Abstract

Incentive-based health insurance applications have been implemented to trigger lower insurance premiums when the individual follows healthy living habits. It has been recognised that this benefit notwithstanding, consumers’ perceptions related to such applications in the life-insurance field and health tracking are not necessarily positive. Recent research has recognised that psychological ownership, a mental state wherein one feels a technology or application to be his or her own, plays a crucial role in individuals’ willingness to adopt and use new technologies. It has been suggested that many digital applications and platforms possess unique empowering and co-creative features that offer special potential to facilitate the emergence of psychological ownership and satisfy the underlying needs. The aim of our study, proceeding from these premises, was to identify and thematize hurdles to take-up of incentive-based health insurance applications with regard to meeting needs that drive development of psychological ownership. We achieved this by conducting a thematic analysis of perceptions of consumers who were not willing to adopt a specific application of the relevant type. The resulting framework, which recognises 14 thematized hurdles in all, holds important implications for scientific and managerial use both.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The insurance industry and associated companies have long been at the forefront of creating and utilising digital tools and analysis methods for purposes of developing backend functions, such as actuarial methods, for insurance companies (cf. Beard et al. 1984; Daykin et al. 1994). Recently, attention has been turned to the consumer interface also (cf. Robson 2015; Harrison 2003, 2015). New digital insurance applications, based on behaviour-tracking, allow the insured to influence the premiums and benefits via certain behaviour.

Incentive-based health insurance applications have been implemented to trigger lower insurance premiums when the individual follows healthy living habits. It has been recognised that this benefit notwithstanding, consumers’ perceptions related to such applications in the life-insurance field and health tracking are not necessarily positive: they are viewed more negatively than corresponding non-life applications (e.g., Voutilainen and Koskinen 2017; Talonen et al. 2021). This article addresses a clear lack of knowledge pertaining to the challenges related to adoption of these applications.

Recent research has recognised that psychological ownership, a mental state wherein one feels a technology or application to be his or her own, plays a crucial role in individuals’ willingness to adopt and use new technologies (e.g., Kirk and Swain 2018; Brasel and Gips 2014; Fuchs et al. 2010; Zhao et al. 2016; Sinclair and Tinson 2017). It has been suggested that many digital applications and platforms possess unique empowering and co-creative features (cf. Denegri-Knott et al. 2006; Plé et al. 2010) that offer special potential to facilitate the emergence of psychological ownership and satisfy the underlying needs(Talonen 2018; Talonen et al. 2016). In discussion of these needs, Karahanna et al. (2015) refer to the motivation behind psychological ownership, which they define as ‘the drive to engage in behaviors to satisfy the motives that underlie psychological ownership’. Therefore, we posit that if an individual does not perceive a new application as having sufficient potential to meet the needs, he or she is not going to be willing to engage in the behaviour of adopting that application.

The aim of our study, proceeding from these premises, was to identify and thematize hurdles to take-up of incentive-based health insurance applications with regard to meeting needs that drive development of psychological ownership. We achieved this by conducting a thematic analysis of perceptions of consumers who were not willing to adopt a specific application of the relevant type. The resulting framework, which recognises 14 thematized hurdles in all, holds important implications for scientific and managerial use both. Firstly, the work extends scientific foundations in a contextual sense, facilitating analysis of the phenomenon of psychological ownership in the insurance context. Accordingly, it contributes to understanding the challenges and nature of insurance-related digital applications and new business models. Secondly, it provides theoretical underpinnings via an initial framework affording conceptualisation of hurdles to digital applications’ satisfaction of psychological ownership motives in other contexts too. Finally, the framework developed should aid managers of insurance companies in examining and improving their incentive-based health insurance applications and services in a manner that deepens the relationship with consumers and could expedite adoption.

Psychological ownership as a theoretical perspective

Psychological ownership, or perceived ownership, is described as a mental ‘state in which individuals feel as though the target object is theirs’ (Pierce et al. 2003, p. 86). This definition refers to ownership as a psychological phenomenon. Accordingly, it is necessary to understand that formal (objective, legal) ownership and ownership as a psychological phenomenon are two separate constructs. In some circumstances, the two may be tied in with each other (e.g., Pierce et al. 1991), but psychological ownership can emerge with or without a legal right of ownership, as in the case of new technologies or applications (e.g., Kirk and Swain 2018). A sense of owning an object emerges through three mechanisms: controlling a target, generating intimate knowledge of it, and investing personal resources in it (e.g., Pierce et al. 2002, 2003). These ‘routes’ refer to the individual-level psychological mechanisms or processes that influence how psychological ownership arises and grows (See Fig. 1.).

Theory of psychological ownership (Jussila et al. 2015, p. 122)

They themselves are relatively well understood. The more fundamental question for our purposes is why individuals develop feelings of ownership toward particular objects. As Jussila et al. (2015) explain, an individual begins travelling along one or more route to psychological ownership if feeling that the object has potential to satisfy the underlying needs. Specific ‘motives’ for psychological ownership have been identified: individuals’ need to feel effectance or efficacy, desire for a sense of home, a self-identification motive, and seeking of stimulation (See Fig. 1.). We consider how insurance consumers perceive incentive-based health insurance applications in terms of responding to these motives, the drivers for psychological ownership.

This work ties in with scholars’ recent efforts to extend the construct of psychological ownership from the psychology and management domain to marketing and consumer research (Pierce and Peck 2018; Jussila et al. 2015). In this expansion of application, special attention has been paid to psychological ownership as predicting and explaining individuals’ willingness to adopt and use new technology and applications (cf. Kirk and Swain 2018). Among the research contexts considered are social media (Zhao et al. 2016; Karahanna et al. 2015), music streaming services (Sinclair and Tinson (2017), online crowdsourcing (e.g., Fuchs et al 2010), virtual worlds/spaces or communities (e.g., Lee and Chen 2011), and touch interfaces (e.g., Brasel and Gips 2014). What makes digital services and applications interesting in this respect is that they are often designed to offer consumers more opportunities to participate in controlling the value-creating processes and in investing personal resources in them (e.g., Hair et al. 2016). According to Kirk and Swain (2018), these possibilities, found in features such as interactive design elements, can increase the chances of individuals cultivating psychological ownership of the target technology. We consider incentive-based health insurance applications’ specific potential in this regard.

The context of incentive-based health insurance applications

An incentive-based health insurance application consists of a mechanism whereby information about a customer’s behaviour is collected and particular behaviour can lead to discounts on that customer’s health insurance premiums or other benefits. The information can be collected by such means as the commonly used wearables that track an individual’s behaviour. It has been observed that giving people an incentive to engage in healthy living habits may well influence the likelihood of insurance claims (cf. Lambert et al. 2009; Patel et al. 2011). In addition to life insurance products, behaviour tracking has been applied for such lines of insurance as motor liability and auto insurance (e.g., Litman 2005; Desyllas and Sako 2013).

Given the theoretical underpinnings presented above, incentive-based health insurance applications should have great potential for facilitating and encouraging emergence of psychological ownership among their users. The new platform creates possibilities for value co-creation and empowerment (cf. Harrison 2002; Hair et al 2016; Fuchs et al 2010; Talonen et al. 2016, 2018) on many levels, where these possibilities, in turn, have potential to satisfy the needs that lead to psychological ownership. Firstly, an application of this type gives consumers control via a mechanism for helping determine the insurance premiums by adopting healthy ways of living, and the consumer takes part in generating the content by providing data on those living habits. Secondly, the application and its use can serve as a tool by which individuals build and express identity-related to, for example, healthy living. Thirdly, as an innovative way to interact with insurance companies and look after one’s health, using the application could be predicted to encompass features that interest, excite, and perhaps inspire individuals, thereby providing stimulation.

Data and methods

Implementation of incentive-based insurance applications is spreading. The objective of preventing accidents and claims via real-time behaviour tracking has been gaining traction and is seen as representing the future role of insurance companies (e.g., Kumar and Yellampalli 2018). The forerunner in this transformation has been the health insurance programme of South Africa’s Discovery; see Patel et al (2010, 2011). In Finland, insurers have been relatively cautious, although several companies have launched pilot programmes. The fact that this development remains in its infancy in Finland offers a suitable context for increasing understanding of the adoption phase. We follow this thinking in our article by investigating the opinions of Finnish people.

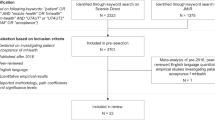

To gather the data for the purposes of qualitative analysis, we carried out a survey utilising general, life-insurance-specific, and non-life-specific insurance-related questions. For the questionnaire, sent out in autumn of 2016, we used a sample that was representative with regard to income level, bank and insurance-company relationships, residence location and profession. The number of responses received from this group, our ‘basic sample’, was 127. In addition, we solicited data from students pursuing a business degree at Finland’s University of Tampere. This 69-response sample represents young people with a high level of education. The average age was 24 for this sample and 58 for the basic sample. With these two datasets, we were able to gain final data that included respondents from several different age categories. For the purposes of our qualitative analysis, we chose only those respondents who were not willing to adopt the incentive-based insurance services. Willingness to adopt was measured with a scale from 1 to 6 (1 = definitely, 6 = never). Accordingly, respondents who had answers from 4 to 6 were included in the analysis. This provided us a final dataset of 62 responses, including 52 from the basic sample and 10 from the students.

The purpose of the study was to identify hurdles to consumers’ adoption of the application in terms of satisfying the needs behind psychological ownership. Since there was no pre-existing framework that we could test against, our survey method employed open-ended questions. In contrast to set, pre-designed questions, these allowed the respondents to freely evaluate what prevented them from adopting the case application and to describe the reasons (cf. Reja et al. 2003; Geer 1988). Respondents were directed to these open-ended questions after having replied that they were not interested in utilising an incentive-based health insurance application. The items were created to address seven themes: the quality of the insurance company’s decision-making, cyber-security, the rewards gained by sharing information, the benefits and the associated terms, one’s state of health, the tracking process, and other possible factors. As such, the idea was not to base these questions on certain theory but to capture relevant contextual issues related to insurance and incentive-based insurance products. The relevance of the questions’ themes was ensured by using researcher triangulation (cf. Jonsen and Jehn 2009). Accordingly, two of the authors, who have a long industry and academic experience in insurance, worked independently at first and came together to discuss the questions after that. This process of independent work followed by discussion session was repeated in an iterative manner several times, which finally produced the final survey.

For the final data of extracted responses, we conducted a thematic analysis, which is based on an idea of identifying patterns related to the phenomena that we’re studying (e.g. Braun and Clarke 2006). Thematic analysis contains two phases. Firstly, the raw data is coded into first-order concepts by identifying answers with similar content from the data. In the second phase, researchers identify common features between the first-order concepts to develop overarching second-order themes. As such, our method for developing the concepts and themes can be described as finding similarities and differences between the units of analysis (e.g. Ryan and Bernard 2003) or as ‘cutting and sorting’ the data (e.g. Lincoln and Cuba 1985).

Before proceeding officially to the first phase of our thematic analysis, we began with an exploratory phase of reading through the data to develop an overall picture of the content (cf. Carley and Palmquist 1992; Rydén et al 2015). After getting familiar with the data, we proceeded into the first phase of coding, where we manually piled answers with same content into the same piles. These piles (altogether 21, see Table 1) were the first-order concepts (description of the hurdles) of our thematic analysis. As a result, some of the piles had only one response while others had several of them. In the second phase, we started searching for similarities between the identified first-order concepts. This categorisation process resulted in altogether 14s-order themes (Hurdles) (Table 1). Again, some of the themes had several first-order concepts while some had only one.

In each phase of the analysis, we used researcher triangulation (cf. Jonsen and Jehn 2009; Patton 1990). Accordingly, three of the authors worked independently at first and came together after this to discuss their identified first-order concepts and second-order themes and agree on the final composition. In both the phases, one round of independent work and discussion was organized. In addition, the authors that took part in the analysis process had a deep knowledge, understanding and experience with insurance and incentive-based applications as well as the theory of psychological ownership. This ensured a proper abductive reflection between the data and existing literature on motives and needs related to psychological ownership (see i.e. Jehn and Doucet 1996, regarding use of experts in the analysis process) that formed the frames for our analysis.

The data analysis was conducted in a construed manner via methods applying the theory of psychological ownership, with specific regard to the underlying motives. Leaning on existing theory but not deductively testing it, the research approach can be described as abductive (e.g., Dubois and Gadde 2002).

During the analysis process, it was recognized that hurdles may contain characteristics from more than one motive. As such, this interrelated nature of the motives is in line with earlier literature (cf. Pierce and Jussila 2011) and was accepted in our analyses as well. However, the decision to which category of PO’s motives the hurdle was classified in was defined by the dominant motive. For example, ‘Violation’ (which clearly had effectance-related characteristics as well) was located under ‘A home and having a place’ since its’ dominant characteristics included intrusive misbehaviour from the company or consumer’s experience of giving access to something that is his/her. These examples have close connection with territorial behaviour (e.g. Brown et al. 2005) literature which is recognized to have a close connection with ‘home and having a place’ -motive.

Results

With regard to the needs driving psychological ownership, we proceeded from Karahanna et al.’s above-mentioned definition of psychological ownership motivation. An individual who thinks an application can satisfy the needs is more likely to adopt and accept the new technology. Below, we characterise the hurdles identified as standing in the way of consumers thinking that the case application could satisfy each of the particular classes of need, in turn.

Effectance

The effectance motivation is related to one’s ability to control objects or things. When controlling an object, one feels competent (e.g., White 1959; Furby 1978; Porteous 1976). Accordingly, the individual’s need to feel effectance and competence leads to seeking objects that provide controllability (e.g., Isaacs 2013; Dittmar 1992; Beggan 1992). If control is not gained, the individual feels a sense of powerlessness (Isaacs 2013). Since the object cannot satisfy the effectance need, a sense of ownership does not emerge.

The intention of incentive-based health insurance applications is to increase the insured person’s control over various factors contributing to insurance premiums. Our data indicate that this ideal is not fully realised, for reason of various hurdles. Firstly, consumers may evaluate an application in accordance with a prior understanding of insurance companies wherein decisions are often made to the consumer’s detriment. Despite the incentive-based insurance application’s potential to grant more control to consumers, they perceive it as doing the opposite. One respondent cited this as a reason for not accepting the application thus:

The insurance company has a supreme right and ability to reach their own conclusions.

Hence, some may perceive the application as not conferring possibilities for increased control. Expanding on this, another respondent noted that, in the event of disagreement with the insurance company, the consumer holds a weak position. Obtaining a positive decision was seen as likely to prove expensive and time-consuming. This finding is important, since the presumed potential costs of control may decrease individuals’ willingness to start exercising control. One respondent said:

If you don’t accept the insurance company’s decision, often the only way to change it is via the courts.

Furthermore, assigning insurance benefits via systematic tracking of healthy living may reduce the sense of control in some cases. It was articulated that changes in life situation can lead to forced changes in habits and deviation from what systems may detect as healthy living, with the result that one appears not to have met the requirements. This was described by one respondent thus:

When I purchased the insurance, my activity may have been at a good level. However, there are many challenges and hardships in life when taking care of one’s health may not get that much attention. This may, in turn, lead to a situation the insurance company interprets as me having not fulfilled the insurance contract in terms of my activity.

Alongside changes in life circumstances, some felt that advancing age does not provide greater possibilities for control. An individual may perceive old age as contributing to loss of control, with one of the respondents saying:

As far as I understand it, my age prevents me from purchasing life insurance. At least the previous [insurance plans] have stopped.

In the data, it was expressed that health depends in many ways on an individual’s genes. Hence, some of the respondents saw health as unable to be influenced or compared fairly across individuals. Such lack of controllability may encourage individuals not to see benefit in the application. One respondent characterised this perspective thus:

Driving behaviour is dependent on the individual. Getting old or sick cannot be influenced […]. The ‘genetically handicapped’ are the outcasts of tomorrow, who are not appreciated in society even if they are eating carrots and running marathons.

Since the outcome of healthy living habits may vary between people, some participants feared that the wrong indicators are being tracked. Despite such applications’ philosophy of tracking and rewarding healthy living habits, it was presumed that monitoring indicators of actual health such as blood pressure would be possible. As one of the respondents put it,

[i]nfluencing health is not related in such a straightforward way to behaviour. Irrespective of healthy living habits, health can decay. So health indicators like blood pressure or body-mass index should not have an influence on the insurance premium.

Finally, respondents stressed doubts as to whether healthy living habits really guarantee health. This betrays prejudice related to the fundamental operation philosophies and premises behind the case application. Hence, it calls special attention to the insurance company’s responsibility to examine the benefits truly perceived by the insured. One respondent was especially emphatic:

Having the right living habits does not guarantee health!

Self-identity

Psychological ownership encompasses not just a feeling of possessiveness over an object but also attaching an object’s meanings to one’s personal identity (e.g., Furby 1991; Snare 1972; Jussila et al. 2015). Accordingly, an object that can facilitate emergence of psychological ownership acts as a tool in building identity, expressing it to others, and helping maintain it. Individuals are thus motivated to interact with their environment and seek objects that provide this possibility (e.g., Jussila et al. 2015).

An incentive-based health insurance application may function as a tool in this identity work with respect to, for example, healthy living. Our data indicate, however, that this too is not straightforward. Participants pointed to several hurdles that may impede satisfying this motive. Firstly, while a consumer may be willing to utilise the application in building an understanding of him- or herself as a healthily living person, there was a sense that this may not be beneficial. After all, the insurance company can make their own decisions regardless. Furthermore, these decisions can contradict the picture the individual has been building of the self while utilising the application. One respondent summed this up thus:

Whatever information is gained can be interpreted in a way that serves the insurance company’s own purposes. [Let me] exaggerate: one who follows healthy living habits can be made to look like an orthorexic, who can be further categorised as a mental-health patient.

Secondly, coming to know oneself is a process that evolves over time. The responses show that the application may be viewed as harmful for its potential to subvert the individual’s journey of attempting to accept the self. That is, in directing focus to healthy living habits, the application may place excessive pressure on young people by sending a message that they are not good enough. The application hence may be perceived as distracting from self-acceptance, as one respondent explained:

As a young woman, you already face so much pressure related to your living habits and looks. It feels disturbing that you would be penalised for gaining a few extra kilos or not exercising enough. There are many individuals who can’t do anything about their health.

In addition, the research material points to concerns that the application may not provide opportunities for expressing self-identity related to others. Establishing the ‘right’ healthy living habits was perceived as standardising individuals’ behaviour. From this standpoint, people are unable to use the application to ‘customise’ their identity. This was expressed by one of the respondents thus:

Smoking cigarettes is, of course, unhealthy, but one needs to have the freedom to make stupid decisions.

Fourthly, the data reveal extensive variety in individuals’ understanding of what constitutes healthy living. When consumers have built their worldview in connection with this, it can be challenging to alter it via any new application. Use may even evoke negative attitudes since it is in conflict with the learned self-identity. One respondent illustrated this well, saying:

My problem with the application is the definition of healthy living habits. If the insurance company agrees with me, I would be interested in using the application. If they define healthy living habits according to the official view, we don’t agree. For example, [what makes] a healthy diet is one thing on which our views probably do not match. So I would get to pay more for my insurance even though I’m living a healthy life and don’t get sick. Merely because my view of a healthy life differs from the official one. This little fact destroys the incentives on my part.

This idea was articulated in another way by a respondent who stated:

I don’t want the insurance company to criticise me.

Finally, the data indicate that emphasising healthy living habits and putting pressure on individuals may contradict the learned self-identity when one’s life situation changes. This emphasis can be perceived as boosting self-identity in situations wherein it is possible for the individual to focus on, for example, exercising; however, receiving such encouragement in situations in which it is impossible or impractical to exercise can be taken to be in conflict with the learned self. More generally, as pointed out in the extract above pertaining to being deemed not to meet the requirements, one’s situation at a specific point in life does not necessarily determine whether the individual’s identity is built on a healthy lifestyle and may not be indicative of this.

The need for a home

Scholars have identified an innate need for people to find or establish their own space or territory (e.g., Porteous 1976; Ardrey 1966). This is obvious in the traditional desire to build one’s own home (e.g., Porteous 1976) or establish a pattern of going to the same restaurant every day (Jussila et al, 2015), but also virtual communities and social media may allow people to establish online homes, as in ‘this is my profile’ (e.g., Karahanna et al. 2015). Whether an object becomes one’s own ‘place’ is influenced by the individual’s personal investments in customising it. This is in line with ample research showing that when having a place of one’s own, the individual feels secure (e.g., Porteous 1976) and also experiences a certain level of control (e.g., Duncan 1981). Furthermore, systematically utilising the application holds potential to structure a person’s day-to-day life. Thereby, it can serve as a fixed point of reference that is a natural element of a place of one’s own (e.g., Kron 1983; Jussila et al. 2015).

According to our data, two themes of hurdles together explain why individuals may perceive use of the application as unable to meet the need for a home. Firstly, the research material bears out that living habits and health details are considered personal information. People may not be willing to accept a seeming breach of their personal territory. One respondent stated:

In my view, living habits belong to personal matters.

Secondly, sharing this information with the insurance company may be perceived as exposing oneself to intrusion into that territory by third parties. As is often the case with concerns about cyber-security and morality of actors in the digital domain, users’ personal information is considered to be in danger. The risks feared or presumed in our dataset are of various types. For instance, violation of personal territory can take the form of civil servants having access to the information:

Courts are handling cases in which civil servants have intruded to look at information related to other people. When this reaches court, the damage and harm have already happened and rumours about people have been set in motion. Therefore, it doesn’t help to go to court anymore.

Another fear expressed is that of the insurance company exploiting the data by selling the material to third parties. This too is perceived as granting outsiders unacceptable access to personal territory. One of the respondents presented this fear with certainty:

The data will be sold to third parties at a later stage.

Finally, though sharing the data with one’s insurance company is accepted, doubt might arise as to situations wherein the customer switches insurance providers. The respondents presumed that the old company will continue utilising the data after a change of provider. This represents yet another scenario for which the consumer presumes inability to maintain control of personal territory. This was characterised by one respondent thus:

If I change insurance provider often, my data will be in everybody’s hands. Not good!

The need for stimulation

Possessions are seen as provoking arousal in individuals (e.g., Duncan 1981; Kamptner 1989; Darling 1937). This ties in with activation theory (e.g., Scott 1966; Gardner 1986), which suggests that individuals share an innate need for stimulation and ‘activation’. Pierce and Jussila (2011, p. 48), for instance, describe satisfying the stimulation motive as the basis for ‘why objects fall into [a] person’s realm in the first place’. In this connection, the object needs to provide stimulation for the individual to start interacting with it and begin building a psychological bond with it. Furthermore, this leads to individuals actively trying to find possessions that can satisfy the need.

An incentive-based health insurance application should offer arousing features for its users. For instance, allowing people to track their health and influence their insurance premiums and benefits has a game-like nature. Furthermore, the philosophy behind such applications may be attractive: it represents a new approach to insuring individuals, in which the insurance premium’ origins are shifted toward evaluating real-time behaviour data and away from actuarial tables of historical data. However, our research data point to hurdles with regard to the stimulation motive too.

The first is that, even though the case application is designed to encourage a healthy lifestyle, it is not necessarily credible in the consumer’s eyes. One might not trust the insurance company to put the good of the insured first. If the application is not found stimulating in this sense, the individual is unlikely to contemplate utilising it. The trust factor was articulated thus by one of the respondents:

They always find a loophole, to deny the claim.

Secondly, individuals tend to perceive great complexity in the insurance contract’s conditions and the health tracking both. When the core idea is not clearly understood, it becomes challenging to captivate the consumer. One of the respondents stated:

From an individual’s point of view, the terms of the insurance contract easily become too complicated.

This was contemplated further by a respondent who described tracking as something that ‘feels so laborious and complicated’. A related hurdle is that tracking of health per se is not necessarily something to which people want to devote a large amount of effort, and it is often not perceived as arousing enthusiasm. Rather, it is considered tiresome, inconvenient, and hence unattractive. This is summed up well by questions posed by one respondent:

What does this application obligate me to do? How and how often will health be checked?

Finally, many saw the new insurance application as not adding enough value to what existing means of tracking health provide. That is, the application may compete with other interfaces for consumers’ interests. One respondent characterised this challenge thus:

Today’s technology and medical centres provide good possibilities [for tracking health].

Discussion and conclusions

The framework we developed for understanding the hurdles in the context of incentive-based health insurance applications helped reveal that many impediments to meeting psychological-ownership-driving needs stem from respondents, not necessarily weaknesses in the application. For example, the insurance company’s decisions may be presumed to be unfair for reason of lack of trust in the process or the system’s low transparency even when the application permits increased control and thereby holds potential to increase transparency substantially. This finding is consistent with the work of Orlikowski (2000, p. 410), who found user behaviour to depend in many cases on the skills, power, knowledge, and assumptions of the users, not just the features of the application or technology. Hence, while it is important to evaluate the features and development of the application critically, one must pay attention to consumer perceptions and psychology also.

By characterising the perceptions of consumers who were not willing to adopt the case application, our work contributes to scholarship in terms of both context and theory. Firstly, this is, to the best of our knowledge, the first article on psychological ownership to focus on the context of digital insurance applications or on insurance in general. The construct of psychological ownership offers a new perspective to inform the understanding of dilution of company–consumer relations in the insurance domain. Secondly, by extending discussion of psychological ownership to the impediments to meeting consumers’ underlying needs, this article provides an initial construed framework to aid in understanding why certain digital applications may not readily satisfy these needs and thus facilitate the emergence of psychological ownership. The contribution opens a new view of psychological ownership for research in other contexts as well.

Management implications

The framework provides a tool clarifying the factors that may pose obstacles to adopting incentive-based health insurance applications from the consumer perspective. Accordingly, it should assist managers in evaluating and directing the development of their smart-insurance applications. We stress that one should take a critical approach when considering which hurdle can be tackled by developing or pivoting the features and operation philosophy of the application and which are more communications-related. For example, consumers’ mental models wherein insurance companies make arbitrary decisions should be approached through well-honed, enhanced communication initiatives.

Limitations and avenues for future research

As every research, our study has limitations and provides several suggestions for scholars to consider in the future. Firstly, with a qualitative approach, the aim of the article was to identify different hurdles and thematize them. Consequently, the research was not designed to provide statistical information or analysis related to the importance or weight of the hurdles compared to each other. On the contrary, our results offer a tentative intellectual framework that can be utilized in the future as a basis for quantitative research. In fact, we truly encourage researchers to follow this path which may prove beneficial in, for example, testing and validating a measurement scale related to the motives behind psychological ownership.

Secondly, our data was gathered via survey of open-ended questions. This did enable us to conduct our analysis and develop a tentative intellectual framework thematizing the hurdles. An important result in this regard is that incentive-based insurance applications may not satisfy the motives for perceiving psychological ownership. At the same time, we believe that the future research could benefit from an additional qualitative research analysing a new data gathered via interviews (i.e. semi-structured). This could aid the researchers to go even deeper into understanding the hurdles by asking for clarifications from the interviewees during the interview. Furthermore, this could potentially reveal new nuances related to the hurdles. Gathering qualitative data from different sources is also an important way to validate the results of a qualitative analysis in general. Compared to numerical data and quantitative methods, qualitative analysis is always dependent on researchers’ skills and knowledge to interpret the data (Ryan and Bernard 2003). While we used tools as researcher triangulation (cf. Jensen and Jehn 2009) and ensured the top-level expertise of the researchers who analysed the data (cf. Jehn and Doucet 1996), the results of our article could benefit from an additional qualitative research analysing data from a different source.

Thirdly, it was important to examine the perceptions of individuals who had not yet used an incentive-based health insurance application, because pre-use attitudes determine one’s willingness to approach the application. Future research should take our work further by addressing how these presumptions can be changed or altered. For example, a few scholars have posited that advertising a product (e.g., Folse et al. 2012), touching it (e.g., Brasel and Gips 2014), or imagery (e.g., Kamleitner and Feuchtl 2015) can raise individuals’ willingness to decide to make a purchase. Corresponding research efforts could be a fruitful way forward.

Fourthly, not all of the hurdles identified may necessarily prove relevant with regard to people who have become familiar with an application of the relevant sort or entered the usage phase. Therefore, some future scholarly endeavours should consider the perceptions of individuals who show interest and positive attitudes related to these applications but have not, for some reason, started to use them. Also, extension of the analysis to the perceptions of individuals who already use such applications would be interesting. This could increase understanding of how they facilitate psychological ownership in action. Also, research on the motives behind psychological ownership in the domain of marketing and consumer research remains scarce (e.g., Sinclair and Tinson 2017; Karahanna et al. 2015). We encourage scholars to take a closer look at psychological ownership in this domain.

References

Ardrey, R. 1966. The territorial imperative. New York: Atheneum.

Beard, R.E., Pentikäinen, T., and Pesonen, E. 1984. Risk theory: the stochastic basis of insurance, 3rd Edition.

Beggan, J.K. 1992. On the social nature of nonsocial perception: the mere ownership effect. Journal of Personality and Social Psychology 62 (2): 229–237.

Brasel, S.A., and J. Gips. 2014. Tablets, touchscreens, and touchpads: how varying touch interfaces trigger psychological ownership and endowment. Journal of Consumer Psychology 24 (2): 226–233.

Braun, V., and Clarke, V. 2006. Using thematic analysis in psychology. Qualitative Research in Psychology 3 (2): 77–101.

Brown, G., T.B. Lawrence, and S.L. Robinson. 2005. Territoriality in organizations. Academy of Management Review 30 (3): 577–594.

Carley, K., and M. Palmquist. 1992. Extracting, representing, and analyzing mental models. Social Forces 70 (3): 601–636.

Darling, F.F. 1937. A Herd of Red Deer. Oxford University Press.

Daykin, C.D., T. Pentikäinen, and M. Pesonen. 1994. Practical Risk Theory for Actuaries. London: Chapman & Hall.

Denegri-Knott, J., D. Zwick, and J.E. Schroeder. 2006. Mapping consumer power: an integrative framework for marketing and consumer research. European Journal of Marketing 40 (9–10): 950–971.

Desyllas, P., and M. Sako. 2013. Profiting from business model innovation: evidence from Pay-As-You-Drive auto insurance. Research Policy 42 (1): 101–116.

Dittmar, H. 1992. The Social Psychology of Material Possessions: To Have Is To Be. Harvester Wheatsheaf and St. Martin's Press.

Dubois, A., and L.E. Gadde. 2002. ‘Systematic combining’ – a decade later. Journal of Business Research 67 (6): 1277–1284. https://www.sciencedirect.com/science/article/abs/pii/S0148296300001958

Duncan, N.G. 1981. Home ownership and social theory. In Housing and Identity: Cross-Cultural Perspectives, ed. J.S. Duncan, 98–134. London.

Folse, J.A.G., J.G. Moulard, and R.D. Raggio. 2012. Psychological ownership: a social marketing advertising message appeal? Not for women. International Journal of Advertising 31 (2): 291–315.

Fuchs, C., E. Prandelli, and M. Schreier. 2010. The psychological effects of empowerment strategies on consumers’ product demand. Journal of Marketing 74 (1): 65–79.

Furby, L. 1978. Possession in humans: an exploratory study of its meaning and motivation. Social Behavior and Personality: An International Journal 6 (1): 49–65.

Furby, L. 1991. Understanding the psychology of possession and ownership: a personal memoir and an appraisal of our progress. Journal of Social Behavior and Personality 6 (6): 457–463.

Gardner, D.G. 1986. Activation theory and task design: an empirical test of several new predictions. Journal of Applied Psychology 71 (3): 411–418.

Geer, J.G. 1988. What do open-ended questions measure? Public Opinion Quarterly 52 (3): 365–367.

Hair, J.F., K. Barth, D. Neubert, and M. Sarstedt. 2016. Examining the role of psychological ownership and feedback in customer empowerment strategies. Journal of Creating Value 2 (2): 194–210.

Harrison, T. 2002. Consumer empowerment in financial services: rhetoric or reality? Journal of Financial Services Marketing 7 (1): 6–9.

Harrison, T. 2003. Understanding the behaviour of financial services consumers: a research agenda. Journal of Financial Services Marketing 8 (1): 6–10.

Harrison, T. 2015. Financial services marketing research: retrospect and prospect. Journal of Financial Services Marketing 20 (4): 231–233.

Isaacs, S. 2013. Social development in young children. London: Routledge.

Jehn, K.A., and Doucet, L. 1996. Developing Categories from Interview Data: text Analysis and Multidimensional Scaling. Part. Power 21: 7–65.

Jonsen, K., and K.A. Jehn. 2009. Using triangulation to validate themes in qualitative studies. Qualitative Research in Organizations and Management 4 (2): 123–150.

Jussila, I., A. Tarkiainen, M. Sarstedt, and J.F. Hair. 2015. Individual psychological ownership: concepts, evidence, and implications for research in marketing. Journal of Marketing Theory and Practice 23 (2): 121–139.

Kamleitner, B., and S. Feuchtl. 2015. ‘As if it were mine’: imagery works by inducing psychological ownership. Journal of Marketing Theory and Practice 23 (2): 208–223.

Kamptner, N.L. 1989. Personal possessions and their meanings in old age. In Claremont symposium on applied social psychology: the social psychology of aging, ed. S. Spacapan and S. Oskamp, 165–196. Thousand Oaks, CA: SAGE Publications.

Karahanna, E., S.X. Xu, and N. Zhang. 2015. Psychological ownership motivation and use of social media. Journal of Marketing Theory and Practice 23 (2): 185–207.

Kirk, C.P., and S.D. Swain. 2018. Consumer psychological ownership of digital technology. In Psychological ownership and consumer behavior, ed. J. Peck and S.B. Shu, 69–90. Cham, Switzerland: Springer.

Kron, J. 1983. Home-Psych: the social psychology of home and decoration. New York: Potter.

Kumar, N.A., and S. Yellampalli. 2018. Disruptive innovation for auto insurance entrepreneurs: New paradigm using telematics and machine learning. In Competitiveness in Emerging Markets, ed. D. Khajehelan, M. Friedrichsen, and W. Mödinger, 555–568. Cham, Switzerland: Springer.

Lambert, E.V., R. da Silva, L. Fatti, D. Patel, T. Kolbe-Alexander, W. Derman, and T. Gaziano. 2009. Fitness-related activities and medical claims related to hospital admissions – South Africa, 2006. Preventing Chronic Disease 6 (4): A120.

Lee, Y., and A.N. Chen. 2011. Usability design and psychological ownership of a virtual world. Journal of Management Information Systems 28 (3): 269–308.

Lincoln, S.Y., and Cuba, E.G. 1985. Naturalistic inquiry. Sage Publications, California.

Litman, T. 2005. Pay-as-you-drive pricing and insurance regulatory objectives. Journal of Insurance Regulation 23 (3): 35–53.

Orlikowski, W.J. 2000. Using technology and constituting structures: a practice lens for studying technology in organizations. Organization Science 11 (4), 404–428.

Patel, D.N., E.V. Lambert, R. da Silva, M. Greyling, C. Nossel, A. Noach, and T. Gaziano. 2010. The association between medical costs and participation in the vitality health promotion program among 948,974 members of a South African health insurance company. American Journal of Health Promotion 24 (3): 199–204.

Patel, D., E.V. Lambert, R. da Silva, M. Greyling, T. Kolbe-Alexander, A. Noach, and T. Gaziano. 2011. Participation in fitness-related activities of an incentive-based health promotion program and hospital costs: a retrospective longitudinal study. American Journal of Health Promotion 25 (5): 341–348.

Patton, M.Q. 1990. Qualitative evaluation and research methods. SAGE Publications, inc.

Pierce, J.L., and J. Peck. 2018. The history of psychological ownership and its emergence in consumer psychology. In Psychological Ownership and Consumer Behavior, ed. J. Peck and S.B. Shu, 1–18. Cham, Switzerland: Springer.

Pierce, J.L., Rubenfeld, S.A., and Morgan, S. 1991. Employee ownership: a conceptual model of process and effects. Academy of Management Review 16 (1): 121–144.

Pierce, J.L., T. Kostova, and K.T. Dirks. 2002. Toward a theory of psychological ownership in organizations. Academy of Management Review 28 (2): 318–329.

Pierce, J.L., T. Kostova, and K.T. Dirks. 2003. The state of psychological ownership: Integrating and extending a century of research. Review of General Psychology 7 (1): 84–107.

Pierce, J.L., and I. Jussila. 2011. Psychological Ownership and the Organizational Context: Theory, Research Evidence, and Application. Edward Elgar Publishing.

Plé, L., X. Lecocq, and J. Angot. 2010. Customer-integrated business models: a theoretical framework. M@n@gement 13 (4): 226–265.

Porteous, J.D. 1976. Home: the territorial core. Geographical Review 66 (4): 383–390.

Reja, U., K.L. Manfreda, V. Hlebec, and V. Vehovar. 2003. Open-ended vs. close-ended questions in Web questionnaires. Developments in Applied Statistics 19 (1): 159–177.

Robson, J. 2015. General insurance marketing: a review and future research agenda. Journal of Financial Services Marketing 20 (4): 282–291.

Ryan, G.W., and Bernard, H.R. 2003. Techniques to identify themes. Field Methods 15 (1): 85–109.

Rydén, P., T. Ringberg, and R. Wilke. 2015. How managers’ shared mental models of business–customer interactions create different sensemaking of social media. Journal of Interactive Marketing 31: 1–16.

Scott, W.E., Jr. 1966. Activation theory and task design. Organizational Behavior and Human Performance 1 (1): 3–30.

Sinclair, G., and J. Tinson. 2017. Psychological ownership and music streaming consumption. Journal of Business Research 71: 1–9.

Snare, F. 1972. The concept of property. American Philosophical Quarterly 9 (2): 200–206.

Talonen, A. 2018. Customer ownership and mutual insurance companies: Refining the role and processes of psychological ownership. Tampere University Press.

Talonen, A., I. Jussila, H. Saarijärvi, and T. Rintamäki. 2016. Consumer cooperatives: uncovering the value potential of customer ownership. AMS Review 6 (3–4): 142–156.

Talonen, A., M. Holmlund-Rytkönen, and T. Strandvik. 2018. Mental models of customer ownership in the executive board: a case study in the pension insurance sector. Journal of Co-Operative Organization and Management 6 (1): 1–10.

Talonen, A., Mähönen, J., Koskinen, L., and Kuoppakangas, P. 2021. Analysis of consumers’ negative perceptions of health tracking in insurance–a value sacrifice approach. Journal of Information, Communication and Ethics in Society.

Voutilainen, R., and L. Koskinen. 2017. Customers’ opinions on incentive based insurance. Journal of Insurance and Financial Management 3 (1): 30–52.

White, R.W. 1959. Motivation reconsidered: the concept of competence. Psychological Review 66 (5): 297–333.

Zhao, Q., C.D. Chen, and J.L. Wang. 2016. The effects of psychological ownership and TAM on social media loyalty: an integrated model. Telematics and Informatics 33 (4): 959–972.

Funding

Open Access funding provided by University of Helsinki including Helsinki University Central Hospital.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Talonen, A., Koskinen, L., Voutilainen, R. et al. Adoption of incentive-based insurance applications: the perspective of psychological ownership. J Financ Serv Mark 28, 794–806 (2023). https://doi.org/10.1057/s41264-022-00173-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41264-022-00173-w