Abstract

We specify all utility functions on wealth implied by four special conditions on preferences between risky prospects in four theories of utility, under the presumption that preference increases in wealth. The theories are von Neumann-Morgenstern expected utility (EU), rank dependent utility (RDU), weighted linear utility (WLU), and skew-symmetric bilinear utility (SSBU). The special conditions are a weak version of risk neutrality, Pfanzagl's consistency axiom, Bell's one-switch condition, and a contextual uncertainty condition. Previous research has identified the functional forms for utility of wealth for all four conditions under EU, and for risk neutrality and Pfanzagl's consistency axiom under WLU and SSBU. The functional forms for the other condition-theory combinations are derived in this paper.

Similar content being viewed by others

References

Aczel, J. (1966). Lectures on Functional Equations and Their Applications. New York: Academic Press.

Allais, M. (1953). “Fondements d'une theorie positive des choix comportant un risque et critique des postulats et axiomes de l'ecole americaine,” Colloques Internationaux du Centre National de la Recherche Scientifique. XL. Econometrie, 257-332.

Allais, M. (1979). “The So-Called Allais Paradox and Rational Decisions under Uncertainty.” In M. Allais and O. Hagen eds., Expected Utility Hypotheses and the Allais Paradox, pp. 437-681. Dordrecht: Reidel.

Bell, D. E. (1988). “On-Switch Utility Functions and a Measure of Risk,” Management Science 34, 1416-1424.

Bell, D. E. (1995a). “Risk, Return, and Utility,” Management Science 41, 23-30.

Bell, D. E. (1995b). “A Contextual Uncertainty Condition for Behavior under Risk,” Management Science 41, 1145-1150.

Bernoulli, D. (1738). “Specimen Theoriae Novae de Mensura Sortis,” Commentarii Academiae Scien-tiarum Imperialis Petropolitanae 5, 175-192. Translated by L. Sommer 1954. “Exposition of a New Theory on the Measurement of Risk,” Econometrica 22, 23-36.

Chew, S. H. (1982). “A Mixture Set Axiomatization of Weighted Utility Theory.” Disc. paper 82-4, College of Business and Public Administration, University of Arizona, Tucson.

Chew, S. H., and K. R. MacCrimmon. (1979). “Alpha-nu Choice Theory: a Generalization of Expected Utility Theory.” Working Paper 669, Faculty of Commerce and Business Administration, University of British Columbia, Vancouver.

Ellsberg, D. (1954). “Classic and Current Notions of ‘Measurable Utility’,” Economic Journal 64, 528-556.

Farquhar, P. H., and Y. Nakamura. (1987). “Constant Exchange Risk Properties,” Operations Research 35, 206-214.

Farquhar, P. H., and Y. Nakamura. (1988). “Utility Assessment Procedures for Polynomial-Exponential Functions,” Naval Research Logistics 35, 597-613.

Fishburn, P. C. (1970). Utility Theory for Decision Making. New York: Wiley.

Fishburn, P. C. (1982). “Nontransitive Measurable Utility,” Journal of Mathematical Psychology 26, 31-67.

Fishburn, P. C. (1983). “Transitive Measurable Utility,” Journal of Economic Theory 31, 293-317.

Fishburn, P. C. (1984). “SSB Utility Theory: An Economic Perspective,” Mathematical Social Sciences 8, 63-94.

Fishburn, P. C. (1988). Nonlinear Preference and Utility Theory. Baltimore: The Johns Hopkins University Press.

Fishburn, P. C. (1989). “Retrospective on the Utility Theory of von Neumann and Morgenstern,” Journal of Risk and Uncertainty 2, 127-158.

Fishburn, P. C. (1998). “Utility of Wealth in Nonlinear Utility Theory.” In C. Dowling, F. Roberts, and P. Theuns eds., Progress in Mathematical Psychology. Mahwah, NJ: Erlbaum.

Friedman, M., and L. J. Savage. (1948). “The Utility Analysis of Choices Involving Risk,” Journal of Political Economy 56, 279-304.

Hagen, O. (1972). “A New Axiomatization of Utility under Risk,” Teorie A. Metoda 4, 55-80.

Hagen, O. (1979). “Towards a Positive Theory of Preferences under Risk.” In M. Allais and O. Hagen eds., Expected Utility Hypotheses and the Allais Paradox, pp. 271-302. Dordrecht: Reidel.

Harvey, C. M. (1981). “Conditions on Risk Attitude for a Single Variable,” Management Science 27, 190-203.

Harvey, C. M. (1990). “Structured Prescriptive Models of Risk Attitudes,” Management Science 36, 1479-1501.

Herstein, I. N., and J. Milnor. (1953). “An Axiomatic Approach to Measurable Utility,” Econometrica 21, 291-297.

Jensen, N. E. (1967). “An Introduction to Bernoullian Utility Theory. I. Utility Functions,” Swedish Journal of Economics 69, 163-183.

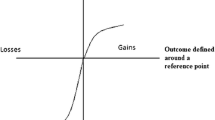

Kahneman, D., and A. Tversky. (1979). “Prospect Theory: An Analysis of Decision under Risk,” Econometrica 47, 263-291.

MacCrimmon, K. R., and S. Larsson. (1979). “Utility Theory: Axioms versus ‘Paradoxes’.” In M. Allais and O. Hagen eds., Expected Utility Hypotheses and the Allais Paradox, pp. 333-409. Dordrecht: Reidel.

Nakamura, Y. (1984). “Nonlinear Measurable Utility Analysis.” Ph.D. Dissertation, University of California, Davis.

Nakamura, Y. (1996). “Sumex Utility Functions,” Mathematical Social Sciences 31, 39-47.

Pfanzagl, J. (1959). “A General Theory of Measureent: Applications to Utility,” Naval Research Logistics Quarterly 6, 283-294.

Phillips, H. B. (1951). Differential Equations, 3rd edition revised. New York: Wiley.

Prelec, D. (1998). “The Probability Weighting Function,” Econometrica 66, 497-527.

Quiggin, J. (1982). “A Theory of Anticipated Utility,” Journal of Economic Behavior and Organization 3, 323-343.

Quiggin, J. (1993). Generalized Expected Utility Theory: The Rank-Dependent Model. Dordrecht: Kluwer.

Quiggin, J., and P. Wakker. (1994). “The Axiomatic Basis of Anticipated Utility Theory: A Clarification,” Journal of Economic Theory 64, 486-499.

Rothblum, U. G. (1975). “Multivariate Constant Risk Posture,” Journal of Economic Theory 10, 309-332.

Savage, L. J. (1954). The Foundations of Statistics. New York: Wiley.

Segal, U. (1989). “Anticipated Utility: A Measure Representation Approach,” Annals of Operations Research 19, 359-373.

Segal, U. (1993). “The Measure Representation: A Correction,” Journal of Risk and Uncertainty 6, 99-107.

Taylor, A. E. (1955). Advanced Calculus. Boston: Ginn.

von Neumann, J., and O. Morgenstern. (1944). Theory of Games and Economic Behavior. Princeton, NJ: Princeton University Press.

Wu, G., and R. Gonzalez. (1996). “Curvature of the Probability Weighting Function,” Management Science 42, 1676-1690.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Bell, D.E., Fishburn, P.C. Utility Functions for Wealth. Journal of Risk and Uncertainty 20, 5–44 (2000). https://doi.org/10.1023/A:1007822718954

Issue Date:

DOI: https://doi.org/10.1023/A:1007822718954