Abstract

Background

Smallholder farmers in developing countries are particularly vulnerable to climate shocks but often lack access to agricultural insurance. Weather index insurance (WII) could reduce some of the problems associated with traditional, indemnity-based insurance programs, but uptake has been lower than expected. One reason is that WII contracts are not yet sufficiently tailored to the needs and preferences of smallholder farmers. This study combines survey and choice-experimental data from Kenya to analyze the experience with an existing WII program and how specific changes in the contractual design might encourage uptake.

Results

Many smallholders struggle with fully understanding the functioning of the program, which undermines their confidence. Regular provision of relevant rainfall measurements and thresholds would significantly increase farmers’ willingness to pay for WII. Mechanisms to reduce basis risk are also positively valued by farmers, although not to the same extent as higher levels of transparency. Finally, offering contracts to small groups rather than individual farmers could increase insurance uptake.

Conclusions

Better training on WII and regular communication are needed. Group contracts may help to reduce transaction costs. Farmer groups can also be important platforms for learning about complex innovations, including novel risk transfer products. These concrete results are specific to Kenya; however, they provide some broader policy-relevant insights into typical issues of WII in a small-farm context.

Similar content being viewed by others

Background

Climate change will affect agricultural production through higher mean temperatures and more frequent weather extremes [1, 2]. Higher variability in crop yields and food prices may increase poverty and food insecurity, especially in developing countries [3, 4]. Smallholder farmers, who make up a large share of the world’s poor and undernourished people, could suffer the most [5]. Often located in the tropics and subtropics, smallholders are particularly vulnerable to climate shocks, and they are usually also ill-equipped to cope with risks [6]. After severe weather events, small farm households often end up selling productive assets to smooth consumption [7]. Frequent weather extremes are also associated with risk-avoidance strategies, such as low uptakes of productivity-enhancing inputs and technologies [8]. Thus, climate shocks can cause and perpetuate poverty traps in the small-farm sector. Agricultural insurance could help, but is literally non-existent in most developing countries due to institutional constraints, including high transaction costs and issues of moral hazard and adverse selection [9,10,11].

Weather index insurance (WII) is a relatively new type of financial risk transfer product, which could help to overcome some of the problems with traditional insurance schemes [12, 13]. Unlike indemnity-based crop insurance, where an insured farmer receives compensation for the verifiable loss at the end of the growing season, WII makes claim payments based on the realization of an objectively measured weather variable (e.g., rainfall) that is correlated with production losses [14, 15]. Neither the insured farmer nor the insurer can easily manipulate rainfall measurements, which reduces issues of information asymmetry. Moreover, instead of reducing effort to increase chances of compensation, farmers with WII actually have an incentive to make the best farming decisions [13]. In comparison with traditional insurance, WII is less expensive to administer, which can lead to more affordable contracts and faster payments to farmers, who often need the funds for timely planting in the subsequent season [16].

Despite these potential benefits, voluntary uptake of index insurance products is much lower than was initially anticipated [17]. Importantly, poor households, who are particularly risk-averse and could benefit most from novel micro-insurance products, were found to be hesitant in adopting WII, unless when premiums are subsidized or bundled with other benefits, such that insurance becomes quasi-compulsory [18, 19]. This mismatch between anticipated and actual demand among smallholder farmers is attributed to liquidity constraints during planting time, limited trust, and lack of insurance experience [20,21,22]. Others cite basis risk or the residual risk that often remains with the index insurance holder as a major issue [14, 23,24,25,26]. Several field experimental studies were undertaken to better understand farmers’ insurance demand and its determinants [27,28,29]. However, farmers’ preferences and willingness to pay for specific attributes of WII contracts have rarely been analyzed. Such knowledge could help to better adjust WII contracts and policies to the needs of smallholder farmers in different contexts. Here, we address this knowledge gap by using data from smallholder farmers in Kenya.

It would be interesting to observe how farmers actually respond to certain changes in the contractual design of a WII scheme. However, observational data with suitable variations in insurance contracts are not available. As an alternative, choice experiments can be conducted to analyze peoples’ preferences for hypothetical contract features that are not (yet) observable in the market. A few studies used choice experiments to examine farmer attitudes toward WII in developed countries, such as Germany and Finland [30, 31]. Two recent studies applied this method to estimate farmers’ willingness to pay for WII in Ethiopia and Bangladesh [32, 33]. The study by [32] found that apart from the premium charged and expected pay-outs, demand for WII was also determined by perceived frequency of droughts and the type of institutions involved in WII distribution. On the other hand, [33] analyzed gender disparities in preferences for WII. They showed that female farmers were more insurance averse, mainly due to differences in financial literacy, and the level of trust toward insurance providers. We add to this choice-experimental literature by analyzing more explicitly how farmers might react to changes in WII contracts aimed at reducing typical issues in a smallholder context. In particular, we study possible mechanisms to reduce basis risk and to increase farmers’ confidence in WII products.

A typical problem that contributes to low confidence in WII is that farmers often do not fully understand when exactly a payment is triggered [12, 14, 25]. Even when the rainfall threshold is clearly stated in the contract, this refers to a weather station located at some distance to the farm, so the insured farmer is usually not perfectly informed. A larger network of weather stations to decrease the mean distance to farms may be one mechanism to reduce basis risk. Another mechanism to improve confidence is regular communication of the weather data recorded at relevant stations. Transparent communication could also help to reduce farmers’ distrust in the insurance provider. While some experimental evidence on the importance of trust in micro-insurance uptake exists [21, 33, 34], the specific influence of insurer transparency on WII demand has never been researched. We use contract features related to distance and regular communication in our choice experiment.

In addition, we analyze the possible role of insurance contracts with farmer groups instead of individual farmers. Group contracts are being proposed as a potential mechanism to increase WII uptake in the small-farm sector [10, 12, 35]. Farmer groups could influence demand for WII through several pathways. First, groups can help to reduce transaction costs. Second, groups can be efficient channels for disseminating information about innovative technologies and products [36, 37]. Third, and related to the previous point, groups may provide a learning platform that increases farmers’ confidence in trying out unfamiliar insurance products [38]. Finally, farmer groups often involve networks that interact in various social dimensions and have norms on how to internalize idiosyncratic risks of their members [39]. Against this background, group WII contracts that help to mitigate covariate weather risks could have interesting complementary effects [10, 12, 35, 40]. Empirical evidence on the effect of group contracts on farmers’ willingness to adopt WII is scarce. A few studies have confirmed a positive influence of informal risk-sharing networks [41, 42]. Others suggest that group dynamics and possible distrust toward other members might actually make group insurance less attractive than individual contracts [43, 44].

The purpose of this paper is to analyze farmers’ preferences for WII, to estimate the average willingness to pay for proposed contract attributes, and to understand causes of heterogeneity in farmer preferences, so as to suggest ways of improving insurance uptake. Our analysis builds on a survey and choice experiment carried out with smallholder farmers in Kenya. Farmers in Kenya already had the opportunity to gain first-hand experience with WII contracts. Since 2009, the so-called Kilimo Salama Program has provided index-based crop insurance products in various parts of the country. We briefly describe this existing program in the next section, before presenting and discussing details of the methodological approach and results.

Weather index insurance in Kenya

Crop production in Kenya takes place mostly under rain-fed conditions, with weather fluctuations having a great impact on productivity [45]. Well-designed WII contracts could therefore be beneficial for development given such production uncertainties. Several pilot projects to introduce WII have been implemented with technical support from the World Bank and other development agencies. Kilimo Salama, which was launched by the Syngenta Foundation for Sustainable Agriculture, is the most widely known and successful out of these projects [46]. Kilimo Salama was started in 2009 as a small initiative with only 200 farmers. By 2013, the project covered close to 200,000 farmers in Kenya, Rwanda, and Tanzania, with a total sum insured of 12.3 million US dollars [47, 48]. While this growth within a few years is impressive, it cannot mask the fact that up till now only a small fraction of farmers has actually adopted WII. In 2014, Kilimo Salama transitioned into a commercial business under the new name ‘Agriculture and Climate Risk Enterprise’ (ACRE). In this study, we stick to the old name because this is better known in the literature.

Kilimo Salama offers rainfall index insurance products that cover farmers against drought and excess rain. As is common for weather-based insurance schemes, Kilimo Salama relies on data from automated weather stations to monitor local rainfall. Farmers are allowed to choose the station that best represents their farm conditions. Initially, the contracts were designed for maize and wheat, but more recently products for other crops have also been developed [47]. Contracts are sold for a crop season divided into three phases (early growth, flowering, and grain filling), which vary in duration and rainfall thresholds. Contracts are location-specific, and threshold (or strike) levels reflect the minimum agronomic requirements for normal plant growth during each particular phase. If the cumulative rainfall in a given phase falls below the threshold (for drought) or exceeds the threshold (for excess rain), a pay-out is triggered for all farmers holding a contract with reference to the particular weather station. The pay-out amount is calculated per millimeter of rainfall below (or above) the strike level and increases proportionately up to the maximum pay-out. However, as we learned through our survey, farmers are rarely aware of the exact details of the pay-out function, even when they purchase an insurance contract. At the end of the contract period, the sum of triggered pay-outs over the three phases is sent to farmers through mobile money transfer. This is different from traditional indemnity-based crop insurance programs, where the insurer has to physically visit the farm to assess individual crop damage.

One important element for the smooth functioning of Kilimo Salama is the existence of a vibrant mobile money network (M-PESA) that facilitates farmers’ access to various financial services [48, 49]. In many cases, farmers purchase WII linked to agricultural loans; in the event of unfavorable weather conditions, the insurer compensates the credit institution, which then writes off the loans of affected farmers. Kilimo Salama also offers input insurance through local input dealers. In that case, the insurance premium is included in the price of purchased inputs.

In 2011, Kilimo Salama-plus was launched, which offers the option to either only insure the cost of the inputs at a lower premium or the value of the output at a higher premium. Both options are offered through local input dealers on behalf of the insurer. The dealers have technical equipment to directly transmit purchase information to an administrative server, which also automatically triggers pay-outs to farmers via M-PESA. To keep our choice experiment simple and easy to understand for farmers, our hypothetical contracts build on the output-based insurance option, as is explained in more detail below.

Materials and methods

The farm survey

This study builds on data from a choice experiment and a socio-economic survey of farm households in Kenya. Primary data were collected in 2014 among smallholder farmers in Embu County, Kenya. Embu was chosen because WII initiatives have been implemented in that area for more than 5 years [50]. This ensured farmers’ familiarity with this type of insurance. Farmers in Embu are predominantly small-scale, and uncertainty about the timing and amount of rainfall is a serious issue in this part of Kenya [51].

The farm households to be surveyed were selected using a stratified sampling procedure. At first, we purposively selected Embu-East sub-county, which had a relatively high number of farmers insured under Kilimo Salama. However, even in Embu-East insurance coverage was below 10%. Embu-East has two administrative divisions (Kyeni and Runyenjes); within each division, we randomly selected three sub-locations (smallest administrative units). In each of the six sub-locations, we interviewed all farmers that were insured at the time of the survey or had purchased an insurance contract in previous years. These farmers were identified through lists provided by Kilimo Salama field staff. Overall, we surveyed 152 “ever-insured” farmers. In addition, we randomly selected 234 non-insured farmers in the same six sub-locations, resulting in a total sample size of 386.Footnote 1 While we deliberately over-sampled insured farmers, the two sub-samples are representative for “ever-insured” and non-insured farmers in Embu-East.

The survey involved face-to-face interviews, which were administered with the help of a small team of local enumerators. The enumerators were students from Egerton University that we hired and trained for this research. The survey instrument included a structured questionnaire to capture socio-economic data at farm and household level, including risk preferences, past experiences with weather shocks, and attitudes toward the existing WII contracts. In addition, each sample farmer participated in a carefully designed choice experiment. In this choice experiment, farmers were asked to make selections between various hypothetical WII insurance options to better understand possible responses to contract changes. Details of the choice experiment are explained in the following.

Discrete choice experiment

We developed and used a discrete choice experiment (DCE) to evaluate subjective preferences of farmers for WII contracts. In particular, we want to assess how farmers value specific contract attributes and trade-off between different attribute levels, which is not possible with other common preference elicitation methods such as contingent valuation [52]. The theoretical basis for DCEs is Lancaster’s consumer choice theory, which postulates that an individual derives utility from the different attributes of a good [54]. DCEs are also consistent with random utility theory, which suggests that, given a finite set of alternatives, a rational individual will always prefer the alternative that yields the highest utility [52]. DCEs are frequently applied in agriculture and environmental valuation to study consumer and producer preferences in multi-attribute choice problems [55,56,57,58]. But, as explained, choice-experimental methods have not yet been widely used to analyze farmer preferences for WII.

Experimental design

For designing the DCE, we first identified contract attributes of possible interest in the WII context through a review of the relevant literature [25, 30, 40, 59, 60]. Then, we carried out focus group discussions with farmers in Kenya and also consulted local insurance agents and agricultural extension officers to narrow down the list of possible attributes to those most meaningful in a smallholder context. In order not to overburden participants in the experiment , we eventually decided to use five contract attributes, as shown in Table 1.

“Premium rate” is the fee charged for insurance coverage. This is expressed as a percentage of the maximum pay-out (expected value of harvest per acre), irrespective of the type of crop cultivated. In the existing WII contracts, premium rates are calculated based on the historical frequency and severity of certain weather events plus a small percentage loading for implementation costs. A simple example, severe droughts in Kenya occur every 7–10 years, so the average premium charged in existing contracts is about 10% (assuming a maximum pay-out). Yet, since the rates are adjusted to local weather conditions where shocks may occur more or less often, premium rates in the Kilimo Salama Program range from 5 to 25% depending on the location [47]. We included six levels ranging from 2 to 20% in the DCE, in order to predict farmers’ responsiveness to changing prices.

Apart from the premium rate, which is treated as numerical, all the other attributes were effects-coded, thus ensuring that the effect of reference levels is not correlated with the intercept [61]. “Strike level,” refers to the percentage deviation in rainfall at which the index triggers a pay-out to the insurance holder in a particular phase of the crop season. We chose to include six levels, where a negative sign (e.g., − 20%) refers to drought contracts, and double signs (e.g., ± 20%) refer to contracts that insure both drought and excess rainfall. Strike levels indicate the magnitude of loss (mild, moderate, or severe) that farmers have to personally manage before a pay-out is triggered. Strike levels also determine how frequently insured farmers will receive compensation over the years. Higher levels (say 40% rainfall deviation) decrease the probability of compensation, hence making insurance contracts more affordable. But this also reduces eligibility and frequency of payments, since payments will only be triggered by rare but extremely severe losses [16, 18]. The tick size (i.e., the payment per millimeter of rainfall deviation) was not varied across attribute levels.

The third attribute is distance from the farm to the weather station, which we use as a proxy for basis risk. With shorter distances, pay-outs will be more closely correlated with actual yield losses on the farm [60]. Distance also signifies the radius of the insurance zone. Insured farmers within this zone pay the same premium rate and receive pay-outs at the same time [13]. For this attribute, we considered three levels as shown in Table 1.

The fourth attribute relates to insurer transparency. In two attribute levels, we differentiate between transparent and non-transparent contracts, referring to the weather information provided to farmers. For transparent contracts, insured farmers would receive weekly text messages from the insurer, summarizing rainfall measurements at the reference weather station, required measurements for a pay-out, and whether a threshold for pay-out has actually been reached in that phase. This information would be publicly verifiable, by comparing with radio broadcasts about local weather facilitated by the national meteorological department. In the Kilimo Salama Program, such information is currently not provided to farmers, but the proposed intervention would be technically feasible without much extra cost.

The last attribute refers to the “contracted party,” which allows us to analyze farmer preferences for individual versus group contracts. Currently, Kilimo Salama sells contracts only to individuals. As explained, group contracts may potentially be attractive for farmers to reduce transaction costs and benefit from mutual learning and broader risk-sharing arrangements. But the effectiveness of groups may depend on group size [36, 62]. Hence, we distinguish between small groups (10 members) and large groups (100 members) in different attribute levels. In Kenya, a minimum of 10 members is required for a group to be legally registered.

The next step in the DCE design was to come up with meaningful choice alternatives from varying combinations of attributes and attribute levels. The generic nature of the research problem prompted the use of an unlabeled experiment [63]. A full factorial design based on the five attributes and associated attribute levels gives a total of 648 (21 ×32 ×62) possible combinations. Using SAS macros [64], we developed 12 generic choice sets with a calculated D-efficiency of 0.79. To prevent fatigue and resulting inefficiency in answering, these 12 choice sets were randomly divided into three blocks, and only one of these blocks was randomly assigned to each participating farmer. That is, each farmer participated in four choice sets by choosing one out of three hypothetical insurance contracts. Every choice set also included a “no-insurance” opt-out choice, which farmers could select when none of the contract choices was satisfactory to them. This design makes it possible to interpret welfare effects resulting from the proposed contract modifications [55].

Prior to presenting the choice sets, the different attributes and attribute levels were explained to farmers in their local language. The choice cards also had shortened texts and pictorial representations of the attribute levels to facilitate understanding. An example of a choice set presented to farmers is shown in Fig. 1.

Econometric Model

The choice data were analyzed using mixed logit (ML), a popular model in discrete choice analysis [65]. ML has several advantages over standard logit models. First, it allows utility parameters to vary over decision-makers rather than being fixed, hence accommodating for preference heterogeneity in the sample. Second, it relaxes the independence from irrelevant alternatives (IIA) assumption in standard logit models. In our case, Hausman specification tests showed that the IIA assumption was violated, so that the standard logit model would have produced biased estimates. Third, ML allows for correlation of unobserved factors over choice situations. In our experiment, each farmer responded to four choice sets, meaning that individual-specific characteristics did not vary. Correlation over choice sets could also occur due to learning effects or fatigue among respondents [63, 65].

The ML models were run in STATA using a maximum simulated likelihood estimator [66]. We assumed a lognormal distribution for the premium rate attribute, allowing us to restrict the coefficient sign to be negative (rational farmers will always prefer a lower premium, holding other things constant) while still being able to account for preference heterogeneity [67]. The coefficients for the non-monetary attributes were assumed to be independent and normally distributed because the direction of preferences could not be determined prior to estimation.

We start by first specifying a main-effects model, assuming preference heterogeneity for all attributes. The simplified empirical model is expressed as:

where \(y_{nt}\) is a binary variable that takes a value of one if farmer \(n\) chooses a WII contract in choice scenario \(t\), and zero otherwise. \(\alpha\) is an alternative specific constant (ASC), and \(\beta\) and \(\gamma '\) are parameters to be estimated for the premium rate (\(p_{nt}\)) and other contract attributes (\(x'_{nt}\)), respectively. The ASC captures the average effect of unobserved factors on utility [65]. In our specification, the ASC is defined such that it tells us how farmers value the no-contract option when observed factors are controlled for. That is, a negative ASC coefficient reveals a negative general attitude toward the non-contract option (a positive preference for WII contracts) and vice versa.

Next, we add interaction terms to analyze the influence of farmer-specific characteristics on contract preferences and thus better understand causes of preference heterogeneity. These extended models are specified as follows:

where \({\text{WII}}_{n}^{2014}\), \({\text{WII}}_{n}^{2013}\), and \({\text{WII}}_{n}^{\text{before}}\) are dummy variables that take a value of one if the household had last purchased WII in 2014, 2013, or any previous year, respectively. Thus, we can evaluate the influence of previous contract experience and drop-out on current contract preferences. In Eq. (3), \(z'_{n}\) is a vector of socio-economic factors that are expected to influence farmers’ demand for WII.

Finally, by working out the total derivative of utility (\(U_{nt}\)) with respect to changes in the premium rate and other contract attributes [\({\text{d}}U_{nt} = \beta_{n} dp + \gamma '_{n} {\text{d}}x'_{{}}\)] and setting this expression equal to zero, we can solve for:

which is the marginal willingness to pay (WTP) of farmer \(n\) for a change in attribute \(x_{k}\) [63]. Given that the premium rate is log-normally distributed, we use the median parameter which is less sensitive than the mean [68]. The median estimate for the premium rate is calculated as \(- \exp (\beta_{n} )\) [66].

Results and discussion

We first introduce sample descriptive statistics and farmers’ experience with the existing Kilimo Salama insurance scheme, before presenting and discussing results from the model estimates with the choice-experimental data.

Socio-economic characteristics

Table 2 presents descriptive statistics of socio-economic characteristics for the full sample of farmers, as well as separately for the sub-samples of ever-insured and non-insured farmers. Overall, sample farmers from Embu County are typical smallholders with an average farm size of around two acres. Statistically significant differences between the sub-samples are observed for sex, age, farming experience, and occupation of the household head. Female-headed households are more likely to purchase insurance than male-headed households mainly due to differences in their willingness/ability to take risk. Women tend to make less risky investment choices and are more vulnerable to weather-related risks [33]; hence, they would have a stronger demand for WII compared to men. Furthermore, insured farmers are older and more experienced than their non-insured colleagues, and they derive a larger share of their income from farming. This suggests that, to some extent, insurance may be a substitute for income diversification, which otherwise tends to be a common strategy to cope with risk. Farmers with access to WII training and those who have been organized in farmer groups for a longer period of time are also more likely to purchase insurance.

Farmers were also asked how willing they are to take risks in their farming decisions using a scale of 1 = very risk-averse to 10 = very risk-loving. This direct question about farmers’ perception of their risk behavior is an alternative to more comprehensive lotteries that can also be used to elicit risk attitudes. In [69], it is argued that farmers sometimes overstate their risk preference (understate their risk aversion) when asked directly, but that in terms of comparing relative risk attitudes, answers to direct questions are equally reliable as lotteries. The last row in Table 2 reveals that average risk preferences are indeed relatively high. However, as the same question was used for all sample farmers, relative comparisons should be in order. Interestingly, we do not observe a statistically significant difference in risk attitudes between ever-insured and non-insured farmers.

Table 3 outlines the main agricultural risks encountered by farmers in the study area. A 5-year recall period was used to enhance reliability in respondents’ answers. In addition to asking respondents about the frequency of events, they also had to rate the severity of shocks based on experienced losses, using a four-point Likert scale (1 = no effect, 2 = mild, 3 = severe, 4 = very severe). Over 80% of the farmers were affected by input and output price shocks, drought, and crop pests during the last 5 years. Other weather-related shocks, such as excess rain, frost, and hailstorms, were more localized, and also occurred less often.

Farmers’ experience with existing WII

We now look at experiences with the existing WII in the Kilimo Salama Program, based on farmers’ responses to the survey questions. Table 4 shows that the number of insured farmers has increased since 2009, when WII started as a small pilot project. However, the number of insured farmers has not further increased since 2012, and has actually fallen in 2014. Similarly, the number and share of insured farmers who received payments have declined since 2012. The lower share of farmers paid in 2013 may possibly have contributed to lower insurance purchase in 2014. Yet, the majority (62%) of all ever-insured farmers has been compensated at least once since the start of the program.

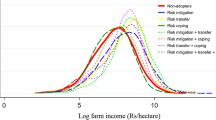

Farmers’ responses reveal that actual insurance payments do not always coincide with their own assessment of yield losses. Differences may be due to basis risk, but they contribute to a lower level of confidence from the farmers’ point of view. Figure 2 illustrates that in the early years of the WII program, several farmers had received pay-outs without having experienced significant yield losses. It is possible that the insurance program paid more generously in the beginning to encourage more farmers to participate in subsequent years. However, in 2013, when many farmers experienced crop losses due to low rainfall, the index failed to trigger a pay-out. As indicated above, this may have contributed to lower insurance uptake in 2014.

Some of the ever-insured farmers purchased insurance in several years, others only in 1 year. The average number of years that farmers in this sub-sample were insured is 2.2 (out of the 6 years considered). Dropping-out is not uncommon, indicating that not all farmers are fully satisfied with their WII experience. In the survey, we assessed the farmers’ level of satisfaction, using a list of 22 statements. Farmers were asked whether they agree or disagree with each statement based on a five-point Likert scale ranging from “completely disagree” to “completely agree.” As most farmers in our sample were aware of WII and had some opinion, the same questions were asked to all respondents, not only those who had ever purchased insurance themselves. Out of the 22 responses for each farmer, we calculated mean satisfaction levels, as summarized in Fig. 3. The majority of the farmers are in the “neutral” category, meaning that they are neither particularly satisfied nor dissatisfied with the WII program. Yet, further disaggregation shows that mean levels of satisfaction are higher among those who had ever purchased insurance themselves than among the non-insured. Overall, this analysis suggests that most farmers have neutral or positive attitudes toward WII in general, but that there is scope for further improvement in the insurance products.

Choice-experimental results

We now present and discuss results from the DCE. Model (1) in Table 5 shows the ML estimates of the main-effects model without interaction terms. Most of the mean parameters are statistically significant with expected signs, suggesting that the chosen contract attributes are relevant for farmers in this context. Most of the standard deviation parameters, which are shown in the lower part of Table 5, are significant as well, pointing at considerable preference heterogeneity.

In model (1), the mean parameter for the ASC is negative, suggesting that farmers have a positive general attitude toward WII contracts. The premium rate coefficient is negative, meaning that farmers prefer lower-priced over higher-priced insurance contracts, holding other contract attributes constant. For the strike level, − 10% is the reference against which the other coefficients can be compared. The coefficient for − 20% is not statistically significant. However, the coefficient for − 40% is statistically significant. The negative sign indicates that farmers have a preference for pay-outs already starting at lower absolute threshold levels. The coefficients for ± 20 and ± 40% are positive and significant, suggesting that farmers value insurance that covers excess rainfall in addition to drought. The coefficient for ± 10% is insignificant, which may be due to the fact that excess rain in moderate dimensions is often less harmful for crop yields. More heavy excess rain, however, can be quite damaging, as farmers’ responses in Table 3 above have shown. This is in line with the estimation results in Table 5.

The positive and significant coefficient for insurer transparency reveals a strong farmer preference for receiving regular text messages about rainfall measurements as part of the insurance contract. This result confirms that information transparency and regular communication can increase farmers’ confidence in WII products, which was also pointed out by [34]. Concerning distance to the weather station, where 5 km is the reference; the negative and significant coefficient for the 50 km alternative shows that farmers prefer shorter distances that are associated with lower basis risk. Currently, the average distance to the weather stations in our sample of farmers is 44 km (Table 1). The estimation results suggest that insurance uptake could be higher with more weather stations installed. Previous research also showed that reducing basis risk can be an important way of increasing the attractiveness of WII contracts [14, 24].

Regarding group insurance, results in Table 5 show that small-group contracts are more likely to be chosen over individual contracts, whereas large-group contracts have a lower probability of being chosen. This implies that offering group contracts could motivate more farmers to take up WII, which is consistent with recent findings from Tanzania and Ethiopia [38, 42]. However, it also becomes evident that structural aspects such as group size matter, as larger groups may be associated with lower levels of group cohesion [36].

Models with interaction effects

To explain possible sources of preference heterogeneity, we added interaction terms as additional covariates, as was explained above. Results of these extended model estimates are shown in models (2) and (3) of Table 5. We concentrate the discussion on the coefficients of the interaction terms. In model (2), ASC is interacted with actual insurance uptake in the past. The insignificant coefficients for the interactions with WII uptake in 2013 and 2014 suggest that recent adopters and non-adopters of insurance contracts have similar preferences. However, the interaction with WII uptake before 2013 is positive and significant, meaning that earlier adopters who then dropped out have less positive attitudes toward insurance contracts. This is plausible, as their decision to drop out from the existing WII program was probably related to not being fully satisfied.

The results in model (3) confirm that levels of satisfaction with the existing insurance program determine farmer attitudes: higher levels of satisfaction contribute to a higher general preference for WII. Somewhat surprising is the negative coefficient for the ASC interaction with risk attitudes, which implies that risk-loving farmers have more positive attitudes toward WII. One would usually expect the opposite, namely that risk-averse farmers have a stronger preference for crop insurance. We interpret this result as another sign that not all farmers are fully confident with the functioning of WII contracts. Given the lack of transparency regarding rainfall measurements and pay-out triggers, risk-averse farmers may not feel properly insured against weather shocks. Some may even consider WII as a kind of gamble on random weather outcomes. This is consistent with previous studies showing that risk-averse farmers are often less likely to adopt WII [20, 22, 70].

Limited confidence may also be related to the complexity of WII, especially for smallholder farmers who are often unfamiliar with formal insurance products [71]. The other interaction terms in model (3) confirm the important role of training and learning. Farmers who received training as part of the Kilimo Salama Program have more positive attitudes toward WII. Furthermore, membership in a farmer group, which can serve as a learning platform for innovations, affects attitudes toward WII in a positive way.

Finally, we were interested in the role of farm size. To analyze possible heterogeneity between smaller and larger farms, we created a dummy variable that takes a value one if a particular farm is above the mean farm size in the sample. The positive and significant coefficient for the interaction of this dummy with ASC reveals that smaller farms have a higher preference for WII. Since farm size is an indicator of wealth, it is possible that smaller farms would be more interested in insurance because they lack the economic muscle to individually cope with weather shocks. However, this is a welcome finding, as it demonstrates the potential of properly designed WII products to benefit smallholder farmers. This potential is not yet fully realized.

Willingness to pay (WTP)

Based on the estimates in model (1), we calculated farmers’ WTP for WII contracts and for changes in particular contract attributes. We used individual-specific coefficients to obtain WTP point estimates for the farmers in our sample [63]. Results are presented in Table 6. We only show results for attribute levels with significant coefficient estimates. For the ASC, we multiplied the coefficient estimates by − 1 because we are interested in the WTP for insurance, not for the no-insurance option. On average, farmers are willing to pay about 7.6% of their expected harvest for a WII contract. As mentioned, the actual price varies by location, but the average premium rate in the Kilimo Salama Program is 10%. Moderate premium reductions could probably increase insurance uptake significantly. The mean estimate also suggests that contracts priced at 20 or 25%, as observed in some locations, are way above what the average farmer is willing and able to pay for WII.

The WTP estimates for the different attribute levels can be interpreted as increments over the base value of insurance. That is, the mean WTP for a contract with transparent communication of weather data through weekly text messages would be 7.56 + 0.79 = 8.35% of the expected harvest. The point estimates for the different attribute levels are all highly significant but quite small in magnitude, which may be due to the assumed lognormal distribution of the premium rate variable. However, even if the marginal WTP for the attribute levels was underestimated, relative comparisons should still be in order because the same calculation methods were used for all attributes. The highest marginal WTP is observed for the transparency attribute. Transparency also seems to be more important than distance to the weather station. Even though farmers are willing to pay less for contracts with reference stations further away from their farm, the WTP comparison suggests that transparent communication and information provision may have a larger effect on insurance uptake than investing in additional weather stations to reduce basis risk.

Concerning the other attributes, farmers are willing to pay 0.41 percentage points less for contracts that only start paying at a rainfall threshold level of − 40%. For contracts that are also covering excess rainfall, farmers are willing to pay more, but the additional WTP is relatively small. Comparing values across attributes we learn that—at least for this study area—focusing on drought risk with a lower absolute strike level is more valuable for farmers than covering additional risks, as the existing Kilimo Salama Program does. Finally, the estimates show that large-group contracts would only be chosen over individual contracts if the premium was 0.31 percentage points lower, whereas small-group contracts would result in a 0.23 percentage point higher WTP.

Conclusions

Weather index insurance (WII) could reduce the high transaction costs involved in traditional, indemnity-based crop insurance programs and could therefore be of particular relevance for smallholder farmers in developing countries. However, the uptake of WII in the small-farm sector has been relatively low up till now. One reason is probably that WII contracts are not sufficiently tailored to the needs and preferences of smallholder farmers. Improved contractual design might help toward more widespread insurance uptake. In this study, we have contributed to the knowledge base focusing on the situation of smallholder farmers in Kenya. We have combined farm survey and choice-experimental data to analyze the experience with an existing WII program and to better understand how hypothetical changes in the insurance contracts might improve the situation.

While the existing WII program in Kenya was launched in 2009, the number of participating farmers has remained relatively low. Several farmers also decided to discontinue their insurance contracts after one or 2 years of participation. One issue is that the insurance contracts are too expensive from the farmers’ point of view. Our analysis has shown that farmers’ mean willingness to pay is about 25% lower than the average premium rate charged by the insurance provider. Lower premium rates could probably contribute to increased insurance uptake.

Beyond the premium rate, we identified several other contract attributes that seem to be critical. Many farmers struggle with fully understanding the functioning of WII contracts and when exactly pay-outs are triggered. The resulting uncertainty undermines farmers’ confidence and thus lowers their demand for insurance. Risk-averse farmers in particular were found to have a low preference for WII contracts, even though they are actually the main target group of insurance products. Our estimates suggest that better training and communication could increase farmers’ confidence and thus insurance uptake.

Transparent provision of relevant rainfall measurements and thresholds—for instance through regular text messages—could significantly increase farmers’ willingness to pay for WII. Mechanisms to reduce basis risk are also valued by farmers, although not to the same extent as higher levels of transparency. Improving communication may therefore be more important for WII providers than investing into additional weather stations in order to reduce basis risk. Offering contracts to farmer groups rather than individuals was also found to be a promising avenue for wider insurance uptake. Group contracts could help to reduce transaction costs. Furthermore, farmer groups can be important platforms for learning about complex innovations, including novel risk transfer products. For this, however, group sizes should be relatively small, as larger groups often lack the necessary cohesion.

We caution that the results are specific to Kenya and that choice-experimental data may be subject to hypothetical bias. Hence, the exact estimates should not be generalized and over-interpreted. However, the findings still provide interesting insights into typical issues of WII design in a small-farm context. Given that smallholder farmers are particularly vulnerable to climate shocks, improving their access to crop insurance is of high policy relevance. More research is needed to further add to the knowledge base about suitable contractual designs in particular situations.

Notes

Sample size of 386 was determined using a formula by [53]: \(n = \frac{{Z^{2} pq}}{{d^{2} }}\); where Z = 1.96, p = 0.5 is the proportion of population that is likely to have taken up WII, q = (1 − p), and d = 0.5 is the acceptable margin of error at 95% confidence level.

References

Daryanto S, Wang LX, Jacinthe PA. Global synthesis of drought effects on maize and wheat production. PLoS ONE. 2016;11(1):e0156362.

Lesk C, Rowhani P, Ramankutty N. Influence of extreme weather disasters on global crop production. Nature. 2016;529:84–7.

Wheeler T, von Braun J. Climate change impacts on global food security. Science. 2013;341(6145):508–13.

Brown ME, Kshirsagar V. Weather and international price shocks on food prices in the developing world. Global Environ Change. 2015;35:31–40.

World Bank. World development report: development and climate change. Washington, DC: The World Bank; 2010.

Vermeulen SJ, Campbell BM, Ingram JSI. Climate change and food systems. Annu Rev Environ Res. 2012;37:195–222.

Carter MR, Barrett CB. The economics of poverty traps and persistent poverty: an asset-based approach. J Dev Stud. 2006;42(2):178–99.

Dercon S, Christiaensen L. Consumption risk, technology adoption, and poverty traps: evidence from Ethiopia. J Dev Econ. 2011;96(2):159–73.

Hazell PBR, Hess U. Drought insurance for agricultural development and food security in dryland areas. Food Sec. 2010;2(4):395–405.

De Janvry A, Dequiedt V, Sadoulet E. The demand for insurance against common shocks. J Dev Econ. 2014;106:227–38.

Jensen ND, Barrett CB. Agricultural index insurance for development. Appl Econ Perspect Policy. 2016. https://doi.org/10.1093/aepp/ppw022.

Barnett BJ, Mahul O. Weather index insurance for agriculture and rural areas in lower-income countries. Am J Agric Econ. 2007;89(5):1241–7.

IFAD. The potential for scale and sustainability in weather index insurance for agriculture and rural livelihoods. Rome: International Fund for Agricultural Development and World Food Program; 2010.

Musshoff O, Odening M, Xu W. Management of climate risks in agriculture: will weather derivatives permeate? Appl Econ. 2011;43(9):1067–77.

World Bank. Weather index insurance for agriculture: guidance for development practitioners. Washington, DC: The World Bank; 2011.

Rao KN. Index based crop insurance. Agric Agric Sci Procedia. 2010;1:193–203.

Binswanger-Mkhize HP. Is there too much hype about index-based agricultural insurance? J Dev Stud. 2012;48(2):187–200.

Clarke DJ, Mahul O, Rao KN, Verma N. Weather based crop insurance in India. Policy research working paper no. 5985, Washington DC: The World Bank; 2012.

Miranda MJ, Farrin K. Index insurance for developing countries. Appl Econ Perspect Policy. 2012;34(3):391–427.

Giné X, Townsend R, Vickery J. Patterns of rainfall insurance participation in rural India. World Bank Econ Rev. 2008;22(3):539–66.

Cole S, Giné X, Tobacman J, Topalova P, Townsend R, Vickery J. Barriers to household risk management: evidence from India. Am Econ J Appl Econ. 2013;5(1):104–35.

Hill RV, Hoddinott J, Kumar N. Adoption of weather-index insurance: learning from willingness to pay among a panel of households in rural Ethiopia. Agric Econ. 2013;44(4–5):385–98.

Breustedt G, Bokusheva R, Heidelbach O. Evaluating the potential of index insurance schemes to reduce crop yield risk in an arid region. J Agric Econ. 2008;59(2):312–28.

Norton MT, Turvey C, Osgood D. Quantifying spatial basis risk for weather index insurance. J Risk Finance. 2013;14(1):20–34.

Elabed G, Bellemare MF, Carter MR, Guirkinger C. Managing basis risk with multiscale index insurance. Agric Econ. 2013;44(4–5):419–31.

Jensen ND, Barrett CB, Mude AG. Index insurance quality and basis risk: evidence from northern Kenya. Am J Agric Econ. 2016;98(5):1450–69.

Carter MR, Barrett CB, Boucher S, Chantarat S, Galarza F, McPeak J, et al. Insuring the never before insured: explaining index insurance through financial education games. BASIS brief 2008–07, Madison: University of Wisconsin; 2008.

Norton M, Osgood D, Madajewicz M, Holthaus E, Peterson N, Diro R, et al. Evidence of demand for index insurance: experimental games and commercial transactions in Ethiopia. J Dev Stud. 2014;50(5):630–48.

Takahashi K, Ikegami M, Sheahan M, Barrett CB. Experimental evidence on the drivers of index-based livestock insurance demand in Southern Ethiopia. World Dev. 2016;78:324–40.

Liebe U, Maart SC, Musshoff O, Stubbe P. Risk management on farms: an analysis of the acceptance of weather insurance using discrete choice experiments. Ger J Agric Econ. 2012;61(2):63–79.

Liesivaara P, Myyrä S. Willingness to pay for agricultural crop insurance in the northern EU. Agric Finance Rev. 2014;74(4):539–54.

Castellani D, Viganò L, Tamre B. A discrete choice analysis of smallholder farmers’ preferences and willingness to pay for weather derivatives: evidence from Ethiopia. J Appl Bus Res. 2014;30(6):1671–92.

Akter S, Krupnik TJ, Rossi F, Khanam F. The influence of gender and product design on farmers’ preferences for weather-indexed crop insurance. Global Environ Change. 2016;38:217–29.

Patt A, Peterson N, Carter M, Velez M, Hess U, Suarez P. Making index insurance attractive to farmers. Mitig Adapt Strateg Glob Change. 2009;14(8):737–53.

Pacheco JM, Santos FC, Levin SA. Evolutionary dynamics of collective index insurance. J Math Biol. 2016;72(4):997–1010.

Fischer E, Qaim M. Smallholder farmers and collective action: what determines the intensity of participation. J Agric Econ. 2014;65(3):683–702.

Wollni M, Fischer E. Member deliveries in collective marketing relationships: evidence from coffee cooperatives in Costa Rica. Euro Rev Agric Econ. 2015;42(2):287–314.

Traerup SLM. Informal networks and resilience to climate change impacts: a collective approach to index insurance. Global Environ Change. 2012;22(1):255–67.

Townsend RM. Consumption insurance: an evaluation of risk-bearing systems in low-income economies. J Econ Perspect. 1995;9(3):83–102.

Delpierre M, Boucher S. The impact of index-based insurance on informal risk-sharing networks. Selected paper at the Agricultural and Applied Economics Association Annual Meeting, Washington, DC, August 4–6; 2013.

Mobarak AM, Rosenzweig M. Selling formal insurance to the informally insured. Economic growth center discussion paper no. 1007, New Haven: Yale University; 2012.

Dercon S, Hill RV, Clarke D, Outes-Leon I, Taffesse AS. Offering rainfall insurance to informal insurance groups: evidence from a field experiment in Ethiopia. J Dev Econ. 2014;106:132–43.

Vasilaky K, Osgood D, Martinez S, Stanimirova R. Informal networks within index insurance: randomizing distance in group insurance. New York: Columbia University; 2014.

McIntosh C, Povel F, Sadoulet E. Utility, risk, and demand for incomplete insurance: lab experiments with Guatemalan cooperatives. San Diego: University of California; 2015.

Omoyo NN, Wakhungu J, Oteng’i S. Effects of climate variability on maize yield in the arid and semi arid lands of lower eastern Kenya. Agric Food Sec. 2015;4(8):1–13.

FSD. Review of FSD’s index based weather insurance initiatives. Nairobi: Financial Sector Deepening; 2013.

International Finance Corporation (IFC). Agriculture and climate risk enterprise (ACRE)—Kilimo Salama—Kenya. http://www.ifc.org/wps/wcm/connect/industry_ext_content/ifc_external_corporate_site/industries/financial+markets/retail+finance/insurance/agriculture+and+climate+risk+enterprise. Accessed Nov 2015.

Greatrex H, Hansen JW, Garvin S, Diro R, Blakeley S. Scaling up index insurance for smallholder farmers: recent evidence and insights. CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS), Report No. 14; 2015.

Kikulwe EM, Fischer E, Qaim M. Mobile money, smallholder farmers, and household welfare in Kenya. PLoS ONE. 2014;9(10):e109804.

Sina J, Jacobi P. Index-based weather insurance: international and Kenyan experiences. Nairobi: Adaptation to Climate Change and Insurance; 2012.

Ngetich KF, Mucheru-Muna M, Mugwe JN, Shisanya CA, Diels J, Mugendi DN. Length of growing season, rainfall temporal distribution, onset and cessation dates in the Kenyan highlands. Agric Forest Meteorol. 2014;188:24–32.

Adamowicz W, Boxall P, Williams M, Louviere J. Stated preference approaches for measuring passive use values: choice experiments and contingent valuation. Am J Agric Econ. 1998;80(1):64–75.

Anderson DR, Sweeney DJ, Williams TA, Martin RK. An introduction to management science: quantitative approaches to decision making. Kendallville: ICC Macmillan; 2008.

Louviere JJ, Hensher DA, Swait JD. Stated choice methods: analysis and applications. Cambridge: Cambridge University Press; 2000.

Hanley N, Mourato S, Wright RE. Choice modelling approaches: a superior alternative for environmental valuation. J Econ Surv. 2001;15(3):435–62.

Schipmann C, Qaim M. Supply chain differentiation, contract agriculture, and farmers’ marketing preferences: the case of sweet pepper in Thailand. Food Policy. 2011;36(5):667–77.

Veettil PC, Speelman S, Frija A, Buysse J, Van Huylenbroeck G. Complementarity between water pricing, water rights and local water governance: a Bayesian analysis of choice behaviour of farmers in the Krishna river basin, India. Ecol Econ. 2011;70(10):1756–66.

Kouser S, Qaim M. Valuing financial, health, and environmental benefits of Bt cotton in Pakistan. Agric Econ. 2013;44(3):323–35.

Giné X, Yang D. Insurance, credit and technology adoption: field experimental evidence from Malawi. J Dev Econ. 2009;89(1):1–11.

Heimfarth LE, Musshoff O. Weather index-based insurances for farmers in the North China plain: an analysis of risk reduction potential and basis risk. Agric Finance Rev. 2011;71(2):218–39.

Bech M, Gyrd-Hansen D. Effects coding in discrete choice experiments. Health Econ. 2005;14(10):1079–83.

Ligon E, Thomas JP, Worrall T. Informal insurance arrangements with limited commitment: theory and evidence from village economies. Rev Econ Stud. 2002;69(1):209–44.

Hensher DA, Rose JM, Greene WH. Applied choice analysis: a primer. Cambridge: Cambridge University Press; 2005.

Kuhfeld WF. Marketing research methods in SAS: experimental design, choice, conjoint, and graphical techniques. Cary: SAS-Institute; 2010.

Train KE. Discrete choice methods with simulation. Cambridge: Cambridge University Press; 2003.

Hole AR. Estimating mixed logit models using maximum simulated likelihood. Stata J. 2007;7(3):388–401.

Hole AR, Kolstad JR. Mixed logit estimation of willingness to pay distributions: a comparison of models in preference and WTP space using data from a health-related choice experiment. Empir Econ. 2012;42(2):445–69.

Meijer E, Rouwendal J. Measuring welfare effects in models with random coefficients. J Appl Econ. 2006;21(2):227–44.

Dohmen T, Falk A, Huffman D, Sunde U, Schupp J, Wagner GG. Individual risk attitudes: measurement, determinants, and behavioural consequences. J Euro Econ Assoc. 2011;9(3):522–50.

Clarke DJ. A theory of rational demand for index insurance. Am Econ J Microecon. 2016;8(1):283–306.

Patt A, Suarez P, Hess U. How do small-holder farmers understand insurance, and how much do they want it? Evidence from Africa. Global Environ Change. 2010;20(1):153–61.

Authors’ contributions

All authors (KWS, PCV, and MQ) conceptualized and designed the survey. KWS analyzed data. KWS and MQ wrote the paper. All authors read and approved the final manuscript.

Acknowledgements

The authors thank local extension officers in Embu, Kenya, for their assistance during the farm survey. We are also grateful to Professors and Doctorate students at the Department of Agricultural Economics, University of Goettingen, for their useful comments during the development of this paper.

Competing interests

The authors declare that they have no competing interests.

Availability of data and materials

The data supporting the results presented in this study are available from the corresponding author upon reasonable request.

Consent for publication

Not applicable

Ethics approval and consent to participate

Although we interviewed Kenyan farmers to generate data used to in this study, participation in the farm survey and choice experiment did not involve any risk for farmers. Hence, the study was not subject to institutional review board approval at the University of Goettingen, as was confirmed by the University’s Ethics Commission. In Kenya, we obtained clearance from the ministries of agriculture and education before collecting the data. Prior to the interviews, farmers were informed about the purpose of the research and asked for their verbal consent to participate. We did not ask for written consent, because many of the respondents were not familiar with formal paper work. It was clarified that the information collected would be treated confidentially, analyzed anonymously, and only used for purposes of this research.

Funding

This research was undertaken with financial support from the Kenyan National Commission for Science, Technology, and Innovation (NACOSTI) and the German Research Foundation (DFG).

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The Creative Commons Public Domain Dedication waiver (http://creativecommons.org/publicdomain/zero/1.0/) applies to the data made available in this article, unless otherwise stated.

About this article

Cite this article

Sibiko, K.W., Veettil, P.C. & Qaim, M. Small farmers’ preferences for weather index insurance: insights from Kenya. Agric & Food Secur 7, 53 (2018). https://doi.org/10.1186/s40066-018-0200-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40066-018-0200-6