Abstract

This paper presents a new decision theory for modelling choice under risk. The new theory is a two-parameter generalization of expected utility theory. The proposed theory assumes that a decision maker: (1) behaves as if maximizing expected utility; but (2) may experience disappointment (elation) when the utility of a lottery’s outcome falls short of (exceeds) the expected utility of the lottery; and (3) may have a preference for gambling (attraction/aversion to positively/negatively skewed lotteries). The proposed theory can rationalize the fourfold pattern of risk attitudes; the common ratio effect and the reverse thereof (in certain types of decision problems); the Allais paradox in classical common consequence problems and the reverse Allais paradox—in common consequence problems with an even split of a probability mass; violations of the betweenness axiom; switching behavior in the Samuelson’s example; violations of ordinal, upper and lower cumulative independence (which falsify rank-dependent utility and cumulative prospect theory); and preference reversals between valuations and choice. In application to insurance, the theory can rationalize full insurance with an actuarially unfair premium and aversion to probabilistic insurance. In application to optimal portfolio investment, the theory can rationalize the equity premium puzzle.

Similar content being viewed by others

Notes

I.e. risk aversion for probable gains or improbable losses and risk seeking for improbable gains or probable losses.

A simultaneous combination of quasi-concave and quasi-convex preferences (Bernasconi 1994).

In other words, cumulative probability \(1-0.01x\) is uniformly distributed over interval [x, 100].

Markowitz (1952, p. 90) noted that the third moment “may be connected with a propensity to gamble”.

This cubic probability weighting function \(w( p )=p-\rho \cdot p( {1-p} )+\tau \cdot p( {1-p} )( {1-2p} )\) is analyzed in Blavatskyy (2016).

Many studies find that decision making under risk is a probabilistic rather than a deterministic process. For example, Camerer (1989, p. 81), Hey and Orme (1994, p. 1296) as well as Ballinger and Wilcox (1997, p. 1100) found that 31.6, 25 and 20.8% of subjects respectively reverse their choice when presented with the same decision problem within a short period of time.

The rule of thumb is the following: (1) choose a lottery with the lowest probability of the worst possible outcome; (2) if both lotteries yield the same probability of the worst possible outcome then choose the lottery with the highest probability of the best possible outcome.

E.g. when comparing expected utility theory and the maximization of expected value.

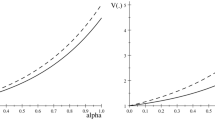

If two or more theories are not significantly different in terms of goodness of fit, then only a theory with fewer subjective parameters is shown on Fig. 5.

References

Allais, Maurice. (1953). Le Comportement de l’Homme Rationnel devant le Risque: Critique des Postulates et Axiomes de l’Ecole Américaine. Econometrica, 21, 503–546.

Astebro, T., Mata, J., & Santos-Pinto, L. (2015). Skewness seeking: Risk loving, optimism or overweighting of small probabilities? Theory and Decision, 78, 189–208.

Ballinger, Parker, & Wilcox, Nathaniel. (1997). Decisions, error and heterogeneity. Economic Journal, 107, 1090–1105.

Becker, Gordon M., DeGroot, Morris H., & Marschak, Jacob. (1964). Measuring utility by a single-response sequential method. Behavioral Science, 9, 226–232.

Bell, David. (1985). Disappointment in decision making under uncertainty. Operations Research, 33, 1–27.

Bernasconi, Michele. (1994). Nonlinear preference and two-stage lotteries: Theories and evidence. Economic Journal, 104, 54–70.

Bernoulli, D. (1738). Specimen theoriae novae de mensura sortis. Commentarii Academiae Scientiarum Imperialis Petropolitanae. [Translated in Bernoulli, D. (1954). Exposition of a new theory on the measurement of risk. Econometrica, 22, 23–36].

Birnbaum, Michael. (2004). Tests of rank-dependent utility and cumulative prospect theory in gambles represented by natural frequencies: Effects of format, event framing, and branch splitting. Organizational Behavior and Human Decision Processes, 95, 40–65.

Birnbaum, Michael. (2005). Three new tests of independence that differentiate models of risky decision making. Management Science, 51(9), 1346–1358.

Birnbaum, Michael, & Gutierrez, R. (2007). Testing for intransitivity of preferences predicted by a lexicographic semi-order. Organizational Behavior and Human Decision Processes, 104, 96–112.

Birnbaum, Michael, & Navarrete, Juan. (1998). Testing descriptive utility theories: Violations of stochastic dominance and cumulative independence. Journal of Risk Uncertainty, 17, 49–78.

Birnbaum, Michael, Patton, Jamie, & Lott, Melissa. (1999). Evidence against rank-dependent utility theories: Violations of cumulative independence, interval independence, stochastic, dominance, and transitivity. Organizational Behavior and Human Decision Processes, 77, 44–83.

Birnbaum, Michael, & Schmidt, Ulrich. (2010). Testing transitivity in choice under risk. Theory and Decision, 69, 599–614.

Blavatskyy, Pavlo. (2010a). Reverse common ratio effect. Journal of Risk and Uncertainty, 40, 219–241.

Blavatskyy, Pavlo. (2010b). Modifying the mean-variance approach to avoid violations of stochastic dominance. Management Science, 56(11), 2050–2057.

Blavatskyy, Pavlo. (2013a). Which decision theory? Economics Letters, 120(1), 40–44.

Blavatskyy, Pavlo. (2013b). Reverse Allais paradox. Economics Letters, 119(1), 60–64.

Blavatskyy, Pavlo. (2014). Stronger utility. Theory and Decision, 76(2), 265–286.

Blavatskyy, Pavlo. (2016). Probability weighting and L-moments. European Journal of Operational Research, 255(1), 103–109.

Blavatskyy, P., & Pogrebna, G. (2010). Models of stochastic choice and decision theories: Why both are important for analyzing decisions. Journal of Applied Econometrics, 25(6), 963–986.

Borch, K. (1969). A note on uncertainty and indifference curves. The Review of Economic Studies, 36(1), 1–4.

Camerer, Colin. (1989). An experimental test of several generalized utility theories. Journal of Risk and Uncertainty, 2, 61–104.

Camerer, Colin, & Ho, T. (1994). Violations of the betweenness axiom and nonlinearity in probability. Journal of Risk and Uncertainty, 8, 167–196.

Carbone, Enrica, & Hey, John. (1995). A comparison of the estimates of EU and non-EU preference functionals using data from pairwise choice and complete ranking experiments. Geneva Papers on Risk and Insurance Theory, 20, 111–133.

Cerreia-Vioglio, S., Dillenberger, D., & Ortoleva, P. (2015). Cautious expected utility and the certainty effect. Econometrica, 83(2), 693–728.

Chew, S. (1983). A generalization of the quasilinear mean with applications to the measurement of income inequality and decision theory resolving the Allais paradox. Econometrica, 51, 1065–1092.

Chew, S., Epstein, L., & Segal, U. (1991). Mixture symmetry and quadratic utility. Econometrica, 59, 139–163.

Cillo, A., & Delquié, P. (2014). Mean-risk analysis with enhanced behavioral content. European Journal of Operational Research, 239(3), 764–775.

Conlisk, John. (1989). Three variants on the Allais example. American Economic Review, 79(3), 392–407.

Conlisk, John. (1993). The utility of gambling. Journal of Risk and Uncertainty, 6, 255–275.

Day, Brett, & Loomes, Graham. (2010). Conflicting violations of transitivity and where they may lead us. Theory and Decision, 68, 233–242.

Debreu, G. (1954). Decision processes. In R. M. Thrall, C. H. Coombs, & R. L. Davis (Eds.), Representation of a preference ordering by a numerical function (pp. 159–165). New York: Wiley.

Delquié, Philippe, & Cillo, Alessandra. (2006). Disappointment without prior expectation: A unifying perspective on decision under risk. Journal of Risk and Uncertainty, 33, 197–215.

Ebert, S. (2015). On skewed risks in economic models and experiments. Journal of Economics Behavior and Organization, 112, 85–97.

Ebert, S., & Wiesen, D. (2011). Testing for prudence and skewness seeking. Management Science, 57(7), 1334–1349.

Friedman, M., & Savage, L. (1948). The utility analysis of choices involving risk. Journal of Political Economy, 56, 279–304.

Gini, Corrado. (1912). Variabilità e Mutabilità, contributo allo studio delle distribuzioni e delle relazione statistiche. Studi economici-giuridici dela Regia Università di Cagliari, 3, 3–159.

Grether, David, & Plott, Charles. (1979). Economic theory of choice and the preference reversal phenomenon. American Economic Review, 69(4), 623–638.

Gul, Faruk. (1991). A theory of disappointment aversion. Econometrica, 59, 667–686.

Harless, D., & Camerer, C. (1994). The predictive utility of generalized expected utility theories. Econometrica, 62, 1251–1289.

Hey, John. (2001). Does repetition improve consistency? Experimental Economics, 4, 5–54.

Hey, John, & Orme, Chris. (1994). Investigating generalisations of expected utility theory using experimental data. Econometrica, 62, 1291–1326.

Hosking, J. R. M. (1990). L-moments: Analysis and estimation of distributions using linear combinations of order statistics. Journal of the Royal Statistical Society, Series B, 52, 105–124.

Humphrey, Steven, & Verschoor, Arjan. (2004). The probability weighting function: Experimental evidence from Uganda, India and Ethiopia. Economics Letters, 84, 419–425.

Huygens, Christiaan. (1657). Exercitationum mathematicarum. In Frans van Schooten (Ed.), De Ratiociniis in Ludo Aleae. Leiden: Elzevir.

Jia, Jianmin, Dyer, James S., & Butler, John C. (2001). Generalized disappointment models. Journal of Risk and Uncertainty, 22(1), 59–78.

Jouini, E., Karehnke, P., & Napp, C. (2014). On portfolio choice with savoring and disappointment. Management Science, 60(3), 796–804.

Kahneman, Daniel, & Tversky, Amos. (1979). Prospect theory: An analysis of decision under risk. Econometrica, XLVII, 263–291.

Karni, Edi, & Safra, Zvi. (1987). “Preference reversal” and the observability of preferences by experimental methods. Econometrica, 55(3), 675–685.

Loomes, Graham, Starmer, Chris, & Sugden, Robert. (1989). Preference reversal: Information-processing effect or rational non-transitive choice? Economic Journal, 99, 140–151.

Loomes, Graham, & Sugden, Robert. (1982). Regret theory: An alternative theory of rational choice under uncertainty. Economic Journal, 92, 805–824.

Loomes, Graham, & Sugden, Robert. (1986). Disappointment and dynamic consistency in choice under uncertainty. Review of Economic Studies, 53, 271–282.

Loomes, Graham, & Sugden, Robert. (1998). Testing different stochastic specifications of risky choice. Economica, 65, 581–598.

Loomes, Graham, & Sugden, Robert. (1991). Observing violations of transitivity by experimental methods. Econometrica, 59, 425–440.

Loomes, Graham, Moffatt, Peter, & Sugden, Robert. (2002). A microeconomic test of alternative stochastic theories of risky choice. Journal of Risk and Uncertainty, 24, 103–130.

Markowitz, Harry M. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Masatlioglu, Y., & Raymond, C. (2016). A behavioral analysis of stochastic reference dependence. The American Economic Review, 106(9), 2760–2782.

Mehra, R., & Prescott, E. (1985). The equity premium: A puzzle. Journal of Monetary Economics, 15(2), 341–350.

Prelec, D. (1990). A ‘pseudo-endowment’ effect, and its implications for some recent nonexpected utility models. Journal of Risk and Uncertainty, 3, 247–259.

Quiggin, John. (1981). Risk perception and risk aversion among Australian farmers. Australian Journal of Agricultural Recourse Economics, 25, 160–169.

Rubinstein, Ariel. (1988). Similarity and decision making under risk: Is there a utility theory resolution to the Allais paradox? Journal of Economic Theory, 46, 145–153.

Samuelson, Paul. (1963). Risk and uncertainty: A fallacy of large numbers. Scientia, 98, 108–113.

Sopher, Barry, & Gigliotti, Gary. (1993). Intransitive cycles: Rational choice or random errors? An answer based on estimation of error rates with experimental data. Theory and Decision, 35, 311–336.

Starmer, Chris. (1992). Testing new theories of choice under uncertainty using the common consequence effect. Review of Economic Studies, 59, 813–830.

Starmer, Chris. (2000). Developments in non-expected utility theory: The hunt for a descriptive theory of choice under risk. Journal of Economic Literature, 38, 332–382.

Starmer, Chris, & Sugden, Robert. (1991). Does the random-lottery incentive system elicit true preferences? An experimental investigation. American Economic Review, 81, 971–978.

Starmer, Chris, & Sugden, Robert. (1998). Testing alternative explanations of cyclical choices. Economica, 65, 347–361.

Tversky, Amos. (1969). Intransitivity of preferences. Psychological Review, 76, 31–48.

Tversky, Amos, & Kahneman, Daniel. (1986). Rational choice and the framing of decisions. Journal of Business, 59(4), 251–278.

Tversky, Amos, & Kahneman, Daniel. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Viscusi, Kip. (1989). Prospective reference theory: Toward an explanation of the paradoxes. Journal of Risk and Uncertainty, 2, 235–264.

von Neumann, John, & Morgenstern, Oscar. (1947). Theory of games and economic behavior (2nd ed.). Princeton: Princeton University Press.

Vuong, Quang. (1989). Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica, 57, 307–333.

Wu, George. (1994). An empirical test of ordinal independence. Journal of Risk and Uncertainty, 9, 39–60.

Yaari, Menahem. (1987). The dual theory of choice under risk. Econometrica, 55, 95–115.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Blavatskyy, P. A second-generation disappointment aversion theory of decision making under risk. Theory Decis 84, 29–60 (2018). https://doi.org/10.1007/s11238-017-9629-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-017-9629-5