Abstract

Promoting prevention is an important goal of public policy. Fifty years ago, Ehrlich and Becker (J Polit Econ 80:623–648, 1972) proposed a simple model of prevention (or self-protection as they called it). Surprisingly enough, subsequent research, mainly within the expected utility paradigm, showed that it is hard to derive clear predictions within this simple model that can help to guide policy. This is what I refer to as the prevention puzzle: why is it so hard for economic theory to guide prevention decisions? In this article I try to shed light on this question. I review the existing literature and add some tentative new results under nonexpected utility. While the impact of risk aversion on prevention is complex, three factors seem to contribute unambiguously to underprevention: prudence, likelihood insensitivity, and loss aversion. I conclude by giving some ideas how empirical research may contribute to the understanding of prevention decisions and help to solve the prevention puzzle.

Similar content being viewed by others

1 Introduction

Government policy often stresses the importance of prevention. This was evident during the Covid pandemic with its emphasis on distancing and hand washing, but it is, perhaps, most prominent in health care.Footnote 1 Over the course of the \(20^{th}\) century chronic diseases such as heart disease, cancer, and diabetes, have replaced acute diseases (e.g., influenza, tuberculosis, pneumonia) as the leading cause of death in developed countries. Chronic diseases tend to be associated with life style choices such as smoking, exercise, and diet. Preventive efforts are particularly relevant for such choices. Even though the benefits of preventive activities vary substantially (Newhouse 2021), prevention will probably dominate the policy agenda in the coming decades.

Given the policy importance of prevention, it is suprising how hard it is for economic theory to guide prevention decisions. Some years ago, I was involved in an interdisciplinary research project on smarter choices for better health at Erasmus University. One aim of the project was to help patients make better prevention decisions. To guide this project from an economic perspective, I tried to set up a simple model of prevention, based on Ehrlich and Becker (1972) to derive predictions, but I was struck by the little guidance I could derive. Intuitively, I thought risk preferences should play a role and that more risk aversion would lead to more prevention. It appears that I am not alone in thinking this as Newhouse (2021) in his recent survey article on prevention, for example, writes “In making decisions about preventive medicine, the degree of risk aversion is relevant.” However, as it turned out, risk aversion alone does not help much in guiding prevention decisions. Higher order risk preferences, particularly prudence, also play a role, but even as I brought these into the picture it remained hard to derive clear predictions.Footnote 2

This is what I refer to as the prevention puzzle, which is actually a double puzzle. First, the conflict between our intuitions that more risk aversion and risk prudence should lead to more prevention and the realities of our economic models, and, second, the tension between the policy relevance of prevention and the difficulty to give guidance on how to foster prevention.

This article is a reflection of my search for an answer to the prevention puzzle. By some coincidence, it also marks the \(50{th}\) anniversary of the classic paper of Ehrlich and Becker (1972). I address the prevention problem from several angles, largely based on the existing literature.Footnote 3 I will try to present the various results in an intuitive manner so as to make the sometimes technical literature accessible to a wide(r) audience. I will start analyzing prevention from the viewpoint of expected utility. In Sect. 2, I describe the basic prevention model of Ehrlich and Becker (1972). In Sect. 3, I recapitulate why risk aversion alone is not enough to make clear predictions regarding prevention decisions. The main reason is that prevention efforts affect the skewness of the risk distribution. People’s preferences regarding the skewness of the risk distribution are governed by their risk prudence and, in Sect. 4, I will explore whether accounting for risk prudence improves our ability to make predictions. As it turns out, while it remains hard to make predictions, at least it can be derived that holding risk aversion constant, more prudence leads to more underprevention.

Given the problems of deriving predictions under expected utility, I turn next to nonexpected utility. I start by using the approach that I learnt from my dear friend Louis Eeckhoudt and switch from expected utility, where outcomes are transformed but probabilities are not, to the dual model of Yaari (1987) in which probabilities are transformed but outcomes are not. The dual model also has difficulty making unequivocal predictions, but it offers the advantage that we can tap into the extensive empirical literature on probability weighting. By exploring in detail the shape of the probability weighting function, I identify another factor besides prudence that contributes to underprevention: the agent’s insensitivity to changes in probabilities.

Besides utility curvature and probability weighting, the literature on nonexpected utility has pointed at another factor that determines risk attitudes: loss aversion. Exploring the impact of loss aversion requires specifying a reference point from which agents view the prevention decision. In Sect. 7, I study a plausible candidate, maxmin, for which Baillon et al. (2020) find substantial empirical support. Under a prospect theory specification with a maxmin reference point, loss aversion clearly contributes to underprevention.

I end this article with some reflections on how to proceed in future research. The interplay between theoretical and empirical research that we observed under nonexpected utility indicates, in my opinion, a promising way forward to better understand and guide prevention decisions. The empirical literature on prevention that tests the predictions of theories is still limited, which is perhaps another puzzle given how important prevention is for policy, but recently some promising studies have appeared that confirm that prudence is associated with less prevention. I outline some questions that empirical researchers may pick up in the years to come. Perhaps the past 50 years since Ehrlich and Becker (1972) have shown how far we can get based on theory alone. There are still theoretical questions to address, e.g., the role of ambiguity, but to solve the prevention puzzle it may now be the time for empirical scientists to play their parts.

2 Ehrlich and Becker

The basic prevention problem was introduced by Ehrlich and Becker (1972). Consider an agent with wealth W who faces a probability \(1-p\) of losing amount l. The literature usually writes p for the probability of the loss, but I find it notationally easier, especially when moving to the nonexpected utility models, to write p for the probability of not losing. I will assume that payoffs are money amounts. Of course, they may also be other consequences the agent cares about, such as health, but for simplicity I will abstract from these.Footnote 4 Following Ehrlich and Becker (1972), I assume that the probability of the loss is known. This assumption is probably too strong as in most real-life decisions the probability of the loss will be ambiguous. However, as we will see, even with the simplifying assumption of known probability of loss the analysis is already sufficiently complex. For analyses of prevention decisions under ambiguity see Snow (2011), Alary et al. (2013), Berger (2016), Berger et al. (2017), Baillon (2017), Peter and Ying (2020), and Baillon et al. (2022). I also assume that the prevention effort and the loss occur in the same period. For a multi-period analysis of prevention see, for, example, Menegatti (2009).Footnote 5

The agent can exert effort e to increase the probability of the good outcome p and, thus, reduce the probability of the loss \(1-p\).Footnote 6 Consequently, \(p=p(e)\) and \(\frac{\partial {p}}{\partial {e}}=p^{\prime }(e)\ge 0\). For simplicity, I assume that the cost of effort is monetary and is equal to 1 per unit of prevention. Taking the cost monetary is clearly a restriction and it constrains the type of prevention efforts that we can consider. For more general cost functions see for example Baillon et al. (2022). I assume, for now, that the agent is an expected utility maximizer with strictly increasing utility function U. The decision problem is then

And the optimality condition is

The left-hand side of Eq. 2 reflects the marginal benefit of prevention and the right-hand side its marginal cost. In equilibrium, these are equal.

The second-order condition requires that

The literature commonly assumes that prevention efforts have decreasing returns: \(p^{\prime \prime }(e)<0\). The first term in Eq. 3 will then be negative. Under risk aversion, \(U^{\prime \prime }<0\), the third term will also be negative, but the second term will be positive and the second-order condition may or may not be satisfied and we may end up with a corner solution. Under risk seeking the second term is negative, but the third term is positive and, again, the second-order condition may or may not be satisfied. Consequently, as Ehrlich and Becker (1972) already point out, the effect of risk attitudes on the prevention decision is equivocal and risk lovers may choose more prevention than risk averters.Footnote 7, Footnote 8

3 Risk aversion is not enough

Dionne and Eeckhoudt (1985) show formally that more risk aversion does not necessarily lead to more prevention. They considered two agents one with utility U and one with utility V. V is assumed to be more risk averse than U, which under expected utility, means that V is a concave transformation of U:

Dionne and Eeckhoudt (1985) assume that both U and V are risk averse, but their argument also holds without that restriction. Given Eq. 2, the first-order condition of agent V becomes

Eq. 5 shows that the effect of risk aversion on prevention is sign-ambiguous. If \(k^\prime >1\) then both the marginal benefit and the marginal cost of prevention are higher for agent V and the overall effect is equivocal. Dionne and Eeckhoudt (1985) proceed to show that if both agents have quadratic utility functions, the more risk averse agent V will make more (less) preventive efforts if \(1-p<(>)\frac{1}{2}\). The intuition is that for \(1-p<\frac{1}{2}\) prevention reduces the variance of the outcome distribution, while for \(1-p>\frac{1}{2}\), prevention increases it. This result depends crucially on the fact that the higher-order derivatives of the quadratic utility function are equal to zero. For the slightly more complex logarithmic (a limiting case of the power utility function) and exponential utility functions, which typically have nonzero higher-order derivatives, Dionne and Eeckhoudt (1985) show that it is impossible to derive clear predictions.

Jullien et al. (1999) extend the result of Dionne and Eeckhoudt (1985) to more general utility functions. They show that the effect of risk aversion on prevention depends on a threshold for the loss probability: below it a more risk averse agent chooses more prevention, above it less. If the probability of the loss is high, risk averse agents are primarily interested in reducing the size of the maximal loss (and, thus, reduce prevention), if it is low, they are more interested in reducing the probability of the loss (and, thus, increase prevention).

The probability threshold depends on the utility functions of both agents and it is hard to say anything conclusive about the effect of risk aversion on prevention.Footnote 9 Moreover, given the dependence on the utility functions of both agents, one increase in risk aversion may lead to more prevention, while another to less. All that can be said is that more risk aversion will likely increase prevention for low probability losses and reduce it for high probability losses. Peter (2021b) gives a more general result where the probability threshold depends only on the preferences of a reference agent. This allows classifying a whole group of agents relative to this reference agent. However, he also shows that it is impossible to make clear predictions unless prudence is incorporated as well. Let us, therefore, now turn to prudence.

4 Risk prudence

Figure 1 shows why information on risk aversion is not enough to determine whether more risk averse agents will undertake more prevention. Prevention has two effects. On the one hand, it reduces the probability of the loss l. This shifts probability mass to the right of the distribution and is clearly desirable for any agent who satisfies first-order stochastic dominance. On the other hand, prevention imposes a sure loss e, the prevention effort, which shifts the probability distribution to the left. The overall effect is a more left-skewed distribution and information on risk aversion alone is insufficient to assess whether or not the agent likes this. Risk aversion tells us that agents dislike increases in the variance of the distribution (holding its other moments constant), but not how they perceive changes in skewness. Prevention implies that the cumulative distribution functions cross twice and, per Jewitt (1989), this shows that it is impossible to unambiguously sign the effect of risk aversion on prevention.

To analyze prevention, downside risk aversion is relevant. Menezes et al. (1980) formally define increasing downside risk as the combination of a spread in the left tail of the distribution and a contraction in the right tail, the joint effect of which is a more left-skewed distribution while holding the mean and variance constant.Footnote 10 This is similar to the effect of prevention. Consider, for example, an agent with wealth \(\$3000\) who faces a risk of \(\frac{3}{4}\) to lose \(\$2000\). Figure 2 illustrates. Suppose that with effort worth \(\$1000\) the agent can reduce the probability of losing to \(\frac{1}{4}\). The resulting risk distribution after prevention is obtained from the original distribution by spreading a probability \(\frac{1}{2}\) of \(\$1000\) into a probability \(\frac{1}{4}\) of \(\$2000\) and a probability \(\frac{1}{4}\) of \(\$0\) and by contracting the remaining probabilities \(\frac{1}{4}\) of \(\$3000\) and \(\frac{1}{4}\) of \(\$1000\) into a probability \(\frac{1}{2}\) of \(\$2000\).

Menezes et al. (1980) show that expected utility maximizers are averse to such mean and variance preserving transformations if the third derivative of their utility function is positive. Kimball (1990) shows that a positive third derivative of the utility function is related to the notion of prudence, the tendency to forearm oneself in the presence of future, uncontrollable risks. This suggests that incorporating prudence in the analysis of prevention might lead to more clearcut conclusions than centering only on risk aversion. In the example above, a prudent agent would forego prevention even though our intuition may suggest that prudence and prevention are positively related. This is another illustration that the analysis of prevention is complex and betrays intuitions.

Eeckhoudt and Gollier (2005) show that prudence indeed contributes to reducing optimal prevention. In the special case where a risk neutral decision maker’s optimal loss probability is equal to \(\frac{1}{2}\) this effect is unambiguous: more prudence leads to less prevention. The reason is that for probability \(\frac{1}{2}\), prevention does not affect the variance of the distribution and, consequently, there is no effect of risk aversion and prudence can be studied in isolation. However, the bottom line of their paper is, in my opinion, that even with information on prudence, it is hard to determine exactly which agents will undertake more prevention. If \(1-p<\frac{1}{2}\), risk aversion and prudence work in opposite directions and it is unclear whether a prudent agent will exert more effort than a risk neutral agent.

The result of Eeckhoudt and Gollier (2005) is limited, because the reference agent is risk neutral. Peter (2021b) extends their result to a nonneutral reference agent. He shows that the effect of more risk aversion and more prudence is generally indeterminate.Footnote 11 The difficulty is that if risk aversion changes, prudence will inevitably change as well. To solve at least some of the indeterminate cases, this change in prudence needs to be limited. These limits depend on the preferences of the reference agent, which makes it hard to apply them in practice. The most interesting case from a policy perspective is where the probability of a loss is small. This is typically the case in health prevention. Then Peter’s results show that if prudence is limited, more risk aversion and more prudence lead to more prevention.

5 Yaari’s model: rank-dependent utility with linear utility

Analyzing optimal prevention under expected utility only gives limited results, which are hard to apply in practice. Does nonexpected utility give clearer results? That’s what I turn to next. This analysis is also interesting from a policy perspective. Even though the optimal prevention decision may be normative, and expected utility is probably the most appropriate normative model of decision under risk, prevention decisions require a model that describes how people actually do behave and in this respect expected utility is unsatisfactory. The experimental literature is rife with systematical deviations from expected utility and with empirical puzzles that cannot be explained by expected utility with a reasonable degree of risk aversion. One such puzzle is people’s dislike of probabilistic insurance, insurance policies with a small risk of non-reimbursement.Footnote 12 Probabilistic insurance has the same structure as prevention where there is also a risk that costly prevention efforts prove fruitless. Wakker et al. (1997) show that expected utility cannot explain the unpopularity of probabilistic insurance, but prospect theory, the dominant nonexpected utility model, can.

Another reason to study nonexpected utility is that psychologists like Lola Lopes and Elke WeberFootnote 13 have questioned whether risk aversion is best modeled through the utility function, which reflects people’s attitudes towards outcomes. They argue that modeling risk attitudes through transforming probabilities, which really refer to risk, makes more sense. An additional advantage of this approach is that we know a lot about the probability weighting function, which could help to make more accurate predictions. Moreover, whereas utility differs radically for different outcome sizes and domains, such as money and health, probability weighting is rather stable across sizes and domains (Abdellaoui 2000; Bleichrodt and Pinto 2000).

Finally, prevention decisions are closely related to optimism bias, which can easily be modeled through the probability weighting function. The relationship between optimism bias and prevention runs two ways (Vieites et al. 2021). First, people tend to have too optimistic estimates of their probability of a bad outcome. For example, they underestimate their probability of gaining weight and developing heart disease relative to others (Sparks et al. 1995) and they believe that they are less likely to develop breast cancer (Katapodi et al. 2009), lung cancer (Dillard et al. 2006), and Covid 19 (Vieites et al. 2021) than the average person.Footnote 14 On the one hand, this optimism bias tends to reduce people’s prevention efforts. On the other hand, prevention efforts also tend to lead to more optimism bias leading in turn to lower than optimal prevention.

To study the effect of probability weighting, I will assume the dual model of Yaari (1987) in which probabilities are transformed, but outcomes are not. Under the dual theory, the agent’s prevention problem becomes:Footnote 15

And the optimality condition is

Equation 7 shows that the derivative of the probability weighting function plays a crucial role in determining optimal prevention. This makes intuitive sense. More sensitivity to changes in probability will make prevention efforts appear more effective and, consequently, will increase their appeal.

The second-order condition is

Given that \(p^{\prime \prime }<0\), the second term in Eq. 8 is negative and the second-order condition is always satisfied when \(w^{\prime \prime }<0\), i.e., when the probability weighting function is concave. When the probability weighting function is convex, the case most commonly assumed in the theoretical literature, the second-order condition is not necessarily satisfied and corner solutions are possible. That said, the situation seems more promising than under expected utility as there is at least a case (concave w) where the second order condition is always satisfied.

Figure 3 shows a convex weighting function. In the dual model risk aversion is captured by the weighting function and a convex weighting function implies that the agent gives less weight to the best outcome, implying risk aversion. (Uniform) risk loving is captured by a concave weighting function. For a convex weighting function, \(w^\prime\) increases with p and prevention efforts will be higher for smaller loss probabilities. This corresponds to the analysis under expected utility, where we also saw that risk averse agents will undertake more prevention when the probability of loss is smaller. The dual model with no probability weighting corresponds to risk neutrality and Eq. 7 shows that if \(w^{\prime } < (>) 1\), probability weighting will lead to less (more) prevention. The convex weighting function has a unique point \({\hat{p}}\) at which \(w^\prime =1\). If the loss probability exceeds \(1-{\hat{p}}\) risk averse dual agents will choose less prevention than a risk neutral agent and if the probability of loss is smaller than \(1-{\hat{p}}\) they will undertake more prevention.

In their experiment, Van De Kuilen and Wakker (2011) find a convex probability weighting function. They estimate it using the two-parameter function of Prelec (1998), which is a bit unfortunate for our purposes because this function is not everywhere convex. Their estimated probability weighting function has a derivative exceeding 1 for \(p \in (0.36,0.99)\), which means that for loss probabilities between 0.01 and 0.64 their representative agent will choose more prevention than a risk neutral agent.Footnote 16

In the dual model more risk aversion is modeled by a more convex probability weighting function w. Hence, we can write the probability weighting function of a more risk averse agent as k(w) with \(k^{\prime }>0\) and \(k^{\prime \prime }>0\). The first-order condition of the more risk averse agent is

A comparison between Eqs. 7 and 9 shows that the more risk averse agent will choose more prevention iff \(k^{\prime }(w)w^{\prime }(p)>w^{\prime }(p)\), i.e., iff \(k^{\prime }(w)>1\).

Figure 4 gives an example. The dotted curve shows a more convex weighting function and, consequently, reflects more risk aversion under the dual model than the solid curve. \({\tilde{p}}\) shows the probability at which the two weighting functions have the same slope. In the figure, it is equal to 0.78. For loss probabilities exceeding \(1-{\tilde{p}}\) the less risk averse agent takes more prevention, for loss probabilities less than \(1-{\tilde{p}}\) the more risk averse agent takes more prevention.

6 Inverse S-shaped probability weighting

Empirical evidence suggests that the most common form of the probability weighting function is not convex, as in Figs. 3 and 4, but inverse S shaped as in Fig. 5. It depicts the Prelec 2-parameter function where, in a moment of immodesty, I plugged in the parameter estimates of Bleichrodt and Pinto (2000). In Baillon et al. (2022) we explore the impact of inverse S-shaped probability weighting on prevention in detail. The first-order condition remains of course equal to Eq. 7, but, unlike in the case of convex weighting, there are now two points at which \(w^\prime (p)=1\): \({\underline{p}}\) and \({\bar{p}}\). For loss probabilities exceeding \(1-{\underline{p}}\) (\(>0.94\) in Fig. 5) and less than \(1-{\bar{p}}\) (\(<0.15\) in Fig. 5) the agent will undertake more prevention than a risk neutral agent and for all intermediate probabilities less.Footnote 17

An agent with inverse S-shaped probability weighting is not everywhere more risk averse than a risk neutral agent. Let \(\dot{p}\) be the probability for which the probability weighting function shifts from overweighting to underweighting: \(w(\dot{p})=\dot{p}\). For loss probabilities exceeding \(1-\dot{p}\), agents are risk seeking, for loss probabilities less than \(1-\dot{p}\), they are risk averse.

In the literature several parametric forms have been proposed, starting with the one-parameter form of Tversky and Kahneman (1992). Nowadays, two-parameter functions are commonly used. An advantage of these two-parameter functions, like Prelec’s or other two-parameter forms like those of Goldstein and Einhorn (1987) and a recent one that Simon Grant, Jingni Yang and I proposed (see Bleichrodt et al. 2022), is that they distinguish two effects: pessimism and likelihood insensitivity.Footnote 18

Pessimism corresponds to risk aversion. It is commonly seen as an attitudinal component of risk preferences, intrinsic to the agent’s preferences. It controls the elevation of the weighting function and, consequently, the weight assigned to the best outcome, that the loss does not occur. Figure 6 shows the impact of more pessimism in Prelec’s two-parameter weighting function: the weighting function shifts downwards and the interval for which \(w^\prime (p)>1\) shifts to the right. For loss probabilities lower than \(1-\tilde{p}\), more pessimism will lead to more prevention. Hence, the effect of more pessimism is similar to the effect of more utility curvature (= risk aversion) in the expected utility model.

Likelihood insensitivity is commonly seen as a cognitive component of probability weighting, which is more susceptible to heuristics and biases and is, therefore, less normative and possibly easier to affect. Figure 7 shows the effect of less likelihood insensitivity (more sensitivity) in Prelec’s two-parameter weighting function. It generally leads to more prevention, as expected because the agent becomes more sensitive to changes in probability. Thus, \(w^{'}(p)\) increases and by the concavity of p(e) the agent generally chooses a higher prevention effort. The exception is for high and low loss probabilities. This is a consequence of the continuity of the two-parameter weighting function. If we want to obtain the more plausible result that more sensitivity of the weighting function to changes in probability always leads to less prevention then we should be willing to give up continuity.

A function that does this is the neo-additive weighting function proposed by Chateauneuf et al. (2007):

Equation 10 assumes that \(\beta \in (-\alpha ,\alpha )\) to ensure inverse S-shaped probability weighting. We could model pessimism everywhere by permitting \(\beta >\alpha\) and by defining \(w(p)= 0\) if \(p \in [0,\frac{\beta -\alpha }{2(1-\alpha )}]\).

Figure 8 gives an example of a neo-additive weighting function. The crucial thing to note is that the prevention decision only depends on the value of \(\alpha\). For \(\alpha \in (0,1]\), it follows from Eq. 7 that the agent will always take less prevention than a risk neutral agent. It is also true that more insensitive agents, those with higher values of \(\alpha\), will take less prevention. It is remarkable that the degree of pessimism, as captured by \(\beta\), does not affect this conclusion. The degree of pessimism only plays a role if we allow for nonlinear utility. Then it reflects the weight given to the different marginal utilities (see Baillon et al. (2022) for details). However, under nonexpected utility, where utility curvature is only one factor determining risk attitudes, the marginal utilities are probably fairly similar and the role of pessimism in explaining prevention decisions is limited. What really matters is the degree of likelihood insensitivity.

7 Loss aversion

Behavioral economic research has shown that, besides utility curvature and probability weighting, loss aversion—i.e., the asymmetric treatment of losses and gains—is an important determinant of people’s risk preferences. For risky options involving both gains and losses, loss aversion is often the dominant factor shaping risk attitudes (Rabin 2000; Bleichrodt et al. 2019).

A difficulty in analyzing whether loss aversion can affect and perhaps even drive the prevention decision is that we have to know what the reference point is. Prospect theory is silent on how people form their reference points. If they see all outcomes as absolute wealth levels then loss aversion will play no role. Likewise, if people take their current wealth level before the loss as their reference point (the status quo) then all outcomes are losses and loss aversion again will play no role. For loss aversion to be relevant, the agent should see some outcomes as gains and others as losses.

Baillon et al. (2022) analyze prevention under the popular reference-dependent model of Kőszegi and Rabin (2006), which uses an expectations-based reference point, but concluded that this model cannot explain underprevention well. This is also the conclusion of a recent paper by Macé and Peter (2021) who derive that in the reference-dependent model of Kőszegi and Rabin (2006), loss aversion generally increases optimal prevention. This is somewhat odd, as empirically underprevention is the more common finding. However, the poor prediction of the model of Kőszegi and Rabin (2006) should come as no surprise. In Baillon et al. (2020) we analyze different rules for forming reference points under prospect theory and find little support for the expectations-based rule of Kőszegi and Rabin (2006). The two reference points that people most often used were the status quo, which as we observed implies that loss aversion does not affect the prevention decision, and a rule which we labeled maxmin. Maxmin implies that when comparing risky options people look at their minimal outcomes and take the maximum of these minimal outcomes as their reference point. This reference point can be interpreted as a security level.

Under maxmin, loss aversion will affect the prevention decision. Comparing prevention with no prevention, the maximum of the minimum outcomes is the loss \(W-l\). Hence, the prevention decision involves balancing the probability \(1-p(e)\) of a loss e with the probability p(e) of a gain \(l-e\). In other words, the prevention decision becomes

In Eq. 11, \(w^+\) is the probability weighting function for gains, \(w^-\) is the probability weighting function for losses and \(\lambda\) is a coefficient reflecting loss aversion. For simplicity, I have abstracted again from utility curvature, which in the presence of loss aversion contributes even less to the explanation of risk attitudes. Let’s simplify matters even more by also abstracting from probability weighting so that we can really isolate the impact of loss aversion.

The difference between Eq. 11 for a loss neutral (who has \(\lambda =1\)) and a loss averse agent gives

Equation 12 is decreasing in e, because \(\lambda >1\). Hence, by Topkis’ monotonicity theorem (Topkis 1978), the maximizing value of e is lower for a loss averse agent. Hence, loss aversion decreases prevention. By a similar line of argument, we can show that an agent who is more loss averse will choose a lower level of prevention. Introducing probability weighting (and utility curvature) makes the analysis richer and more complex, but the basic point remains: under maxmin more loss aversion leads to less prevention.

8 Empirical evidence

The above discussion has shown that the theoretical literature on prevention is rich, particularly under expected utility. In spite of the remaining open cases, it has also provided clear predictions, most notably the negative relation between prudence and prevention. Under nonexpected utility, we saw that more likelihood insensitivity and more loss aversion should lead to less prevention. The prediction of loss aversion is particularly interesting because it makes it possible to distinguish models with a maxmin reference point, which predict that more loss aversion leads to less prevention as we saw in Sect. 7, from the expectations-based reference-dependent model of Kőszegi and Rabin (2006), which predicts a positive effect of loss aversion on prevention (Macé and Peter 2021), and from models that assume that the status quo is the reference point and which predict that there is no relation between loss aversion and prevention.

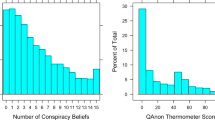

The empirical literature on prevention is as yet limited, but first findings appear largely to confirm the theoretical results presented although they also raise some new questions. Krieger and Mayrhofer (2017) find that prudence had a negative impact on prevention decisions, whereas risk aversion had no impact (which is perhaps unsurprising given that they held the variance of the options constant). Masuda and Lee (2019) also find that prudence reduced prevention and that risk aversion had no effect, but they also found violations of expected utility and show that probability weighting using Prelec’s one-parameter function could explain their data. Mayrhofer and Schmitz (2020) study the relation between risk preferences and real-world decisions. They find a weakly negative relation (significant at the 10% level) between prudence and influenza vaccinations, which they interpret as self-protection. They find no relation between risk aversion and influenza vaccinations. The measure of prudence used by Mayrhofer and Schmitz (2020) is based on financial decisions. However, Attema et al. (2019) find that prudence for wealth and prudence for longevity are correlated, providing some support that measures of prudence for financial decisions reflect prudence for health.

In Lambregts et al. (forthcoming), we looked in more detail at insurance decisions with nonperformance risk, both when the probability of nonperformance risk was known and when it was unknown. As mentioned above, this decision (as long as full insurance is available) is equivalent to the prevention decision. We find that risk aversion increases prevention, particularly if we restrict the loss probability to less than 0.50 and risk prudence reduced prevention. Ambiguity aversion and ambiguity prudence (Baillon 2017) have no effect. Surprisingly, individuals’ propensity to choose insurance (= undertake prevention) increased with the loss probability, which, as can be seen from Fig. 5, is inconsistent with inverse S-shaped probability weighting.

9 Suggestions for future research

In the 50 years since Ehrlich and Becker (1972) published their model of self-protection, a lot of progress has been made, particularly under expected utility and particularly theoretically. Progress has also been made under nonexpected utility, for example, the role of probability weighting is now better understood. Work remains to be done on the impact of loss aversion, particularly because the first analysis I presented here suggests that loss aversion may have clear implications. Of course, my simple analysis is only a first cautious step. I assumed a specific reference point (maxmin) and I abstracted from different probability weighting for gains and losses (in fact, I abstracted from probability weighting altogether). One advantage of focusing on nonexpected utility is that the role of utility curvature becomes less important in explaining risk preferences. This implies that the degree of prudence reflected by the utility function will be diminished. Several authors have shown that limiting the degree of prudence allows for more robust predictions about the effect of risk aversion (e.g., Dionne and Li 2011).

Another topic that I find interesting to explore is the impact of ambiguity attitudes on prevention. Some studies exist, but they mostly assume the smooth model of ambiguity aversion (Klibanoff et al. 2005), which cannot account for the rich pattern of ambiguity attitudes that has been found empirically (Kocher et al. 2018). An interesting avenue for future research would be to explore the prevention problem under descriptively more promising models like \(\alpha\)-maxmin expected utility (Ghirardato et al. 2004) and prospect theory. For example, empirical evidence suggests that ambiguity makes the weighting function more insensitive. The analysis of Sect. 6 suggests that this will further reduce the agent’s investment in prevention. An interesting contribution along these lines is Peter and Toquebeuf (2020). They study the prevention problem under Choquet expected utility with mean-preserving capacities and find that more ambiguity aversion leads to less prevention. A limitation of mean-preserving capacities is that they can only account for uniform ambiguity aversion or ambiguity loving and not for the more common joint occurrence of ambiguity loving for unlikely events and ambiguity aversion for more likely events.

A lot of work also remains to be done empirically. The above analysis has revealed three factors that are particularly worthy of further investigation: prudence, likelihood insensitivity, and loss aversion. As mentioned, some studies have already explored the role of prudence and the results are largely consistent with the theoretical predictions. The measure of prudence is, however, a bit crude: the number of choices consistent with prudence. I would like to see the analysis repeated with a more precise measure of prudence. The only paper I am aware of is Ebert and Wiesen (2014) who use a willingness to pay (WTP) measure. A limitation of their method is that WTP measures tend to be subject to many biases and that their method lacks a clear interpretation under nonexpected utility. With Jingni Yang, Iván Paya and Jason Doctor I am currently working on a different quantitative measure of prudence, which measures the curvature of utility also under nonexpected utility. Our measure is easy to apply in empirical research and will hopefully further help settle, amongst others, the role of prudence in prevention.

Several measures exist to measure likelihood insensitivity. Using the methods of Abdellaoui (2000) or Bleichrodt and Pinto (2000), this can be done nonparametrically. With approximately 10 questions, the weighting function can be measured and then fitting one of the two-parametric weighting functions to it will give a measure of likelihood insensitivity. The two-parametric weighting functions tend to fit equally well so whether one uses the one by Prelec (1998), the one by Goldstein and Einhorn (1987) or the recent one Jingni Yang, Simon Grant, and I proposed is immaterial. If 10 elicitations is deemed excessive, the semi-parametric method by Abdellaoui et al. (2008) could be used instead. This method only needs to elicit 5 indifferences.

While measuring loss aversion used to be complex as the utility for gains and the utility for losses had to be measured simultaneously, new methods have made this measurement easy. The most straightforward method is in Abdellaoui et al. (2016), which measures loss aversion nonparametrically using just three elicitations. There are, however, still two complications with measuring loss aversion. First, several authors have proposed different definitions of loss aversion. This is less of a problem nowadays as most researchers seem to have come to accept the definition of Köbberling and Wakker (2005) of loss aversion as the kink at the reference point. A more serious problem in operationalizing loss aversion is what the reference point is. In Baillon et al. (2020) we show that the most plausible candidates are the status quo and maxmin (see Sect. 7). I encourage researchers to concentrate on these concepts. Behavioral economics has focused too much on the expectations-based reference point of Kőszegi and Rabin (2006). I see little point in this. We found little support for expectations-based reference points and I strongly doubt whether people use this strategy. Previous studies that claim to find support for the rule of Kőszegi and Rabin (2006) are unconvincing as they cannot distinguish well between different reference points. Their data are consistent with other reference points as well. Finally, as shown by Masatlioglu and Raymond (2016), the reference-dependent model of Kőszegi and Rabin (2006) is a special case of rank-dependent utility as long as first-order stochastic dominance holds. Given that rank-dependent utility is not a reference-dependent theory, this essentially disqualifies the model of Kőszegi and Rabin (2006) as a theory of reference-dependence.

10 Conclusion

Fifty years ago, Ehrlich and Becker (1972) published their influential model of prevention. Even though the model was simple, it turned out to be surprisingly difficult to sign the effect of risk aversion. Since then a lot of progress has been made, particularly highlighting the negative effect of prudence on prevention. In this article, I show that extending the analysis to nonexpected utility identifies two other factors worthy of exploration: likelihood insensitivity and loss aversion. Even after 50 years, a lot of research on prevention remains to be done, theoretical but probably primarily empirical. Hopefully in the next 50 years, we will be able to conclude that the prevention puzzle has finally been solved.

Notes

Another important area is climate change where substantail investments are required to reduce the risk of environmental catastrophes in the future.

The model of Ehrlich and Becker (1972) only considers the private effects of prevention. For policy, the external effects of prevention are perhaps even more important.

For an earlier review of the literature see Courbage et al. (2013).

For a nice analysis of the prevention decision of risk lovers see Jindapon (2013).

It is unlikely that the second-order condition will be met for a risk lover but not for a risk averter given that the third term of Eq. 3 is positive for a risk lover and negative for a risk averter. It can only occur if \(U^{'}\) is strongly concave for a risk lover (and less so for a risk averter). Fagart and Fluet (2013) provide conditions on U and p so that the prevention problem is globally concave in effort.

Dachraoui et al. (2004) study the case of more mixed risk aversion. They show that if a more mixed risk averse agent V chooses more prevention than agent U then the optimal probability of loss for agent u, \(p_u\), must be less than \(\frac{1}{2}\). Or, equivalently, the only thing that can be said is that if \(p_u<\frac{1}{2}\) then a more mixed risk averse agent will choose less prevention. Of course, mixed risk aversion is a strong comparability assumption that involves not only risk aversion, but also higher-order risk preferences like prudence and temperance.

The variance is held constant to avoid the confounding effect of risk aversion.

To be exact, Peter (2021b) concentrates on downside risk aversion as ranking two decision makers in terms of their downside risk aversion may be different from ranking them in terms of their degree of prudence.

Other examples are the equity premium puzzle, the finding that historically the returns of stocks are so much higher than those of bonds, the disposition effect, the finding that investors tend to sell winning stocks too soon and hold on to losing stocks for too long, and the simultaneous buying of lottery tickets and insurance.

This underestimation may partly be caused by overconfidence. For example, people may overestimate their ability to stick to a diet or follow an exercise regime.

Re-estimating their median data using a power function, which is everywhere convex, gives that their representative agent chooses more prevention than a risk neutral agent if the probability of a loss is less than 0.54.

That the dual model gives no clear predictions either should perhaps not come as a surprise. Peel and Paya (2021) show in detail that the preference for skewness is complex under prospect theory and depends on probability weighting.

The distinction between pessimism and likelihood insensitivity also underlies the analysis of Etner and Jeleva (2013) although they do not consider inverse S-shaped probability weighting. Their fatalists are pessimistic and insensitive, their moderate pessimists are pessimistic, but not everywhere insensitive.

References

Abdellaoui, M. 2000. Parameter-free elicitation of utility and probability weighting functions. Management Science 46: 1497–1512.

Abdellaoui, M., H. Bleichrodt, and O. l’Haridon. 2008. A tractable method to measure utility and loss aversion under prospect theory. Journal of Risk and Uncertainty 36: 245–266.

Abdellaoui, M., H. Bleichrodt, O. l’Haridon, and D. Van Dolder. 2016. Measuring loss aversion under ambiguity: A method to make prospect theory completely observable. Journal of Risk and Uncertainty 52: 1–20.

Alary, D., C. Gollier, and N. Treich. 2013. The effect of ambiguity aversion on insurance and self-protection. Economic Journal 123: 1188–1202.

Attema, A.E., O. l’Haridon, and G. van de Kuilen. 2019. Measuring multivariate risk preferences in the health domain. Journal of Health Economics 64: 15–24.

Baillon, A. 2017. Prudence with respect to ambiguity. Economic Journal 127: 1731–1755.

Baillon, A., H. Bleichrodt, A. Emirmahmutoglu, J. Jaspersen, and R. Peter. 2022. When risk perception gets in the way: Probability weighting and underprevention. Operations Research 70: 371–1392.

Baillon, A., H. Bleichrodt, and V. Spinu. 2020. Searching for the reference point. Management Science 66: 93–112.

Berger, L. 2016. The impact of ambiguity and prudence on prevention decisions. Theory and Decision 80: 389–409.

Berger, L., J. Emmerling, and M. Tavoni. 2017. Managing catastrophic climate risks under model uncertainty aversion. Management Science 63: 749–765.

Bleichrodt, H., J.N. Doctor, Y. Gao, C. Li, D. Meeker, and P.P. Wakker. 2019. Resolving Rabin’s paradox. Journal of Risk and Uncertainty 59: 239–260.

Bleichrodt, H., S. Grant, and J. Yang (2022). testing Hurwicz expected utility. Australian National University (Working Paper).

Bleichrodt, H., and J.L. Pinto. 2000. A parameter-free elicitation of the probability weighting function in medical decision analysis. Management Science 46: 1485–1496.

Chateauneuf, A., J. Eichberger, and S. Grant. 2007. Choice under uncertainty with the best and worst in mind: Neo-additive capacities. Journal of Economic Theory 137: 538–567.

Courbage, C. 2001. Self-insurance, self-protection and market insurance within the dual theory of choice. Geneva Papers on Risk and Insurance Theory 26: 43–56.

Courbage, C., and B. Rey. 2006. Prudence and optimal prevention for health risks. Health Economics 15: 1323–1327.

Courbage, C., B. Rey, and N. Treich. 2013. Prevention and precaution. Handbook of Insurance, 185–204.

Dachraoui, K., G. Dionne, L. Eeckhoudt, and P. Godfroid. 2004. Comparative mixed risk aversion: Definition and application to self-protection and willingness to pay. Journal of Risk and Uncertainty 29: 261–276.

Dillard, A.J., K.D. McCaul, and W.M. Klein. 2006. Unrealistic optimism in smokers: Implications for smoking myth endorsement and self-protective motivation. Journal of Health Communication 11: 93–102.

Dionne, G., and L. Eeckhoudt. 1985. Self-insurance, self-protection and increased risk aversion. Economics Letters 17: 39–42.

Dionne, G., and J. Li. 2011. The impact of prudence on optimal prevention revisited. Economics Letters 113: 147–149.

Ebert, S., and D. Wiesen. 2014. Joint measurement of risk aversion, prudence, and temperance. Journal of Risk and Uncertainty 48: 231–252.

Eeckhoudt, L., and C. Gollier. 2005. The impact of prudence on optimal prevention. Economic Theory 26: 989–994.

Ehrlich, I., and G.S. Becker. 1972. Market insurance, self-insurance, and self-protection. Journal of Political Economy 80: 623–648.

Etner, J., and M. Jeleva. 2013. Risk perception, prevention and diagnostic tests. Health Economics 22: 144–156.

Fagart, M.-C., and C. Fluet. 2013. The first-order approach when the cost of effort is money. Journal of Mathematical Economics 49: 7–16.

Ghirardato, P., F. Maccheroni, and M. Marinacci. 2004. Differentiating ambiguity and ambiguity attitude. Journal of Economic Theory 118: 133–173.

Goldstein, W.M., and H.J. Einhorn. 1987. Expression theory and the preference reversal phenomena. Psychological Review 94: 236.

Jewitt, I. 1989. Choosing between risky prospects: The characterization of comparative statics results, and location independent risk. Management Science 35: 60–70.

Jindapon, P. 2013. Do risk lovers invest in self-protection? Economics Letters 121: 290–293.

Jullien, B., B. Salanie, and F. Salanie. 1999. Should more risk-averse agents exert more effort? Geneva Papers on Risk and Insurance Theory 24: 19–28.

Katapodi, M.C., M.J. Dodd, K.A. Lee, and N.C. Facione. 2009. Underestimation of breast cancer risk: Influence on screening behavior. Oncology Nursing Forum 36: 306.

Kimball, M.S. 1990. Precautionary saving in the small and in the large. Econometrica 58: 53–73.

Klibanoff, P., M. Marinacci, and S. Mukerji. 2005. A smooth model of decision making under ambiguity. Econometrica 73: 1849–1892.

Köbberling, V., and P.P. Wakker. 2005. An index of loss aversion. Journal of Economic Theory 122: 119–131.

Kocher, M.G., A.M. Lahno, and S.T. Trautmann. 2018. Ambiguity aversion is not universal. European Economic Review 101: 268–283.

Konrad, K.A. and S. Skaperdas. 1993. Self-insurance and self-protection: a nonexpected utility analysis. Geneva Papers on Risk and Insurance Theory, 131–146.

Kőszegi, B., and M. Rabin. 2006. A model of reference-dependent preferences. Quarterly Journal of Economics 121: 1133–1165.

Krieger, M., and T. Mayrhofer. 2017. Prudence and prevention: An economic laboratory experiment. Applied Economics Letters 24: 19–24.

Lambregts, T., P. van Bruggen, and H. Bleichrodt. forthcoming. Insurance decisions under nonperformance risk and ambiguity. Journal of Risk and Uncertainty.

Lopes, L.L. 1984. Risk and distributional inequality. Journal of Experimental Psychology: Human Perception and Performance 10: 465.

Lopes, L.L. 1987. Between hope and fear: The psychology of risk. Advances in Experimental Social Psychology 20: 255–295.

Macé, S., and R. Peter. 2021. The impact of loss aversion on optimal prevention. University of Iowa (Working Paper).

Masatlioglu, Y., and C. Raymond. 2016. A behavioral analysis of stochastic reference dependence. American Economic Review 106: 2760–82.

Masuda, T., and E. Lee. 2019. Higher order risk attitudes and prevention under different timings of loss. Experimental Economics 22: 197–215.

Mayrhofer, T., and H. Schmitz. 2020. Prudence and prevention: Empirical evidence, 863, Ruhr Economic Papers.

Menegatti, M. 2009. Optimal prevention and prudence in a two-period model. Mathematical Social Sciences 58: 393–397.

Menezes, C., C. Geiss, and J. Tressler. 1980. Increasing downside risk. American Economic Review 70: 921–932.

Newhouse, J.P. 2021. An ounce of prevention. Journal of Economic Perspectives 35: 101–18.

Peel, D.A., and I. Paya. 2021. On risk, return, skewness and preferences of the decision maker in cumulative prospect theory. Universidad de Alicante (Working Paper).

Peter, R. 2017. Optimal self-protection in two periods: On the role of endogenous saving. Journal of Economic Behavior & Organization 137: 19–36.

Peter, R. 2021. A fresh look at primary prevention for health risks. Health Economics 30: 1247–1254.

Peter, R. 2021. Who should exert more effort? Risk aversion, downside risk aversion and optimal prevention. Economic Theory 71: 1259–1281.

Peter, R., and P. Toquebeuf. 2020. Separating ambiguity and ambiguity attitude with mean-preserving capacities: Thoery and applications. University of Iowa (Working Paper).

Peter, R., and J. Ying. 2020. Do you trust your insurer? Ambiguity about contract nonperformance and optimal insurance demand. Journal of Economic Behavior & Organization 180: 938–954.

Prelec, D. 1998. The probability weighting function. Econometrica, 497–527.

Rabin, M. 2000. Risk aversion and expected-utility theory: A calibration theorem. Econometrica 68: 1281–1292.

Snow, A. 2011. Ambiguity aversion and the propensities for self-insurance and self-protection. Journal of Risk and Uncertainty 42: 27–43.

Sparks, P., R. Shepherd, N. Wieringa, and N. Zimmermanns. 1995. Perceived behavioural control, unrealistic optimism and dietary change: An exploratory study. Appetite 24: 243–255.

Topkis, D.M. 1978. Minimizing a submodular function on a lattice. Operations Research 26: 305–321.

Tversky, A., and D. Kahneman. 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5: 297–323.

Van De Kuilen, G., and P.P. Wakker. 2011. The midweight method to measure attitudes toward risk and ambiguity. Management Science 57: 582–598.

Vieites, Y., G. Ramos, E.B. Andrade, C. Pereira, and A. Medeiros. 2021. Can self-protective behaviors increase unrealistic optimism? Evidence from the COVID-19 Pandemic. Journal of Experimental Psychology: Applied, Forthcoming.

Wakker, P.P., R. Thaler, and A. Tversky. 1997. Probabilistic insurance. Journal of Risk and Uncertainty 15: 7–28.

Weber, E.U. 1994. From subjective probabilities to decision weights: The effect of asymmetric loss functions on the evaluation of uncertain outcomes and events. Psychological Bulletin 115: 228.

Yaari, M.E. 1987. The dual theory of choice under risk. Econometrica, 95–115.

Acknowledgements

Aurélien Baillon, Iván Paya, Richard Peter, Béatrice Rey, and the editors Alexander Mürmann and Casey G. Rothschild, gave very helpful comments on previous versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bleichrodt, H. The prevention puzzle. Geneva Risk Insur Rev 47, 277–297 (2022). https://doi.org/10.1057/s10713-022-00079-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s10713-022-00079-6