Abstract

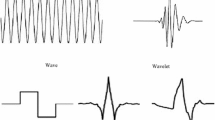

This paper focus on comparison between three wavelets methodologies to estimate a time–frequency varying parameter. In the discrete case, we oppose the intuitive application of the rolling regression on wavelets frequency bands to the time–frequency rolling window. We compare if we have to use the time rolling window directly on the wavelet’s frequency bands or apply the time–frequency rolling window on the series realizing the wavelet decomposition at each step of the process. A time–frequency varying estimator by continuous wavelets is also considerate in the comparison. Our objective is to show that the time–frequency rolling window and the Continuous estimates are more suitable than the intuitive way. We use in first time simulated data and also the daily returns of AXA and the CAC 40 index from 2005 to 2015 as empirical application. We show that the differences between discrete methods are more important at low-frequencies. Moreover, the continuous time–frequency Betas are closer to the time–frequency windows estimates.

Similar content being viewed by others

References

Bekiros S, Marcellino M (2013) The multiscale causal dynamics of foreign exchange markets. J Int Money Finance 33:282–305

Bekiros S, Nguyen DK, Uddin GS (2016) On time scale behavior of equity commodity links: implications for portfolio management. J Int Financ Market Inst Money 41:79–121

Black F, Jensen M, Scholes M (1972) The capital asset pricing model: some empirical test; studies in the theory of capital markets. In: Jensen M (ed) Praeger Publishers, New York, pp 79–121

Brooks RD, Faff RW, Lee JHH (1992) The form of time variation of systematic risk: some Australian evidence. Appl Financ Econ 2:191–198

Brooks RD, Faff RW, McKenzie MD (1998) Time-varying Beta risk of Australian industry portfolios: a comparison of modelling techniques. Aust J Manag 23(1):1–22

Fabozzi F, Francis J (1978) Beta as random coefficient. J Financ Quant Anal 13(1):101–116

Faff RW, Lee JHH, Fry TRL (1992) Stationarity of systematic risk: some Australian evidence. J Finance Account 19(2):253–270

Faff RW, Brooks RD (1998) Time-varying risk for Australian industry portfolios, an exploratory analysis. J Bus Finance Account 25(5):721–774

Fama E, MacBeth J (1973) Risk, return, and equilibrium: empirical tests. J Political Econ 81:607–636

Gabor JG (1946) Theory of communication. J Chin Inst Electr Eng 93(3):429–457

Gençay R, Selçuk S, Whitcher B (2003) Systematic risk and timescales. Quant Finance 3(2):108–116

Gençay R, Selçuk S, Whitcher B (2005) Multiscale systematic risk. J Int Money Finance 24:55–70

Mallat S (1989) A theory for multiresolution signal decomposition: the wavelet representation. IEEE Trans Pattern Anal Mach Intell 11(7):674–693

Mallat S (2009) Une exploration des signaux en ondelettes, Ecole polytechnique

Mallat S (2009) Wavelet tour of signal processing: the sparse way. Academic Press, New York

McNevin B, Nix J (2018) The Beta heuristic from a time/frequency perspective: a wavelets analysis of the market risk of sectors. Econ Modell 68:570–585

Mestre R, Terraza M (2018) Time-frequency analysis of CAPM-application to the CAC 40. Manag Glob Trans 16(2):141–157

Mestre R, Terraza M (2018) Time-frequency varying beta estimation-a continuous wavelets approach-. Econ Bull 38(4):1796–1810

Rua A, Nunes L (2009) International comovement of stock market returns: a wavelets analysis’. J Emp Finance 16(4):632–639

Rua A, Nunes L (2012) A wavelet based assessment of market risk: the emerging market case. Q Rev Econ Finance 52:84–92

Sharpe W (1964) Capital asset prices: a theory of market equilibrium under risk. J Finance 19(3):425–442

Vacha L, Barunik J (2012) Co-movement of energy commodities revisited: evidence from wavelets coherence analysis. Energy Econ 34:241–247

Torrence C, Compo GP (1989) A practical guide to wavelet analysis’. Bull Am Meteorol Soc 79(1):61–78

Torrence C, Webster PJ (1999) Interdecadal in the ENSO-monsoon system. J Clim 12:2679–2690

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mestre, R., Terraza, M. Time–frequency varying estimations: comparison of discrete and continuous wavelets in the market line framework. J BANK FINANC TECHNOL 3, 97–111 (2019). https://doi.org/10.1007/s42786-019-00008-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42786-019-00008-8