Abstract

Most studies on benefit sanctions within the German welfare system rely on established datasets about welfare receipt. This paper analyzes how using a dataset from the operational system of the German Federal Employment Agency for processing welfare claims can contribute to further research on benefit sanctions. For this purpose, I use a random sample of welfare recipients with at least one sanction between 2016 and 2018. First, this allows the detailed analysis of time lags between different steps in the sanction process. Second, linking this dataset with established datasets allows the identification of imposed sanctions for which sanction periods could not be (fully) implemented. This is largely explained by individuals leaving the welfare system between sanction events and sanction periods, e.g., by taking up employment. Third, the paper shows differences in benefit cuts across subgroups. This opens up paths for future research.

Similar content being viewed by others

1 Introduction

In most welfare states, individuals who are capable of working but unable to achieve a minimum standard of living via their own funds are eligible to receive unemployment insurance or welfare benefits. However, a core element of many welfare systems is the principle of rights and duties. This means that eligible individuals are provided with the necessary means by which to secure a minimum standard of living and receive additional support to achieve labor market integration. In return, benefit recipients must strive toward ending their need for support as soon as possible. Hence, benefit recipients are obliged, e.g., to search for a job and take up suitable job offers. Benefit sanctions can be imposed to ensure that benefit recipients comply with their duties.

In Germany, the unemployment benefit system consists of two tiers. First, individuals can receive unemployment benefits I (UB I), which is comparable to unemployment insurance benefits schemes in other countries, for a limited amount of time if they fulfill the qualifying period among other requirements. The amount of UB I depends on previous wages. Individuals not fulfilling the eligibility criteria for UB I or who have exhausted their claim, can receive unemployment benefits II (UB II), which is the German scheme of (means-tested) welfare benefits. In contrast to UB I, the receipt of UB II is not time limited and depends on household composition.Footnote 1 This paper focuses on welfare benefits in the German benefit system, i.e. UB II.

The existing empirical literature provides some evidence that benefit sanctions can have a positive impact on reemployment rates.Footnote 2 Busk (2016) compares the effect of sanctions for individuals receiving earnings-related unemployment benefits and individuals receiving welfare benefits in Finland and finds that effects of sanctions differ across benefit schemes. While sanctions increase employment rates for welfare benefit recipients, recipients of unemployment insurance benefits are more likely to leave the labor force following a sanction.

The literature also provides evidence that benefit sanctions can have negative impacts on the quality of future employment, resulting in lower earnings, shorter job durations, switching to part-time employment or changing to lower occupational levels as well as withdrawal from the labor force.Footnote 3

Qualitative studies by Götz et al. (2010) and Schreyer et al. (2012) further illustrate how severe sanctions in particular can lead to negative effects for sanctioned welfare recipients in Germany; e.g., recipients face the risk of accumulating debt, losing their home, the (at least temporary) severance of contact with the job centerFootnote 4 or leaving the labor market and engaging in a shadow economy.

In its ruling at the end of 2019, the German Constitutional Court declared that sanctions above 30% of the basic cash benefit of an individual are not in accordance with the requirements of the basic right to a guaranteed subsistence minimum (German Federal Constitutional Court 2019; Gantchev 2020). Since then, sanction amounts have been limited to 30% of the basic cash benefits. In its ruling, the German Constitutional Court criticized the fixed duration of the benefit sanctions independent of subsequent behavior, as well as the insufficient empirical evidence that more severe sanctions (above 30% of the basic cash benefits) further improve labor market integration. The Court also concludes that there seems to be inconsistences in the results of the existing empirical literature, which is partly due to the lack of suitable datasets (German Federal Constitutional Court 2019, sec. 61). Additional data can therefore help to shed more light on the effects of benefit sanctions, which is especially relevant in light of recent policy changes in the German welfare system.

Thus, the aim of this paper is to analyze the research potential of combining data from the IT procedure used for processing unemployment benefit II claims (ALLEGRO; Department of Statistics of the Federal Employment Agency 2020a)Footnote 5 with already established administrative datasets about welfare receipt for future studies of benefit sanctions in the German welfare system. This paper illustrates exemplary findings and research potentials by shedding more light on the sanction process and on the distribution of sanction amounts across different subgroups. For this purpose, this paper uses a random sample of individuals with at least one imposed sanction between 2016 and 2018.Footnote 6

The paper contributes to the existing literature in three ways.

First, the existing analyses on benefit sanctions in Germany focus on sanctions that were implemented and led to a reduction in unemployment benefits.Footnote 7 Combining data from the operational system and established datasets allows the identification of sanction periods that were imposed but could not be fully or only partially implemented. A possible explanation for this outcome is the observed time lag between the event that caused a sanction and the start of the corresponding sanction period. Thus, I am able to show that a large share of this group leaves the welfare system before or early during the sanction period and takes up employment in the meantime. Existing studies using the established datasets might therefore not completely capture the impact of unemployment benefit II sanctions in Germany.

Second, most datasets that are used to analyze the effects of sanctions in the German welfare system on labor market outcomes only include the start and end dates of a sanction period. Thus, little is known about the time lag between different steps of the sanction process, e.g., between the event that caused a benefit sanction and the observed starting date of the sanction, and how such a time lag might affect the impact of a sanction.Footnote 8 This information is important for studies analyzing the effect of benefit sanctions which in general rely on individuals not anticipating a pending sanction. Otherwise individuals could increase their job-search activities resulting in them leaving welfare receipt before the implementation of a sanction. Using data from a random sample of sanctioned welfare recipients, this study provides a more detailed analysis of the time lag between different steps in the sanction process. In line with Wolff and Moczall (2012), I find that the decision process seems to be quicker for sanctions due to minor noncompliance actions, which are therefore implemented in closer proximity to the sanction event. However, I observe a larger time lag between sanction events and the start of sanction periods in comparison to Wolff and Moczall (2012). In addition, I analyze how much time passes between different sanction events for the same person. Again, I find substantial differences between sanction events due to minor noncompliance actions in comparison to severe infringements.

Third, the Department of Statistics of the German Federal Employment Agency provides some basic information on the sanction amounts of welfare recipients (see Department of Statistics of the Federal Employment Agency 2020b). However, apart from that information, little is known about how sanction amounts differ across subgroups. Using detailed administrative data on sanction amounts and welfare benefit receipt, I analyze the sanction amounts for different subgroups, i.e., by gender, age and type of benefit unit, as well as level of education. In addition, the information on actual benefit cuts could be useful for future studies to disentangle the impact of different sanction amounts, which capture the severity of benefit sanctions, for an individual.

This paper is structured as follows. Section 2 gives an overview of the institutional background. Section 3 introduces the datasets used for this analysis. Section 4 shows the results, and Section 5 concludes.

2 Institutional background: benefit sanctions in Germany

At the start of 2005, the unemployment benefit II program replaced the former earnings-related unemployment assistance and social assistance programs in Germany. UB II values are means-tested and do not depend on the former earnings of recipients. To be eligible, recipients must be between 15 and 65 years of age and able to work for at least 3 h a day (§§ 7 and 8 SGB II). In addition, the recipient has to be unable to achieve a minimum standard of living via his or her own income or funds (§ 9 SGB II).Footnote 9 If a potential recipient shares a household with other (related) individuals, they are considered a benefit unit (Bedarfsgemeinschaft), and their income and funds, if any, are also considered when assessing if the unit as a whole meets the necessary criteria to be eligible for UB II benefits. In general, the UB II program comprises the following three main components: costs related to housing (Kosten der Unterkunft), including costs for heating; a basic cash benefit (Regelbedarf) to cover regular expenditures; and additional expenses for special needs (Mehrbedarf), e.g., costs related to a pregnancy.

The goal of the UB II program is to provide recipients with the necessary means by which to secure a minimum standard of living, as well as to enable them to take up employment and become independent of unemployment benefits (§ 1 SGB II). The individual duties and rights of welfare recipients are documented in a so-called integration agreement (Eingliederungsvereinbarung), which is a mandatory contract agreed upon between the case worker and the benefit recipient.

Benefit sanctions are used to enforce that welfare recipients adhere to their duties, as stated in SGB II, either by preventing benefit recipients from not complying with their duties in the first place; or by punishing benefit recipients who do not comply.Footnote 10 Benefit sanctions can be imposed due to minor noncompliance actions (Meldeversäumnisse), i.e., mild sanctions, or severe infringements (Pflichtverletzungen), i.e., strong sanctions. The latter occurs if recipients do not fulfil their duties as stated in the integration agreement, refuse to take up or stay in suitable employment or training and/ or refuse to participate in or choose to terminate their participation in a suitable active labor market policy program (§ 31 SGB II).Footnote 11 If individuals cannot provide a good reason for their behavior, their basic cash benefits are cut by 30% in the first step. If a second severe infringement occurs within a year, their basic cash benefits are cut by 60%, with every further severe infringement within the year completely cutting their UB II benefits (including costs for housing). Stricter rules apply for benefit recipients under the age of 25, whose welfare benefits are limited to costs for housing after the first severe infringement and then are cut altogether if another severe infringement occurs within a year.

Minor noncompliance actions occur if welfare recipients do not attend an appointment with their caseworker or a psychological or medical appointment without providing a good reason. Their basic cash benefits are cut by 10% for every minor noncompliance action, and this percentage can be added to an already existing reduction of UB II because of a severe infringement or a different minor noncompliance action.Footnote 12

Imposing a sanction requires several steps. If an infringement or noncompliance is observed by the caseworker, the welfare recipients receive a written notification informing them about resulting cuts in benefits. Welfare recipients have the opportunity to reply to this notification and provide a justification for their behavior. If the reason provided is not satisfactory or none is given, the job center then formally decides to impose a sanction and informs the welfare recipients about the starting date of the sanction. The reduction of UB II take effect on the first day of the month following the formal decision to impose a benefit sanction. The duration is fixed at three months (§ 31b SGB II).Footnote 13

Since the November 2019 judgment by the German Constitutional Court, benefit reductions due to sanctions have been limited to 30% of the basic cash benefits. In addition, during the beginning of the COVID-19 pandemic, the imposition of sanctions was widely suspended. However, this analysis focuses on the years 2016 to 2018, when sanctions up to 100% of the benefit claims were still possible.

3 Data

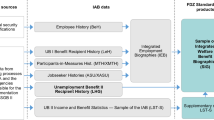

This analysis combines information from four different administrative datasets stored at the Institute for Employment Research (IAB), which are briefly described in this section.

First, I use data from ALLEGRO, which is the IT procedure used by job centers administered jointly by the Federal Employment Agency (FEA) to process UB II claims (Antoni et al. 2019; Department of Statistics of the Federal Employment Agency 2020a).Footnote 14 This dataset includes for each sanction information on the type of sanction, specific reason for the sanction, and start and end dates of the sanction period, as well as date of the noncompliance action or infringement and the formal decision to impose a sanction. The ALLEGRO dataset encompasses the universe of all imposed sanctions.Footnote 15 The sample drawn for this analysis is based on all individuals who were registered with at least one imposed benefit sanction in ALLEGRO between 2016 and 2018. In total, these criteria apply to 731,467 individuals. A 10% random sample is drawn from this population, resulting in 73,147 individuals prior to data cleaning.

Second, I use data from the Integrated Employment Biographies (IEB; Version V14.00.00–190,927), which encompasses daily information about individuals who have at least one of the following labor market statuses: employment subject to social security contributions, marginal part-time employment, receipt of benefits in accordance with Social Code Book II or III, participation in an employment or training measure or registration as a jobseeker with the Federal Employment Agency (Antoni et al. 2019). In addition to characteristics relating to the labor market history of an individual, the IEB data also provides information on demographic characteristics, e.g., date of birth, gender as well as school and occupational degrees.

Third, the Unemployment II Benefit recipient history (LHG; Version V10.00.00–201,904) provides additional information on UB II recipients who are eligible for benefits and capable of work (Dummert et al. 2020). The LHG includes on a daily level information about the composition of the benefit unit and the occurrence of benefit sanctions. However, it does not provide information on benefit amounts or the amount of benefit cuts made due to sanctions of an individual.

Information on the benefit amount can be obtained from the UB II Income and Benefits Statistics (LST-S), which is the fourth dataset used in this analysis. On a monthly basis, the LST-S contains information about standard benefit claims and the actual received benefits of eligible and registered welfare recipients (Dummert et al. 2020).

All datasets stem from administrative data from the German Federal Employment Agency and can be linked by using the unified consolidated personal identifier.

One main challenge in combining the datasets consists of managing the different granularities, which range from daily to monthly information. As a result, an analysis using combined data from these sources has to rely on information formatted on a monthly basis. Since some of the information included in the ALLEGRO data for individuals with more than one sanction per month will be lost in such a data preparation process, the main analysis will be based on two datasets; one will comprise a monthly panel of all linked datasets, and the other will be formatted as a sanction spell dataset based on the ALLEGRO data. The data preparation and cleaning process is described in more detail in Appendix 2

In the analysis, no restrictions are imposed on the employment status of individuals at the time of their sanction. Thus, the observed UB II recipients do not have to be unemployed at the time of their sanction.Footnote 16

Table 1 provides some sample statistics (Column 1) for the individuals included in the final linked dataset. I compare these statistics to those of individuals who are included in the Sample of Integrated Welfare Benefit Biographies (SIG) dataset, which is a representative dataset for UB II recipients in Germany and contains information ranging from 2007 until 2017 (see Bruckmeier et al. 2020 for an introduction and Dummert et al. 2020 for the data report). Approximately half of the welfare recipients included in the SIG are female (cf. Column 2), but this characteristic applies only to approximately one-third of the sample of sanctioned individuals (cf. Column 1). This difference is in line with Knize (2021), who shows that female welfare recipients are half as likely to be sanctioned as male recipients. On average, individuals in the sample are approximately four years younger than those in the SIG. The differences are most pronounced in the 50–65 age group, which might indicate a smaller probability of getting sanctioned above the age of 50. Compared to welfare recipients in the SIG, the observed sanctioned individuals have a lower level of education; nearly half of the sample has not completed an occupational degree (cf. Column 1). Regarding the type of benefit unit, Table 1 shows that a larger share of sanctioned individuals live in a one-person benefit unit, and a lower share cohabitates with children. This is in line with Wolff and Moczall (2012), who show that sanctions can be observed more often for males, singles and individuals with a lower level of education.

4 Results

This section provides some exemplary findings and illustrates the research potential of using the ALLEGRO dataset in addition to established datasets.

4.1 Type of sanction and time lag between different steps in the sanction process

For each sanction spell, the ALLEGRO dataset includes detailed information on the type of sanction and the specific reason for the sanction. Overall, about 82% of all observed sanction spells within the three-year observation period are imposed due to a minor noncompliance.Footnote 17 The share of sanctions due to a first severe infringement (within a year) is 13%, while the share due to an additional severe infringement is even lower (5%). Approximately 40% of the benefits recipients in the sample are sanctioned only once within the observed 3 year period.

Table 2 provides further details by depicting the share of individuals experiencing different types of sanctions in the sample and across subgroups. About 82% of all individuals in the dataset experience at least one minor noncompliance in the observation period. This share is slightly higher for females and individuals below the age of 25. About 40% of individuals in the dataset experience at least one first severe infringement and about 10% receive at least one additional severe infringement. The share of individuals receiving a sanction due to severe infringements is higher for males and individuals being 25 years or older. Overall, the table provides some evidence that individuals experience sanctions which lead to more severe cuts in benefits, i.e. severe infringements, comparably less frequently than sanctions resulting in less severe cuts, i.e. minor noncompliance. However, it is important to note that the dataset is limited to individuals receiving at least one sanction between 2016 and 2018.

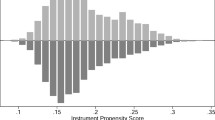

As depicted in Fig. 1, the median duration between a sanction event and the decision to impose a sanction is 35 days (cf. left panel of Fig. 1a. See Table 9 in Appendix 1 for more details).Footnote 18 Looking at strong and mild sanctions separately shows that the median time gap for strong sanctions is nearly three weeks (19 days) longer than it is for mild sanctions (cf. right panel of Fig. 1a). As stated in the SGB II, the starting date of a sanction is set at the first day of the next month after the formal decision to impose a sanction is made. This increases the time gap between the sanction event and the beginning of the respective sanction period. Approximately two months (59 days) pass in at least half of the observed sanctions between the event and the start of the corresponding sanction period (cf. left panel of Fig. 1b). Again, even more time passes—approximately three weeks at the median—between a severe infringement and the starting date of the sanction compared to that for a minor noncompliance action (cf. right panel of Fig. 1b). Hence, the decision process for mild sanctions seems to be quicker; therefore, they are implemented with closer proximity to the event that caused the sanction. This suggests that imposing a strong sanction might involve more complex internal procedures than imposing a mild sanction. I find no differences between mild and strong sanctions when comparing the time lag between the decision to impose a sanction and the start of the corresponding sanction period. In both cases, the median duration lies at 22 days (cf. left and right panel of Fig. 1c).

Source: IEB V14.00.00–190,927, data from the data warehouse (DWH) of the FEA January 2020. Own calculations

Time passed between different steps in the sanction process. The figure depicts how many days pass between different steps in the sanction process for all observed sanctions (left panel) and for severe infringements and minor non-compliance separately (right panel). The x-Axis of the figures is limited to 0 < x ≤ 180 days. In addition, analysis is limited to sanctions with a duration of 1 to 180 days between sanction event and decision (this excludes 1743 sanctions). No limitation is set on time passed between decision to impose a sanction and start of the sanction period. However, the observation period only includes sanctions implemented between 2016 and 2018. Strong sanctions include severe infringements of any kind. See Table 8 for more details. Restrictions of dataset 2 apply (see Appendix 2).

In addition, the ALLEGRO data allows to analyze how many days pass until the next sanction event of a person is observed in the data. This analysis is limited to individuals with another sanction event observed within the 3 year observation period, which applies to approximately 60% of all individuals observed in the dataset. As displayed in Fig. 2 (cf. left panel) and Table 3, the median duration until the next observed sanction event of an individual is 29 days (for more details see Table 3).Footnote 19

Source: IEB V14.00.00 – 190,927, data from the data warehouse (DWH) of the FEA January 2020. Own calculations

Days until next observed sanction event. This figure shows the failure function for all individuals (left panel) experiencing more than one sanction between 2016 and 2018 and separated by type of preceding sanction (right panel). X-axis of figure is limited to 0 ≤ x ≤ 700 days. Duration until next sanction cannot exceed three years, since the observation period only includes sanctions implemented between 2016 and 2018. See Table 3 for more details. Strong sanctions include severe infringements of any kind. Restrictions for dataset 2 apply (see Appendix 2).

This result differs when distinguishing between mild and strong sanctions (cf. right panel of Fig. 2 and Table 3). Following a severe infringement, at the median nearly two months pass until the next sanction event is observed. However, in at least half of the observed sanction events more than three months (101 days) pass from one severe infringement to the next (cf. Table 3). Minor noncompliance actions occur with a shorter time lag between sanction events. This might indicate the more deterring effect of receiving a strong sanction on the behavior of welfare recipients. A different explanation could be that it is more likely for welfare recipients to receive mild sanctions than strong sanctions, since, e.g., they receive more appointments with their case worker than job offers. This also corresponds with the previously determined higher shares for sanctions due to minor noncompliance actions.

Combining this outcome with the result that at the median it takes about two months between a sanction event and the start of the corresponding sanction period suggests that in many cases, the next sanction event takes place even before individuals experience the financial impact of the previous sanction event and can change their behavior accordingly. Given the large time lag between sanction events and the start of the sanction period, there does not seem to be enough time between sanction events for individuals to learn from their mistakes before committing a new one.

4.2 Identifying imposed and implemented benefit sanctions

When combining data from the ALLEGRO and the UB II Income and Benefits Statistics datasets, not every month documented with a sanction in ALLEGRO can be matched with corresponding information in the LST-S data and vice versa. In total, the information in the two datasets about the existence and number of sanctions for an individual in a particular calendar month match in 349,405 months. However, there are also several months in which the information on the existence of a benefit sanction or the number of imposed sanctions of an individual does not correspond to information in the other data source. Table 4 provides an overview of all the possible mismatches. With approximately 12% of all months identified, by far the most common mismatch present is that sanctions are documented for an individual in ALLEGRO while no information on benefit receipt can be obtained from the UB II Income and Benefits Statistics dataset for this month (cf. Row 3).Footnote 20 Other mismatches concern information on a sanction that is documented in the LST-S dataset while no information of an individual being sanctioned in this month can be obtained from ALLEGRO (cf. Row 4) or the number of documented sanctions in the datasets not corresponding to each other (cf. Row 5 and Row 6).Footnote 21 However, it is important to note that these mismatches do not necessarily apply to a whole sanction period but can also affect only certain calendar months of an individual’s sanction period (see Table 5 for an overview of which months of a sanction period are affected).

To evaluate the plausibility of the cases identified in Row 3, Table 5 displays for each imposed sanction with at least one mismatching month which months of the sanction period cannot be matched with information in the LST-S dataset. For the majority of affected sanctions (65%) at least one month of overlapping information between the data sources ALLEGRO and LST-S can be identified. However, in more than a third of the sanctions (35%) all months of a sanction period are affected, which means that the sanction is not included in the LST-S at all. This is followed by either the second and third or only the third month being affected (23% each). This outcome provides evidence that some individuals leave the welfare system before the sanction takes effect or at least early in the sanction period.

A possible explanation for the mismatch could be that the start of a sanction is postponed and therefore begins later than the start date documented in ALLEGRO. In this case, at least one month per individual should be mismatched both in ALLEGRO and in the LST-S dataset. However, while 20,397 persons have been identified as having a sanction only documented in either ALLEGRO or in the LST-S dataset, only approximately 1% (232) of individuals are included in both datasets.Footnote 22 In addition, individuals are not registered in the LST-S during these months, even without a sanction. Thus, this is not a feasible explanation for the sanction mismatch between the data sources.

Table 6 displays sociodemographic characteristics for individuals with a sanction documented in ALLEGRO only (cf. Column 1) and compares them to individuals in the final sample (cf. Column 2). This comparison reveals that sanctions that were only imposed but not implemented are more likely to be observed in younger age groups and among persons who appear to be closer to the labor market but are also sanctioned more heavily at the same time. Thus, the share of individuals without an occupational degree is lower in this group. In addition, individuals who belong to this group for at least one month were employed for approximately 22 days longer on average in the last three years and received welfare benefits for approximately 80 days less. On the other hand, the number of valid sanctions is slightly higher for this group. The share of individuals with at least one mild sanction is 6 percentage points higher for this group. The share of individuals with at least one additional infringement that results in particularly severe sanctions on welfare benefits is also 6 percentage points higher. However, it is unclear whether being aware of this (pending) stronger sanction caused individuals to increase their job search efforts and, as a result, take up employment to evade the sanction or if the individuals already knew that they were going to be employed shortly and therefore no longer complied with their obligations, which in turn resulted in more (severe) sanctions.

Information from the IEB provides some additional context information on the labor market status of individuals whose sanction spell is only documented in ALLEGRO. Only very few of the affected individuals (approximately 4%) receive welfare benefits according to the IEB data during the month of the (mismatched) sanction. However, at the time of the sanction event, in approximately 91% of all affected sanctions the individual is documented to have an UB II spell in the IEB data. This outcome lends some support to the fact that the identified mismatching months are not due to faulty data in the LST-S or ALLEGRO dataset. In addition, the mismatches do not accumulate over a few months but are rather evenly distributed over the observation period. Approximately 48% of the affected individuals are documented to be employed at the time of the sanction according to the IEB data. Recalling the two months’ time lag between an infringement that causes a sanction and the start of the corresponding sanction period, it seems plausible that at least some share of the welfare recipients took up employment in the meantime.Footnote 23 Individuals who are not eligible or registered for UB II and therefore do not receive any benefits are also no longer documented in the LST-S dataset. This restriction does not apply to entries documented in ALLEGRO, since the procedure for imposing a sanction has to be followed regardless of whether cuts to the benefits can be implemented. If individuals were to return to UB II within the sanction period, the imposed sanction would still be valid, and their benefits would be cut by the proposed amount. In addition, even if a sanction cannot be implemented, it still counts toward the number of severe infringements within a year. As a result, the ALLEGRO dataset documents all imposed sanctions, while the UB II Income and Benefits Statistics dataset documents implemented sanctions for individuals who are still eligible and registered for UB II only.Footnote 24

4.3 Sanction amount across subgroups

The number of simultaneously valid sanctions per welfare recipient and per month ranges from one to six in the sample (final dataset 4 see Appendix 2).Footnote 25 However, in approximately 60% of all the months observed, an individual’s benefits are only cut by one sanction. On average, sanctions cut an individual’s welfare benefits by approximately 105 € per month (see column 1 of Table 7). This amount is comparable to the official statistics provided by the Department of Statistics of the Federal Employment Agency, which show that on average, benefits were cut by approximately 109 € between 2016 and 2018 (Department of Statistics of the Federal Employment Agency 2020b).

The amount varies slightly when considering different sociodemographic characteristics (see Table 7 column 1). Compared to male welfare recipients, female welfare recipients’ benefits are on average reduced by 18 € less per month.

Table 7 also indicates that welfare reductions are on average 32 € higher for individuals below the age of 25 compared to individuals aged 25 or above.Footnote 26 This could be a result of stricter sanction rules applying to individuals who have not yet reached the age of 25 (see Sect. 2). Comparing the average sanction amount for different types of benefit units shows that one-person benefit units display the highest reduction amounts per month. In addition, on average, individuals without an occupational degree display 6 € higher sanction amounts compared to individuals with an occupational degree.

Even without sanctions, an individual’s actual benefit claim can be lower than the standard basic cash benefits, e.g., due to income from employment or other assets. The sanction amounts reported in column 1 of Table 7 show only the cuts in benefits that could be implemented based on the actual benefit claim of individuals. Thus, it is possible that the calculated sanction amount should have been higher since deductions can only be made up to the height of the actual benefit claim of welfare recipients, e.g., if an individual’s benefit claim is not sufficient to cover the whole amount. To analyze this possibility, I look at the sanction amount for individuals whose standard basic cash benefits correspond to their basic cash benefit claim (before being reduced by sanctions). This situation applies to approximately 70% of all observations in the sample. On average, the total sanction amount is approximately 3 € higher if individuals receive the full standard basic cash benefits (see Table 10 in Appendix 1).

Since sanction amounts depend on the benefit claims of an individual, column 2 of Table 7 displays the reduction of welfare benefits in relation to the unabated total benefit claim (Leistungsanspruch ohne Bildung und Teilhabe) per person and per month. On average, benefit reductions correspond to one-fifth of the unabated total benefit claim.Footnote 27 However, in at least half of the observed sanctioned months, the reduction does not exceed 13% of the benefit claim. In line with the results displayed in column 1 of Table 7, higher shares can be observed for males, individuals with no occupational degree and recipients below the age of 25.Footnote 28 In contrast, one-person benefit units display the second lowest sanction amounts, apart from single parents, when considering their sanction amount in relation to their total benefit claim.

Another option to compare sanction amounts across different subgroups which is independent from individual benefit claims is to calculate the theoretical sanction amount as the percentage of cuts on standard basic cash benefits, based on the valid sanctions of a person during each month.Footnote 29 One drawback of this calculation is that cuts that affect costs for housing cannot be displayed, since they cannot be represented as a share of the welfare benefits. As a result, I am not able to differentiate if individuals with 100% cuts are also affected by cuts on costs for housing.Footnote 30 Nevertheless, combined with the results obtained earlier, this approach allows gaining some additional insight into the height of benefit cuts across different subgroups.

As Fig. 3 in Appendix 1 displays, in approximately 40% of all the observed months, individuals’ benefits are only cut by 10% of the basic cash benefits. Thus, in approximately 40% of all months, individuals are sanctioned for one minor noncompliance action only. In approximately 80% of all the observed months, theoretical benefit cuts do not exceed 30% of the basic cash benefits, which is the limit set by the German Constitutional Court in 2019. The median cut in benefits is 20% (see column 3 of Table 7). Again, females show lower, while individuals below the age of 25 or without an occupational degree show higher theoretical sanction amounts based on the types of sanctions implemented. As seen in column 3 of Table 7, one-person benefit units show the second lowest amounts, with only single parents having lower sanction amounts.

To take into account that sanction amounts might differ between subgroups depending on the type of benefit unit or amount benefit claims, I regress the sanction amounts presented in column 1 to 3 of Table 7 on a number of characteristics. The results are depicted in Table 8.

Overall, the results are in line with those depicted in Table 7: sanction amounts are lower for females, individuals with an occupational degree, and higher for individuals below the age of 25 or living in one-person benefit units. However, the difference in sanction amounts between male and female welfare recipients is no longer significant when controlling for the number and types of sanctions received (cf. column 2). Individuals living in one-person benefit units display higher total sanction amounts in comparison to other types of benefit units—even when controlling for types of sanctions. However, considering their sanction amount in relation to their overall benefit claim or calculating their theoretical sanction amounts while also controlling for types of sanctions reveals much smaller differences between benefit units (cf. columns 3 to 6). This indicates that differences in sanction amounts across subgroups are not mainly driven by differences in the amount of standard basic cash benefits but rather by differences in the number or severity of sanctions received. One notable exception are individuals below the age of 25. However, results for this subgroup have to be interpreted with caution since they are subject to stricter sanctioning rules.

Overall, it is important to note that these results are only of a descriptive nature and do not reflect if individuals with certain characteristics engage in more sanctionable behavior. A possible explanation for the differences in sanction amounts could be that some subgroups are subject to higher scrutiny by the job center, e.g., individuals below the age of 25, which results in observing a higher number or more severe sanctions for this group.

5 Conclusion

Most studies on benefit sanctions within the German welfare system rely on established datasets about welfare receipt. In this paper, I illustrate which additional insights can be gained by linking data from the operational system of the German Federal Employment Agency for processing UB II claims (ALLEGRO) with established datasets about welfare receipt. For this purpose, I use a random sample of welfare recipients with at least one imposed sanction between 2016 and 2018.

Using the detailed information provided in the ALLEGRO dataset allows to analyze the time lag between different steps in the sanction process. At the median, approximately two months pass between the sanction event and the start of the corresponding sanction period. I show that more time is needed to impose a strong sanction than a mild sanction. The observed time lag between the sanction event and the consequence might decrease the learning effect of a sanction. In general, taking the time passed between a sanction event and the starting date of the sanction period into account might be important for analyzing the effect of a sanction. Changes in behavior, e.g., taking up employment, might not be attributed to a sanction if much time has passed until the implementation of a sanction. On the other hand, some welfare recipients have taken up employment in the meantime and are therefore no longer observed in the data.

Second, combining data from ALLEGRO with data from the UB II Income and Benefits Statistics dataset reveals that not for every sanction the (whole) sanction period can be implemented. To a large share, this outcome is due to individuals taking up employment between the sanction event and the sanction period and therefore no longer being eligible or registered for welfare benefits. Other possibilities include individuals dropping out of the labor force or engaging in a shadow economy.

Third, using data from the UB II Income and Benefits Statistics dataset allows analyzing sanction amounts across subgroups in more detail. I show that it is also important to consider differences in benefit claims when comparing subgroups. Looking at theoretical sanction amounts based on implemented types of sanctions per month reveals that in approximately 80% of the observed months, individuals are not sanctioned by more than 30% of their standard basic cash benefits, which corresponds to the limit set on sanction amounts since the ruling of the German constitutional Court in November 2019. This is potentially interesting in light of the recent policy reforms in the German welfare system.

Examining the effects of benefit sanctions on labor market outcomes of individuals is of great policy relevance. However, established datasets may only show part of the picture and leave some questions unanswered. I illustrate how combining established datasets with data from the ALLEGRO operational system can improve data quality for future studies about benefit sanctions in the German welfare system. One major finding is the identification of imposed sanctions which could not be fully or only partially implemented since recipients are no longer eligible or registered for welfare benefits at the time of the sanctions. The former are not included in established German datasets and therefore not subject of existing studies about benefit sanctions.

One limitation of the ALLEGRO dataset is that it only contains imposed sanctions and not all infringements that could result in a sanction, i.e. if the benefit recipient can provide a good reason for his or her behavior, the potential sanction event is not documented in ALLEGRO. Future research might also take into account the time lag between different steps in the sanction process to determine how this affects the impact of a sanction. In addition, focusing not only on differences in the effect of mild and strong sanctions but also considering the actual amount of benefit cuts received might shed more light on the impact of the severity of benefit sanctions on labor market outcomes.

Availability of data and materials

The datasets used and analyzed during the current study are not publicly available since they are social data and of administrative origin; they contain sensitive information and are subject to confidentiality regulations. Access to the data is therefore restricted but can be obtained through the research data center of the Institute for Employment Research (IAB).

Notes

See Sect. 2 for more details on the institutional background.

See e.g., Abbring et al. (2005) in the context of unemployment insurance benefit sanctions in the Netherlands or Hillmann and Hohenleitner (2012), Schneider (2009), Bookman et al. (2014), van den Berg et al. (2014), van den Berg et al. (2022) in the context of UB II in Germany as well as van den Berg et al. (2004) for recipients of (means-tested) welfare benefits in the Netherlands.

See e.g., Arni et al. (2013), van den Berg and Vikström (2014) in the context of unemployment insurance benefits in Switzerland and Sweden or van den Berg et al. (2022) in the context of UB II in Germany as well as van den Berg et al. (2019a) on the negative effects of UB I sanctions on subsequent wages and employment durations.

A job center takes the role of the local welfare agency and is responsible for administering the tasks of the Federal Employment Agency on site, i.e. providing welfare benefits and administering active labor market policy programs.

ALLEGRO is an acronym and stands for “ALG II Leistungsverfahren Grundsicherung Online” which roughly translates to unemployment benefit II payment system online.

Sanctions imposed during this period were not affected by the German Constitutional Courts ruling; thus, benefit cuts up to 100% of the benefit claim can still be observed.

Note that current studies can use benefit sanctions for each month in which welfare recipients receive benefits for at least one day.

Two notable exceptions are the studies by Wolff and Moczall (2012) and van den Berg et al. (2022). Using data from the working process A2LL, which was the predecessor of ALLEGRO, Wolff and Moczall (2012) show that the median duration between a sanction event and the start of a sanction period is 43 days for a mild sanction and 53 days for a strong sanction. However, their study is based on a specific sample of welfare recipients. Thus, their results might not be generalizable to the universe of welfare recipients; also, the sanction process might have changed in the meantime. Van den Berg et al. (2022) use the fact that the imposition of sanctions was largely suspended in Germany during the first COVID-19 lockdown in 2020 and show that one month passed before the number of registered sanctions dropped in response. However, they solely focus on strong sanctions.

This implies that being unemployed is not a prerequisite for receiving UB II; rather, individuals can receive UB II in addition to their regular income if the income of their benefit unit is below the subsistence level.

§ 31 SGB II lists some additional reasons for imposing a strong sanction.

In contrast, benefit cuts due to severe infringements cannot be cumulative. Hence, if an individual obtained a first severe infringement (leading to a 30% cut in basic cash benefits), as well as a repeated severe infringement (leading to a 60% cut in basic cash benefits), the total cut in benefits is only 60%.

It is possible to limit the duration of a sanction to six weeks if a benefit recipient is under the age of 25. In addition, the sanction can be limited to 60% of the basic cash benefits if the welfare recipient declares to adhere to his or her duties from now on. If cuts on basic cash benefits exceed 30%, noncash benefits may be provided by the job center upon request.

Prior to 2014 the IT procedure A2LL was used for this purpose.

This includes only data from job centers administered jointly by the Federal Employment Agency.

As stated in Sect. 2, employed individuals or their household members can receive welfare benefits if their income is below the subsistence level.

Note that the results of the underlying analysis are not included in this paper, but are available upon request.

Note that while it is possible to observe the infringement and decision to impose a sanction on the same day, this should only apply to exceptional cases. In addition, according to SGB II §31b a sanction can be only imposed within six months of the infringement or noncompliance. The underlying analysis for Fig. 1 and Table 9 is therefore limited to sanctions with durations of 1 to 180 days between sanction event and decision (this excludes 1743 sanctions).

Note that while it is possible to observe more than one infringement or noncompliance at the same day, this should only apply to exceptional cases. Of the 140,615 observed durations until the next sanction, only 2228 durations equal 0 days (1.58%).

Thus, this does not include cases in which individuals receive welfare benefits but no sanction is registered in the LST-S. Rather individuals are not included in the LST-S at all in this calendar month.

This includes 4981 months in which the welfare benefits of a person should be sanctioned according to ALLEGRO and a benefit receipt can be identified in the LST-S but no sanction is documented for this individual in the LST-S.

Other possibilities include that individuals are dropping out of the labor force, become self-employed, are no longer capable of working as defined in the SGB II, sever contact with the job center or become engaged in the shadow economy.

This even holds for sanctions which have been objected to by the welfare recipient, since a lawsuit does not have a suspensive effect on the sanction. This way sanctions cannot be avoided or drawn out by objecting to them. However, cancelled sanctions are not included in this dataset due to data quality concerns.

The raw data includes individuals with up to 16 benefit sanctions per month. However, those cases were discarded as outliers in the data cleaning process (see Appendix 2).

Note that age is calculated at the start of each month. Age at the time of the sanction event could be lower; thus, welfare recipients who are close to the age of 25 at the time of the sanction event could have been under the age of 25 at the time of the sanction and thus subject to the stricter sanction rules.

Note that this calculation is based on to the benefit claim of the corresponding month of the sanction period. This might not be in line with benefit claims at the date when the infringement occurred, e.g., if the benefit unit composition or financial situation changed in the meantime.

The same pattern remains when considering only individuals whose standard basic cash benefits correspond to their actual basic benefit claim (not reported in this paper). However, in this case, the cuts on unabated total benefit claims are on average approximately 3 percentage points lower.

For example, a sanction due to a minor noncompliance action and a first severe infringement for a person above the age of 25 would lead to a total sanction amount of 40% of the basic cash benefit (10% for the minor noncompliance action and 30% for the severe infringement). Following this calculation, an additional severe infringement for a welfare recipient below the age of 25 would lead to a 100% cut in basic cash benefits.

In addition, it is possible that implemented cuts on benefits deviate from the calculated theoretical cuts, e.g., if an individual’s basic cash benefit claim is not sufficient to cover the whole sanction amount.

Sanction information in ALLEGRO includes: the personal identifier, the benefit unit identifier, the date of the sanction event, the date of the decision to impose a sanction, the type of sanction, the specific reason for the sanction and the start and end date of the sanction period.

This could be the case if a person moves to a different benefit unit during the sanction period. The sanction is then not valid for the whole sanction period in this benefit unit and therefore starts at a later time.

In this case, sanctions take effect at the same time as the unemployment insurance cutoff period. This resulted in poor matching quality with data from the LST-S for those sanctions. Affected individuals are discarded from the sample to ensure that number of sanctions are not underestimated.

I use dataset 1 in this step to link as many sanction spells as possible with the LST-S dataset.

Note that the age at the time of the sanction event is relevant for the decision if the stricter sanctioning rules for under 25 year-olds apply to an individual. Since age is calculated at the start of each month in this dataset, an individual can be classified as over 24 even though he or she was younger at the time of the sanction event. However, age is only overestimated and never underestimated; i.e., no individual is misclassified as being under the age of 25 if they were not that age at the time of the sanction event.

If as a result the standard basic cash benefit would exceed the actual benefit claim, then the standard basic cash benefit is replaced by the basic cash benefit claim instead.

In theory, each of those types of sanctions should not appear more than once in one month; i.e., a person can only have one first severe infringement at the same time. The second first infringement should therefore be documented as a repeated first infringement. However, it is possible for an individual to cause the next severe infringement before it was formally decided to sanction them for the first infringement and they were informed about the sanction. In this case, it is not possible to apply stricter sanction rules for the second sanction. However, since those cases distort the sanction amounts associated with specific types of sanctions, those observations are discarded as outliers from the sample.

Abbreviations

- ALLEGRO:

-

ALG II Leistungsverfahren Grundsicherung online

- DWH:

-

Data warehouse

- FEA:

-

Federal employment agency

- IAB:

-

Institute for employment research

- IEB:

-

Integrated employment biographies

- LHG:

-

Leistungshistorik Grundsicherung

- LST-S:

-

UB II Income and benefit statistics

- SGB II:

-

Second Book of the German code of social law

- SIG:

-

Sample of integrated welfare benefit biographies

- UB II:

-

Unemployment benefit II

- UB I:

-

Unemployment benefit I

References

Abbring, J.H., Berg, G.J., Ours, J.C.: The effect of unemployment insurance sanctions on the transition rate from unemployment to employment. Econ. J. 115(505), 602–630 (2005)

Antoni, M., Schmucker, A., Seth, S., Vom Berge, P.: Sample of integrated labour market biographies (SIAB) 1975–2017. FDZ-Datenrep. 55(1), 1 (2021)

Arni, P., Lalive, R., van Ours, J.C.: How effective are unemployment benefit sanctions? Looking beyond unemployment exit. J. Appl. Econ. 28(7), 1153–1178 (2013). https://doi.org/10.1002/jae.2289

Boockmann, B.: Intensifying the use of benefit sanctions: an effective tool to increase employment? IZA J. Labor Policy 3(21), 1–19 (2014). https://doi.org/10.1186/2193-9004-3-21

Bruckmeier, K., Dummert, S., Grunau, P., Hohmeyer, K., Lietzmann, T.: New administrative data on welfare dynamics in Germany the sample of integrated welfare benefit biographies (SIG). J. Labour Market Res. (2020). https://doi.org/10.1186/s12651-020-00280-y

Busk, H.: Sanctions and the exit from unemployment in two different benefit schemes. Labour Econ. 42, 159–176 (2016). https://doi.org/10.1016/j.labeco.2016.09.001

Department of statistics of the federal employment agency: Grundlagen: Qualitätsbericht – Statistik der Grundsicherung für Arbeitsuchende nach dem SGB II, Nürnberg, März 2020. (2020a)

Department of statistics of the federal employment agency: Sanktionen (Zeitreihe Monats- und Jahreszahlen ab 2007) Deutschland, West/Ost und Länder Januar 2007 bis März 2020. (2020b)

Dummert, S, Grunau, P, Hohmeyer, K, Lietzmann, T, Bruckmeier, K, Oertel, M: Sample of integrated welfare benefit biographies (SIG) 2007–2017. FDZ-Datenreport 02/2020 (en), Vol 76, (2020)

Gantchev, V.: Welfare sanctions and the right to a subsistence minimum: a troubled marriage. Eur. J. Soc. Secur. 22(3), 257–272 (2020). https://doi.org/10.1177/1388262720940328

German federal constitutional court: Urteil des Ersten Senats vom 05. November 2019–1. 1 BvL 7/16, Rn. (1–225). (2019)

Götz, S., Ludwig-Mayerhofer, W., Schreyer, F.: Unter dem Existenzminimum: Sanktionen im SGB II. IAB-Kurzbericht, 10/2010, 8. (2010)

Hillmann, K., Hohenleitner, I.: Impact of benefit sanctions on unemployment outflow: evidence from German survey data. HWWI research paper, 129 [rev.] 30. (2012). http://hdl.handle.net/10419/67940

Knize, V.J.: What gender-neutral activation? understanding the gender sanction gap in germany’s welfare system. Int Stud Gender State Soc. Soc. Polit. (2021). https://doi.org/10.1093/sp/jxab037

Schneider, J.: Activation of welfare recipients: impact of selected policies on reservation wages, search effort, re-employment and health dissertation. Freie Universität Berlin, Berlin (2009)

Schreyer, F., Zahradnik, F., Götz, S.: Lebensbedingungen und Teilhabe von jungen sanktionierten Arbeitslosen im SGB II. Sozialer Fortschritt 61(9), 213–220 (2012)

van den Berg, G.J., van der Klaauw, B., van Ours, J.C.: Punitive sanctions and the transition rate from welfare to work. J. Law Econ. 22(1), 211–241 (2004). https://doi.org/10.1086/380408

van den Berg, G.J., Uhlendorff, A., Wolff, J.: Sanctions for young welfare recipients. Nordic Econom. Policy Rev. 1, 178–208 (2014)

van den Berg, G.J., Vikström, J.: monitoring job offer decisions, punishments, exit to work, and job quality. Scand. J. Econom. 116(2), 284–334 (2014). https://doi.org/10.1111/sjoe.12051

van den Berg, G.J., Hofmann, B., Uhlendorff, A.: Evaluating vacancy referrals and the roles of sanctions and sickness absence. Econ. J. 129(November), 3292–3322 (2019a). https://doi.org/10.1093/ej/uez032

van den Berg, G.J., Müller, G., Kesternich, I., Siflinger, B.M.: Reciprocity and the interaction between the unemployed and the caseworker SSRN Journal. (2019b). https://doi.org/10.2139/ssrn.3490411

van den Berg, G.J., Uhlendorff, A., Wolff, J.: The impact of sanctions for young welfare recipients on transitions to work and wages, and on dropping out. Economica 89(353), 1–28 (2022). https://doi.org/10.1111/ecca.12392

Wolff, J, Moczall, A.: Übergänge von Alg-II-Beziehern in die erste Sanktion. IAB-Forschungsbericht, 11/2012, Vol 72, (2012)

Acknowledgements

I thank Jörg Heining, Gesine Stephan, Leonie Wicht, Markus Wolf as well as the editor and two anonymous reviewers for their valuable comments and suggestions. I am grateful to Karsten Strien and Tanja Jackenkroll for expert insights about the sanction process. I am indebted to the IAB-DIM unit, who carried out the sampling.

Funding

This study was funded by the Institute for Employment Research (IAB).

Author information

Authors and Affiliations

Contributions

As a sole author, I prepared and wrote the entire article. The author read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The author has no competing interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

See Fig. 3

Source: IEB V14.00.00—190,927, LHG V10.00.00—201,904, LST-S V10.00.00—201,904, data from the data warehouse (DWH) of the FEA January 2020. Own calculations

Histogram of the theoretical sanction amount based on the implemented types of sanction in relation to basic cash benefits (in percent). Note: Figure displays theoretical cuts on standard basic cash benefits based on valid sanctions per person and month. Restrictions of dataset 4 apply (see Appendix B).

Appendix 2

Data cleaning

3.1 Preparing the ALLEGRO dataset

The raw sample from ALLEGRO consists of 318,298 sanction spells and 73,747 individuals. Before being able to merge these data with the other datasets outlined in Sect. 3, the data must be further prepared beforehand. First, I identify individuals who move to a different benefit unit between the sanction event and the start of the sanction period by comparing information on the sanction included in ALLEGRO.Footnote 31 If only the benefit identifier changes, it can be assumed that the same sanction was registered twice in the system due to the move. This also applies if the starting date of the sanction period is set to a later date.Footnote 32 In both cases, only the first registered sanction spell is kept in the sample, since keeping both sanction spells would lead to an overestimation of valid sanctions for the affected calendar months of an individual. Overall, 1923 sanction spells are discarded from the sample during this step.

Second, I discard individuals from the sample who, at any point during the three-year observation window, have obtained a cutoff period of unemployment insurance benefits and therefore also obtained a UB II sanction at the same time.Footnote 33 In total, this applies to 7012 individuals and 17,732 sanction spells. For future reference, the resulting dataset is referred to as “dataset 1”.

For analyses solely based on the ALLEGRO spell dataset (see Subsect. 4.1), sanction spells are dropped if the sanction period started prior to 2016 (49,531 spells) or ended after 2018 (30,611 spells). In addition, sanction spells including implausible dates are dropped. This applies if the sanction period started prior to the decision to impose a sanction (1285 sanctions) or the date of the decision is earlier than the date of noncompliance action or infringement that caused the sanction (787 sanctions).

In a last step, time-invariant individual characteristics from the IEB, such as gender and date of birth, are matched to the dataset. This leads to the exclusion of 84 individuals for whom no valid IEB spell could be identified. The dataset is restricted to individuals who were between the ages of 20 and 65 at the time of their noncompliance action or severe infringement; this restriction discards 18,456 sanction spells from the sample. The resulting dataset, which is referred to as “dataset 2”, comprises 57,068 individuals and 197,683 sanction spells.

3.2 Combining data from ALLEGRO and established datasets about UB II receipt

The data used for this analysis from the UB II Income and Benefits Statistics dataset are available on a monthly basis for the years 2016 to 2018. The LST-S provides information for all months during which an individual is eligible and registered for UB II benefits. First, individuals who are identified as having a benefit sanction due to a cutoff period from unemployment insurance benefits in the ALLEGRO dataset are also excluded from the LST-S sample. In a few cases, a person is included more than once per month in the LST-S, e.g., if he or she lives in more than one benefit unit. In this case, individuals are discarded from the dataset in this month. This applies to 5983 months and 1346 individuals in the sample.

To facilitate the combination of data from ALLEGRO with the data from the income and benefit statistics dataset, dataset 1 is reshaped to a monthly panel.Footnote 34 The sample is restricted to the calendar months of 2016 to 2018 to match the time period for which information from the LST-S is available. When combining data from ALLEGRO and the LST-S, it can be observed that not every month that is documented with a sanction in ALLEGRO can be matched with corresponding information in the UB II Income and Benefits Statistics dataset and vice versa. To eliminate the possibility that steps made in the data preparation process or poor data quality caused such mismatches, further steps are taken for months in which a sanction is only documented in ALLEGRO or the LST-S. First, individuals with no valid spell in the IEB are excluded. Second, individuals who were in an earlier step identified as living in more than one benefit unit in a month are discarded from this dataset as well. In addition, sanctions with implausible dates are excluded from this dataset, i.e., if the decision to impose a sanction is dated earlier than the sanction event or if the sanction period started before the sanction event occurred. The remaining months in which information on a sanction of an individual from ALLEGRO and LST-S are not consistent with each other are saved in a different dataset (dataset 3) to be able to analyze those cases in more detail later (see Subsect. 4.2). This also includes months in which the number of sanctions does not correspond between the two data sources.

From this point forward, only observations in which information on the occurrence and number of benefit sanction corresponds between ALLEGRO and LST-S are kept in the sample, i.e., those not contained in dataset 3. Observations from calendar months in which individuals were not capable of working are discarded from the sample (310 observations). In the next step, outliers in the number of valid sanctions per month and sanction amount are identified. Months are discarded from the sample if the number of valid sanctions is above the 99th percentile (7 to 16 sanctions), if the sanction amount on costs for housing is above the 99th percentile (516 €) or if the total amount of benefit sanction is below the 1st percentile (24.7 €). In total, 3850 observations are discarded in this step. Next, months are kept in the sample if an individual is at least 20 years old and not older than 65 on the first day of the month (22,491 months).Footnote 35 No data are available from the LST-S module that includes the standard benefits for May 2018. If available, this information is imputed first from the previous month (April 2018) or second from the following month (June 2018).Footnote 36 If this is not possible, individuals are discarded from the sample for this month (9 observations). In addition, observations are dropped if an individual has more than one first severe infringement, a repeated first infringement or an additional infringement in one calendar month (2167 observations).Footnote 37 Observations for which occupational degree or type of benefit unit is missing are also dropped from the sample (3592 observations). The resulting dataset, which is referred to as dataset 4, includes 55,224 individuals with at least one observed sanctioned month and a total of 315022 calendar months.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Schmidtke, J. Linking information on unemployment benefit sanctions from different datasets about welfare receipt: proceedings and research potential. J Labour Market Res 57, 20 (2023). https://doi.org/10.1186/s12651-023-00347-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s12651-023-00347-6