Abstract

Following the invasion of Ukraine, there is a call to replace Russian gas and oil with green electric energy. A prime sector subject to electrification is the transportation sector. Consequently, access to the critical minerals for electrification has become an important strategic issue in the electric vehicle industry. Our analysis indicates that the markets for scarce and critical minerals, like cobalt, graphite, lithium, and rare earth elements, are in a highly concentrated number of countries. China, a strategic partner of Russia, has a dominant power position in both graphite and rare earth elements and is a dominant player in the processing of copper, nickel, cobalt, lithium, and rare earth elements. Furthermore, at least 70% of cobalt, graphite, and rare earth element resources are in corrupt or very corrupt states. Transportation sector electrification might therefore increase Europe’s and the USA’s resource dependency on totalitarian, corrupt, and unstable countries. The surging resource dependency on China, Russia’s most important strategic partner, intensifies the geopolitical risk to the green transition. We suggest strategies like vertical control of supply chains, specific technology and infrastructure investments, innovation of other green energy sources, and exploration of critical minerals in other countries. Substitution and closed-loop technology also reduce resource dependency and geopolitical risk. However, closed-loop recycling cannot compensate for the short-run growth in the electric vehicle markets. Thus, the circular economy will reduce but not eliminate geopolitical risk. Countries, supply chains, and companies should examine the geopolitical risk and strategic uncertainty associated with different green energy sources and technology.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

During the aftermath of the Ukraine invasion, countries around the world have cut their trade relationship with Russia. However, a short time ago, trade was an approach to achieving peace and the development of democracy in the USA and Europe through “Wandel durch Annäherung” (“change through rapprochement”) [1] politics and the surging business relationship with China following its membership of the World Trade Organization (WTO) in 2001 [2]. The Ukraine war led to a sudden disruptive change of the east–west security architecture that fundamentally exposed the power dependency structure in supply chains organizing the exchange of critical resources. Consequently, the value of relationship trust that previously drove strategic decisions evaporated and the new reality of power and dependency, not trust, characterizes the green transition of energy and transportation. Car companies, like energy supply systems, are struggling to find a sustainable alternative source of critical minerals to supply their increasing electric vehicle (EV) production. The scarcity of minerals like cobalt, which occurs in only a few countries, is forcing EV manufacturers into an oligopolistic “small-number” strategic problem of power and dependency [3, 4]. The concentration of fewer, larger, and more powerful suppliers of critical minerals has the potential to exploit their dominant bargaining positions [5] and expose vulnerable buyers in the EV industry to potential opportunism [3]. Therefore, the increasingly concentrated global markets for critical minerals to replace carbon emission technology with electrification have created a need to rethink strategic repositioning and governance structures. For instance, the World Bank estimated that the production of essential minerals, like cobalt, graphite, and lithium, will have to increase by more than 450% by 2050 to meet the demand for battery capacity to cover the growth of the markets for EVs and other green technology products [6]. The IEA [7] projected that the average EV needs more than 200 kg of minerals, which is five times as much as conventional cars.

Small-Number Problems in the EV Industry

Small-number bargaining makes it costly for EV companies to leave or switch to other supplier host countries [3]. When EV manufacturers rely solely on a few suppliers, they also build upstream specific capital tailored to the supply chain technology, knowledge, and capital [8]. A lack of alternatives leads to dependency, vulnerability, and strategic uncertainty. However, companies can respond to a small-number oligopolistic supply market structure with increased vertical integration and control of mineral production. The other option is to write incomplete complicated contracts using incentives, bureaucracy, and monitoring based on laws and enforcement [9]. Integration (“make”) and “contracting” with upstream suppliers are often complicated and costly and subject to a lack of the institutional trust that protects long-term business relationships. In critical mineral markets, vertical integration is often not an option to curb potential uncertainty.

The car industry has previously faced similar resource dependency and uncertainty through the powerful Organization of the Petroleum Exporting Countries (OPEC) [10]. The growing uncertainty was associated with higher gasoline prices and expanding demand. For instance, the oil embargo following the 1973 Yom Kippur War between Israel and Egypt led to a 300% price shock [11]. Today, the car industry may yet again be exposed to uncertainty because of its resource dependency in sourcing critical minerals from concentrated supply markets, as shown in Fig. 1 [12].

Comparison among the top three nations in the production and processing of fossil fuels and critical minerals (source: IEA [7])

The small-number oligopoly of supplier countries is more concentrated than in the fossil fuel market (Fig. 1). Thus, the history of geopolitical uncertainty and dependency due to the concentration of fossil fuel resources might be a repetitive scenario for disruptive and strategic decisions in the car industry.

EVs and Human Rights

The globalization of supply chains has become increasingly uncertain and complex. The sourcing of minerals is becoming progressively difficult as the demand rises due to the growing markets for EVs and the green transition in general. Therefore, the increased demand for EVs exposes car manufacturers to a scarcity of critical minerals and to geopolitical uncertainty in production countries [8]. The scarcity of critical minerals is not only a market failure problem. For example, the electrification of products may sponsor the organized slavery of 35,000 children in the cobalt mines in the southeast of the Democratic Republic of Congo (DRC) [13]. Cobalt is the primary resource in the production of the lithium batteries used in EVs. The disruptive “green” change in the direction of, for example, EVs has expanded the demand for cobalt by 300% over the last 5 years [13]. While buyers of EVs have increased the demand for cobalt, the situation is quite different at the other end of the global supply chain. Children are injured and killed in mines located in areas characterized by poverty, criminality, and corruption [14]. Simultaneously, the global car industry is planning a $300 billion investment in EV technology over the next 5 to 10 years [15].

The Electrification of the Car Industry

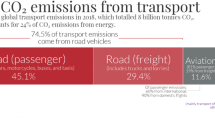

The electrification of the transportation sector is one the most important transformations of the green economy [16]. Our preliminary and explorative analyses focus on the limits of green growth in the electrification of the car industry caused by critical minerals [17]. The World Bank released a report titled “The growing role of minerals and metals for a low-carbon future” [18] that analyzed the minerals that are critical resources in the process of producing cleaner energy to keep the global temperature rise below 2 °C. For instance, the development of electric storage capacity is creating a demand for access to critical minerals.

Several countries have made the decision to transform the transportation sector into a zero-emission area [19]. The UK, for example, plans to have a zero-emission transportation sector by 2050. France will ban all petrol and diesel cars from 2040. Major car manufacturers are contributing to this strategy by converting their products into zero-emission cars. For instance, Volvo has a strategy to convert its cars into electric or hybrid vehicles. The massive change to sustainable technology will lead to a dramatic shift in the demand for minerals [20]. The prognosis from Bloomberg New Energy Finance (NEF) [21] indicated a disruptive shift in the direction of EVs in the global transportation sector before 2040. This report concluded that EVs will dominate the passenger car segment as well as bus transportation by 2040. In addition, the number of electric trucks and vans will increase significantly in the short-distance market and, as a result, will drive the demand for critical minerals.

Empirical Research on the EV Industry and Critical Minerals

The current situation of sales growth in EV markets has increased the research interest in this area [22]. We examined post-2017 refereed publications. EV production is highly dependent on critical minerals, and this has prompted an interest in relevant and recent high-impact empirical research (cited > 40 times on Google Scholar). Table 1 presents the empirical articles published after 2017 related to the EV industry and critical minerals. Cimprich et al.’s [23] comparative study of EVs and traditional car technology addressed the role of critical minerals in the strategy of the EV industry. They pointed to the geopolitical risk caused by dependency on critical minerals and the essential organization of the life cycle of minerals as mitigating factors to reduce the supply risk. Gemechu et al.’s [24] analysis of 14 minerals also brought to light the geopolitical risk related to the life cycle of EVs. Similarly, Ballinger et al. [25] analyzed the supply risk related to seven critical minerals in the EV industry based on forecast prediction methods with EV sales data. They emphasized that natural graphite, lithium, and cobalt represent a serious supply risk to the production of electric vehicle batteries. Their investigation concluded that seven minerals posed supply risks for electric vehicles: lithium, cobalt, and graphite for batteries and the rare earths neodymium, praseodymium, dysprosium, and terbium for electric motors. Furthermore, they emphasized the role of geopolitical risks related to the unstable production of cobalt in the Democratic Republic of Congo (DRC) and the monopolization of mineral markets by China.

Baars et al. [26] provided insights from a strategic analysis of constraining supply risks based on material flow data on cobalt in the EV industry. They concluded that the EV industry needs to introduce circular systems to avoid and constrain the serious supply risk related to cobalt. Bazilian [27] suggested, based on scenario analyses of critical EV minerals, that policy and regulatory responses mitigate supply risk due to critical geopolitical factors. Hache et al.’s [28] dynamic analysis of lithium in the EV industry emphasized that critical minerals are closely related to geopolitical vulnerability.

Recent publications on critical minerals and EVs highlighting the potential geopolitical risk have been based on different data, methods, and minerals. There is a rich variation in methods, ranging from comparative case studies [23] and flow analysis [26] to forecast and scenario methods [25, 27] and projection analysis [28], as well as different data, from sales and production EV data [25] to inventory data [24, 29]. The general emphasis in all these recent studies has been on the dependency on critical minerals, which creates uncertainty regarding the future development of a sustainable transportation sector.

Theoretical Model

The “small-number problem” caused by the existence of few suppliers of critical minerals to EV manufacturing companies should incentivize a choice between make (organization) contracts or buy (market transactions) contracts [8]. In the theoretical make-or-buy decision, EV manufacturing companies should consider the geopolitical uncertainty and the small-number problem associated with the supply to reduce their level of costly uncertainty (Fig. 2). Closed-loop recycling systems are a “make” option in which an EV company controls uncertainty by reducing its dependency on critical minerals through integration of the processes [26]. The other intermediate option is to obtain the supply needed for production from the recycling contract market, that is, in accordance with the EU End of Life Vehicles Directive, or through long-term supply contracts. The third outcome decision is the gray, unauthorized market for critical minerals, like the DRC artisan market. Consequently, there are three basic strategies that affect the transaction costs stemming from uncertainty (see Table 2): organization (make), contracts, and markets (buy) [30].

The EV company strategic choice among sourcing critical minerals from making in closed-loop recycling (the Audi-Umicore project), contracts (the EU End of Life Vehicles Directive), or gray market (Artisan Cobalt Mining) alternatives when upstream scarcity and concentration of critical minerals and geopolitical uncertainty produce strategic uncertainty

This inductive research design intends to build theoretical propositions for future research on the choice to move from make to buy governance structures for the sourcing of critical minerals. We applied an inductive exploratory research design [31, 32] to explore how major forces drive the development of closed-loop circular governance models. Theoretical propositions based on transaction cost theory [3] should benefit the development of empirical research in this area. We know little about how governance structures affect green growth and its impact on closed-loop recycling. Consequently, an exploratory and inductive design is preferable to reveal general theoretical tendencies [33] for later empirical testing and validation. We therefore develop research propositions on how the scarcity of minerals and geopolitical relations affect the choice between closed-loop systems (make), contracts, and markets (buy).

We selected the EV industry as an empirical context and EV companies as the level of analysis to investigate the research problem because the EV industry is a crucial driving force behind worldwide green growth. We gathered secondary data from multiple sources to generate propositions regarding the effects of scarce and critical minerals and geopolitical uncertainty on the choice of upstream (“make-or-buy”) sourcing (Fig. 2).

Closed-Loop Recycling, Contracts, or Gray Markets

We explore how uncertainty affects transaction costs and the governance structures that facilitate access to critical minerals. Transaction costs spurred by uncertainty determine the choice among upstream sourcing in closed-loop recycling, contracts, and market transactions [8, 34]. Based on patterns revealed through exploratory analysis, we develop a preliminary conceptual model and research propositions for further empirical investigation and structural tests. Closed-loop recycling reduces the small-number dependency on a few sources and the transaction costs [3] of sourcing minerals from fragile, corrupt, and often totalitarian countries. Multiple sources of data and contextual evidence should strengthen our preliminary theoretical model [33] and our propositions for further empirical analyses. As in Minzberg’s [35] analysis of the patterns of strategic decisions caused by external shocks in the car industry, this study is based on different sources of background evidence. His investigation of strategic decisions in the car industry (VW) produced insights into the structure of its non-linear strategic changes and decisions [35]. Inductive reasoning starts with an exploration of detailed data from different sources [36]. Here, we propose a preliminary model derived from the transaction cost theory [8] as a basis for understanding the managerial implications behind the choice of supply models from among closed-loop recycling (integration), contracts, or gray markets for the supply of minerals (Fig. 2).

Critical Minerals and the Small-Number Bargaining Problem

Resource dependency changes the distribution of power in the supply chain as it “organizes around critical and scarce resources” [37, 38]. The interaction effect [39] between political problems (resource dependency) [38] and economy (small-number bargaining) [3] affects the make-or-buy choice of an organization for the supply of critical minerals. For instance, the National Research Council [40] in the USA defined a “critical mineral” as:

-

A non-fuel mineral or mineral material essential to the economic and national security of the USA.

-

The supply chain of which is vulnerable to disruption.

-

A supply chain that serves as an essential function in manufacturing of a product, the absence of which would have significant consequences for our economy and national security.

-

Furthermore, the EU defined critical raw materials as (cit.)Footnote 1:

-

Industrial value chains — non-energy raw materials are linked to all industries across all supply chain stages.

-

Strategic technologies — technological progress and quality of life rely on access to a growing number of raw materials. For example, a smartphone might contain up to 50 different kinds of metals, all of which contribute to its small size, light weight, and functionality.

-

Climate, energy, and environment — raw materials are closely linked to clean technologies essential to reach carbon neutrality targets by 2050. They are irreplaceable in solar panels, wind turbines, electric vehicles, and energy efficient lighting.

When an EV manufacturing company faces uncertainty due to natural resource scarcity, complexity, and unsustainable sources of critical minerals, it may change its business model to adapt to more predictable sourcing [41]. For instance, Pfeffer [42] stated that “acquiring companies’ motives were consistent with resource dependence predictions (the acquisition of a critical resource, crude oil supplies, at favorable economic terms).” Following the logic of resource dependency theory, business organizations respond to this external uncertainty by integrating transactions subject to uncertainty using closed-loop recycling [38]. Closed loops, urban mining, or certified local recycling models may curb the uncertainty produced by the perils of operating global supply chains in a few corrupt, fragile, totalitarian, or dysfunctional operations in host countries.

Strategically, the resource dependency of critical minerals might be mitigated by the innovation of alternative sources [37] or the opposite when alternatives are costly and painful [43]. Innovation in closed-loop recycling technology to alleviate resource dependency requires investments in asset-specific technology (R&D) in the EV supply chain [44]. The normative recommendation from transaction cost economics is to control the development of closed-loop technology through ownership, contracts, or vertical control [8]. The concentration of upstream resources in a few countries consistently produces increased dependency and the potential risk of opportunism, which lead to transaction costs for safeguarding the transactions in the upstream supply chains. The transaction costs of a circular economy increase when the product complexity grows, product life cycles become shorter, and asymmetry of information is eminent.

Strategic uncertainty is related to both the interest in (due to the scarcity of critical minerals and lack of alternatives) and control of minerals in the relationship between the EV producer supply chain and the mineral-producing country (Fig. 1). When the EV manufacturer has a strong interest in the minerals of a few host countries because of their scarcity, the strategic uncertainty of the supply chain will increase. If the production host country has many alternatives, the strategic uncertainty of the EV manufacturer is likely to increase [45]. The distribution of power in the EV industry between the host country of the critical resources and the EV manufacturer that sources the minerals is essential to understanding the dynamics of the structural change [46]. Thus, the levels of scarcity of critical minerals and the geopolitical uncertainty in the EV industry influence strategic the uncertainty in the EV market. Furthermore, we theorize that strategic uncertainty affects the choice of governance structures for sourcing minerals. We illustrate the sourcing model outlined in Fig. 2 by using descriptive secondary data and applied case information to deduct research propositions. We propose (see Fig. 2) that EV manufacturers can choose among the alternatives of “make” (produce their own minerals) in closed-loop recycling (e.g., the Audi-Umicore project), contracts (e.g., the EU End of Life Vehicles Directive or long-term supply contracts), or the gray markets (e.g., Artisan Cobalt Mining). The choice among these alternatives depends on the interaction between the critical minerals and the dependency on them and geopolitical uncertainty. A high degree of strategic uncertainty (Fig. 2) should encourage EV manufacturers to choose investments in closed-loop recycling (make option), a medium degree of strategic uncertainty should encourage EV manufacturers to choose long-term contracts, and, when the strategic uncertainty is minimal, the gray, undocumented markets represent an option if sustainable operations are possible. The model is presented in Fig. 2.

Resource dependency on critical minerals is a predictive factor that affects governance structures [37, 41]. As a resource, critical minerals create a basis for power distribution and strategic uncertainty between the production countries and the EV manufacturing companies serving the sustainable transformation of the EV industry. Dependency on access to critical minerals and potential geopolitical uncertainty produce strategic uncertainty (Fig. 2). This dependency is mitigated by the number of alternatives that the supply chain potentially has [38, 47]. When there are fewer alternative sources of minerals, the interest in one supplier is greater, the dependency is greater, and, consequently, the uncertainty is greater (ceteris paribus). Whenever the geopolitical uncertainty is great, there is less EV company control over the supply of minerals and the strategic uncertainty versus the production country is greater (ceteris paribus).

Asymmetric power dependency often leads to coercive power and pathological conflicts in supply chains [48]. Consequently, asymmetric power dependency increases the strategic uncertainty even more [49]. In the mineral industry, there is a growing concentration of sources that limits access to alternative resources and increases the chance of conflict within the chains [50]. Whenever the power imbalance increases, the potential for the use of coercive instead of non-coercive power by the powerful actor increases [51]. For instance, OPEC increased its power position relative to consumer countries as its oil production grew above 50% of the world production at the start of the oil embargo in 1973 [10]. There are often few alternatives to the resources used in EV battery and motor technology. Therefore, it is complex and costly to switch from one supplier to another due to transaction-specific investments in supplier relationships. Given the strong growth in the demand for critical minerals, the imbalanced power distribution favors production countries. The strong increase, for example, in the demand for lithium and cobalt, which will increase by 300% and 60%, respectively, from 2017 to 2025 [52], will affect the power position of the supply chains that source minerals. The consequence of this demand increase will affect the resource dependency in the EV industry and, subsequently, the level of strategic uncertainty (Fig. 2). Coercive power, however, can often be counterbalanced with a countervailing power strategy [53], such as investment in closed-loop technology. The IEA [7] forecast significant growth in closed-loop recycling that will probably counteract the power imbalance between EV manufacturers and supplier host countries of critical minerals (Fig. 3).

IEA [7] estimated that recycling of copper, lithium, nickel, and cobalt from end-of-life batteries could reduce the combined primary supply requirements for these minerals by around 10%

Both the scarcity of minerals and the geopolitical uncertainty associated with the host countries are important factors that illuminate the structural change in the direction of the make option (closed loop) [8]. Therefore, we need to consider the resource dependency that is produced by the lack of alternatives. Lack of control of a critical mineral source does not increase strategic uncertainty according to power–dependency theory if there are many alternatives [37]. Therefore, we investigate the potential limitation of critical sources of essential minerals in the EV industry.

Research Propositions

Scarcity and Concentration

The scarcity of essential minerals has the potential to limit future growth in the EV industry. Some sectors of sustainable technology are more vulnerable to short-term exploitation of non-renewable minerals than others. The future scarcity of all 90 elements has been analyzed by the European Chemical Society (EuChemS) [54], an organization of more than 160,000 chemists.Footnote 2 There is growing concern about the growth limitations for new advanced and sustainable consumer technology. To analyze sustainable growth in the EV industry, we therefore applied the time frame suggested by EuChemS in our development of research propositions. EuChemS [54] estimated the global level of scarcity of elements in four categories: (a) no immediate threat, (b) limited availability, (c) rising threat from increased use, and (d) serious threat in the next 100 years. We employed this categorization to explore the scarcity of minerals faced by the EV industry.

According to a report from the International Institute for Sustainable Development (IISD) [55], 23 key minerals are essential to the production of EVs. Consistent with the classification by the World Bank [18], Levin Sources [20], Bloomberg NEF [21], and the IISD [55], we applied the classification to minerals that are essential to growth in the EV sector. We combined this list of critical minerals with the EuChemS [54] classification of future mineral limitations to create a new list of critical minerals in the EV industry, as presented in Table 2.

EV Industry Minerals’ Scarcity

The European Union has analyzed the general dependency on critical minerals based on a methodology that measures a combination of economic importance and supply risks (see Fig. 4) [56]. The level of supply risk for critical minerals combines indicators of global supply and recycling. The estimates of economic importance are based on substitutes, sectors, and value-added factors.

We combined the list of the scarcity of EV minerals from EuChemS [54, 57] with the European Union’s estimation of 30 critical minerals to produce a new list (Table 3). The minerals mentioned in both places are the cases for further investigation based on the analysis of concentration of supplier power.

A conventional method to estimate supply power is market concentration, performed by applying the estimation of the Herfindahl–Hirschman Index (HHI). Estimates of HHI = s12 + s22 + s32 + … + sn2, where sn is the market share (percentage) of firm n. N is the number of host country suppliers in each critical mineral market. Markets in which the HHI is between 1,500 and 2,500 points are moderately concentrated, and markets in which the HHI is more than 2,500 points are highly concentrated.Footnote 3

The results based on the HHI estimates of market power among the supplier countries of critical minerals indicate that the markets for cobalt (HHI = 5,129), graphite (HHI = 4,369), lithium (HHI = 3,726), REEs (HHI = 3,825), and silicon (HHI = 4,752) are highly concentrated. The markets for titanium have low concentration (HHI = 1,448), while the markets for aluminum and bauxite are moderately concentrated (HHI = 1,615). The raw data are presented in the Appendix Table 7.

The HHI results reported in Table 4 show that countries that produce five critical minerals operate in highly concentrated supply markets. The growth of the global EV markets can further increase the dependency on a few production countries. Only a 1% increase in EV sales will increase the demand for lithium by 70,000 tons each year. A Tesla model S needs more than 50 kg of lithium and 8 kg of cobalt per car.Footnote 4

Likewise, REEs are essential in electric motors because of their efficiency, size, and power. The IEA [7] raised concerns about the concentration of suppliers, as indicated by the presented HHI analyses. The lack of recycling of REEs exposes the EV industry to price fluctuations and uncertainty [12]. In general, the IEA supports the development of recycling, innovations, and substitution of critical minerals to avoid disruptive shocks and price variations [58]. For example, synthetic graphite can become a substitute if the price of graphite increases [7] and can mitigate the market power of the dominant player, China. China is the dominant producer in the highly concentrated supply markets of graphite, REEs, and silicon. The DRC controls more than 70% of the world production of cobalt and China almost 60% of the global production of REEs.

The results of our HHI estimations of critical minerals are exhibited in Table 4, which shows where the most critical, concentrated, and scarce minerals in the green transformation of the EV sector are located. Five of the critical minerals of scarce and critical EV minerals are characterized as highly concentrated markets. Consequently:

-

Proposition 1: Resource scarcity and the concentration of critical minerals increase strategic uncertainty in the EV market.

Geopolitical Uncertainty

Geopolitical stability represents a global lens for investigating uncertainty following the geographical distribution of power [59]. In the context of the EV industry, threats to stability have become increasingly important due to the globalization of the supply chains. A few countries dominate the supply of important critical minerals. Geopolitical uncertainty affects strategic uncertainty in the EV industry. Stability is threatened by the geopolitical uncertainty in states that offer essential material inputs to EV technology [60].

The network of organizations within a complex supply chain will predictably seek to absorb the resource uncertainty produced by the global context [42, 61]. According to transaction cost theory, one conventional strategy to neutralize this uncertainty is to integrate sourcing and production (make) to control the supply (Fig. 2) [8]. The historic parallel occurred when the group of dominating multinational oil companies, the “Seven Sisters,” was vertically and often horizontally integrated to stabilize, secure, and control the flow of petroleum from production to retailing [10]. Accordingly, one of the world’s largest oil production companies, Aramco, was owned by SoCal, Exxon, Mobil, and Texaco [10] to secure energy flow to car owners. In the current context of the EV industry, we can observe some of the same structural development toward integration to absorb resource dependency (Fig. 2). Integration through direct international investments in the cobalt supply chains has increased substantially because of a combination of uncertainty and concentration of minerals. These foreign direct investments safeguarded about 30% of the demand for cobalt in 2016 [62]. For instance, the foreign direct investment in cobalt supply chains was dominated by the ownership of cobalt mines in the Democratic Republic of Congo [62]. Vertical integration through alliances or long-term contracts increases the control over the sourcing of cobalt. Therefore, control mitigates and reduces the level of strategic uncertainty (Fig. 1). For example, Tesla signed a long-term agreement with the Swiss cobalt producer Glencore to supply cobalt from the Democratic Republic of Congo [63]. After a fall in cobalt prices in the market in 2018, the bargaining position changed in favor of the EV industry, and producers favored long-term supply contracts to reduce their uncertainty. Tesla declared, in its Conflict Minerals Report [64] filed with the Securities and Exchange Commission (SEC), that “all of our contracts require suppliers to adhere to Tesla policies, which include our Supplier Code of Conduct, Human Rights and Conflict Minerals Policy, and environmental and safety requirements.” However, the owner of Tesla, Elon Musk, pledged to “remove an obscure mineral mined in the Democratic Republic of Congo from the next generation of Tesla’s electric cars” [65]. If Tesla is still doing business with the Democratic Republic of Congo through the Swiss producer Glencore, it is because the mining company is certified through the Responsible Minerals Initiative (RMI). There are several initiatives to reduce the resource dependency on cobalt from Congo that will decrease the geopolitical uncertainty in the EV industry and ultimately the level of strategic uncertainty. The resource dependency experienced by Tesla reflects a need to address innovative initiatives like alternative battery technology and closed-loop recycling systems to neutralize strategic uncertainty (Fig. 2).

Geopolitical uncertainty related to the supply of critical minerals is connected to the US–China economic relationship in general. For instance, 80% of the REEs used in the USA is imported from China [66]. The China–US relationship is characterized by high geopolitical uncertainty due to potential trade wars and military, scientific, technological, and regional rivalry. The China–Russia strategic partnership has utterly exposed this potential conflict after the invasion of Ukraine. Potentially, there are a number of international conflicts related to existing territorial or political disagreements between China and countries like Taiwan, India, Japan, and Vietnam [67]. There is an escalation in China–US uncertainty that could increase geopolitical instability related to minerals like REEs [68]. China, in 2020, produced about 60% of REEs worldwide.Footnote 5 A developing trade war and long-term strategic conflicts between the USA and China therefore contribute to the geopolitical uncertainty of the supply of minerals necessary for the worldwide growth of green technology in the EV industry. If we look at Asia, China plays a dominant role as a producer of minerals required for the green technology revolution even in comparison with other resource-rich players in the market, like the USA or Canada [18]. For instance, China is a top five producer of aluminum, steel, lithium, silicon, and titanium, all of which are important minerals to expand the growth of green sectors in the economy, including EVs.

According to the study by the IISD [55], 28% of bauxite and alumina reserves are in Guinea, which is classified as a very fragile and potentially unstable state. Of the world’s resources, 56% of cobalt reserves are found in the Democratic Republic of Congo, which is classified as both a fragile and a corrupt state, according to Transparency International [69]. Other minerals, such as chromium and graphite, are exclusively located in corrupt states. Of the minerals essential for growth in the EV industry, the IISD [55] concluded that substantial reserves “are found in states perceived to be either corrupt or very corrupt in 2017” [69]. Of the 23 minerals essential to the EV manufacturing industry, many are produced in countries that are unstable or corrupt. Furthermore, the geopolitical threat of conflicts could arise between production countries and consumer countries or, as is the current case, competing companies may have different access to the extraction of critical minerals. Table 5 shows that the global market for essential minerals for EV growth is subject to global geopolitical instability that contributes to strategic uncertainty in the EV industry (Fig. 2).

Stakeholder groups have a progressive role that may illuminate and constrain the unsustainable operations that supply minerals to the EV industry. For instance, a study by Oh et al. [72] indicated that mining close to lakes or ecologically vulnerable areas negatively affected the stock value of firms only in countries with a strong legal structure. Mining in more fragile states had the opposite effect on the stock value. This study indicates that fragile and corrupt countries (Table 5) are potential “pollution heavens” [72, 73]. Therefore, the location of mining matters, probably because of the stakeholder interest groups that contribute to strategic uncertainty [74]. In the area of green growth, stakeholder groups are well organized and have broad public support [75].

In the USA, there has been growing concern about the outsourcing to other countries of supply chains for essential elements [76]. However, critical minerals are not the only constraint on national interests. Sustainable development is vulnerable to a combination of geopolitical constraints and the concentration of critical resources (Table 4). The geopolitical rivalry between China and the USA influences business strategy and organizational models [77]. The increased rivalry between these economic superpowers may lead to rising strategic uncertainty in the EV industry if green minerals like REEs are used in a trade war [78]. Sourcing minerals in countries driven by a politically unstable and corrupt economic regime increases uncertainty in the EV industry. Hence, it produces uncertainty for EV manufacturing companies, which affects the sourcing of minerals in the EV industry and influences strategic uncertainty. Thus, we propose that:

-

Proposition 2: Geopolitical uncertainty increases the level of strategic uncertainty in the EV industry.

Make-or-Buy Propositions

According to the logic in transaction cost theory, potential opportunism drives behavioral uncertainty and the counteracting strategy to integrate transactions (make) [8]. Long-term supply contracts are an option that is apparent, for example, between Tesla and the Swiss cobalt producer Glencore to supply cobalt from the Democratic Republic of Congo [63]. The other counteracting strategy to control strategic uncertainty is closed-loop recycling (Table 6). Therefore, it is evident that the number of closed-loop recycling projects is increasing. Closed-loop recycling is circular technology tailored to reuse a product’s resources in a “loop” to achieve close to zero waste. The intention is to bring resources back into the value chain. Stahel [79] stated that the new era of industrial sustainability would implement systems to achieve a cradle-to-cradle circular economy. However, the network of organizations within a complex global supply chain needs to coordinate and facilitate the transformation from a linear to a circular economy. The organization of the circular economy is thus an interaction effect of both political power and economic factors [39]. Resource dependency accelerates countervailing power [53] through investment in technology to overcome dependency and subsequently curb strategic uncertainty. Thus, investments in closed-loop technology are specifically tailored to the products and technology in question. Product design directly fits the specific technology in the circular process of closed-loop recycling. The closed-loop technology is a tailored “specific asset” designed to recirculate the product-related resources back into the value chain of the EV companies [8]. According to transaction cost theory, closed-loop technology fits directly into the theoretical definition of asset specificity. Following the logic of transaction cost theory, the greater the investment in specific assets to reuse critical minerals, the more controlled and “integrated” into closed-loop technology is each EV manufacturer [8] (Fig. 2). Table 6 illustrates the current development of closed-loop cases in the EV industry to recycle minerals that produce strategic uncertainty. Six minerals that are essential to the EV industry (see Table 2) are recycled through new technology controlled by the EV companies exhibited in Table 6. Therefore, closed-loop investments are a countervailing strategy to curb strategic uncertainty and avoid potential opportunism related to geopolitics or the concentration of the supply of critical minerals (Fig. 2). As a reference, the estimates of the concentration of supply power—the closed-loop technology in Table 6—illustrate closed-loop investments in assets to recycle cobalt and graphite, both of which are classified as highly concentrated in the HHI estimation analyses of supply power in Table 4.

For example, Audi, in collaboration with Umicore, has invested heavily in closed-loop technology. As a result, Audi can now recover more than 90% of both cobalt and nickel in the high-voltage battery used in the Audi “e-tron” model.Footnote 6 The recovered material can be used to produce new battery cells. Audi’s alliance with Umicore enables the company to make new battery cells from recovered cobalt and nickel material. The Audi e-tron is specifically designed to fit closed-loop technology. The closed-loop technology was planned on the initial production platform of Audi’s first fully electric car. This circular technology has now been developed further to serve other EV projects of Audi. The project is facilitating other, more sustainable, alternatives to the dependency on dominant host country production (Fig. 2). Consequently, the closed-loop technology is contributing to curbing strategic uncertainty in Audi’s supply of critical minerals.

Other closed-loop systems in the EV industry recycle aluminum. For example, Volvo implemented closed-loop recycling systems in collaboration with the specialist recycling company Novelis in 2019. Volvo’s aim was to save CO2 and the input sourcing of aluminum from external supply chains. The closed-loop recycling technology reduces the CO2 footprint of aluminum sheeting by 78% as it creates a secure source of high-quality input into the company’s car production. The closed-loop technology also allows greener logistics by transforming the company’s transportation chain from road transport to railroad. This transformation reduces transportation-generated CO2 by 68%. Michael Hahne, Vice President of Automotive at Novelis Europe, explicitly stated that, by using closed-loop technology, “we are reducing our dependence on primary aluminum and creating a more efficient and sustainable business model for us and our customers.”Footnote 7 Other companies, like the BMW Group, have developed battery technology to repurpose end-of-life-vehicle batteries into industrial applications. The specialist company Northvolt has developed technology to reuse batteries that substantially reduce CO2 emissions.Footnote 8 Beginning in 2014, more lead was produced via recycling than through mining [20]. For example, the BMW Group, Northvolt, and Umicore used circular-value closed loops to recycle lead. Another initiative is the ICARRE95 project, a collaboration with Renault to recycle copper in a closed-loop recycling system. Furthermore, the Australian company EcoGraf (subsequently renamed Kibaran Resources) developed its graphite purification technology to recycle lithium battery anode material in Germany. The company has stated that the technology “represents a major step forward to support electric vehicle and battery manufacturers to achieve sustainable, closed-loop manufacturing processes” [80].

Fortum is another specialist recycling company that is contributing to reduced uncertainty and dependence on primary sources of minerals. Tero Holländer, Head of Business Development, Fortum Recycling and Waste, stated that, “by recycling valuable metals in lithium-ion batteries, we reduce the environmental impact of EV batteries by supplementing the supply of cobalt, nickel and other critical metals from primary sources.”Footnote 9 The company BASF is now cooperating with other firms to use recycled materials such as lithium and nickel from a recycling plant in Harjavalta, Finland, to produce EV batteries. This is a cooperation between major actors to reduce external uncertainty in the market for critical sustainable minerals. According to the World Economic Forum, closed-loop technology is “a systemic answer to reducing dependency on resource markets.”Footnote 10

Investments in specific assets, such as closed-loop systems, must be safeguarded by increased control through ownership or quasi-integration by means of long-term contracts [8]. The more a company invests in unique technology related to the supply of critical minerals (Table 3), the more control is needed by the EV manufacturers to protect their specific assets [8]. Consequently, we propose that:

-

Proposition 3: The more investments in specific assets related to the supply of critical minerals, the greater the level of integration to safeguard these assets.

The limited access to critical minerals in concentrated markets (Table 4) is a potential limitation on growth in the EV industry. However, EV manufacturing companies now integrate downstream by investing in closed-loop recovery technology (Table 6) to avoid further dependency on unsustainable mining, which is often located in a few corrupt, fragile, or totalitarian host countries characterized by crime, corruption, and civil wars [81].

EV companies also have a less favorable position once their foreign direct investment in a mining project is realized. Investment in mining is site specific and difficult or costly to reverse [8] as it is subject to protection from legal systems that defend property rights. Fragile and corrupt regimes often lack the necessary institutional trust to protect contracts or foreign direct investments [9]. Therefore, the strategic position of supply is weak and uncertain, reflecting the position of heavily concentrated resources (Table 4) of critical minerals in a few unstable countries.

Following the logic of resource dependency theory [38] and transaction cost theory [8], we have analyzed the strategic uncertainty related to the interaction between limited resources and geopolitical instability in production countries. The EU Commission assessment concludes that the dependency on critical minerals “requires that the EU secures access to key raw materials and processed materials and redevelops manufacturing opportunities.”Footnote 11

Geopolitical instability may produce price or supply shocks in the EV industry. Both variables could lead to opportunism related to the EV manufacturing industry’s sourcing of minerals. Potential opportunism increases when there are few alternatives, and the EV industry is highly dependent on minerals [8]. This is potentially a highly volatile “small-number situation” [3]. Simultaneously, investment in specific technology designed to fit one or a few product lines contributes to the problem of choosing between market (buy) or organization (make). When these specific investments, whether in product technology, know-how, location, or other tailored assets, have few or no alternative applications, the EV company becomes vulnerable to potential opportunism [3]. For example, some minerals are highly prized due to their scarcity and high demand. The growing demand for EVs might create price fluctuations because of the potential time between the discovery of minerals and the production. Furthermore, it can take more than 16 years between exploration and production to produce additional minerals from alternative sources.Footnote 12

Thus, there is substantial uncertainty that shocks, conflicts, or price pressures could cause a supply stoppage or other problems that would hurt the entire supply chain. Therefore, investment in the supply of critical minerals should incentivize the EV industry to control more of the minerals through the development of closed-loop recycling systems. Consequently, we theorize that:

-

Proposition 4: The greater the level of strategic uncertainty, the greater the tendency to integrate the supply of critical minerals vertically.

Discussion

The uncertainty implications addressed here are an essential factor of international business in general. However, leadership in the era of sustainable change must take the new uncertainties of critical minerals into strategic consideration. In the automobile industry, the myopic view of oil market dependency exposed the industry to a disruptive oil price shock in 1973. Today, critical minerals lead to uncertainty caused by dependency and yet again “small-number” concentration of the supply in global markets. Companies’ management should therefore carefully evaluate the need to control the effects of this situation and define the counteracting “make-or-buy” governance structure that best responds to this strategic uncertainty. The closed-loop recycling technology [82] provides a managerial instrument for the EV industry to reduce dependency, uncertainty, and eventually the outcome level of transaction costs in the supply chain. The management should consider downscaling the strategic uncertainties of unsustainable gray markets and non-certified suppliers of minerals. As closed-loop technology is a viable alternative for reducing strategic uncertainty, the management should build capacity to control plural organizational forms [83] that handle both integrated closed-loop systems and independent contract relationships with long-term certified suppliers. The management of plural forms (“make and buy” supply systems) that are closed-loop organizations, together with contracts and gray, undocumented markets (Fig. 2), is essential in growing EV markets. This is because circular closed-loop technology does not have the short-term capacity to meet the growing demand for critical minerals (Fig. 3). In particular, the transaction costs of monitoring sustainable production of minerals in unstable and corrupt host countries are essential managerial operations.

This research adds perspectives to the presented review [84] of newer (post-2017) published articles on critical minerals in the EV industry (Table 1). Propositions based on transaction cost theory have been associated with the outcome variables in this review. Supply risk from a few countries and geopolitical uncertainty are the basic theoretical mechanisms related to the choice of governance structures in the presented model and propositions. Sustainable sourcing of critical minerals in the EV industry should inspire research in new areas [85]. Contingency theory should add ideas for future research due to the complexity and uncertainty of the supply chains in the EV industry [86]. The theory presents competing propositions to the ones presented here. The costly burden of centralized decisions and complex communication systems might lead to less control and more independence in the production of critical minerals [87].

Anecdotical evidence and secondary data that support our propositions encourage more centralized control to support future sustainable performance. In addition, the governance structure should be adapted to the levels of specific assets in closed-loop recycling technology [8]. More empirical investigations using qualitative [33], quantitative, and longitudinal research are needed to explore the effects of the choice between the asset specificity of the circular economy and the standard transactions in a market context. Governance structures in a world of uncertainty should reflect the dependency of the supply of critical minerals from a few unstable host countries.

Conclusions

According to the model in Fig. 2, an EV manufacturer has three basic sourcing alternatives for governance structures, ranging from integrated to contracts to market transactions. One alternative is the global undocumented and unauthorized gray markets in which the minerals may or may not come from unsustainable mining using child labor and civil war areas in the East Democratic Republic of Congo. When sourcing in the gray markets, it is difficult and costly to trace the source of the mineral. This is an essential problem for manufacturers of EVs because their main market segment is consumers who have a serious preference for sustainable products and often zero tolerance for unsustainable products. As the recent IEA report put it, “Consumers and investors are increasingly calling for companies to source minerals that are sustainably and responsibly produced. Without efforts to improve environmental and social performance, it may be challenging for consumers to exclude poor-performing minerals as there may not be sufficient quantities of high-performing minerals to meet demand.”Footnote 13

Another alternative involves systems for material recovery, for example the European Union and the European Free Trade Association (EFTA) markets. Here, EV manufacturers can choose from collective recovery systems or from producers’ own closed-loop systems (see Fig. 2). The collective recovery system follows the EU End of Life Vehicles Directive, in which one or more companies owned by producers have the responsibility for recovering components from EVs. This is a contract system in which one or more companies have the delegated “rights” to facilitate the recovery of materials. Recovery systems are, for example, financed partly by the deposit paid at the point of sale by the first owner of the EV. To develop contract markets for the sustainable reuse of minerals, the IEA suggests that firms “negotiate trade agreements, challenge trade distortion measures, develop research and innovation actions” to “assure a fast and responsible transition to electric vehicles.”Footnote 14

We have developed propositions related to the strategic uncertainty of EV manufacturers’ interest in and control over their supply of critical minerals. We argue that the larger this strategic uncertainty is, the more important it will be to switch the sourcing of critical minerals in the direction of integrated closed-loop recycling systems. For instance, Tesla has announced that it will source its cobalt from other markets than the gray markets in which it may be exposed to extreme geopolitical instability in combination with the strategic limitations of minerals. Sarah Maryssael, the global supply manager for battery minerals at Tesla, “told a closed-door Washington conference of miners, regulators and lawmakers that the automaker sees a shortage of key EV (EVs) minerals coming in the near future, according to the sources” [88]. Our research theorizes that strategic uncertainty drives other companies in the same direction to absorb potential uncertainty, reduce the complexity in global supply chains, and enhance the stability of operations [89].

Figure 2 summarizes the logic of our model. Consistent with research on dependency theory [38] and transaction cost theory [8, 34], uncertainty drives the increased integration of supply chains in the EV industry and is an essential finding in our review of research articles on EVs and critical minerals (Table 1). Pieter Nota, a member of the board of BMW, commented on the growing geopolitical uncertainty in the car industry by stating, “What we really need and what we want is an end to this period of uncertainty. We would call out to officials and politicians to end this current uncertainty because it’s bad for business” [90]. The EU Commission therefore stated that “The EU must act to become more resilient in coping with possible future shocks and in leading the twin green and digital transformations” and that the “EU institutions, national and sub-national authorities as well as companies should become much more agile and effective in securing a sustainable supply of critical raw materials.”Footnote 15

This study emphasizes the crucial demand for more research to assess and predict the long-term impact of uncertainty related to critical minerals [91]. Companies in the EV industry should bring both resource dependency on critical minerals in a few countries and its associated geopolitical uncertainty into their strategic plans when prioritizing investments. Russia is supported by its chief strategic partner, China, in the aftermath of the invasion in Ukraine. Our presented analyses show that China is a dominant market player in mineral markets that are crucial to the green transition. Therefore, EV companies must consider business models that control their closed-loop supply systems and long-term supply contracts. This might be ownership, rent systems, and other contract systems that safeguard the recovery of critical minerals in closed-loop systems after the end of the product life or long-term supply contracts with certified suppliers. Companies should prioritize innovations in closed-loop technology, other green energy sources, and the exploration of critical minerals in other countries. The EV industry should explore substitution alternatives to critical minerals to reduce long-term dependency and geopolitical uncertainty of sourcing. However, the geopolitical uncertainty of the political economy of the business environment [92] and the supply chains of critical minerals [93] has been largely ignored in the research on sustainable organizations. We hope that this study has illuminated both problems and strategies to curb strategic uncertainty in the increasingly important EV industry.

Code Availability

Not applicable.

Notes

EuChemS, press release, January 22, 2019.

U.S. Department of Justice & FTC, Horizontal Merger Guidelines § 5.3, 2010.

US Department of Defense (2018) Assessing and strengthening the manufacturing and defense industrial base and supply chain. Resiliency of the United States. Report to President Donald J. Trump by the Interagency Task Force in Fulfillment of Executive Order 13,806, September 2018; Levin Sources (2017).

European Commission (2020) Critical raw materials for strategic technologies and sectors in the EU: A foresight study.

European Commission (2020) Critical raw materials for strategic technologies and sectors in the EU: A foresight study.

Abbreviations

- DRC:

-

Democratic Republic of Congo

- EU:

-

European Union

- EuChemS:

-

European Chemical Society

- EV:

-

Electric vehicle

- HHI:

-

Herfindahl–Hirschman Index

- IEA:

-

International Energy Agency

- IISD:

-

International Institute for Sustainable Development

- NEF:

-

New Energy Finance

- OPEC:

-

Organization of the Petroleum Exporting Countries

- REEs:

-

Rare earth elements

- SEC:

-

Securities and Exchange Commission

References

Stelzenmuller C (2009) Germany’s Russia question—a new Ostpolitik for Europe. Foreign Aff, Mar/Apr 88(2):89–100

Phalnikar S, Welle D (2005) Kritik an Schröders Prinzip des “Wandel durch Handel,” May 4. https://www.dw.com/de/kritik-an-schr%C3%B6ders-prinzip-des-wandel-durch-handel/a-1572911-0

Williamson OE (1975) Markets and hierarchies: analysis and antitrust implications. The Free Press, New York

Johnson K, Gramer R (2020) U.S. falters in bid to replace Chinese rare earths. Foreign Policy, May 25. https://foreignpolicy.com/2020/05/25/china-trump-trade-supply-chain-rare-earth-minerals-mining-pandemic-tensions/

Dobrev SD, Carroll GR (2003) Size (and competition) among organizations: modeling scale-based selection among automobile producers in four major countries, 1885–1981. Strateg Manag J 24(6):541–558. https://doi.org/10.1002/smj.317

The Economist (2021) Governments have identified commodities essential to economic and military security. Obtaining them is another matter. Finance & Economics, Mar 31st 2021 (Updated Apr 6th 2021), New York. https://www.economist.com/finance-and-economics/2021/03/31/governments-have-identified-commodities-essential-to-economic-and-military-security

IEA (2021) The role of critical minerals in clean energy transitions. Flagship report — May 2021. IEA, Paris. https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

Williamson OE (1985) The economic institutions of capitalism. The Free Press, New York

North DC (1990) Institutions, institutional change, and economic performance. Cambridge University Press, Cambridge. https://doi.org/10.1017/CBO9780511808678

Sampson A (1975) The seven sisters: the great oil companies and the world they shaped. 1 October. Coronet Books, London

Painter DS (2014) Oil and geopolitics: the oil crises of the 1970s and the cold war. Hist Soc Rec 39(4): 186–208. https://www.jstor.org/stable/24145533

IEA (2021) Minerals used in electric cars compared to conventional cars. May 4. https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars

Kelly A (2019) Apple and Google named in US lawsuit over Congolese child cobalt mining deaths. The Guardian, Dec. 16. https://www.theguardian.com/global-development/2019/dec/16/apple-and-google-named-in-us-lawsuit-over-congolese-child-cobalt-mining-deaths

Kara S (2018) Is your phone tainted by the misery of the 35,000 children in Congo’s mines? The Guardian, Nov. 6. https://www.theguardian.com/global-development/2018/oct/12/phone-misery-children-congo-cobalt-mines-drc

Reuters (2019) U.S. dependence on China’s rare earth: trade war vulnerability. In: Webb S, Shumaker L, Oatis J (eds). Reuters Business News, June 28

Burkart K (2012) How do you define the “green” economy? http://www.mnn.com/green-tech/research-innovations/blogs/how-do-you-define-the-green-economy

Meadows DH, Meadows DL, Randers J, Behrens WW III (1972) The limits to growth; a report for the Club of Rome’s project on the predicament of mankind. Universe Books, New York

Arrobas DL, Hund KL, McCormick MS, Ningthoujam J, Drexhage JR (2017) The growing role of minerals and metals for a low carbon future. World Bank, Washington, D.C. https://openknowledge.worldbank.org/handle/10986/28312

Anser MK, Yousaf Z, Awan U, Nassani AA, Qazi Abro MM, Zaman K (2020) Identifying the carbon emissions damage to international tourism: turn a blind eye. Sustainability 12(5):1937. https://doi.org/10.3390/su12051937

Levin Sources (2017) Hybrid electric, plug-in hybrid electric and battery electric vehicles. Green Economy Series, August 25. https://www.levinsources.com/assets/pages/Green-Economy-Series-Electric-Vehicles-CC-Aug29.pdf

Bloomberg NEF (2019) Electric vehicle outlook 2019—BNEF’s annual forecast of electric vehicles. Shared Mobility and Road Transport to 2040. Report 15. mai

Khan SAR, Yu Z, Umar M, Tanveer Green M (2022) Capabilities and green purchasing practices: a strategy striving towards sustainable operations. 22 January, Bus Strateg Environ. https://doi.org/10.1002/bse.2979

Cimprich A, Young SB, Helbig C, Gemechu ED, Thorenz A, Tuma A, Sonnemann G (2017) Extension of geopolitical supply risk methodology: characterization model applied to conventional and electric vehicles. J Clean Prod 162:754–763. https://doi.org/10.1016/j.jclepro.2017.06.063

Gemechu ED, Sonnemann G, Young SB (2017) Geopolitical-related supply risk assessment as a complement to environmental impact assessment: the case of electric vehicles. Int J Life Cycle Ass 22(1):31–39. https://doi.org/10.1007/s11367-015-0917-4

Ballinger B, Stringer M, Schmeda-Lopez DR, Kefford B, Parkinson B, Greig C, Smart S (2019) The vulnerability of electric vehicle deployment to critical mineral supply. Appl Energ 255. https://doi.org/10.1016/j.apenergy.2019.113844

Baars J, Domenech T, Bleischwitz R, Melin HE, Heidrich O (2021) Circular economy strategies for electric vehicle batteries reduce reliance on raw materials. Nat Sustain 4:71–79. https://doi.org/10.1038/s41893-020-00607-0

Bazilian MD (2018) The mineral foundation of the energy transition. Extr Ind Soc 5(1):93–97. https://doi.org/10.1016/j.exis.2017.12.002

Hache E, Seck GS, Simoen M, Bonnet C, Carcanague S (2019) Critical raw materials and transportation sector electrification: a detailed bottom-up analysis in world transport. Appl Energ 240:6–25. https://doi.org/10.1016/j.apenergy.2019.02.057

Awan U, Kraslawski A, Huiskonen J (2018) The impact of relational governance on performance improvement in export manufacturing firms. J Ind Eng Manag 11(3):349–370. https://doi.org/10.3926/jiem.2558

Williamson OE (1991) Comparative economic organization: the analysis of discrete structural alternatives. Admin Sci Quart 269–296. https://doi.org/10.2307/2393356

Fisher E, Mwaipopo R, Mutagwaba W, Nyange D, Yaron G (2009) The ladder that sends us to wealth: artisanal mining and poverty reduction in Tanzania. Resour Policy 34(1–2):32–38. https://doi.org/10.1016/j.resourpol.2008.05.003

Yin RK (2017) Case study research and applications: design and methods. Sage, Thousand Oaks

Eisenhardt KM (1989) Building theories from case study research. Acad Manag Rev 14(4):532–550. https://doi.org/10.5465/amr.1989.4308385

Walker G, Weber D (1984) A transaction cost approach to make-or-buy decisions. Admin Sci Quart 29(3):373–391. https://doi.org/10.2307/2393030

Mintzberg H (1978) Patterns in strategy formation. Manag Sci 24(9):934–948. https://doi.org/10.1287/mnsc.24.9.934

Neuman WL (2004) Social research methods: qualitative and quantitative approaches, 7th edn. Pearson Education Limited, Harlow

Emerson RM (1962) Power-dependence relations. Am Sociol Rev 27(1 Feb.):31–41. https://doi.org/10.2307/2089716

Pfeffer J, Salancik GR (2003) The external control of organizations: a resource dependence perspective. Stanford University Press, Stanford

Stern LW, Reve T (1980) Distribution channels as political economies: a framework for comparative analysis. J Mark 44(3):52–64 (Summer). https://doi.org/10.1177/002224298004400306

National Research Council (2008) Minerals, critical minerals, and the U.S. economy. The National Academies Press, Washington. https://doi.org/10.17226/12034

Tashman P (2017) A resource dependence perspective on natural resource scarcity. Acad Manag Ann Meet Proc 1(August). https://doi.org/10.5465/AMBPP.2017.11240abstract

Pfeffer J (1987) A resource dependence perspective on intercorporate relations. In: Mizruchi MS, Schwartz M (eds) Intercorporate relations: the structural analysis of business (structural analysis in the social sciences, series number 1). Cambridge University Press, Cambridge, pp 25–56

Galbraith JK (1983) The anatomy of power. Houghton Mifflin, Boston

Begum S, Xia E, Ali F, Awan U, Ashfaq M (2021) Achieving green product and process innovation through green leadership and creative engagement in manufacturing. J Manuf Technol Manag 33(4). https://doi.org/10.1108/JMTM-01-2021-0003

Coleman J (1973) The mathematics of collective action. Aldine, Chicago

Nygaard A, Dahlstrom R (1992) Multinational company strategy and host country policy. Scand J Manag 8(1):3–13. https://doi.org/10.1016/0956-5221(92)90003-W

Cox A, Ireland P, Lonsdale C, Sanderson J, Watson G (2001) Supply chains, markets, and power: managing buyer and supplier power regimes. Routledge, Oxfordshire

Coughlan A, Anderson E, Stern LW, El-Ansary A (2013) Marketing channels. Pearson, New York City

Palmatier RW, Dant RP, Grewal D, Evans KR (2006) Factors influencing the effectiveness of relationship marketing: a meta-analysis. J Mark 70(4):136–153. https://doi.org/10.1509/jmkg.70.4.136

Frazier GL, Rody RC (1991) The use of influence strategies in interfirm relationships in industrial product channels. J Mark 55(1):52–69. https://doi.org/10.1177/002224299105500105

Raven BH (1993) The bases of power: origins and recent developments. J Soc Issues (Winter) 49(4):227–251. https://doi.org/10.1111/j.1540-4560.1993.tb01191.x

Azevedo M, Campagnol N, Hagenbruch T, Hoffman K, Lala A, Ramsbot O (2018) Lithium and cobalt—a tale of two commodities. Metals and Mining Report. https://www.mckinsey.com/industries/metals-and-mining/our-insights/lithium-and-cobalt-a-tale-of-two-commodities

Galbraith JK (1993) American capitalism: the concept of countervailing power (Vol. 619). Transaction Publishers, New Jersey

EuChemS (2019) Chemical elements which make up mobile phones placed on “endangered list.” Press release, 22 January 2019. Brussels

Church C, Crawford A (2018) Green conflict minerals: the fuels of conflict in the transition to a low-carbon economy. Report August 13, International Institute for Sustainable Development (IISD) Winnipeg, Manitoba

Bobba S, Carrara S, Huisman J, Mathieux F, Pavel C (2020) Critical raw materials for strategic technologies and sectors in the EU—a foresight study. European Commission. https://ec.europa.eu/docsroom/documents/42881

Rhodes CJ (2019) Endangered elements, critical raw materials and conflict minerals. Sci Prog 102(4):304–350. https://doi.org/10.1177/0036850419884873

Chen Y, Lee CC (2020) Does technological innovation reduce CO2 emissions? Cross-country evidence. J Clean Prod 263:121550. https://doi.org/10.1016/j.jclepro.2020.121550

Rosenberg M (2017) Strategy and geopolitics: understanding global complexity in a turbulent world. Emerald Publishing, Bingley

Overland I (2015) Future petroleum geopolitics: consequences of climate policy and unconventional oil and gas. Handbook of Clean Energy Systems 3517–3544. https://doi.org/10.1002/9781118991978.hces203

Harrigan KR (1985) Vertical integration and corporate strategy. Acad Manag J 28(2):397–425. https://doi.org/10.5465/256208

Gulley AL, McCullough EA, Shedd KB (2019) China’s domestic and foreign influence in the global cobalt supply chain. Resour Policy 62:317–323. https://doi.org/10.1016/j.resourpol.2019.03.015

Sanderson H (2020) Tesla to buy cobalt from Glencore for new car plants. Financial Times, June 16. https://www.ft.com/content/aa09dbcb-37ed-4010-a0ee-ab6cfab4d4b5

Tesla Conflict Minerals Report (2018) Form SD: specialized disclosure report. Securities and Exchange Commission (SEC.gov). https://www.sec.gov/Archives/edgar/data/1318605/000156459018014530/tsla-sd.htm

Jolly J (2020) Cutting battery industry’s reliance on cobalt will be an uphill task. The Guardian, January 5. https://www.theguardian.com/environment/2020/jan/05/cutting-cobalt-challenge-battery-industry-electric-cars-congo

Webb S, Shumaker L, Oatis J (2019) U.S. dependence on China’s rare earth: trade war vulnerability. Reuters Business News, June 28. https://www.reuters.com/article/us-usa-trade-china-rareearth-explainer-idUSKCN1TS3AQ

Ford LW, Gewirtz J (2020) China’s post-coronavirus aggression is reshaping Asia. Foreign Policy, June 18. https://foreignpolicy.com/2020/06/18/china-india-aggression-asia-alliances/

Johnson K, Groll E (2019) China raises threat of rare-earths cutoff to U.S. Foreign Policy, May 21. https://foreignpolicy.com/2019/05/21/china-raises-threat-of-rare-earth-mineral-cutoff-to-us/

Transparency International (2017) Corruption perceptions index 2017. https://www.transparency.org/news/feature/corruption_perceptions_index_2017. Accessed 21 Feb 2018

USGS (2019) Mineral commodity report. National Minerals Information Center. https://www.usgs.gov/centers/nmic

Fund for Peace (2018) Fragile states index 2018-Annual Report. In: Messner JJ, Haken N, Taft P, Onyekwere I, Blyth H, Fiertz C, Murphy C, Quinn A, Horwitz M (eds). http://fundforpeace.org/fsi/data/

Oh CH, Shapiro D, Ho SH, Shin J (2017) Capital markets’ reaction to environmental sensitivity. Acad Manag Proc 1:11458. https://doi.org/10.5465/AMBPP.2017.167

Nassani AA, Awan U, Zaman K, Hyder S, Aldakhil AM, Abro MMQ (2019) Management of natural resources and material pricing: global evidence. Resour Policy 64:101500. https://doi.org/10.1016/j.resourpol.2019.101500

Oh CH, Shapiro D, Ho SH, Shin J (2020) Location matters: valuing firm-specific non-market risk in the global mining industry. Strateg Manag J 41(7):1210–1244. https://doi.org/10.1002/smj.3153

Schaltegger S, Hörisch J, Freeman RE (2019) Business cases for sustainability: a stakeholder theory perspective. Organ Environ 32(3):191–212. https://doi.org/10.1177/1086026617722882

Fortier SM, Hammarstrom JM, Ryker SJ, Day WC, Seal RR (2019) USGS critical minerals review. Min Eng 71(5):35–47

Wolf M (2019) The looming 100-year US–China conflict. Financial Times, June 4

Lienert P, Shirouzu N, Taylor E (2019) Exclusive: VW, China spearhead $300 billion global drive to electrify cars. Reuters Business News

Stahel W (2010) The performance economy. Palgrave Macmillan, London

Ogg M (2020) EcoGraf makes headway with EV battery recycling trial. Australian Business News, March 9. https://www.businessnewsaustralia.com/articles/ecograf-makes-headway-with-ev-battery-recycling-trial.html

Le Billon P (2004) The geopolitical economy of resource wars. Geopolit 9(1):1–28. https://doi.org/10.1080/14650040412331307812

Awan U, Sroufe R, Shahbaz M (2021) Industry 4.0 and the circular economy: a literature review and recommendations for future research. Bus Strateg Environ 30(4):2038–2060. https://doi.org/10.1002/bse.2731

Bradach JL, Eccles RG (1989) Price, authority, and trust: from ideal types to plural forms. Annu Rev Sociol 15:97–118. https://doi.org/10.1146/annurev.so.15.080189.000525

Khan SAR, Shah ASA, Yu Z, Tanveer M (2022) A systematic literature review on circular economy practices: challenges, opportunities and future trends. J Entrep Emerg Econ. https://doi.org/10.1108/JEEE-09-2021-0349

Alhawari O, Awan U, Bhutta MKS, Ülkü MA (2021) Insights from circular economy literature: a review of extant definitions and unravelling paths to future research. Sustainability 13(2):859. https://doi.org/10.3390/su13020859

Burns T, Stalker GM (1961) The management of innovation. Tavistock, London

Galbraith JR (1974) Organization design: an information processing view. Interfaces 4(3):28–36

Lambert F (2019) Tesla warns of upcoming shortages of battery minerals, like nickel, copper, & lithium. Electrek, May 2

Bruckner M, Giljum S, Lutz C, Wiebe KS (2012) Materials embodied in international trade—global material extraction and consumption between 1995 and 2005. Glob Environ Chang 22(3):568–576. https://doi.org/10.1016/j.gloenvcha.2012.03.011

McAleer M (2019) Uncertainty stalks global car industry as it prepares to go electric: Brexit, threatened US tariffs and slowing Chinese market among potential hazards. Irish Times, March 15. https://www.irishtimes.com/business/manufacturing/uncertainty-stalks-global-car-industry-as-it-prepares-to-go-electric-1.3823247

Watari T, Nansai K, Nakajima K (2020) Review of critical metal dynamics to 2050 for 48 elements. Resour Conserv Recycl 155:104669. https://doi.org/10.1016/j.resconrec.2019.104669

Achrol RS, Reve T, Stern LW (1983) The environment of marketing channel dyads: a framework for comparative analysis. J Mark 47(4):55–67. https://doi.org/10.1177/002224298304700407

Ndubisi NO, Nygaard A, Chunwe NG (2020) Managing sustainability tensions in global supply chains: Specific investments in closed-loop technology vs “blood metals.” Prod Plan Control 31(11–12):1005–1013. https://doi.org/10.1080/09537287.2019.1695921

Acknowledgements

The author thanks the chief editor, Dr Alexandros I. Stefanakis; the two reviewers, Professor Harald Biong and Professor Ragnhild Silkoset; and colleagues at Florida Atlantic University, the Arctic University of Norway, and Kristiania University College for their support, comments, motivation, and insights regarding previous versions of this paper.

Funding

Open access funding provided by Kristiania University College Open access funding was provided by Kristiania University College.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The author declares no competing interests.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Nygaard, A. The Geopolitical Risk and Strategic Uncertainty of Green Growth after the Ukraine Invasion: How the Circular Economy Can Decrease the Market Power of and Resource Dependency on Critical Minerals. Circ.Econ.Sust. 3, 1099–1126 (2023). https://doi.org/10.1007/s43615-022-00181-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s43615-022-00181-x