Abstract

Real estate plays a crucial role in driving national economies. However, the process of transferring properties and engaging with various stakeholders can be hindered by a lack of adequate information, complex procedures, and excessive paperwork. The advent of digital real estate has revolutionized the industry and how stakeholders interact. The present study aims to conduct a bibliometric and systematic review of digital real estate, utilizing historical, institutional, country, and keyword analyses for the bibliometric review and Preferred Reporting Items for Systematic Reviews and Meta-Analysis (PRISMA) guidelines for the systematic review. Through thematic analysis, the study identified four key themes for transforming digital real estate: information communication technologies, data collection technologies, data networking tools, and digital decision-making systems. Additionally, the study proposes a digital real estate transformation framework that can assist stakeholders, urban planners, and decision-makers in embracing digital tools and technologies. The study concludes that digital real estate has the potential to revolutionize future urban planning and real estate development through the use of decision support systems and advanced technologies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The real estate industry encompasses a wide range of activities beyond the traditional concept of buying or selling properties. It encompasses the design, financing, development, construction, and management of land, infrastructure, and buildings [67]. The dynamics of real estate development are rapidly evolving, with a growing link between construction, marketing, regulation, finance, and management [84]. Digital real estate refers to any domain name, website, or blog that can be found online, and it encompasses buying or selling properties such as houses, apartments, or plots of land [79]. According to recent estimates, global residential and commercial real estate is valued at USD 162 trillion and USD 29 trillion, respectively [120]. In 2017, global commercial real estate transactions reached USD 873 billion, increasing to USD 30,000 billion by 2019. The value of global residential properties also grew, reaching USD 160,000 billion in 2020 [114]. Additionally, international commercial real estate reached USD 32.6 trillion, and residential real estate value grew by 13%, totaling USD 258.5 trillion [112]. These figures demonstrate that commercial and residential property transactions have grown more than any other type of real estate asset worldwide.

The real estate sector plays a significant role in the economies of nations worldwide. In the United States, the sector contributed 11.13% to the gross output, while in China, it represented 5.98% of GDP [134]. In Australia, the real estate market accounted for 11.4% of the GDP of its capital cities [19]. In Malaysia, the real estate industry contributed 4.2% to GDP from 2011 to 2014 [94]. In India, the real estate sector has a significant impact, accounting for approximately 7% of GDP and providing a significant number of job opportunities [117]. These figures demonstrate that the real estate sector is a significant contributor to the wealth of nations worldwide and plays a significant role in the GDP of many countries.

The global real estate industry is undergoing a significant transformation in response to the integration of digital technologies. It is estimated that approximately one-third of countries have already digitized their land records [95]. The fourth industrial revolution, characterized by the emergence and development of technologies such as big data analytics, cloud computing, machine learning, the Internet of Things (IoT), Artificial Intelligence (AI), distributed manufacturing, 3D printing, robotics, and automated decision-making, has brought about significant disruption in various industries and has influenced the evolution of the real estate industry as well [100, 114]. These technologies have created new opportunities for investment and growth, as well as new risks and challenges. The digitalization of the real estate industry is expected to continue to shape the future of the sector in various ways.

Digital technologies and decision-making systems have become integral to the digital transformation of the real estate industry, promoting innovative methods for acquiring, operating, and managing properties [98]. The growing accessibility of digital real estate tools has benefited customers, developers, planners, economists, and institutions alike. All stakeholders, including buyers, sellers, financial institutions, and brokers, require access to real estate data to make informed decisions. Therefore, examining and reviewing current research on digital real estate technologies and tools is necessary. This study conducts a bibliometric and systematic review of published scientific literature on digital real estate, focusing on digital real estate technologies and their applications. The study recommends future research directions for mainstreaming digital technologies and real estate development and management tools. The research specifically tries to address the following research questions:

-

RQ1: What are the common themes or thematic areas in digital real estate?

-

RQ2: How integrating different technologies can help in transforming digital real estate?

2 Methodology

The research design employed in this study is based on a longitudinal and systematic literature review, utilizing bibliometrics, historical trend analysis, and thematic analysis. Through this analysis, the study aims to identify specific digital real estate studies, technologies, and tools that have been developed and implemented in the industry.

2.1 Data collection

The Web of Science database was utilized for retrieving relevant publications for the study. A search query of "Digital Real Estate" was used to obtain a total of 616 results from the database on 8th August 2021. After carefully examining the titles and themes of these publications, 229 were deemed irrelevant to the applied query and were subsequently excluded. The methodology employed in this study is summarized in Fig. 1, which illustrates the flowchart of the research process.

A systematic review is a technique used to evaluate or summarize the results of multiple studies. It is achieved by identifying, selecting, evaluating, and synthesizing available and appropriate research evidence (Gates & March, 2016). It can also be referred to as a meta-analysis. The Preferred Reporting Items for Systematic Reviews and Meta-Analysis (PRISMA) guidelines were adopted in this study to analyze literature based on a checklist of 27 items, along with a flow diagram of four phases, providing a robust and detailed framework for the systematic review. The purpose of using PRISMA guidelines is to provide transparent and comprehensive systematic or meta-analysis of research areas within the research community [59, 70, 72, 99, 101]. On the Web of Science platform, a total of 387 publications were obtained after applying filters to include only those suitable for review. Among these, 150 were articles that underwent a screening process, and those publications that failed to meet the inclusion criteria based on abstract examination were excluded, resulting in a final set of 32 publications for this thematic analysis. The number of articles extracted from the Web of Science database using the PRISMA flow diagram is illustrated in Fig. 2. The inclusion criteria for this study were any publications in the selected database that analyzed and examined the topic of digital real estate in a comprehensive manner. After reviewing the abstracts, publications that did not meet the inclusion criteria were removed. Articles focused on mathematical modeling, the real estate brokerage industry, 3D modeling, digital financial services, pricing models, building construction, urban expansion, and environmental protection were excluded. Microsoft Excel 365, Microsoft PowerPoint (for listing and infographics), Mendeley Desktop (for citation), and VosViewer 1.6.16 (for keyword analysis) were used in this study.

2.2 Data analytical tools

2.2.1 Bibliometric analysis

Bibliometrics is a method used to analyze and quantify the growth of published literature on a specific topic [25]. It supports historical assumptions about field development, recognizes links between scientific advancement and policy changes, and explores the formation of interdisciplinary fields [131]. The process of bibliometrics consists of two steps: collecting related work from the appropriate database through a valid search query and reviewing and analyzing the searched work [48].

For this study, a topic search was conducted using selected keywords that included searches from the title, abstract, and author's keywords. Bibliometric analysis covers all types of publications, such as academic articles, books, conference papers, etc. The search incorporated Title, Abstract, and Author's keywords to identify relevant publications. The year limit was not applied to the search criteria, so according to the keywords, the oldest article was from 2006. Therefore, it can be assumed that publications were extracted from the duration of 2006–2021.

The retrieved data of published literature was exported to Microsoft Excel and incorporated a year-wise number of publications, countries, authors, journals, citations, and keyword analysis. All cited references and full records were exported in text file format (delimited tabs) and used for network visualization in VOSviewer (version 1.6.16). The exported data comprises title Information, source title (journal name), author-wise publication data, publication year, subject categories (discipline), abstract, author’s keywords, language, and the number of citations (if present on publication). VOSviewer (version 1.6.16) is an open software used to analyze bibliometric data through a visualization network based on co-authorship and co-citation (van Eck and Waltman, 2009). The research findings were reaffirmed by using the online tools “Citation Report” and “Analyse Results” of Web of Science.

2.2.2 Thematic analysis

Thematic analysis is a qualitative or descriptive study approach that is widely used for the analysis of qualitative data in various studies (Attride-Stirling, 2001a, Braun & Clarke, 2008, Nowell et al., 2017a, Naeem & Rana, 2020, Zilembo, 2021). It is a methodological procedure of coding that examines and describes common facts by creating themes. A four-phased theme development approach was used in this study to identify, select, and name thematic areas: Initialization, Construction, Rectification, and Finalization, to ensure high-quality results and findings (Mojtaba Vaismoradi, 2016).

The first step in the thematic analysis process included familiarization with all published articles and generating provisional ideas [35]. At the initial stage, coding was done for generic themes extracted from published articles using an inductive approach (also known as open coding with no pre-determined codes). The process was repeated three times to revisit articles to identify any missed code/theme. After that, themes were constructed based on a qualitative analysis of the content of published articles. The constructed themes were reviewed again as a final refinement until different themes were merged as sub-themes under the umbrella of major themes. All the sub-themes were also discussed under each finalized theme.

3 Results and discussions

3.1 Bibliometric analysis

The bibliometric analysis conducted in this study provides an overall review of publications, including historical development of literature, publication sources analysis, citation analysis, country analysis, and keyword analysis. The summary of the bibliometric analysis is presented in Fig. 3. This analysis provides valuable insights into the current state of research on digital real estate and highlights key trends and areas for future research and development.

The overall summary of the publications is presented in Fig. 3. A total of 1,283 authors have published research on digital "real estate." The most citations were observed in 2020 and 2021, with an average citation of 6.0 per article.

The trend of a particular topic can be analyzed through the annual number of publications. Results showed an annual increase in the number of publications on digital real estate until 2020 (Fig. 4). The first publication on digital real estate was in 2006, with 14 publications published. Results show that in 2006, 08 publications were published, which increased to 76 publications in 2020 and 43 by August 2021 (Fig. 4a). This identifies an expansion of research interest of the scientific community in digital real estate. There are nine most productive journals in which most articles have been published on digital real estate. Automation in Construction, Remote Sensing, Computers Environment and Urban Systems, Geocarto International, Building Research and Information, International Journal of remote Sensing, Annals of The Association of American Geographers, Sensors, and Science of the Total Environment are the most productive journals (Fig. 4b). Citation analysis revealed which publications on digital real estate were the most-cited ones (Table 1). The documents on digital real estate received 2,331 citations (an average of 6.0 citations per document). The total number of citations increased from 2007 to 2020 and up until August 2021.

The research strength of a region can be shown by the number of publications on a given topic by a particular country. The analysis revealed that institutions published the most publications from mainland China, the USA, and Australia (Fig. 5). On digital real estate, most of the research has been conducted in developing countries. China, Malaysia, and the USA were at the top of the list in this research. In this regard, China, Malaysia, and the USA published 21.68%, 18.44%, and 14.88% of total research publications on the selected topic.

3.2 Keyword analysis

Keyword analysis shows the precise content of digital real estate research. There were 2061 distinct keywords and 40 unique keywords. VOSviewer, an open-source software, was used to visualize the linkages and co-occurrence of specified or selected keywords by study authors. The circles in the visualization map represent the co-occurrence of each keyword, and the diameter of a circle shows the number of links between one keyword and another. Therefore, the larger the diameter of a circle, the more linkages with other keywords. The line thickness between two circles indicates how often keywords appear together. Figure 6 shows keywords used in publications on digital real estate with at least five times the co-occurrence of a keyword in extracted publications. This analysis has demonstrated that the concepts of GIS, blockchain, and BIM were the most frequently used keywords in digital real estate research.

Geographic Information System (GIS) is a valuable tool for enhancing access to documents and data, expediting transactions [38]. Its capabilities include creating three-dimensional maps and models, assessing the livability of an area, and presenting diverse datasets that assist real estate development [8, 76]. On the other hand, Building Information Modeling (BIM) functions as a digital representation of a building's physical and functional attributes [22, 128]. Through BIM, available data and information in digital format can be easily edited, copied, and shared with project stakeholders. This approach saves time and costs, enhances design and communication processes, boosts productivity and efficiency, and reduces the likelihood of errors [88, 104]. Additionally, blockchain technology has been investigated to digitize and legitimize informal land ownership across various regions worldwide. Blockchain can significantly save time and money by eliminating paperwork, reducing fraud, and expediting transactions. Its implementation has the potential to revolutionize the field of land administration and contribute to streamlined and transparent processes [85]. This highlights the role of these technologies and concepts in shaping the future of the digital real estate industry.

3.3 Themes of digital real estate

Thematic analysis has proven to be a valuable approach to identifying recurring themes within the realm of digital real estate. As a qualitative data analysis method, it involves discerning and constructing themes from a given dataset. This analytical technique enables the segmentation and categorization of extensive data in an easily comprehensible manner [5, 69]. It serves as a means to identify, analyze, and interpret patterns of meaning, commonly referred to as "themes," or shared characteristics inherent in qualitative data [16, 81]. After thoroughly reviewing selected articles, themes were categorized and named as Information and Communication Technology (ICT), Data Collection Technologies, Data Networking Tools, and Decision-Making Systems (Fig. 7).

Nowadays, ICT plays a vital role in every domain of life in this era of technology. ICT is used in smart cities to enable real-time monitoring, proficient management of urban facilities, and public safety insurance. ICT can promote the modernization process, and it positively affects urbanization and regional development. Data collection technologies deal with hardware and gadgets. In real estate, gadgets are used to tell a digital story based on augmented information through the integration of VR and BIM, real-time tracking of accidents, and as-built modeling with Lidar and 3D laser scanning. Various data collection methods and devices have been developed with the passage of time to augment real estate activities. Data Networking Tools means to use digital telecommunications that allow devices to share resources on a network. It has been used in several real estate domains, including coordinating multi-site construction projects via federated clouds, indoor door environment detection, reconstruction and modeling of as-built 3D pipelines, etc. Decision-making is a critical part of a typical real estate property valuation, as selecting a home to purchase or rent is an important multi-criteria decision. From a monetary point of view, a property purchase can be the largest investment an individual can make and carries a high financial risk. The decision is primarily based on three high-level criteria: household needs, building facilities, and location characteristics. Decision-making systems or procedures fed with property information are based on different methods and models. Some of them are geographic information systems (GIS) for locational characteristics/geostatistical analysis/geographic locations and building information systems for describing building details/facilities. While the more dominant approach involves artificial-intelligence-based methods in the framework of Geo-Computation.

The convergence and integration of various data sources and technologies (such as GIS, BIM, AI, and networking) in the real estate domain have the potential to enhance decision-making, improve efficiency, and provide valuable insights for investors, developers, and stakeholders. This digital transformation will likely continue shaping the future of real estate and urban development. All these themes represent the key areas where digital technologies are being applied to transform the real estate industry.

3.4 Information and communication technology

3.4.1 Urbanization and smart city

Urbanization is a process that is driven by technological advancements, particularly in the field of information and communication technology (ICT). ICT significantly promotes modernization and positively impacts urbanization and regional development [121]. It also contributes to reducing poverty by generating employment opportunities and enhancing per-capita income (T.D. Stanley, Chris Doucouliagos, 2015). The widespread use of ICT in urban planning and management, including infrastructure, property and land records, finance and mortgage, and digital information systems [31, 109], has led to the emergence of the concept of the "smart city."

The review showed that the smart city concept has been extensively covered in the digital real estate literature (Fig. 8). Smart buildings are shifting real estate from the physical to the digital realm. Technology has become the main differentiating factor for real estate in smart cities, both at the city and property scales [54]. Real estate technology in smart cities is considered an evolving solution to address the challenges of urbanization and achieve sustainable development [10]. Smart buildings, smart mobility, smart citizens, smart governance, smart education, smart infrastructure, smart technology, and smart energy are all components of a smart city, and they are interconnected through the Internet of Things and Big Data. The real estate sector plays a crucial role in the transition towards smart cities and is making rapid progress in the development and innovation of smart buildings in smart cities [47].

A smart city utilizes comprehensive ICT infrastructure to enable real-time monitoring, efficient management of urban facilities, and public safety. The smart housing concept and commercial real estate are two areas that are closely linked to smart cities [111]. Real estate is shifting from a physical to a digital environment through smart cities, and commercial real estate is shifting from providing assets to providing services [54]. Policymakers around the world are actively supporting and implementing smart city concepts. The Covid-19 pandemic has further accelerated the trend towards smart built environments, which are equipped with smart devices, such as sensors, and can interact intelligently with their human occupants and assist them in their daily activities [127]. While ICT acts as a primary engine of urbanization, it also has the potential to widen the digital divide, which can impede urbanization. In the information age, the digital divide poses a significant challenge to healthy urbanization. However, if the digital divide can be reduced, there is huge potential for effective urban governance. The government plays a crucial role in urbanization and technological progress, and government-led and ICT-based urbanization is believed to mitigate the effects of the digital divide and achieve balanced regional growth [121].

3.4.2 Digitalization

Digitalization refers to the process of converting information into digital format and making everything that can be digitized (Bhadra, 2015). It involves using digital technologies to transform business models and create new revenue streams and value-producing opportunities, leading to a digital business [15, 37]. It is closely linked to future socioeconomic pathways such as urbanization, sustainability, climate change, and demographics, which all significantly impact the daily lives of individuals and society [29].

In the real estate industry, digitalization is important for coding residential property attributes, such as location, size, and standard, in digital format [111]. This has led to real estate organizations investing in digitalization and modern computer-aided facility management software [49]. This provides the input for supporting Building information models (BIM), big data, Internet of Things (IoT), augmented reality (AR), blockchain, and building information standards [49]. The COVID-19 pandemic has provided an opportunity to invest in digitalization to revolutionize the real estate industry [74].

3.4.3 Real estate transactions

Real estate transactions involve the transfer of ownership of land, properties, and apartments and can be a costly and time-consuming. For example, on average, it takes about 22 days to complete a property transfer, costing around 5% of the total value (The World Bank 2018). Factors that contribute to delays in transactions include the unavailability of accurate or digital information, inefficient search criteria for customers, inconsistencies in parcel identification due to the difference between digitalized and paper plans, and the unavailability of standard inquiry forms or reporting mechanisms [90].

To address these challenges, an online land registry system is needed. This system is a conceptual and abstract model that includes four components: parties (individuals and organizations), administrative units (ownership rights), spatial units (parcels), and spatial sources (surveying) [42, 55]. An efficient electronic system can better monitor the registration process, automatically prevent fraud, and alert by detecting typical fraud patterns [89]. These systems can save time, reduce workforce, minimize bureaucratic delays, improve convenience and public access to land registration, enhance search possibilities, and provide remote access to records or registers. Additionally, it can provide a trusted and reliable source of information for the public, property buyers and sellers, and other stakeholders [124].

3.4.4 Proptech innovation

Proptech, short for property technology, refers to integrating technology with real estate operations. It involves using technology to perform tasks, facilitate interactions between buyers and sellers, transform physical products and information into data and services, and support the organization of people [106]. The development of real estate digital technologies, commonly referred to as Proptech, is expected to have a transformative impact on the entire real estate industry [51].

Proptech, short for property technology, refers to integrating technology with real estate operations. It involves using technology to perform tasks, facilitate interactions between buyers and sellers, transform physical products and information into data and services, and support the organization of people. The development of real estate digital technologies, commonly referred to as Proptech, is expected to have a transformative impact on the entire real estate industry.

Large-scale real estate organizations are adapting to recent technological advancements by focusing on new technology platforms, tools, and paradigms [9]. Proptech enhances customer experiences, increases sales, and improves operational efficiencies (Nikolai Siniak, 2020). Baum (2017) divided the Proptech industry into three categories: Smart real estate (SRE), Shared Economy, and Real Estate Fintech. These categories encompass technology-oriented systems that make it easier to utilize, operate, or manage real estate assets and ownership transactions. The real estate framework includes automation, brokerage, digitization, and management processes that explain the overall impact of technology on the industry [106].

3.5 Data collection technologies

3.5.1 Augmented and virtual reality

Various data collection technologies have been utilized in digital real estate, such as virtual reality (VR), drones, and big data. Virtual and augmented reality (AR) are among the most common tools used in the industry [20]. Virtual reality (VR) creates virtual worlds without a spatial reference to the real world, while augmented reality (AR) combines actual life with digital reality by superimposing computer-created virtual objects, scenes, and systems on actual scenes to enhance reality. These technologies have evolved, and in 2017 alone, they attracted huge investments of around $13 billion [115]. By 2025, revenues generated from VR/AR software are expected to reach $2.6 billion, and the market of VR and AR is expected to reach at least $80 billion in real estate (Forbes Real Estate [21].

Real estate agencies are using AR technologies to enhance classified advertisements and real estate search functions (Fig. 9). AR and VR offer opportunities such as platforms of virtual property, directed and interactive visits, virtual presentations, architectural visualization, and virtual trade [34]. 3D-virtual tours can be accessed through VR headsets. Individuals wear these headsets over their eyes and the upper part of their faces, allowing them to be fully immersed in a virtual home [97]. AR has also caught the attention of design review and collaboration as it is suitable for creating an interactive 3D communication setting. It allows consumers to explore greater possibilities for design scenarios and more intuitively analyze 3D BIM models before they are physically constructed [46]. In this way, the end-user can get a sense of an asset before viewing it, increasing their confidence in purchasing such property [115]. The advantages of using such technologies include global transactions, time savings, addressing intangibility, and narrowing down the pool of interest for buyers (Forbes Real Estate [21].

The current state of Augmented Reality (AR) technology is not without limitations. Technical issues such as difficulties in detecting real-time tracking sensors, user discomfort, and dissatisfaction with visual quality and display screens have been commonly cited as criticisms of existing AR displays. In response to these shortcomings, Spatial Augmented Reality (SAR) has been introduced as a potential solution. This technology uses an optical projector to alter the appearance of the real-world environment, providing a more immersive and realistic AR experience [46].

3.5.2 Drones

Drones, also known as unmanned aerial vehicles (UAVs), have become increasingly popular in the real estate industry for data collection purposes. These devices, which are operated through remote control or a ground control station, allow property managers and agents to capture aerial views of properties in the form of videos and images, which can then be used for marketing and promotional purposes [53].

In recent years, the use of drones in real estate management has increased significantly. They are used for various purposes, such as aerial photography, automated mapping, property marketing, 3D images, and the development of land surface data [71]. According to industry statistics, 72% of real estate companies in the United States, 52% in the United Kingdom, 48% in France, and 24% in Germany use drones for their business [53].

One of the major advantages of using drones in real estate is that they allow customers to view properties from an aerial perspective, providing them with a better understanding of the proximity of the property to neighboring houses and facilities without having to visit in person [115]. Customers highly value this feature, with 83% of home sellers globally preferring to work with agents who use drones. As a result, the selling rate of properties with aerial photographs taken by drones is 68% quicker than properties with normal photographs [130].

3.5.3 3D Scanning

3D scanning is a powerful data collection technique that is increasingly being used in the real estate industry to create accurate and detailed models, views, and images. This technology allows real estate stakeholders to access more reliable and credible data, which can be used for various purposes such as construction, renovation, and preservation [107].

Several types of 3D scanning technologies are available, including hand-held scanners, mobile scanners, and structured light scanners. Hand-held scanners, such as Lidar, are commonly used to create as-built drawings, which can be used to amend existing drawings or keep a record of maintenance and repairs. These scanners allow construction managers to update data and drawings using updated multi-dimensional models [92]. Scanned models can also be used to restore and preserve historical buildings, making them an important tool for real estate departments and government agencies [115]. These models can also be used in virtual tours and virtual walkthroughs, which can help to sell properties faster and more efficiently.

3.5.4 Wearable technology

Wearable technology, or wearables, refers to electronic devices or accessories that can be worn on the body and provide real-time data and information to the wearer. Due to their proximity to the body, wearables can provide more accurate and detailed information about a user and their surroundings [78, 113, 123].

In the real estate industry, wearable technology and devices can be used for various purposes, such as tracking maintenance and equipment records, providing visual cues for building elements, and presenting public data to potential customers [123]. The integration of wearable technologies with building management systems can also provide benefits such as fault detection and as-built drawings, allowing customers to make more informed decisions [115, 91]. Similarly, in the construction industry, wearable technology can play a critical role in monitoring the well-being and safety of workers and equipment in real-time [96]. Wearable devices can be used to track workers' location, monitor their vital signs, and alert managers in case of any emergency. This can help improve the safety and efficiency of construction sites and protect workers from potential hazards.

3.5.5 Big data

Big data is complex and multidimensional, entailing overlaps with various data collection and analysis technologies. It refers to the large and complex data sets generated by various sources such as smartphones, computers, and social media [123]. These data sets are difficult to process and analyze using traditional software techniques, making big data management and analytics challenging and costly [52]. According to a report, nearly 95% of businesses produce unstructured data and spent $187 billion 2019 on big data management and analytics [7].

With the wide utilization of technology, the real estate industry has also become a data-driven sector. Big data is increasingly being used in various forms, such as visualization of properties [30], virtual and augmented realities [116], stakeholder management [113], and online customer management [73]. Big data can save time and resources by providing real-time information on property prices, rents, and customer needs [123]. It can also help real estate agents and property managers to find potential clients and make more informed decisions. Big data in real estate incorporates a wide range of databases that include transaction histories, sociodemographic data, and geo-referenced data [9]. This data can be used for research purposes to better understand urban dynamics and infrastructure management [108].

3.6 Data networking tools

3.6.1 Cloud computing

Networking refers to the ability of devices to connect and share resources on a network through wired or wireless connections. Various tools and technologies are available for networking and computing, including cloud storage, retrieval, and computing (Fig. 10). Cloud computing is a data networking technology that offers on-demand self-service, broad network access, resource pooling, rapid elasticity, and measured service [17, 18]. In 2021, the global cloud market had a value of US$133.6 billion and is projected to reach US$168.6 billion by 2025 [63].

In the real estate industry, cloud computing offers several benefits, such as cost-effectiveness, improved security, data tracking, enhanced customer relationships, and increased productivity [36, 45, 75, 77]. For instance, cloud-based software and apps can help archive, store, and display real estate data for decision-making, reducing the risk of regret associated with insufficient information [115]. Additionally, it can assist in tracking and displaying maintenance and refurbishment records to stakeholders, providing them with financial details of the property. Furthermore, cloud computing improves scalability, flexibility, device integration, data security, and reliability [17, 119, 135]. Several studies have highlighted the use of cloud-computing services, such as Google App Engine, Microsoft Azure, Salesforce.com, Google Docs, Online Payroll, Cloudwatch, and Azurewatch, in the management of real estate [1, 2, 39, 44]. The market share of cloud computing in the real estate industry is expected to grow to 9.7% in the next five years [60].

3.6.2 Internet of Things (IoT)

The Internet of Things (IoT) refers to the interconnected network of devices that can detect physical characteristics such as temperature, humidity, lighting, and other parameters [125]. It is a novel internet-based model that connects various things or objects in the environment through wireless or wired technologies to achieve specific goals [115, 125]. The global market for IoT is projected to reach $875,000 million by 2025, with an annual compound growth rate of 26.9% [80].

In real estate property management, IoT devices are used to monitor buildings and associated environments to manage temperature, humidity, indoor air quality, and lighting levels [115]. IoT in real estate includes real-time production logistics synchronization systems and fog computing for wind farms, smart grids, and smart cities [11, 83]. Almost 73% of real estate businesses have already adopted IoT. IoT is transforming the real estate industry through innovations such as house hunting, smart real estate homes, smart buildings, and management systems [68]. It can help to reduce operational costs, improve the quality of life, and provide additional security. In large sites such as industrial zones, office parks, shopping malls, airports, and seaports, IoT can reduce energy costs, improve spatial management, and lower building maintenance costs by up to 30% [93].

3.6.3 Software as a Service (SaaS)

Software as a Service (SaaS) is a model of providing software in the technology industry by offering remote access to software via web-based network services instead of installing it on the user's desktop. This remote access is provided through the internet, making it cost-effective for agents and users [123]. SaaS integrates various solutions by combining several property management services under one platform [115].

SaaS has been widely used in construction management, client care management, supplier management, marketing, retailing, and various administrative tasks [61, 123]. SaaS-based software packages such as RealSpace and PropertyBase facilitate sharing information regarding contracts and work orders, lease and occupancy, maintenance, and security among key stakeholders, including consumers. This information reduces post-purchase regrets [115]. In the real estate industry, SaaS platforms typically offer key functions such as customer management, transaction management, property management, team management, listing management, and marketing automation [28].

The benefits of SaaS in the real estate industry include ease of accessibility, affordability, flexibility, cost-effectiveness, and ease of use. SaaS software can be accessed from anywhere, making it convenient for users. Additionally, as the software is provided as a service, it eliminates the need for high initial investments, making it cost-effective for businesses [4]. Furthermore, SaaS software is flexible and can be customized to meet specific needs, and it is easy to use, making it accessible to a wide range of users.

3.6.4 Blockchain

A blockchain is a decentralized and distributed database that stores ownership records in digital format through blocks linked together through cryptography. In the case of Bitcoin, transactions are recorded permanently and are viewable to anyone. Decentralized blockchains cannot be modified, and once entered, data is irreversible [40].

The real estate industry has relatively high profits but also faces significant issues such as high transaction fees, lack of transparency, time-consuming transactions, fraud, and undue commissions [3, 129]. Blockchain technology has emerged as a powerful supporting technology to address these real estate investment market issues. It offers various benefits such as speed, reliability, immutability, traceability, transparency, decentralization, and trust [3, 33, 129]. Therefore, the need for a blockchain-based structure arises to execute efficient, tamper-proof, fast, fraud-free, and reliable property transactions.

Blockchain technology can act as a registry that records property rights (token title) and transactions. Due to this, it fits both legal traditions by keeping title records and chains of deeds [50]. To minimize the risk of fraud, personal digital keys are given to involved parties in a contract [3]. The technologies in blockchain include smart contracts, immutable record management, and time-stamped [3, 33, 49, 50]. These technologies can ensure that property transactions are secure, transparent, and tamper-proof, which are essential for the real estate industry.

3.6.5 Property passports

A property passport, a digital logbook, is a unique digital file containing comprehensive information about an individual's property. This information is maintained and transmitted by the property owner and can include details such as the property's title, legal documents, and any relevant information about its occupants. To ensure that property passports are detailed, transparent, and cost-effective, it is essential to integrate advanced digital technologies such as IoT (Internet of Things) and BIM (Building Information Modeling) and automated means of managing occupants and properties. Real estate professionals have identified the implementation of property passports as a crucial step towards streamlining real estate transactions and reducing delays [90].

3.7 Decision making systems

Decision-making is critical to real estate property valuation, selection, purchase, or rental. From a financial perspective, purchasing property can be a significant investment with a high level of risk. Decision-making is typically based on three key criteria: household needs, building facilities, and location characteristics. Various decision-making systems and procedures have been developed to assist in this process, including geographic information systems (GIS) for evaluating locational characteristics, geostatistical analysis for identifying patterns in the data and building information systems (BIM) for describing building details and facilities. However, the most prevalent approach involves using artificial intelligence-based methods for real estate management (Fig. 11).

3.7.1 Building Information Model (BIM) and Geographic Information System (GIS)

Building Information Modeling (BIM) is a digital representation of the physical and functional characteristics of a building that creates a shared information resource for building information [27]. Originally introduced in the architecture, engineering, and construction (AEC) industry, BIM provides a reliable foundation for decision-making throughout the life cycle of a building, from initial conception and design to construction, operation, maintenance, and demolition [22, 128]. The data and information available in digital format through BIM can be modified, replicated, and shared with project stakeholders [66, 88, 104]. BIM and GIS can be used together to identify specific property units, accurately depict cadastral boundaries, and provide detailed representation of complex buildings [104].

BIM is a new paradigm for real estate that allows for the design, building, and management of built assets in a digital environment. It facilitates the flow of information throughout the project's life cycle and enables effective collaboration among all real estate stakeholders [13]. Using BIM has numerous benefits, including cost and time savings, improvements in quality and performance, detection of potential design conflicts, improved accuracy, enhanced collaboration and communication, better process of presentation and documentation, improvement in planning and design, and better visualization, cost estimation, facility management, and sustainability management [6, 65, 82].

A Geographic Information System (GIS) is a computing system designed for assembling, processing, and analyzing spatial data or information [26, 62, 103]. GIS has become vital in designing and planning real estate projects, particularly in community management. Using GIS, real estate professionals can measure the precise impact of location and make informed decisions based on that knowledge. GIS has become a widely used tool for property valuation by comparing the physical characteristics of a property, proximity, and network analysis [26, 103, 110, 126, 132].

GIS technology presents a means of implementing vastly improved land information systems, providing consistent, accurate, and timely data. GIS-based frameworks can support sustainable land use planning or land use scenario planning in the urban renewal of high-density cities, acting as an assessment tool to evaluate particular land sites and as a prototype of planning support systems [54, 114]. GIS tools can support and facilitate urban planners and other stakeholders involved in decision-making [23]. GIS data provides opportunities to locate regional real estate markets for new residential, retail, and industrial developments. It also provides an opportunity to improve real estate analysis by linking geographic location with data types such as demographics, customer profile, transport network, distance, employment, climate, etc. Large institutional investors such as real estate investment trusts, pension funds, life insurance companies, mortgage bankers, and international banks can utilize GIS databases to evaluate real estate investments in their portfolios [32, 86].

3.7.2 Artificial Intelligence (AI)

Artificial Intelligence (AI) is the ability of computers and intelligent programs to perform complex tasks using various forms of rules and reasoning [87]. The field of AI is rapidly growing and is being adopted by various industries. According to industry estimates, global AI revenue is expected to reach approximately $126 billion by 2025 [64].

AI-based technologies have been extensively used in the fields of civil engineering, urban planning, and smart city domains. In the real estate industry, AI can assist real estate agents in filtering potential buyers by collecting information through data-mining search algorithms and marketing strategies. AI-based solutions can also connect buyers to their dream properties by applying filters to narrow their search and extract related attributes based on massive data sets through AI predictive analysis. This type of intelligent matching can help prevent consumers from making decisions they may regret [115]. AI will continue to play an important role in the real estate industry, becoming an instrument for value-added and innovative business models and products. Examples include automated data validation and evaluation, documentation review, benchmarking, and other analytical applications [14]. The use of AI in the real estate industry will help improve the buying and selling process, making it more efficient, accurate, and cost-effective.

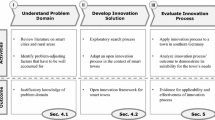

3.8 The Digital Real Estate Transformation Framework (DReTF)

The Digital Real Estate Transformation Framework (DReTF) is a comprehensive approach that outlines the essential components of digital real estate. This framework emphasizes the importance of information communication technology, data collection, networking tools, and decision-making systems in facilitating a successful digital real estate transformation (Fig. 12). The Digital Real Estate Transformation Framework (DReTF) envisions these components of digital real estate through the adoption, integration, and implementation of specialized software and technologies.

Adoption: Adoption is a crucial aspect of digital real estate transformation. As the field of real estate evolves rapidly, real estate professionals and firms need to learn and utilize the specialized software required for modern real estate practices. Real estate agencies must adapt to the digitization of consumer behavior to increase their competitiveness or meet the changing market demands. This can be achieved by staying current with digital updates and progress to remain competitive. Additionally, by placing sustainability and quality of life at the heart of their projects through technology and digitalization, real estate firms can generate a safer, healthier, and more fulfilling future.

Integration: Integration is another critical aspect of the DReTF, as it emphasizes the seamless integration of digital real estate technologies with website components to provide customers with useful tools for making decisions about selecting and purchasing a property. These tools can include inspection, view, and customization services. Digitalizing all available stored data related to the environment, transportation, landmarks, amenities, property/real estate, cadastral, legal affairs, planning, demographics, remote sensing, and mapping is essential. This can bring greater transparency to real estate transactions and protect individuals from fraudulent activity. Furthermore, digital developments should provide new forms of integration between physical and digital urban infrastructure, which can support future territorial and urban management and development.

Implementation: Implementation is the final component of the DReTF, which is hindered by various factors, including a lack of awareness, understanding, and capabilities among stakeholders, as well as a lack of support and willingness to adopt these technologies. Additionally, the high cost of software, hardware, and digital services poses a significant challenge for digital real estate. Moreover, in developing countries, data inaccessibility and availability also limit the adoption of digital technologies. Furthermore, as digital technologies evolve, so do the policies, regulations, standards, security protocols, and user privacy concerns surrounding their use.

To address these barriers, consumers need access to information that allows them to make informed decisions about using digital technologies in real estate. Governments can also play a key role in promoting the adoption of digital technologies in real estate by developing urban development plans and investing in ICT projects. This can help to enhance city operations and improve urbanization levels and efficiency. Additionally, governments should focus on promoting the digitalization of records at both the national and local levels and establishing clear regulations regarding real estate ownership data. By promoting innovation and expediting the widespread use of ICT services, governments can help to overcome these barriers and facilitate the adoption of digital technologies in the real estate sector.

4 Conclusion

The real estate sector is a significant contributor to global economies, and digital technologies are increasingly shaping the industry operations and customer behaviors in the real estate market. Digital technologies provide various decision support tools and services to various stakeholders, including real estate agents, developers, and consumers, which can enhance the proficiency and effectiveness of day-to-day operations, decision-making, cooperation, and monitoring.

This study has reviewed the current literature on digital technologies, data collection methods, network techniques, and decision-making tools in the real estate sector. It also addresses the possible barriers and benefits of adopting particular digital technologies in real estate. The study aims to provide a benchmark for practitioners, scholars, and policymakers to consider as they undertake work in the field of digital real estate.

It is worth noting that this study is limited to published literature on digital technologies used in real estate, and future research can expand on this by collecting primary data from real estate experts through structured or unstructured interviews to understand the implications of digital technologies in the real estate industry. Moreover, based on subjective judgment, themes identified might differ for similar analysis. Additionally, this study can be extended to investigate the impact of digital technology on consumer decision-making about purchasing a property through questionnaires.

Availability of data and materials

Data available on reasonable request.

References

Aboul ND, Hassanien E, Bhatt C, Suresh ASA, Satapathy C (2011). Studies in Big Data 30 Internet of Things and Big Data Analytics Toward Next-Generation Intelligence. http://www.springer.com/series/11970

Aceto G, Botta A, De Donato W, Pescapè A (2013) Cloud monitoring: A survey. Comput Netw 57(9):2093–2115. https://doi.org/10.1016/j.comnet.2013.04.001

Ahmad I, Alqarni MA, Almazroi AA, Alam L (2020) Real estate management via a decentralized blockchain platform. Computers, Materials and Continua 66(2):1813–1822. https://doi.org/10.32604/cmc.2020.013048

Albert Aranbaev. (2021). SaaS for Real Estate. UnitConnect. https://www.unitconnect.com/saas-for-real-estate/#:~:text=What are the Benefits of,process%2C and reduced infrastructure costs.

Alhojailan MI, Ibrahim M (2012) Thematic ANALYSIS : a critical review of Its process and evaluation. WEI Int Europ Academ Conference Proceed 1(2011):8–21

Ali B, Zahoor H, Mazher KM, Maqsoom A (2018) BIM Implementation in Public Sector of Pakistan Construction Industry. ICCREM 2018: Innov Technol Intellig Construct - Proceedings Int Conference Construction Real Estate Manag 1:42–51. https://doi.org/10.1061/9780784481721.005

Arina L (2019). 39+ Big Data Statistics for 2022. Leftronic. https://leftronic.com/blog/big-data-statistics/

Ashok Mohanani. (2018). Why GIS technology is important for real estate? 99 Acres. https://www.99acres.com/articles/why-gis-technology-is-important-for-real-estate.html

Battisti E, Shams SMR, Sakka G, Miglietta N (2020) Big data and risk management in business processes: implications for corporate real estate. Bus Process Manag J 26(5):1141–1155. https://doi.org/10.1108/BPMJ-03-2019-0125

Armin A (2020). The Impact of Real Estate Technology on Smart City Stakeholders[Masters dissertation, Metropolia University of Applied Sciences]. Theseus. https://urn.fi/URN:NBN:fi:amk-202202162521.

Bessis N, Dobre C (2014) Fog computing: a platform for internet of things and analytics. Studies Computational Intelligence 546:1–19. https://doi.org/10.1007/978-3-319-05029-4

Bhadra, O. M. and K. (2015). ICT: A magic wand for social change in rural India. In handbook of research on cultural and economic impacts of the information society (p. 25). https://doi.org/10.4018/978-1-4666-8598-7.ch021

Bilge EC, Yaman H (2021) Information management roles in real estate development lifecycle: literature review on BIM and IPD framework. Constr Innov 21(4):723–742. https://doi.org/10.1108/CI-04-2019-0036

Bodenbender M, Kurzrock BM, Müller PM (2019) Broad application of artificial intelligence for document classification, information extraction and predictive analytics in real estate. J Gen Manag 44(3):170–179. https://doi.org/10.1177/0306307018823113

Branca TA, Fornai B, Colla V, Murri MM, Streppa E, Schröder AJ (2020) The challenge of digitalization in the steel sector. Metals 10(2):1–23. https://doi.org/10.3390/met10020288

Braun V, Clarke V (2012) Thematic analysis. APA Handbook of research methods in psychology, Vol 2: research designs: quantitative. Qualitative, Neuropsychological, Biological 2:57–71. https://doi.org/10.1037/13620-004

Bulusu, S., & Sudia, K. (2012). A Study on Cloud Computing Security Challenges. In School of Computing Blekinge Institute of Technology. http://sea-mist.se/fou/cuppsats.nsf/all/2789843dd1fffc4cc1257c4f0043e653/$file/BTH2013Bulusu.pdf

Carroll, M., Van Der Merwe, A., & Kotzé, P. (2011). Secure cloud computing: Benefits, risks and controls. 2011 Information Security for South Africa - Proceedings of the ISSA 2011 Conference, September. https://doi.org/10.1109/ISSA.2011.6027519

Chandler, T. (2016). Spotting Major Threats That Lie Ahead For The Australian Housing Market. Trace Chandler Buyers Agent. https://buyersagent-sydney.com.au/threats-australian-housing-market/

Chai CS, Lau SEN, Aminudin E, Loo SC, Gheisari M, Abdalrahman MA (2019) Integration of augmented reality in building information modeling: Applicability and practicality. WIT Transactions on the Built Environment, 192, 281–290. https://doi.org/10.2495/BIM190241

Council, F. R. E. (2017). Eight Ways Virtual And Augmented Reality Are Changing The Real Estate Industry. https://www.forbes.com/sites/forbesrealestatecouncil/2017/07/14/eight-ways-virtual-and-augmented-reality-are-changing-the-real-estate-industry/?sh=143b8a2165a3

Dainty A, Leiringer R, Fernie S, Harty C (2017) BIM and the small construction firm: a critical perspective. Building Research and Information 45(6):696–709. https://doi.org/10.1080/09613218.2017.1293940

de Toro, P., Nocca, F., Renna, A., & Sepe, L. (2020). Real estate market dynamics in the city of naples: An integration of a multi-criteria decision analysis and geographical information system. Sustainability (Switzerland), 12(3). https://doi.org/10.3390/su12031211

Demirkan H, Spohrer J (2014) Developing a framework to improve virtual shopping in digital malls with intelligent self-service systems. J Retail Consum Serv 21(5):860–868. https://doi.org/10.1016/j.jretconser.2014.02.012

Du H, Li N, Brown MA, Peng Y, Shuai Y (2014) A bibliographic analysis of recent solar energy literatures: The expansion and evolution of a research field. Renewable Energy 66:696–706. https://doi.org/10.1016/j.renene.2014.01.018

Dueker KJ, Delacy PB (1990) Gis in the land development planning process balancing the needs of land use planners and real estate developers. J Am Plann Assoc 56(4):483–491. https://doi.org/10.1080/01944369008975451

Eastman C, Teicholz P, Sack R, Liston K (2011) BIM Handbook, a Guide to Building Information Modelling, 2nd edn. In John Wiley & Sons Inc, Hoboken

Elena Semeniak. (2022). How to build a SaaS solution for real estate: software types, key features, and development nuances. Apriorit. https://www.apriorit.com/dev-blog/767-web-saas-for-real-estate

European Commission (2018). European Commission Digital Strategy: A digitally transformed, user-focused and data-driven Commission C(2018) 7118. https://ec.europa.eu/transparency/documents-register/detail?ref=C(2018)7118&lang=en.

Felli F, Liu C, Ullah F, Sepasgozar SME (2018) Implementation of 360 videos and mobile laser measurement technologies for immersive visualisation of real estate & properties. Australian Universities Building Education Association (AUBEA) 2(November):294–305

Fields D, Rogers D (2021) Towards a Critical Housing Studies Research Agenda on Platform Real Estate. Hous Theory Soc 38(1):72–94. https://doi.org/10.1080/14036096.2019.1670724

Fletcher RG (2003) Geographic Information Systems in Real Estate. Encyclopedia of Information Systems 2:433–441. https://doi.org/10.1016/b0-12-227240-4/00078-2

Garcia-Teruel RM (2020) Legal challenges and opportunities of blockchain technology in the real estate sector. Journal of Property, Planning and Environmental Law 12(2):129–145. https://doi.org/10.1108/JPPEL-07-2019-0039

Gleb B., V. V. (2020). Five Innovative Ways You Can Use Virtual Reality in the Real Estate Business. https://rubygarage.org/blog/virtual-reality-in-real-estate

Glisczinski D (2018) Thematic Analysis. J Transform Educ 16(3):175. https://doi.org/10.1177/1541344618777367

GRAFF, J. (2020). 8 Ways Cloud Computing Benefits Real Estate Agents. Ashby and Graff Real Estate. https://ashbygraffadvantage.com/real-estate-sales-skills-blog/8-ways-cloud-computing-benefits-real-estate-agents

Gray J, Rumpe B (2015) Models for digitalization. Softw Syst Model 14(4):1319–1320. https://doi.org/10.1007/s10270-015-0494-9

Greg Geilman. (2018). How the real estate industry can use, benefit from GIS. Hexagon. https://blog.hexagongeosystems.com/gis-real-estate/#:~:text=GIS provide an advanced level,accurate estimates of commuting paths.

Hashem IAT, Yaqoob I, Anuar NB, Mokhtar S, Gani A, Ullah Khan S (2015) The rise of “big data” on cloud computing: Review and open research issues. Inf Syst 47:98–115. https://doi.org/10.1016/j.is.2014.07.006

Hayes A (2022) Blockchain Facts: What is it, How it Works, and How It can be Used. Investopedia. https://www.investopedia.com/terms/b/blockchain.asp. Accessed 09 Oct 2022.

Huang T, Kong CW, Guo HL, Baldwin A, Li H (2007) A virtual prototyping system for simulating construction processes. Autom Constr 16(5):576–585. https://doi.org/10.1016/j.autcon.2006.09.007

ISO. (2012). Geographic information — Land Administration Domain Model (LADM) (1st ed.). ISO 19152:2012. https://www.iso.org/standard/51206.html

Jack Caulfield. (2022). How to Do Thematic Analysis | Step-by-Step Guide & Examples. Scribbr. https://www.scribbr.com/methodology/thematic-analysis/

Jaeger T, Schiffman J (2010) Outlook: Cloudy with a chance of security challenges and improvements. IEEE Secur Priv 8(1):77–80. https://doi.org/10.1109/MSP.2010.45

Jane. (2022). Benefits of Cloud Computing in Real Estate. REALTYNA. https://realtyna.com/blog/benefits-cloud-computing-real-estate/

Jin, Y., Seo, J. O., Lee, J. G., Ahn, S., & Han, S. U. (2020). BIM-based spatial augmented reality (SAR) for architectural design collaboration: A proof of concept. Applied Sciences (Switzerland), 10(17). https://doi.org/10.3390/app10175915

Jonathan Hills TD (2018). The role of real estate in smart city development. https://apacresearch.cbre.com/en/research-and-reports/Asia-Pacific-ViewPoint---The-Role-of-Real-Estate-in-Smart-City-Development-April-2018

Keramatfar A, Amirkhani H (2019) Bibliometrics of sentiment analysis literature. J Inf Sci 45(1):3–15. https://doi.org/10.1177/0165551518761013

Koch C, Hansen GK, Jacobsen K (2019) Missed opportunities: two case studies of digitalization of FM in hospitals. Facilities 37(7–8):381–394. https://doi.org/10.1108/F-01-2018-0014

Konashevych O (2020) Constraints and benefits of the blockchain use for real estate and property rights. Journal of Property, Planning and Environmental Law 12(2):109–127. https://doi.org/10.1108/JPPEL-12-2019-0061

KPMG, G. P. S. (2017). Bridging the gap: How the real estate sector can engage with PropTech to bring the built and digital envournments together. November. https://assets.kpmg/content/dam/kpmg/uk/pdf/2017/11/proptech-bridging-the-gap.pdf

Kumar Padhi B, Nayak SS, Biswal BN (2018) Machine Learning for Big Data Processing: A Literature Review. INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY; IJIRT 140001 December 2018 | IJIRT | Volume 5 Issue 7 |ISSN: 2349-6002 Samples, 5(7):10. https://www.researchgate.net/publication/331497335

Kuzma, J., O’ Sullivan, S., Philippe, T., Koehler, J., & Coronel, R. (2017). Commercialization Strategy in Managing Online Presence in the Unamanned Aerial Vehicle Industry. International Journal of Business Strategy, 17(1), 59–68. https://doi.org/10.18374/ijbs-17-1.6

Lecomte P (2019) What is smart? A real estate introduction to cities and buildings in the digital era. J Gen Manag 44(3):128–137. https://doi.org/10.1177/0306307018823108

Lemmen CHJ, van Oosterom PJM, Uitermark HT, Zevenbergen JA, Cooper AK (2011). Interoperable Domain Models: the Iso Land Administration Domain Model Ladm and Its External Classes. The International Archives of the Photogrammetry, Remote Sensing and Spatial Information Sciences, XXXVIII-4/(Udms), 31–40. https://doi.org/10.5194/isprsarchives-xxxviii-4-c21-31-2011

Li, C. Z., Xue, F., Li, X., Hong, J., & Shen, G. Q. (2018). An Internet of Things-enabled BIM platform for on-site assembly services in prefabricated construction. Automation in Construction, 89(November 2017), 146–161. https://doi.org/10.1016/j.autcon.2018.01.001

li, H., Yu, L., & Cheng, E. W. L. (2005) A GIS-based site selection system for real estate projects. Constr Innov 5(4):231–241. https://doi.org/10.1108/14714170510815276

Li, Max Z. -Y., Bian F (2010) Research and Solution On The Issues of Information System Updates and Upgrades In Digital Realestate. 2010 SECOND INTERNATIONAL CONFERENCE ON E-LEARNING, E-BUSINESS, ENTERPRISE INFORMATION SYSTEMS, AND E-GOVERNMENT (EEEE 2010), 2. https://doi.org/10.1080/03075079.2010.482981

Liberati, A., Altman, D. G., Tetzlaff, J., Mulrow, C., Gøtzsche, P. C., Ioannidis, J. P. A., Clarke, M., Devereaux, P. J., Kleijnen, J., & Moher, D. (2009). The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. PLoS Medicine, 6(7). https://doi.org/10.1371/journal.pmed.1000100

Lilia Shkuropat. (2022). Future of Real Estate Software Industry: What You Need To Know Today. Mindk. https://www.mindk.com/blog/real-estate-software-industry/

Limbăşan A, Rusu L (2011) Implementing SaaS Solution for CRM. Informatică Economică 15(2):175–183

Lin C, Meng L, Pan H (2001) Applications and Research on GIS for the Real Estate. Centre for Remote Imaging, Sensing and Processing 53(November):1689–1699

Liu, S. (2022a). Global cloud applications market size 2013–2025. Statista.Com. https://www.statista.com/statistics/475670/cloud-applications-market-size-worldwide/

Liu, S. (2022b). Revenues from the artificial intelligence (AI) software market worldwide from 2018 to 2025. Statista.Com. https://www.statista.com/statistics/607716/worldwide-artificial-intelligence-market-revenues/

Ma, C., Li, X., & Meng, Y. (2014). Study on the Application of BIM Technology in Construction Projects under IPD Mode. ICCREM 2014: Smart Construction and Management in the Context of New Technology - Proceedings of the 2014 International Conference on Construction and Real Estate Management, 2010, 229–236. https://doi.org/10.1061/9780784413777.028

Mahdjoubi L, Moobela C, Laing R (2013) Providing real-estate services through the integration of 3D laser scanning and building information modelling. Computers in Industry, 64(9):1272–1281. https://doi.org/10.1016/j.compind.2013.09.003

Mahlon Apgar, I. (2009). What Every Leader Should Know About Real Estate. Harvard Business Review. https://hbr.org/2009/11/what-every-leader-should-know-about-real-estate

Mihir Mistry. (2022). How solid is IoT’s prominence in the real estate industry? Let’s find out! Odytechnolab. https://kodytechnolab.com/blog/iot-technology-in-real-estate/

Miroslav Damyanov. (2023). How to do thematic analysis. Dovetail. https://dovetail.com/research/thematic-analysis/

Mitrović VL, O’Mathúna DP, Nola IA (2019) Ethics and Floods: A Systematic Review. Disaster Med Public Health Prep 13(4):817–828. https://doi.org/10.1017/dmp.2018.154

Mohan, H. (2015). Innovation is the key order in Start Ups – Recent Paradigms in Marketing Vertical. 2(2), 24–30.

Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., Altman, D., Antes, G., Atkins, D., Barbour, V., Barrowman, N., Berlin, J. A., Clark, J., Clarke, M., Cook, D., D’Amico, R., Deeks, J. J., Devereaux, P. J., Dickersin, K., Egger, M., Ernst, E., … Tugwell, P. (2009). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Medicine, 6(7). https://doi.org/10.1371/journal.pmed.1000097

Munawar HS, Qayyum S, Ullah F, Sepasgozar S (2020) Big data and its applications in smart real estate and the disaster management life cycle: A systematic analysis. Big Data and Cognitive Computing 4(2):1–53. https://doi.org/10.3390/bdcc4020004

Nanda A, Yishuang X, Fangchen Z (2021) “How Would the COVID-19 Pandemic Reshape Retail Real Estate and High Streets through Acceleration of E-Commerce and Digitalization?” Journal of Urban Management 10(2):110–24. https://doi.org/81410.1016/j.jum.2021.04.001

ONGC Systems. (2019). How Real Estate Can Benefit From Cloud Computing. Ongc. https://www.ongc.com.au/resources/blog/how-real-estate-can-benefit-from-cloud-computing

Ovramenko, V. (2022). Applying GIS Solutions in The Real Estate Industry. Mappitall. https://mappitall.com/blog/gis-solutions-for-real-estate

PADMALOSANI. (2021). 5 reasons why your real estate business needs an online file storage solution. WorkDrive. https://www.zoho.com/workdrive/digest/5-benefits-of-running-your-real-estate-business-on-the-cloud.html

Page T (2015) A forecast of the adoption of wearable technology. International Journal of Technology Diffusion 6(2):1370–1388. https://doi.org/10.4018/978-1-5225-5484-4.ch063

Peek, S. (2022). Want to Invest in Digital Real Estate? How to Get Started. Business.Com. https://www.business.com/articles/investing-in-digital-real-estate/

Petrov, C. (2022). 49 Stunning Internet of Things Statistics 2021 [The Rise Of IoT]. TechJury. https://techjury.net/blog/internet-of-things-statistics/#gref

Pramonos S (2015) Thematic Analysis Ekp 13:1–5

Qie ET, Jiao YY (2014) Discussion of the BIM implementation mode in real estate development companies. Appl Mech Mater 651–653:1147–1150. https://doi.org/10.4028/www.scientific.net/AMM.651-653.1147

Qu T, Pan Y, Liu X, Kang K, Li C, Thurer M, Huang GQ (2017) Internet of Things-based real-time production logistics synchronization mechanism and method toward customer order dynamics. Trans Inst Meas Control 39(4):429–445. https://doi.org/10.1177/0142331217691218

Ratcliffe, J., Stubbs, M., & Shepherd, M. (2004). Urban planning and real estate development: Second edition. Urban Planning and Real Estate Development: Second Edition, March, 1–497. https://doi.org/10.4324/9780203428245

Rodima-Taylor D (2021) Digitalizing land administration: The geographies and temporalities of infrastructural promise. Geoforum 122(March):140–151. https://doi.org/10.1016/j.geoforum.2021.04.003

Rodriguez M, Sirmans C, Marks A (1995) Using Geographic Information Systems to Improve Real Estate Analysis. Journal of Real Estate Research 10(2):163–173. https://doi.org/10.1080/10835547.1995.12090785

Rossini P (2000) Using_Expert_Systems_and_Artificial_Intelligence_for_RE_Forecasting. Sixth Annual Pacific-Rim Real Estate Society Conference, Sydney, January, 24–27.

Saka, A. B., Chan, D. W. M., & Siu, F. M. F. (2020). Drivers of sustainable adoption of building information modelling (BIM) in the nigerian construction small and medium-sized enterprises (SMEs). Sustainability (Switzerland), 12(9). https://doi.org/10.3390/su12093710

Sandberg H (2010) Real estate e-conveyancing: Vision and risks. Information and Communications Technology Law 19(2):101–114. https://doi.org/10.1080/13600834.2010.494047

Saull A, Baum A, Braesemann F (2020) Can digital technologies speed up real estate transactions? Journal of Property Investment and Finance 38(4):349–361. https://doi.org/10.1108/JPIF-09-2019-0131

Sepasgozar, S. M. E., Lim, S., Shirowzhan, S., & Kim, Y. M. (2014). Implementation of as-built information modelling using mobile and terrestrial lidar systems. 31st International Symposium on Automation and Robotics in Construction and Mining, ISARC 2014 - Proceedings, Isarc, 876–883. https://doi.org/10.22260/isarc2014/0118

Sepasgozar, S. M. E., Wang, C. C., & Shirowzhan, S. (2016). Challenges and opportunities for implementation of laser scanners in building construction. ISARC 2016 - 33rd International Symposium on Automation and Robotics in Construction, Isarc, 742–751. https://doi.org/10.22260/isarc2016/0090

Serhiy Chernyshov. (2022). Smart Real Estate: IoT Real Estate Technology. Softengi. https://softengi.com/blog/smart-real-estate-iot-real-estate-technology/#:~:text=The IoT for Real Estate,easier with building maintenance analytics.

Shahid S, Pour SH, Wang X, Shourav SA, Minhans A, Ismail T, bin. (2017) Impacts and adaptation to climate change in Malaysian real estate. International Journal of Climate Change Strategies and Management 9(1):87–103. https://doi.org/10.1108/IJCCSM-01-2016-0001

Shang Q, Price A (2019) A Blockchain- Based Land Titling Project in the Republic of Georgia: Rebuilding Public Trust and Lessons for Future Pilot Projects. Innovations: Technology, Governance, Globalization 12(3–4):72–78. https://doi.org/10.1162/inov_a_00276.

Shirowzhan, S., Sepasgozar, S. M. E., Zaini, I., & Wang, C. (2017). An integrated GIS and Wi-Fi based Locating system for improving construction labor communications. ISARC 2017 - Proceedings of the 34th International Symposium on Automation and Robotics in Construction, Isarc, 1052–1059.

Sihi D (2018) Home sweet virtual home: The use of virtual and augmented reality technologies in high involvement purchase decisions. J Res Interact Mark 12(4):398–417. https://doi.org/10.1108/JRIM-01-2018-0019

Siniak N, Kauko T, Shavrov S, Marina N (2020) The impact of proptech on real estate industry growth. IOP Conference Series: Materials Science and Engineering, 869(6). https://doi.org/10.1088/1757-899X/869/6/062041

Sohrabi C, Franchi T, Mathew G, Kerwan A, Nicola M, Griffin M, Agha M, Agha R (2021) PRISMA 2020 statement: What’s new and the importance of reporting guidelines. Int J Surg 88(March):39–42. https://doi.org/10.1016/j.ijsu.2021.105918

Starr CW, Saginor J, Worzala E (2021) The rise of PropTech: emerging industrial technologies and their impact on real estate. Journal of Property Investment and Finance 39(2):157–169. https://doi.org/10.1108/JPIF-08-2020-0090

Stewart, G., Tierney, J. F., & Group, P. D. (2015). Preferred Reporting Items for a Systematic Review and Meta-analysis of Individual Participant Data The PRISMA-IPD Statement. 313(16). https://doi.org/10.1001/jama.2015.3656

Su S, Hu Y, Luo F, Mai G, Wang Y (2014) Farmland fragmentation due to anthropogenic activity in rapidly developing region. Agric Syst 131:87–93. https://doi.org/10.1016/j.agsy.2014.08.005

Sun, L., & Zhu, H. (2009). GIS-based spatial decision support system for real estate appraisal. ICCIT 2009 - 4th International Conference on Computer Sciences and Convergence Information Technology, 1339–1344. https://doi.org/10.1109/ICCIT.2009.215

Sun Mi, Olsson P, Harrie. (2019) Utilizing BIM and GIS for Representation and Visualization of 3D Cadastre. ISPRS Int J Geo Inf 8(11):503. https://doi.org/10.3390/ijgi8110503

Stanley TD, Doucouliagos H, Steel P (2018) Does Ict Generate Economic Growth? a Meta-Regression Analysis. Journal of Economic Surveys 32:705–726. https://doi.org/10.1111/joes.12211

Tagliaro, C., Bellintani, S., & Ciaramella, G. (2021). R.E. property meets technology: cross-country comparison and general framework. Journal of Property Investment and Finance, 39(2), 125–143. https://doi.org/10.1108/JPIF-09-2019-0126

Takin, M., Peng, J., Sepasgozar, S. M. E., & Ebrahimi, H. (2017). A framework for using advanced visualization tools for residential property management. ISARC 2017 - Proceedings of the 34th International Symposium on Automation and Robotics in Construction, Isarc, 359–365. https://doi.org/10.22260/isarc2017/0049

Talamo C, Atta N, Martani C, Paganin G (2016) L’integrazione delle infrastrutture urbane fisiche e digitali: Il ruolo dei “big Data.” Techne, 11:217–225. https://doi.org/10.13128/Techne-18424

Tapp R, Kay K (2019) Fiscal geographies: “Placing” taxation in urban geography. Urban Geogr 40(4):573–581. https://doi.org/10.1080/02723638.2019.1585141

Thrall GI (1998) GIS Applications in Real Estate and Related Industries. J Hous Res 9(1):33–59. https://doi.org/10.1080/10835547.1998.12091928

Tomal, M. (2020). Moving towards a smarter housing market: The example of Poland. Sustainability (Switzerland), 12(2). https://doi.org/10.3390/su12020683

Tostevin, P. (2021). The total value of global real estate. September, 12–14. https://www.savills.com/impacts/market-trends/the-total-value-of-global-real-estate.html

Ullah, F., Sepasgozar, S., & Ali, T. H. (2019). Real Estate Stakeholders Technology Acceptance Model (RESTAM): User-focused Big9 Disruptive Technologies for Smart Real Estate Management. International Conference on Sustainable Development in Civil Engineering, December, 1–8. https://www.researchgate.net/publication/337772796

Ullah F, Sepasgozar SME, Thaheem MJ, Al-Turjman F (2021) Barriers to the digitalisation and innovation of Australian Smart Real Estate: A managerial perspective on the technology non-adoption. Environ Technol Innov 22:101527. https://doi.org/10.1016/j.eti.2021.101527

Ullah, F., Sepasgozar, S. M. E., & Wang, C. (2018). A systematic review of smart real estate technology: Drivers of, and barriers to, the use of digital disruptive technologies and online platforms. Sustainability (Switzerland), 10(9). https://doi.org/10.3390/su10093142

Ullah F (2017) An Investigation of Real Estate Technology Utilization in Technologically Advanced Marketplace. In D. S. H. L. Dr. Farrukh Arif, Prof. Dr. Abdul Jabbar Sangi (Ed.), International International Civil Engineering Congress (ICEC-2017) “Striving Towards Resilient Built Environment” December 22-23 (Issue March 2018, pp. 173–182). IEP Karachi Centre. https://www.academia.edu/36094969/An_Investigation_of_Real_Estate_Technology_Utilization_in_Technologically_Advanced_Marketplace

Union Housing and Urban Affairs Ministry. (2021). Realty contribution to GDP to reach 10% by 2025: Official. Moneycontrol. https://www.moneycontrol.com/news/business/real-estate/realty-contribution-to-gdp-to-reach-10-by-2025-official-7248301.html

Vaismoradi, M., Jones, J., Turunen, H., & Snelgrove, S. (2016). Theme development in qualitative content analysis and thematic analysis. Journal of Nursing Education and Practice, 6(5). https://doi.org/10.5430/jnep.v6n5p100

Vennam, S. (2020). Cloud Computing. IBM Cloud Learn Hub. https://www.ibm.com/cloud/learn/cloud-computing

Wallace, B. (2018). How Real Estate Will be Revolutionized on the Blockchain. Hackernoon. https://hackernoon.com/how-real-estate-will-be-revolutionized-on-the-blockchain-63e0f0c8327

Wang, D., Zhou, T., & Wang, M. (2021). Information and communication technology (ICT), digital divide and urbanization: Evidence from Chinese cities. Technology in Society, 64(December 2020), 101516. https://doi.org/10.1016/j.techsoc.2020.101516

Wang, H., Shen, Q., Tang, B. S., & Zheng, W. (2014). A GIS-Based Framework for Sustainable Land-Use Decision-Making in Urban Renewal: A Case Study in Hong Kong. ICCREM 2014: Smart Construction and Management in the Context of New Technology - Proceedings of the 2014 International Conference on Construction and Real Estate Management, 1627–1642. https://doi.org/10.1061/9780784413777.193

Warburton, D. (2018). The Role of Technology in the Real Estate Industry. Journal of Chemical Information and Modeling, 53(July), 227. http://library.wur.nl/WebQuery/wurpubs/fulltext/353506