Abstract

In recent years, with the increasing attention paid to climate risks, the changes in climate policies are also more full of uncertainties, which have brought tremendous impact to economic entities, including companies. Using the dynamic threshold model, this study investigates the nonlinear and the asymmetric effect of climate policy uncertainty on Chinese firm investment decisions with panel data of 128 Chinese energy-related companies from 2007 to 2019. The empirical findings indicate that the influence of climate policy uncertainty on firm investment is significantly nonlinear. Overall, climate policy uncertainty is not apparently related to corporate investments in the high-level range, while it negatively affects the investments in the low-level range. In addition, to be more specific, the negative impact of climate policy uncertainty on the mining industry is tremendous, while the influence on the production and supply of electricity, heat, gas, and water sector is remarkably positive. The results of this study could help the company managers and policymakers to arrange appropriate related strategies under different climate policy conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Corporate investment is a fundamental and vital part of business activities for companies, which affects the company’s input, product diversity, and business strategy. There is no denying that proper investment decisions are crucial to ensure sound commercial logic and sustainable growth in a company [1, 2]. However, corporate investment is so vulnerable to various factors. Research has indicated that outside factors, including oil price, economic policy, climate conditions, and inflation, become increasingly crucial to companies’ investment decisions [3,4,5,6]. Climate policy aims to deal with the worsening climate conditions, but due to the constraints of practical needs, their implementation is very uncertain [7]. The economic activities of the companies will inevitably be impacted, especially in the energy industry, which is closely related to climate change or environmental protection [8]. As a result, it is crucial to explain the energy-related company’s investment with climate policy uncertainty. In this paper, we study the relationship between investment in energy companies and climate policy uncertainty in the context of China, filling some gaps for this topic.

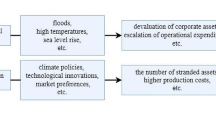

In the process of China’s industrialization, with the rapid development of the economy, the environmental conditions of China have been destroyed, and it has become one of the largest carbon emitters around the world [9, 10]. In order to mitigate the resulting climate risks, China has also adopted a number of climate improvement policies. Among them, the construction of low-carbon cities is one of the most representative climate policies [11, 12]. Studies have shown that low-carbon cities do help companies to improve their carbon emissions [13]. However, as we all know, enterprises are still market participants whose main objective is to maximize benefits. The pressure of environmental improvement brought by climate policy may also affect the financial performance of the companies. The energy industry bears the brunt. On the one hand, as the current climate policy of low-carbon transition is increasingly strengthened, their original assets may face the risk of grounding, which directly results in their financial losses [14, 15]. On the other hand, the pressure of low carbon transformation leads to the change of social capital flow, which brings higher financing costs for these companies [13]. It would also bring about more technology research and development costs for energy industries [8].

The company’s investment activities have always been the focus of attention of all stakeholders, and uncertainty from plenty of aspects can cause substantial interference to corporate investment. For example, the price of crude oil and other commodity fluctuations [16], the economic policy uncertainty [17]. In terms of other macroeconomic indicators, previous research has also shown a close linkage between changes in the macro market and company investment [18]. Some articles also examined the correlation between uncertainty and company-level or industry-level indicators, such as the uncertainty of product prices, industry uncertainty [19, 20], market uncertainty [21, 22] and the cash flow uncertainty [23, 24]. However, these researches are mainly focused on the connection between the commodity markets, stock and bond markets, and so on [25, 26].

Research on the relationship between the financial performance of companies and climate risk has gradually taken off. The seriousness of climate risks will make investors pay more attention to the environmental performance of enterprises, and climate news risk would be reflected in corporate bond yields [27]. Good corporate governance can improve the company’s awareness of climate risk or carbon risk, which can lead to improved carbon performance [28]. It is worth noting that there is strong evidence that the impact of carbon risk on corporate investment is negative and statistically significant [29]. Studies have shown that carbon price shocks caused by climate risks can significantly affect corporate investment. Climate policies, such as carbon taxes, have a significant impact on corporate environmental spending and investment [30, 31].

Of course, various climate policies have also promoted the rise of “green investment” by companies, the most obvious being the prosperity of green bonds [32]. However, the impact of the climate policy uncertainty on company investment has not received enough attention. Furthermore, little literature focused on the effects of climate policy uncertainty on firm investment of Chinese companies considering the asymmetric effect, especially in the energy industry.

This paper combines the dynamic threshold model to examine the linkage between climate policy uncertainty and corporate investment. The threshold model refers to a model that considers asymmetric effects in the process of empirical analysis. This paper focuses on the energy industry and discusses the effect of climate policy uncertainty on firm investment of Chinese listed companies under different climate policy conditions.

Overall, this paper has these contributions: Firstly, this paper is the first to investigate the effect of climate policy uncertainty on energy-related firms’ investment in China. Gavriilidis [7] pointed out that a potential area is examining the role of climate policy uncertainty on firm-level investment, especially for firms in climate-sensitive industries (for example, mining and energy), at the end of his paper about the construction of the climate policy uncertainty index. Little previous studies have discussed the linkage between climate policy uncertainty and firm investment and have not considered the asymmetric effects. This article fills this gap. Secondly, this study also highlights the fact that the asymmetric impacts and threshold points of climate policy uncertainty on firm investment are dissimilar in different sectors. Also, this article classifies the samples according to company characteristics and discusses the responses of corporate investment in various industries. The results of this study can help company managers and officials understand corporate investment better to make appropriate decisions under different climate policy conditions.

The rest of the paper is structured as follows: Section 2 reviews related literature. Section 3 introduces the variables and methods. Section 4 reports the empirical results, and Section 5 is the conclusions.

2 Literature review

From a financial point of view, investment is the process by which investors pay certain valuable assets because of the future income of the investee. The company’s investment activities, in a narrow sense, is the act of taking the company property as input funds to obtain profits [33]. The essence of company investment is allocating funds rationally and realizing the enterprise’s maximum value. Corporate investment is the core of company business activities [34]. It is easily affected by many factors, and many pieces of literature have discussed the impact mechanism of uncertainty on company investment.

Generally, uncertainty can affect corporate investment through multiple channels. Bernanke [35] first began to explore the effect mechanism between the uncertainty or irreversibility on the corporate investment at the theoretical level. When an investment project is irreversible, managers must choose the best time to invest in order to obtain the highest possible return based on the promised return and market information. Appelbaum and Katz [36] indicate that when companies are at a high level of risk aversion, they tend to reduce investment and production when faced with uncertainty. Moreover, because investment funds are irrevocable and companies need to avoid risks, company investment and uncertainty are significantly negatively correlated. Dixit and Pindyck [37] point out that when a company needs to make an unchangeable investment decision, the increase in uncertainty will reduce the company’s investment level. Bhagat and Obreja [38] adopt a new cash flow uncertainty measurement method. They empirically find that cash flow uncertainty has a strong negative impact on the employment and investment of enterprises. Other uncertainties, such as those arising from trade conflicts, credit risk and fluctuations in energy prices, will bring about changes in corporate investment strategies [39,40,41].

In general, most scholars find and believe that uncertainty will adversely affect investment. However, corporate governance ability or behavior performance determines the specific results when facing uncertainty. For example, the evidence provided by Sanford and Yang [34] shows that the higher R&D investment of the company can significantly improve the investment response-ability of the enterprise to the impact of external information uncertainty.

In the case of economic-related policy uncertainty, existing studies have found that the increase in this kind of uncertainty has a restraining effect on the economy and the real estate market, whether at the macro or micro level. This change also raises the financial cost of the market, and the company’s investment will be reduced accordingly [42]. Julio and Yook [43] examined the effect of political uncertainty on company investment behaviour in 48 countries in a period from 1980 to 2005. The results show that the process of political activities directly reduces the company’s investment decisions. Gulen and Ion [18] selected a news-based uncertainty index to measure policy uncertainty. Their findings indicate that for companies that are highly dependent on government expenditure, high economic policy volatility will have a more substantial negative impact on investment than companies less dependent on government expenditure. Kim and Kung [44] use significant economic and political events to represent economic uncertainty. After the uncertainty increases, the friction of asset reallocation will affect liquidation value, thus making the company be cautious about investment decisions under uncertainty.

China has excellent determination and action on environmental issues in recent years, various ecological policies have been closely implemented and achieved initial results. Although the core of climate policy is to mitigate climate change, it is actually inextricably linked with economic activities. Liu and Wang [8] found that the climate policy could significantly affect the short-term related behaviors and activities of energy-intensive industries. Energy companies will definitely have a greater impact and interference when facing climate policy uncertainty [45].

However, other scholars hold different views. Abel [46] suggests that if the company’s ability to deal with uncertainty becomes more robust than before, risks could provide new opportunities and become investment incentives for decision-makers. In this circumstance, the linkage between company investment and uncertainty is positive. For companies that rely more on free funds in the market, investment is less affected by policy uncertainty. Ghosal and Loungani [47] used panel data from the US manufacturing industry to examine the effect of price uncertainty on firm investment. For all companies, the uncertainty does not affect the current investment. Phan et al. [48] established a data set covering 33,075 companies in 54 countries or regions. Based on these data, it can be concluded that large companies are more easily affected.

Xu et al. [49] empirically examine the correlation between total firm uncertainty and companies’ capital expenditure in China. They find that higher uncertainty may increase corporate investment among government-controlled companies. They also suggest that government-controlled firms in financial distress are more likely to take a risk in a market full of uncertainty. In addition, with the popularity of corporate social responsibility, investors from all parties pay more attention to environment-friendly investment [50, 51]. For the traditional energy industry, if it can seize the opportunity of transformation to win the favour of investors, it will also help the long-term survival [52, 53]. Therefore, the pressure of climate policy may be turned into an impetus to increase investment.

To sum up, it seems certain that the company will be affected by the uncertainty. However, although most studies show that various uncertainties reduce corporate investment, in some cases, companies may increase their investment out of the idea of taking risks or because they are forced to do so. Based on the studies above, we put forward the hypothesis as follows:

H1: Climate policy uncertainty will significantly affect corporate investment for energy-related industries.

In addition to the uncertainty of climate, this paper also argues that GDP growth positively impacts company investment. Prior studies show that the overall economic development maintains its influence on the operating and development of domestic enterprises through taxation and government policies [18]. Moreover, in the process of China’s economic reform, GDP is a vital achievement test standard, and the investment projects of energy companies usually have relatively large amounts. Furthermore, in China, companies in the energy industry are usually state-owned enterprises, and their business decisions are affected to a certain extent by the government and local officials [54]. As a result, the relationship between the investment expenditure of Chinese energy companies and GDP is involved, which has great research significance. It is more likely that a higher GDP growth rate positively influences firm investment expenditure.

To some extent, the growth of GDP also represents the strengthening of the country’s economic strength, which often leads to more active financial market activities and more diversified investment and financing channels [55]. For example, with the further development and improvement of China’s financial market, companies can complete investment and financing through various forms such as green bonds, even under the pressure of low-carbon transformation [56]. Therefore, the growth of GDP is likely to promote the investment activities of energy companies in most aspects. From the argument above, the second hypothesis is formulated:

H2: GDP growth positively impacts Chinese corporate investment in the energy industries.

Ghosal and Loungani [57] document that although the investment expenditure of all companies is negatively correlated with external fluctuations, different industries have different sensitivity to fluctuations. Specifically, the industry average of investment spending in sectors where companies are generally small is more sensitive to changes. In sectors with more large companies, the external uncertainty has a less negative impact on company investment. Some energy-related companies are energy suppliers in the market, while others are demanders. For example, according to the supply-demand relationship function in economics, the increase in oil prices is a good condition for the fossil energy supplier, which is beneficial to the company’s business development and profitability. On the contrary, for the fossil energy demander, sharp fluctuations in oil prices are likely to lead to poor management of the company, and it is even impossible for the company to make a large-scale external investment in a turbulent market environment [58].

Even if they all belong to the energy industry and face the same risk impact, the company may have different investment strategies due to different technology intensity or the characteristics of the main business [59]. Grabinska et al. [45], through the analysis of Poland’s energy industry, also found that differences in corporate internal governance structure and other characteristics will also lead to different corporate performances. Based on the previous literature that considers the impact of uncertainty on company investment by industry, the following hypothesis is formulated:

H3: The impact of climate policy uncertainty on company investment varies in different energy-related industries.

3 Data and methodology

3.1 Data and variables

To examine the effect of climate policy uncertainty on firm investment in Chinese energy-related industries, this study uses a balanced panel data of 128 Chinese energy-related companies’ yearly financial statement data from 2007 to 2019. All financial data are taken from the Wind database. Since 2007, China’s stock market regulatory authorities have regulated listed companies’ accounting information disclosure standards. This makes corporate investment more standardized and comparable. So, our dataset period starts from 2007 and ends with the latest issued financial statements of the 2019 fiscal year. During this period, the data are relatively complete, making the sample more balanced. Besides, in order to eliminate the impact of listed companies operating in abnormal conditions, the data set also excludes “special treatment” (ST) shares. Also, this study winsorizes data to limit the effect of outliners. Specifically, observations outside the range of 1% and 99% are substituted with the observations lying on 1% and 99%. Based on the industry classification by CSRC,Footnote 1 this study considers the energy-related companies from two industries, the industry of production and supply of electricity, heat, gas, and water (Industry I), and the mining industry (Industry II).

This study applies the climate policy measurement of the previous study of Gavriilidis [7] to stand for climate policy uncertainty (CPU). His climate policy uncertainty index was calculated by refining climate-related policy changes in eight mainstream media. In these media reports, Gavriilidis [7] refers to the method of constructing economic policy uncertainty indicators of Baker [60] by retrieving reports that contain multiple keywords, such as “uncertainty” and “climate change” with “regulations”, or “the White House”. Then, combining the number of these reports with the number of all news and other factors, the climate policy uncertainty index is constructed.

Corporate investment (INV) in this study is measured by corporate investment expenditure divided by a company’s total assets. We use indicators reflected firm financial conditions and indicators related to economic environments to be control variables, including leverage (Leverage), Tobin’s Q (TQ), company size growth rate (Asset), sales growth rate (Sales), Gross Domestic Product (GDP). The leverage ratio is a vital indicator account for investing and financing activities. Tobin’s Q is used to indicate a firm’s investment development chances [3]. Company size growth rate is widely agreed that corporate size is interrelated to the external environment and projects that the company can access, thereby further affecting the company investment expenditure [61]. The sales growth rate is the proxy of the company’s internal financing capabilities and external investment capabilities [17]. The control variables also include real GDP growth in order to control for China’s economic conditions, which may have an effect on firm external investment [62].

The specific definitions of our variables are shown in Table 1, and the descriptive statistics are displayed in Table 2.

3.2 Methods

3.2.1 Panel unit root test

Before the investigation, we need to test the data’s stationarity first. Therefore, this study employs the IPS panel unit root test Im et al., [63] to examine the stationarity properties of the variables in this study. The IPS panel unit root test is as follow:

In this equation, ρi = 0 indicates that y has a unit root for individual I, while ρi < 0 implies that y is stationary. For heterogeneous coefficients, we need to consider the \( {t}_{\rho_i} \) to test the null hypothesis: ρi = 0 for all I, which is as follow:

\( t=\frac{1}{N}\sum \limits_{i=1}^N{t}_{\rho_i} \)

where t is asymptotically N (0, 1) distributed.

3.2.2 Regression model

Based on the literature about determinants of corporate investment behaviour Bond and Meghir [64], the baseline regression equation uses the lag of variable by one period, which is as follows:

wheres ui denotes the unobserved firm-specific effects and εi, t is the error term.

To better examine the real relationship, we should take the nonlinearity and the possible asymmetry in the effect of climate policy uncertainty into account. To do this, the panel model with threshold effects [65] has been applied by some researchers to explore the asymmetric effects in corporate finance, such as the investment decision of firms under financial constraints. However, this model is static and assumes the covariates to be strongly exogenous, which can be restrictive in many real applications. Therefore, this study employs the dynamic model with threshold, referring to Wu et al. [66] and Diallo [67], allowing lagged dependent and endogenous independent variables. Then, the above model can be modified as follows:

where CPUi, t − 1 is the threshold variable, I{∙} is an indicator function. The threshold variable in this paper is the lagged climate policy uncertainty. This threshold model describes the impact of climate policy uncertainty on investment in energy-related industries and the specific performance of the threshold when the degree of impact changes. In the process of running the threshold model, We set corporate finance-related variables as endogenous variables, leverage ratio, assets, etc. Climate policy uncertainty and GDP are exogenous variables. Additionally, the variables that lag by one period are used as the tool variables.

4 Results and discussion

In this section, we first test the data’s stationarity by the IPS panel unit root test. Then, both the panel-data model and dynamic threshold model will be employed to examine the correlation and Influence transmission between climate policy uncertainty and company investment.

4.1 Panel unit root test and multicollinearity test

Before the regression analysis, the stationarity of the variables needs to be tested. Table 3 demonstrates the p-value and statistic of the IPS test, which indicate that all variables are stationarity. Based on these results, we can then employ the panel-data and dynamic threshold models to examine the linkage and influence transmission between climate policy uncertainty and company investment in Chinese energy-related companies. In addition, we performed a multicollinearity test on our variables based on the least square regression (OLS) through the variance inflation factor (VIF) test. Our test results show no significant multicollinearity among the variables in our model.

4.2 Regression analysis

Based on the outcomes of the panel unit root test and VIF values, the panel models are appropriate for examining the linkage and influence transmission between climate policy uncertainty and company investment. Following the literature involving companies in multiple industries [43, 68], we also examined whether the effect of climate policy fluctuations on the firm’s financial decisions varies by industry.

4.2.1 Impacts of climate policy uncertainty

This part shows the results of the basic panel model. We analyze all companies in the data set and then divide them into two industries according to the Chinese industry classification standard, testing with the panel regression model, respectively. The dynamic threshold panel model will also be employed in the next part to further investigate the asymmetric effects of climate policy uncertainty on firm investment.

Table 4 demonstrates the empirical results of the dynamic panel estimation, which aims to explore the linkage and influence transmission between climate policy uncertainty and company investment in Chinese energy-related companies. Column 1 reports the overall outcome of policy uncertainty on firm investment. Columns 2 and 3 display the empirical results of the industry I and II, respectively. The results indicate that the negative effect of CPU on investment expenditure is statistically significant at 1% significance level overall and significant at 5% level for industry II. These results show that, on the whole, the increase of uncertainty of climate policy will lead to the decrease of investment expenditure of companies in China’s energy-related industries. This shows our hypothesis H1 overall. Judging from the results of different sub-industries, the negative impact of climate policy changes on the mining industry is much more significant. On the other hand, the effects on the industry I are not statistically significant. This proves the correctness of our hypothesis H3.

There are several possibilities that could make the mining industry more susceptible to disruption. China’s coal mining industry occupies a leading position and is one of the main raw materials for power production. The use of mineral resources such as coal directly increases carbon emissions. Therefore, when climate policy changes, these traditional energy companies are the first to be hit. As mentioned earlier, mining companies may face large amounts of stranded assets (resources already mined or equipment used, etc.), leading to a large amount of impairment of the investment funds of these companies. On the other hand, the unpredictability or suddenness of the direction of climate policy changes may disrupt the plans of companies and investors, making companies unable to put their money into specific projects decisively. They are more likely to sit tight and choose their investment strategies more cautiously.

The industry I is mainly engaged in the production and supply of electricity, oil and gas and water. These companies are closely related to the daily life of the people, and the supply-demand relationship of their products will not change significantly under the condition of steady economic development. Therefore, the change of climate policy will not bring precipitate obstacles to them in a short time. On the other hand, even with transformational climate policy changes, these companies will have more coordination space than mining companies. For example, the current trend of developing clean energy is unstoppable, which will substantially impact the main business of mining companies. But these companies of industry I, such as power supply companies, can choose other energy supply companies.

Numerous previous studies on corporate investment have taken GDP as the control variable of the empirical model and shown that high GDP growth rates lead to increased corporate investment [61, 69]. The effects of GDP are positive for both industry I and industry II but only significant for the former, which indicates that economic growth can increase corporate investment, especially for the industry for the production and supply of electricity, heat, gas, and water. From this perspective, hypothesis H2 is valid for energy-related companies as a whole but not for industry II. This may still be related to China’s environmental protection policy and the trend of low-carbon development. Economic growth will promote the overall progress of the energy industry, activate their investment activities and create better investment channels. However, due to the existence of regulatory pressure caused by environmental problems, mining companies are facing a more severe living environment.

The estimated coefficients of leverage are − 0.1072, − 0.0158, − 0.0987, respectively, for the whole sample, firms from industries I and II. The coefficients are negative and highly significant except for industry I. This result means that an increase in leverage decreases investment expenditure, which is roughly consistent with prior studies [70]. It is because that capital structure plays a vital role in each business process. Based on the agent theory, when executives work for the benefit of shareholders, they tend to give up some investment projects with a positive NPV when the company already has too much debt [71].

The influence of Tobin’s Q is also different by industry. For the companies from industry II, the empirical results indicate that Tobin’s Q has a statistically significant positive effect on firm investment expenditure. They note that higher Tobin’s Q to some extend captures the future profitability of the company’s existing investment projects. However, the empirical result for industry I is not significant. The growth rate of sales also has a very different impact on industries I and II while the growth of assets does not take effect.

4.2.2 Asymmetric impacts of climate policy uncertainty under different market conditions

The panel model has verified the negative linkage between climate policy uncertainty and corporate investment, but this model could only reveal the linear relationship. This section employs the dynamic threshold panel model to examine nonlinearity and possible asymmetry impacts better, and the results are shown in Table 5. Column 1 reports the overall effect of climate policy uncertainty in two industries. Columns 2 and 3 display the empirical results for the industry I and industry II, respectively.

Compared with the static panel model, the dynamic model has a main character that the lag term of the explained variable is added for analysis. From the empirical results, the past investment of the company (L.INV) has a very significant positive effect on the current investment expenditure. The other coefficients depict that the impact of climate policy uncertainty is negative and statistically significant in the low-level range (below the threshold point). Consistent with the panel regression results (Table 4), this negative influence is only evident for the total sample pool and industry II companies. This shows that hypothesis H1 is valid for both industry I and industry II, and at the same time, it once again confirms the robustness of our hypothesis H3. This reflects one of the contributions of our article, as the previous literature often only verified a single correlation between uncertainty and corporate investment. Our research found the different performance of sub-industry companies in the energy industry when dealing with climate policies. What’s more, the advantages of the threshold model are also reflected because we can see that the entire sample has completely different significant results in the upper and lower threshold ranges.

These results show that the increase in climate policy uncertainty will decrease corporate investment expenditures for the whole piece of Chinese listed companies. Still, when this uncertainty exceeds the threshold, this inhibitory effect disappears instead. In China, most of the listed companies in the energy industry are state-owned enterprises [72]. For Chinese state-owned enterprises, management may be inclined to adopt a more conservative investment strategy when climate policy changes, as they are generally facing less competitive pressure with the support of government forces. For industry II, the upper and lower threshold ranges have significant negative impact coefficients, but it can also be seen that the lower range has a greater impact than the upper range. This may also be because the mining industry will be more directly impacted by climate policy changes, and they’re probably own a large number of sunk costs or stranded assets in the future. The dynamic threshold model reflects the nonlinear and asymmetric relationship between climate policy uncertainty and corporate investment under the condition of controlling the past state of the explained variables and demonstrates the relationship between the two in more detail and comprehensively.

In addition, the dynamic threshold regression results of the industry I are quite different from the panel regression results. The second column of Table 5 shows that climate policy uncertainty has a significant positive effect on the investment of companies in Industry I, and it is more obvious in the low-level range. This suggests that industry I companies will increase their investment when climate policy becomes more uncertain. This result is also logical to some extent. As mentioned in Section 4.2.1, the main business of the companies in Industry I is not directly related to activities such as energy mining, but to produce the corresponding products in the form of purchasing energy. So when climate policy changes, the consumer base of their products will not change significantly, but they may look for alternative investment projects, such as clean energy research as a part of long-term development, and so on.

Moreover, the threshold point for the energy-related companies in the mining industry (2.023386) is the same with the whole sample and is larger than that for industry I (1.92843). These results imply that the companies in the industry I was more responsive to the fluctuations in climate policy uncertainty. This outcome may be own to the profitability of the companies in industry I is impacted by both the demand and supply, while the demand for energy mainly impacts the mining industry.

For the GDP term, the results are consistent with those of the panel model, indicating that economic growth positively affects corporate investment and verifying our hypothesis H3 again. First, this may be explained by the investment opportunities that the company has access to. When the country’s GDP growth rate is high, it can be inferred that the country’s economy is undergoing rapid development, the possibility of enterprises capturing investment opportunities will increase [73].

In Table 5, the leverage displays significantly negative coefficients of-0.0548, − 0.0379 and − 0.0534 in three columns, thus indicating that the companies with higher debts spend less when investing outside than other companies. The opinions of Jensen [74], Stulz [75], and Grossman and Hart [76] also support that excessive financial leverage will reduce the amount of investment. The estimated coefficients of sale growth are 0.0175, − 0.0612 and 0.0564 for all firms, industries I and II, respectively.

The results of the other control variables are basically consistent with the results of the panel model, and the corresponding coefficients are also significantly different due to the existence of corporate heterogeneity. This shows many differences between the two types of energy industries, and it is worth exploring the different influence mechanisms behind them.

5 Conclusions

In recent years, climate change has become a hot topic globally. Influenced by international organizations or major policymakers and concerned about the national living environment, China has gradually adopted low-carbon cities, carbon markets and other measures to cope with the deterioration of climate conditions in recent years. At the end of 2020, the “carbon peak, carbon neutrality” initiative was put forward, and more detailed regulations were issued to ensure the successful realization of low-carbon transformation. This is both an opportunity and a challenge for the energy industry. This paper explores the relationship between climate policy uncertainty and the investment of two types of energy companies.

We initially understood the negative relationship between climate policy uncertainty and corporate investment through the ordinary panel model with balanced panel data of 128 Chinese listed energy-related companies from 2007 to 2019. Then, through the dynamic threshold model, we further dig out the nonlinear and asymmetric influence between them. For the mining industry, uncertainty about climate policy could significantly reduce corporate investment. For the electricity, heat, gas and water production industries, stronger fluctuations in climate policy could instead boost corporate investment. In addition, we have demonstrated the overall impact of economic growth on corporate investment in the energy industry.

The threshold for the industry I to change its response to climate policy uncertainty is lower than industry II, which indicates that industry I is in fact more sensitive to climate policy changes. It is noteworthy that the effects of climate policy uncertainty do differ significantly between the two different sub-industries. But the same is true, when climate policy uncertainty is in a low-level range, i.e. below the threshold, the impact on corporate investment in these industries is greater, regardless of whether the relationship is positive or negative. The results of this study could help the company managers and policymakers to select appropriate investment decision that maximizes firm value under different climate policy conditions.

This paper still has some limitations in the analysis, which can be improved in future research. The first limitation is the sample period of this study, which starts in 2007 and ends with the latest issued financial statements of the 2019 fiscal year. With a larger sample size, the results could be more robust and efficient. Due to the lack of data, the second limitation is that this study only controls some company characteristics, including leverage, Tobin’s Q, company size growth rate, sales growth rate, without the corporate governance’s factors, such as the ownership and the characters of the woman on boards. Finally, we could investigate the influence channels between climate policy uncertainty and corporate investment.

Notes

China Securities Regulatory Commission(CSRC)

Abbreviations

- CPU:

-

Climate policy uncertainty

- CSRC:

-

China Securities Regulatory Commission

- GDP:

-

Gross Domestic Product

- Industry I:

-

The industry of production and supply of electricity, heat, gas, and water

- Industry II:

-

The mining industry

- IPS:

-

Im-Pesaran-Shin panel unit root test

- NPV:

-

Net present value

- OLS:

-

The least square regression

- R&D:

-

Research and development

- VIF:

-

The variance inflation factor

- I{∙}:

-

Indicator function

- L.:

-

One period lag

- Δ:

-

Sign of difference

References

Arora A, Belenzon S, Sheer L (2021) Knowledge spillovers and corporate investment in scientific research. Am Econ Rev 111(3):871–898. https://doi.org/10.1257/aer.20171742

Fazzari, S., Hubbard, R G. and Petersen, B C. (1987). Financing constraints and corporate investment (no. w2387). National Bureau of Economic Research

Baum CF, Caglayan M, Talavera O (2008) Uncertainty determinants of firm investment. Econ Lett 98(3):282–287. https://doi.org/10.1016/j.econlet.2007.05.004

Beaudry P, Caglayan M, Schiantarelli F (2001) Monetary instability, the predictability of prices, and the allocation of investment: An empirical investigation using UK panel data. Am Econ Rev 91(3):648–662. https://doi.org/10.1257/aer.91.3.648

Dang V A, Gao N, Yu T. (2020). Climate policy risk and corporate capital structure: evidence from the NOx budget trading program. Available at SSRN 3677004, DOI: https://doi.org/10.2139/ssrn.3677004

Wang Y, Chen CR, Huang YS (2014) Economic policy uncertainty and corporate investment: evidence from China. Pac Basin Financ J 26:227–243. https://doi.org/10.1016/j.pacfin.2013.12.008

Gavriilidis, K. (2021). Measuring climate policy uncertainty. Available at SSRN https://ssrn.com/abstract=3847388:

Liu W, Wang Z (2017) The effects of climate policy on corporate technological upgrading in energy-intensive industries: evidence from China. J Clean Prod 142:3748–3758. https://doi.org/10.1016/j.jclepro.2016.10.090

Dong KY, Dong XC, Ren XH (2020) Can expanding natural gas infrastructure mitigate CO2 emissions? Analysis of heterogeneous and mediation effects for China. Energy Econ 90:104830. https://doi.org/10.1016/j.eneco.2020.104830

Ren XH, Cheng C, Wang Z, Yan C (2021) Spillover and dynamic effects of energy transition and economic growth on carbon dioxide emissions for the European Union: a dynamic spatial panel model. Sustain Dev 29(1):228–242. https://doi.org/10.1002/sd.2144

Li H, Zhao X, Wu T, Qi Y (2018) The consistency of China’s energy statistics and its implications for climate policy. J Clean Prod 199:27–35. https://doi.org/10.1016/j.jclepro.2018.07.094

Zhou W, McCollum DL, Fricko O, Gidden M, Huppmann D, Krey V, Riahi K (2019) A comparison of low carbon investment needs between China and Europe in stringent climate policy scenarios. Environ Res Lett 14(5):054017. https://doi.org/10.1088/1748-9326/ab0dd8

Chen S, Mao H, Sun J (2021) Low-carbon city construction and corporate carbon reduction performance: evidence from a quasi-natural experiment in China. J Bus Ethics:1–19. https://doi.org/10.1007/s10551-021-04886-1

Delis M D, de Greiff K, Ongena S. (2019). Being stranded with fossil fuel reserves? Climate policy risk and the pricing of bank loans. Climate Policy Risk and the Pricing of Bank loans, EBRD Working Paper

Dong KY, Ren XH, Zhao J (2021) How does low-carbon energy transition alleviate energy poverty in China? A nonparametric panel causality analysis. Energy Econ 103:105620. https://doi.org/10.1016/j.eneco.2021.105620

Wang Y, Xiang E, Ruan W, Hu W (2017) International oil price uncertainty and corporate investment: evidence from China’s emerging and transition economy. Energy Econ 61:330–339. https://doi.org/10.1016/j.eneco.2016.11.024

An H, Chen Y, Luo D, Zhang T (2016) Political uncertainty and corporate investment: evidence from China. J Corp Finan 36:174–189. https://doi.org/10.1016/j.jcorpfin.2015.11.003

Gulen H, Ion M (2016) Policy uncertainty and corporate investment. Rev Financ Stud 29(3):523–564

Ogawa K, Suzuki K (2000) Uncertainty and investment: some evidence from the panel data of Japanese manufacturing firms. Jpn Econ Rev 51(2):170–192. https://doi.org/10.1111/1468-5876.00145

Song S., and Wang J. (2020). Boardroom networks, corporate investment, and uncertainty. SSRN Electronic Journal

Bulan LT (2005) Real options, irreversible investment and firm uncertainty: new evidence from US firms. Rev Financ Econ 14(3–4):255–279. https://doi.org/10.1016/j.rfe.2004.09.002

Ilyas M, Khan A, Nadeem M, Suleman MT (2021) Economic policy uncertainty, oil price shocks and corporate investment: evidence from the oil industry. Energy Econ 97:105193. https://doi.org/10.1016/j.eneco.2021.105193

Alnahedh S, Bhagat S, Obreja I (2019) Employment, corporate investment, and cash-flow risk. J Financ Quant Anal 54(4):1–128. https://doi.org/10.1017/S0022109019000437

Baum CF, Caglayan M, Talavera O (2010) On the sensitivity of firms’ investment to cash flow and uncertainty. Oxf Econ Pap 62(2):286–306. https://doi.org/10.1093/oep/gpp015

Huang S, An H, Gao X, Wen S, Hao X (2017) The multiscale impact of exchange rates on the oil-stock nexus: evidence from China and Russia. Appl Energy 194:667–678. https://doi.org/10.1016/j.apenergy.2016.09.052

Horra L, Perote J, Fuente G (2021) Monetary policy and corporate investment: a panel-data analysis of transmission mechanisms in contexts of high uncertainty. Int Rev Econ Financ 75(September 2021):609–624. https://doi.org/10.1016/j.iref.2021.04.035

Huynh TD, Xia Y (2021) Climate change news risk and corporate bond returns. J Financ Quant Anal 56(6):1985–2009. https://doi.org/10.1017/S0022109020000757

Luo L, Tang Q (2021) Corporate governance and carbon performance: role of carbon strategy and awareness of climate risk. Account Finance 61(2):2891–2934. https://doi.org/10.1111/acfi.12687

Phan DHB, Tran VT, Ming TC, Le A (2021) Carbon risk and corporate investment: a cross-country evidence. Financ Res Lett 102376:102376. https://doi.org/10.1016/j.frl.2021.102376

Jaraite J, Kazukauskas A, Lundgren T (2014) The effects of climate policy on environmental expenditure and investment: evidence from Sweden. J Environ Econ Policy 3(2):148–166. https://doi.org/10.1080/21606544.2013.875948

Ren X, Li Y, Shahbaz M, Dong K, Lu Z (2022) Climate risk and corporate environmental performance: empirical evidence from China. Sustain Prod Consum 30:467–477. https://doi.org/10.1016/j.spc.2021.12.023

Ngwakwe C (2021) Forecasting corporate green investment bonds–An out of sample approach. J Account Manage 11(1)

Malmendier U, Tate G (2005) CEO overconfidence and corporate investment. J Financ 60(6):2661–2700. https://doi.org/10.1111/j.1540-6261.2005.00813.x

Sanford A, Yang MJ (2022) Corporate investment and growth opportunities: the role of R&D-capital complementarity. J Corp Finan 72:102130. https://doi.org/10.1016/j.jcorpfin.2021.102130

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98(1):85–106. https://doi.org/10.2307/1885568

Appelbaum E, Katz E (1986) Measures of risk aversion and comparative statics of industry equilibrium. Am Econ Rev 76(3):524–529

Dixit AK, Dixit RK, Pindyck RS (1994) Investment under uncertainty. Princeton university press, Princeton. https://doi.org/10.1515/9781400830176

Bhagat S, Obreja I (2013) Employment, corporate investment and cash flow uncertainty. https://ssrn.com/abstract=1923829

Choi, Y. (2021). Uncertainty, credit risks, and corporate investment. Doctoral dissertation, American University

Fan Z, Zhang Z, Zhao Y (2021) Does oil price uncertainty affect corporate leverage? Evidence from China. Energy Econ 98:105252. https://doi.org/10.1016/j.eneco.2021.105252

Jory SR, Khieu HD, Ngo TN, Phan HV (2020) The influence of economic policy uncertainty on corporate trade credit and firm value. J Corp Finan 64:101671. https://doi.org/10.1016/j.jcorpfin.2020.101671

Pastor L, & Veronesi P (2012) Uncertainty about government policy and stock prices. The journal of Finance, 67(4),1219–64

Julio B, Yook Y (2012) Political uncertainty and corporate investment cycles. J Financ 67(1):45–83. https://doi.org/10.1111/j.1540-6261.2011.01707.x

Kim H, Kung H (2017) The asset redeployability channel: how uncertainty affects corporate investment. Rev Financ Stud 30(1):245–280. https://doi.org/10.1093/rfs/hhv076

Grabinska B, Kedzior M, Kedzior D et al (2021) The impact of corporate governance on the capital structure of companies from the energy industry. The case of Poland. Energies 14(21):7412

Abel AB (1983) Optimal investment under uncertainty. Am Econ Rev 73(1):228–233

Ghosal V, Loungani P (1996) Product market competition and the impact of price uncertainty on investment: some evidence from US manufacturing industries. J Ind Econ 44(2):217–228. https://doi.org/10.2307/2950647

Phan DHB, Tran VT, Nguyen DT (2019) Crude oil price uncertainty and corporate investment: new global evidence. Energy Econ 77:54–65. https://doi.org/10.1016/j.eneco.2018.08.016

Xu L, Wang J, Xin Y (2010) Government control, uncertainty, and investment decisions in China’s listed companies. China J Account Res 3:131–157. https://doi.org/10.1016/S1755-3091(13)60022-2

Dou Y, Li YY, Dong KY, Ren XH (2021) Dynamic linkages between economic policy uncertainty and the carbon futures market: does Covid-19 pandemic matter? Resources Policy 75:102455

Ren XH, Lu ZD, Cheng C, Shi YK, Shen J (2019) On dynamic linkages, of the state natural gas markets in the USA: evidence from an empirical spatiotemporal network quantile analysis. Energy Econ 80:234–252. https://doi.org/10.1016/j.eneco.2019.01.001

Shahab Y, Ntim CG, Chen GY et al (2018) Environmental policy, environmental performance, and financial distress in China: do top management team characteristics matter? Bus Strateg Environ 27(8):1635–1652. https://doi.org/10.1002/bse.2229

Xing C, Zhang Y, Tripe D (2021) Green credit policy and corporate access to bank loans in China: the role of environmental disclosure and green innovation. Int Rev Financ Anal 77:101838. https://doi.org/10.1016/j.irfa.2021.101838

Xu N, Xu X, Yuan Q (2013) Political connections, financing friction, and corporate investment: evidence from Chinese listed family firms. Eur Financ Manag 19(4):675–702. https://doi.org/10.1111/j.1468-036X.2011.00591.x

Farooq U, Ahmed J, Khan S (2020) Do the macroeconomic factors influence the firm’s investment decisions? A generalized method of moments ( GMM ) approach. Int J Financ Econ 2020(2):790–801. https://doi.org/10.1002/ijfe.1820

Zheng H. (2021). Climate policy and corporate green bond issuances. Available at SSRN 3878e791, DOI: https://doi.org/10.2139/ssrn.3878791

Ghosal V, Loungani P (2000) The differential impact of uncertainty on investment in small and large businesses. Review of Economics and Statistics 82(2):338–343

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99(3):1053–1069. https://doi.org/10.1257/aer.99.3.1053

Wen H U., Zuo Z R., School B, et al. (2019). Debt heterogeneity, macroeconomic factors and corporate investment behavior. Modern finance and economics-journal of Tianjin University of finance and economics, 2019

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636. https://doi.org/10.1093/qje/qjw024

Yoon KH, Ratti RA (2011) Energy price uncertainty, energy intensity and firm investment. Energy Econ 33(1):67–78. https://doi.org/10.1016/j.eneco.2010.04.011

Grier R, Grier KB (2006) On the real effects of inflation and inflation uncertainty in Mexico. J Dev Econ 80(2):478–500. https://doi.org/10.1016/j.jdeveco.2005.02.002

Im KS, Pesaran MH, Shin Y (2003). Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

Bond S, Meghir C (1994). Dynamic investment models and the firm's financial policy. Rev Econ Stud, 61(2):197–222

Hansen BE (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. J Econ 93(2):345–368

Wu H, Xu L, Ren S, Hao Y, Yan G (2020) How do energy consumption and environmental regulation affect carbon emissions in China? New evidence from a dynamic threshold panel model. Resour Policy 67(2):101678. https://doi.org/10.1016/j.resourpol.2020.101678

Diallo, I. (2020). XTENDOTHRESDPD: Stata module to estimate a dynamic panel data threshold effects model with endogenous regressors. Statistical Software Components, Boston College Department of Economics

Servén L (2003) Real-exchange-rate uncertainty and private investment in LDCs. Rev Econ Stat 85(1):212–218. https://doi.org/10.1162/rest.2003.85.1.212

Kim J, Mcguire S, Savoy S et al (2021) Expected economic growth and investment in corporate tax planning. Rev Acc Stud 2021(5). https://doi.org/10.1007/s11142-021-09625-5

Aivazian VA, Ge Y, Qiu J (2005) The impact of leverage on firm investment: Canadian evidence. J Corp Finan 11(2):277–291. https://doi.org/10.1016/S0929-1199(03)00062-2

Myers SC (1977) Determinants of corporate borrowing. J Financ Econ 5(2):147–175. https://doi.org/10.1016/0304-405X(77)90015-0

Wang Y, Chen CR, Chen L, Huang YS (2016) Overinvestment, inflation uncertainty, and managerial overconfidence: firm-level analysis of Chinese corporations. North Am J Econ Finance 38:54–69. https://doi.org/10.1016/j.najef.2016.07.001

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–176. https://doi.org/10.1257/jep.28.2.153

Jensen MC (1986) Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev 76(2):323–329

Stulz R (1990) Managerial discretion and optimal financing policies. J Financ Econ 26(1):3–27. https://doi.org/10.1016/0304-405X(90)90011-N

Grossman, S J. and Hart, O D. (1982). Corporate financial structure and managerial incentives. The Economics of Information and Uncertainty. University of Chicago Press, 107–140

Funding

The authors did not receive support from any organization for the submitted work. The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Contributions

The slipt of contribution of the work is Xiaohang Ren: Conceptualization, Methodology, Analysis, Software and Writing - Original draft; Yukun Shi: Supervision, Writing – Reviewing and Editing; Chenglu Jin: Writing – Reviewing. The author(s) read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ren, X., Shi, Y. & Jin, C. Climate policy uncertainty and corporate investment: evidence from the Chinese energy industry. Carb Neutrality 1, 14 (2022). https://doi.org/10.1007/s43979-022-00008-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43979-022-00008-6