Abstract

The purpose of this study is to determine the essential indicators to improve insurtech systems and select the most critical alternative to increase insurtech-based investments in European countries. A novel fuzzy decision-making model is generated by integrating entropy and additive ratio assessment (ARAS) techniques with spherical fuzzy sets. First, the indicators are weighted using spherical fuzzy entropy. Then, the alternatives are ranked using spherical fuzzy ARAS. The alternatives are also ranked with the spherical fuzzy technique for order of preference by similarity to the ideal solution methodology. The main contribution of this study is that it would help investors to take the right actions to increase the performance of insurtech investments without incurring high costs. Another important novelty is that a new fuzzy decision-making model is proposed to solve this problem. The results of the two models are quite similar, proving the validity and coherency of the findings. It is found that pricing is the most critical factor that affects the performance of insurtech investments. Insurtech companies are required to make accurate pricing by conducting risk analyses to increase their profits and minimize their risks. Additionally, according to the ranking results, big data are the most appropriate way to improve the performance of insurtech investments in Europe. Big data analytics helps companies learn more about the behavior of their customers. By analyzing data about their customers’ past transactions, companies can provide more convenient services to them. This would increase customer satisfaction and enable companies to achieve long-term customer loyalty.

Similar content being viewed by others

Introduction

Insurtech (coined from the combination of the words “insurance” and “technology”) is a concept that refers to the active and effective use of technology to improve operations and processes in the insurance industry. Insurtech encourages the use of innovative technologies instead of traditional methods in the insurance industry (Zarifis and Cheng 2022). It offers various opportunities for insurance companies to increase their customer experience. Examples of such technologies are mobile applications, artificial intelligence (AI), and big data. Using such technologies would help insurance companies to provide faster, cheaper, and more customer-oriented services. Thus, insurtech offers the opportunity to digitize and restructure the insurance industry (Che et al. 2022). This contributes significantly to the development of the sector.

Insurtech systems provide many advantages to the insurance industry. Insurtech systems help to increase customer satisfaction by providing faster and more affordable services to customers. Due to these new applications, customers can easily perform insurance transactions and access them everywhere and whenever they want (Bittini et al. 2022). Moreover, insurtech systems can respond faster to customers’ demands by increasing the speed of insurance transactions, leading to an increase in customer satisfaction and efficient performance of transactions. Furthermore, insurtech systems help reduce operating costs by automating insurance operations (Chang 2023). Insurtech systems also improve insurance companies’ risk management processes. These systems help to better understand risks and make a more accurate risk assessment.

Due to these advantages, some actions need to be taken to develop the insurtech system. Insurtech companies must be able to respond to customer demands more quickly and accurately. In this context, technologies such as online platforms and mobile applications should be used to better respond to customers’ demands (Kimberly et al. 2022). This ensures that customer requests are recorded more quickly and easily. Insurtech companies should implement effective marketing strategies to increase the awareness of their target audience and acquire customers (Kou et al. 2021). By using digital marketing strategies, insurtech companies can reach their target audiences more effectively, deliver the right messages to them (Sosa and Montes 2022), and attract their attention.

The success of insurtech companies also depends on their ability to apply the right pricing policies. The right underwriting strategies can help them to be successful in terms of both profitability and customer satisfaction. An accurate pricing model makes it possible to offer appropriate pricing to customers’ demands and to gain a competitive advantage (Njegomir and Demko-Rihter 2023). Insurtech companies must gain a competitive advantage in the industry by developing new products and services tailored to their customers’ needs (Kou et al. 2023). New product development is a vital factor in increasing the growth potential of insurtech companies (Tladinyane et al. 2022). New products give customers more choices and increase customer satisfaction, significantly increasing customer loyalty and the growth of the market share of insurtech companies.

The popularity of insurtech in European countries has increased, especially in recent years, and the importance of investments in this field is increasing. Insurtech investments contribute to the European economy and create new business opportunities. This contributes to the establishment of new companies and increases employment. European countries have been experiencing significant inflation problems recently, especially due to the volatility in the energy market. This situation may lead to a decrease in investments in Europe. These risks can be minimized by using insurtech applications.

For insurtech investments to develop, different issues need to be taken into consideration. However, all the steps taken to improve these factors lead to incurring new costs; thus, improvements in many different aspects of businesses cause financial difficulties (Agarwal et al. 2022). Therefore, due to budget constraints, businesses need to prioritize more important factors. In this way, investments can be improved without experiencing financial problems (Li et al. 2022a, b). For this reason, a priority analysis of these criteria is of great importance. Through this, more priority strategies will be offered to businesses, and this will contribute to increasing the performance of investments efficiently.

This study aims to identify the most essential indicators to improve insurtech systems and select the most critical alternative to increase insurtech-based investments in European countries. A novel fuzzy decision-making model is generated by integrating entropy and additive ratio assessment (ARAS) techniques with spherical fuzzy sets. In the first stage, the indicators are weighted using spherical fuzzy entropy. Then, the alternatives are ranked using spherical fuzzy ARAS. Further, the alternatives are also ranked with the spherical fuzzy technique for order of preference by similarity to the ideal solution (TOPSIS) methodology. This helps to measure the validity and coherency of the results of the proposed model.

The main contribution of this study is that due to the priority analysis of insurtech investments, investors can take the right actions without incurring high costs. For the long-term sustainability of investments, these actions must be taken without incurring excessive costs (Kou et al. 2022). Additionally, the most effective innovative financial products are determined to increase the performance of insurtech investments. In particular, with the development of technology, new financial products have been developed in recent years (Zhao et al. 2022). However, there is a risk that not all the products would be suitable for all areas. Therefore, this analysis of innovative financial products in this study is important.

Weighting the criteria with the entropy method has some advantages. Compared with other techniques such as the analytic hierarchy process (AHP) and decision-making trial and evaluation laboratory (DEMATEL) methods, the entropy method produces more precise results in the decision-making process (Barukab et al. 2019). This helps determine the importance of each criterion more accurately. Improvements to the factors affecting insurtech investments involve significant costs. In order not to incur excessive costs, more important criteria should be determined. Otherwise, the actions taken would decrease the profitability of the investments. In summary, the analysis to be carried out in this study is very sensitive. Compared with other techniques, the entropy method is much more suitable for this study (Jin et al. 2019).

Using the ARAS technique to rank the alternatives also has some advantages. The main benefit of using the ARAS approach is that the degree of alternative utility is calculated by comparing the variable with the ideal best alternative. Calculating distance measurements with the ideal negative has been criticized in the literature. Contrary to these methods, the ARAS technique is preferred because it considers the ratio to the ideal in the evaluation instead of the distance. Due to these sensitive analysis steps, the ARAS method is preferred in choosing the most optimal innovative financial product to be developed for insurtech investments.

The integration of the entropy, ARAS, and TOPSIS techniques with spherical fuzzy numbers also adds some advantages to the proposed model. Unlike the others, these numbers are expressed with a sphere (Yüksel et al. 2022; Özdemirci et al. 2023). This helps spherical fuzzy numbers to produce more accurate results (Yüksel and Dinçer 2023; Kayacık et al. 2022). Increasing insurtech investments is a difficult process that involves very complex steps to make a priority analysis of the determined criteria and the alternatives. Using spherical fuzzy numbers in the analysis process helps to minimize the uncertainty in these complex processes. Another important novelty of this study is that, in addition to ARAS, the TOPSIS methodology is also considered when ranking the alternatives. Using this comparative evaluation, the reliability of the findings of the proposed model can be measured.

The second section presents a literature review. The third section focuses on the details of the methodology. The fourth section gives information about the analysis results. In the final section, the conclusions, policy implications, and discussions are provided.

Literature review

The European insurance industry is undergoing a rapid transformation that is primarily driven by digitalization and the increasing use of advanced technologies. The term “insurtech,” which refers to disruptive innovation in the insurance industry, has attracted considerable interest in recent years from both established insurance companies and startups (Ho 2023; Awais et al. 2023). The implementation of next generation technologies presents a new opportunity for improving the entire insurance value chain, ranging from claims management to distribution (Balasubramanian et al. 2018). Advanced technologies such as AI, blockchain, and the Internet of things (IoT) are contributing to the enhancement of the core business processes of insurance firms as well as the development of financial and nonfinancial performance (Rjoub et al. 2023). Cai et al. (2021) made a panel data evaluation of 30 provinces in China, highlighting the importance of such technologies. Currently, although several investment options exist, it is essential to prioritize investments to achieve maximum benefits (Walker et al. 2023).

In recent years, several studies have examined the effects of insurtech on various aspects of insurance. Claims management, which is one of the fundamental functions of insurance, has emerged as a significant area of research (Fursov et al. 2022). Claims management means collecting, recording, analyzing, tracking, and settling claims (Farbmacher et al. 2022). Insurtech companies use advanced technologies to improve customer experience and satisfaction to better respond to customers’ demands (Eckert et al. 2022). For instance, Che et al. (2022) conducted a study on the impact of usage-based insurance (UBI) technologies on US insurance companies and found that the implementation of UBI enhances underwriting performance by reducing claims. Wang and Xu (2018) and Gomes et al. (2021) evaluated insurance fraud in European countries. They demonstrated that deep learning technologies are more effective than traditional models in preventing insurance fraud.

Insurtech research has also focused on marketing and distribution areas. Effective marketing activities ensure that the right messages are delivered to the target audiences through the right channels (Zhou et al. 2022). These activities increase awareness of the products and services of insurtech companies, strengthen their brand image, and expand their customer base (Gatzert and Schubert 2022; Ege and Stuber 2022). Stoeckli et al. (2018) argued that the emergence of new digital intermediaries in the personal insurance market would have a significant impact on the European insurtech industry. Similarly, Sun et al. (2020) claimed that the utilization of blockchain technology would eliminate the effects of asymmetric information and representative problem in insurance as well as decrease transaction and agency costs. Moreover, Lee et al. (2015) made a questionnaire survey of 538 respondents in Taiwan. They demonstrated that employing mobile applications enhances customer satisfaction, and the extent to which the application is practical and useful amplifies this effect.

Policy management is another fundamental part of the insurance value chain, and insurtech significantly improves this function (Li et al. 2022a, b). Therefore, it is necessary to establish an appropriate policy administration process for the growth and development of insurtech companies (Leiria et al. 2022). Borselli (2020) maintained that the use of blockchain-based smart contracts would automate production and claim processes while enhancing the transparency of policy management. Nayak et al. (2019) made in-depth personal interviews with 53 Indian health insurance experts, and Chang (2023) created a new econometric model for the effectiveness of an insurtech system. They demonstrated that adopting insurtech technologies leads to improved operational efficiency and financial performance of insurance companies. Furthermore, based on their conceptual study on the areas in which AI is used in insurance, Riikkinen et al. (2018) stated that chatbots would improve the effectiveness of after-sales services in the insurance industry.

Insurtech investments in pricing and underwriting have the potential to significantly affect the performance of the insurance sector. Correct pricing strategies can also help increase customer satisfaction (Dahiya et al. 2022). Because through insurtech, customers can choose policies that suit them, with the right pricing and pay more affordable prices (Pareek et al. 2022), it increases customer loyalty and satisfaction (Seth and Gulati 2022). For instance, Marafie et al. (2018) proposed a model that would improve driving behavior and reduce the risk of accidents by offering real-time feedback to drivers via telematics data. Parek et al. examined the influence of big data and AI on the insurance value chain, arguing that the insurance business model would shift from loss compensation to loss prediction and prevention through the widespread adoption of these technologies.

Utilizing new technologies in insurance also facilitates the development of innovative products to meet evolving consumer demands and expectations. The new product development process helps insurtech companies understand customer needs and explore new technologies (Saxena and Kumar 2022). This also presents opportunities for improving existing products (Nai et al. 2022). Cortis et al. (2019) and Christofilou and Chatzara (2020) focused on European countries and argued that the adoption of IoT technologies in insurance would enable the development of customized products. Abbas et al. (2015) proposed a cloud-based framework that offers personalized recommendations for health insurance by forecasting users’ needs. Similarly, using blockchain infrastructure, Feng et al. (2018) outlined a model for better administration and insurance of cyber risks. Mirza et al. (2023) examined European countries and reached similar conclusions.

The literature review reveals the following. First, insurtech investments have become quite popular, especially in the last years mainly because of technological development. To improve the financial system in a country, necessary actions should be taken to increase the performance of insurtech investments. In this context, there are different indicators that improve the performance of insurtech investments, such as claim management, effective pricing, and innovative new product development. However, these improvements increase costs. For the long-term sustainability of investments, these actions must be taken without excessive costs. The existing literature mainly focused on the significance of these items. However, there are limited studies on identifying more critical factors. Based on these significant conclusions, this study aims to define the most essential indicators to improve insurtech systems and select the most critical alternative to increase insurtech-based investments in European countries. Therefore, in this study, a novel fuzzy decision-making model is generated by integrating entropy and ARAS techniques with spherical fuzzy sets.

Methodology

In this section, the steps of the approaches are explained. The details are presented in the following subsections.

Spherical fuzzy entropy

Entropy measure is an important mathematical method for calculating uncertain information and is used to measure the degree of turbidity (Aydoğdu and Gül, 2022). The entropy method, which is used in multi-criteria decision-making, is a mathematical tool that uses information measurement to determine the weights of criteria (Ma et al. 2023). In this study, the entropy technique is used with spherical fuzzy numbers (Naji Alwerfali et al. 2020; Jin et al. 2019; Barukab et al. 2019). First, expert opinions are obtained and converted into fuzzy numbers using the values in Table 1.

Second, the decision matrix (D) is formed by taking the arithmetic mean (SWAM) of the obtained values using Eqs. (1) and (2).

Third, the ratio of the entropy value (E) to the D matrix is calculated using Eq. (3).

Then, the divergence value (div) is computed using Eq. (4).

Finally, the weights (w) of the criteria are determined using Eq. (5).

Spherical fuzzy ARAS

The ARAS method is a multi-criteria decision-making method in which the alternatives are evaluated by experts, and it then compares the scores of the selected alternatives with the best alternative (Gocer and Sener 2022). One of its most important advantages is that it is an easy calculation method that does not require complex operations (Menekşe and Camgöz Akdağ, 2022). In this study, the ARAS method is used together with spherical fuzzy numbers. First, expert opinions are obtained using the scales in Table 1. Similarly, based on the values in the table, these views are translated into fuzzy numbers. The decision matrix (D) is formed by taking the average of the expert opinions using Eq. (1). The weighted decision matrix (X) is obtained by multiplying the decision matrix by the criterion weights (w). Equations (6) and (7) are utilized to achieve this goal.

Next, the optimal values for each criterion are calculated. For the benefit criteria, the largest value is accepted as the optimal value, while for the cost criteria, the smallest value is selected as the optimal value. In spherical fuzzy numbers, the larger of the two numbers are the score and accuracy values. If the score values are equal, the number with the greater accuracy value is considered large. These values are calculated using Eqs. (8) and (9).

The spherical fuzzy optimality function (\(\tilde{S}_{Si}\)) is calculated by summing the optimal values and alternatives based on the criteria. Equation (10) is used for this calculation.

Using the score and accuracy functions, \(\tilde{S}_{Si}\) values are defuzzified, and Si values are calculated. S0 is the defuzzified value of the sum of the optimal values. Finally, using Eq. (11), the sum of the alternatives is divided by the sum of the optimal values, and the utility degree (Ki) is calculated.

Spherical fuzzy TOPSIS

The TOPSIS technique is also used to rank different alternatives. In this study, the TOPSIS technique is considered together with spherical fuzzy sets. First, expert opinions are evaluated using Table 1. Then, the decision matrix (D) is formed by taking the average of the expert opinions using Eq. (1). Further, the decision matrix is multiplied by the criterion weights (w) to obtain the weighted decision matrix (X). Equations (6) and (7) are utilized in this process. In the next step, ideal negative (X−) and ideal positive (X*) optimal values are calculated for each criterion using Eqs. (12) and (13).

The distances of each alternative from the negative and positive ideal values are calculated. In this process, the normalized Euclidean distance formula in Eqs. (14) and (15) is used.

Finally, the classical closeness ratio (C) is computed using Eq. (16).

Analysis results

The findings of the proposed model are presented in the following subsections.

The definition of the problem

This study aims to find the most essential indicators to improve insurtech systems and select the most critical alternative to increase insurtech-based investments in European countries. For this purpose, a novel fuzzy decision-making model is generated by integrating entropy and ARAS techniques with spherical fuzzy sets. The main research aim is to find the top priorities indicators that drive innovation in European insurance companies through insurtech-based investments. Using the proposed model, priority strategies can be generated for companies to improve these investments. Additionally, the spherical fuzzy TOPSIS technique is also used to rank the alternatives to measure the validity of the findings.

The details of the criteria and alternatives

The criteria and alternatives are identified through a detailed literature review. Table 2 presents information about the selected criteria.

Claims management is one of the areas where insurtech companies can make a difference and stand out in competition by using advanced technology. Claim management helps insurtech companies to provide a customer-oriented service while increasing revenues. Therefore, claim management has an important role in the development of an insurtech system. Effective marketing activities ensure that the right messages are delivered to the target audiences through the right channels. These activities increase awareness of the products and services of insurtech companies, strengthen their brand image, and expand their customer base. In addition, insurtech companies can interact with their customers through digital channels to improve customer experience. These interactions can help customers recommend products and services that fit their needs. This contributes to increasing customer satisfaction and loyalty.

Policy management is one of the fundamental functions of an insurtech system. Therefore, it is necessary to establish an appropriate policy administration process for the growth and development of insurtech companies. Well-designed policy management infrastructure help insurtech companies increase their agility and gain customers’ trust. Correct pricing strategies can also help increase customer satisfaction. Because customers can choose the policies that suit them with the right pricing and pay more affordable prices, it helps increase customer loyalty and satisfaction. The new product development process helps insurtech companies understand customer needs and explore new technologies. This also presents opportunities for improving existing products. Therefore, companies need to pay attention to customer feedback and market trends during the product development process. Table 3 presents the details of the selected alternatives.

AI applications are essential innovation tools for insurtech companies and play an important role in the development of the industry. By using AI applications, insurtech companies can improve customer experience, manage risk more effectively, and price more accurately. Big data analytics helps insurance companies understand customer needs, make precise underwriting, manage risks, and make better decisions. In addition, big data analytics helps insurance companies to establish stronger bonds with their customers and increase customer satisfaction. Blockchain technology is another important factor in the development of an insurtech system. Blockchain is a decentralized and secure data storage and transfer system. In the insurance industry, blockchain technology can provide many benefits in areas such as data security, fraud prevention, and transaction acceleration. An insurtech system can use mobile applications for customers to access insurance services more quickly and easily. Mobile applications offer customers the opportunity to purchase or make changes in their policy, make payments, report claims, and perform other insurance transactions. An insurtech system can enable customers to access, pay, and claim insurance policies using IoT technology. Due to this application, customer behavior can be analyzed more accurately.

Weighting the indicators using spherical fuzzy entropy

In the analysis process, first, an expert team was formed, including three decision-makers, which is appropriate based on the literature on the fuzzy decision-making theory (Yüksel and Dinçer 2023; Yuan et al. 2023; Adem et al. 2022; Unal and Temur 2022). One of them is an academician who makes significant research in financial investment, fintech, and insurtech projects. The other two decision-makers work as top managers in international companies. They have participated in many fintech and insurtech projects. Their opinions are shared in the Appendix (Table 14). Using steps 1 and 2, the expert opinions are averaged. The results obtained are presented in Table 4.

Entropy values are calculated using Eq. (3) over the D matrix. The results are presented in Table 5.

Using Eq. (4), divergence values are calculated. The obtained values are presented in Table 6.

In the next step, the weights of the criteria are calculated using Eq. (5). The analysis results are presented in Table 7.

Table 7 reveals that pricing is the most critical factor that affects the performance of insurtech investments, with the greatest weight of 0.2429. Effective and accurate pricing is of great importance in increasing the performance of insurtech investments. Effective pricing is a crucial factor in ensuring the profitability of an insurance company. To offer appropriate pricing to customers, insurance companies must carefully assess potential risks and adjust their rates accordingly. Insurtech companies are also required to make accurate pricing by conducting advanced risk analysis to increase their investment returns. In this way, companies can increase their profits by minimizing their risks. In addition, insurtech companies offering better prices to their customers can increase customer satisfaction. Proper pricing can help customers feel more secure when purchasing insurance policies. This can increase customer loyalty and enable companies to obtain long-term revenues.

It is also found that policy management is the second most important item. The effectiveness of the policy management process is very important in increasing the performance of insurtech investments. Through the use of next generation technologies, insurtech companies can reinvent the traditional insurer–customer relationship. By its nature, insurtech enables end-to-end digitalization of insurance transactions. This allows insurance operations to be managed much more quickly, transparently, and efficiently. In addition, the smoothness of the policy management process enables insurtech companies to expand their business more quickly and experience a healthier growth process.

Ranking the alternatives using spherical fuzzy ARAS

The expert opinions in Table 2 and the weights obtained from Eq. (5) are analyzed. The weighted decision matrix (X) is obtained using Eqs. (6) and (7). Table 8 presents information about this matrix.

Using the values in Table 8, score and accuracy values are calculated using Eqs. (8) and (9). As all the criteria are benefit, the highest value is the optimal value. The optimal values are presented in Table 9.

Equation (10) calculates the spherical fuzzy optimality function values. These values are then defuzzified and the results are presented in Table 10.

Using Eq. (11), Ki values are calculated, and alternatives are ranked. The results of the ranking are presented in Table 11.

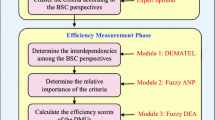

Figure 1 also presents information about the ranking results of the alternatives.

Table 11 and Fig. 1 demonstrate that big data are the most appropriate way to improve the performance of insurtech investments in Europe. Blockchain and mobile applications are other key alternatives. The use of big data is of great importance in increasing the performance of insurtech investments. Insurtech companies can make more accurate pricing by collecting and analyzing data from their customers. These companies have more data than traditional insurance providers. These data help companies learn more about the behavior of their customers. Big data can also enhance the customer experience of insurtech companies. By analyzing data about their customers’ past transactions, companies can provide more convenient services to them. This increases customer satisfaction and enables companies to achieve long-term customer loyalty.

Making comparative evaluation with spherical fuzzy TOPSIS

Finally, in the proposed model, alternatives are also ranked using spherical fuzzy TOPSIS. The expert opinions in Table 2 and the weights obtained from Eq. (5) are utilized. The weighted decision matrix (X) is obtained using Eqs. (6) and (7). Using the values in Table 6 and Eqs. (8) and (9), the score and accuracy values are calculated. Negative and positive ideal solution values are calculated using Eqs. (12) and (13). The calculated negative and positive ideal values are presented in Table 12.

The distances to the ideals are calculated using Eqs. (14) and (15). Then, classical closeness ratio values are computed using Eq. (16). The results are presented in Table 13.

Figure 2 depicts information about the comparative ranking results obtained using both spherical fuzzy ARAS and spherical fuzzy TOPSIS.

Figure 2 explains that big data and blockchain are the most essential ways to improve the performance of insurtech investments. The ranking results are quite similar with both techniques. This proves the coherency and validity of the findings.

Discussions

According to the results of the analysis, the most important factor for improving the performance of an insurtech system is an effective and accurate pricing strategy. In this framework, it would be appropriate for insurance companies to take the right actions to make more accurate pricing. Insurance companies should be able to provide individual-specific pricing. However, to achieve this goal, a serious study of customer data is required. Based on the data obtained, customers would be prevented from overpaying by providing them with individual prices. This will increase customer satisfaction. In this way, consumers will be more willing to buy insurance. To achieve this goal, insurance companies must establish a highly robust technological infrastructure. With a technological infrastructure, a large amount of data can be collected and processed. Employing qualified personnel will also helps achieve this goal because the data obtained will not make sense unless they are analyzed by experts. Thus, insurance companies should take care to employ personnel who are specialized in data analysis.

On the other hand, the inflation rate should be considered to make the right pricing in an insurtech system. Because inflation refers to an increase in prices, for insurance companies, the rate of inflation can directly affect costs. Insurance policies often include long-term agreements (Liu et al. 2023). Therefore, these long-term costs must be considered to develop an effective insurtech system (Basse et al. 2022). The expected inflation rate should also be considered to make accurate pricing in such a system (Park et al. 2023). This is important because too much increase in costs may cause a company to incur losses. When inflation is not considered in pricing, it causes insurance premiums to be below the real costs. This puts the sustainability of the business at risk (Dizaji and Payandeh Najafabadi 2022). Thus, ignoring inflation can lead to imbalances and financial losses between insurance companies and policyholders.

Next, some theoretical and practical implications based on the analysis results are presented. Regarding the theoretical implications, data analytics and the use of AI come to the fore. An insurtech system uses a huge amount of information. To analyze this information effectively, an AI system must be used effectively. This would help develop more effective and accurate pricing strategies. For the practical implications, customer satisfaction should be considered. Insurtech companies should conduct a comprehensive analysis of customer expectations. After these expectations are determined, necessary measures should be taken to increase customer satisfaction. In this process, customer expectations should also be considered in determining the right pricing.

Many studies have emphasized that the right pricing strategy plays an important role in the development of an insurtech system. Xu and Zweifel (2020) evaluated insurtech with a general framework using a Delphi method integrated with AHP. In their study, the importance of technology and customer expectations in the success of the insurtech process was mentioned, and it was highlighted that the right pricing strategy should be implemented. Cao et al. (2020) analyzed the word frequency of 25,662 news articles about insurtech in China from 2015 to 2019 using the text mining method. They found that pricing strategies play an important role. Nunes (2018) examined the relationship between behavioral patterns and the price of insurtech applications. He revealed that customer differences are rarely considered, and even if personalization is made, pricing is mostly based on sociodemographic characteristics and self-reported attitudes and habits. Furthermore, it was argued that the psychographic information of individuals should also be extracted through data collection. Thus, reaching wider masses with more favorable pricing policies through insurtech activities is one of the most appropriate solutions. Kimberly et al. (2022) conducted a study on online usage and insurtech developments in the insurance market in Malta. Their study, which was conducted with factor analysis and multiple linear analyses, included 471 participants. They highlighted that insurtech companies should mainly focus on pricing. In addition, Chatzara (2020) and Sosa and Montes (2022) stressed that the product design and development process is important for the development of insurtech.

Another result obtained in our study is that effective policy management is of great importance for insurtech development. Policy management, one of the fundamental tasks in insurance management, which includes creating quotes, policy issuance, collection, and renewal, can lead to a series of problems such as operational inefficiency and customer dissatisfaction due to the inability to carry out these processes digitally and smoothly to meet the expectations of customers. Therefore, customer satisfaction in insurtech would increase when the policy management process is soundly designed. Through this, insurtech products would be preferred by more customers, and it would lead to an increase in the share of the insurance sector in the financial sector. Nayak et al. (2019) examined the relationship between the use of new technologies and the operational efficiencies of insurance companies. They concluded that the adoption of insurtech technologies leads to improved operational efficiency. Ricci and Battaglia (2021) empirically evaluated how insurtech start-up investments are responded to. In their study conducted in Europe, they found that one of the most significant potential benefits that insurtech investments can bring is the restructuring of the traditional insurance value chain, resulting in enhanced efficiency and adaptability.

The development of an insurtech system is important for the economic development of a country. In this study, many important factors affecting this process were found. However, according to the results obtained about the development of an insurtech system, big data should be given importance. Big data are the collection of customer data and the creation of a big data pool. By effectively analyzing the data in a big data pool, clearer and more specific information about customers can be obtained. This method will significantly contribute to the development of an insurtech system. Based on the findings of this study, it is imperative to implement an effective pricing strategy. To implement the right pricing strategies and personalized pricing, it is important to analyze customer data in a big data pool. Saeed and Arshed (2022) investigated the barriers to the use of big data in the insurance industry in India and found solutions to them. They recommended that big data should be utilized in insurtech applications. Agarwal et al. (2022) examined how insurtech has transformed the insurance industry and emphasized that big data and other technological developments have an important place in this process.

Insurtech investments are of great importance to the European economy. European countries are experiencing high inflation problems due to both the pandemic and the Russia–Ukraine war. These situations have caused prices in these economies to rise very much. This may lead to a decrease in investments due to increased uncertainty in the market, which will negatively affect economic performance. The development of insurtech investments can combat the price increases in the market more easily. Thus, insurtech investments can play an indirect role in the fight against inflation by making the financial system more efficient. For example, these investments allow more favorable prices to be offered to customers.

Conclusions

This study aims to identify the most essential indicators to improve insurtech systems and select the most critical alternative to increase insurtech-based investments in European countries. A novel fuzzy decision-making model is generated by integrating entropy and ARAS techniques with spherical fuzzy sets. First, the indicators are weighted using spherical fuzzy entropy. Then, the alternatives are ranked using spherical fuzzy ARAS. The alternatives are also ranked with the spherical fuzzy TOPSIS methodology. The study finds that pricing is the most critical factor that affects the performance of insurtech investments. It also finds that policy management is the second most important item in this respect. Furthermore, big data are the most appropriate way to improve the performance of insurtech investments in Europe. Blockchain and mobile applications are other key alternatives in this situation. Insurtech companies can make more accurate pricing by collecting and analyzing data on their customers.

The main contribution of this study is that the proposed model would help investors take the right actions without incurring high costs through the priority analysis of insurtech investments. For the long-term sustainability of investments, these actions must be taken without excessive costs. Therefore, the priority analysis conducted in this study contributes significantly to achieving this goal. This study also has some methodological contributions. Weighting the criteria with the entropy method has some advantages. It helps determine the importance of each criterion more accurately. Additionally, due to the sensitive analysis steps, the ARAS method is preferred in choosing the most optimal innovative financial products for insurtech investments. The integration of entropy, ARAS, and TOPSIS techniques with spherical fuzzy numbers also adds some advantages because they help to minimize the uncertainty in complex processes.

The main limitation of this study is that the analysis is conducted only for European countries. However, the priority factors can be changed based on the conditions in different countries. Emerging countries can be examined in future research. These countries face higher risks. The main reason is that they aim to increase their investments in the short term to become developed economies. Therefore, developing the insurance industry plays a crucial role for these countries to hedge these risks more appropriately. Moreover, in a future study, some improvements can be made to the proposed model. Different fuzzy sets can also be considered such as picture fuzzy sets. Similarly, different decision-making techniques can also be used such as DEMATEL. For instance, by using a multi-stepwise weight assessment ratio analysis approach, the weights of the items can be computed by considering the causal relationship among the factors.

Availability of data and materials

Data sharing is not applicable to this article as no datasets were generated or analysed during the current study.

Abbreviations

- ARAS:

-

Additive ratio assessment

- TOPSIS:

-

Technique for order preference by similarity to ideal solution

References

Abbas A, Bilal K, Zhang L, Khan SU (2015) A cloud based health insurance plan recommendation system: a user centered approach. Future Gener Comput Syst 43:99–109

Adem A, Çakıt E, Dağdeviren M (2022) A fuzzy decision-making approach to analyze the design principles for green ergonomics. Neural Comput Appl 34:1–12

Agarwal S, Bhardwaj G, Saraswat E, Singh N, Aggarwal R, Bansal A (2022) Insurtech fostering automated insurance process using deep learning approach. In: 2022 2nd International conference on innovative practices in technology and management (ICIPTM), vol 2. IEEE, pp 386–392

Awais M, Afzal A, Firdousi S, Hasnaoui A (2023) Is fintech the new path to sustainable resource utilisation and economic development? Resour Policy 81:103309

Aydoğdu A, Gül S (2022) New entropy propositions for interval-valued spherical fuzzy sets and their usage in an extension of ARAS (ARAS-IVSFS). Expert Syst 39(4):e12898

Balasubramanian R, Libarikian A, McElhaney D (2018) Insurance 2030—the impact of AI on the future of insurance. McKinsey & Company, Atlanta

Barukab O, Abdullah S, Ashraf S, Arif M, Khan SA (2019) A new approach to fuzzy TOPSIS method based on entropy measure under spherical fuzzy information. Entropy 21(12):1231

Basse T, Reddemann S, Rodriguez Gonzalez M (2022) Dividend signaling or dividend smoothing? New empirical evidence from the italian insurance industry after the global financial crisis. Z Gesamte Versicherungswissenschaft 111:1–22

Bittini JS, Rambaud SC, Pascual JL, Moro-Visconti R (2022) Business models and sustainability plans in the FinTech, InsurTech, and PropTech industry: evidence from Spain. Sustainability 14(19):12088

Borselli A (2020) Smart contracts in insurance: a law and futurology perspective. Springer, Berlin, pp 101–125

Cai L, Firdousi SF, Li C, Luo Y (2021) Inward foreign direct investment, outward foreign direct investment, and carbon dioxide emission intensity-threshold regression analysis based on interprovincial panel data. Environ Sci Pollut Res 28:1–14

Cao S, Lyu H, Xu X (2020) InsurTech development: evidence from Chinese media reports. Technol Forecast Soc Change 161:120277

Chang VY (2023) Technology investments and firm performance under the wave of InsurTech. Geneva Pap Risk Insur Issues Pract. https://doi.org/10.1057/s41288-023-00286-w

Chatzara V (2020) FinTech, InsurTech, and the regulators. In: Marano P, Noussia K (eds) InsurTech: a legal and regulatory view. Springer, Cham, pp 3–25

Che X, Liebenberg A, Xu J (2022) Usage-based insurance—Impact on insurers and potential implications for InsurTech. N Am Actuar J 26(3):428–455

Christofilou A, Chatzara V (2020) The internet of things and insurance. In: Marano P, Noussia K (eds) InsurTech: a legal and regulatory view. AIDA Europe research series on insurance law and regulation, vol 1. Springer, Cham. https://doi.org/10.1007/978-3-030-27386-6_3

Cortis D, Debattista J, Debono J, Farrell M (2019) InsurTech. In: Lynn T, Mooney JG, Rosati P, Cummins M (eds) Disrupting finance: FinTech and strategy in the 21st century. Springer, Cham, pp 71–84

Dahiya M, Sharma S, Grima S (2022) Big data analytics application in the Indian insurance sector. In: Sood K, Balusamy B, Grima S, Marano P (eds) Big data analytics in the insurance market. Emerald Publishing Limited, Bingley, pp 145–164

Dizaji AK, Payandeh Najafabadi AT (2022) Updating bonus-malus indexing mechanism to adjust long-term health insurance premiums. N Am Actuar J. https://doi.org/10.1080/10920277.2022.2110123

Eckert C, Neunsinger C, Osterrieder K (2022) Managing customer satisfaction: digital applications for insurance companies. Geneva Pap Risk Insur Issues Pract 47(3):569–602

Ege MS, Stuber SB (2022) Are auditors rewarded for low audit quality? The case of auditor lenience in the insurance industry. J Account Econ 73(1):101424

Eling M, Nuessle D, Staubli J (2021) The impact of artificial intelligence along the insurance value chain and on the insurability of risks. Geneva Pap Risk Insur Issues Pract 47:1–37

Farbmacher H, Löw L, Spindler M (2022) An explainable attention network for fraud detection in claims management. J Econom 228(2):244–258

Feng S, Wang W, Xiong Z, Niyato D, Wang P, Wang SS (2018) On cyber risk management of blockchain networks: a game theoretic approach. IEEE Trans Serv Comput 14(5):1492–1504

Fursov I, Kovtun E, Rivera-Castro R, Zaytsev A, Khasyanov R, Spindler M, Burnaev E (2022) Sequence embeddings help detect insurance fraud. IEEE Access 10:32060–32074

Gatzert N, Schubert M (2022) Cyber risk management in the US banking and insurance industry: a textual and empirical analysis of determinants and value. J Risk Insur 89(3):725–763

Gocer F, Sener N (2022) Spherical fuzzy extension of AHP-ARAS methods integrated with modified k-means clustering for logistics hub location problem. Expert Syst 39(2):e12886

Gomes C, Jin Z, Yang H (2021) Insurance fraud detection with unsupervised deep learning. J Risk Insur 88(3):591–624

Ho CM (2023) Research on interaction of innovation spillovers in the AI, Fin-Tech, and IoT industries: considering structural changes accelerated by COVID-19. Financ Innov 9(1):7

Jin Y, Ashraf S, Abdullah S (2019) Spherical fuzzy logarithmic aggregation operators based on entropy and their application in decision support systems. Entropy 21(7):628

Kayacık M, Dinçer H, Yüksel S (2022) Using quantum spherical fuzzy decision support system as a novel sustainability index approach for analyzing industries listed in the stock exchange. Borsa Istanbul Rev 22(6):1145–1157

Kimberly P, Grima S, Özen E (2022) Perceived effectiveness of digital transformation and insurtech use in malta: a study in the context of the European Union’s green deal. In: Sood K, Dhanaraj RK, Balusamy B, Grima S, Uma Maheshwari R (eds) Big data: a game changer for insurance industry. Emerald Publishing Limited, Bingley, pp 239–263

Kou G, Olgu Akdeniz Ö, Dinçer H, Yüksel S (2021) Fintech investments in European banks: a hybrid IT2 fuzzy multidimensional decision-making approach. Financ Innov 7(1):39

Kou G, Yüksel S, Dinçer H (2022) Inventive problem-solving map of innovative carbon emission strategies for solar energy-based transportation investment projects. Appl Energy 311:118680

Kou G, Dincer H, Yuksel S, Alotaibi FS (2023) Imputed expert decision recommendation system for QFD-based omnichannel strategy selection for financial services. Int J Inf Technol Decis Mak. https://doi.org/10.1142/S0219622023300033

Lee CY, Tsao CH, Chang WC (2015) The relationship between attitude toward using and customer satisfaction with mobile application services: An empirical study from the life insurance industry. J Enterp Inf Managt 28:680–697

Leiria M, Rebelo E, deMatos N (2022) Measuring the effectiveness of intermediary loyalty programmes in the motor insurance industry: loyal versus non-loyal customers. Eur J Manag Bus Econ 31(3):305–324

Li C, Firdousi SF, Afzal A (2022a) China’s Jinshan Yinshan sustainability evolutionary game equilibrium research under government and enterprises resource constraint dilemma. Environ Sci Pollut Res 29(27):41012–41036

Li Y, Kou G, Li G, Hefni MA (2022b) Fuzzy multi-attribute information fusion approach for finance investment selection with the expert reliability. Appl Soft Comput 126:109270

Liu J, Ye S, Zhang Y, Zhang L (2023) Research on InsurTech and the technology innovation level of insurance enterprises. Sustainability 15(11):8617

Ma QX, Zhu XM, Bai KY, Zhang RT, Liu DW (2023) A novel failure mode and effect analysis method with spherical fuzzy entropy and spherical fuzzy weight correlation coefficient. Eng Appl Artif Intell 122:106163

Marafie Z, Lin KJ, Zhai Y, Li J (2018) Proactive fintech: using intelligent iot to deliver positive insurtech feedback. In: 2018 IEEE 20th conference on business informatics (CBI), vol 2. IEEE, pp 72–81

Menekşe A, Camgöz Akdağ H (2022) Seismic vulnerability assessment using spherical fuzzy ARAS. In: Intelligent and fuzzy techniques for emerging conditions and digital transformation: proceedings of the INFUS 2021 conference, held August 24–26, 2021, vol 2. Springer, pp 733–740

Mirza N, Umar M, Afzal A, Firdousi SF (2023) The role of fintech in promoting green finance, and profitability: evidence from the banking sector in the euro zone. Econ Anal Policy 78:33–40

Nai W, Yang Z, Wei Y, Sang J, Wang J, Wang Z, Mo P (2022) A comprehensive review of driving style evaluation approaches and product designs applied to vehicle usage-based insurance. Sustainability 14(13):7705

Naji Alwerfali HS, Al-qaness AA, Abd Elaziz M, Ewees AA, Oliva D, Lu S (2020) Multi-level image thresholding based on modified spherical search optimizer and fuzzy entropy. Entropy 22(3):328

Nayak B, Bhattacharyya SS, Krishnamoorthy B (2019) Integrating wearable technology products and big data analytics in business strategy: a study of health insurance firms. J Syst Inf Technol 21:255–275

Njegomir V, Demko-Rihter J (2023) InsurTech: new competition to traditional insurers and impact on the economic growth. Digital transformation of the financial industry: approaches and applications. Springer, Cham, pp 133–150

Nunes B (2018) Behavioural design and price optimization in InsurTech. In: The VanderLinden SL, Millie SM, Anderson N, Chishti S (eds) InsurTech Book: the insurance technology handbook for investors, entrepreneurs and FinTech visionaries. Wiley, Hoboken, pp 165–170

Özdemirci F, Yüksel S, Dinçer H, Eti S (2023) An assessment of alternative social banking systems using T-Spherical fuzzy TOP-DEMATEL approach. Decis Anal J 6:100184

Pareek T, Sood K, Grima S (2022) The impact of big data technology on the advancement of the insurance industry. In: Sood K, Balusamy B, Grima S, Marano P (eds) Big data analytics in the insurance market. Emerald Publishing Limited, Bingley, pp 221–239

Park K, Wong HY, Yan T (2023) Robust retirement and life insurance with inflation risk and model ambiguity. Insur Math Econ 110:1–30

Ricci O, Battaglia F (2021) The development of InsurTech in Europe and the strategic response of incumbents. In: King T, Lopes FS, Srivastav A, Williams J (eds) Disruptive technology in banking and finance: an international perspective on FinTech. Palgrave Macmillan, London, pp 135–160

Riikkinen M, Saarijärvi H, Sarlin P, Lähteenmäki I (2018) Using artificial intelligence to create value in insurance. Int J Bank Mark 36:1145–1168

Rjoub H, Adebayo TS, Kirikkaleli D (2023) Blockchain technology-based FinTech banking sector involvement using adaptive neuro-fuzzy-based K-nearest neighbors algorithm. Financ Innov 9(1):1–23

Saeed M, Arshed N (2022) big data analytics adoption in the indian insurance industry: challenges and solutions. In: Sood K, Balusamy B, Grima S, Marano P (eds) Big data analytics in the insurance market. Emerald Publishing Limited, Bingley, pp 81–102

Saxena S, Kumar R (2022) The impact on supply and demand due to recent transformation in the insurance industry. Mater Today Proc 56:3402–3408

Seth P, Gulati K (2022) Use of wearable and health applications in insurance industry using internet of things and big data. In: Sood K, Dhanaraj RK, Balusamy B, Grima S, Uma Maheshwari R (eds) Big data: a game changer for insurance industry. Emerald Publishing Limited, Bingley, pp 1–13

Sosa I, Montes Ó (2022) Understanding the InsurTech dynamics in the transformation of the insurance sector. Risk Manag Insur Rev 25(1):35–68

Stoeckli E, Dremel C, Uebernickel F (2018) Exploring characteristics and transformational capabilities of InsurTech innovations to understand insurance value creation in a digital world. Electron Mark 28:287–305. https://doi.org/10.1007/s12525-018-0304-7

Sun RT, Garimella A, Han W, Chang HL, Shaw MJ (2020) Transformation of the transaction cost and the agency cost in an organization and the applicability of blockchain—a case study of peer-to-peer insurance. Front Blockchain 3:24

Tladinyane L, Gumede L, Bick G (2022) Pineapple: the growth challenges faced by a South African Insurtech disruptor. The Case Writing Centre, University of Cape Town, Graduate School of Business, Cape Town, pp 1–16

Unal Y, Temur GT (2022) Sustainable supplier selection by using spherical fuzzy AHP. J Intell Fuzzy Syst 42(1):593–603

Walker T, Nikbakht E, Kooli M (2023) Fintech and banking: an overview. In: Walker T, Nikbakht E, Kooli M (eds) The fintech disruption: how financial innovation is transforming the banking industry. Springer, Berlin, pp 1–8

Wang Y, Xu W (2018) Leveraging deep learning with LDA-based text analytics to detect automobile insurance fraud. Decis Support Syst 105:87–95

Xu X, Zweifel P (2020) A framework for the evaluation of InsurTech. Risk Manag Insur Rev 23(4):305–329

Yuan Q, Zhang X, Zhu H, Zhang B, Chen J (2023) Research on influencing factors of coal mine safety production based on integrated fuzzy DEMATEL-ISM methods. Energy Sources Part A Recov Util Environ Effects 45(1):2811–2830

Yüksel S, Dinçer H (2023) Sustainability analysis of digital transformation and circular industrialization with quantum spherical fuzzy modeling and golden cuts. Appl Soft Comput 138:110192

Yüksel S, Dinçer H, Eti S, Adalı Z (2022) Strategy improvements to minimize the drawbacks of geothermal investments by using spherical fuzzy modelling. Int J Energy Res 46(8):10796–10807

Zarifis A, Cheng X (2022) A model of trust in Fintech and trust in Insurtech: how artificial intelligence and the context influence it. J Behav Exp Finance 36:100739

Zhao Y, Wei S, Du H, Chen X, Li Q, Zhuang F, Kou G (2022) Learning Bi-typed multi-relational heterogeneous graph via dual hierarchical attention networks. IEEE Trans Knowl Data Eng. https://doi.org/10.1109/TKDE.2022.3220520

Zhou YM, Yang W, Ethiraj S (2022) The dynamics of related diversification: evidence from the health insurance industry following the Affordable Care Act. Strateg Manag J 44:1753–1779

Acknowledgements

Not applicable.

Funding

There is no funding.

Author information

Authors and Affiliations

Contributions

SE participated in the design of the study, performed the statistical analysis and helped to draft the manuscript. HD participated in the design of the study and performed the statistical analysis. HM participated in the design of the study and performed the statistical analysis. SY conceived of the study and participated in its design and coordination and helped to draft the manuscript. YG conceived of the study and participated in its design and coordination and helped to draft the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Eti, S., Dinçer, H., Meral, H. et al. Insurtech in Europe: identifying the top investment priorities for driving innovation. Financ Innov 10, 38 (2024). https://doi.org/10.1186/s40854-023-00541-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-023-00541-y