Abstract—

The objective of this study is to reveal what has changed under the influence of digital transformation in the “physical” spatial structure of the retail/purchase process in connection with the emergence of a choice between online and offline “spaces,” or environments, as well as how e-commerce has changed the “physical” spatial principles of organizing nonfood retail in a Russian city with a case study of St. Petersburg. The principles of placement of new e-commerce facilities were analyzed by comparing various shopping models and spatiotemporal systems formed by them, including specific objects (warehouses-stores, warehouses-distributors, order pickup points and parcel terminals), features of interaction between retail actors and transport and logistics flows in the city. Two opposing trends in the placement of new types of retail facilities are described: towards the transfer of the trading function to non-trading premises and the transfer of the non-trading retail function to retail premises. They create spatial competition with traditional retail as well as a new hierarchical competition with office and warehouse business types. The trend towards retail infrastructure for durable goods to be within walking distance means the rollout of a new type of competition for locations: with FMCG sellers. The fact that in delivery the logistics of the “last mile” passes from consumer to seller/logistician means a fundamental shift in the economic geography of goods flows. Instead of private spontaneous pedestrian flows, it forms new regulated small-tonnage types of “last mile” commercial cargo transportation using both alternative transport modes (personal transporter) and transport routes (sidewalks, pedestrian walkways, etc.). All these require the development of a new urban regulation policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

In recent years, both in the world as a whole and in Russia, there has been exponential growth in various types of e-commerce, accelerated by the coronavirus pandemic (Fig. 1). The relatively low level of e-commerce penetration in Russia compared to the leading countries in terms of this process suggests a high potential for continued growth. Thus, the share of e-commerce in the total retail turnover in 2020 in the UK reached 30%; in China, 25%; and in Russia, only 9%, or RUB 3.2 trln.Footnote 1

Russian e-commerce market in 2021, bln RUB. * The accounting method has changed starting with the given year. Compiled by author from: E-commerce Market in Russia in 2021. Report. https://admin.akit.ru/wp-content/uploads/2022/03/AKIT-Analitika-2021-Rev.2.pdf. Accessed May 11, 2022.

Analysts note an increase in the market share of Internet aggregators in the form of marketplaces compared to specialized online stores: in 2020, slightly less than half of all online orders in the Russian Federation were made on marketplaces, and according to data for the first half of 2021, it was already 58% of orders.Footnote 2 At the same time, the growth of the Russian e-commerce market is still clearly extensive in nature: it is taking place due to an increase in orders with a trend towards a decrease in cost.Footnote 3 All this partly replicates some of the trends that the offline trading market had gone through before the digital transformation era (Aksenov, 2016), discussed below.

The role of technological (“industrial”) revolutions in the reorganization of traditional markets and the creation of new markets has been repeatedly noted in the literature (Gritsay et al., 1991; Schwab, 2017). A characteristic feature of the fourth industrial revolutionFootnote 4 is digital transformation, which has, in particular, generated markets in a fundamentally new—virtual or cyber—space (Fekete, 2020; Sikos et al., 2019). This phenomenon has also given rise to the transformation of retail,Footnote 5 which is the focus of this study in relation to cities that, both in Russia and abroad, remain the undisputed leaders of e-commerce markets (Kochieva and Dalakova, 2019). The fundamental difference between the current transformation of retail and the previous ones that followed the “explosive impact” of all technological revolutions is not just the reformatting of old and the emergence of new products and markets, but the emergence of competing environments or spaces in which parallel (or intersecting) development of each of the food retail markets occurs. Whereas before the digital transformation, for retail product A there existed only one physical “offline” market, and the consumer, when buying A, could choose from competing sellers 1, 2, … N in this market (which could have had different sales and marketing channels, including various remote ones), now, in the digital revolution, the consumer can choose between competing retail environments. As well, the number of available sellers to choose from is no longer increasing manifoldly (as though a certain number of sellers have been added in a standard offline market), but exponentially, and they limited neither from above or by location. This is shown schematically in Fig. 2.

As for the relationship of online–offline and hybrid formats in retail, the following are most frequently studiedFootnote 6: the specific features of distribution and market interaction of offline, online and hybrid (omnichannel) trading formats (Fan et al., 2019; Mikhailyuk, 2019a; Setiawan et al., 2020; Shi et al., 2019; Sikos et al., 2019; Winters and Swoboda, 2019), in particular, the threats and effects of cannibalization/complimentarity of online and offline sales channels (Fan et al., 2019; Ratchford et al., 2022); problems related to a buyer’s reasons for choosing an online or offline format (Setiawan et al., 2020); the same for manufacturers, intermediaries, and sellers of goods (Fan et al., 2019); emergence and development of a new delivery market (Mikhailyuk, 2019b), etc.

Since the retail consumer, manufacturer, logistician, and most goods still exist in the physical world, all competing environments, even the new online marketplace, inevitably operate to a greater or lesser extent in the physical space. The classification of such environments/spaces—real, virtual, and hybrid—is described in relation to commerce in (Sikos et al., 2019). In general, over the past 20 years, ideas have evolved from the ‘‘spaceless’’ Internet economy to a sharp increase in attention to its spatial organization (Warf, 2013).

In particular, in the subject area of interest to us, which is related to the effects of the digital revolution in retail for transformation of the physical space of a city, the following are analyzed:

—the consequences of the gap between the potential ubiquitous availability of online shopping and physical delivery restrictions associated with numerous geographical factors, ranging from infrastructure (transport, logistics, and communication), to settlement patterns and sociodemographic characteristics of a territory (Fekete, 2020; Ren and Kwan, 2009; Sikos et al., 2019);

—spatial competition between online and offline formats (e.g., the effectiveness of online sales in territories with different development of traditional trading formats) (Forman et al., 2009; Warf, 2013);

—the impact of online trading on the consumers’ attachment and their behavioral loyalty to specific locations, objects, and traders as a factor of preserving the spatial structure of retail (Horáková et al., 2022).

In addition, researchers ponder the conceptualization and practical applicability of the concepts of online place and environment (Kellerman, 2016), including retail (Horáková et al., 2022).

One important consequence of the development of cyberspace, the emergence of virtual communities in it, and the transition of potential consumers to communication in the “cloud”, is depreciation for the development of marketing and trade of the spatial proximity of consumers and the possibility of their physical contact both with each other (for word-of-mouth exchange of important commercial information) and with a potential seller. This requires the development of new mechanisms and principles, including spatial, of interaction between retail actors (Nagy, 2017; Sikos et al., 2019). However, whereas some features of the transition of trade to the new media would seem to reduce the dependence of retail trade on physical space (e.g., for global retailers like AliExpress and eBay, who operate nearly worldwide), others, on the contrary, increase: it suffices to mention the increasing importance of geolocation in marketing and delivery (Fekete, 2020; Sikos et al., 2019; Warf, 2013).

Thus the objective of this study is to reveal what has changed under the influence of digital transformation:

(1) in the physical spatial and business structure of the retail/purchase process due to the emergence of a choice between online and offline “spaces” environments;

(2) how e-commerce has changed the “physical” spatial principles of retail organization in the city.

DATA AND METHODS

Since the principles of spatial organization of food and nonfood retail significantly differ (Aksenov et al., 2006) and the space of the article format is limited, we here focus on the case of nonfood retail, which in 2021, according to AKIT and Sberbank, constituted more than 90% of the Russian e-commerce market.Footnote 7 According to the research company Data Insight, the top three ranks of the major online stores in Russia in 2021 were taken up by Russian nonfood retailersFootnote 8: Wildberries (online sales amounted to RUB 805 700 mln), Ozon (RUB 446 700 mln), and DNS (RUB 185 300 mln). Growth on online sales in 2021 was 95% for Wildberries, 126% for Ozon, and 41% for DNS. The marketplaces and nonfood online stores Citilink, M.Video, Yandex Market, Aliexpress, Lamoda, Petrovich, and VseInstrumenty.ru, almost all of Russian origin, were also in the top ten. The first online food retailer in this ranking appears only in 17th place.Footnote 9

St. Petersburg was chosen as being one of the main innovation centers of retail development in Russia. St. Petersburg is less dependent on the capital city factor than Moscow is; its experience to a greater extent can serve as a basis for predicting the development of similar processes in other large Russian cities (Aksenov, 2016). According to AKIT and Sberbank, at the end of 2021, the share of St. Petersburg was 7.1% for Russia’s local and 7.5% for cross-border e-commerce markets, which corresponds to third place after Moscow and Moscow oblast; it was two times higher than the city’s share in Russia’s population.Footnote 10

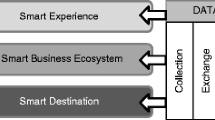

During the digital transformation of retail, four critical abilities for its survival in a market economy remained the same: the right product must be delivered/presented to the consumer in the right place, at the right time and at the right price (Christensen and Tedlow, 2000). However, in addition to this, the buyer and seller are now constantly choosing between real (offline), virtual (online) and hybrid (Sikos et al., 2019) “space”: in which of them, how, when, from whom and with what costs each action related to the purchase/sale should be performed (Wrigle and Lowe, 2014). Moreover, as stated, the main driver for the development of e-commerce, compared to the traditional, is not the assortment and volume of supply, but the development of logistics and services, which together make a purchase convenient (Mikhailyuk, 2019b).

Following this logic and traditional marketing ideas, for analysis, the author has divided buying/selling into separate steps: deciding to buy, comparative marketing (selection from product offers), choice of seller, payment, receipt of goods, return. The author has generalized the time component for comparisons in different environments to the traditional categories of demand frequency: everyday (typical to a greater extent of food retail), periodic, and sporadic.

Thus, attention is focused on the spatial system generated by new specific offline objects formed/used by different new types of shopping:

A, warehouse stores (with display and consumer access to comparative marketing of goods);

B, warehouses/manufacturers/distributors (without display and consumer access to comparative marketing of goods), a dark store;

C, order pickup points (self-service facilities/parcel terminals, and facilities with service).

Since our goal is to study not just the changing spatial structure of traditional retail, but also a complete change in the principles of interaction of all its actors, then it is necessary to use the spatial analysis methodology suitable for describing such principles. The most generalized spatial level of such a comparison can be the structure of the physical space, consisting of the places of residence of the main “physical participants” in the buying/selling process: the buyer, seller, and goodsFootnote 11 and their spatial interaction (relative location, movement, contact, etc.). The author also analyzes the three main types of places according to these parameters, which form the necessary level of spatial generalization in which actions related to buying/selling can take place:

Location 1: location of the buyer outside of physical/visual contact with the seller or goods (at home, at work, on the road, on vacation, and other places where the need to purchase goods occurs). That is, not just “at home,” etc., but also not in contact with the goods; therefore, a good can neither be received nor returned at location 1: there is a physical buyer, but there is neither seller nor good (Buyer).

Location 2: the location of the seller with the goods or place of sale with the disposition of the goods (outlet, a cluster of shops, market, shopping center, shopping area or street, etc.; location offering possibility to choose and make a purchase). That is, these are specialized places where goods can be “handled” and bought: physically there is/may be a seller, a good, and a buyer (Seller + Buyer + Item).

Location 3: the location of the good somewhere beyond the location of the seller and/or place of permanent exhibition for sale (warehouse, parcel locker, pickup point, courier/logistician, etc., locations without choice for the buyer). That is, these are the places where the goods are moved, already physically “detached” from the seller’s location: physically there is a buyer and goods, but there is no seller, at best, only an intermediary-logistician or parcel locker (Buyer + Item + ?Footnote 12).

Of all the approaches and aspects of evaluating the spatial structure of retail, the author has chosen an approach based on type of shopping, when the focus is on the specific features of spatiotemporal interaction between the consumer, seller, and item (Kent and Omar, 2003). In addition to the fact that it unites in a single assessment the full range of relationships of all actors and agents present in the market, it focuses on the consumer as an active co-author of the creation of a spatio-temporal retail system in a city. This seems particularly important with active redistribution of functions in the execution of the above actions in buying/selling in the course of digital transformation of retail.

The initial information about enterprises of new types of industries represented in St. Petersburg was acquired from business analytics, business aggregators, and company websites: links to specific sources are given in the text (data as of August–September 2021).Footnote 13

RESULTS AND DISCUSSION

In previous works, the author presented a spatiotemporal typology of the stages of transformation of the mutual influence of the sociospatial model of shopping and spatial organization of the retail sector in the Russian metropolis in the post-Soviet period. New (in addition to ones existing since Soviet times) models (types) of shopping, both specific transformational and counterparts of international ones, that consistently emerged and consolidated in the city were described (Aksenov, 2016, 2019). The first four presented in Table 1 of such types developed in St. Petersburg in 1989–2016; they coexist in the city to this day and are described in detail in the cited studies. The digital transformation of retail has spawned two new types that have been actively developing since the mid-2010s. These two types are listed in the last two rows of Table 1 and are discussed below. In order to ensure comparability of shopping patterns that exist both in the physical and the cyberspace, the author followed the above methodological principles and compared the locations of different actions for selling/buying for all types of shopping.

The different places of these actions are not the only important thing. The change of one numeral to another in the fields of the table moving along its rows in reality means physical movement of either the buyer, the goods, or both in the urban space. The content of these movements, depending on their reflection in specific rows and fields of the table, is fundamentally different both for the participants in the purchase process and development of the entire city. One of the parameters of these differences is described in the last column, indicating the different average approximate frequency of such movements associated with differences in the frequency of demand. Of course, the table reflects only model types of consumer behavior for each type of shopping (distinguishing it from others). In reality, consumers combine different types of shopping in their behavior, and these aggregate combinations at each moment of time forms a special type of retail impact on the urban space.

In 1997, 60% of all purchases were made in kiosks, pavilions, and open markets (the first and second types of shopping in Table 1), and only 17% in supermarkets.Footnote 14 Hypermarkets as a format did not exist. Ten years later, in 2007, the structure was exactly the opposite: 66% of purchases were made at chain supermarkets, discounters, and hypermarkets (third type in Table 1), and only 23%, at markets, kiosks, and pavilions.Footnote 15 After another 7 years, in 2014, in large enterprises, which include hypermarkets and chains (third and fourth typesFootnote 16), consumers did 76% of their spending. Medium and small formats, which include most of the remaining convenience stores (type four), accounted for 19% of spending. And the formats involving kiosks, markets, etc., accounted for only 5% of costs.Footnote 17 These data give an idea of the dynamics of demand for various retail formats during periods in which different types of shopping predominated. In the behavior of an individual consumer, such combinations of shopping types highly depend on a family’s income and vary over time with changing periods in the development of retail, providing fundamentally new opportunities for choosing locations, retail formats, prices, and a way to search for goods (Aksenov, 2016).

For the latter two types of shopping from Table 1, the development of which in recent years are primarily associated with digital transformation, the various trading formats involved in them differ significantly in the specific features reflected in Table 2, as well as for a number of other spatiotemporal parameters.

If some of these new formats form only a new system of transport, logistics, and consumer flows (e.g., online private advertising services), then the rest also form a new type of system of material business objects. These include store warehouses, distribution warehouses (open to consumers and dark stores), and pickup points. Since, as shown by the differences in the locations of action for purchase between formats (see Table 2), the latter potentially form different spatial requirements both for the system of physical objects associated with their activity and with logistics (in particular, organization of flows in the city).

In market analytics and the scientific literature, there are ideas about the structure of the new logistics system, which was formed under the influence of the digital transformation of retail. Its most frequently distinguished categories in Russia are: own delivery of an online store (“to the door” or to a pickup pointFootnote 18), pickup from a pickup point/parcel locker, third-party courier/postal service (Mikhailyuk, 2019b). At the same time, there is a continuing trend of the market shifting from classic courier delivery to self-delivery (Mikhailyuk, 2019b): the growth in 2021/2020 in self-delivery in various online sales channels ranged from 29 to 237%, exceeding everywhere the growth/decline in door-to-door delivery.Footnote 19 For us, this means the concomitant rapid growth in stationary physical objects of the new trade and logistics infrastructure in the urban space and slower growth of logistics delivery flows involving the “last mile.”Footnote 20 According to AKIT, the area of logistics infrastructure for e-commerce in Russia has increased from 626 000 m2 in 2018 to more than 3 mln (according to the forecast) m2 in 2022. The number of couriers in Russia in 2021 was estimated at 330 000, and retail warehouse workers, at 88 000.Footnote 21 All this either opens up new business locations in the city or transforms the existing ones, forming, together with the associated flows and service functions, a new spatial system of the tertiary sector. Table 3 shows examples of businesses corresponding to different new types of shopping, related to online shopping, broken down by frequency of demand. Each are associated with the special types of offline objects that they generate. Specific offers (and/or sellers) of goods in these formats can be broken down into different types of frequency of demand: everyday, almost daily (food, tobacco products, etc.); periodic, after certain periods (shoes, clothes, etc.) and sporadic, occasionally (furniture, jewelry, delicacies, etc.). The frequency of demand for a particular product/seller/retail industry, as in the case of classical offline trade (Aksenov et al., 2006), is also the most important factor in the formation of an urban spatial system of offline objects serving online operations, determining the density and location of objects in city.

As mentioned above, the most successful recent format of all e-commerce both in Russia and in the world are marketplaces—services of an intermediary aggregator of online stores and delivery, which can in parallel develop trade in their own goods. Given the importance of this format, it is worth separately analyzing the principles for locating their offline objects in the urban space. As an example, let us consider one of the sectoral leaders in Russia, Ozon, rated second in online stores in 2021 in the Russian Federation according to Data InsightFootnote 22; in August–September 2021, St. Petersburg had 548 Ozon pickup points and 81 service parcel lockers (Table 4). No branded offline nonfood retail store had such a network; such a number of trade and logistics outlets rather corresponds to the largest network formats of predominantly food retail chains of convenience stores serving mainly everyday demand.Footnote 23

From the materials in Table 4, the differences in the priorities of locating the two main types of retail facilities of this format become apparent: pickup points with service and parcel lockers. The retailer clearly prefers pickup points as a more versatile logistics point and to move points as close as possible to places of residence (individual premises in residential buildings, apartments) or consumer flows (retail facilities, business centers). Since the lockers require protection, they are located according to the same principles, with the exception of their own branded premises (mostly subleased locations in others) and unguarded objects (not in residential buildings). Clearly, the location of objects corresponds to the local and central-local type of retail industries, gravitating towards the locations of retail consumers (Aksenov et al., 2006). It can be concluded that such location principles force the largest online retailer to compete in the urban space with all kinds of small offline retailers (from street retail and convenience stores to shopping malls), as well as office business, which is a novelty compared to previous shopping models.

CONCLUSIONS

New trends related to the digital transformation of retail and shaping the system of spatial needs of objects of emerging new nonfood trade formats in a city are, at a minimum, the following.

(1) Large-scale transfer of the trading function of nonfood retail to the once nontrade (not specialized for retail) premises occurs, which differ in location requirements, namely:

(a) premises with buyer’s access tend to be located in office centers, post offices, etc., entering into competition with nontrade business types that are “core” for such location facilities;

(b) premises without buyer access (warehouses, distribution centers, dark stores), from which goods are delivered to the end consumer (either to the home or to a pickup point/parcel locker), form a hierarchical system of retail requirements in the location of objects depending on the volume, frequency of demand served, and logistical features of the business. Therefore, such formats compete for location both with traditional wholesale trade sectors (large warehouses, infrastructure) and with other noncommercial industries - for smaller premises closer to the end consumer in industrial zones, nonresidential buildings, and premises (workshops, basements, plant management, class C offices, etc.).

(2) The counterdirectional process contributes to the transfer of the nontrade function of retail to retail premises:

(a) a new logistical function of the distribution warehouse is being added to the traditional store premises. A rapidly developing trend of omnichannel retail augments this function to existing stores, attracting new types of logistics flows to them, and also forms new specialized locations where omnichannel formats are initially formed (such as Ulmart, VseInstrumenty.ru, etc.). Whereas the first ones were located according to the principles traditional for offline retail (Aksenov et al., 2006), the new ones combine the requirements of traditional retail with the convenience of transport logistics (IKEA);

(b) a new logistical functionof issuing online orders in the form of pickup points and parcel terminals, which does not imply the actual purchase (payment) in a given location, gravitates towards the consumer flows formed by already existing retail outlets. They are located in the rented premises of shopping centers, individual stores, etc. the new function is often competing with them, and in some cases, can even replace the initial one. For example, in the United States, entire shopping centers are being reformatted for the logistics of the largest electronic retail sites such as Amazon. In St. Petersburg, pickup points in a number of locations are replacing smaller trading platforms of individual stores, pharmacies, etc.

(3) Emerging formats of nonfood online retail form their new points in places that are either close to existing consumer flows, or within reach of consumers’ places of residence: in built-in and attached premises of residential buildings, stand-alone structures that could be/are used by traditional offline retail. Here there is direct spatial competition between new and old retail formats.

Perhaps even larger shifts are taking place in the spatial structure of logistics and the flows of goods, people and transport in the city that it generates. There is a redistribution of the logistics function between the actors of the retail trade in different new channels, namely:

(a) delivery of the purchase is separated from the tasks of the buyer and transferred to the seller (door delivery);

(b) delivery of the purchase is separated from the tasks of the seller and transferred to the buyer (pickup from warehouse);

(c) both: the delivery goes to an intermediary logistician (with the possible participation of the buyer with self-pickup from a pickup point/parcel locker).

This redistribution forms a new transport and logistics infrastructure and the corresponding spatial systems in the city:

—On the manufacturer/seller side, not only new distribution warehouses with different density and location system in the city, depending on the trade model, but also new transport capacities appear;

—On the side of new logistic intermediaries, there are companies with different specializations that affect spatial systems in different ways: complex logisticians (fulfilment), using the entire range of transport and logistics infrastructure; B2B and B2C carriers/deliverers specializing only in transport infrastructure; issuance infrastructure operators (B2B transportation, pickup points and parcel terminals);

—On the consumer side, when transferring the delivery function to him, new types of objects form new transport and pedestrian flows.

The quality of the spatial organization of activity (location of new types of objects and optimization of logistics) of the companies participating in the new Internet retail significantly affects urban development as a whole. AKIT’s annual report for 2021 provides an example of the business and urban effects in general from the competent management of such quality: by optimizing the spatial organization of activity of only one company participating in a new online retail in Moscow, the number of couriers was reduced by 74% and their total mileage by 45%.Footnote 24 Such effects on the scale of the entire urban Internet retail mean fundamental shifts in the core employment markets, transport, in the organization and regulation of flows and transport infrastructure.

In addition, it can be concluded that the principles of the spatial division of the territory between competing businesses have changed, when the most effective coverage of the universal service not for a specific, but for the entire/maximum possible territory becomes critical in Internet commerce. The importance of the logistics zoning of the city within the companies has significantly increased, ensuring the most universal delivery time and quality throughout the service area. Whereas before the digital transformation of retail, the purchase/return of durable goods required the consumer to travel, as a rule, by transport to single retail outlets in the city, now the entire purchase can be carried out within walking distance from the place of residence/work (pickup point), or without moving at all. This means that the retail infrastructure for durable goods (periodic and sporadic demand) has relocated within walking distance and begun to compete with FMCG sellers for locations. The fact that, in delivery, the logistics of the “last mile” has partially passed from the consumer to the seller/logistician means a fundamental change in the economic geography of goods flows. Instead of private spontaneous pedestrian flows, it forms new regulated small-tonnage types of commercial last-mile cargo transportation using both alternative modes of transport and transport routes (sidewalks, pedestrian walkways, etc.).

The scale of penetration of Internet commerce in Russia will increase, which will require the development and adoption of serious administrative decisions to adapt and reorganize urban space to meet its new needs. This topic requires separate consideration.

Notes

E-commerce Market in Russia in 2021. Report. https://admin.akit.ru/wp-content/uploads/2022/03/AKIT-Analitika-2021-Rev.2.pdf. Accessed May 11, 2022.

Logistics for e-commerce 2021. Report. https://www.datainsight.ru/sites/default/files/DI_Logistics_for_ecom_2021.pdf. Accessed May 11, 2022.

E-commerce Market in Russia in 2021. Report. https://admin.akit.ru/wp-content/uploads/2022/03/AKIT-Analitika-2021-Rev.2.pdf. Accessed May 11, 2022.

Digitalization is mentioned as a feature of both the third and, according to an alternative viewpoint, fourth industrial revolutions. For more details, see (Tsifrovaya …, 2017).

Although retail in a broad sense refers to retail trade in goods and services (Kellerman, 2016), for the purposes of this article, the author uses this term to denote only commodity retail trade.

For the most current overview of research issues in this area, see (Nagy, 2017).

The term nonfood retail used here excludes the category retail food trade and public catering (E-commerce Market in Russia in 2021. Report. https://admin.akit.ru/wp-content/ uploads/2022/03/AKIT-Analitika-2021-Rev.2.pdf), which the author has studied separately.

The author also includes in this category hybrid marketplaces, the turnover of which is primarily based on the nonfood segment.

Data Insight has rated the largest online stores in the Russian Federation at the end of 2021. https://www.retail.ru/news/data-insight-top-100-krupneyshikh-rossiyskikh-internet-magazinov-4-maya-2022-216471/. Accessed May 11, 2022.

Association of e-commerce companies. https://akit.ru/analytics/analyt-data/.

The participation of possible “secondary” physical elements of this process (intermediaries, infrastructure, environment, etc.) can also be taken into account, but at a lower level.

The question mark indicates the potential for an intermediary logistician or parcel locker.

A. Sharkova, a master student of the Geourban Studies program at St. Petersburg State University, took part in the acquisition, peer review, and primary processing of the initial data.

Komsomolskaya Pravda–St. Petersburg, November 4, 1997.

Ekspert. Severo-Zapad, no. 18, May 14–20, 2007.

Some chains have occupied the niche of convenience stores.

Socioeconomic situation of St. Petersburg in January–December 2014. St. Petersburg: Petrostat, 2015.

Point of receipt of order. Hereinafter, we separate this format (with service at the pickup point) from a locker with a self-service system.

Logistics for e-commerce 2021. Report. https://www.datainsight.ru/sites/default/files/DI_Logistics_for_ecom_2021.pdf. Accessed May 11, 2022.

The final stage in the chain of delivery of goods to the final consumer.

E-commerce Market in Russia in 2021. Report. https://admin.akit.ru/wp-content/uploads/2022/03/AKIT-Analitika-2021-Rev.2.pdf. Accessed May 11, 2022.

Data Insight has compiled a rating of the largest online stores in the Russian Federation at the end of 2021. https://www.retail.ru/news/data-insight-top-100-krupneyshikh-rossiyskikh-internet-magazinov-4-maya-2022-216471/. Accessed May 11, 2022.

In 2021, before the takeover of assets under the brand Dixie, the largest FMCG retailer in the neighborhood format, Magnit, had a network of only 458 outlets in St. Petersburg and Leningrad oblast (G. Boyarkova, Magnit has taken on metropolitan ambitions. What does the takeover of Dixie mean for the market and buyers, Daily Petersburg online publication Fontanka.ru, May 18, 2021. https://www.fontanka.ru/2021/05/18/69921287/. Accessed May 15, 2022).

E-commerce Market in Russia in 2021. Report. https://admin.akit.ru/wp-content/uploads/2022/03/AKIT-Analitika-2021-Rev.2.pdf. Accessed May 11, 2022.

REFERENCES

Adams, P.C. and Warp, B., Introduction: Cyberspace and geographical space, Geogr. Rev., 1997, vol. 87, no. 2, pp. 139–145.

Aksenov, K., Brade, I., and Bondarchuk, E., Transformatsionnoe i postransformatsionnoe gorodskoe prostranstvo. Leningrad-Sankt-Peterburg 1989–2002 (Transformation and Post-Transformation Urban Space. Leningrad-St. Petersburg 1989–2002), St. Petersburg: Gelikon-plyus, 2006.

Aksenov, K.E., Evolution of the types of shopping and spatial organization of retail trade in the post-soviet metropolis, Reg. Res. Russ., 2016, vol. 6, no. 4, pp. 375–386.

Aksenov, K.E., Transformation of urban spatiotemporal systems: the influence of retail on the post-socialist large housing estates areas in Leningrad–St. Petersburg in 1989–2016, Reg. Res. Russ., 2019, vol. 9, no. 3, pp. 225–235.

Christensen, C.M. and Tedlow, R.S., Patterns of disruption in retailing, Harvard Bus. Rev., 2000, vol. 78, no. 1, pp. 42–45.

Fan, C., Liu, Y., Yang, X., Chen, X., and Hu, J., Online and offline cooperation under buy-online, pick-up-in-store: pricing and inventory decisions, Manage. Optim. 2019, vol. 15, no. 3, pp. 1455–1472.

Fekete, E., Online retailing, in Geographies of the Internet, Warf, B., Ed., London: Routledge, 2020, pp. 157–169.

Forman, C., Ghose, A., and Goldfarb, A., Competition between local and electronic markets: How the benefit of buying online depends on where you live, Manage. Sci., 2009, vol. 55, no. 1, pp. 47–57.

Gritsai, O.V., Ioffe, G.V., and Treivish, A.I., Tsentr i periferiya v regional’nom razvitii (Center and Periphery in Regional Development), Moscow: Nauka, 1991.

Horáková, J., et al., Does the digitalization of retailing disrupt consumers’ attachment to retail places?, J. Retailing Consum. Serv., 2022, vol. 67, p. 102958.

Kellerman, A., Geographic Interpretations of the Internet, Cham: Springer, 2016.

Kent, T. and Omar, O., Retailing, New York: Palgrave Macmillan, 2003.

Kochieva, A.K. and Dalakova, A.N., Features of the development of online trading in Russia, Ekon. Ustoich. Razvit., 2019, vol. 38, no. 2, pp. 54–57.

Mikhailyuk, M.V., Marketplaces as a factor in the progressive transformation of Internet commerce in Russia: A logistical aspect, Ekon. Nauki, 2019a, no. 172, pp. 57–61.

Mikhailyuk, M.V., Internet trade logistics market in 2017–2018: Self-pickup development and spatial expansion of delivery geography, in Nauka v sovremennom obshchestve: zakonomernostii i tendentsii (Science in Modern Society: Laws and Trends), 2019b, pp. 96–102.

Nagy, E., New consumption spaces and cross-border mobilities., in Tourism and Geopolitics: Issues and Concepts form Eastern and Central Europe, Hall, D., Ed., CAB Int., 2017, pp. 142–158.

Ratchford, B., Soysal, G., Zentner, A., and Gauri, D.K., Online and offline retailing: What we know and directions for future research, J. Retailing, 2022, vol. 98, no. 1, pp. 152–177.

Ren, F. and Kwan, M.-P., The impact of geographic context on e-shopping behavior, Environ. Plann., B, 2009, vol. 36, no. 2, pp. 262–278.

Schwab, K., The Fourth Industrial Revolution, New York: Crown Business, 2017.

Setiawan, R., et al., References for shopping online versus in stores what do customers prefer and how do offline retailers cope with it?, Prod. Manage., 2020, no. 1, pp. 874–898.

Shi, M., Zhou, J., and Jiang, Z., Consumer heterogeneity and online vs. offline retail spatial competition, Front. Bus. Res. China, 2019, vol. 13, no. 1, pp. 1–19.

Sikos, T.T., Kozak, T., and Kovacs, A., New retail models in online and offline space, Deturope—Central Eur. J. Reg. Dev. Tourism, 2019, vol. 11, no. 3, pp. 9–28.

Tsifrovaya ekonomika: global’nye trendy i praktika rossiiskogo biznesa, Analiticheskii doklad (Digital economy: Global trends and Russian business practice, Analitical Report), Moscow: Vysshaya Shkola Ekon., 2017.

Warf, B., Global Geographies of the Internet, Springer, 2013.

Winters, A. and Swoboda, B., Pathways of offline-online and online-offline channel integration in omni-channel retailing, Proc. Eur. Marketing Acad., 2019, vol. 48, p. 9578.

Wrigley, N. and Lowe, M., Reading Retail: A Geographical Perspective on Retailing and Consumption Spaces, London: Routledge, 2014.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

The author declares that he has no conflicts of interest.

Rights and permissions

Open Access. This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Aksenov, K.E. Impact of Digital Transformation on the Spatial Organization of Nonfood Retail in a Russian City. Reg. Res. Russ. 13, 524–533 (2023). https://doi.org/10.1134/S2079970523700910

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S2079970523700910