Abstract

Drop-shipping is an arrangement whereby an e-tailer, who does not hold inventories, processes orders and requests a manufacturer to ship products directly to the end customers. To explore the economic benefits of adopting drop-shipping distribution strategy in a competitive environment, we investigate the profitability and the efficiency of the drop-shipping channel as compared to the traditional channel. Specifically, we develop Economic Order Quantity (EOQ) games with pricing and lot-sizing decisions to examine the strategic interactions between a manufacturer and its retailer/e-tailer in the traditional/drop-shipping distribution channels. We identify conditions under which the drop-shipping channel profitably outperforms the traditional one. It is found that the economic interests of adopting drop-shipping distribution for the channel members may not always be consistent. There are cases where only the manufacture would favour drop-shipping. In this study, we also reveal that the inefficiency caused by lack of coordination in the traditional channel can be alleviated in the drop-shipping channel where the lot-sizing decision is made by the manufacturer.

Similar content being viewed by others

References

Abad PL (1988). Determining optimal selling price and lot size when the supplier offers all-unit quantity discounts. Decision Sci 19(3): 622–634.

Ayanso A, Diaby M and Nair KS (2006). Inventory rationing via drop-shipping in Internet retailing: A sensitivity analysis. Eur J Opl Res 171: 135–152.

Chiang WK, Chhajed D and Hess JD (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Mngt Sci 49(1): 1–20.

Deng S and Yano CA (2006). Joint production and pricing decisions with setup costs and capacity constraints. Mngt Sci 52(5): 741–756.

Eliashberg J and Steinberg R (1987). Marketing-production decisions in an industrial channel of distribution. Mngt Sci 33: 981–1000.

eRetailing World (2000). The state of eRetailing (Supplement, March).

Fuscaldo D (2003). E-commerce: B-to-B—Looking big: How can online retailers carry so many products? The secret is ‘drop-shipping’. Wall Street Journal (Apr): R7.

Gilbert SM (2000). Coordination of pricing and multiple-period production across multiple constant priced goods. Mngt Sci 46(12): 1602–1616.

Khouja M (2001). The evaluation of drop shipping option for e-commerce retailers. Comput Ind Eng 41: 109–126.

Kim D and Lee WJ (1998). Optimal joint pricing and lot sizing with fixed and variable capacity. Eur J Opl Res 109(1): 212–227.

Kunreuther H and Richard JF (1971). Optimal pricing and inventory decisions for non-seasonal items. Econometrica 39(1): 173–175.

Kunreuther H and Schrage L (1973). Joint pricing and inventory decisions for constant priced items. Mngt Sci 19(7): 732–738.

Lal R and Staelin R (1984). An approach for developing an optimal discount pricing policy. Mngt Sci 30: 1524–1539.

Lee WJ (1993). Determining order quantity and selling price by geometric programming: Optimal solution, bounds, and sensitivity. Decision Sci 24(1): 76–87.

Li SX, Huang ZM and Ashley A (1996). Improving buyer-seller system cooperation through inventory control. Int J Prod Econ 43: 37–46.

Monahan JP (1984). A quantity discount pricing model to increase vendor profits. Mngt Sci 30: 720–726.

Netessine S and Rudi N (2006). Supply chain choice on the internet. Mngt Sci 52(6): 844–864.

Pan X, Ratchford BT and Shankar V (2002). Price competition between pure play versus bricks-and-clicks e-tailers: Analytical model and empirical analysis. In: Baye MR (ed). Advances in Applied Microeconomics, Vol. 11, Emerald Group Publishing Limited, pp 29–61.

Pekelman D (1974). Simultaneous price-production decisions. Oper Res 22: 788–794.

Thomas J (1970). Price-production decisions with deterministic demand. Mngt Sci 16(11): 747–750.

Van den Heuvel W and Wagelmans APM (2006). A polynomial time algorithm for a deterministic joint pricing and inventory model. Eur J Opl Res 170(11): 463–480.

Whitin TM (1955). Inventory control and price theory. Mngt Sci 2(1): 61–68.

Zhao H and Cao Y (2004). The role of e-tailer inventory policy on e-tailer pricing and profitability. J Retailing 80(3): 207–219.

Zhao W and Wang Y (2002). Coordination of joint pricing-production decisions in a supply chain. IIE Transactions 34: 701–715.

Acknowledgements

The authors thank the anonymous referees for their valuable comments and constructive suggestions.

Author information

Authors and Affiliations

Appendices

Appendix A. The centralized traditional channel

The profit function of the centralized traditional channel is given by

The first-order condition with respect to p, Q are:

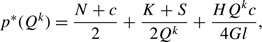

Then we have the following relationship between the retail price and the ordering quantity:

The optimal solutions of p, Q are inter-related. Then we have:

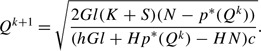

The profit function Π 1(Q) is a convex-concave function of Q. A line-search algorithm specified below can be applied to find the optimal solution for the problem:

- Step 1::

-

Let k=0 and Q 0=∞.

- Step 2::

-

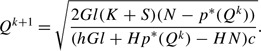

Compute

- Step 3::

-

Compute

- Step 4::

-

If |Q k+1−Q k|<ε, stop. Otherwise let k=k+1 and go to Step 2.

Appendix B. The centralized drop-shipping channel

The profit function of the centralized drop-shipping channel is given by

The first-order condition with respect to p, Q are:

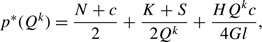

Similar to the previous analysis, we have the following relationship between the retail price and the production plan:

Then we get:

It can be verified that this objective function is also a convex-concave function. A similar line-search algorithm in Appendix A can be applied to find the optimal solution.

Rights and permissions

About this article

Cite this article

Chiang, W., Feng, Y. Retailer or e-tailer? Strategic pricing and economic-lot-size decisions in a competitive supply chain with drop-shipping. J Oper Res Soc 61, 1645–1653 (2010). https://doi.org/10.1057/jors.2009.139

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jors.2009.139