Abstract

The circular economy (CE) has recently gained attention as a key transformative strategy. However, as with previous transformation processes, the transition towards the CE is not a smooth process since there are underlying structural tensions in incumbent systems that need to be overcome. One industry that is currently undergoing transformative pressure is the automobile industry where the transition to electric vehicles that use lithium-ion batteries is creating structural tensions. In this paper, we adopt a multi-actor perspective and analyze the strategies that different actors pursue to manage the structural tensions that are induced by the transition towards lithium-ion batteries with the goal of creating and sustaining a closed-loop supply chain (CLSC) model. Through a case study of the key actors (mining firms, material manufacturers, vehicle manufacturers, and recyclers), we reveal the particularities of managing structural tensions which are influenced by temporal, spatial, and contextual factors. We demonstrate our claim by first expanding the application boundary of the concept of structural tensions to show the interconnection between strategic choices made by actors at operational and technological levels; and second, unfolding the dynamics of managing structural tensions in the CE transitions from a multi-actor perspective. The results of this study may support industrial actors to achieve a better understanding of the consequences of their short- and long-term CE transition strategies, and resolve conflicts in visions and priorities during the transition process.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Ecological limits and the impact of climate change have increased the urgency of transforming and restructuring the current industrial systems. As argued by classic theories on transformation processes [17] (Dahmén 1950; Dosi 1982; Dosi et al. 2000; Hughes 1992; Tushman and Anderson 1997; Schumpeter 1934), industrial and technological changes are preceded by the presence of transformative pressure with both opportunities and challenges for incumbent actors. In recent years, the circular economy (CE) model has become a key transition strategy to mitigate climate change and contribute to sustainable development. However, this transition is far from straight forward since there are structural tensions that need to be identified, addressed, and managed. An example of an ongoing structural tension is the current transition to electric vehicles (EVs) that is enabled by various interrelated technological innovations, chiefly high-voltage lithium-ion battery technologies. The transition to electric vehicles concerns not only battery technological development, but also the creation of circular material systems, where the emergence and sustention of a closed-loop supply chains (CLSC) is viewed as crucial in order to secure the supply of EV batteries (Midema and Moll 2013). In this context, the incumbent actors, such as mining companies, material, battery, vehicle manufacturers, and recyclers are faced with the challenge of managing structural tensions in more complex circumstances compared to the typical transitions that are solely driven by the dynamics of technological development.

A numbers of studies on the development of circular material systems for EV batteries have recently emerged. Most of these are based on the principles of the CE, where the notion of CLSC takes centre stage (see e.g., [2, 19, 58, 64]. From an operational perspective, for instance, some studies investigate the impact of actors’ circular strategies in the development of a circular EV battery value chain [2], essential infrastructures for the EV battery CLSC [48], opportunities and challenges in adopting innovative business models that capture economic value from extending batteries’ life cycle [56, 57], and the strategic alignment of actors in the development of high-performance technologies for battery end-of-life (EOL) management [46, 54]. Other studies discuss the influence of various actors on the transition from internal combustion engine (ICE) to EVs tend to focus on a variety of aspects which influence the dynamics of technological change from a socio-technological standpoint. Generally, these studies analyze the role of incumbent actors on the transition process, or focus on issues around transition perceptions and strategies (see for example, [5, 7, 55, 73].

All together these studies have broadened our understanding of the diverse and sometimes conflicting strategic choices made by incumbent actors during the transition process (see for example, [4], Mossel et al. [47]). Nonetheless, to the best of our knowledge, there is still a need to identify and understand how incumbent actors along the value chain of the emerging lithium-ion batteries address structural tensions and steer and manage them properly. While the identification of the structural tensions affecting particular actors has been explored, both conceptually and empirically, in some socio-technical transition studies [16, 26, 42] as well as in some CE studies [15, 67], a comprehensive and holistic view that is grounded empirically in a multi-actor perspective is lacking in the extant literature.

Against this backdrop, the overall aim of this paper is to explore the management of structural tensions in the transition to the CE and the development of a CLSC of EV lithium-ion batteries. In doing so, we revisit the concept of structural tensions, which initially emerged from technology and innovation studies but which today is useful in understanding the transition to the CE. We seek to identify the triggers of structural tensions, and analyze how the various incumbent actors perceive these tensions as well as discuss the strategies they adopt to steer the CE transition.

Accordingly, we pose the following research question:

-

How do incumbent actors manage structural tensions in the transition to the CE of EV lithium-ion batteries?

Guided by the above question, we conducted a case study covering key actors along the entire value chain of lithium-ion batteries, which include mining companies, a material manufacturer, EV manufacturers, a recycler, an automotive extended producer responsibility (EPR) organization, a legal body, and a policy-making body. The findings point to three interrelated aspects of managing structural tensions: (i) actors have to overcome various structural tensions at different levels, which are interconnected and influence each other simultaneously; (ii) efforts to mitigate structural tensions are not necessarily aligned between different supply chain actors and may in some cases conflict with each other; and finally, (iii) the weakest and most passive actors in the supply chain, who are unable to eliminate structural tensions, paradoxically have a strong influence on the pace and direction of the transition process. Moreover, the result of this study demonstrates that actors’ perception of structural tensions in the transition to the CE of EV lithium-ion batteries is influenced by temporal, spatial, and contextual factors.

The remainder of the paper is organized as follows. The “Circular Economy and Structural Tensions” section presents the concept of structural tension and discusses how this concept is viewed in socio-technical transition and CE studies. In the “Methodology” section, we describe the methodology used for this study. In the “Findings” section, we present the findings, focusing on structural tensions in the value chain of EV lithium-ion batteries, how the tensions are perceived by actors, and the strategies they pursue. In the “Discussion” section, we analyze and discuss the findings, while the “Conclusions” section concludes the paper.

Circular Economy and Structural Tensions

The CE is currently the most influential paradigm-altering phenomenon that is argued to mitigate climate change and realize sustainable development goals [61]. The idea of circularity of materials and reliability of renewable energies are the backbone of industrial transformation towards the CE. The transition towards the CE poses transformation pressure on industries and demands a wide range of radical changes in the existing industrial systems. In the literature, there have been attempts to identify and characterize the transition to the CE at different system levels (micro-meso-macro) (e.g., [14, 50, 51]. The transformation towards a CE paradigm is also related to the other building blocks of the CE such as circular design, business models, reverse network management, and system enablers and the interplay of these [30]. At the micro-level, companies are expected to change their business models, product designs, supplier-customer relationships, and comply with new environmental regulations. However, as discussed in several case studies (see for example, [1, 12, 22, 31, 33], the implementation of these changes is not a smooth process. These studies have identified a number of challenges that companies have to overcome in order to capitalize on the business opportunities that are brought by the CE. One challenge relates to unclear long-term economic benefits of CE business models and low efficiency of new technologies. Another challenge concerns uncertainties in the selection of the appropriate technologies that are ready, reliable, and aligned with the existing infrastructure and standard process designs. A further challenge relates to the selection of product materials in the design phase that fit with long-term and short-term product reusability requirements, integration of innovative design concepts into existing production system, and the lack of cost and risk sharing among stakeholders via strategic partnerships. In addition, there are challenges that could be sourced to conflicts of interest among actors and the absence of supporting policies to provide comprehensive guidelines and incentives for trading reused products and recycled materials. It is worth mentioning that the list of challenges of transition to the CE is unique for different industries, sectors, and companies.

Structural Tensions

In any transformation process such as the current one towards the CE, structural tensions are inevitable, as argued decades ago by Schumpeter (1939) and Dahmén (1950). Industrial and technological transformations generally create both positive and negative transformation pressures which turn into imbalances and disequilibria in the prevailing system. Generally, transformation pressure is a double-edged sword. On the one hand, it provides incentives to new actors, that is, opportunities for new business domains. On the other hand, it creates challenges for actors in finding ways to survive in a changing business environment. The notion of structural tensions was first introduced by the Swedish economist Erik Dahmén (1950) when analysing Swedish industrial transformation during the interwar period. It bears resemblance to what Thomas Hughes (1983) calls “salient” and “reverse salient”, which is based on the misalignments and the frictions that arise during the transformation of the incumbent socio-technical system. In recent years, scholars of socio-technical transition have discussed the nature of structural tensions in giving rise to uneven development of complementarities in different stages of the transformation process [3, 20, 21, 26, 45, 53]. Overall, structural tensions can be identified and analyzed at several levels, such as organizational-industrial-institutional, technological-organizational, ethical-normative, and behavioural [32, 53]; Dahl and Markard [16]. Also, the socio-technical transition perspective (e.g., Geels 2002) identifies the primary sources of tensions as uneven evolution and misalignment among the actors within the system, where transformative pressures are created by landscape actors and complexity in the socio-technical regime. In short, structural tensions may be attributed to three levels:

The organizational-technological level concerns the incumbents’ ability to deal with the complexity of making strategic decisions and managing ambidexterity, the exploitation of existing accumulated knowledge (e.g., technology, infrastructure and intangible resources), and the exploration of new business opportunities [53] (e.g., Tushman and Anderson 1997; Schumpeter 1934). This is in line with the notion of “dynamic capability of a regime” [69] which is linked to the incumbents’ ability to balance the elimination of tensions created by structural changes and the discontinuity of the dominant design (Utterback and Abernathy 1975; Tushman and Anderson 1997; Reilly and Tushman 2008; Winter 2003).

The actor interrelationships level is where tensions arise among established economic actors due to conflicting expectations, interests, and strategic choices. Incumbent actors have multiple identities and participate with different modes of engagement in the transition process. Some actors take on the role of supporter groups that tend to employ exploration strategies. Others become resistant and might ignore emerging socio-technical systems, adopting a “watch and wait” approach. These conflicting strategic behaviours create misalignments and tensions, and may result in even supporters of the transition having conflicting expectations and visions about the transition itself (Bakk 2014; Budde et al. 2012).

There is also the institutional level, where external pressures from the landscape and disruptive changes in societal and cultural preferences, as well as changes in market orientations, can create tensions and disrupt existing equilibria in the dominant regime [32].

Strategies and Mitigation of Structural Tensions

In order to achieve successful transformations [17, 18], it is essential to eliminate structural tension. This is particularly true where there exist negative transformation challenges as well as opportunities from which to benefit (e.g., a set of innovation-derived opportunities for increasing the performance of the entire industry) as a result of structural tensions [21, 26, 52]. Mitigation of structural tensions can be enabled by actors’ successful reinvestment strategies in connected and aligned technologies, complementary innovations, changing organizational configurations, marketing strategies, loosening capital market facilitating for the expansion of specific firms and industries, and access to R&D infrastructure and skilled labour. Here it is important to mention that actors’ perceptions of the transition process may lead to wrong investments and poor choice of strategies regarding structural tensions [73] (see Bergek et al. 2013; Fischer and Newig 2016, Steen and Weaver 2017). In this context, actors’ perceptions and interventions are influenced by how much of their business revolves around elements within the current socio-technical system, such as infrastructure, dominant technologies, and regulations.

Actors perceive structural tensions in the transition process differently, and their perceptions change over time as they constantly assess whether the transition involves negative repercussions and threats to their current business models, resources, and capabilities, or brings new opportunities for building a competitive advantage in the dominant system (Farla et al. 2012). For instance, Bakk (2014) categorizes actors’ interests into short term and long term, based on their collective and individual expectations regarding the emerging socio-technical system. Moreover, van Mossel et al. [47] build on organization theories to conclude that at different stages of the transition, incumbent firms display different modes of behaviour: they are the first to enter the niche; then follow into the niche; remain inert; and delay the transition. It can be said that the complex mechanisms that drive the transition process are strongly influenced by the strategies adopted by established actors to overcome the structural tensions, which can be viewed as either stabilization or destabilization mechanisms during the transition process. Figure 1 provides a summary of transition studies concerning the sources and the levels of structural tensions, and the types of strategies that actors adopt to manage these tensions.

Structural Tensions in the Context of Circular Material Systems

Structural tensions and their management is of uttermost importance in the transition toward circular economy (CE), an emerging economic model that is based on restoration and regeneration of energy and natural resources, where the formation of CLSC plays a key role (see for example, [10, 40]). The CE may be viewed as an evolutionary economic paradigm that is expected to alter the conventional linear production and consumption model of the current industrial-economic system (see for example, [35, 35, 36, 36], Chirazyfard et al. 2020). The main principles of the CE are minimizing material and energy consumption, reusing them to the extent that is economically and environmentally feasible, and finally implementing appropriate product end-of-life management solutions which boils down to a set of principles known as R strategies (e.g., 6Rs: reuse, recycle, redesign, remanufacture, reduce, recover) [9, 34, 62]. Although criticized for being unclear and fuzzy [29, 35, 36], the CE has been widely adopted by firms to explore its economic, social, and environmental benefits. Some studies on innovation and industrial transformation (e.g., [15, 67]) argue that the transition toward CE may be viewed as creating structural tensions within the established linear economic system that push radical structural changes at various levels, in particular at the supply-chain level.

Several studies have attempted to explore the impacts of the transition to the CE at the supply chain level. For instance, the recent studies by Braz et al. [10] and Berlin, Feldmann, and Nuur [8] explore different CE supply chain network configurations, such as closed loop supply network. The establishment of CLSC models is at the heart of the CE, since the focus is on developing circular supply chains with the goal of extending and reclaiming the economic value of products throughout their lifecycle. The most cited definition of CLSC management is the “design, control, and operation of a system to maximize value creation over the entire life cycle of a product with dynamic recovery of value from different types and volumes of returns over time” (Guide Jr & Van Wassenhove, 2010, p. 345). The CLSC is a system consisting of a forward and reverse supply chain controlled by a group of actors along the value chain. These are mainly material producers, manufacturers, customers, reverse logistics providers, and EOL treatment firms (e.g., repairing, reusing, refurbishing, remanufacturing and lastly, recycling). In addition to economic incentives (see for example, [74], the evolution of the CLSC has been prompted by legislation such as extended producer responsibility (EPR) and the European Commission’s directives on vehicle EOL (2000/53/EC) and battery EOL (2006/66/EC) (Heydari et al., 2017).

Overall, structural tensions within CLSC may be related to a variety of issues, including market and demand uncertainties, customer acceptance and participation in product acquisition, lack of required infrastructure, unclear and conflicting regulations at national and international levels, and lack of technical and operational capabilities [27, 40]. Of course, actors perceive these tensions differently, depending on their position along the value chain [10], their business capabilities, and their business dependencies on the other actors’ resources and capacities (Bouzon et al., 2018). In responding to these tensions, firms seek to employ various strategies and create economic value by integrating the CLSC into their core businesses (Larsen et al., 2018). For instance, designing for waste minimization, disassembling, adding new business activities to the previous business model, and expanding collaboration with other actors are examples of strategies that actors employ to overcome the tensions and the complexity of developing a CLSC model [8, 63, 75].

Methodology

Research Design

This study is based on a case-study research approach which allows for understanding and exploring complex phenomena (Bent 2006; Yin 2014). In this study, we have adopted a value-chain perspective to identify the leading actors in the emerging landscape of lithium-ion batteries for EVs.

We commenced the study by having initial discussions with the key actors along the value chain, starting with those extracting the raw materials in the production of lithium-ion batteries, and with recyclers. We also participated in industrial seminars in order to gain a better understanding of the business ecosystem and consequently identify the leading firms along the lithium-ion battery value chain. For the purposes of our study, we identified the main industrial actors as mining companies, material manufacturers, cell/battery producers, vehicle manufacturers, and battery recyclers (see Table 1). These actors are engaged in several processes along the value chain, and thus, the ecosystem is a complex one; for instance, material manufacturers might be involved in recycling as well. Although we attempted to cover the whole value chain, we did not succeed in collecting relevant data on battery-pack manufacturers. This limitation was mostly due to the limited numbers (mostly battery pack manufacturers) of high-voltage lithium-ion battery manufacturers in Europe, which is the geographical context of our study.

Following the initial contact and discussions, we considered two main criteria for case selection. First, the companies should be positioned along the lithium-ion battery value chain in Europe, or considering such a position. Second, we focused on incumbent firms in the vehicle-battery sector, such as those involved in mining natural graphite, recyclers of lithium-ion batteries, and global vehicle manufacturers. To present a holistic picture of the ecosystem, interviews with one EPR company (collector, reverse logistic service provider) and legal and policy-making bodies at the European level were conducted. This choice is motivated by our study’s aim to enhance understanding of the system by implementing a multi-actor perspective.

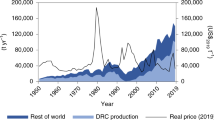

As shown in Figs. 2, and 3, we focus on five main stages in the value chain of lithium-ion vehicle batteries. MC1 and MC2 are mining companies, which also process raw materials. MC2 is one of the largest mining companies in Europe and produces metals, such as lead, zinc, nickel, and copper. MC1 is engaged in lithium-ion production. It mainly produces graphite from graphitic rock, which is the raw material of the anode part of lithium-ion batteries. At the time of our data collection, MC1’s business was limited to the production of graphite, but it has recently announced the discovery of new mineral reserves of lithium in Europe. MC3 is one of the largest and oldest global suppliers of lithium carbonate and lithium hydroxide. It is involved in lithium-mining operations, encompassing chemical processing of lithium carbonate and lithium hydroxide. Cell-component manufacturers, including cathode-active material manufacturers, are positioned in the third stage of the lithium-ion battery value chain, linking mining/refining companies to cell/battery producers. MM is a cathode-active material producer and a recycler of battery metals. EVM1 and EVM2 are two of the largest vehicle manufacturers in Europe for both domestic and international markets; EVM1 launched the production of EVs in 2008 and EVM2 its first hybrid product in 1997 and full battery electric product in 2019. RC1 is a recycler of both low-grade and high-grade cobalt portable lithium-ion batteries in Europe. It receives used batteries mainly from Northern Europe and processes them by crushing, mechanical separation, and then metal concentration (cobalt, copper, and iron), which are sold as raw materials to metal refineries. Recently, RC1 has also been assessing investments in recycling facilities for EV lithium-ion batteries in Europe. Similarly, RC2 is a recycler of lead from used lead-acid batteries and is looking at a potential business expansion to include the recycling of lithium-ion batteries.

Research Context

Historically, the electric engine was among many technological options in the first years of experimentation of the automotive industry; however, it did not become the dominant design back then [7, 11]. In recent years, there has been a shift to alternative kinds of fuel systems, including hybrid (Heffner et al. 2007) and full electric vehicles (EVs) (see for example, Groenewald et al. 2017; Nykvist and Nilsson 2015). From 2010 onwards, the production of lithium-ion batteries for EVs has been growing at 26% annually, and the trend is increasing [70]. It is anticipated that by 2022, the global production capacity of these batteries will be 2.5 to 4 times higher than 2018, and by 2040, the global demand is expected to exceed €200 bn/year in value (Bobba et al. 2018). All these figures point to lithium-ion battery technology becoming the dominant battery technology for EVs (Budde-Meiwes et al. 2013; Groenewald et al. 2017).

Similar to other emerging technologies, the technological shift to lithium-ion batteries is characterized by several challenges, such as limited supply of critical materials (Grosjean et al. 2012; Speirs and Contestabile 2018), high price in the market [43], competition among leading actors over the dominant design, and lack of infrastructure for EOL management (Zeng et al. 2014). The high economic value of the metals inside lithium-ion batteries, material supply security, and environmental obligations (e.g., Regulation (EU) 2019/631) have put the concept of closing the loop of this product on the agenda of the key actors [28, 71]. This means that lithium-ion batteries are expected to emerge from within a closed-loop system [66]. However, the complexity of this technology at product level (e.g., design and performance) and an unestablished industry value chain results in various uncertainties. These include volatile economic value of elements (e.g., cobalt), battery degradation and health state [60] (Harlow et al. 2019), unpredictable return volume of the batteries [49], inconsistencies in transportation regulations at international level, lack of operational experience and viable business models for remanufacturing and second-life applications [57, 66, 76], and lack of recycling technologies deployed at industrial scale [38, 39, 44, 59]. Moreover, the implementation of a CLSC for EV batteries has been associated with high transportation and battery-handling costs as well as with increased negative environmental impacts [65]. In a nutshell, the current economic and technological challenges of the emerging lithium-ion battery CLSC constitute a complex transition. This circumstance is by itself an important factor, making the emergence of a CLSC for lithium-ion batteries protracted and problematic.

Data Collection and Analysis

In this study, we opted for a case-study research design which is a multidimensional investigation that does not follow a linear path (Silverman 2013). Hence, we collected data via various methods, including participant fieldwork, observations (Spradley 1980), notetaking, interviews (Yin 2014), and participation in industrial seminars. Due to the emergent nature of the EV industry and battery technologies, we relied on multiple data sources to enhance the reliability of our findings (Yin 2003). We collected secondary data, including newspaper articles and policy reports. The data collection process started with three initial discussions with experts (e.g., EV and energy experts) and representatives of firms that are actively involved in the lithium-ion business ecosystem. The main agenda of the discussions was to understand the challenges and opportunities that the participants had experienced as a result of the emerging technological shift. The system perspective on the value chain of batteries for electro-mobility in Europe was the outcome of a 2-week observation of the whole value chain of lithium-ion batteries, organized by EITRACE2019 between 18 and 31 August 2019 (Raw Materials & Circular Economy Expedition, future e-mobility). Direct observations through field visits covered all four main stages of the value chain: exploration and mining at Outokumpu (Finland), design and manufacturing at Audi (Germany), use and consumption at CIC Rotterdam (the Netherlands), and finally, closing the loop via recycling at Umicore (Belgium).

Furthermore, to gain a better understanding of this complex business ecosystem, we conducted 13 semi-structured interviews with the leading actors along the value chain of lithium-ion batteries. The interviewees belonged to three mining companies, two EV manufacturers, two recyclers, one material manufacturer, one automotive EPR organization, one legal body, and one policy body. Table 2 provides information about the interviews and other sources of collected data. The interviews were recorded with the consent of the interviewees. Each interview lasted approximately 1 h. We used a semi-structured interview protocol with open-ended questions, complemented by follow-up questions during the interviews (e.g., asking specific questions as well as repeating questions).

Following the aim of the study and the type of collected data, thematic analysis (TA) or top-down analysis (Anderson et al. 2014) was used to analyze the empirical data. This analytical approach provides more detail on certain aspects of the data, which are related to the theoretical background of the study. Compared to techniques for analysing qualitative data, such as Gioia methodology (Gioia and Chittipeddi 1991), TA is more aligned with the research question of the study, which does not aim at generating grounded theory.

The process of data analysis started with familiarizing ourselves with the part of the data with particular features to interpret through the lens of transition theories in order to identify structural tensions that are perceived by the actors along the value chain of EV lithium-ion batteries. The nature of our data revealed that the uncertain availability of some metals and other critical materials is the major concern of all actors in terms of structural tensions. Accordingly, we focused on two approaches actors use to secure the availability of the essential metals: one, the extraction of raw materials, and two, aiming at circularity of the minerals via implementation of CLSC. Second, we identified the sources of tensions in each of the two approaches, and the different actors’ perceptions of and strategic decisions to overcome them. The third and last step was to understand the dynamics of transition mechanisms that are influenced by actors’ behaviour. The result of our analysis helped us to structure the findings section as well as discuss and answer the research question of this study.

Findings

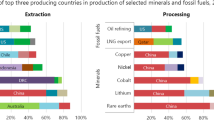

The technological diffusion of high-voltage lithium-ion batteries for EVs is tied to the necessity to develop a dedicated CLSC system. All of the value-chain actors viewed the availability of raw materials as the main bottleneck that creates uncertainty for the development and diffusion of the dominant design of lithium-ion batteries for EVs. Accordingly, in this section, we present the structural tensions that are involved in the extraction of primary minerals and in the CLSC of minerals in Europe.

Structural Tensions in Mining and Extraction of the Minerals

Due to increasing demand for lithium-ion batteries (from 0.5 GW-h in 2010, to roughly 526 GW-h in 2020 [13]), the industry needs to rely on both secondary and primary minerals, particularly because some of the minerals that are used to produce lithium-ion batteries had not been in high demand previously. In the current broader context of industrial transformation to a carbon-free society, this issue is highly significant, as explained by the general manager of MC2:

When we shift from a fossil fuel-driven economy to another type of economy, then industrial development will require different types of metals. Thus, we go from high demand for one metal to low demand for another, and that will change the scope of minerals.

Therefore, there is a need for further development at the mining stage to increase the investment on further extraction. This clear business opportunity for the mining companies is disturbed by various tensions caused by sectorial limitation, lack of social acceptance of mining activities and lack of regulatory incentives, i.e., a straightforward process of obtaining permission for mineral extraction and production. As the CEO of MC2 says:

… starting up a new mine takes time – for instance, in Sweden, it takes five to 10 years from [the] exploration stage to receiving environmental permissions …

Mining companies claim that hesitation about mining activities in European society is due to the traditional perception of mining business that is not environmentally sustainable business and necessary to be implemented in Europe. The managers of MC1 and the CEO of MC2 explain that society does not consider that European mining companies extract the minerals by means of sustainable advanced technologies and renewable energies, and respecting societal values. In response to these tensions, the mining companies suggest strategic transparency to increase awareness about their business by means of their customers and other actors who are closer to the end consumers and can give visibility to them. For instance, the mining companies’ perception is that the vehicle manufacturers are the main drivers of the transformation to EVs and the key players in shaping the CLSC for lithium-ion batteries in Europe, and aim at controlling the entire supply chain by direct collaboration with their suppliers. Therefore, in a transparent way, they could communicate the important role of European mining companies in supplying the essential material in the current industrial transformation to their customers and society. Interestingly, the EV manufacturers also encourage mining companies to be engaged in securing specific minerals such as nickel that are essential for specific cathode technologies [68],BBC [6]. Therefore, the mining companies’ public statements about the availability of resources and reserves of primary minerals are strategies to show their capability to secure the future production of lithium-ion batteries, which makes the business more attractive for their customers, that is, battery manufacturers and vehicle manufacturers (see for example, Bloomberg, 2019).

Despite implementing these strategies, some actors who are heavily reliant on minerals for their production such as MM, a cathode-active material manufacturer, who are expected to select sustainable mining companies have decided to invest more in the recycling business and rely on secondary materials (recycled minerals). This strategic decision is motivated not only by the global shortage in the metal supply, but also the fact that the rapid increase in the electrification of the automotive industry has had a positive impact on MM’s business. In the words of the sustainability director of MM, the company has changed its business direction due to reasons of both opportunity and necessity:

The top management board [has] analysed the situation, the capabilities and strength of the company and the main trends in the world, which are EVs. At the same time, [it] is true that we felt pressure from NGOs and other external groups to use recycled and sustainable minerals in our products.

MM is expanding its recycling facilities, mainly cobalt, to support the raw materials for internal production, and this is expected to impact their relationships with their current suppliers in the long term. However, its current dependence on primary minerals will not be completely eliminated in the near future. The company has assessed that for at least the next 10 to 12 years, it will become even more dependent on suppliers, which are mainly mining companies. These strategic behaviours by cathode-active material manufacturers such as MM have created destabilization in the traditional configuration of the upstream value chain, and push mining companies to see the opportunity to be suppliers of the raw materials, even by becoming recyclers. In this regard, the CEO of MC2 highlights that his company is looking at the possibility of recycling graphite from lithium-ion batteries. Similarly, the manager of MC1 explains that:

… we want to be part of this transformation, yet we do not know how we can position ourselves in the value chain. We think about being suppliers of other metals and partly recyclers, for instance, of nickel, zinc and also copper; that is not a big part of our business now, but we can see that the value of these metals is growing…

Structural Tensions in the CLSC of Minerals

The issue of availability of essential minerals for the diffusion of lithium-ion batteries and the necessity of developing a CLSC system has been widely discussed at policy and firm levels. Also, as discussed in the previous section, mining companies argue that the rapid growth of lithium-ion batteries puts a question mark on the availability of essential minerals, which makes the development of CLSC systems a vital step. However, there are various imbalances in the development of the CLSC of high-voltage EV lithium-ion batteries in Europe. The actors in this study point to six main factors that create the imbalance situation: lack of dominant technological design due to rapid change in the battery technologies; an unestablished market for secondary materials in Europe; competition over the return flow of lithium-ion batteries in Europe and Asia; competition between Asian and European producers along the value chain; uneven development of infrastructure in Europe; and lastly, the European regulations are not equally applied to all actors.

The unestablished market for secondary materials and rapid change in the battery technology are cited as a key challenge mainly by recyclers RC1 and RC2, who hesitate to invest in specific recycling technologies and infrastructures, particularly those recyclers that manage other battery technologies such as lead-acid batteries. From the EVM1 manager’s perspective, this strategic behaviour of recyclers has made the recycling stage an undeveloped part of the supply chain, and has created tensions for other actors who are obligated to manage the EOL of the batteries for their products. Interestingly, EVM1 and 2, which still produce conventional products for ICE vehicles, have to manage the two battery technologies within the same system. In this regard, the manager of EVM compares the two battery systems to evaluate the possibility of learning from the successful CLSC system for lead-acid batteries:

We do not have the same challenge for lead-acid batteries. There are reverse logistics infrastructure and recycling companies in every European country.

Moreover, the managers at EVM1, RC1, and RC2 stress that the most significant difference between these two battery systems is the time period that companies will have to develop the CLSC infrastructure and the required knowledge. Unlike the lead-acid battery industry, which uses a mature technology and has an established CLSC system and secondary material market, the lithium-ion battery industry has to be developed in a short time, which creates uneven development along the supply chain and tensions for vehicle manufacturers. This situation has opened a window of opportunity for emerging innovative recycling companies in various regions to fill this gap outside Asia; for instance, Nevada-based recycling company Redwood Materials, Li-Cycle based in Canada [41], and Stockholm-based Northvolt, which is jointly building an EV battery recycling plant with Norway’s Hydro [37].

Another factor that creates structural tensions is the competition between European companies and Asian competitors over the return flow of the batteries. There is imbalanced development of reverse logistics and infrastructure in Europe, which gives advantage to Asian competitors. As mentioned by our interviewees, the EV market is still at an early stage of development, and there is a lack of early investment in infrastructures for recycling and battery development. From the EVM1 company director’s point of view, the CLSC for lithium-ion batteries has a different evolution pattern to that of other battery systems:

The reverse logistics and return flow systems are not developed, while other aspects have developed much faster; thus, nobody can work alone in this value chain.

Moreover, the managers of RC2 and AEP point to the complexity of the system for transporting lithium-ion batteries across European countries, as each country has different regulations for the transportation of dangerous materials:

In some countries, like Germany and Denmark, it is very fast and cheap to proceed, but in other countries, like Finland, it takes so much time to prepare required documents and is costly to get permissions to cross the borders.

The same competition is observed between the European cathode-active material and battery manufacturers and their Asian competitor, which is also negatively affected by the uneven development of the European battery production industry and value chain. This situation is mostly due to the dependency of the dominant production system in Europe on Asian suppliers, who have an advantage over European companies in terms of an established supply chain, technological knowhow, and capital investment, as stated by the managers of MC3 and RC1.

Responding to this challenge, European policy makers have encouraged reinvestment policies such as establishing battery production gigafactories (large-scale battery cell production facilities) in several countries (e.g., Sweden, Italy, and Germany) since covering the EU demand alone requires at least 10 to 20 “gigafactories”; investing in exploration and mining capacity; strengthening the European battery supply chain; policy coherence in relation to EV and battery directives; and waste shipment regulations. Moreover, as stated by the representative of BP:

Strengthening domestic production and EU industrial value chains, all starting with raw materials, particularly critical raw materials; and strengthening partnerships between the EU, Member States and regions such as EU Battery Alliance

She further adds that the importance of the EU Battery Alliance as a cooperative platform is to involve key stakeholders such as the European Investment Bank, and innovation actors with the objectives of creating a competitive manufacturing value chain in Europe with sustainable battery cells at its core and capturing a battery market of up to €250 billion a year from 2025 onwards. Despite these reinvestment strategies, actors in our study have various perceptions about the short-term and long-term landscape of the European battery value chain. The sustainability manager of MM expects that the largest recycling centre would be located in China because it has capital investment, institutional flexibility, and an established market compared to European regions, which have unsynchronized regional regulations for handling used batteries, as well as an undeveloped infrastructure. The manager suggests that the European Commission needs to act fast to build battery production plants in Europe in the next 2 to 3 years, otherwise the momentum will belong to Asian battery manufacturers and recyclers. Additionally, as a manager of a material manufacturing company, he believes that in the long term, the business landscape will become a regional configuration.

We supply worldwide, and we believe that in the future, the recycling solution for EV batteries will be regional, since it is not logistically possible to send these heavy and dangerous batteries around the world.

Another question raised by several interviewees was whether it is possible to develop a new supply chain and a reverse logistics infrastructure for lithium-ion batteries within a short time span if a 10–15-year battery lifecycle is considered. This is more critical for firms who have to think quickly about and make decisions on the reverse logistics infrastructure, such as vehicle manufacturers. The manager of EVM1 notes that there is a short time period for securing the availability of battery return streams. He continues:

… firms receive pressures from regulations to develop and implement the solution of closing the loop of materials at the early stages of product development and increase the recycling rate of EV batteries. However, this demand has been posed without any concrete road map…

Our data shows that in this situation, actors tend to adopt three different strategic behaviours: (i) become involved in other parts of the value chain to fulfil the undeveloped parts of the chain; (ii) collaborate with other actors to jointly develop the value chain (e.g., strategic alliance); or (iii) passively wait for the development of the value chain to occur in due course.

As presented in Fig. 3, actors such as MM, EVM1, and MC1 tend to be involved in activities that were previously not part of their traditional core business. This strategy involves reinvestment in other technologies and new operational skills; for example, MM has shifted to production and recycling of active materials and has recently launched a new business line of lithium-ion batteries for EVs in order to become independent from mining companies and secure availability of material for their production. Further, the company’s evolutionary path shows that it was revamped through a business model transformation in 1980–1999; it stopped mining and refining operations and changed its business strategy to value-added processes of material manufacturing and recycling. This business transformation has brought a unique knowhow advantage. The company decided to change its business model, invest in technologies and infrastructure for manufacturing materials, and recycle a complex combination of minerals in batteries for electric devices. The company claims that their customers need to fulfil other missing parts of the value chain and adjust their business models. The director of MM gives an example of EV manufacturers:

We tell them that we have the technology for recycling, but we need the materials, so if they support the return stream of the materials, we can guarantee the availability of secondary materials, too.

Controversially, the business model of vehicle manufacturers does not follow a smooth evolutionary pattern. Now, they are interested in having ownership of the EV battery so that they know where their product is and how to bring it back for reusing or recycling. The manager of EVM1 explains that EVs have not been on the market for a long time, and the greatest challenge for the company is managing the fast transition to the CLSC for lithium-ion batteries. There are missing parts of the overall infrastructure, both within and outside the organization. Therefore, the vehicle manufacturers need to expand their business activities and enter the EOL business in order to have full control over their products and components with high economic value:

… we need to handle it ourselves or share the responsibility with suppliers, yet we are new in this business, and we are changing the traditional picture of the business ecosystem around the battery value chain…

… there are various opportunities in EVs, which we did not perhaps consider as a possible business case before, such as the high metal value in the batteries, although not all of these opportunities are environmentally acceptable… (Manager of EVM1)

Collaboration among actors is another strategic behaviour to overcome uneven development of the value chain. The manager of MC3 states:

The value chain consists of four or five main industrial actors. However, this value chain is complex, technologically intense, and actors completely rely on others’ capabilities.

For instance, the vehicle manufacturers have been adopting two different strategies toward the development of the CLSC of lithium-ion batteries. On one hand, some of EVM’s competitors in Europe have chosen to establish long-term collaborations with their suppliers in Europe, and others are collaborating with Asian battery producers. All companies confirm that the second form of collaboration makes it challenging to have access to the return stream of batteries and close the loop of materials within Europe. In this situation, the CEO of MC2 mentions that if a regulation were to push a specific technological design and demands that vehicle manufacturers support European battery producers over their Asian competitors, it would be an inefficient strategy in the long term. Another example of actors’ collaboration is a new configuration among three key actors in the value chain, namely battery manufacturers, vehicle manufacturers, and recyclers (for example, Waste Management World [72]). The director of MM claims that collaboration among these three stakeholders creates a critical triangle for the future of EVs in Europe. Recently, this form of strategic partnership has become trendy in Europe too [23, 24]. For instance, other companies have initiated the same set-up, with collaboration occurring among vehicle manufacturers such as BMW, VW, and Scania (Clover, 2019),material producers (Umicore 2019); and battery producers such as Northvolt (Lambert and Lambert 2019). The director of MM points to this type of collaboration as an experimental case to identify the bottlenecks in closing the value chain of EV batteries in Europe. The manager at EVM2 highlights that the cell/battery manufacturer needs to design recyclable batteries, where the demand and technological knowhow come from vehicle manufacturers and recycling companies:

This way, we can negotiate with regulators at local and national level[s] to come up with the main criteria to facilitate the transformation and offer a business model that is attractive and risk free for firms to invest in a new infrastructure in Europe.

However, as the CEO of MC2 mentions, this type of collaboration requires specific business models from battery producers to standardize their products which will limit their competitive advantage over other battery producers, for instance, Asian competitors. The third strategy that we identified in our study is the passive strategic behaviour that is adopted by recyclers who also partially handle lead-acid batteries. RC1 highlights that most of the large lead-acid battery recycling companies in Europe plan to expand their businesses to lithium-ion batteries. However, the manager of RC1 and CEO of RC2 state that at this stage, recycling companies dealing with both battery systems do not invest in capital-intensive infrastructure and business developments, since it is not clear what the future dominant technology will be, and there is not enough reverse flow to secure the economies of scale required for such investments. One example is the position of the operator Recylex, where the annual recycling of 10 million lead-acid batteries accounts for two-thirds of its revenues, and there are few overlaps with the technologies and skills needed to enter the lithium-ion battery recycling territory. This leaves room for interpretation that the company tries to use its general competencies to manage two technologically very different business lines. Consequently, they tend to either adopt a “watch and wait” strategy or look for opportunities for collaboration with other actors along the value chain, such as battery manufacturers and vehicle manufacturers.

Table 3 presents a structural summary of tensions and mitigation strategies in relation to different levels of the socio-technological system and actors along the value chain of EV lithium-ion batteries.

Discussion

This paper analyzes structural tensions along the emerging value chain of lithium-ion batteries for EVs from a multi-actor perspective. By identifying and analysing various sources and levels of tensions, and the strategies that actors employ to overcome them, this section discusses the particularities of managing structural tensions, and reveals the dimensions that influence actors’ perceptions of structural tensions in the transition to a CLSC for EV lithium-ion batteries.

Managing multi-level structural tensions

Our study suggests that there are three interrelated aspects of managing structural tensions in the transition to the CE of EV lithium-ion batteries. The first is that in the transition to the CE, actors have to overcome various structural tensions at different levels[50, 51], which are interconnected and influence each other simultaneously. Thus, the conceptualization of structural tensions in the CE context goes beyond its classic understanding in innovation studies [18, 32], which mainly focuses on imbalance situations caused by technological innovation and disruption at technological level. Looking at the reported case study, since the development and diffusion of lithium-ion batteries for EVs largely depend on the availability of minerals via circularity of materials and the development of CLSC models [2, 10], the CE transition tensions are related to both the technological innovation and the operational capacity of actors. In some instances, actors are required to manage structural tensions that are not even directly related to their business, as they greatly depend on the performance of other actors along the supply chain. Moreover, imbalanced development can hit actors’ business differently: for some, such as mining companies, it mainly takes the form of sectorial limitations and institutional tensions (i.e., lack of social acceptance and regulatory incentives for expansion of mining activities),for others, like EV manufacturers, it is the need to deal with tensions at the level of actors’ interrelationships.

Second, actors’ efforts to alleviate structural tensions are not aligned and in some cases conflict with each other. Actors may adopt strategies for becoming involved in other parts of the value chain in order to fulfil the undeveloped parts of the chain, which can in turn create tensions and risks for the business of other actors. Hence, instead of approaching equilibrium and a balance stage of transition by overcoming certain tensions, they in fact create further imbalances in different parts of the value chain, which is also referred to as “circular tensions” by Chizaryfard et al. [15]. For instance, cathode-active material manufacturers’ reinvestment in the recycling business not only creates tensions for recycling companies but also for mining companies that supply metals to them. Similarly, collaborations between EV manufacturers, battery producers, and other actors aimed at jointly developing the value chain may result in a risk of being locked in certain battery technologies for the battery manufacturer who needs to compete with Asian producers on the global market. Even reinvestment strategies [21] that are supposed to effectively eliminate tensions can lead to a reverse result. One clear example is the reinvestment policies and penalties for EOL management of batteries pushed by the European Commission, which are not aligned and in some cases force EV manufacturers to choose Asian suppliers which are able to provide better recycling solutions.

Lastly, the weakest and passive actors in the supply chain influence the pace and direction of the transition process, since they are mostly unable to eliminate structural tensions, and other stronger actors remain deeply dependent on their behaviour. As mentioned by Mossel et al. [47], these actors display the strategic behaviour of “delaying the transition”. This is most apparent when we look at the issue of incapability of actors to deliver essential materials, components, or services that are critical for the development and diffusion of batteries. Unlike exploration, which concerns mainly upstream actors, the development of a closed-loop material system relies on the engagement of all actors along the value chain [40]. Therefore, the lack of engagement of some actors creates necessities and sometimes opportunities for others to adopt strategies to increase their involvement in the undeveloped parts of the CLSC system and fill the gaps. One observable aspect here is related to the degree of diversification vs. specialization among the incumbents. The EV manufacturers and MM are pursuing diversification strategies in their business activities to fill the gaps in the value chain development, which require them to focus on operations that are not part of their core business. On the other side, recycling companies focus on specialization strategies and face challenges in handling the technological shift to lithium-ion batteries if their established operational and technological focus is mostly on other product technologies, such as lead-acid batteries. Thus, here what determines the behaviour of recycling companies is whether they consider the shift from lead-acid to lithium-ion batteries as transition or diversification of their business activities.

Perception of Criticality of Structural Tensions

Our findings show that structural tensions in the transition to the CE are viewed differently by different actors according to the particularity and changes of their business landscape over time and their position in the value chain, as well as the prevailing contextual conditions, such as societal and regulatory forces. Along these lines, it is possible to argue that actors have different perceptions of the criticality of structural tensions in the CE transition processes and they may also respond to them in unique ways. More precisely, the perceived criticality of structural tensions determines the degree to which actors opt to respond to the tensions, based on their constant assessment of risk to their business, available capabilities—e.g., technological capabilities and functional relationships with other actors—and the potential window of opportunity in a new business landscape. In this study, the criticality of structural tensions involved in the transition to the CE and development of a CLSC for EV lithium-ion batteries appears to be influenced by three types of factors, namely temporal, spatial, and contextual.

Temporal Dimension

Tensions are dynamic and change over time as the system may go through different imbalance and balance states, for instance, because of future developments in actors’ capabilities (e.g., organizational, technological-operational), or even due to overshooting in the development of missing complementarities in some part of the value chain which may cause a further imbalance in the system. Accordingly, actors evaluate the criticality of structural tensions by considering whether they will disrupt their business in the short or long term. This means that if they can use existing capacities to develop missing complementarities and overcome tensions in the short term, or based on the degree of their responsiveness “dynamic capabilities”, they will develop required capacities in an effective time period. For example, EV manufacturers perceive structural tensions caused by lack of recycling solutions for the batteries as mostly a short-term issue, as they plan to handle this tension in the long term by becoming independent from recyclers. However, for MM, securing availability of minerals via recycling is expected to be a potential tension with their suppliers (mining companies) in the long term, since they would still keep their relationship in the short term. Similarly, recyclers perceive uneven development of the infrastructure for reverse flow of the batteries [76], maturity of the technologies, and availability of a market for recycled metals as short-term tensions. Their expectation is that these tensions will be overcome by other actors such as battery producers, EV manufacturers, and policy makers in the future. Therefore, temporal factors are essential for understanding the evolutionary nature of structural tensions for actors, as they do not necessarily perceive tensions similarly over time.

Spatial Dimension

The positions of actors along the value chain (upstream to downstream) can illustrate “firm’s business boundary” the distance that they have with their direct and indirect suppliers and end consumers. In other words, their position in the value chain indicates the dependencies of products that they manufacture, operational skills that they have, and their business model regarding specific suppliers and customers [57]. The criticality of structural tensions is also influenced by actors’ position in the value chain and the distance that they observe to have with disrupted parts of the chain, where the unevenly developed parts of the value chain are, and how it will affect them,for instance, whether it is their supplier whose business is disrupted by a radical technological shift and does not have the capability to catch up, or whether the disruption is from the customer and market side. Additionally, the criticality of disruptions caused by structural tensions will push some actors along the value chain to change their entire business model, while others will need to make incremental adjustments in their operational capacities to respond to changes in demand from their customers that have been transferred to them. In this regard, the business models of actors such as EVMs are going through radical changes that are forced by adaptation of their current product systems to EVs. EV manufacturers are the closest actors to end consumers along the value chain and they perceive the urge to respond to structural changes as fast as possible. The mining companies which perceive radical change in the demand for specific metals do not necessarily need to make changes in their technological knowhow and operational skills. This situation is the opposite for recycling companies, as they need to either introduce diversification and reinvestment in their technological and operational capacity or start a new business line for handling lithium-ion batteries. The cathode-active material manufacturer perceives the disruption at their suppliers who are the mining companies, i.e., their long-term capacity to secure metals, as well as their customers; thus, criticality is related to dependencies of their operations on upstream and downstream parts of the chain.

Contextual Dimension

The particularity of factors such as institutional capacities, intervention policies, and penalties influences the criticality of structural tensions for actors that pursue the adaptation to the CE principles. The contextual dimension reflects differences at the level of global governance and distribution of power and the influence of different regions and countries on the transition process. One example is the differences between the development of the CLSC for EV lithium-ion batteries in European and Asian countries. The Asian companies have the least criticality of institutional structural tensions compared to their European competitors. Moreover, actors such as EV manufacturers in Europe are under pressure from regulatory penalties to increase their EV production and management of EOL batteries, which is not the case for actors such as mining and recycling companies. Societal norms and expectations regarding the mining business mainly affect European mining companies that need to expand their production in order to meet the emerging metal demand for the production of EV lithium-ion batteries.

Conclusions

In this paper, we have analyzed how incumbent actors manage structural tensions in the transition to the CE of EV lithium-ion batteries. From a theoretical standpoint, we build on the classic studies on technological shift and innovation [17] (Dahmén 1950; Dosi 1982; Dosi et al. 2000; Hughes 1992; Tushman and Anderson 1997; Schumpeter 1934) to explore the notion of structural tensions and put this in the empirical context of the transition to a CLSC for EV lithium-ion batteries. Further, by adopting a holistic view, we show the interconnection between the way in which studies on sustainability transition [26, 42], Dahl and Markard [16] and circular economy [15, 67] approach the role of actors in managing structural tensions. We claim that in order to articulate the complexity of managing structural tensions in the transition process, it is important to analyze and compare strategies pursued by actors in different positions along the value chain. Therefore, from a multi-actor perspective, we identify and analyze the relevant structural tensions and related strategies adopted by different actors to overcome them. Our analysis reveals three particularities of managing structural tensions. First, actors have to overcome various structural tensions at different levels, which are interconnected and influence each other simultaneously. Second, actors’ efforts to alleviate structural tensions are not necessarily aligned, and are in some cases even conflicting with each other. Third, actors perceive that the pace and direction of the transition is strongly influenced by the weakest and passive actors, who are unable to eliminate structural tensions. In addition, we argue that actors’ perception of the criticality of structural tensions in the transition to CLSC of EV lithium-ion batteries is influenced by temporal, spatial, and contextual factors.

The central argument of this study is that the transition process to a sustainable industrial-economic system involves radical changes at multiple levels, if we consider both the dynamics of technological change from a socio-technical standpoint and the development of energy and material systems based on CE principles. We demonstrate our claim by, first, expanding the application boundary of the concept of structural tensions to show the interconnection between the strategic choices of actors at operational (e.g., value chain of minerals) and technological levels and, second, unfolding the dynamics of managing structural tensions from a multi-actor perspective, by leveraging on the particularity of our empirical context.

Grounded on the results of our analysis, industrial actors may achieve a better understanding of the consequences of their short- and long-term strategic decisions on the transition process. This might help resolve conflicts in visions and priorities among the different companies involved in the transition. Additionally, our results facilitate a more comprehensive consideration of the role of all actors in the transition process, thus overcoming the lock-in of the old cultural system perpetuated by policy makers and other institutional actors.

The major limitation of our study is the lack of inclusion of perspectives of battery and cell manufacturers, which are not covered in our empirical work. This limitation forced us to rely mostly on the perceptions of other actors along the value chain and indirectly infer the role of battery and cell manufacturers in the transition process. Finally, we encourage future studies to explore the potentials of the concept of structural tensions to unfold the dynamics of actors’ behaviour in other research contexts.

Data Availability

Not applicable.

References

Abdul-Hamid AQ et al (2020) Impeding challenges on industry 40 in circular economy: palm oil industry in Malaysia. Comput Oper Res 123:105052. https://doi.org/10.1016/j.cor.2020.105052 (Elsevier Ltd)

Albertsen L et al (2021) Circular business models for electric vehicle lithium-ion batteries: an analysis of current practices of vehicle manufacturers and policies in the EU. Resour Conserv Recycl 172(443):105658. https://doi.org/10.1016/j.resconrec.2021.105658 (Elsevier B.V)

Andersen AD, Markard J (2020) Multi-technology interaction in socio-technical transitions: how recent dynamics in HVDC technology can inform transition theories’. Technol Forecast Soc Change 151(October 2019):119802. https://doi.org/10.1016/j.techfore.2019.119802 (Elsevier)

Augenstein K, Palzkill A (2015) The dilemma of incumbents in sustainability transitions: a narrative approach. Adm Sci 6(1):1. https://doi.org/10.3390/admsci6010001

van Baal PA, Finger M (2020) The energy-mobility system in transition: the case of the Swiss Federal Railways. Compet Regul Netw Ind 21(4):367–379. https://doi.org/10.1177/1783591720954118

BBC NEWS (2021) ‘Tesla partners with nickel mine amid shortage fears’. Available at: https://www.bbc.com/news/business-56288781

Berggren C, Magnusson T, Sushandoyo D (2015) Transition pathways revisited: established firms as multi-level actors in the heavy vehicle industry. Res Policy 44(5):1017–1028. https://doi.org/10.1016/j.respol.2014.11.009 (Elsevier B.V.)

Berlin D, Feldmann A, Nuur C (2022) Supply network collaborations in a circular economy: a case study of Swedish steel recycling. Resour Conserv Recycl 179(March 2021):106112. https://doi.org/10.1016/j.resconrec.2021.106112 (Elsevier B.V.)

Bocken NMP et al (2017) Taking the circularity to the next level: a special issue on the circular economy. J Ind Ecol 21(3):476–482. https://doi.org/10.1111/jiec.12606

Braz AC, Marotti de Mello A (2022) Circular economy supply network management: a complex adaptive system. Int J Prod Econ 243(2021):108317. https://doi.org/10.1016/j.ijpe.2021.108317 (Elsevier B.V)

van Bree B, Verbong GPJ, Kramer GJ (2010) A multi-level perspective on the introduction of hydrogen and battery-electric vehicles. Technol Forecast Soc Change 77(4):529–540. https://doi.org/10.1016/j.techfore.2009.12.005 (Elsevier Inc)

Bressanelli G, Perona M, Saccani N (2019) Challenges in supply chain redesign for the Circular Economy: a literature review and a multiple case study. Int J Prod Res 57(23):7395–7422. https://doi.org/10.1080/00207543.2018.1542176 (Taylor & Francis)

Bullard N (2020) This is the dawning of the age of the battery. Bloomberg Green. Available at: https://www.bloomberg.com/news/articles/2020-12-17/this-is-the-dawning-of-the-age-of-the-battery?srnd=green. Accessed 20 Dec 2020

Chizaryfard A (2020) The transformation to a circular economy : framing an evolutionary view. Journal of Evolutionary Economics

Chizaryfard A, Trucco P, Nuur C (2020) The transformation to a circular economy : framing an evolutionary view. J Evol Econ. https://doi.org/10.1007/s00191-020-00709-0 (springer)

Dahl A, Markard J (2020) (2020) ‘Multi-technology interaction in socio-technical transitions : how recent dynamics in HVDC technology can inform transition theories.’ Technol Forecast Soc Change 151(October 2019):119802. https://doi.org/10.1016/j.techfore.2019.119802 (Elsevier)

Dahmén E (1984) Schumpeterian dynamics: Some methodological notes. J Econ Behav Org 5(1):25–34. Available at: http://www.sciencedirect.com/science/article/pii/0167-2681(84)90024-6

Dahmén E (1988) ’Development blocks’ in industrial economics. Scand Econ Hist Rev 36(1):3–14. https://doi.org/10.1080/03585522.1988.10408102

Drabik E, Rizos V (2018) Prospects for electric vehicle batteries in a circular economy

Enflo K, Kander A, Schön L (2008) Identifying development blocks-a new methodology : IIIImplemented on Swedish Industry 1900–1974. J Evol Econ 18(1):57–76. https://doi.org/10.1007/s00191-007-0070-8

Erixon L (2011) Development blocks, malinvestment and structural tensions-the kerman-Dahmén theory of the business cycle. J Inst Econ 7(1):105–129. https://doi.org/10.1017/S1744137410000196

Farrell CC et al (2020) Technical challenges and opportunities in realising a circular economy for waste photovoltaic modules. Renew Sustain Energy Rev 128(February):109911. https://doi.org/10.1016/j.rser.2020.109911 (Elsevier Ltd)

Galea-Pace S (2020) Northvolt confirms partnership with BMW and Umicore, Manufacturing. Available at: https://manufacturingglobal.com/lean-manufacturing/northvolt-confirms-partnership-bmw-and-umicore. Accessed 15 June 2020

GreenCarCongress (2021) Groupe Renault, Veolia & Solvay partner to recycle end-of-life EV battery metals in a closed loop. Available at: https://www.greencarcongress.com/2021/03/20210319-renauklt.html. Accessed 20 May 2021

Hache E (2019) Critical Raw Materials and Transportation Sector Electrification : A detailed bottom-up analysis in world transport CRITICAL RAW MATERIALS AND TRANSPORTATION SECTOR ELECTRIFICATION : A detailed bottom-up analysis in world transport BY Clément BONNET, Sam, (February)

Haley B (2018) Integrating structural tensions into technological innovation systems analysis: application to the case of transmission interconnections and renewable electricity in Nova Scotia, Canada. Res Pol 47(6):1147–1160. https://doi.org/10.1016/j.respol.2018.04.004 (Elsevier)

Harrison TP, Van Wassenhove LN, Area TM (2003) The challenge of closed-loop supply chains. Interfaces 33(6):3–6. https://doi.org/10.1287/inte.33.6.3.25182

Helbig C et al (2018) Supply risks associated with lithium-ion battery materials. J Clean Prod 172:274–286. https://doi.org/10.1016/j.jclepro.2017.10.122 (Elsevier Ltd)

Homrich AS et al (2018) The circular economy umbrella: trends and gaps on integrating pathways. J Clean Prod 175:525–543. https://doi.org/10.1016/j.jclepro.2017.11.064

Hopkinson P, De Angelis R, Zils M (2020) Systemic building blocks for creating and capturing value from circular economy. Resour Conserv Recycl 155(December 2019):104672. https://doi.org/10.1016/j.resconrec.2019.104672 (Elsevier)

Hossain MU et al (2020) Circular economy and the construction industry: existing trends, challenges and prospective framework for sustainable construction. Renew Sustain Energy Rev 130(June):109948. https://doi.org/10.1016/j.rser.2020.109948 (Elsevier Ltd)

Johansson P, Blomkvist P, Laestadius S (2016) A dynamic mind: perspectives on industrial dynamics in honour of Staffan Laestadius. Stockholm, Sweden: Division of Sustainability and Industrial Dynamics, INDEK, KTH

Kakwani NS, Kalbar PP (2020) Review of Circular Economy in urban water sector: challenges and opportunities in India. J Environ Manag 271(July):111010. https://doi.org/10.1016/j.jenvman.2020.111010 (Elsevier Ltd)

Kirchherr J, Reike D, Hekkert M (2017) Conceptualizing the circular economy: An analysis of 114 definitions. Resour Conserv Recycl 127(April):221–232. https://doi.org/10.1016/j.resconrec.2017.09.005

Korhonen J et al (2018) Circular economy as an essentially contested concept. J Clean Prod 175:544–552. https://doi.org/10.1016/j.jclepro.2017.12.111 (Elsevier Ltd)

Korhonen J, Honkasalo A, Seppälä J (2018) Circular economy: the concept and its limitations. Ecol Econ 143:37–46. https://doi.org/10.1016/j.ecolecon.2017.06.041 (Elsevier B.V)

Kumagai J (2021) Lithium-Ion Battery Recycling Finally Takes Off in North America and Europe. IEEE Spectrum. Available at: https://spectrum.ieee.org/energy/batteries-storage/lithiumion-battery-recycling-finally-takes-off-in-north-america-and-europe. Accessed 10 Sep 2021

Li L et al (2017) Sustainable recovery of cathode materials from spent lithium-ion batteries using lactic acid leaching system. https://doi.org/10.1021/acssuschemeng.7b00571

Lv W et al (2018) A Critical review and analysis on the recycling of spent lithium-ion batteries. https://doi.org/10.1021/acssuschemeng.7b03811

MahmoumGonbadi A, Genovese A, Sgalambro A (2021) Closed-loop supply chain design for the transition towards a circular economy: a systematic literature review of methods, applications and current gaps. J Clean Prod 323(November 2020):129101. https://doi.org/10.1016/j.jclepro.2021.129101 (Elsevier Ltd)

Marchant N (2021) 5 innovators making the electric vehicle battery more sustainable. World Economic Forum. Available at: https://www.weforum.org/agenda/2021/05/electric-vehicle-battery-recycling-circular-economy/. Accessed 10 June 2021

Markard J, Hoffmann VH (2016) Analysis of complementarities : framework and examples from the energy transition. Technol Forecast Soc Change 111:63–75. https://doi.org/10.1016/j.techfore.2016.06.008 (Elsevier Inc)

Martin G et al (2020) Lithium market research – global supply, future demand and price development. Energy Storage Materials 6(November):171–179. https://doi.org/10.1016/j.ensm.2016.11.004 (Elsevier)

Mayyas A, Steward D, Mann M (2019) The case for recycling: overview and challenges in the material supply chain for automotive li-ion batteries. Sustain Mater Technol 19:e00087. https://doi.org/10.1016/j.susmat.2018.e00087 (Elsevier B.V)

Morgunova M, Kutcherov VG (2016) Structural change in the petroleum industry’, in A Dynamic Mind: Perspectives on Industrial Dynamics in Honour of Staffan Laestadius. Stockholm, Sweden: Division of Sustainability and Industrial Dynamics, INDEK, KTH, 249–275

Mossali E, et al (2020) Lithium-ion batteries towards circular economy : a literature review of opportunities and issues of recycling treatments. 264. https://doi.org/10.1016/j.jenvman.2020.110500

van Mossel A, van Rijnsoever FJ, Hekkert MP (2018) Navigators through the storm: a review of organization theories and the behavior of incumbent firms during transitions. Environ Innov Soc Trans 26(September 2016):44–63. https://doi.org/10.1016/j.eist.2017.07.001 (Elsevier)

Naor M, Coman A, Wiznizer A (2021) Vertically integrated supply chain of batteries, electric vehicles, and charging infrastructure: a review of three milestone projects from theory of constraints perspective. Sustainability (Switzerland) 13(7). https://doi.org/10.3390/su13073632

Natkunarajah N, Scharf M, Scharf P (2015) Scenarios for the return of lithium-ion batteries out of electric cars for recycling. Procedia CIRP 29:740–745. https://doi.org/10.1016/j.procir.2015.02.170 (Elsevier B.V)

Nikolaou IE, Jones N, Stefanakis A (2021) Correction to: Circular economy and sustainability: the past, the present and the future directions. Circ Econ Sustain 1(2):783–783. https://doi.org/10.1007/s43615-021-00054-9

Nikolaou IE, Stefanakis AI (2022) A review of circular economy literature through a threefold level framework and engineering-management approach. Circular Economy and Sustainability. Elsevier Inc. https://doi.org/10.1016/b978-0-12-819817-9.00001-6

Novotny M (2016) ‘Technological transformation in process industries’, in A Dynamic Mind Perspectives on Industrial Dynamics in Honour of Staffan Laestadius. Stockholm, Sweden: Division of Sustainability and Industrial Dynamics, INDEK, KTH

Novotny M, Laestadius S (2014) Beyond papermaking: technology and market shifts for wood-based biomass industries - management implications for large-scale industries. Technol Anal Strat Manag 26(8):875–891. https://doi.org/10.1080/09537325.2014.912789