 25, and 26 for happiness as the highest scale. It is expected that the reporter will observe the two most prominent action units from the facial expressions of the decision-makers for each pairwise comparison of criteria and alternatives. If the observed action units correspond to different emotions, the evaluation is assigned an intermediate emotion on the five-point scale. However, if the observed action units are associated with both contempt and happiness, it is assumed that the evaluation of the decision-makers is neutral and assigned a medium scale referred to as surprise.

The three main participants of derivatives for fintech investors are defined as hedgers, speculators, and arbitrageurs to measure the weights and impact-relation degrees among them. The observations are obtained from three decision-makers who are experts in the field of fintech and capital markets. In most similar studies, three decision-makers are selected for the evaluations (Ouyang 2022; Liu et al. 2022; Rastpour et al. 2022). The observation results of facial expressions are given by the pairs of action units for each decision-maker in Table 6.

-

Step 2: The action units are transformed into fuzzy sets to determine the evaluation criteria. The completion of expert evaluations—incorporating preference numbers—is followed by their transformation into fuzzy sets. The overall evaluation of the decision-makers is presented in Table 7. To obtain the overall quantum spherical fuzzy set results, the aggregated values of the fuzzy sets are utilized and calculated with Eq. (19). This process facilitated the integration of multiple sources of information (expert evaluations and preference numbers) to arrive at a comprehensive and quantifiable representation of the overall evaluations of the decision-makers.

-

Step 3: The defuzzification process is employed to determine the relation degrees with Eq. (19). Table 8 defines the defuzzified values of the relation matrix.

-

Step 4: The values of sj, kj, qj, and wj are calculated for the relationship degrees using Eqs. (20)–(22). The values are explained in Table 9. The sj values are considered by using the normalized values of the score function.

-

Step 5: The relation matrix is created, and the inter-criteria relationships are determined. The directions are detailed in Table 1.

Table 1 Relation matrix with impact directions

In determining the inter-criteria relationships, the average of the relation matrix serves as a threshold. A value greater than this threshold indicates that the criterion in the corresponding row has a significant effect on the criterion in the column. The threshold is 0.50, and the directions of impact are established accordingly. Table 1 indicates that speculators and hedgers have mutual impacts on each other. Further, hedgers are the most influential among the main participants of derivatives for fintech investors.

-

Step 6: The stabilization process is applied by limiting the matrix to the power of 2t + 1, where t is an arbitrarily large number. The results are presented in Table 2.

Table 2 Stabilized matrix

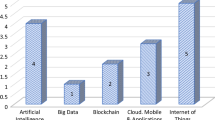

According to the stabilization results, hedgers have the highest weighting degree (37.5%), whereas arbitrageurs are the weakest (28.6%).

Impact-relation directions of the participants are measured for fintech investors

-

Step 1: A dataset is collected for the decision matrix by observing the experts’ facial expressions. In this study, E7 economies—Indonesia, Turkey, Russia, Brazil, India, Mexico, and China—are defined as a set of alternatives to analyze the performance of fintech investors in terms of the main participants of derivatives. Similarly, pairs of action units are collected from the decision-makers after evaluating the E7 with respect to the three main participants in the derivatives market for fintech investors. The action units for the decision matrix are presented in Table 10.

-

Step 2: The action units are transformed into fuzzy sets to evaluate alternatives. Similar to the transformation process of the criteria, the aggregated values of the fuzzy decision set are used (calculated with Eq. (18)). The aggregated values of QFNSs for decision degrees are presented in Table 11.

-

Step 3: The defuzzification process is applied for decision degrees with Eq. (19). Table 12 presents information about the defuzzified values of the decision matrix.

-

Step 4: The decision matrix is normalized with Eq. (24). The normalized scores of the decision degrees are presented in Table 13.

-

Step 5: The weighted decision matrix is constructed using Eq. (25). Table 14 illustrates the weighted values of the decision matrix.

-

Step 6: Economies are listed by the value of CCi. The ranking results of the E7 economies are presented in Table 3.

Table 3 Performance results of the E7 economies

In Table 3, the ranking lists are presented in descending order as China, Russia, India, Indonesia, Turkey, Mexico, and Brazil. The overall performance results of the E7 economies prove that China has the best ranking results, whereas Brazil has the weakest performance in the alternative country list.

Discussion

Many studies have highlighted the significance of hedging purposes while investing in financial derivatives. Wang and Zhou (2022) evaluated the importance of derivative instruments. They concluded that commodity hedging with derivatives reduces stock price volatility. Miloş and Miloş (2022) studied this situation in the banking industry. They highlighted that derivatives should be considered mainly for hedging purposes. Hao et al. (2022) also identified that foreign exchange derivatives should be used for risk minimization. Similarly, Shen et al. (2022) and Azam et al. (2022) highlighted the importance of this while making investments in financial derivatives. Meo et al. (2022) evaluated Islamic financial products, and Ranasinghe et al. (2022) focused on the US oil and gas industry. They found that derivatives should be considered to minimize the risks in these industries.

This result is especially valid for emerging economies. Emerging economies may face more risks in financial markets. They may be exposed to factors such as currency and commodity price fluctuations, changes in interest rates, and other financial risks. Therefore, there are many reasons for companies in such countries to manage these risks by using derivatives for hedging purposes. Bachiller et al. (2021) stated that the importance of using derivatives for hedging purposes for companies in emerging economies is that it helps them reduce financial risks and protect cash flows. Bartram (2019) also highlighted that this can help companies maintain financial stability and reduce the uncertainty created by financial risks. In addition, risk management using derivatives can attract more interest from investors in companies in emerging economies. However, using derivatives for hedging purposes may carry some risks (Das and Kumar 2023). Derivatives can cause financial losses when misused. Therefore, Hao et al. (2022) stated that it is important for companies in emerging economies to carefully manage risks and implement the right strategies when using derivatives.

Conclusions

The findings indicate that hedging is the most appropriate purpose for making investments in derivative products in emerging economies. However, speculation and arbitrage have lower significance in this framework. Among the E7 economies, China has the greatest performance with respect to the appropriate purpose for making derivative investments, whereas Turkey, Mexico, and Brazil have lower performance. These results reveal that derivative investments should be made primarily for risk management purposes, especially in emerging economies. The right strategy is to choose these products to manage interest rates and foreign exchange risk. On the other hand, using these products to make profits for speculative purposes is not the right investment, especially in emerging economies. Because the economies of these countries are fragile, volatility in the markets can be very high. This causes prices to change very quickly. Therefore, in such complex and risky economies, investing in derivatives to make speculative profits can cause companies to incur very high losses. The results obtained in this study reveal that Turkey, Mexico, and Brazil are not very successful in this process. To effectively manage this problem in these countries, it is recommended to prevent the speculative use of derivative products through legal regulations.

The main contribution of this study is that an appropriate investor profile should be identified for financial derivative investments in emerging economies. The results will guide investors who intend to invest in the E7 economies. Additionally, this study makes some methodological contributions to the literature. The facial expressions of experts while answering questions were considered. This increased the consistency of the results obtained. Additionally, one of the important originalities of this study is the development of a new technique called M-SWARA by making some improvements to the classical SWARA method. The main limitation of this study is that only emerging economies are evaluated. Thus, in future studies, different country groups can be evaluated so that it can be possible to make a comparative examination. Moreover, there are some limitations in the proposed model. For instance, in the analysis process, a comparative analysis was not carried out to test the coherency of the findings. In future research, the VIKOR methodology can be employed to rank the alternatives.

Availability of data and materials

All data is given in the text properly.

Abbreviations

- ETF:

-

Exchange-traded funds

- FACS:

-

Facial action coding system

- IFS:

-

Intuitionistic fuzzy sets

- HDG:

-

Hedgers

- SPC:

-

Speculators

- ARB:

-

Arbitrageurs

References

Abraham RMK (2022) Our preoccupation with speculation and its consequences for commodity derivatives markets in India. Indian economy and neoliberal globalization. Routledge, India, pp 58–87

Adekoya OB, Oliyide JA, Tiwari AK (2022) Risk transmissions between sectoral Islamic and conventional stock markets during COVID-19 pandemic: What matters more between actual COVID-19 occurrence and speculative and sentiment factors? Borsa Istanbul Rev 22(2):363–376

Alhenawi Y, Hassan MK, Hasan R (2022) Evolution of research in finance over the last two decades–a topographical view. Res Int Bus Financ 59:101550

Almeida J, Gonçalves TC (2022) Portfolio diversification, hedge and safe-haven properties in cryptocurrency investments and financial economics: a systematic literature review. J Risk Financ Manag 16(1):3

Aslan I, Chohan UW, Van Kerckhoven S (2023) Speculative behavior and expectations in economic turmoil: a Keynesian view. Activist retail investors and the future of financial markets. Routledge, India, pp 69–82

Avdjiev S, Aysun U, Tseng MC (2022) Regulatory arbitrage behavior of internationally active banks and global financial market conditions. Econ Model 112:105857

Azam N, Mamun A, Tannous GF (2022) Credit derivatives and loan yields. Financ Rev 57(1):205–241

Bachiller P, Boubaker S, Mefteh-Wali S (2021) Financial derivatives and firm value: What have we learned? Financ Res Lett 39:101573

Baker C (2022) Derivatives and ESG. Am Bus Law J 59(4):725–772

Baker HK, Kumar S, Goyal K (2023) Publication trends in the journal of international financial management and accounting: a retrospective review. J Int Financ Manag Account. https://doi.org/10.1111/jifm.12176

Bartram SM (2019) Corporate hedging and speculation with derivatives. J Corp Finan 57:9–34

Bäuerle N, Göll T (2023) Nash equilibria for relative investors via no-arbitrage arguments. Math Methods Oper Res 97(1):1–23

Boussaidi A, Chkir I, Hussainey K, Sidhom-Hamed M (2022) Are financial derivatives related to intra-entities’ tax aggressiveness? UK evidence. Eur Financ Manag. https://doi.org/10.1111/eufm.12395

Carta S, Consoli S, Podda AS, Recupero DR, Stanciu MM (2022) Statistical arbitrage powered by explainable artificial intelligence. Expert Syst Appl 206:117763

Corbet S, Hou YG, Hu Y, Oxley L (2022) The influence of the COVID-19 pandemic on the hedging functionality of Chinese financial markets. Res Int Bus Financ 59:101510

Das JP, Kumar S (2023) The dynamic effect of corporate financial hedging on firm value: the case of Indian MNCs. Borsa Istanbul Rev 23(3):696–708

Depren Ö, Kartal MT, Kılıç Depren S (2021) Recent innovation in benchmark rates (BMR): evidence from influential factors on Turkish Lira Overnight Reference Interest Rate with machine learning algorithms. Financ Innov 7(1):1–20

Dinçer H, Yüksel S, Aksoy T, Hacıoğlu Ü (2022) Application of M-SWARA and TOPSIS methods in the evaluation of investment alternatives of microgeneration energy technologies. Sustainability 14(10):6271

Draganidis S (2023) Jurisdictional arbitrage: combatting an inevitable by-product of cryptoasset regulation. J Financ Regul Compliance 31(2):170–185

Eichengreen B, Hausmann R, Panizza U (2023) Yet it endures: the persistence of original sin. Open Econ Rev 34(1):1–42

Emm EE, Gay GD, Ma H, Ren H (2022) Effects of the Covid-19 pandemic on derivatives markets: evidence from global futures and options exchanges. J Futur Mark 42(5):823–851

Feregrino J, Espinosa-Cristia JF, Lay N, Leyton L (2022) Inappropriate corporate strategies: Latin American companies that increase their value by short-term liabilities. Int J Financ Stud 10(4):100

Friesen W, Ekman P (1983) EMFACS-7: emotional facial action coding system. Unpublished manual. University of California, California

Gavrilakis N, Floros C (2022) The impact of heuristic and herding biases on portfolio construction and performance: the case of Greece. Rev Behav Finance 14(3):436–462

Geyikçi UB, Özyıldırım S (2023) Deviations from covered interest parity in the emerging markets after the global financial crisis. J Int Finan Markets Inst Money 85:101765

Ghazani MM, Jafari MA (2021) Cryptocurrencies, gold, and WTI crude oil market efficiency: a dynamic analysis based on the adaptive market hypothesis. Financ Innov 7:29. https://doi.org/10.1186/s40854-021-00246-0

Gluhov V, Kartavenko O, Kamyshova A, Popova E, Kapustin N (2022) Structural shifts on derivatives markets at the time of increasing digitalization and post-pandemic transformation of the market. In: Internet of Things, Smart Spaces, and Next Generation Networks and Systems: 21st International Conference, NEW2AN 2021, and 14th Conference, ruSMART 2021, St. Petersburg, Russia, August 26–27, 2021, Proceedings (pp. 201–211). Cham: Springer International Publishing

Guo B, Wang Z, Fan S (2022a) Does the listing of options improve forecasting power? evidence from the Shanghai stock exchange. Emerg Mark Financ Trade 58(15):4300–4308

Guo J, Long S, Luo W (2022b) Nonlinear effects of climate policy uncertainty and financial speculation on the global prices of oil and gas. Int Rev Financ Anal 83:102286

Hao X, Sun Q, Xie F (2022) International evidence for the substitution effect of FX derivatives usage on bank capital buffer. Res Int Bus Financ 62:101687

Hirota S, Huber J, Stöckl T, Sunder S (2022) Speculation, money supply and price indeterminacy in financial markets: an experimental study. J Econ Behav Organ 200:1275–1296

Hwang CL, Yoon K (1981) Methods for multiple attribute decision making. multiple attribute decision making. Springer, Berlin, Heidelberg, pp 58–191

Jin L, Yuan X, Long J, Li X, Lian F (2022) Price discovery in the CSI 300 Index derivatives markets. J Futur Mark 42(7):1352–1368

Kafka KI, Dinçer H, Yüksel S (2022) Impact-relation map of innovative service development regarding the sustainable growth for emerging markets. J Knowl Econ. https://doi.org/10.1007/s13132-022-01080-0

Karim S, Naeem MA, Mirza N, Paule-Vianez J (2022) Quantifying the hedge and safe-haven properties of bond markets for cryptocurrency indices. J Risk Finance 23:191–205

Kumar S, Kozhikode IIM (2022) Risk rationalization of OTC derivatives in SOFR (secured overnight funding rate) transition: evidence from linear interest rate derivatives. Acad Account Financ Stud J 26(3):1–22

Li J, Yüksel S, Dınçer H, Mikhaylov A, Barykin SE (2022) Bipolar q-ROF hybrid decision making model with golden cut for analyzing the levelized cost of renewable energy alternatives. IEEE Access 10:42507–42517

Lin B, Tan Z (2023) Exploring arbitrage opportunities between China’s carbon markets based on statistical arbitrage pairs trading strategy. Environ Impact Assess Rev 99:107041

Lin CG, Yu MT, Chen CY, Hsu PH (2022) Market sentiments and artificial intelligence neural network algorithms in Taiwan derivatives markets. Advances in pacific basin business, economics and finance. Emerald Publishing Limited, London

Liu F, Liu T, Chen YR (2022) A consensus building model in group decision making with non-reciprocal fuzzy preference relations. Complex Intell Syst 8(4):3231–3245

Long S, Guo J (2022) Infectious disease equity market volatility, geopolitical risk, speculation, and commodity returns: comparative analysis of five epidemic outbreaks. Res Int Bus Financ 62:101689

Martínez HM (2022) Between the Washington, post-Washington, and Wall Street Consensus in the COVID era: the Mexican case. Stud Polit Econ 103(2):182–193

Martínez L, Dinçer H, Yüksel S (2023) A hybrid decision making approach for new service development process of renewable energy investment. Appl Soft Comput 133:109897

Mensi W, Aslan A, Vo XV, Kang SH (2023) Time-frequency spillovers and connectedness between precious metals, oil futures and financial markets: Hedge and safe haven implications. Int Rev Econ Financ 83:219–232

Meo MS, Durani F, Kouser R, Haris M, Iram T (2022) Modern derivatives in Islamic perspectives in Pakistan: Shari’ah issues on current Islamic derivative practices. J Public Aff 22(2):e2454

Miloș MC, Miloș LR (2022) Use of Derivatives and Market Valuation of the Banking Sector: Evidence from the European Union. J Risk Financ Manag 15(11):501

Mundi HS, Vashisht S (2023) Shed old baggage and invest wisely. A bibliometric and thematic analysis of disposition effect and investment. Qual Res Financ Mark

Naeem MA, Raza Rabbani M, Karim S, Billah SM (2023) Religion vs ethics: hedge and safe haven properties of Sukuk and green bonds for stock markets pre-and during COVID-19. Int J Islam Middle East Financ Manag 16(2):234–252

Niu Z, Demirer R, Suleman MT, Zhang H (2022) Speculation, cross-market sentiment and the predictability of gold market volatility. J Behav Finance. https://doi.org/10.1080/15427560.2022.2109639

Nkrumah-Boadu B, Owusu Junior P, Adam A, Asafo-Adjei E (2022) Safe haven, hedge and diversification for African stocks: cryptocurrencies versus gold in time-frequency perspective. Cogent Econ Finance 10(1):2114171

Ospina-Forero L, Granados OM (2023) A network analysis of the structure and dynamics of FX derivatives markets. Physica A 615:128549

Ouyang Z (2022) Construction and application of economic management fuzzy decision model based on fuzzy relevance method. J Math 2022:1–11

Ranasinghe T, Yi L, Zhou L (2022) Do auditors charge a client business risk premium? Evidence from audit fees and derivative hedging in the US oil and gas industry. Rev Account Stud 28:1–33

Rastpour E, Kayvanfar V, Rafiee M (2022) Multi-criteria decision-making methods for the evaluating of a real green supply chain in companies with fast-moving consumer goods. Int J Manag Sci Eng Manag 17(3):175–187

Reus L, Sepúlveda-Hurtado GA (2023) Foreign exchange trading and management with the stochastic dual dynamic programming method. Financ Innov 9(1):1–38

Schmitt N, Schwartz I, Westerhoff F (2022) Heterogeneous speculators and stock market dynamics: a simple agent-based computational model. Eur J Finance 28(13–15):1263–1282

Shen H, Cheng X, Ouyang C, Li Y, Chan KC (2022) Does share pledging affect firms’ use of derivatives? Evidence from China. Emerg Mark Rev 50:100841

Stádník B (2022) Convexity arbitrage–the idea which does not work. Cogent Econ Finance 10(1):2019361

Sun L, Peng J, Dinçer H, Yüksel S (2022) Coalition-oriented strategic selection of renewable energy system alternatives using q-ROF DEMATEL with golden cut. Energy 256:124606

Tayeh M, Kallinterakis V (2022) Feedback trading in currency markets: international evidence. J Behav Financ 23(1):1–22

Wang N, Zhou Q (2022) Does commodity hedging with derivatives reduce stock price volatility? Financ Res Lett 50:103321

Wang X, Lucey B, Huang S (2022) Can gold hedge against oil price movements: evidence from GARCH-EVT wavelet modeling. J Commod Mark 27:100226

Wu X, Dinçer H, Yüksel S (2022) Analysis of crowdfunding platforms for microgrid project investors via a q-rung orthopair fuzzy hybrid decision-making approach. Financ Innov 8(1):52

Xiao H, Wu Y (2022) Influence of Financial Derivatives on Innovation Behavior of Listed Companies. 2022 7th International conference on financial innovation and economic development (ICFIED 2022). Atlantis Press, Dordrecht, pp 383–388

Xu X, Yüksel S, Dinçer H (2023) An integrated decision-making approach with golden cut and bipolar q-ROFSs to renewable energy storage investments. Int J Fuzzy Syst 25(1):168–181

Yoon K (1980) Systems selection by multiple attribute decision making. Kansas State University, Kansas

Yüksel S, Dinçer H (2023) Sustainability analysis of digital transformation and circular industrialization with quantum spherical fuzzy modeling and golden cuts. Appl Soft Comput 138:110192

Zhan B, Zhang S, Du HS, Yang X (2022) Exploring statistical arbitrage opportunities using machine learning strategy. Comput Econ 60(3):861–882

Acknowledgements

Not applicable.

Funding

There is no funding information.

Author information

Authors and Affiliations

Contributions

The problem is proposed by AM and HD. The solving method is proposed by DR, AF, HD, SY, AM, and FE. The method is applied by AM, HD and SY. The writing of manuscript is done by DR, AF, HD, SY, AM, and FE. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

There was no conflict or competing interest for the authors in establishing this manuscript. This manuscript has not been published or presented elsewhere in part or in entirety and is not under consideration by another journal. We have read and understood your journal’s policies, and we believe that neither the manuscript nor the study violates any of these. There are no conflicts of interest to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 4, 5, 6, 7, 8, 9, 10, 11, 12, 13 and 14.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Rahadian, D., Firli, A., Dinçer, H. et al. A hybrid neuro fuzzy decision-making approach to the participants of derivatives market for fintech investors in emerging economies. Financ Innov 10, 37 (2024). https://doi.org/10.1186/s40854-023-00563-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-023-00563-6