Abstract

Climate change-induced risks, such as global warming, can affect the economic development of entities and, consequently, the stability of financial markets. Businesses are progressively making the transition to green in order to lessen the negative consequences of climate threats. This study examines the relationship between corporate risk-taking (CRISK) and financialization (FIN) in light of climate change. The impact of business risk-taking on financialization is experimentally investigated through the transmission chain of “CRISK - enterprise value – FIN” using a fixed-effects model. The study also analyzes the moderating effect of climate change on the direct and indirect channels of climate change by using “temperature” and “investors’ concern about climate,” respectively. In addition, the empirical results are tested for robustness using propensity score matching and an instrumental variable method. This study’s findings reveal the following key insights. First, CRISK significantly enhances FIN by improving firm value. Second, enterprises with high financing constraints and manufacturing enterprises are more likely to have a positive correlation between CRISK and FIN. Third, the relationship between CRISK and FIN is enhanced by the direct transmission channel of increasing climate risk, but the indirect transmission channel is not significant. This study proposes policy recommendations to address the effect of climate risk on CRISK and FIN. Among these suggestions are the prudent distribution of financial resources among enterprises according to their level of risk-taking and the reinforcement of regulatory authorities’ financial oversight of businesses with high financing constraints and the manufacturing sector. By implementing these policies, companies can better manage climate-related risks and contribute to financial stability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a complex and volatile domestic and international environment, China’s economic development has undergone major transformations. A complex financial sector has emerged as a result of the expansion of the Chinese market economy. Enterprises today have the advantage of using diverse financial instruments for investment purposes. However, this has led to the Chinese economy diverging from the real economy which in turn poses a serious challenge for further development (Tian & Sun, 2023). From a micro perspective, the increasing level of company financialization is the primary reason for the diversion out of the real economy. Enterprise financialization can be viewed from two perspectives. The first perspective is based on the behavior of enterprises, where they tend to place their resources in financial investment instead of conventional production and operational endeavors, leading to a capital-biased mode of operation. The second perspective looks at the results of such behavior, where profits are mainly generated from the value-added of financial capital instead of production and operations. This viewpoint is supported by Gillan et al. (2021). A moderate level of financialization helps enterprises broaden profit channels, increase their sources of financing, enhance operational efficiency, improve corporate investment, reduce the volatility of working capital, and maximize the profit of short-term corporate investment (Sahay et al., 2015; Naeem & Li, 2019; Xu & Guo, 2023). Therefore, the proportion of enterprise financialization continues to increase. The COVID-19 pandemic’s effects, growing pressure from international competition, rising labor costs, and the complexity of global industry chains have all contributed to the market economy’s downward pressure and a fall in enterprises’ return on investment (Emrouznejad et al., 2023). Thus, to obtain greater profits, enterprises transfer more capital to financial investments to maximize short-term profits, and the scale of China’s financial assets continues to expand. This leads to the “over-financialization” of enterprises, which, in serious cases, may trigger a financial crisis (Wu & Huang, 2022).

Therefore, effectively avoiding enterprise over-financialization has become an important aspect of the study of corporate investment decisions. Nakano and Nguyen (2012) have demonstrated that corporate risk-taking (CRISK) serves as an important indicator affecting the process of corporate financialization. CRISK refers to the price a corporation is willing to pay to obtain potentially high returns; it illustrates how companies’ earnings fluctuate as they strive for large profits (Boubakri et al., 2013). A corporation is more likely to select high-risk but positive net present value investment opportunities when CRISK is higher (Koirala et al., 2020). To a certain extent, this helps promote technological advancement and increase social productivity, while also being significant in increasing the competitiveness and value of the enterprise (Koirala et al., 2020; John et al., 2008). Financial assets exhibit higher liquidity and reversibility than physical assets; therefore, they can easily realize resource integration. This is conducive to improving enterprises’ financing ability and efficiency, leading to enterprises with strong CRISK preferring to invest in high-yield and high-risk financial assets, increasing

the financialization (FIN) (Gehringer, 2013; Arizala et al., 2013). However, under the crowding-out effect, when corporate investments shift towards financial assets, it engenders adverse effects on the enterprise’s real investments (Orhangazi, 2008; Demir, 2009), exacerbates the instability of the financial system, and ultimately backfires on firms through the knock-on effect, increasing their business risks. An elevated level of CRISK has numerous economic advantages. For example, it facilitates technological progress, augments societal productivity, and provides momentum for sustained economic growth over the long term (John et al., 2008). Nonetheless, there is a lack of academic research on the connection between CRISK and the extent of FIN.

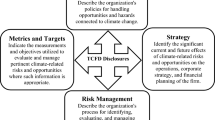

In recent years, the global environmental situation has been deteriorating (Xian et al., 2024). The incidence rate of extreme climate events, including high temperatures and floods, has increased dramatically under the influence of global warming. As a result, risks brought on by climate change (CRT) have increasingly had a greater influence on corporate operations (Lee et al., 2024; Wahab et al., 2023). China accounts for approximately 23% of global carbon emissions, making it one of the largest contributors (Cohen et al., 2019). With the proposal of the “dual-carbon” goal, Chinese enterprises will be more seriously affected in the process of managing climate risks than other countries (Li &Zhang, 2023). CRT risks to enterprises are categorized into physical and transition risks. Physical risk encompasses the devaluation of corporate assets and the escalation of operational expenditures directly caused by CRT (e.g., high temperatures, droughts, and acidification of seawater) (Barrot & Sauvagnat, 2016; Nurunnbi, 2016). Transition risk denotes the process of addressing CRT, the enactment of green policy, green technology innovation, and changes in market preferences that lead to a deterioration in the enterprise’s operating conditions, solvency, and market valuations, which, in turn, threaten business operations and market stability (Cosemans et al., 2023; Wang & Chen, 2022). Physical risks can lead to decreased business profitability due to asset price volatility, disruptions in production operations, underwriting and credit losses, and financial market volatility (Chen & Yang, 2019; Zivin et al., 2020). Moreover, transition risks may impact the number of stranded assets, energy prices, renewable energy development, reinvestment, and capital replacement costs that reduce firms’ profitability and trigger financial market turmoil (Wen et al., 2021; Briera & Lefèvre, 2024; Zhao et al., 2024). Both suggest that CRT can directly affect the level of FIN and, through affecting CRISK, influence their FIN. Thus, CRT may act as a moderator in the relationship between CRT and firms’ FIN (Fig. 1).

Scholars have examined how CRT affects agriculture and the environment from the standpoint of physical risks. For example, Abbass et al. (2022a, c) pointed out the threat that CRT poses to food supply and agricultural productivity. From the perspective of transition risks, scholars have studied the effects of green technologies developed to mitigate CRT, carbon emission policies enacted, and fiscal policies on energy consumption and carbon emissions (Abbasi & Choukolaei, 2023; Abbass et al., 2022a, c; Amin et al., 2023). From the standpoint of international collaboration, several academics have looked at how different countries would be affected by CRT mitigation. For example, Wang et al. (2023a) studied the effects of green transformation on developing countries from the perspective of the “resource curse”. Abbass et al. (2022a, c) studied the effects of technological innovation on Asian countries from the perspective of “pollution halo/paradise hypothesis.” Existing literature shows that previous research on CRT focuses on the macro perspective and lacks research on micro-enterprises. Furthermore, previous studies have primarily focused on the direct implications of climate risk, ignoring its moderating influence on already existing financial ties. Therefore, from the micro perspective of corporate asset allocation, this research investigates how CRT affects the link between CRISK and FIN. Moreover, to provide a more thorough assessment of the moderating influence of CRT, this study analyzes the different transmission channels of CRT from both direct and indirect perspectives.

Contrary to previous studies, this study considers three key aspects. First, the impacts of CRT were integrated into the corporate behavioral framework, combining the internal operations of enterprises with the external ecological environment. Although the literature has acknowledged the impact of CRT on financial and economic systems, the macro level has received most attention. There is a notable gap in the discourse about the influence of CRT on the financial dimension of enterprises, particularly about the perspective of risk-taking. Second, this study broadens the academic comprehension of the impact of CRT on firms through indirect channels. Most existing research focuses on direct channels such as temperature, precipitation, and climate policy. Based on the direct channels of CRT represented by temperature, this study further constructs the indirect channels of an index for “investors’ attention regarding CRT.” The moderating effects of the direct and indirect channels on CRISK and FIN were analyzed. Third, diverging from prior investigations predominantly grounded in the analysis of financial asset characteristics, this study combines the internal operation of enterprises with the external ecological environment. This enriches research in the realm of climate finance, fostering a heightened comprehension of the connection between CRT and the operation and development of enterprises.

The paper is organized as follows. Section 2 presents theoretical analysis and hypotheses. Section 3 provides an explanation of model settings, data sources, sample treatments, variable definitions, and descriptive statistics. Section 4 examines the interplay between CRISK and FIN using benchmark regression analyses and robustness tests. Subsequently, Sect. 5 investigates heterogeneity and CRT moderation analyses. The study is finally concluded in Sect. 6.

2 Theoretical analysis and hypotheses

2.1 Impact of CRISK on FIN

Under pressure from unfavorable conditions, such as the COVID-19 pandemic, firms reinterpret their quest for large profits, which encourages non-financial businesses to take more risks (Tian et al., 2022a). This transformation influences and reshapes their investment behavior. It has been shown that firms’ motives for FIN are mainly divided into two types: preventive and profit-chasing. In terms of preventive motives, to obtain better investment opportunities, enterprises with high CRISK pursue investment projects with higher-average returns. This prompts them to invest more funds in high-yield and high-risk financial assets to obtain more financing, thus enhancing firms’ competitive advantages and value (Koirala et al., 2020; Wu & Lu, 2023). The advancement of technology, such as cloud computing and big data, has broken down traditional financial sector boundaries. This has given businesses new opportunities to invest in finance. As a result, there has been an increase in the level of FIN within businesses (Wu & Lu, 2023; Zhao et al., 2024). Because of the complex and volatile domestic and international environment, Chinese real economy profits have endured a continued decline, financial sector earnings gradually exceeding those of the real sector, and enterprises seeking new profit growth points and the need to invest funds in higher-return financial assets. In this process, enterprises with high CRISK tend to allocate increased funds to financial assets owing to the “high risk and high return” of these assets. The percentage of financial assets recorded on the balance sheet is increasing quickly, which raises the FIN for businesses (Tian et al., 2022b). Consequently, CRISK and the extent of financial output are closely intertwined. In other words, the higher the CRISK, under the joint effect of precautionary and profit-seeking motives, the more the enterprise will invest in the financial sector, and the higher the FIN will be. Hence, we propose the following hypothesis.

H1

CRISK has a positive impact on FIN.

Existing research has shown that firms’ ability to raise sufficient funds promptly and efficiently can significantly impact their investments; in other words, the degree of firms’ FIN exhibited is influenced by the extent of their financing constraints (Wang et al., 2023a). Specifically, Andersen (2017) showed that financing constraints distort firms’ asset composition and investment decisions, which affect their financial performance and increase their financing costs. This is particularly evident in the process of firms engaging in external borrowing. Wu and Huang (2022) showed that companies facing elevated financing constraints obtain credit support after a comprehensive weighing of risks and returns. Furthermore, they suggest that in the process of obtaining credit support, enterprises with high financing constraints are in a comprehensive trade-off between risk and return, and lenders tend to show “stint loan” behavior, resulting in a rise in the cost of financing for the enterprise. Therefore, enterprises tend to allocate their limited capital to higher-yielding businesses to compensate for the higher risk premium. This may lead to financing diverting from the real economy and increasing firms’ FIN (Sahay et al., 2015).

Additionally, manufacturing companies also run the danger of having more stranded assets and a decline in asset value as a result of climate risk. Consequently, manufacturing firms with more stranded assets face the risk of reduced profits and falling market value in the future, resulting in higher operating costs (Andersen, 2017). To ensure good enterprise development, manufacturing firms may adopt more aggressive investment strategies and ignore the high risks associated with high-yield investments, ignoring the CRISK. Manufacturing enterprises’ CRISK has a stronger impact on their FIN behavior compared to non-manufacturing enterprises. Based on this analysis, two hypotheses are formulated as follows.

H2a

The positive relationship between the CRISK of firms facing high financing constraints and their FIN is more significant than that for firms characterized by low financing constraints.

H2b

The positive relationship between the CRISK of manufacturing firms and their FIN is more significant than that for non-manufacturing firms.

2.2 Mediating effect of TQ on CRISK and FIN

Enterprises improve their CRISK to increase TQ. Previous research has indicated the inseparability of risk and return, with scholars directing their attention to the relationship between enterprise risk and value. Nguyen (2011) identified a positive association between CRISK and TQ, highlighting that a high CRISK corresponds to an elevated level of TQ. He et al. (2023) also confirmed the relationship between the level of CRISK and TQ. Moreover, when firms have a low CRISK, this can lead to negative operations, which are ultimately not conducive to increasing TQ. Furthermore, changes in TQ inevitably affect the level of FIN. Enterprise value is a key consideration for a firm when determining when and how to fund its investments. The enterprise value can influence the direction and level of future investments for the company (Graham & Harvey, 2001; Hirshleifer et al., 2006). Additionally, the timing of equity financing can be affected by fluctuations in TQ. This may impact fixed asset investments and ultimately raise the FIN level (Campello & Graham, 2013). The above factors have led us to formulate the following hypothesis.

H3

TQ mediates the relationship between CRISK and FIN.

2.3 Moderating effect of CRT on CRISK and FIN

The business circumstances of an enterprise may be influenced in various ways by the climate physical and transition risks. In the direct transmission channel, physical risks can negatively affect businesses by disrupting operations, creating a short supply of resources, and, in severe cases, requiring post-disaster reconstruction. Scholarly investigations have demonstrated an inverse U-shaped correlation between temperature and total factor productivity. With no intervention, CRT is anticipated to result in an annual 12% decline in the output of China’s manufacturing sector by the middle of the 21st century (Zhang et al., 2018). Droughts caused by higher temperatures can also result in lower efficiency and slower machine operation, which will ultimately have a detrimental effect (Hong et al., 2019). Furthermore, extreme weather may lead to higher insurance payouts, which increases insurance costs for insured businesses and insurance companies (Bowen & Dietz, 2016). Under the effects of climate policy and changing consumer preferences, mainly caused by temperature, firms face increasing transition risks, specifically in the manufacturing sector that has a high level of tangible assets. Barnett finds that uncertainty about transition risks can exacerbate the volatility of oil prices, which subsequently leads to downside risks for the share prices of physical firms through the oil chain (Barnett, 2019). Owing to the close relationship between different industries, the risk associated with stranded assets will affect the upper and lower industrial chains of the relevant enterprises and, ultimately, have a radial risk impact on the financial market. As consumer preferences change, numerous carbon-intensive assets will lose value, triggering a wave of firms to sell at reduced prices, leading to financial liquidity problems for carbon-intensive firms and affecting their profitability (Agénor & Pereira, 2019). Based on this, firms also prefer financial assets when making investments to reduce the risk of stranded assets. Therefore, this study proposes hypothesis H4a.

H4a

In the direct transmission channel, as CRT increases, the relationship between CRISK and FIN strengthens.

In the indirect transmission channels, scholars have already proven that the levels of FIN and CRISK are affected by investors’ attention. For example, Michal et al. (2018) revealed that excessive levels of interest from US investors lead to excessive stock volatility, which impacts the company’s risk. David & Zhao (2014) also pointed out that investors’ attention affects a firm’s ability to obtain outside funding, leading to cyclicality in the firm’s FIN level with investors’ sentiment fluctuations. Xu et al. (2023) discovered that investors choose to sell their stocks when they are concerned about the risks arising from stranded assets. This lowers the share price of the company and raises its cost of capital, which has an impact on the company’s operations. Thus, from an indirect channel approach, this study investigates whether investors’ attention to CRT modifies the link between the FIN and CRISK of Chinese enterprises. It is worth noting that scholars have shown that investors’ attention on CRT can have a significant effect on the European and American markets. Nevertheless, owing to a belated initiation and a dearth of focus from Chinese investors on CRT, the influence of climate change awareness on enterprises is relatively limited and controversial (Bolton & Kacperczyk, 2021; Choi et al., 2020; El Ouadghiri et al., 2021). Therefore, in light of the analysis above, this study further proposes hypothesis H4b.

H4b

In the indirect transmission channel, CRT does not have a significant moderating effect between CRISK and FIN.

3 Methods

3.1 Model settings

In 2016, the China Changan Trust declared bankruptcy because its risk-taking and asset-liability matching were ignored in favor of investment projects on high-risk and high-yield financial products. The challenges faced by enterprises have intensified in recent years owing to the impact of unfavorable factors, such as climatic disasters and COVID-19, compounded by intensifying external uncertainties (Abbasi et al., 2023). China’s financial regulators have recently introduced the New Regulations on Asset Management to promote a better business environment and ensure financial stability. The aim is to prevent incidents like Changan Trust’s financial bankruptcy, which occurred because of insufficient risk management. Studies show that a corporation’s level of FIIN is closely linked to its risk-taking behavior. Therefore, to test H1, we set up a panel regression model (1):

where \({v}_{t}\) is time fixed effect, \({\mu }_{i}\) is the industry fixed effect, and \(\psi\) is a vector of the control variables’ coefficients. Furthermore, the estimates’ standard errors were clustered at the firm level.

We designed models (2) and (3) to examine the mediating effect of TQ based on model (1):

As CRT may strengthen the relationship between CRISK and FIN, we used model (4) to test the moderating effect of CRT.

3.2 Data sources and sample selection

Financial data on companies listed on the Chinese A-share index were obtained from the CSMAR Database, Wind Database, and Baidu Index. To improve the representativeness of the sample data, it was processed as follows (Zhao & Su, 2022). First, we excluded financial and real estate listed companies because their accounting standards are significantly different from other industries. Second, listed companies in the ST, *ST, and delisted categories were excluded. Third, samples that lacked data on the primary variables were eliminated. To mitigate the effects of extreme values, winsorizing was applied to all variables at the 1% and 99% levels. Annual average temperature data for each province were obtained from the China Meteorological Yearbook. Finally, the study selected listed companies from 2007 to 2022, including 30,700 sets of company-year observations from 3,825 Chinese A-share non-financial listed companies.

3.3 Definition of variables

3.3.1 Dependent variables

Financialization (FIN)

Referencing Du et al. (2017), a measure of a firm’s FIN is the proportion of financial assets to total assets. As an enterprise’s business activities also generate monetary funds, and long-term equity investment between enterprises can be considered structural reorganization within the enterprise sector, this study does not consider monetary funds or long-term equity investment when calculating the main dependent variables. Therefore, when calculating the main dependent variables, financial assets included only held-to-maturity investments, trading financial assets, dividend receivables, investment properties, available-for-sale financial assets, and interest receivables.

China released a new enterprise accounting standard in 2018 that changed how financial assets are treated in accounting. In the new standard, China changed the refinement of held-to-maturity investments and available-for-sale financial assets into four sub-items: debt and other debt investments, other investments in equity instruments, and other non-current financial assets. The study developed a new FIN indicator standard based on existing literature, covering various aspects such as trading financial assets, investing in properties, debt investments, and other financial assets (Liu & Liu, 2022). Despite the statistical changes to financial asset criteria in 2018, data connectivity remains intact. Therefore, we computed the total company financial assets for 2018–2022, using the matching financial asset accounting methodologies.

3.3.2 Independent variables

Corporate risk-taking (CRISK)

A firm’s level of risk-taking is frequently determined by surplus volatility; the higher the indicator, the higher the firm’s level of risk-taking. Surplus volatility can be measured by choosing the return on total assets (ROA). This study used the risk-taking measured by the ROA (CRISK1) as the main independent variable. The robustness test’s independent variable is the degree of risk-taking as measured by the extreme ROA (CRISK2). According to existing literature, to avoid the effect of industry heterogeneity, a firm’s annual ROA is first adjusted by the industry average in the same year. Then its future three-period rolling standard deviation is used as a measure of CRISK. Following Zhou et al. (2022), the study used the difference between the maximum and minimum values calculated by rolling regression (i.e., the extreme value) as a measure of CRISK2.

3.3.3 Mediating variables

Firm value (TQ)

Tobin’s Q reflects the market’s expectation of a company’s future profits. This affects the company’s investment and has become an important indicator of TQ (Tobin, 1969; Li & Rainville, 2021). Therefore, we used Tobin’s Q as a proxy for TQ.

3.3.4 Moderator variables

Climate change (CRT)

On the direct transmission channel, we measured the CRT risk (CRT1) using the absolute value of temperature deviation. Specifically, the annual average temperature of each province and city was first subtracted from the annual average temperature of the past five years on a rolling basis. Subsequently, the deviation was taken as an absolute value, which is a measure of CRT risk. Referring to Da et al. (2011), the study used the Baidu index of “gaowen,” “tianqi,” “wendu,” and “qiwen” to measure the CRT risk on the indirect transmission channel (CRT2). First, the study obtained the Baidu index of these four words. To smoothen the data, we took the logarithmic sum of the words as the proxy variables for the index of Chinese investors’ attention on CRT.

3.3.5 Control variables

Based on Chen et al. (2022), the study incorporated a set of control variables in our empirical model that may affect FIN: corporate characteristic variables, including firm size (Size), firm growth (Growth), financial leverage (Lev), cash flow (Cf), capital expenditure (Expenditure), profitability of the company (Margin), the ratio of independent directors (Id), and dual jobs (Dual). Lev and Cf reflect a firm’s financial strength and risk tolerance, respectively. Expenditure crowds out investment funds, which subsequently reduces investment in financial assets; thus, capital expenditure is also used as a control variable. Margin, Id, and Dual can also influence firms’ FIN behavior. Detailed definitions are in Appendix Table A1.

Table 1 presents descriptive statistics results, with a minimum of 0 and a maximum of 0.410 for the FIN. This result indicates that some companies hold financial assets totaling more than 40% of their total assets. The mean of 2.951 and a standard deviation of 3.125 for CRISK1, clearly show significant differences in the CRISK of the sampled firms.

4 Results

4.1 Baseline results

The outcomes of the univariate and multivariate regressions of CRISK on FIN are displayed in Table 2. The regression results include industry-fixed, year-fixed, and industry and time-fixed effects, shown in columns (2)-(4), respectively. Control variables have been added, except in column (1).

Column (1) of Table 2 demonstrates that, at the 10% significance level, the coefficient of CRISK1 is positive. The regression coefficients of CRISK1 are considerably positive at the 1% level, as shown in columns (2), (3), and (4). This suggests that the greater the CRISK, the higher the level of FIN. Conversely, the weaker the CRISK, the lower the FIN. In summary, when CRISK is higher, the enterprise will pursue investment projects with higher returns. The feature of “high risk and high return” of financial assets will strongly attract the attention of the enterprise. As a result, a company with a high CRISK will invest a larger percentage of its funds in financial assets, which will eventually result in a higher FIN. This outcome aligns with H1.

4.2 Robustness tests

Although the benchmark regression results prove a significant positive association between CRISK and FIN, their robustness deserves further investigation. To test the empirical results’ robustness, we replace the dependent and independent variables, cluster adjustment, propensity score matching (PSM), and instrumental variable methods.

4.2.1 Alternative indicator of FIN

Long-term equity investments in joint ventures and associates can be considered financial assets, per the China Accounting Standards for Business Enterprises. As such, the equity technique can be applied to account for them. In our adjusted definition of the dependent variable, “long-term equity investment” in financial assets was added. That is, long-term equity investment was added to the indicators to calculate FIN. Based on the above calculations, the new dependent variable was set to FIN_. Subsequently, the regression analysis was repeated. After substituting the FIN for the financial assets of the firms, Table 3’s column (1) presents the regression results.

4.2.2 Alternative indicator of CRISK

The extreme value of the rolling standard deviation of ROA was changed, denoted as CRISK2, as an independent variable for robustness. The outcomes of our rerun regression analysis are displayed in Table 3’s column (2).

4.2.3 Cluster adjustment

To control for issues related to heteroscedasticity, at the firm level, the study adjusts for standard error clustering. Heterogeneity analysis results are displayed in Table 3, column (3).

4.2.4 Propensity score matching

To address the endogeneity problem created by the counterfactual fact that firms are more risk-taking but are assumed to be less risk-taking, the study used the PSM approach to construct a counterfactual framework for analysis. The study matched the samples using the median of CRISK1. CRISK takes a value of one if it exceeds the median, and zero otherwise. Table 3’s column (4) shows the regression results after one-to-one matching.

4.2.5 Instrumental variable estimation

To address the endogeneity issue, instrumental variable estimation was employed, with the mean CRISK value of other companies operating in the same industry serving as the instrumental variable. To prevent an endogeneity issue with the control variables, we lagged all control variables by one period and regressed them using the 2SLS method. Column (5) of Table 3 presents the results.

The robustness test results are shown in Table 3. Our earlier findings are supported by the results in column (1), which demonstrates that the coefficient of CRISK1 on FIN is significantly positive at the 1% level. The findings in column (2) demonstrate that, at the 1% level, the coefficient of CRISK2 on FIN is likewise significantly positive, suggesting that the benchmark regression’s conclusion holds true. In column (3), the coefficient of CRISK1 is significantly positive at the 5% level, in line with the baseline regression. In column (4), the results show that the coefficient of CRISK1 on FIN is significantly positive at the 1% level, confirming the robustness of the regression findings after the endogeneity tests.

The results of the Kleiberger-Paap rk LM and Kleibergen-Paap rk Wald F indicate that there is no under-identification or weak instrumental variable problem, which indicates that the instrumental variable is reasonable. As shown in column (5), the coefficient of CRISK1 on FIN is significantly positive at the 10% level and consistent with the results of benchmark regression, indicating the robustness of the study’s findings.

4.3 Mediating effect

The study reveals a significant and robust positive association between CRISK and FIN based on the analysis above. Furthermore, by applying Models (2) and (3), the study introduced the variable of TQ to investigate the mediating effect between CRISK and FIN. Table 4 presents the results of the study.

Column (2) of Table 4 demonstrates that CRISK has a considerable impact on TQ’s value, with the regression coefficient of CRISK1 on TQ being significant at the 1% level. The results of column (3) show that TQ had a partially mediating impact because both CRISK1 and TQ’s coefficients are significant at the 1% level. Therefore, H3 is supported; changes in CRISK change the occurrence of TQ, which resultantly changes investment behavior and triggers changes in the FIN.

5 Heterogeneity analysis and moderating effect

5.1 Heterogeneity analysis

5.1.1 Heterogeneity analysis of the financing constraints

Financing constraints are important factors that affect CRISK. Higher financing constraints limit the firm’s ability to obtain external funds, increasing the firm’s default risk. Conversely, lower financing constraints make it simpler for firms to secure outside funding, which allows them to retain higher cash flows (Feng et al., 2023; Restrepo & Uribe, 2023). Firms with low financing constraints face lower default risk because of the reservoir effect of their financial assets. Contrarily, firms with high financing constraints may face more risks, such as share price collapse and performance decline (Demir, 2009). Therefore, in companies with significant funding restrictions, the impact of CRISK on FIN is more noticeable.

Regarding the measurement indexes of financing constraints, existing literature adopts three indexes: KZ, WW, and SA. As enterprise size and listing time are exogenous, both are important factors for banks to consider when providing loans to enterprises. This study chose the SA index to measure financing constraints. The following formula calculates the SA index:

where Size equals ln(total assets/1,000,000), and Age denotes the number of years that a company has been listed. A higher absolute number in the event that the SA index is negative denotes a greater level of financing constraints for the company, and vice versa.

As the SA index calculated for all samples was negative, the median of the absolute values of the SA index was used as the cutoff point for classifying high and low financing constraints. Financial restrictions are indicated by groups with values above the median as having significant financial constraints and those with values below the median as having minimal financial constraints. Table 5 displays the regression results for the two categorical samples in columns (1) and (2).

5.1.2 Heterogeneity analysis of industries

Compared with the non-manufacturing industries, the manufacturing industry undertakes more social production tasks and tends to have a larger share of fixed assets. The manufacturing industry typically has more fixed assets that are difficult to change and, thus, more likely to become stranded assets in times of transformation. Therefore, manufacturing firms face greater pressure to transform. Simultaneously, for better future development of firms, according to the rational man assumption, they are more likely to choose suitable financial assets to invest in based on their CRISK. In other words, the manufacturing sector exhibits a greater degree of CRISK’s influence on FIN than the non-manufacturing sector. The impact of CRISK on the FIN in the manufacturing and non-manufacturing sectors is displayed in Table 5’s columns (3) and (4), respectively.

Table 5’s columns (1) and (2) present the empirical findings about the influence of financial constraints on firms. When enterprises face greater financing constraints, CRISK1’s coefficients on FIN are strongly positive at the 1% level; however, when enterprises face less financing constraints, CRISK1’s coefficients on FIN are insignificant. Thus, H2a is supported. This shows that, in terms of corporate financing constraints, the more restrictions imposed, the harder it is to get a financial loan. This has a number of detrimental effects, such as decreasing the enterprise’s asset liquidity and raising the default risk. In other words, to avoid negative impacts in business situations when making financial investments, companies must invest in financial assets according to their CRISK (Addoum, 20201).

The heterogeneity analysis results for the industry are presented in columns (3) and (4) of Table 5. The coefficients of CRISK1 on FIN are significantly positive at the 1% level for the manufacturing industry. However, they are not significant for the non-manufacturing industry, which is consistent with H2b. In terms of industry division (manufacturing vs. non-manufacturing), CRISK has a more significant positive effect on the manufacturing industry’s FIN behavior. This may be because firms in the manufacturing industry tend to hold excessive real assets, especially in carbon-intensive manufacturing, and may face the risk of significant future asset depreciation in response to the transition to a green economy (Yao et al., 2021). Therefore, in the process of increasing manufacturing firms’ CRISK, they actively search for investment opportunities, causing them to invest in high-risk and higher-return financial assets to mitigate the risk of a future decline in TQ. Consequently, CRISK is more important for FIN in the manufacturing industry.

5.2 Moderating effect of CRT

Prior research suggests that the physical and transition risks arising from CRT affect firms’ profitability and CRISK. Climate risks can directly cause property damage to firms’ production facilities and increase the cost of goods sold and various types of expenses incurred by firms in coping with CRT (Pankratz et al., 2023). It can also reduce worker productivity and attendance (Somanathan et al., 2021). These factors can negatively affect firm development. Measures such as carbon taxes, carbon emission quotas, and carbon emission rights trading are often implemented to reduce CRT risks. Nevertheless, these negatively affect the future cash flows of carbon-intensive businesses. The risk of a decrease in the TQ of carbon-intensive firms is further increased by the introduction of new energy technologies (Hsu et al., 2023). Along with the increasing transition risks associated with CRT, carbon-intensive firms increase their financial asset reserves and may also increase their investments in financial assets to mitigate the repercussions of stranded assets. This uncertainty may influence the relationship between CRISK and FIN. Table 6 presents the regression results for CRISK, CRT, and FIN.

Columns (1) and (2) of Table 6 show the results for CRISK1 and its cross-multiplier with CRT (CRISK1×CRT1) for scenarios with and without control variables, respectively, in the direct transmission channel. The results show that the interaction term’s coefficient is significantly positive at the 1% level, indicating that CRT strengthens the relationship between CRISK and FIN. Therefore, H4a is supported. The global stranded value of fossil fuels is causing a loss of 1 to 4 trillion US dollars in global wealth as the threat of CRT continues to increase (Mercure et al., 2018). To prevent the risks associated with stranded assets, businesses will constantly decrease their reserves of such assets, which will result in more investment in financial assets. In the process of investing their funds in the financial field, enterprises will reasonably choose the proportion of financial investment according to their CRISK, to ensure their returns and long-term development.

In column (3) of Table 6, there is no significant moderating effect of Chinese investors’ attention on CRT in the indirect transmission channel. Therefore, H4b is supported. This may be because Chinese investors are less likely to consider the impact of climate factors on listed firms when making investments. Compared with the direct transmission pathway, investors focus more on such perspectives as corporate annual reports and popular sectors when investing in companies. CRT accounts for a smaller proportion of investor attention, making it harder to play a moderating role (Hao, 2023). In addition, there is a lack of a clear measure of the climate risks faced by Chinese firms, and firms’ disclosure of their high-carbon assets is not transparent or specific, which also weakens the moderating role of CRT2 between CRISK and FIN.

6 Conclusions and policy implications

6.1 Conclusions

The influence of CRT on financial stability and economic development has become a major worry for governments, businesses, and other stakeholders owing to the growing associated risks. This will undoubtedly have a significant effect on the business models and development of society in the future. Most existing research is based on a macro perspective on how CRT affects the financial sector. However, there are only a few studies on micro-financial changes of enterprises. So, it is difficult to quantify the impact of CRT on the operation of enterprises in-depth for enterprises and government regulators to better manage the risks of corporate operations, and to avoid the recurrence of extreme cases of over-financialization that lead to corporate bankruptcy because of the neglect of CRISK.

This study is based on the data of A-share non-financial listed companies from 2007 to 2022. The study explored the impact of CRISK on firms’ FIN, the mediating effect of TQ, and the moderating effect of CRT in the relationship between them.

The conclusions drawn from the analysis are as follows.

(1) CRISK can affect the level of FIN through TQ, and there is a positive relationship between them. Firms with strong risk-taking own more financial assets, whereas those with weak risk-taking hold fewer financial assets. (2) The effect of CRISK on FIN differs significantly among firms with different financing constraints and industry types. Specifically, CRISK has a more significant positive relationship with FIN under high financing constraints. Moreover, compared to non-manufacturing industries, CRISK has a more significant positive relationship with FIN behavior in the manufacturing industry. (3) As CRT uncertainty increases, in the direct transmission channel, the relationship between CRISK and FIN gradually strengthens. However, the indirect channel of transmission based on investors’ attention is not as effective.

6.2 Policy implications

These conclusions have critical policy implications.

-

1.

When making investments, businesses should judiciously distribute the percentage of real and financial assets invested based on their tolerance for risk to better manage the risks associated with CRT. In recent years, as the global economic situation has become increasingly tense, how to seek long-term good development in the economic winter has become an important issue facing enterprises. Enterprises should be very aware of the dangers they take on when pursuing greater financial returns because financial assets are known for their high risk and high return characteristics. On the one hand, enterprises should dynamically monitor their risk-taking level and regularly adjust their financial asset ratios according to their risk-taking ability. On the other hand, enterprises should strengthen ESG information disclosure and gradually complete green and low-carbon transformation to reduce the adverse impact of climate risk.

-

2.

Regulatory authorities must focus on controlling the FIN of highly finance-constrained manufacturing industries to avoid finance being diverted out of the real economy. The empirical findings demonstrate that enterprises with significant financial constraints and manufacturing enterprises are more significant, possibly because they are more susceptible to the impacts of asset depreciation. Therefore, regulatory authorities should differentially regulate firms’ FIN. Financial institutions can be encouraged to provide enterprises with appropriate preferences to alleviate their credit difficulties and other resource constraints. This can be done by increasing the amount of credit guarantees. Additionally, for manufacturing enterprises, the risk of loss due to a fall in asset values can be reduced by appropriately increasing the contractual scope and amount of property damage insurance.

-

3.

We should actively address the challenges posed by CRT and avoid fluctuations in CRISK and financial turbulence. First, in the process of mitigating CRT, relevant government departments should closely monitor the diverse effects of temperature and other climatic changes on enterprises’ development. Simultaneously, they should provide accurate and effective early warning mechanisms for CRT to ensure stable and high-quality economic development. Second, enterprises should closely observe CRT to avoid adverse impacts, such as an increase in the number of stranded assets and shrinking asset values, to ensure their risk-taking and enterprise value. Finally, financial institutions should be encouraged to develop green bonds, sustainable bonds, and other products to support the green transformation of enterprises. They should attempt to build a new ecology of sustainable development in the financial market to maintain its stability. There is currently no significant moderating effect of Chinese investors’ attention on CRT between firms’ CRISK and FIN. The Chinese government should make climate-related risk disclosure regulations for businesses more stringent to prevent potential hazards in the indirect channel and lessen knowledge asymmetry between investors and businesses.

6.3 Limitations

This study is among the first exploratory works to examine the impact of CRT on CRISK and FIN. However, this method has certain limitations, mainly from the following four points.

-

1.

While this study empirically tested the level of CRISK on the FIN of the enterprise, it is limited by the constraints of the theoretical model. Therefore, it cannot provide a clear-cut solution for enterprises on how to allocate their physical and financial assets according to their risk-taking level to maximize investment efficiency. However, the findings do suggest that companies should consider the impact of CRT-induced risks on their risk-taking behavior and FIN, and regulatory authorities should strengthen financial supervision on enterprises with high financing constraints and in the manufacturing industry.

-

2.

The impact of CRT is gradually expanding in scope, increasing in ways and deepening in degree, while this study explored only the direct impact of temperature change and the indirect impact of investors’ concern about CRT. This is not fully representative of the how the CRT situation has developed. In addition, the Baidu search index used in this study can only characterize individual investors, and cannot fully reflect the concerns of professional financial institutions.

-

3.

This study only investigated Chinese A-share listed companies, which cannot reflect the impact of the global issue of CRT on different countries and regions. For example, the studies of Amin et al. (2022); Wang et al. (2023a) on ASEAN countries and developing countries can provide heterogeneous recommendations for different country attributes. The empirical analyses in this study can hardly provide heterogeneous recommendations for different countries and regions.

-

4.

The majority of existing research on how CRT affects economic development is qualitative in nature. Empirical research models for CRT, including IAMs, DICE, and RICE, have disadvantages, such as ignoring the fact that policy formulation occurs at the national level, and the large differences in the geographic scope of countries (Nordhaus, 1992; Nordhaus & Yang, 1996). Therefore, the model should be further studied and optimized by the academic community in the future.

6.4 Recommendations for future research

Whether for China or globally, the impacts of CRT on the development of macroeconomics and micro-enterprises have considerable research space. There is currently insufficient research on how macroeconomics and microenterprises are affected by CRT. This study highlights the research gaps and proposes future research directions. Firstly, a quantitative model for CRISK and asset allocation can be developed. This model can assist firms in allocating their financial assets based on their risk-taking abilities, ultimately maximizing their investment efficiency. Second, we can improve the accuracy of climate risk measurement. To better understand physical risks related to CRT, we can work with government departments like the Meteorological Bureau to obtain more accurate climate data, such as temperature and wind speed. Additionally, to monitor changes in investor attention on transformation risk, we can use advanced methods like machine learning and neural networks to mine and analyze relevant text data from social networks, such as stock bar comments, microblogs, and tweets, in a more comprehensive and in-depth manner. Third, expand the scope of research objects. Based on the international trade perspective, the research sample is expanded from China’s A-share market to developing countries or even the global scope, and then compare the heterogeneous impacts of climate risk on developed and developing countries, oil-importing and exporting countries, and fossil fuel-dependent and renewable energy-dependent countries. Fourth, we can use artificial intelligence and large language models to optimize existing climate economic models to help governments formulate climate policies that are better aligned with their economic development, natural environment, and resource reserves.

Data availability

Data will be made available on reasonable request.

References

Abbasi, S., & Choukolaei, H. A. (2023). A systematic review of green supply chain network design literature focusing on carbon policy. Decision Analytics Journal, 6, 100189. https://doi.org/10.1016/j.dajour.2023.100189.

Abbasi, S., Daneshmand-Mehr, M., & Ghane Kanafi, A. (2023). Green closed-loop supply chain network design during the coronavirus (COVID-19) pandemic: A case study in the Iranian automotive industry. Environmental Modeling & Assessment, 28(1), 69–103. https://doi.org/10.1007/s10666-022-09863-0.

Abbass, K., Song, H., Khan, F., Begum, H., & Asif, M. (2022). Fresh insight through the VAR approach to investigate the effects of fiscal policy on environmental pollution in Pakistan. Environmental Science and Pollution Research, 1–14. https://doi.org/10.1007/s11356-021-17438-x.

Abbass, K., Qasim, M. Z., Song, H., Murshed, M., Mahmood, H., & Younis, I. (2022a). A review of the global climate change impacts, adaptation, and sustainable mitigation measures. Environmental Science and Pollution Research, 29(28), 42539–42559. https://doi.org/10.1007/s11356-022-19718-6.

Abbass, K., Song, H., Mushtaq, Z., & Khan, F. (2022c). Does technology innovation matter for environmental pollution? Testing the pollution halo/haven hypothesis for Asian countries. Environmental Science and Pollution Research, 29(59), 89753–89771. https://doi.org/10.1007/s11356-022-21929-w.

Addoum, J. M., Kumar, A., Le, N., & Niessen-Ruenzi, A. (2020). Local bankruptcy and geographic contagion in the bank loan market. Review of Finance, 24(5), 997–1037. https://doi.org/10.1093/rof/rfz023.

Agénor, P. R., & da Pereira, L. A. (2019). Global banking, financial spillovers, and macroprudential policy coordination. Economica, 90(359), 1003–1040. https://doi.org/10.1111/ecca.12475.

Amin, N., Shabbir, M. S., Song, H., & Abbass, K. (2022). Renewable energy consumption and its impact on environmental quality: A pathway for achieving sustainable development goals in ASEAN countries. Energy & Environment, 0958305X221134113. https://doi.org/10.1177/0958305X221134113.

Amin, N., Shabbir, M. S., Song, H., Farrukh, M. U., Iqbal, S., & Abbass, K. (2023). A step towards environmental mitigation: Do green technological innovation and institutional quality make a difference? Technological Forecasting and Social Change, 190, 122413. https://doi.org/10.1016/j.techfore.2023.122413.

Andersen, D. C. (2017). Do credit constraints favor dirty production? Theory and plant-level evidence. Journal of Environmental Economics and Management, 84, 189–208. https://doi.org/10.1016/j.jeem.2017.04.002.

Arizala, F., Cavallo, E., & Galindo, A. (2013). Financial development and TFP growth: Cross-country and industry-level evidence. Applied Financial Economics, 23(6), 433–448. https://doi.org/10.1080/09603107.2012.725931.

Barnett, M. D. (2019). A run on oil: Climate policy, stranded assets, and asset prices (Doctoral dissertation, The University of Chicago).

Barrot, J. N., & Sauvagnat, J. (2016). Input specificity and the propagation of idiosyncratic shocks in production networks. The Quarterly Journal of Economics, 131(3), 1543–1592. https://doi.org/10.1093/qje/qjw018.

Bolton, P., & Kacperczyk, M. (2021). Do investors care about carbon risk? Journal of Financial Economics, 142(2), 517–549. https://doi.org/10.1016/j.jfineco.2021.05.008.

Boubakri, N., Cosset, J. C., & Saffar, W. (2013). The role of state and foreign owners in corporate risk-taking: Evidence from privatization. Journal of Financial Economics, 108(3), 641–658. https://doi.org/10.1016/j.jfineco.2012.12.007.

Bowen, A., & Dietz, S. (2016). The effects of climate change on financial stability, with particular reference to Sweden. A report for Finansinspektionen (The Swedish Financial Supervisory Authority).

Briera, T., & Lefèvre, J. (2024). Reducing the cost of capital through international climate finance to accelerate the renewable energy transition in developing countries. Energy Policy, 188, 114104. https://doi.org/10.1016/j.enpol.2024.114104.

Campello, M., & Graham, J. R. (2013). Do stock prices influence corporate decisions? Evidence from the technology bubble. Journal of Financial Economics, 107(1), 89–110. https://doi.org/10.1016/j.jfineco.2012.08.002.

Chen, X., & Yang, L. (2019). Temperature and industrial output: Firm-level evidence from China. Journal of Environmental Economics and Management, 95, 257–274. https://doi.org/10.1016/j.jeem.2017.07.009.

Chen, Z., Zhou, M., & Ma, C. (2022). Anti-corruption and corporate environmental responsibility: Evidence from China’s anti-corruption campaign. Global Environmental Change, 72, 102449. https://doi.org/10.1016/j.gloenvcha.2021.102449.

Choi, D., Gao, Z., & Jiang, W. (2020). Attention to global warming. The Review of Financial Studies, 33(3), 1112–1145.

Cohen, G., Jalles, J. T., Loungani, P., Marto, R., & Wang, G. (2019). Decoupling of emissions and GDP: Evidence from aggregate and provincial Chinese data. Energy Economics, 77, 105–118. https://doi.org/10.1016/j.eneco.2018.03.030.

Cosemans, M., Hut, X., & Van Dijk, M. (2023). Climate change and long-horizon portfolio choice: Combining theory and empirics. WFA Meetings Paper. https://doi.org/10.2139/ssrn.3920481.

Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461–1499. https://doi.org/10.1111/j.1540-6261.2011.01679.x.

Demir, F. (2009). Financial liberalization, private investment and portfolio choice: Financialization of real sectors in emerging markets. Journal of Development Economics, 88(2), 314–324. https://doi.org/10.1016/j.jdeveco.2008.04.002.

Du, J., Li, C., & Wang, Y. (2017). A comparative study of shadow banking activities of non-financial firms in transition economies. China Economic Review, 46, S35–S49. https://doi.org/10.1016/j.chieco.2016.09.001.

El Ouadghiri, I., Guesmi, K., Peillex, J., & Ziegler, A. (2021). Public attention to environmental issues and stock market returns. Ecological Economics, 180, 106836. https://doi.org/10.1016/j.ecolecon.2020.106836.

Emrouznejad, A., Abbasi, S., & Sıcakyüz, Ç. (2023). Supply chain risk management: A content analysis-based review of existing and emerging topics. Supply Chain Analytics, 3, 100031. https://doi.org/10.1016/j.sca.2023.100031.

Feng, Y., Meng, M., & Li, G. (2023). Impact of digital finance on the asset allocation of small-and medium-sized enterprises in China: Mediating role of financing constraints. Journal of Innovation & Knowledge, 8(3), 100405. https://doi.org/10.1016/j.jik.2023.100405.

Gehringer, A. (2013). Growth, productivity and capital accumulation: The effects of financial liberalization in the case of European integration. International Review of Economics & Finance, 25, 291–309. https://doi.org/10.1016/j.iref.2012.07.015.

Gillan, S. L., Koch, A., & Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 66, 101889. https://doi.org/10.1016/j.jcorpfin.2021.101889.

Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60(2–3), 187–243. https://doi.org/10.1016/S0304-405X(01)00044-7.

Hao, J. (2023). Retail investor attention and corporate innovation in the big data era. International Review of Financial Analysis, 86, 102486. https://doi.org/10.1016/j.irfa.2023.102486.

He, F., Ding, C., Yue, W., & Liu, G. (2023). ESG performance and corporate risk-taking: Evidence from China. International Review of Financial Analysis, 87, 102550. https://doi.org/10.1016/j.irfa.2023.102550.

Hirshleifer, D., Subrahmanyam, A., & Titman, S. (2006). Feedback and the success of irrational investors. Journal of Financial Economics, 81(2), 311–338. https://doi.org/10.1016/j.jfineco.2005.05.006.

Hong, H., Li, F. W., & Xu, J. (2019). Climate risks and market efficiency. Journal of Econometrics, 208(1), 265–281. https://doi.org/10.1016/j.jeconom.2018.09.015.

Hsu, P. H., Li, K., & Tsou, C. Y. (2023). The pollution premium. The Journal of Finance, 78(3), 1343–1392. https://doi.org/10.1111/jofi.13217.

John, K., Litov, L., & Yeung, B. (2008). Corporate governance and risk-taking. The Journal of Finance, 63(4), 1679–1728. https://doi.org/10.1111/j.1540-6261.2008.01372.x.

Koirala, S., Marshall, A., Neupane, S., & Thapa, C. (2020). Corporate governance reform and risk-taking: Evidence from a quasi-natural experiment in an emerging market. Journal of Corporate Finance, 61, 101396. https://doi.org/10.1016/j.jcorpfin.2018.08.007.

Lee, C. C., Zeng, M., & Luo, K. (2024). How does climate change affect food security? Evidence from China. Environmental Impact Assessment Review, 104, 107324. https://doi.org/10.1016/j.eiar.2023.107324.

Li, Z., & Rainville, M. (2021). Do military independent directors improve firm performance? Finance Research Letters, 43, 101988. https://doi.org/10.1016/j.frl.2021.101988.

Li, Y., & Zhang, Z. (2023). Corporate climate risk exposure and capital structure: Evidence from Chinese listed companies. Finance Research Letters, 51, 103488. https://doi.org/10.1016/j.frl.2022.103488.

Liu, X., & Liu, F. (2022). Environmental regulation and corporate financial asset allocation: A natural experiment from the new environmental protection law in China. Finance Research Letters, 47, 102974. https://doi.org/10.1016/j.frl.2022.102974.

McLean, R. D., & Zhao, M. (2014). The business cycle, investor sentiment, and costly external finance. The Journal of Finance, 69(3), 1377–1409. https://doi.org/10.1111/jofi.12047.

Mercure, J. F., Pollitt, H., Viñuales, J. E., Edwards, N. R., Holden, P. B., Chewpreecha, U., & Knobloch, F. (2018). Macroeconomic impact of stranded fossil fuel assets. Nature Climate Change, 8(7), 588–593. https://doi.org/10.1038/s41558-018-0182-1.

Naeem, K., & Li, M. C. (2019). Corporate investment efficiency: The role of financial development in firms with financing constraints and agency issues in OECD non-financial firms. International Review of Financial Analysis, 62, 53–68. https://doi.org/10.1016/j.irfa.2019.01.003.

Nakano, M., & Nguyen, P. (2012). Board size and corporate risk taking: Further evidence from Japan. Corporate Governance: An International Review, 20(4), 369–387. https://doi.org/10.1111/j.1467-8683.2012.00924.x.

Nguyen, P. (2011). Corporate governance and risk-taking: Evidence from Japanese firms. Pacific-Basin Finance Journal, 19(3), 278–297. https://doi.org/10.1016/j.pacfin.2010.12.002.

Nordhaus, W. D. (1992). An optimal transition path for controlling greenhouse gases. Science, 258(5086), 1315–1319. https://doi.org/10.1126/science.258.5086.1315.

Nordhaus, W. D., & Yang, Z. (1996). A regional dynamic general-equilibrium model of alternative climate-change strategies. The American Economic Review, 741–765. http://www.jstor.org/stable/2118303.

Nurunnabi, M. (2016). Who cares about climate change reporting in developing countries? The market response to, and corporate accountability for. Climate Change in Bangladesh Environment Development and Sustainability, 18, 157–186. https://doi.org/10.1007/s10668-015-9632-3.

Orhangazi, Ö. (2008). Financialisation and capital accumulation in the non-financial corporate sector: A theoretical and empirical investigation on the US economy: 1973–2003. Cambridge Journal of Economics, 32(6), 863–886. https://doi.org/10.1093/cje/ben009.

Pankratz, N., Bauer, R., & Derwall, J. (2023). Climate change, firm performance, and investor surprises. Management Science. https://doi.org/10.1287/mnsc.2023.4685.

Restrepo, N., & Uribe, J. M. (2023). Cash flow investment, external funding and the energy transition: Evidence from large US energy firms. Energy Policy, 181, 113720. https://doi.org/10.1016/j.enpol.2023.113720.

Sahay, R., Čihák, M., N’Diaye, P., & Barajas, A. (2015). Rethinking financial deepening: Stability and growth in emerging markets. Revista De Economía Institucional, 17(33), 73–107. https://doi.org/10.18601/01245996.v17n33.04.

Somanathan, E., Somanathan, R., Sudarshan, A., & Tewari, M. (2021). The impact of temperature on productivity and labor supply: Evidence from Indian manufacturing. Journal of Political Economy, 129(6), 1797–1827. https://doi.org/10.1086/713733.

Tian, J., & Sun, H. (2023). Corporate financialization, internal control and financial fraud. Finance Research Letters, 104046. https://doi.org/10.1016/j.frl.2023.104046.

Tian, G., Li, B., & Cheng, Y. (2022a). Bank competition and corporate financial asset holdings. International Review of Financial Analysis, 84, 102391. https://doi.org/10.1016/j.irfa.2022.102391.

Tian, G., Li, B., & Cheng, Y. (2022b). Does digital transformation matter for corporate risk-taking? Finance Research Letters, 49, 103107. https://doi.org/10.1016/j.frl.2022.103107.

Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money Credit and Banking, 1(1), 15–29. https://doi.org/10.2307/1991374.

Wahab, F., Khan, M. J., Khan, M. Y., & Mushtaq, R. (2023). The impact of climate change on agricultural productivity and agricultural loan recovery; evidence from a developing economy. Environment Development and Sustainability, 1–14. https://doi.org/10.1007/s10668-023-03652-9.

Wang, S., & Chen, H. (2022). Could Chinese enterprises real benefit from embedding in global value chains? Environment Development and Sustainability, 1–30. https://doi.org/10.1007/s10668-022-02348-w.

Wang, S., Tian, W., & Lu, B. (2023). Impact of capital investment and industrial structure optimization from the perspective of resource curse: Evidence from developing countries. Resources Policy, 80, 103276. https://doi.org/10.1016/j.resourpol.2022.103276.

Wang, H., Sun, K., & Xu, S. (2023a). Does Housing Boom Boost Corporate Financialization?—Evidence from China. Emerging Markets Finance and Trade, 59(6), 1655–1667. https://doi.org/10.1080/1540496X.2022.2138702.

Wen, F., Li, C., Sha, H., & Shao, L. (2021). How does economic policy uncertainty affect corporate risk-taking? Evidence from China. Finance Research Letters, 41, 101840. https://doi.org/10.1016/j.frl.2020.101840.

Wu, Y., & Huang, S. (2022). The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China’s new energy enterprises. Energy Economics, 112, 106158. https://doi.org/10.1016/j.eneco.2022.106158.

Wu, K., & Lu, Y. (2023). Corporate digital transformation and financialization: Evidence from Chinese listed firms. Finance Research Letters, 57, 104229. https://doi.org/10.1016/j.frl.2023.104229.

Xian, B., Xu, Y., Chen, W., Wang, Y., & Qiu, L. (2024). Co-benefits of policies to reduce air pollution and carbon emissions in China. Environmental Impact Assessment Review, 104, 107301. https://doi.org/10.1016/j.eiar.2023.107301.

Xu, S., & Guo, L. (2023). Financialization and corporate performance in China: Promotion or inhibition? Abacus, 59(3), 776–817. https://doi.org/10.1111/abac.12213.

Xu, H., Lin, K., & Qiu, L. (2023). The impact of local government environmental target constraints on the performance of heavy pollution industries. Sustainability, 15(22), 15997. https://doi.org/10.3390/su152215997.

Yao, S., Pan, Y., Sensoy, A., Uddin, G. S., & Cheng, F. (2021). Green credit policy and firm performance: What we learn from China. Energy Economics, 101, 105415. https://doi.org/10.1016/j.eneco.2021.105415.

Zhang, P., Deschenes, O., Meng, K., & Zhang, J. (2018). Temperature effects on productivity and factor reallocation: Evidence from a half million Chinese manufacturing plants. Journal of Environmental Economics and Management, 88, 1–17. https://doi.org/10.1016/j.jeem.2017.11.001.

Zhao, Y., & Su, K. (2022). Economic policy uncertainty and corporate financialization: Evidence from China. International Review of Financial Analysis, 82, 102182. https://doi.org/10.1016/j.irfa.2022.102182.

Zhao, C., Dong, K., Wang, K., & Nepal, R. (2024). How does artificial intelligence promote renewable energy development? The role of climate finance. Energy Economics, 107493. https://doi.org/10.1016/j.eneco.2024.107493.

Zhou, M., Jiang, K., & Chen, Z. (2022). Temperature and corporate risk taking in China. Finance Research Letters, 48, 102862. https://doi.org/10.1016/j.frl.2022.102862.

Zivin, J. G., Song, Y., Tang, Q., & Zhang, P. (2020). Temperature and high-stakes cognitive performance: Evidence from the national college entrance examination in China. Journal of Environmental Economics and Management, 104, 102365. https://doi.org/10.1016/j.jeem.2020.102365.

Funding

This study was funded by the Social Science Planning Project of Shandong Province (Grant number 23CJJJ20).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Qiguang An, Lin Zheng and Mu Yang. The first draft of the manuscript was written by Lin Zheng and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Compliance with ethical standards

Not applicable.

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zheng, L., An, Q. & Yang, M. Climate change, corporate risk-taking, and financialization: evidence from Chinese A-share non-financial listed companies. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-05045-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-024-05045-y