Abstract

We investigate how a firm’s corporate pledgeable asset ownership (CPAO) affects the risk of future stock price crashes. Using pledgeable asset ownership and crash risk data for a large sample of U.S. firms, we provide novel empirical evidence that a firm’s risk of a future stock price crash decreases with an increase in its pledgeable assets. Our main findings are valid after conducting various robustness tests. Further channel tests reveal that firms with pledgeable assets increase their collateral value, thereby enhancing corporate transparency and limiting bad news hoarding, resulting in lower stock price crash risk. Overall, the results show that having more pledgeable assets enables easier access to external financing, making it less likely that managers will hoard bad news.

Similar content being viewed by others

Introduction

Asset pledgeability is an important aspect of a firm’s capital structure. Pledgeable assets benefit both firms and creditors. Because pledgeable assets support additional borrowing (Almeida and Campello 2007), firms can use these assets when they need capital or for further investment. Pledgeable assets help creditors recover loans from debtors, and if a debtor fails to meet the required payment, the creditor can use the collateral to minimize its losses. Additionally, pledgeable assets help mitigate enforcement frictions between borrowers and creditors (Tirole 2010), and the ability to pledge both collateral and redeployable collateral reduces the cost of external financing and increases debt capacity (Benmelech and Berman 2009).

The advantages of pledgeable assets have motivated firms to maintain a high level of such assets in their asset management portfolios. While various views offer different explanations for why firms own pledgeable assets, an underlying common thread is that these assets can be collateralized and liquidated when needed. These benefits encourage firms to purchase and strategically use these assets. For example, Cvijanovic (2014) finds that firms modify their debt structure when the value of real estateFootnote 1 increases. Furthermore, this increase in real estate value positively influences firms’ future investment decisions (Chaney et al. 2012).

Although many studies observe this relationship at the firm level, few have examined how variations in pledgeable assets affect a CEO’s behavior. Therefore, we address this gap in the literature by investigating how changes in pledgeable assets affect a CEO’s tendency to hoard bad news. Our research departs from the literature by showing the firm-specific benefits of using pledgeable assets and investigates whether firms with higher volumes of such assets engage in less bad news hoarding and have a lower crash risk. To test this relationship empirically, we use crash risk measures as the main dependent variable. Numerous studies have examined stock price crash risk. Among the many explanations for such risks, most studies assume that managers intentionally hide and hoard bad news. When negative news is eventually revealed to the market, typically all at once, there is a significant negative effect on stock prices (Hutton et al. 2009; Kothari et al. 2009). Managers hide bad news for several reasons, including financial reporting opacity (Hutton et al. 2009), asymmetric information between managers and the market (Kothari et al. 2009), corporate social responsibility (CSR) disclosure (Kim et al. 2014), tax avoidance (Kim et al. 2011b), takeover protection (Bhargava et al. 2017), formal compensation contracts and career concerns (Kothari et al. 2009; LaFond and Watts 2008), and managerial opportunism (Kim et al. 2011a), among others.

Here, we focus on the classical notion that managers intentionally hoard bad news to make it easier for them to receive external financing. While firms deliberately hide bad news that might hinder them from obtaining a loan, “pledgeable” assets provide insurance against possible bad events that result in agents needing “liquid” instruments (Gorton 2017). Therefore, access to a greater value of pledgeable assets eases the CEO’s burden of receiving external financing, thus encouraging them not to hide bad news.

We hypothesize that an increase in firm-level pledgeable assets decreases CEOs’ bad news hoarding behavior, as measured by stock price crash risk. In economic terms, we find that when a firm increases its pledgeable assets ratio by one standard deviation, the risk of a crash decreases by 0.037 (0.154 × 0.241) for the crash risk measure of \(CRASH_{t}\),Footnote 2which amounts to approximately 16% of the mean crash risk (0.232 in Table 1). This accounts for approximately 24% of the mean crash risk measures. The results are economically significant even after including other control variables and fixed effects to control for possible unobserved heterogeneity.

Although our main finding shows that variations in pledgeable assets affect future stock price crash risks, interpreting this finding may be difficult owing to potential endogeneity concerns arising from omitted variable bias. In other words, other endogenous variables may bias our interpretation of the main findings. To address potential endogeneity concerns, we further test our assumption using an instrumental variable, propensity score matching (PSM) (Rosenbaum and Donald 1983; Roberts and Whited 2013), and the Oster test (Oster 2017) based on the literature. The results show that our findings are robust to other tests. In addition to statistical tests, we use alternative sampling periods and measures to confirm the baseline estimation results. For instance, we test whether the previously mentioned relationship between pledgeable assets and future stock price crash risk manifests, excluding the financial crisis period (2007–2009). For example, the U.S. stock market decreased significantly during the Great Recession, which may have directly or indirectly affected managers’ trust in safe assets. We also extend the forecasting windows to verify the long-term effects of corporate pledgeable asset ownership (CPAO) and employ alternative measures, crash risk variables, and industry classifications to validate the main findings.

Finally, the study tests a channel through which the pledgeable asset-owning firms contribute to lowering the likelihood of future stock price crash risk. Prior studies find that accrual management obscures at least some information about firm fundamentals (Sloan 1996), and is thus a direct, firm-specific measure of opacity. In addition, aggressive earnings management is likely to be a proxy for management’s general proclivity to hide information from the capital market, and thus captures less easily quantifiable or observable aspects of opacity. The analysis shows that CPAO is negatively associated with information opacity in firms with a higher volume of pledgeable assets as they have relatively fewer incentives to hide and hoard bad news. We also investigate how CPAO may contribute to enhancing information transparency, measured by the readability of 10-K reports. Decreased readability of 10-Ks is reported to be related to adverse news hiding (Li 2008; Rogers et al. 2014). Thus, if pledgeable asset-owning firms have less incentive to hide negative information, the annual reports of such firms would also be more readable. Our empirical tests show that asset-owning firms’ annual reports are less obscure.

Our study contributes to the recent empirical literature on the behavioral characteristics that determine future stock price crashes (An and Zhang 2013; Bao et al. 2018; Bhargava et al. 2017; Callen and Fang 2013, 2015; He 2015; Kim and Zhang 2016; Kim et al. 2011a, 2016; Wen et al. 2019; Xu et al. 2014; Yuan et al. 2016). We contribute to the crash risk literature by showing that a firm’s choice of pledgeable assets affects the risk of future stock price crashes. Firms manage tail risk by securing pledgeable assets, which helps protect shareholders from subsequent losses related to these risks, should negative events occur.

These findings also have important implications for the role of pledgeable assets held by firms. While studies on alternative investments, such as fintech, are growing (Kou et al. 2021a), relatively little attention has been paid to firms’ real estate ownership. Thus, we focus on the beneficial effects of pledgeable assets as a mechanism to protect against stock price crash risk and provide new evidence on the economic consequences of such assets. As discussed earlier, previous studies have focused on how pledgeable asset holdings affect a firm’s debt structure, future investment decisions, productivity uncertainty, stock return performance, and risk (Cvijanovic 2014; Chaney et al. 2012; Zhao and Sing 2016; Krumm and Linneman 2001; He and Ren 2017). We extend these works by focusing on the unique role played by pledgeable asset holdings in reducing crash risk, which captures the asymmetry in risk or the third moment of a stock return distribution. This role is distinct from the effect of asset pledgeability on firm performance (first moment) and firm risk (second moment), as documented in prior studies (Hart and Moore 1994; Aghion and Bolton 1992; Fazzari et al. 1988; Kaplan and Zingales 1997; Gomes 2001; Almeida and Campello 2007; Gorton 2017). Thus, our results broaden the understanding of the implications for firms and investors holding real estate.

Furthermore, investigating the role of pledgeable assets in reducing crash risk likelihood is important for researchers studying firms’ bankruptcy predictions. Most bankruptcy prediction models use firm-level accounting and financial ratios (Kou et al. 2021b). The number of models considered suitable for large-scale financial datasets is also increasingly developed (Zha et al. 2020; Li et al. 2021). Therefore, firm’s pledgeable asset ratio may be one factor that reduces the likelihood of bankruptcy, which would be well captured in recently developed prediction models.

The remainder of this paper is organized as follows. In “Literature review and hypothesis development” sectionsection, we review the literature on pledgeable assets and stock price crash risk. “Data and variable description” section presents our hypotheses. “Main results” section describes the data and methodologies. “Endogeneity tests” section presents our main findings and interpretation of the results. We include robustness tests in “Further test” section to address potential endogeneity and bias concerns. Finally, “Conclusion” section concludes the paper.

Literature review and hypothesis development

Maintaining a certain volume of pledgeable assets is critical for firms, because such assets support additional borrowing (Almeida and Campello 2007). Classical literature in this field is based on the premise that firms use these assets to alleviate financial frictions from adverse selection effects and moral hazard (Stulz and Johnson 1985; Hart and Moore 1994; Hart 1995). These studies developed theoretical models showing that the collateral may be correlated with unobserved characteristics affecting loan rates. Therefore, firms can divest pledgeable assets more easily than intangible assets when they need capital. Another stream of the literature finds that firms with greater default risk pledge their pledgeable assets as a mechanism to increase pledgeable income (Tirole 2010; Rampini and Viswanathan 2008; Eisfeldt and Rampini 2009).

Pledgeable assets also help creditors recover loans from their debtors. If a debtor fails to make the required payment, the creditor can use collateral to minimize losses. Additionally, pledgeable assets help mitigate enforcement frictions between borrowers and creditors (Tirole 2010), and the ability to pledge collateral and redeployable collateral reduces the cost of external financing and increases debt capacity (Benmelech and Berman 2009). Recent evidence shows that borrowers rely on collateral when their pledgeability is high. This implies that high pledgeability makes it easier to obtain new loans or debt, diluting existing creditors. This induces creditors to seek protection against possible dilution by means of collateralized assets (Donaldson et al. 2019).

Among the various types of pledgeable assets, real estate has long been considered a typical example. Corporate real estate is the largest asset class for many firms (Zeckhauser and Silverman 1983; Brounen and Eichholtz 2005), and recent literature identifies the potential advantages real estate ownership may bring to a firm. Firms purchase real estate for numerous reasons, one of which is that real estate, unlike other tangible assets, is relatively pledgeable (Chaney et al. 2012). One approach to discipline and ease borrowers’ financing ex ante is to offer creditors the option of liquidating pledged assets. This is because liquidation is an important determinant of corporate financial decisions (Stiglitz and Weiss 1981; Grossman and Hart 1986; Hart and Moore 1990), and liquidable assets (collateral) are often used to moderate financial frictions in the presence of unexpected hazards (Hart and Moore 1994; Aghion and Bolton 1992). In this respect, Cvijanovic (2014) hypothesizes and shows that creditors’ willingness to lend money to a firm increases with the liquidation value of assets. Cvijanovic (2014) explains that in the presence of financing frictions, firms with higher-value real estate tend to increase their leverage ratios rather than attempting to link the variation in pledgeable assets to stock price crash risk.

Many studies have investigated the determinants of significant stock price drops with respect to stock price crash risk. For example, studies have used information blockage (Cao et al. 2002) and the volatility feedback effect (French et al. 1987; Campbell and Hentschel 1992) to explain such events. The volatility feedback effect states that investors are likely to reassess market volatility and increase the risk premium when there is a significant price movement. This reinforces the impact of negative information, which offsets positive information, resulting in a large drop in a firm’s stock price in a short period.

Recent research on stock price crashes indicates an agency problem-based view that the information asymmetry between corporate insiders and stakeholders results in crash risks (Jin and Myers 2006). Such information asymmetry motivates managers to intentionally hide and hoard bad news (Kothari et al. 2009). However, the firm cannot stockpile bad news forever, and once a threshold has been crossed, the news is released into the market all at once, leading to a crash.

Why do managers hide bad news? Kothari et al. (2009) state that managers intentionally hide bad news from the market to protect their positions, maintain their compensation packages, protect their employment, and minimize potential litigation risks. The literature postulates channels that strengthen this argument. Hutton et al. (2009) find that firms with opaque financial statements are vulnerable to stock price crashes. Kim et al. (2011b) show that tax avoidance behavior is positively associated with crash risks. In addition, overconfident CEOs (Kim et al., 2016) and younger CEOs (Andreou et al. 2017) are associated with a higher stock price crash risk, although Kim et al. (2014) show that firms managed by philanthropic CEOs are less prone to a stock price crashFootnote 3 and He (2015) finds that inside debt holdings of CEOs decrease the risk of a crash.

Examining studies on corporate pledgeable asset ownership and stock price crash risk, we believe that there is a gap in the literature. Firms need real estate assets to run their businesses, and choose between owning or leasing these assets. Firms decide to purchase real estate because such pledgeable assets can be liquidated more easily than other tangible assets. Pledgeable assets support additional borrowing that can be used for further investment (Almeida and Campello 2007) and provide insurance against possible bad events in which agents need liquid instruments (Gorton 2017). These benefits alleviate the financial frictions that arise from moral hazards or adverse selection effects (Aghion and Bolton 1992; Stulz and Johnson 1985; Hart 1995). Hence, when a firm increases its pledgeable assets, it increases its likelihood of obtaining loans and decreases its potential moral hazard. Therefore, we argue that when a firm is relatively free of financing concerns, managers are less worried about hiding bad news (Kothari et al. 2009), which reduces the risk of stock price crashes. Thus, we hypothesize as follows:

Hypothesis

The number of pledgeable assets is negatively associated with the risk of a future stock price crash.

Data and variable description

Sample construction

We first combine firms’ weekly stock return data from the Center for Research in Security Prices (CRSP) with firms’ financial data provided by Compustat to obtain the sample. We exclude observations with missing stock returns and trading volume data in the CRSP database as well as those with missing accounting data in the Compustat database. Furthermore, we exclude firms with fewer than 26 weeks of stock return data and those in the financial services and utilities industries (Hutton et al. 2009). The data span from 1988 to 2019, consisting of 88,248 firm-year observations.

Measurement of pledgeable assets

Our main independent variable, corporate pledgeable asset ownership (CPAO), is calculated following the definition of Chaney et al. (2012) using the Compustat database. The data source provides firm-specific property, plant, and equipment (PPE) data, and we derive the CPAO as the sum of lagged building costs (item name: FATB), lagged land and improvements (item name: FATP), and lagged construction in progress (item name: FATC) divided by the total asset value.

Measurements of stock price crash risk

We employ three different measures of crash risk following previous studies (Chen et al. 2001; Jin and Myers 2006; Kim et al. 2011a,b). We first estimate the weekly returns for each firm and year to observe the firm-specific factors that contribute to a firm’s crash risk. We then define \(W\) as the firm-specific weekly return, computed as the natural log of one plus the residual return from the expanded market model regression. The market model regression is expressed as follows.

where \(r_{j,\tau }\) is the return on stock \(j\) in week \(\tau\) and \(r_{m,\tau }\) is the return on the CRSP value-weighted market index in week \(\tau\). Following Dimson (1979), we include the lead and lag terms for the market index return to consider non-synchronous trading.

The firm-specific weekly return for firm \(j\) in week \(\tau\), \(W_{j,\tau }\), is computed as the natural log of one plus the residual return.

We define crash weeks in a given fiscal year for a given firm as those in which the firm’s weekly return drops by more than 3.09 standard deviations below the mean firm-specific returns over the entire fiscal year (Hutton et al., 2009; Kim et al., 2011a,b). Our first measure for each firm in each year, \(CRASH_{j,t}\), is an indicator variable that takes the value of 1 if a firm-year includes one or more crash weeks (as defined above), and 0 otherwise.

The second measure of crash risk is negative conditional return skewness (\(NCSKEW\)). Here, we borrow from Chen et al. (2001) and Kim et al. (2011a,b), in which a firm’s \(NCSKEW\) in a fiscal year is calculated as the negative third moment of the firm-specific weekly returns for each year divided by the standard deviation of the firm-specific weekly returns to the third power.

Following Chen et al. (2001), our third measure is the down-to-up volatility (\(DUVOL\)). For each firm \(j\) over a fiscal-year period \(t\), we categorize all weeks as “down” or “up” weeks, where down weeks are those in which the firm-specific weekly returns are below the annual mean, and up weeks are those above the annual mean. We then calculate the standard deviation for each group. The \(DUVOL\) variable is calculated as the log of the ratio of the standard deviation for the down weeks to the standard deviation for the up weeks:

where \(n_{u}\) and \(n_{d}\) denote the number of up-and down-weeks, respectively, during fiscal year \(t\).

For all crash risk variables (i.e., \(CRASH_{j,t}\), \(NCSKEW_{j,t}\), and \(DUVOL_{j,t}\)), higher values indicate greater crash risk.

Other control variables

Following Chen et al. (2001) and Jin and Myers (2006), we include several control variables: lagged stock turnover (\(DTRURN_{t - 1}\)), lagged negative conditional skewness (\(NCSKEW_{t - 1}\)), lagged stock return volatility (\(SIGMA_{t - 1}\)), lagged firm-specific average weekly return (\(RET_{t - 1}\)), lagged firm size (\(SIZE_{t - 1}\)), lagged market-to-book ratio (\(MB_{t - 1}\)), lagged leverage ratio (\(LEV_{t - 1}\)), lagged return on assets (\(ROA_{t - 1}\)), lagged earnings quality (\(ACC_{t - 1}\)), lagged R&D ratio (\(R\& D_{t - 1}\)), lagged missing R&D indicator variable (\(R\& D\_MISSING_{t - 1}\)), lagged kurtosis (\(KUR_{t - 1}\)), lagged goodwill (\(GW_{t - 1}\)), and lagged firm age (\(LOG\_FIRM\_AGE_{t - 1}\)).

We lag all control variables to mitigate (but not completely remove) potential endogeneity concerns from reverse causality. We also include industryFootnote 4-and year-fixed effects. ““Appendix A”” provides detailed explanations and definitions of the variables used in this analysis.

Main results

Descriptive statistics

Table 1 presents the descriptive statistics of our main variables.\(CRASH_{t}\) measures the probability of a firm-specific stock price crash during a year. The mean value for \(CRASH_{t}\) is 0.232, indicating that the probability of a price crash is approximately 23.2%. Our second measure of crash risk, \(NCSKEW_{t}\), identifies negative outliers in the return distribution by calculating the size of the distribution’s left tail. The average value of \(NCSKEW_{t}\) is 0.027, suggesting that the return distributions are slightly negatively skewed. However, the sample includes observations with extremely negative returns because the median value of \(NCSKEW_{t}\) is -0.012. Our third crash risk measure, \(DUVOL_{t}\), measures the asymmetric volatility between the negative and positive firm-specific weekly returns. The mean value of \(DUVOL_{t}\) is 0.025, and the median value is 0.007, suggesting that some observations are extremely vulnerable to crash risk because higher \(DUVOL_{t}\) indicates higher likelihood of a stock crash.

Our main variable of interest, CPAO, measures the proportion of real estate (sum of land, buildings, and construction in progress) in total assets. The average value of CPAO is 0.094, implying that approximately 9.4% of firm-specific assets are pledgeable assets.

Baseline regression results

In this subsection, we investigate the effect of CPAO on the risk of a future stock price crash. Following the literature, we also control for other determinants of crash risk (Chen et al., 2001; Hutton et al., 2009; Kim et al., 2011a,b). All variables are lagged by one year relative to the crash risk variables. We also control for lagged crash risk in the regression to address reverse causality. We use the following regression specification to test our first hypothesis.

where \(CPAO_{j,t - 1}\) indicates CPAO and \(CONTROLS_{j,t - 1}\) denotes the set of control variables used in the main regression. For the regression analysis with \(CRASH_{t}\) as a dependent variable, we use logistic regression, and for other variables, \(NCSKEW_{t}\) and \(DUVOL_{t}\), we use OLS regressions.

Regardless of the crash risk measures, the results shown in Table 2 indicate that CPAO is negatively associated with the one-year ahead risk of a stock price crash. The findings are statistically significant at the 1% level, even after including all the control variables, year fixed effects, and industry fixed effects. Moreover, our results indicate the economic significance of the effect of asset pledgeability on crash risks. For example, based on the coefficients in the first regression in Table 2, when the number of pledgeable assets increases from the first to the third quartile, the crash risk proxy \(NCSKEW_{t}\) (\(DUVOL_{t}\)) decreases by 15.5% (7.1%). Overall, this result suggests that companies suffer less of a price crash risk when they include a high volume of pledgeable assets in their asset management portfolios.

Regarding the control variables, firms with a larger size, higher market-to-book ratio, higher past returns, and lower leverage ratio are associated with a higher risk of a future stock price crash, consistent with findings in the crash risk literature (see e.g., Kim et al., 2011a,b, 2014). In summary, the results of our analysis imply that the decrease in default risk resulting from an increase in pledgeable asset ownership provides a positive signal to managers, which reduces their likelihood of hiding and hoarding bad news.Footnote 5

Endogeneity tests

Instrumental variable (IV)

Although our baseline regression shows a negative association between CPAO and the risk of a future stock price crash, the results may be biased and driven by endogeneity. Therefore, in this section, we employ several robustness tests to show empirically that the baseline regression results are not potentially driven by endogeneity. The first approach is the instrumental variable (IV) estimation. Borrowing ideas from prior studies, we use the equally weighted average of the pledgeable asset intensity of firms with the same life cycle, excluding the firm. We create an IV variable (\(CPAO\_IND\_MEAN_{t - 1}\)), which is calculated as the yearly average of firms’ CPAO-given industry, excluding the firm. Firms with the same life cycle have high similarity in characteristics; thus, IV is closely related to pledgeable asset intensity because it represents the average volume of the pledgeable asset intensity of peer firms, and the relevance assumption is satisfied (Wu and Lai 2020; Wu and Ai 2021). In addition, the instrument variable satisfies the exclusion restriction because peer firms’ average asset intensity is unlikely to have a direct effect on their stock price crash risk.

Table 3 presents the IV regression results. Column (1) reports the first-stage regression results. The IV has a positive relationship with pledgeable asset intensity, suggesting that the IV is closely related to the endogenous variable. The results of the second-stage regression are generally consistent with the baseline regression. The results in column (1) for CRASH narrowly miss the conventional level of statistical significance (p = 0.165). However, the point estimate is very large, representing an effect more than twice that of the unconditional mean of the dependent variable. We find a negative association between CPAO and future stock price crash risk as measured by \(NCSKEW_{t}\) and \(DUVOL_{t}\). The results imply that endogeneity concerns do not drive the association between CPAO and future stock price crash risk.

We also conduct multiple tests to verify whether the IV is sufficiently strong to include. Specifically, we use the Kleibergen-Paap rank LM statistic (Kleibergen 2002), Kleibergen-Paap rank Wald F-statistic, Anderson-Rubin Wald test (Anderson and Rubin 1949), and Stock-Wright S-statistic test (Stock and Wright 2000) to verify that the instruments are not weak. Regardless of the verification tests, the p-values of the statistics are below 1%, indicating that endogenous regressors have explanatory power in the presence of weak instruments. Overall, the statistical tests show that the finding of a negative association between CPAO and future stock price crash risk is robust after alleviating endogeneity concerns over using the IV model.

Propensity score matching (PSM)

The second potential concern relates to possible selection bias. Our baseline regression may contain a selection bias associated with a firm’s propensity to engage in pledgeable asset ownership. To alleviate this concern, we employ the PSMFootnote 6 procedure to match firms with higher pledgeable assets-to-total assets ratios (top quartile) to control firms with lower ratios (below the top quartile). This matching criterion enables us to compare firms that consider pledgeable assets important in a portfolio with other firms that are identical in all other observable dimensions. This allows us to distinguish the effects related to real estate purchases from those of other firm characteristics.

Table 4 reports the estimation results using the matched sample. The control variables are identical to variables used for analysis in Table 2, except that we retain only those firms with a high proportion of real estate, and match the firms identified using the PSM approach. The negative association between CPAO and future crash risk holds after applying the PSM method, confirming that endogeneity is not an issue in our data.

Oster’s delta

We also employ Oster’s (2017) method to address potential unobservable endogeneity concerns. Our model may omit important control variables, the variation of which affects both crash risk measures and the CPAO. Based on the theory of Altonji (2005), Oster (2017) proposes a diagnosis to measure the sensitivity of the coefficient of interest to unobserved variables. The test attempts to address the possible omitted variable endogeneity problems in both the coefficient of interest and the \(R^{2}\) between regressions by including and then omitting the control variables. Oster’s (2017) formula provides a proportionality coefficient, \(\delta\), which compares the strength of selection on observable and unobservable variables, suggesting one as a cutoff \(\delta\)-value for comparison.Footnote 7

Table 5 presents the estimates of crash risk measuresFootnote 8 and CPAO in the main regression in Table 2. The calculated \(\delta\)-values are based on the movements recorded in panel A. We report the values of \(R_{max}\) = 1.3 * \(R^{2}\) as the main results of the diagnostic tests. The results show that to drive the coefficients down to zero, the selection of unobservable variables should be 26.409 times more significant than that on observable variables in the \(NCSKEW_{t}\) regressions and 271.923 times more significant in the \(DUVOL_{t}\) regressions. Interpreting the results is clear because situations in which the calculated \(\delta\)-values are significantly greater than the threshold (i.e., \(\left| \delta \right| > 1\)) are very unlikely to occur (Oster 2017). This means that the baseline regressions (Table 2) control for the first-order determinants of crash risk and the included coefficients are stable. Therefore, the selection of unobservable variables does not hinder our main regression.Footnote 9

Financial crisis

In this subsection, we test whether the aforementioned relationship between the CPAO and the risk of a future stock price crash is observed, excluding the financial crisis period (2008–2011).Footnote 10 Real estate is one of the largest classes of pledgeable assets (Zeckhauser and Silverman 1983; Brounen and Eichholtz 2005; Zhao and Sing 2016) and a major cause of the Great Recession (Paul 2010). The real estate bubble peaked in early 2006. Consequently, in 2008, prices began to decline sharply, before reaching their lowest point in 2012.Footnote 11 Therefore, the sudden drop in US real estate prices directly and indirectly affected the mortgage markets, institutions, and firms. In other words, pledgeable assets, including real estate, are no longer pledgeable during a financial crisis. This implies that managers’ tendency to hoard bad news may not be affected by pledgeable asset holdings during crisis periods. Therefore, although we show that the amount of pledgeable assets is negatively associated with the future risk of a stock price crash, the relationship may be biased because of the effects of including the financial crisis period. All other methods and control variables are identical to those used in baseline regression. The idea is that since many concurrent events occur during the crisis period, it may be difficult to find a suitable explanation for the empirical findings.

Table 6 presents the results, excluding the financial crisis period. Similar to our main findings, we find a negative relationship between the CPAO and crash risk. Our findings indicate that the baseline results are not potentially biased by the sample during the financial crisis period.

Extension of forecasting windows

In this subsection, we further test the predictive power of the CPAO variable by examining longer forecasting periods, namely two- and three-year-ahead windows. If pledgeable asset ownership is a good measure of a firm’s future crash risk, it should hold for longer forecasting periods. To test this conjecture, we first calculate \(CRASH_{t}\), \(NCSKEW_{t}\), and \(DUVOL_{t}\) using each firm’s weekly returns during the two -and three-year periods. This procedure reduces the number of observations from 88,248 (Table 2) to 80,946 and 72,615 for the two and three-year periods, respectively.

Table 7 presents the results. Columns 1–3 report the effects of the CPAO on two-years-ahead stock price crash risk, and Columns 4–6 report their effects on three-years-ahead risk. Regardless of the forecasting window, we find a unidirectional negative association between CPAO and the risk of a future stock price crash. Overall, the results imply that the CPAO is a strong measure of the risk of a future stock price crash and that it has a predictive ability up to three years ahead.

Alternative variables

Another potential concern of this study is the measurement bias. Our main variable of interest, CPAO (calculated as the sum of building costs (item name: FATB), land and improvements (item name: FATP), and lagged construction in progress (item name: FATC), divided by total assets), may not correctly measure the CPAO. These findings confound our interpretation of our main findings. Therefore, we adopt two alternative definitions of CPAO: the sum of building costs (FATB), land and improvements (FATP), and lagged construction in progress (FATC), divided by net PPE (\(CPAO\left( {PPE} \right)_{t - 1}\)) (Tuzel 2010), and net PPE divided by total assets (\(CPAO\left( {Asset} \right)_{t - 1}\)) (Brounen and Eichholtz 2005). All the variables are constructed using the Compustat database. The remaining control variables are identical to those listed in the main table. We limit the data period from 1988 to 2019 to ensure consistency with the stock price crash risk data.

Table 8 presents the results. Columns 1–3 present the results when the main variable of interest is \(CPAO\left( {PPE} \right)_{t - 1}\), and Columns 4–6 present the results when the main variable of interest is \(CPAO\left( {Asset} \right)_{t - 1}\). The results obtained using these alternative measures are qualitatively similar to those reported in Table 2. Therefore, our findings are not driven by measurement bias.

We use the S&P 500 index as a benchmark market index to calculate crash risk measures. While this is a commonly accepted method in the crash risk literature, we further calculate the crash risk variables by calculating the return residuals by discounting Fama and French’s (2015) five factors. The baseline regression results using crash risk measures that discount Fama and French’s (2015) five factors are reported in Table 9. We find that the negative relationship between CPAO and other stock price crash risk measures still holds true.

Finally, we use different industry classifications to verify the significance of the industry fixed effects model, following the industry classification method suggested by Hoberg and Phillips (2016). They suggest text-based network industries. The baseline regression results using the different industry fixed effects models are presented in Table 10. We again confirm that CPAO is negatively associated with the likelihood of a future stock price crash risk.

Further test

Information transparency channel

With a significant baseline estimation result that firms with higher volumes of pledgeable assets are less likely to hide and hoard negative information, we then move the focus to the possible channels that may affect the firm’s bad news-hiding behavior. Therefore, in this section, we investigate the channels through which firms with CPAOs reduce their stock price crash risk. If pledgeable asset-owning firms lead to less bad news hiding behavior, then we should observe less informational opacity. The CPAO is expected to increase the collateral value of the firm, thereby enhancing corporate transparency and limiting bad news hoarding, resulting in a lower stock price crash risk. To test the information opacity channel, we examine whether information opacity decreased after board reformation.

Following the literature on corporate information opacity and crash risk, we construct an opacity variable (Hutton et al. 2009). Opacity is measured by the three-year moving sum of absolute discretionary accruals (Hutton et al. 2009). Prior studies find that accrual management obscures at least some information about firm fundamentals (Sloan 1996), and is thus a direct, firm-specific measure of opacity. In addition, aggressive earnings management is likely to be a proxy for management’s general proclivity to hide information from the capital market, and thus captures less easily quantifiable or observable aspects of opacity. Loureiro and Silva (2018) also find that firms with less earnings management reduce their crash risk likelihood. Thus, we hypothesize that an increased CPAO would decrease accruals, which reduces managers’ incentives to withhold negative information.

We also use the readability of a firm’s annual financial reports (10-Ks) as another channel to explain the relationship between CPAO and future crash risk. Financial reports are one of the primary methods used by managers to communicate with investors. Thus, firms may strategically hide adverse information by obscuring the 10-K reports. For instance, Li (2008) shows that some firms strategically use less readable and longer annual reports to make information less transparent and hide adverse information from investors. Therefore, previous studies have used financial report readability to measure bad news hoarding behavior (Rogers et al. 2014; Li and Zhan 2019). We calculate the readability of the 10-k report by using the Bog index as a proxy and test how CPAO is associated with the readability of the annual report (Bonsall et al. 2017).Footnote 12 Kim et al. (2019) find that 10-K readability is associated with a reduced likelihood of crash risk. An increase in the CPAO may reduce a firm’s risks, implying that those firms have less incentive to make obscure financial reports. Thus, we conjecture that the increased CPAO would reduce the Bog index or increase the readability of the 10-K reports.

Table 11 presents the regression results. Column (1) shows the results for the opacity measure, and Column (2) presents the regression results for 10-K readability. Consistent with this hypothesis, we find that CPAO is negatively associated with future accrual. Furthermore, we show that a firm’s 10-Ks becomes less difficult to read given the higher volume of pledgeable assets. The analysis confirms that firms with a higher volume of pledgeable assets have relatively fewer incentives to hide and hoard negative news.

Conclusion

Regardless of their location, firms strategically manage the level of pledgeable assets in their asset portfolios. Leaving aside the ongoing debate about whether the CPAO benefits firms, firms have maintained a certain level of pledgeable assets for decades (Zhao and Sing 2016; Chaney et al. 2012). Although numerous prior studies examine how CPAO affects firm-specific risks, few have investigated its effect on managers’ behavior.

Therefore, we examine the association between variation in CPAO and managers’ behavior in terms of hoarding bad news proxied by crash risk measures. Our findings show that, as CPAO increases, the risk of a future stock price crash decreases. When a firm increases its level of pledgeable assets, it sends a positive signal to investors that it is pursuing assets that provide insurance against risk, or assets that may increase the likelihood of receiving external loans. Therefore, increasing the CPAO significantly reduces the likelihood of a stock price crash. Furthermore, to address potential endogeneity issues, we first adopt several robustness tests (IV, PSM, and coefficient stability tests), showing that the negative association between the CPAO and a firm’s risk of a stock price crash is not driven by endogeneity. We also revisit the baseline regression using alternative measures for CPAO, crash risk, and a fixed-effects model to further strengthen the argument.

Although we employed an instrumental variable based on the book value of real estate, it remains true that the pledgeability of these real estate assets is greatly affected by the actual market value. This is a limitation of the research and provides suggestions for future research. Using market value may reduce within-firm variation, thus enabling the observation of more evident relationships between CPAO and future crash risks. We leave this as a possible extension to future research.

Our study adds to the growing literature on asset pledgeability and provides implications for both firms and investors. We focus on the unique role of a firm’s real estate holdings in mitigating the risk of a crash and provide new evidence on the economic consequences of such ownership. We also extend the existing literature on crash risk by providing another source of stock price crash. Specifically, we provide empirical evidence linking the level of a firm’s asset pledgeability to the risk of a future stock price crash. Our findings provide policy implications related to protecting shareholder value because a change in a firm’s CPAO sends a signal to shareholders about whether the firm is vulnerable to a stock price crash.

Availability of data and materials

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Real estate is a typical example of a pledgeable asset (Chaney et al. 2012).

\(CRASH_{t}\), \(NCSKEW_{t}\) and \(DUVOL_{t}\) are popularly used stock price crash variables and detailed explanation and calculation of the variables are documented on the Sect. 3 of this paper.

Kim et al. (2014) use CSR scores as a proxy for CEOs’ philanthropic behavior.

We also adopt an identical baseline regression, except that it excludes the missing main variable of interest, CPAO. The results are consistent and reported in “Appendix C”. Furthermore, we employ industry times year (industry × year) fixed effects to understand whether firm with more CPAO are less likely to hide information within the same industry year and over time. This method allows us to control for unobservable time-varying industry-specific differences in CPAO measure. The results are statistically significant, and they are reported in “Appendix D”.

PSM is a popular econometric technique used to address endogeneity problems. The advantages of the PSM approach are documented in Armstrong et al. (2010), as follows: “…using propensity scores to generate matched pairs with maximum variation in the causal variable of interest while minimizing the variation in the controls is, in many cases, a superior econometric approach to matching on the outcome variable and relying on a linear or some other assumed functional form to control for confounding variables. Moreover, propensity-score methods also enable the researcher to explicitly quantify the sensitivity of the results for the primary causal variable to unobserved correlated omitted variables.”.

If \(\left| \delta \right| > 1\), for the selection of unobserved variables to drive the coefficient of interest to zero, it should be stronger than selection of observable variables. Thus, if the regression includes most first-order determinants of the dependent variables, the selection on unobservable factors is unlikely to be more important than the selection on observable factors.

Oster’s test is only valid when the variable is continuous; hence, we omit the estimation of \(CRASH_{t}\) because it is an indicator variable.

To ensure the robustness of the findings, we consider more conservative thresholds of \(R_{max}\), such as \(R_{max}\) = 2.0 * \(R^{2}\) and \(R_{max}\) = 3.0 * \(R^{2}\), and run the same test. The results are similar and do not contain unobservable bias.

Based on the Case–Shiller home price index, real estate prices began dropping in 2007, before bouncing back from 2012. Therefore, we choose the sample period as 2008 to 2011, because the index price only decreased during this period.

Retrieved from the Case–Shiller home price index; “Appendix A” provides a historical index price change since 2002.

The lower value of Bog index indicates more readable document, while higher value indicates a more obscure text.

References

Aghion P, Bolton P (1992) An incomplete contracts approach to financial contracting. Rev Econ Stud 59(3):473–494

Almeida H, Campello M (2007) Financial constraints, asset tangibility, and corporate investment. Rev Financ Stud 20(5):1429–1460

Altonji JG (2005) Employer learning, statistical discrimination and occupational attainment. Am Econ Rev 95(2):112–117

An H, Zhang T (2013) Stock price synchronicity, crash risk, and institutional investors. J Corp Finan 21:1–15

Anderson TW, Rubin H (1949) Estimation of the parameters of a single equation in a complete system of stochastic equations. Ann Math Stat 20(1):46–63

Andreou PC, Louca C, Petrou AP (2017) CEO age and stock price crash risk. Rev Finance 21(3):1287–1325

Armstrong CS, Jagolinzer AD, Larcker DF (2010) Chief executive officer equity incentives and accounting irregularities. J Account Res 48(2):225–271

Bao D, Fung SYK, Su L (2018) Can shareholders be at rest after adopting clawback provisions? Evidence from stock price crash risk. Contemp Account Res 35(3):1578–1615

Benmelech E, Bergman NK (2009) Collateral pricing. J Financ Econ 91(3):339–360

Bhargava R, Faircloth S, Zeng H (2017) Takeover protection and stock price crash risk: evidence from state antitakeover laws. J Bus Res 70:177–184

Bonsall SB IV, Leone AJ, Miller BP, Rennekamp K (2017) A plain English measure of financial reporting readability. J Account Econ 63(2–3):329–357

Brounen D, Eichholtz PM (2005) Corporate real estate ownership implications: international performance evidence. J Real Estate Financ Econ 30(4):429–445

Callen JL, Fang X (2013) Institutional investor stability and crash risk: monitoring versus short-termism? J Bank Finance 37:3047–3063

Callen JL, Fang X (2015) Short interest and stock price crash risk. J Bank Finance 60:181–194

Campbell JY, Hentschel L (1992) No news is good news: an asymmetric model of changing volatility in stock returns. J Financ Econ 31(3):281–318

Cao HH, Coval JD, Hirshleifer D (2002) Sidelined investors, trading-generated news, and security returns. Rev Financ Stud 15(2):615–648

Chaney T, Sraer D, Thesmar D (2012) The collateral channel: How real estate shocks affect corporate investment. Am Econ Rev 102(6):2381–2409

Chen J, Hong H, Stein J (2001) Forecasting crashes: trading volume, past returns, and conditional skewness in stock prices. J Financ Econ 61:345–381

Cvijanović D (2014) Real estate prices and firm capital structure. Rev Financ Stud 27(9):2690–2735

Dimson E (1979) Risk measurement when shares are subject to infrequent trading. J Financ Econ 7(2):197–226

Donaldson JR, Gromb D, Piacentino G (2019) The paradox of pledgeability. J Financ Econ

Eisfeldt AL, Rampini AA (2009) Financing shortfalls and the value of aggregate liquidity. In: Unpublished working paper. Duke University and Northwestern University

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116(1):1–22

Fazzari S, Hubbard RG, Petersen B (1988) Investment, financing decisions, and tax policy. Am Econ Rev 78(2):200–205

French KR, Schwert GW, Stambaugh RF (1987) Expected stock returns and volatility. J Financ Econ 19:3–29

Gomes JF (2001) Financing investment. Am Econ Rev 91(5):1263–1285

Gorton G (2017) The history and economics of safe assets. Ann Rev Econ 9:547–586

Grossman SJ, Hart OD (1986) The costs and benefits of ownership: a theory of vertical and lateral integration. J Polit Econ 94(4):691–719

Hart O (1995) Corporate governance: some theory and implications. Econ J 105(430):678–689

Hart O, Moore J (1994) A theory of debt based on the inalienability of human capital. Quart J Econ 109(4):841–879

Hart O, Moore J (1990) Property rights and the nature of the firm. J Polit Econ 98(6):1119–1158

He G, Ren H (2017) Financial constraints and future stock price crash risk. In: Working paper

He G (2015) The effect of CEO inside debt holdings on financial reporting quality. Rev Acc Stud 20:501–536

Hoberg G, Phillips G (2016) Text-based network industries and endogenous product differentiation. J Polit Econ 124(5):1423–1465

Hutton AP, Marcus AJ, Tehranian H (2009) Opaque financial reports, R2, and crash risk. J Financ Econ 94:67–86

Jin L, Myers SC (2006) R-squared around the world: new theory and new tests. J Financ Econ 79:257–292

Kaplan SN, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financing constraints? Q J Econ 112(1):169–215

Kim J, Zhang L (2016) Accounting conservatism and stock price crash risk: firm-level evidence. Contemp Account Res 33:412–441

Kim J, Li Y, Zhang L (2011a) CFOs versus CEOs: equity incentives and crashes. J Financ Econ 101:713–730

Kim J, Li Y, Zhang L (2011b) Corporate tax avoidance and stock price crash risk: firm-level analysis. J Financ Econ 100:639–662

Kim Y, Li H, Li S (2014) Corporate social responsibility and stock price crash risk. J Bank Finance 43:1–13

Kim J, Wang Z, Zhang L (2016) CEO overconfidence and stock price crash risk. Contemp Account Res 33:1720–1749

Kim C, Wang K, Zhang L (2019) Readability of 10-K reports and stock price crash risk. Contemp Account Res 36(2):1184–1216

Kleibergen F (2002) Pivotal statistics for testing structural parameters in instrumental variables regression. Econometrica 70(5):1781–1803

Kothari SP, Shu S, Wysocki PD (2009) Do managers withhold bad news? J Account Res 47:241–276

Kou G, Akdeniz ÖO, Dinçer H, Yüksel S (2021a) Fintech investments in European banks: a hybrid IT2 fuzzy multidimensional decision-making approach. Financ Innov 7(1):1–28

Kou G, Xu Y, Peng Y, Shen F, Chen Y, Chang K, Kou S (2021) Bankruptcy prediction for SMEs using transactional data and two-stage multiobjective feature selection. Decis Support Syst 140:113429

Krumm PJ, Linneman P (2001) Corporate real estate management. Wharton Real Estate Rev 5(1)

LaFond R, Watts RL (2008) The information role of conservatism. Account Rev 83(2):447–478

Li F (2008) Annual report readability, current earnings, and earnings persistence. J Account Econ 45(2–3):221–247

Li S, Zhan X (2019) Product market threats and stock crash risk. Manage Sci 65(9):4011–4031

Li T, Kou G, Peng Y, Philip SY (2021) An integrated cluster detection, optimization, and interpretation approach for financial data. IEEE Trans Cybern

Loureiro G, Silva S (2018) Earnings management and stock price crashes: the deteriorating information environment post-cross-delisting

Oster E (2017) Unobservable selection and coefficient stability: theory and evidence. J Bus Econ Stat 40:1–18

Paul BP (2010) The role of macro imbalances in the US recession of 2007–2009. Int J Bus Econ 9(3):253

Rampini AA, Viswanathan S (2008) Collateral, financial intermediation, and the distribution of debt capacity. In: Working paper. Duke University

Roberts MR, Whited TM (2013) Endogeneity in empirical corporate finance 1. Handb Econ Finance 2:493–572

Rogers JL, Schrand CM, Zechman SL (2014) Do managers tacitly collude to withhold industry-wide bad news?. In: Chicago booth research paper, 13–12

Rosenbaum PR, Donald BR (1983) The central role of the propensity score in observational studies for causal effects. Biometrika 70:41–55

Sloan RG (1996) Do stock prices fully reflect information in accruals and cash flows about future earnings?. Account Rev 289–315

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Stock JH, Wright JH (2000) GMM with weak identification. Econometrica 68(5):1055–1096

Stulz R, Johnson H (1985) An analysis of secured debt. J Financ Econ 14(4):501–521

Tirole J (2010) The theory of corporate finance. Princeton University Press

Tuzel S (2010) Corporate real estate holdings and the cross-section of stock returns. Rev Financ Stud 23(6):2268–2302

Wen F, Xu L, Ouyang G, Kou G (2019) Retail investor attention and stock price crash risk: evidence from China. Int Rev Financ Anal 65:101376

Wu K, Ai W (2021) Do intangible assets foster corporate tax avoidance? Available at SSRN 3811955

Wu K, Lai S (2020) Intangible intensity and stock price crash risk. J Corp Finance 64:101682

Xu N, Li X, Yuan Q, Chan KC (2014) Excess perks and stock price crash risk: evidence from China. J Corp Finane 25:419–434

Yuan R, Sun J, Cao F (2016) Directors’ and officers’ liability insurance and stock price crash risk. J Corp Finane 37:173–192

Zeckhauser S, Silverman R (1983) Rediscover your company’s real-estate. Harv Bus Rev 61(1):111–117

Zha Q, Kou G, Zhang H, Liang H, Chen X, Li CC, Dong Y (2020) Opinion dynamics in finance and business: a literature review and research opportunities. Financ Innov 6(1):1–22

Zhao D, Sing TF (2016) Corporate real estate ownership and productivity uncertainty. Real Estate Econ 44(2):521–547

Funding

This work was supported by Institute for Information and communications Technology Planning and Evaluation (IITP) grant funded by the Korea government (MSIT) (No. 2017-0-01779, A machine learning and statistical inference framework for explainable artificial intelligence).

Author information

Authors and Affiliations

Contributions

SH and SG carried out the data handling and empirical analysis. HI conceived of the study and draft the first manuscript, and JY conceived of the study, carried out the test design and helped to draft, revise, and finalize the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

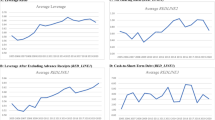

Appendix A: S&P/Case-Shiller U.S. National Home Price Index (2000–2019)

Appendix B: Variable definitions

Variable | Definition | |

|---|---|---|

Crash risk variables | ||

CRASHt | Equal to one if the firm has a weekly return that is less than 3.09 standard deviation below the average weekly return for the entire fiscal year | |

NCSKEWt | Negative of the third moment of firm-specific weekly returns for each firm and fiscal year divided by the standard deviation of firm-specific weekly returns raised to the third power | |

DUVOLt | Natural log of the ratio of the standard deviation of firm-specific weekly returns below the annual mean for the fiscal year to the standard deviation of firm-specific weekly returns above the annual mean for the fiscal year | |

Real estate variable | ||

CPAOt−1 | Corporate pledgeable asset ownership is derived from the components of the property, plant, and equipment (PPE), which is defined as the sum of building costs, land and improvements, and costs of construction in progress normalized by total assets. It is set to zero if missing | |

CPAO(PPE)t−1 | Sum of building costs, land and improvements, and costs of construction in progress normalized by property, plant, and equipment (PPE). It is set to zero if missing | |

CPAO(Asset)t−1 | Property, plant, and equipment (PPE) normalized by total assets. It is set to zero if missing | |

Control variables | ||

DTURNt−1 | Detrended turnover, defined as the difference between the average monthly share turnover over the current fiscal-year period and the average monthly share turnover over the previous fiscal-year period, where monthly share turnover is calculated as the monthly trading volume divided by the total number of shares outstanding during the month | |

NCSKEWt−1 | One-year lagged value of NCSKEWt | |

SIGMAt−1 | Standard deviation of firm-specific weekly stock returns over the fiscal year | |

RETt−1 | Average firm-specific weekly return during the entire fiscal year | |

SIZEt−1 | Natural log of total assets | |

MBt−1 | Ratio of the market value of equity to the book value of equity | |

LEVt−1 | Long-term debt divided by total assets | |

ROAt−1 | Income before extraordinary items divided by lagged total assets | |

ACCt−1 | Performance-matched discretionary accruals following Kothari, Leone, and Wasley (2005) | |

R&Dt−1 | Ratio of research and development expenses to total assets. Missing values of research and development expenses are replaced with zero | |

R&D_MISSINGt−1 | Dummy variable that equals one if the value of research and development expenses is missing | |

KURt−1 | Kurtosis of firm-specific weekly returns over the fiscal year | |

GWt−1 | The ratio of goodwill to total assets. Missing values of goodwill are replaced with zero | |

LOG_FIRM_AGEt−1 | The natural log of one plus firm age. Firm age is measured as the number of years the firm has been reported on COMPUSTAT | |

Other variables | ||

CPAO_IND_MEANt−1 | The yearly average of firms’ CPAO given industry except itself | |

LOG_BOGt | The natural log of one plus Bog index | |

OPAQUEt | Three-year moving sum of the absolute value of ACCt-1 | |

Appendix C: Main results without missing value

This table reports main OLS regression results without the observation which have missing value on real estate. The sample covers 72,479 U.S. public firm-year observations in CRSP and Compustat database from 1988 to 2019 with non-missing values for the crash risk measures and all independent variables. All models include controls, year, and industry fixed effects. Reported in parentheses are p-values based on standard errors clustered by firm. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively. All variables are defined in “Appendix B”.

CRASHt | NCSKEWt | DUVOLt | |

|---|---|---|---|

(1) | (2) | (3) | |

CPAOt−1 | − 0.333*** | − 0.162*** | − 0.088*** |

(0.000) | (0.000) | (0.000) | |

DTURNt−1 | 0.212*** | 0.112*** | 0.082*** |

(0.000) | (0.001) | (0.000) | |

NCSKEWt−1 | 0.063*** | 0.048*** | 0.029*** |

(0.000) | (0.000) | (0.000) | |

SIGMAt−1 | − 3.407*** | − 1.414*** | − 0.933*** |

(0.000) | (0.000) | (0.000) | |

RETt−1 | 16.977*** | 15.148*** | 10.470*** |

(0.000) | (0.000) | (0.000) | |

SIZEt−1 | 0.056*** | 0.071*** | 0.044*** |

(0.000) | (0.000) | (0.000) | |

MBt−1 | 0.015*** | 0.028*** | 0.024*** |

(0.000) | (0.000) | (0.000) | |

LEVt−1 | − 0.140*** | − 0.178*** | − 0.130*** |

(0.005) | (0.000) | (0.000) | |

ROAt−1 | 0.131*** | 0.034*** | 0.012* |

(0.001) | (0.009) | (0.093) | |

ACCt−1 | 0.030 | − 0.005 | − 0.000 |

(0.250) | (0.695) | (0.984) | |

R&Dt−1 | 0.070 | − 0.058* | − 0.105*** |

(0.292) | (0.095) | (0.000) | |

R&D_MISSINGt−1 | − 0.067*** | − 0.000 | 0.009 |

(0.007) | (0.967) | (0.205) | |

KURt−1 | 0.025*** | 0.004*** | 0.002** |

(0.000) | (0.009) | (0.016) | |

GWt−1 | 0.142* | 0.079** | 0.045* |

(0.079) | (0.031) | (0.078) | |

LOG_FIRM_AGEt−1 | − 0.139*** | − 0.087*** | − 0.057*** |

(0.000) | (0.000) | (0.000) | |

Constant | − 1.266*** | − 0.224*** | − 0.168*** |

(0.000) | (0.002) | (0.004) | |

Year FE | Yes | Yes | Yes |

Industry FE | Yes | Yes | Yes |

Observations | 72,479 | 72,479 | 72,479 |

Pseudo/Adj. R2 | 0.032 | 0.061 | 0.061 |

Appendix D: Main results with industry × year fixed effects

This table reports main OLS regression results with industry × year fixed effects. The sample covers 88,248 U.S. public firm-year observations in CRSP and Compustat database from 1988 to 2019 with non-missing values for the crash risk measures and all independent variables. All models include controls and industry × year fixed effects. Reported in parentheses are p-values based on standard errors clustered by firm. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively. All variables are defined in “Appendix B”.

CRASHt | NCSKEWt | DUVOLt | |

|---|---|---|---|

(1) | (2) | (3) | |

CPAOt−1 | − 0.236*** | − 0.115*** | − 0.061*** |

(0.001) | (0.000) | (0.002) | |

DTURNt−1 | 0.213*** | 0.114*** | 0.077*** |

(0.000) | (0.000) | (0.000) | |

NCSKEWt−1 | 0.066*** | 0.048*** | 0.029*** |

(0.000) | (0.000) | (0.000) | |

SIGMAt−1 | − 3.709*** | − 1.238*** | − 0.773*** |

(0.000) | (0.000) | (0.000) | |

RETt−1 | 17.390*** | 15.311*** | 10.715*** |

(0.000) | (0.000) | (0.000) | |

SIZEt−1 | 0.037*** | 0.066*** | 0.040*** |

(0.000) | (0.000) | (0.000) | |

MBt−1 | 0.017*** | 0.028*** | 0.024*** |

(0.000) | (0.000) | (0.000) | |

LEVt−1 | − 0.158*** | − 0.171*** | − 0.122*** |

(0.001) | (0.000) | (0.000) | |

ROAt−1 | 0.119*** | 0.036*** | 0.012 |

(0.001) | (0.004) | (0.109) | |

ACCt−1 | 0.034 | 0.000 | 0.003 |

(0.164) | (0.991) | (0.706) | |

R&Dt−1 | − 0.003 | − 0.059* | − 0.108*** |

(0.957) | (0.060) | (0.000) | |

R&D_MISSINGt−1 | − 0.072*** | 0.002 | 0.012* |

(0.002) | (0.836) | (0.082) | |

KURt−1 | 0.029*** | 0.003** | 0.002** |

(0.000) | (0.014) | (0.044) | |

GWt−1 | 0.206*** | 0.125*** | 0.082*** |

(0.009) | (0.000) | (0.001) | |

LOG_FIRM_AGEt−1 | − 0.134*** | − 0.082*** | − 0.052*** |

(0.000) | (0.000) | (0.000) | |

Constant | − 1.855* | 0.028 | 0.021 |

(0.075) | (0.287) | (0.285) | |

Industry × Year FE | Yes | Yes | Yes |

Observations | 88,248 | 88,248 | 88,248 |

Pseudo/Adj. R2 | 0.047 | 0.075 | 0.083 |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Jung, H., Choi, S., Lee, J. et al. Corporate pledgeable asset ownership and stock price crash risk. Financ Innov 8, 28 (2022). https://doi.org/10.1186/s40854-022-00334-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-022-00334-9