Abstract

We examine the interaction between an individual’s pension scheme and her purchase of long-term care insurance in a context where individuals learn their longevity risk type over time. We show that the structure of an individual’s retirement pension scheme is an important component of her selection of long-term care insurance coverage. When individuals purchase their retirement product and long-term care insurance after learning their risk type, low-risk individuals signal their type solely on the retirement product market, which allows all individuals, irrespective of their risk type, to perfectly insure against the incidence of long-term care shocks. When individuals purchase their retirement product before learning their risk type, then the retirement product will pool all risk types, which prevents any signaling in that market. If individuals still learn their type before purchasing long-term care insurance, then having to signal their type in the long-term care insurance market considerably reduces the take-up rate for such protection for all risk types.

Similar content being viewed by others

Notes

We will abstract from other differences between DB and DC plans, and tax-financed pension plans, such as Social Security in the USA and the Canadian (and Québec) Pension Plan, which are similar in nature to DB schemes in that contributions are not based on risk type.

See for example Hurd et al. (2014) who calculate the prevalence of nursing home stays by age for HRS respondents. The average number of nights respondents spent in a nursing home stay in the two years prior to the survey increases steadily from 0.64 nights for respondents under the age of 55, to 202.97 nights for respondents aged 95 and older.

From a practical point of view, there is a subtle difference between DB and DC schemes and the timing of annuitization since private annuities always come with risk underwriting, even when the contract is written at a young age. One could argue that if annuitization occurs when an individual is young, it is the insurer that is better informed about an individual’s longevity risk because it has underwriting experience and access to data that allow a risk classification even in the absence of concrete information about an individual’s health. The individual, who has no concrete evidence for her health type nor the data and statistical tools allowing a personalized prediction of her risk type becomes the less informed party. To abstract from these complications, we choose to frame early annuitization as a DB scheme, which does not entail any underwriting, and late annuitization as a DC scheme with underwriting.

To lighten the text, we will let the agents be feminine (she) and the principals (the LTC insurers and the annuity providers) be neutral (it).

As Brown and Weisbenner (2014) point out, it is increasingly common for U.S. public sector employees to be given the choice between a DB and a DC scheme. In the private sector, it is rare that an employer offers a choice between different retirement vehicles. Nonetheless, in a global compensation framework, the type of pension is one of the criteria when choosing an employer. At the margin, a firm’s pension plan might become the deciding factor. It is in this perspective that we say that an individual “chooses” a retirement vehicle.

See Brown et al. (2017) for an overview of how jurisdictions vary internationally in how much leeway individuals are given with respect to annuitization of their retirement wealth.

The 99 largest public retirement systems in the USA in 2013, representing 85% of all public pension funds, covered over 20 million Americans, including 12.65 million active employees (Mohan and Zhang 2014).

See the OECD report for more details regarding the pension arrangements in those countries that are reported as not having occupational pension plans. In some countries, individuals are obliged to join a personal pension plan, sometimes with voluntary (e.g., in Peru) or obligatory (e.g., in Colombia) contributions from the employer. These are not occupational pension plans according to the OECD since the employer did not set up the plan and is not responsible for its operations.

https://www.nia.nih.gov/health/what-long-term-care, last accessed on 12 March 2019.

https://longtermcare.acl.gov/the-basics/how-much-care-will-you-need.html; last accessed on 21 November 2019.

See Webb and Zhivan (2010) for a more conservative estimate.

https://www.genworth.com/aging-and-you/finances/cost-of-care.html, last accessed on 19 August 2019.

This means that all savings occur through the employer in the case of a DB scheme. We further assume, following Villeneuve (2003), Finkelstein and Poterba (2004), and Finkelstein et al. (2009), that all DC scheme accumulated sums must be annuitized with a single provider, so that annuity contracts are exclusive. See Rothschild (2015) for a discussion of the impact of removing the exclusivity aspect of annuity purchases. In Sect. 6.2 we examine the impact of introducing savings outside of the DB and DC schemes.

By assuming that \(\pi\) is the same for all agents, we are diverging from Murtaugh et al. (2001), Warshawsky (2007) and Webb (2009) who suppose that \(\pi\) is correlated with \(p_i\). While this may seem restrictive, what is relevant for our model is that obtaining information about an individual’s risk on one market is informative about the individual’s risk on the other market. Therefore, our results would hold for a type-specific \(\pi _i\) if it is public knowledge that type i always has a specific combination of longevity and LTC risk.

The impact of introducing bequest and legacy motives in our model is not obvious as it would depend on the way such motives are presented. If bequest motives exist only in the event the policyholder is dead in the last period (which occurs with average probability \((1-\bar{p})=1- (1-x) p_L - x p_H\)), then having a product that pays in the event of death—say, a life insurance policy—would be valuable. This bequest product would have a cost paid for in the initial period, which would necessarily reduce the amount annuitized because total wealth is reduced. An alternative, we could say that all bequest motives are embedded in the last period’s wealth, \(W_2\), such that \(U(W_2)=0\). Another alternative would be to let bequest motives be present in all states of the world in the final period, which would then increase the amount annuitized because policyholders want to leave a legacy after death, whenever death happens (i.e., either at the beginning or at the end of the final period). Including bequest and legacy motives would surely change the nature of the equilibrium demand for retirement and/or LTC insurance products. Nonetheless, the demand for LTC insurance would remain smaller under a DB scheme than under a DC scheme, whichever way we model bequest motives.

Even though in reality insurers must incur expenses for marketing, management, underwriting, and claims-handling, even in competitive markets, we will assume that there are no loading factors, so that in each market, the premium paid is simply equal to the expected loss.

Equivalently, we could also assume that suppliers are restricted to offer a single contract designed for either type of agents, so that cross-subsidization becomes irrelevant. Moreover, as shown by Sandroni and Squintani (2007), if insurers compete locally in single-contract offers in the Nash sense, then, irrespective of the share of high risks in the market, the Rothschild-Stiglitz allocation is feasible, sustainable, and stable. See Sect. 6 for further discussion.

The two simplified first-order conditions are \(U^\prime ( W_1-\eta ^{FB})=( 1-\pi ) U^\prime ( W_2+B^{FB}) + \pi U^\prime ( W_2+B^{FB}-( 1-d^{FB})\lambda )\) and \(U^\prime ( W_1-\eta ^{FB}) = U^\prime ( W_2+B^{FB}-( 1-d^{FB})\lambda )\).

Put differently, \(\Delta =U^\prime (W_1- \bar{p} B^*- p_i \pi d_i^{DB-sym} \lambda )-p_i [(1-\pi ) U^\prime ( W_2+B^*) +\pi U^\prime ( W_2+B^*-( 1-d_i^{DB-sym}) \lambda )]\) is the difference between the marginal utility of an agent of type \(i \in \{L,H\}\) in the initial period and her expected marginal utility in the final period. Knowing that under symmetric information, an agent’s intertemporal expected utility is maximized when \(\Delta =0\), we can show that as \(d_i^{DB-sym} \longrightarrow 0\), then \(\Delta <0\) and \(\frac{\partial ^2 \Delta }{\partial d_i \partial p_i}>0\).

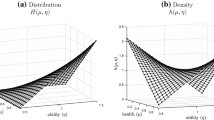

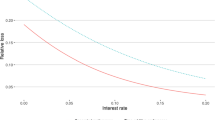

Note that when the average survival probability is 0.60, and for a share of high-risk agents of \(x=0.3\), the high-risk agent’s survival probability would have to be higher than 1 for a survival probability of the low-risk agent that is smaller than 43%. While for the purpose of consistency with the other numerical example, the graph is shown for the entire domain of survival probabilities, the results for a survival probability lower than 43% should be disregarded.

In principle, there are three possible contract combinations that high-risk agents could choose instead of the one designed for them: (1) Both the annuity and the LTC insurance contract designed for the low-risk agent; (2) the annuity contract designed for the high-risk agent and the LTC insurance contract designed for the low-risk agent; or (3) the annuity contract designed for the low-risk agent and the LTC insurance contract designed for the high-risk agent. For simplicity, we will assume that only the first incentive constraint binds, so that the high-risk agent can only choose the low-risk agent’s annuity contract if she also chooses the low-risk agent’s LTC insurance contract and vice versa. This is tantamount to assuming there is information sharing between insurance providers as described by Fluet and Pannequin (1997)

All remaining figures are in the paper’s Appendix.

Or that their saving choice is made before the accepting the DB/DC contract, and that this choice is observable.

The argument is similar with respect to insuring the deductible in a “simple” Rothschild-Stiglitz equilibrium: If the deductible is insured (through a non-exclusive contract), then there is no signal.

In other words, by saving outside of the DC scheme agents would reduce the validity of the signal they send about their type, which means that all information gathered on the annuity market would have no value for LTC insurers.

We thank an anonymous referee and the editor for suggesting that we discuss the implications of allowing savings outside of the DB / DC schemes.

http://www.goodventures.org/research-and-ideas/conversations/pew-charitable-trusts-government-performance-project-november-14-2013; last accessed on 15 July 2020

The report can be found at www.epi.org/publication/retirement-in-america/; last accessed on 15 July 2020. See also Chien and Morris (2018).

In a DB system, individuals are grouped together with their fellow workers in such a way that each individual’s specific risk type is irrelevant. In a DC scheme, however, agents can convert their retirement savings into an annuity at the time of their retirement—at which point they will have more information about their risk type.

An individual’s insurance decision and preference over pension schemes are affected by many factors that were left our of our model. One such important factor is risk aversion (Finkelstein and McGarry 2006; Webb 2009). Another important factor is the investment risk that individuals assume in a DC scheme, but not in a DB scheme (see Davidoff (2009) for more on the investment choices through which retirement wealth is accumulated). And even though investment returns can be considerably higher in a DC scheme than in a DB scheme (OECD 2017), the investment risk (and necessary investment in financial literacy) that accompanies higher expected investment returns might deter individuals from choosing a DC scheme (Clark et al. 2006; Gerrans and Clark 2013). Other considerations, such as bequest and legacy motives (Pauly 1990; Courbage and Montoliu-Montes 2018), as well as inter-generational moral hazard (Courbage and Zweifel 2011; Ko 2017), were left out to keep our model tractable.

This cannot possibly be correct since it would imply no signalling whatsoever. The exercise is done to see whether signalling makes the low-risk agent’s annuity contract more or less generous than the high-risk agent’s annuity contract, \(A_H^{sym}\).

References

Adams, C., C. Donnelly, and A. Macdonald. 2015a. Adverse selection in a start-up long-term care insurance market. British Actuarial Journal 20: 298–347.

Adams, C., C. Donnelly, and A. Macdonald. 2015b. The impact of known breast cancer polygenes on critical illness insurance. Scandinavian Actuarial Journal 2015: 141–171.

Allen, F. 1985. Repeated principal-agent relationships with lending and borrowing. Economics Letters 17: 27–31.

Armstrong, M., and J.-C. Rochet. 1999. Multidimensional screening: A user’s guide. European Economic Review 43: 959–979.

Barigozzi, F., and D. Henriet. 2011. Genetic information: Comparing alternative regulatory approaches when prevention matters. Journal of Public Economic Theory 13: 23–46.

Bernheim, B.D. 1987. The economic effects of social security: Toward a reconciliation of theory and measurement. Journal of Public Economics 33: 273–304.

Boyer, M.M., P. De Donder, C. Fluet, M.-L. Leroux, and P.-C. Michaud. 2019. A Canadian parlor room-type approach to the long-term care insurance puzzle. Canadian Public Policy 45: 262–282.

Boyer, M.M., P. De Donder, C. Fluet, M.-L. Leroux, and P.-C. Michaud. 2020. Long-term care insurance: Information frictions and selection. American Economic Journal: Economic Policy 12: 134–169.

Brown, J.R., and A. Finkelstein. 2004. Supply or demand: why is the market for long-term care insurance so small? (No. w10782). National Bureau of Economic Research.

Brown, J., and M. Warshawsky. 2013. The life care annuity: A new empirical examination of an insurance innovation that addresses problems in the markets for life annuities and long-term care insurance. Journal of Risk and Insurance 80: 677–700.

Brown, J.R., and A. Finkelstein. 2007. Why is the market for long-term care insurance so small? Journal of Public Economics 91: 1967–1991.

Brown, J.R., and A. Finkelstein. 2008. The interaction of public and private insurance: Medicaid and the long-term care insurance market. American Economic Review 98: 1083–1102.

Brown, J.R., and A. Finkelstein. 2009. The private market for long-term care insurance in the United States: A review of the evidence. Journal of Risk and Insurance 76: 5–29.

Brown, J.R., and A. Finkelstein. 2011. Insuring long-term care in the United States. Journal of Economic Perspectives 25 (4): 119–142.

Brown, J.R., A. Kapteyn, E.F. Luttmer, and O.S. Mitchell. 2017. Cognitive constraints on valuing annuities. Journal of the European Economic Association 15: 429–462.

Brown, J.R., and S.J. Weisbenner. 2014. Why do individuals choose defined contribution plans? Evidence from participants in a large public plan. Journal of Public Economics 116: 35–46.

Brugiavini, A. 1993. Uncertainty resolution and the timing of annuity purchases. Journal of Public Economics 50: 31–62.

Chiappori, P.-A., I. Macho, P. Rey, and B. Salanié. 1994. Repeated moral hazard: The role of memory, Commitment, and the Access to Credit Markets. European Economic Review 38: 1527–1553.

Chien, Y.L. and P. Morris. 2018. Many Americans still lack retirement savings. Tech. rep., Federal Reserve Bank of St. Louis.

Clark, R.L., L.S. Ghent, and A.A. McDermed. 2006. Pension plan choice among university faculty. Southern Economic Journal, 560–577

Cocco, J.F., and P. Lopes. 2011. Defined benefit or defined contribution? A study of pension choices. Journal of Risk and Insurance 78: 931–960.

Cole, H., and N. Kocherlakota. 2001. Efficient allocations with hidden income and hidden storage. The Review of Economic Studies 68: 523–542.

Courbage, C., and G. Montoliu-Montes. 2018. Estate fiscal policies, long-term care insurance and informal care. Geneve: University of Geneve. Tech. rep.

Courbage, C., and P. Zweifel. 2011. Two-sided intergenerational moral hazard, long-term care insurance, and nursing home use. Journal of Risk and Uncertainty 43: 65–80.

Cremer, H., P. De Donder, and P. Pestieau. 2009. Providing sustainable long term care: A looming challenge. Toulouse School of Economics.

Crocker, K.J., and A. Snow. 2011. Multidimensional screening in insurance markets with adverse selection. Journal of Risk and Insurance 78: 287–307.

Davidoff, T. 2009. Housing, health, and annuities. Journal of Risk and Insurance 76: 31–52.

Davidoff, T. 2013. Long-term CareInsurance. In Handbook of insurance, ed. G. Dionne, 1037–1059. New York: Spinger. chap. 35.

Davidoff, T., J.R. Brown, and P.A. Diamond. 2005. Annuities and individual welfare. The American Economic Review 95: 1573–1590.

De Donder, P., and M.-L. Leroux. 2015. The political economy of (in) formal long term care transfers. Montréal: Université du Québec à Montréal. Tech. rep.

Doherty, N.A. and L.L. Posey. 1998. On the value of a checkup: Adverse selection, moral hazard and the value of information. Journal of Risk and Insurance, 189–211.

Doherty, N.A., and P.D. Thistle. 1996. Adverse selection with endogenous information in insurance markets. Journal of Public Economics 63: 83–102.

Drolet, M., and R. Morissette. 2014. New facts on pension coverage in Canada. Statistics Canada. http://www.statcan.gc.ca/pub/75-006-x/2014001/article/14120-eng.htm. Accessed 18 Dec 2014d

Farhi, E., M. Golosov, and A. Tsyvinski. 2009. A theory of liquidity and regulation of financial intermediation. Review of Economic Studies 76: 973–992.

Finkelstein, A., and K. McGarry. 2006. Multiple dimensions of private information: Evidence from the long-term care insurance market. The American Economic Review 96: 938–958.

Finkelstein, A., and J. Poterba. 2002. Selection effects in the United Kingdom individual annuities market. The Economic Journal 112: 28–50.

Finkelstein, A., and J. Poterba. 2004. Adverse selection in insurance markets: Policyholder evidence from the UK annuity market. Journal of Political Economy 112: 183–208.

Finkelstein, A., J. Poterba, and C. Rothschild. 2009. Redistribution by insurance market regulation: Analyzing a ban on gender-based retirement annuities. Journal of Financial Economics 91: 38–58.

Fluet, C., and F. Pannequin. 1997. Complete versus incomplete insurance contracts under adverse selection with multiple risks. The Geneva Papers on Risk and Insurance Theory 22: 81–101.

Frank, R.G. 2012. Long-term care financing in the United States: Sources and institutions. Applied Economic Perspectives and Policy 34: 333–345.

Gerrans, P., and G.L. Clark. 2013. Pension plan participant choice: Evidence on defined benefit and defined contribution preferences. Journal of Pension Economics and Finance 12: 351–378.

Glenzer, F., and B. Achou. 2019. Annuities, long-term care insurance, and insurer solvency. The Geneva Papers on Risk and Insurance-Issues and Practice 44: 252–276.

Grignon, M., and N. F. Bernier. 2012. Financing long-term care in Canada. IRPP Study (33): 1.

Hoy, M., and M. Ruse. 2005. Regulating genetic information in insurance markets. Risk Management and Insurance Review 8: 211–237.

Hoy, M., F. Orsi, F. Eisinger, and J.P. Moatti. 2003. The impact of genetic testing on health care insurance. The Geneva Papers on Risk and Insurance: Issues and Practice 28: 203–221.

Hurd, M., P.-C. Michaud, and S. Rohwedder. 2014. The lifetime risk of nursing home use. Discoveries in the Economics of Aging, 81–109.

Hurd, M., P.-C. Michaud, and S. Rohwedder. 2017. Distribution of lifetime nursing home use and of out-of-pocket spending. Proceedings of the National Academy of Sciences 114: 9838–9841.

Jacklin, C. 1987. Demand deposits, trading restrictions, and risk sharing. In Contractual arrangements for intertemporal trade, ed. E. Prescott, and N. Wallace, 26–47. Minnesota: University of Minnesota Press.

Ko, A. 2017. An equilibrium analysis of the long-term care insurance market, Tech. rep., Georgetown University Working paper and AEA Conference Proceeding. https://www.aeaweb.org/conference/2018/preliminary/paper/8Ztdt2zQ.

Liu, W., and J. Liu. 2019. The effect of political frictions on long term care insurance (July 5, 2019). Ssrn: https://ssrn.com/abstract=3388542, Harvard.

Lopez-Fernandini, A. 2010. Unrestricted Savings. https://www.nasi.org/research/2004/long-term-care-financing-models-issues, New America Foundation.

Mimra, W., and A. Wambach. 2014. New developments in the theory of adverse selection in competitive insurance. The Geneva Risk and Insurance Review 39: 136–152.

Mitchell, O.S., J.M. Poterba, M.J. Warshawsky, and J.R. Brown. 1999. New evidence on the money’s worth of individual annuities. American Economic Review 89: 1299–1318.

Miyazaki, H. 1977. The rat race and internal labor markets. The Bell Journal of Economics, 394–418.

Mohan, N., and T. Zhang. 2014. An analysis of risk-taking behavior for public defined benefit pension plans. Journal of Banking & Finance 40: 403–419.

Morrissey, M. 2016. The state of American retirement: How 401(k)s have failed most American workers. Washington: Economic Policy Institute. Tech. rep.

Murtaugh, C.M., B.C. Spillman, M.J. Warshawsky. 2001. I sickness and in health: An annuity approach to financing long-term care and retirement income. Journal of Risk and Insurance, 225–253.

OECD. 2017. OECD Pension Markets in Focus. Paris: OECD.

Pauly, M.V. 1990. The rational nonpurchase of long-term-care insurance. Journal of Political Economy, 153–168.

Pestieau, P., and G. Ponthière. 2012. Long-term care insurance Puzzle. In Financing long-term care in Europe (pp. 41–52). London: Palgrave Macmillan.

Peter, R., A. Richter, and P. Steinorth. 2016. Yes, no, perhaps? Premium risk and guaranteed renewable insurance contracts with heterogeneous incomplete private information. Journal of Risk and Insurance 83: 363–385.

Peter, R., A. Richter, and P. Thistle. 2017. Endogenous information, adverse selection, and prevention: Implications for genetic testing policy. Journal of Health Economics 55: 95–107.

Picard, P. 2019. Splitting risks in insurance markets with adverse selection. Journal of Risk and Insurance. forthcoming.

Porell, F., and B. Almeida. 2009. The pension factor: Assessing the role of defined benefit plans in reducing elder hardships. Tech. rep., National Institute on Retirement Security

Rochet, J.-C., and P. Choné. 1996. Ironing, sweeping, and multidimensional screening. Econometrica 66: 783–826.

Rothschild, C. 2015. Nonexclusivity, linear pricing, and annuity market screening. Journal of Risk and Insurance 82: 1–32.

Rothschild, M., and J. Stiglitz. 1976. Equilibrium in competitive insurance markets: An essay on the economics of imperfect information. In Foundations of insurance economics, ed. G. Dionne, 355–375. New York: Springer.

Sandroni, A., and F. Squintani. 2007. Overconfidence, insurance, and paternalism. American Economic Review 97: 1994–2004.

Sandroni, A., and F. Squintani. 2013. Overconfidence and asymmetric information: The case of insurance. Journal of Economic Behavior & Organization 93: 149–165.

Sloan, F.A., and E.C. Norton. 1997. Adverse Selection, Bequests, Crowding Out, and Private Demand for Insurance: Evidence from the Long-term Care Insurance Market. Journal of Risk and Uncertainty 15: 201–219.

Snow, A. 2009. On the possibility of profitable self-selection contracts in competitive insurance markets. Journal of Risk and Insurance 76: 249–259.

Spence, M. 1978. Product differentiation and performance in insurance markets. Journal of Public Economics 10: 427–447.

Steinorth, P. 2012. The demand for enhanced annuities. Journal of Public Economics 96: 973–980.

Tennyson, S., and H.K. Yang. 2014. The role of life experience in long-term care insurance decisions. Journal of Economic Psychology 42: 175–188.

Tumlinson, A., C. Aguiar, and M. O’Malley Watts. 2009. Closing the long-term care funding gap: the challenge of private long-term care insurance. Tech. rep., Kaiser Commission on Medicaid and the Uninsured

Villeneuve, B. 2003. Mandatory pensions and the intensity of adverse selection in life insurance markets. Journal of Risk and Insurance 70: 527–548.

Warshawsky, M.J. 2007. The life care annuity: A proposal for an insurance product innovation to simultaneously improve financing and benefit provision for long-term care and to insure the risk of outliving assets in retirement. Tech. rep., Georgetown University Long-Term Care Financing Project Working Paper.

Webb, D.C. 2009. Asymmetric Information, Long-Term Care Insurance, and Annuities: The Case for Bundled Contracts. Journal of Risk and Insurance 76: 53–85.

Webb, A. and Zhivan, N. 2010. What is the Distribution of Lifetime Health Care Costs from Age 65? Tech. Rep. 10-4, Center for Retirement Research at Boston College.

Wilson, C. 1977. A model of insurance markets with incomplete information. Journal of Economic theory 16: 167–207.

Yaari, M.E. 1965. Uncertain lifetime, life insurance, and the theory of the consumer. The Review of Economic Studies 32: 137–150.

Zhou-Richter, T., M.J. Browne, and H. Gründl. 2010. Don’t they care? or, are they just unaware? Risk perception and the demand for long-term care insurance. Journal of Risk and Insurance 77: 715–747.

Zick, C.D., C.J. Mathews, J.S. Roberts, R. Cook-Deegan, R.J. Pokorski, and R.C. Green. 2005. Genetic testing for Alzheimer’s disease and its impact on insurance purchasing behavior. Health Affairs 24: 483–490.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper was written while the first author was a visiting scholar at the College of Human Ecology at Cornell University, and the second was finishing her doctoral studies at the House of Finance, Goethe Universität Frankfurt. We are indebted to Sharon Tennyson for discussions on a-many related topic, and for very insightful comments by the Journal’s editor, Michael Hoy, and the Journal’s referees. We both gratefully acknowledge the continuing financial support of the Direction de la recherche at HEC Montréal and Boyer acknowledges the financial support of the Social Science and Humanities Research Council of Canada (435-2016-1109). We would also like to thank seminar and conference participants at Université Laval, Universität St-Gallen, St. John’s University, the Société canadienne de science économique, the Southern Finance Association, the Southern Risk and Insurance Association, and the American Risk and Insurance Association.

Appendix: Proofs

Appendix: Proofs

1.1 Proof of Proposition 2

For each agent \(i\in \{L,H\}\), the second stage problem is

The first-order conditions, one for each risk type, can be written as:

so that

Subtracting (31) from (30) and rearranging the terms, we find

Since \(p_H > p_L\), it follows that \(d_L^{DB-sym} > d_H^{DB-sym}\).

We thank the editor, Michael Hoy, for proposing a simpler proof of this Proposition. \(\square\)

1.2 Proof of Proposition 3

The first two parts of the proof are a simple restatement of Proposition 1: 1- Once agents have signaled their type on the annuity market, no residual adverse selection is left so that perfect consumption smoothing in the final period becomes possible for all agents (i.e., \(d_L^{DC}=d_H^{DC}=1\)); 2- High-risk agents do not need to signal their type and thus receive the contract allocation they would have received under symmetric information (i.e., \(A_H=A_H^{sym}\)). For the third case, let us use the incentive compatibility constraint of (22) in which we let \(d_L^{DC}=d_H^{DC}=1\) and \(A_H=A_H^{sym}\), and find that the incentive compatibility constraint holds if and only if

Suppose \(A_L=A_H^{sym}\) (i.e., the low-risk agent receives the annuity contract of the high riskFootnote 35 agent), then the above equation simplifies to \(U ( W_1- p_H A_H^{sym} -p_H \pi \lambda ) \ge U( W_1- p_L A_H^{sym} - p_L \pi \lambda )\), which cannot be true unless \(p_L=p_H\). It therefore follows that

This inequality holds only if \(A_L<A_H^{sym}<A_L^{sym}\). \(\square\)

1.3 Proof of Proposition 4

In a DB scheme, agents choose their LTC insurance in the second stage of the initial period after they have already chosen their pension benefit (\(B^*,\beta ^*\)). This means that agents are maximizing only with respect to the LTC insurance coverage. The problem in its Langrangian form is:

The first-order conditions are

To first show that \(d_H^{DB}<1\), consider the \((\frac{\partial \Omega _L}{\partial d_H})\) constraint from (27), and suppose that the second stage solution yields \(d_H^{DB}=1\). It would then follow that

which would be a solution provided that

Retirement amount \(\widehat{B}\) assumes, however, that agents already know their risk type since the premium paid by high-risk agents is included in the calculation of \(\widehat{B}\). That cannot be the case since agents do not know their type at the time the DB contract is purchased. It must therefore be that \(B^*>\widehat{B}\). Because there is a negative relationship between the choice of annuities and the choice of the LTC indemnity, knowing that \(B^*>\widehat{B}\) means that \(d_H^{DB}<1\).

Lastly, given the presence of information asymmetry, low-risk agents, who cannot signal their type on the annuity market under a DB scheme, must signal their type on the LTC insurance market by accepting a contract that is less generous than what is offered to high-risk agents. We therefore have that \(d_L^{DB}<d_H^{DB}<1\). \(\square\)

Rights and permissions

About this article

Cite this article

Boyer, M.M., Glenzer, F. Pensions, annuities, and long-term care insurance: on the impact of risk screening. Geneva Risk Insur Rev 46, 133–174 (2021). https://doi.org/10.1057/s10713-020-00058-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s10713-020-00058-9