Abstract

The purpose of the paper is to investigate the attitude to risk related to low-probability, high-impact events. To do this, we compare the willingness to pay (WTP) to reduce mortality risks and the WTP for life insurance against earthquakes. We explore whether risk perception affects these measures, and exploit WTP to reduce risk of fatality to calculate the Value of a Statistical Life (VSL) related to seismic events. We rely on data from a survey administered to a representative sample of the Italian population. Our results highlight that the WTP to reduce mortality risk is lower than the WTP for life insurance, and that the correlations between risk perception and these two measures differ. The findings suggest that individuals’ preferences are directed toward risk management strategies in which the mortality risk is transferred to the capital market, rather than risk mitigation strategies involving the individual in sharing the costs and benefits with all of society.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In 2009, a seismic event of 6.3 (Mw) magnitude in L’Aquila (Italy) caused more than 300 fatalities, 1,500 injuries and huge damage to buildings, infrastructures, and cultural heritage sites (Modica et al. 2019). In May 2012, two major earthquakes (registering 5.5 Mw and 6 Mw) hit the Emilia-Romagna regionFootnote 1 and caused severe structural damage to one of Italy’s most productive industrial districts. In the aftermath of these earthquakes, 27 people died and several public and private buildings collapsed (Meroni et al. 2017). This anecdotal evidence highlights a peculiar feature characterising these catastrophes: despite their low-probability, they cause huge losses in terms of human lives and economic damage.

Policy makers and scholars have tried to understand social behaviour towards low-probability, high impact events. Based on a recent survey, Rheinberger and Treich (2017) found evidence suggesting that society tends to be accepting of catastrophe rather than averse to it. This apparently counterintuitive finding builds on a complex behaviour, which involves individual preferences towards risk and human life. It resonates also with work on the regulation of risk associated with catastrophes. Sunstein (2005) argues that given the tendency to overestimate dreadful events, the policy response is disproportionately high in developed countries and results in over-investment, triggered by people’s fear and anxiety. However, the literature emphasises, also, that whereas people assign a zero probability to worst-case scenarios, if they acknowledge that the possibility exists they tend to overestimate its probability (e.g., Camerer 1995, Sunstein 2009). That is, “individuals appear either to dismiss low-probability risks by bidding zero or near zero or to worry about the risk so much that they bid in a mode substantially above expected value” (McClelland et al. 1993: pp. 109). The resulting behaviour is in line with so-called prospect theory (Kahneman and Tversky 1979; Tversky and Kahneman, 1992).Footnote 2

The objective of the present article is to shed light on individuals’ behaviour in the context of natural disasters. We are interested in whether beliefs about and attitudes to mortality risk differ with respect to how individuals manage these risks. Our empirical investigation considers two main strategies related to hazard mitigation or adaptation to hazard. First, a priority in risk management is preventing natural disaster losses. The individual can exchange wealth for a reduced risk of mortality caused by a natural disaster, which is the Willingness To Pay (WTP) for a decrease in the risk of premature death. This is achieved by investing financial resources in reducing exposure to risk and vulnerability or in strengthening the institutional setting to achieve a more rapid and effective response to an emergency (Linnerooth-Bayer et al. 2011). Second, the individual might adapt to the natural disaster mortality risk and insure against this risk by means of an insurance contract or other risk-financing instruments (e.g., catastrophe bond, etc.). This way of managing mortality risk allows an assessment of whether people neglect or alternatively overweight the low-probability risks associated with natural disasters (McClelland et al. 1993). In addition, estimating the demand for insurance is important from both a public and private perspective. Since insurance provides a price signal related to the risk, it can be exploited by policy makers to measure the welfare effects of introducing natural disaster insurance (Botzen et al. 2009; Botzen and van den Bergh 2012). At the same time, the ability of the insurer to assess what influences the level of premium that the individual is willing to pay is crucial for increasing market share and improving economic performance. The latter is of particular importance since anthropogenic climate change may increase the incidence and/or intensity of natural disasters in the near future (IPCC 2014).Footnote 3

The exploration of individual attitudes to mortality risk should highlight whether people prefer to mitigate the overall risk or adapt to the current risk level. Moreover, being these two strategies related to shared or individual benefits, by analysing the willingness to pay enables us to assess the presence of potential altruistic behaviour when dealing with mortality risk associated to natural disasters. To explore individual attitudes to mortality risk associated with a natural disaster, we build on the stream of work that relies on stated preferences methods to assess the non-market benefits associated with hypothetical scenarios (see, e.g., Alberini et al. 2006). Specifically, our empirical analysis is based on data from a Contingent Valuation (CV) survey, administered to a representative sample of the Italian population of 800 individuals living in areas characterised by different seismic risk levels.

The contribution of the analysis is manifold. First, we adopt and compare two alternative approaches to trading income for risk reduction. A common approach to cost-benefit analysis of public interventions involves measuring how much people would pay to reduce the risk of premature mortality caused by a specific event. CV techniques rely on the creation of a hypothetical contingent scenario which allows the respondent to state his or her WTP to obtain a (public) good. Both the provider of the good and the payment method affect the individuals’ monetary evaluation.Footnote 4 The CV survey employed in our study created a contingent market in which the respondent expressed WTP in the form of a donation to a public institution which would implement the intervention to reduce the risk of premature mortality caused by the direct and indirect effects of an earthquake. Moreover, we explored a real-world scenario by asking respondents to indicate their WTP for a life insurance contract. We compare a strategy involving individuals bearing the cost of the intervention and sharing the benefits with the whole of society, for example, implementing a solution to a public health threat (Onwujekwe and Uzochukwu 2004), with a strategy where the costs (insurance premium) and the benefits (compensation for losses) are exclusive to the household – the second strategy to manage risk.Footnote 5 While the former strategy refers to mitigation of a mortality risk by financing a public intervention, the latter is at the other end of the spectrum and involves the individual adapting to the baseline hazard. The difference between these two financial decisions sheds light on the emergence of altruistic or free-riding behaviour in the context of a natural disaster. Moreover, since in both cases the costs are borne by the individual, we define shared benefits as those benefits that arise from the public intervention and idiosyncratic benefits as those that accrue to the individual (household) in the case of WTP for life insurance.

Second, we contribute to the extant literature by focusing on seismic events. Few studies examine individuals’ attitudes to risk from earthquakes. However, they are of particular interest in the Italian case since most of the Italian territory is affected by seismic risk and Italy’s history has been marked by numerous earthquakes. According to the Italian Parametric Earthquake Catalogue (Version 2015; Rovida et al. 2016) between the years 1000 and 2014, there were 4,584 earthquakes with intensities greater than 5 and/or magnitudes greater than 4.0 Mw. However, despite the high propensity for earthquakes in Italy, so far, there is no strong or effective policy focused on reducing earthquake mortality.

Third, we examine what influences the WTP for a reduced mortality risk through public intervention and the WTP for insurance against earthquakes. To do this, we statistically analyse the effect of the individual’s demographic (age, family size, etc.), behavioural (risk perception, propensity to donate, experience of past events, etc.) and economic (income, source of income, etc.) characteristics on the WTP to mitigate the risk or finance a risk adaptation strategy.

Fourth, whereas the damage to property caused by natural disasters has been explored extensively in several studies (Kouski, 2019), the focus on exploring social attitudes in the context of low-probability, high impact events that affect health has been slight. The present paper contributes by exploring the demand for insurance against mortality risk. To do so, we build on the extant literature and create three main indicators: (i) the willingness to pay for insurance purchase, (ii) the willingness to insure, which measures in a dichotomous way whether the individual is willing to sign an insurance contract or not, and (iii) the conditional willingness to pay for insurance which is calculated on those respondents who are willing to pay a positive amount of money to insure their life against earthquakes. The analysis confirms previous findings about the effects of catastrophes on the demand for property insurance and provides evidence that natural disasters trigger a broad range of attitudes to behavioural risk that go beyond increased purchase of property insurance (Skidmore 2001; Fier and Carson 2015).

Furthermore, to provide implications for policy making in the context of mitigation of the effects of natural disasters, we calculate the Value of a Statistical Life (VSL) associated with seismic events. The VSL can be estimated based on the WTP for a reduced statistical risk of death arising from a specific danger.Footnote 6 Most work on VSL is related to road accidents (De Blaeij et al. 2003), air pollution (e.g., Vassanadumrongdee and Matsuoka, 2005) and generic risks (e.g., Alberini et al. 2004, Kruonick et al. 2002) and there is scant evidence on the VSL related to natural disasters.

Our analysis provides three main findings. First, we observe that the WTP to reduce mortality risk through public intervention is lower than the WTP for insurance. This suggests that people tend to prefer mortality risk management strategies involving adaptations to existing risk and the transfer of that risk to capital markets. The finding also highlights that idiosyncratic benefits are higher than shared ones. Second, individuals have a correct perception of the objective risk in their geographical area and experiencing past events leads to higher WTP. Third, the VSL related to seismic events is in line with previous studies and has an average value of €4.2 million and a standard deviation of 2.3.

The paper is organised as follows: Section 2 delves into the related literature, Section 3 presents the empirical analysis, while Section 4 describes the results. Finally, Section 5 concludes the paper.

Related Literature

Attitudes Toward Insurance Against Catastrophes

Understanding whether people underestimate or ignore events characterised by low-probability outcomes has given rise to a large stream of research in economics (Rheinberger and Treich 2017). Prospect and cumulative prospect theories, formulated by Kahneman and Tversky (1979) and Tversky and Kahneman (1992),Footnote 7 emphasise the need for further investigation into how individuals behave when faced with a close-to-zero probability that a specific event will occur. People tend to either overweight or underestimate (round to zero) low-probability events (McClelland et al. 1993). This behaviour might be explained by the existence of a risk threshold below which the individual substantially neglects the event, even though the outcome may cause huge losses (Slovic et al. 1977; Kunreuther and Pauly 2004). The so-called “attention threshold” can be affected by various factors such as how the potential losses are presented to the individual (Laury et al. 2009).

Individuals’ attitudes to low-probability, high-loss events, such as natural disasters, have been investigated from different perspectives. An extensively exploited heuristic to assess whether people overestimate or underestimate the occurrence of such events focuses on the examination of insurance purchase patterns (e.g., McClelland et al. 1993; Kunreuther and Pauly 2004; Robinson and Botzen 2019). Botzen et al. (2009) emphasise that insurance premiums may provide an incentive to introduce private mitigation measures to reduce the losses from natural disasters. Also, insurance is a valuable tool which supports the victims of disasters, thereby improving local resilience (Kunreuther 1996).

Some authors suggest that insurance should be promoted or should be partially/totally compensated by government, especially in hazard-prone areas (Kunreuther 1996; Laury et al. 2009). However, in a study of the Netherlands case, Botzen and van den Bergh (2012) investigated the patterns that characterise the WTP for insurance against floods and found that, on the one hand, people tend to underestimate the risk of flooding and, on the other hand, ex-post government compensation schemes reduce demand for insurance. Their findings are confirmed by Kousky et al. (2018), who provide evidence for the US case, that disaster assistance decreases the incentive to buy insurance to protect against natural disasters.

The related literature also investigates the factors that lead to underestimation of the natural disaster hazard. Laury et al. (2009) argue that, in laboratory experiments, the way people express their preferences about insurance purchase have a strong influence on insurance behaviour. The authors show that when insurance alternatives are presented in abstract terms individuals are more likely to neglect low-probability risks – which is in line with prospect theory. However, if the decision making occurs in a less abstract context, expressed in terms of dollars lost, people tend to have a higher willingness to insure. In works based on a revealed preferences approach, it has been observed that people often fail to purchase insurance against high-loss, low-probability events such as floods (Kunreuther et al. 1978; Kunreuther 1996). This is explained mainly as the result of government relief in the aftermath of the natural disaster which crowds out other types of private investment, such as insurance purchases if the government aid is treated as a substitute for ex-ante insurance (Kousky et al. 2018). In addition, there are certain individual characteristics that predispose the individual to purchasing or not insurance. For instance, Kunreuther (1984) highlights that past experience of a natural disaster combined with knowledge about someone who is insured, increase the likelihood of insurance purchase. Browne and Hoyt (2000) provide evidence for the US case that while insurance premiums are negatively correlated with insurance demand, there is a positive and statistically significant relationship between income and insurance purchases.

Other studies, such as Tian and Yao (2015), directly measure the WTP for insurance and the Willingness To Insure (WTI) against earthquakes. They observe that the WTP for insurance is positively affected by risk perception and exposure to risk, whereas WTI is affected only by previous experience. Cameron and Shah (2015) show that changes in the perception of risk due to direct experience of floods or earthquakes have a negative effect on individuals’ risk-taking behaviour.

However, most of the literature focuses on individual behaviour in the context of property losses. Very few studies adopt a broader perspective and analyse attitudes to risk in the context of health losses caused by natural disasters. Fier and Carson (2015) emphasise that anxiety about an event can increase protection efforts, in the form of property insurance purchase, whereas witnessing a traumatic event, such as a destructive catastrophe, makes the individual more willing to purchase life insurance. In an attempt to investigate the relationship between natural disasters, political risk and the insurance market, Chang and Berdiev (2013) find that the number of natural disaster-related deaths positively influences consumption of life insurance.

More research is needed to investigate individual attitudes to mortality risks associated with natural disasters. We employ the stated preferences method to directly explore the relationship between life insurance and natural disasters. We provide insights into whether and to what extent people transfer mortality risk to the capital market, by assessing the WTP for life insurance.

The VSL Related to Natural Disasters

In the context of natural disasters, insurance plays a crucial role by providing the financial resources to enhance resilience and increasing the incentives to implement mitigation measures aimed at reducing the risk of incurring economic and health losses. That is, households may be rewarded by reduced premiums if they introduce ex-ante measures such as house constructions that are resistant to earthquakes or floods.Footnote 8

Mitigation measures can be introduced by governments in the form of public goods (more secure public schools, roads, infrastructures, etc.) that reduce the mortality risk for the whole society. Public interventions can also provide financial resources to improve the safety of private buildings. This type of intervention is similar to monetary compensation for economic losses that governments (usually) provide in the aftermath of a natural disaster.

A possible way to measure individual behaviour toward mortality risk associated with low-probability, high consequences events is to explore to what extent people are willing to pay to reduce mortality risk. The exchange of wealth for a risk reduction has been employed to measure the welfare gains from public projects that reduce mortality risks (either directly, e.g., through improved road safety, or indirectly, e.g., by switching to resource saving technologies). In this case, the so-called VSL is defined as the trade-off between monetary wealth and fatal safety risk (e.g., Viscusi and Aldy 2003, Ashenfelter 2006).Footnote 9 VSL is crucial for effective cost-benefit analysis since it can be considered in terms either of the individuals’ WTP for a fatality risk reduction or as the marginal cost of increasing safety related to a specific cause (Kniesner and Viscusi 2019). The VSL has been employed widely to assess the benefits of environmental regulation to reduce greenhouse gas emissions and premature death. The technique is particularly important in the context of natural disasters due to the health-related benefits which, often, are associated with policy interventions.

Different studies provide different estimates of the VSL; however, the literature on natural disasters and, especially, seismic events is rather limited. In a review of the existing work, Kochi et al. (2006) point out that the mean VSL can vary widely across studies and its standard deviation may be very large.

Among the few studies that assess the VSL in the context of mortality risk associated with natural hazards, Zhou et al. (2020) proposed a framework to measure the direct losses caused by earthquakes in China. They adopt a human capital approach, based on average characteristics of the local areas, and assess the VSL based on residents’ life expectancy, human capital investment, income, etc. In our paper, we measure the VSL by adopting a stated preferences approach based on a CV method.

Empirical Analysis

Seismic Risk in Italy

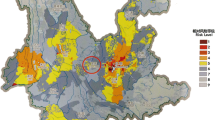

A large part of the Italian territory is affected by seismic risk, which varies considerably depending on the specific geographical area. According to the Civil Defence risk map there are a few risk-free areas (e.g., the region of Sardinia); however, the population’s perception of risk depends more on past experience than on the current level of danger (Deng et al. 2015). Italian law defines four risk levels for municipalities – see Fig. 1 for each municipalities pre-assigned risk level. The Italian Institute of Geophysics and Vulcanology (Istituto Nazionale di Geofisica e Vulcanologia - INGV), reports every earthquake with a magnitude of over 4.0 Mw or an intensity of over 5. Table 1 presents the yearly number of earthquakes in our cohort of interest. By combining information on the frequency of earthquake events and the number of fatalities, we can obtain a risk of death indicator, which will allow us to investigate perception and anxiety of the population. This is in line with studies showing that the public has a short memory of the fatalities from natural disasters. We consider the number of fatalities in the 1952–2014 cohort; unfortunately, the available data on the victims of Italian earthquakes is less sophisticated than the available data on earthquakes and objective risk. Therefore, the number of casualties is retrieved from various sources (see Table 2).

The Survey

The survey, delivered in 2017, covers the entire Italian territory, which includes a few earthquake-free areas. Specifically, we created a random sample of 800 individuals in order to be representative of the population of the geographical areas, gender and age (Table 3). In particular, 400 individuals were interviewed by phone, following the computer assisted personal interviews (CATI) methodology, and the other 400 interviewees completed an on-line questionnaire, following the computer assisted web interviews (CAWI) methodology. Moreover, we split the sample in four groups of 200 people, spread across the four seismic risk areas identified by Italian law. We balance the responses with respect to the people located in the four Nielsen regions (Table 3). As already mentioned, the objective of the survey was to measure the WTP for a reduction in the mortality risk due to a seismic event. The survey respondents were required to consider the opportunity to reduce this risk while taking account of the real probability of experiencing an earthquake and not overestimating this probability.

The questionnaire was organised in four main sections. The first section asked about risk perception and past experience of seismic events. These multiple choice questions were aimed at capturing the perceived risk in the respondent’s location, based on a measure ranging from low-risk to high-risk. We compared this information with the real, objective risk for the respondent’s municipality.

The second part of the survey asked about the WTP for a reduction in the mortality risk related to earthquakes. The main question designed to elicit WTP asked how much the respondent would be willing to pay to reduce the fatality risk related to a seismic event. The respondents were given information on the Average Death Risk (ADR) from an earthquake, which is 8.9 per 100,000 people, and how an earthquake-proof building policy could reduce this risk.Footnote 10 ADR is computed by considering the time series for the most recent two decades:

The earthquakes considered were those with an intensity of over 5 or a magnitude of over 4.0 MwFootnote 11 and the average was computed for each year between 1952 and 2014. This yielded an average of 8.9 fatalities. Respondents were then asked whether they would be willing to finance a fund to provide financial resources for preventative measures such as earthquake-proof buildings, that would reduce the mortality risk from 9 to 8 people over 100,000 inhabitants. This fund would be managed by the Italian Civil Defence, and individuals could make a voluntary one-time money transfer. We explained that the fund would be managed efficiently by the public institution and that donors would be able to monitor exactly how the money was spent. These are crucial aspects because WTP is affected by the respondent’s trust in the public institutions; our explanation was aimed at reducing potential distortions. To quantify the WTP, we built on Santagata and Signorello (2000) and asked a discrete choice question related to the respondent’s willingness to donate €X. A “yes” response then led to an open-ended question about the maximum amount he/she would be willing to donate. A “no” answer led to a question asking the reasons for this response and offered a set of possible options including low trust in public institutions or low confidence in how the resources would be spent. In a pilot study, we identified the bids offered through a discrete choice question. The sample was then split into five sub-samples (of 160 respondents each) depending on the amount of the donation indicated {€5; €10; €20; €50; €100}.

The third section of the survey asked about the respondents socio-economic and demographic characteristics including family size, gender, age, propensity to donate to NGOs, income and education level.

The fourth section was related to the WTP for life insurance and property insurance (the latter to be used as a robustness check). We used the same approach described to elicit the WTP for mortality risk reduction. We identified whether the respondent was willing to purchase life insurance and then asked about their WTP for life insurance, through an open-ended question. We also asked whether the respondent had insurance. Finally, we asked whether the respondent would purchase a property insurance and his/her willingness to pay for a hypothetical insurance policy against damage to property.

Survey Results

In this section, we present the results of the empirical analysis. First, we discuss attitudes to and beliefs about risk in the context of mortality associated to an earthquake. Second, we explore the factors influencing the WTP for insurance and mortality risk reduction, by focusing on the features characterising both WTP measurement approaches. Finally, we calculate the VSL with respect to seismic events which highlights important implications for public decision making processes.

Risk Attitudes and WTP

The survey described in Section 3 captured individual attitudes to earthquake mortality risk, in two ways. It defined a hypothetical scenario in which respondents were informed about the risk they faced and the opportunity to finance a public intervention aimed at reducing the mortality risk associated to a seismic event. It also asked respondents to state their preferences about how much to spend to purchase a life insurance policy that transfers the mortality risk to the capital market. Again, we defined the WTP for a reduction in the mortality risk as an indicator of how much wealth the individual would be willing to sacrifice for an increase in health. In addition, we measure the Conditional Willingness To Pay (CWTP), which excludes individuals not willing to pay a positive amount to reduce the fatality risk linked to earthquakes.

We also follow Botzen and van den Bergh (2012) and identify three ways to elicit individual attitudes to life insurance: (i) WTI which captures the percentage of people who are willing to pay a positive amount for earthquake life insurance (dichotomous); (ii) WTP which is a relevant measure to assess the welfare effects related to the introduction of life insurance policies; and (iii) CWTP which excludes from the WTP calculation those respondents who are not willing to pay for life insurance.Footnote 12

WTP for Insurance vs. WTP for Fatality Risk Reduction

Table 4 summarises the above described measures and provides average values (€ per year) for the geographical areas in the Italian territory. Based on the WTP to reduce the mortality risk, we observe that the highest WTP is linked to the northwest area followed by the northeast, the south and the centre where the WTP is lowest. The results are similar for CWTP: while respondents in the northwest regions demonstrate the maximum WTP, those in the centre are more willing to pay for mortality risk reduction than those in the south and northeast – which may be due to the recent seismic events which hit the centre of Italy. In other words, having decided to pay a positive amount of money to reduce fatality risk (i.e., CWTP), the individual WTP is higher in the centre than in other regions less affected in recent years by high-magnitude earthquakes (Cameron and Shah 2015). In terms of insurance purchase behaviour, although respondents located in the south are more willing to insure against property and health losses (WTI), WTP and CWTP are lower than in the north-west of Italy. This may be due to the polarised (north-south) economic conditions, that affect the Italian territory. By comparing the various measures used to capture people’s attitudes to mortality risk, we observe that the WTP to reduce mortality risk, in the form of a donation and overall increased safety, is lower than the WTP for life insurance. This finding is even more clear if we make the WTP measures conditional on those respondents who stated a positive WTP.

Table 5 provides statistical evidence supporting the higher WTP for insurance, based on a test for mean differences. Differences on the number of observations are related to the availability of information provided by the respondents.Footnote 13 We compare the two open-ended questions eliciting the WTP for mortality risk reduction and the WTP for insurance. Unlike the simple exploratory data analysis in Table 3, here we delve into individual preferences by comparing the WTP for mortality risk reduction and for life insurance.Footnote 14 The WTP for individual insurance (either conditional or non-conditional on a positive WTP) is always greater than the WTP for fatality risk reduction through public intervention. This finding provides insights into individual attitudes to mortality risk. The respondents reported a higher WTP for risk adaptation measures than risk mitigation measures. That is, individuals assign greater value to strategies that transfer the mortality risk to the capital markets compared to those involving public goods which might provide an overall increase in safety. This would suggest that people are more interested in protecting themselves through the purchase of life insurance than financing public interventions that would reduce the overall risk and benefit the society as a whole. This holds even when we exclude protest responses from those who do not trust the public institutions and how the financial resources would be used.Footnote 15

Although this would suggest non-altruistic behaviour, we would recommend some caution when interpreting this result since estimation of the WTP using a CV method could be biased downward (or upward). One source of bias is the so-called anchoring effect that affects evaluation questions where discrete choice questions are followed by open-end questions. It may be that the response to the open-ended question depends on the bid offered in the discrete choice question (Santagata and Signorello 2000). Since this potential bias would affect only the WTP for mortality risk reduction, the difference with respect to the WTP for insurance may be driven by this effect. On the other hand, the yea-saying effect may work in the opposite direction. That is, compliance bias implies that the respondent will answer “yes” regardless of the amount of the bid (Brown et al. 1996). This bias would overestimate the WTP for mortality risk reduction.

Although these two sources of bias may be counterbalancing, it is important to stress that, in our empirical exercise, the open-ended question may overestimate the WTP for mortality risk reduction because respondents are asked to state their preferred amount, in an open-ended format, only if they had accepted the discrete bid.Footnote 16 Although this methodology may inflate the WTP for mortality risk reduction, we observe that the WTP for life insurance is consistently higher.Footnote 17

Factors Affecting the WTP

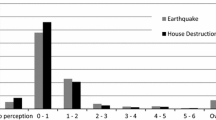

Table 6 presents the variables used in the empirical exercise to identify the factors influencing the WTP for mortality risk reduction and the WTP for life insurance against earthquakes.Footnote 18 Since our interest is in risk beliefs and attitudes to risk, the key variables of interest are those that concern risk perception and past experience of natural disasters. The former is a dummy variable that is equal to 1 if the risk perception in the area is medium-high and is equal to zero if the respondent perceives a low level of seismic risk. We are also interested on the relationship between past experience of earthquakes and WTP. Thus, we introduce the Past experience variable which is equal to 1 if the respondent directly witnessed a seismic event in the previous five years and is zero otherwise. We also include a control variable to capture the respondent’s altruistic behaviour, i.e. Family Size, and socio-economic and demographic controls such as age, net income (based on three main income classes: 0-1k€, 1k-2k€, >2k€ per month), education (bachelors degree or higher) and home insurance for the models that employ WTP for life insurance as the dependent variable. Finally, in order to control for the quality of the buildings we also include a variable that captures the location of the individuals with respect to the city centre (Periphery). The results in Table 6 show that if the focus is on WTP to reduce mortality risk (Columns 1–4), the coefficients of Risk Perception are negatively correlated with the WTP (in the models with open-ended questions). However, focusing on specifications that exploit WTP for life insurance as dependent variable, the perception of seismic risk has a positive and significant coefficient. Moreover, the coefficient of Past Experience is positively correlated to the WTP in models that employ a WTP elicited through an open-ended question as the dependent variable. This insights suggests that direct experience of a natural disaster is associated with either WTP for insurance or WTI. To investigate the role of perceived risk in more depth, Fig. 2 compares the perceived vs. the objective risk. Italian Law differentiates among four types of seismic risk to which municipalities are exposed. We observe that individuals have an overall non-distorted perception of risk with respect to the objective seismic risk assigned to the area. Most respondents living in an area designated as high risk (1st and 2nd bars in Fig. 2) correctly perceived higher levels of risk. However, such relationship is not linear.

The Education and Family size variables capture, respectively, individuals with a bachelor’s degree (or higher) and the number of family members living in the building. The former has a positive correlation with the WTP to reduce mortality risk through public intervention and a negative one when the WTP for life insurance is concerned. Conversely, Family size has a positive correlation with WTP for life insurance and a negative one for WTP for mortality risk reduction. The Age variable emphasise that higher WTP for mortality risk reduction is associated to younger respondents, whereas the only negative coefficients are found when the WTP for life insurance is employed as dependent variable. This finding is in line with Alberini et al. (2004). Moreover, we control for the location of the building in which the respondents live. The Periphery variable accounts for the fact that buildings in the city centre tend to be older than those located outside it. Only for the specifications in columns 5 and 6 we control for the propensity of the respondent to insure his/her house against damages. We can observe that the coefficient of the House insurance variable is positive and significant in both specifications.

Finally, the income variables (introduced via dummies for different levels of income), suggest that higher income levels are associated with lower WTP with respect to the omitted category – which includes people with net income below 1,000 euros. This finding may be correlated to the quality of the dwelling with richer respondents who live in more recent and restructured houses (which comply with the last releases of the seismic building code) being less willing to pay.

VSL and Natural Disasters

The final empirical exercise calculates the VSL related to earthquakes using two approaches. We employ the open-ended and discrete choice evaluation questions to measure the WTP to reduce mortality risk. Table 7 presents the results of the VSL assessment. Estimates of the WTP are presented with and without the control variables. We estimated a logit model including only the dichotomous dependent variable and the bids offered to respondents. We added the controls presented in Table 5 and Section 4.2. The WTP was measured following Santagata and Signorello (2000) who adopt the formula ln[1 + exp(α)]/β to calculate the expected value of the mean WTP from an estimated logit model (Hanemann 1984). We observe that the VSL derived from a discrete choice question is higher than the VSL measured based on an open-ended question. This is in line with Brown et al. (1996), who emphasise that the two types of evaluation questions can lead to different results and should be considered the lower and upper bounds of the true WTP value.

The VSL we obtained is in line with the adjusted results in the meta-analysis conducted by Kochi et al. (2006) who estimate the VSL as $5.4 million with a standard deviation of $2.4 million. In our study, the average VSL value is €4.2 million with a standard deviation of 2.3, and varies between €1.2 million (open-ended WTP) and €6.8 million (discrete choice WTP). When we control for different respondent characteristics (see Table 7) the resulting WTP using the discrete choice model is lower than in the model without controls and, consequently, leads to a lower VSL.

The findings suggest that a considerable benefit is associated to the policy interventions that are aimed at reducing the mortality risk due to earthquakes. Indeed, this should be considered in the measurement of the benefits that specific kind of actions may bring about. That is, the VSL calculation shows that a reduction in mortality risk leads to an economic benefit for individuals.

Conclusions

This paper investigated risk beliefs and attitudes to low-probability, high impact events such as earthquakes. It contributes to the literature on people’s behaviour in the context of mortality risk and confirms previous findings from studies that focus only on property losses. We analysed whether risk attitudes are contingent on how the costs and benefits are distributed according to the mechanism employed to manage risky activities. That is, we identified two ways of managing mortality risk and compared individual preferences across these strategies. On the one hand, mitigation activities rely on public interventions, financed hypothetically by individuals through voluntary donations to the public authority, which reduce the mortality risk for the whole society. On the other hand, individuals can transfer the mortality risk to the capital market through life insurance purchases.

Based on a survey administered to a sample of the Italian population, we estimated the different types of WTP through a CV method. The results highlight the WTP for a reduction in mortality risk caused by earthquakes is lower than the WTP for life insurance. People’s WTP is higher if the costs and benefits accrue exclusively to the individual household. That is, respondents value risk adaptation strategies (no reduction of risk) higher than mitigation strategies – aimed at reducing the mortality risk for the whole society.

We also assessed the influence of risk perception and observed that the patterns related to the WTP for fatality risk reduction and the WTP for life insurance are different. As expected, risk perception is positively correlated with the WTP for insurance and the WTI. However, in the case of WTP to reduce the mortality risk, it has the opposite negative sign. This corroborates the previous result by providing further evidence that people weight strategies that concern private goods more heavily than public strategies (i.e., remedy for a public health threat).

Finally, the paper exploited the WTP to reduce mortality risk to estimate the VSL related to earthquakes. The VSL ranges between €1.1 and €6.8 million depending on the evaluation question, with an average value of €4.2 million.

The present work sheds some light on the heterogeneity of WTP measures with respect to the strategies related to managing mortality risk. This research could be extended in several directions. First, it would be interesting to compare hazard adaptation and mitigation strategies in a field or lab experiment that would allow us to disentangle the attributes of each payment method. Second, in-depth exploration of the causes of these differences would contribute to analyses of individual behaviour.

Change history

19 July 2022

Missing Open Access funding information has been added in the Funding Note

Notes

Both seismic events affected the Modena province and their epicentres were Finale Emilia and Mirandola.

The prospect theory emphasises that in decision making processes people are more sensitive to outcomes that are connected to losses than those related to gains. This is in line with the loss aversion element.

Some studies highlight that, given the high-impact nature of catastrophes, in areas characterised by higher insurance density, the insurance industry may experience serious capacity problems (Berz 1999).

Pearce et al. (2006) provide a detailed description of several techniques that can be adopted to measure the WTP or to accept a compensation in CV studies. They argue that the payment can take diverse forms, including voluntary or coercive methods, and can influence the monetary evaluation. For instance, taxes, fees and charges (i.e., coercive methods) involve issues such as accountability, trust in government, how tax revenues are spent, etc.

Several authors highlight that property insurance may also provide an incentive to invest in mitigation measures to limit the potential damage caused by natural disasters (Botzen et al. 2009; Botzen and van den Bergh 2012). This can be achieved by a reduction (e.g., via discounts or partial compensation from government) in insurance premiums based on ex-ante mitigation measures. This does not change our empirical setting since in this case also the costs and benefits accrue to the household.

Thus, the VSL can be defined as the change in the risk rather than a valuation of a specific individual’s life (De Blaeij et al. 2003). The present paper takes an economic perspective, although there are obvious social and moral dimensions related to this issue.

See Barberis (2013) for a review of empirical work supporting prospect theory.

Here we refer to interventions that go beyond the requirements of Italian building codes.

To this regard, consolidated streams of the literature focus on whether and how government actions may reduce the impact of natural disasters (see, e.g., Booth and Key 2006; Andreotti et al. 2018). Therein, regulations for new buildings, code enforcement, and updating of existing buildings are effective ways to tackle disaster hazard (Spence 2004).

These are the earthquake criteria used in the Italian Parametric Earthquake Catalogue, version 2015 (Rovida et al. 2016).

Moreover, we replicate these last measures in the context of insurance against damage to property caused by an earthquake. This is used as a robustness check. As reported later, the main findings are confirmed in the context of property insurance which is, however, a different framework of analysis.

For the purpose of the study we require that the same respondent answers to both questions (i.e., the WTP for the reduction of mortality risk and the WTP for life insurance). In so doing we can compare the two risk management strategy within the same individual.

For this reason, the rows in Table 4 include different numbers of observations. To restrict the analysis, we included respondents who replied to both elicitation questions, i.e., the question about the WTP for public intervention and question about the WTP for life (property) insurance.

Although moral hazard may affect the results, we must be aware that we interview people who do not already have a life insurance against natural disasters. This implies that the respondents have only a limited opportunity to adapt their behaviour to the fact that they have an insurance.

In the succeeding sections, WTP for mortality risk reduction is calculated also by employing only the discrete choice question. To compare the two WTP variables, we exploit the open-ended question since the WTP for life (property) insurance is based on this format. Several authors argue that WTP calculated based on an open-ended question should be interpreted as the lower bound to the true WTP, while WTP estimated based on a discrete choice model should be considered the upper bound to the true WTP.

The results are confirmed when we employ the WTP for property insurance.

The difference in the number of observations across the various specifications is due to missing data in the reply of each respondent.

References

Ackerman F, Heinzerling L (2004) Priceless: on knowing the price of everything and the value of nothing. The New Press, New York

Alberini A, Hunt A, Markandya A (2006) Willingness to pay to reduce mortality risks: evidence from a three-country contingent valuation study. Environ Resour Econ 33(2):251–264

Alberini A, Cropper M, Krupnick A, Simon NB (2004) Does the value of a statistical life vary with age and health status? Evidence from the US and Canada. J Environ Econ Manag 48(1):769–792

Andreotti G, Famà A, Lai CG (2018) Hazard-dependent soil factors for site-specific elastic acceleration response spectra of Italian and European seismic building codes. Bull Earthq Eng 16(12):5769–5800

Ashenfelter O (2006) Measuring the value of a statistical life: problems and prospects. Econ J 116(510):C10–C23

Barberis NC (2013) Thirty years of prospect theory in economics: A review and assessment. J Econ Perspect 27(1):173–196

Berz GA (1999) Catastrophes and climate change: concerns and possible countermeasures of the insurance industry. Mitig Adapt Strat Glob Change 4(3):283–293

Booth ED, Key D (2006) Earthquake design practice for buildings. Thomas Telford, London

Botzen WJ, Aerts JC, van den Bergh JC (2009) Willingness of homeowners to mitigate climate risk through insurance. Ecol Econ 68(8–9):2265–2277

Botzen WW, van den Bergh JC (2012) Risk attitudes to low-probability climate change risks: WTP for flood insurance. J Econ Behav Organ 82(1):151–166

Brown TC, Champ PA, Bishop RC, McCollum DW (1996) Which response format reveals the truth about donations to a public good? Land Economics 72(2): 152–166

Browne MJ, Hoyt RE (2000) The demand for flood insurance: empirical evidence. J Risk Uncertain 20(3):291–306

Camerer C (1995) Individual decision making. The Handbook of Experimental Economics. Princeton University Press, Princeton, pp 587–704

Cameron L, Shah M (2015) Risk-taking behavior in the wake of natural disasters. J Hum Resour 50(2):484–515

Chang CP, Berdiev AN (2013) Natural disasters, political risk and insurance market development. The Geneva Papers on Risk and Insurance-Issues and Practice, 38(3), 406–448

De Blaeij A, Florax RJ, Rietveld P, Verhoef E (2003) The value of statistical life in road safety: a meta-analysis. Accid Anal Prev 35(6):973–986

Deng G, Gan L, Hernandez MA (2015) Do natural disasters cause an excessive fear of heights? Evidence from the Wenchuan earthquake. J Urban Econ 90:79–89

Fier SG, Carson JM (2015) Catastrophes and the demand for life insurance. J Insur Issues 38(2):125–156

Hanemann WM (1984) Welfare evaluations in contingent valuation experiments with discrete responses. Am J Agric Econ 66(3):332–341

IPCC (2014) Climate change 2014: impacts, adaptation, and vulnerability. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47:263–291

Kniesner TJ, Viscusi WK (2019) The value of a statistical life. Forthcoming, Oxford Research Encyclopedia of Economics and Finance, 19 – 15

Kochi I, Hubbell B, Kramer R (2006) An empirical Bayes approach to combining and comparing estimates of the value of a statistical life for environmental policy analysis. Environ Resour Econ 34(3):385–406

Kousky C, Michel-Kerjan EO, Raschky PA (2018) Does federal disaster assistance crowd out flood insurance? J Environ Econ Manag 87:150–164

Kousky C (2019) The role of natural disaster insurance in recovery and risk reduction. Annual Rev Resour Econ 11:399–418

Krupnick A, Alberini A, Cropper M, Simon N, O’Brien B, Goeree R, Heintzelman M (2002) Age, health and the willingness to pay for mortality risk reductions: a contingent valuation survey of Ontario residents. J Risk Uncertain 24(2):161–186

Kunreuther H (1984) Causes of underinsurance against natural disasters. Geneva Papers on Risk and Insurance, 206–220

Kunreuther H (1996) Mitigating disaster losses through insurance. J Risk Uncertain 12(2):171–187

Kunreuther H, Ginsberg R, Miller L, Sagi P, Slovic P, Borkan B, Katz N (1978) Disaster insurance protection: Public policy lessons. Wiley, New York

Kunreuther H, Pauly M (2004) Neglecting disaster: Why don’t people insure against large losses? J Risk Uncertain 28(1):5–21

Laury SK, McInnes MM, Swarthout JT (2009) Insurance decisions for low-probability losses. J Risk Uncertain 39(1):17–44

Linnerooth-Bayer J, Mechler R, Hochrainer-Stigler S (2011) Insurance against losses from natural disasters in developing countries: Evidence, gaps and the way forward. J Integr Disaster Risk Manag 1(1): 59–81

McClelland GH, Schulze WD, Coursey DL (1993) Insurance for low-probability hazards: a bimodal response to unlikely events. J Risk Uncertain 7:95–116

Meroni F, Squarcina T, Pessina V, Locati M, Modica M, Zoboli R (2017) A damage scenario for the 2012 Northern Italy Earthquakes and estimation of the economic losses to residential buildings. Int J Disaster Risk Sci 8(3):326–341

Modica M, Faggian A, Aloisio R (2019) The post-earthquake reconstruction in L’Aquila: some reflections. Scienze Regionali 18(3):515–522

Onwujekwe O, Uzochukwu B (2004) Stated and actual altruistic willingness to pay for insecticide-treated nets in Nigeria: validity of open‐ended and binary with follow‐up questions. Health Econ 13(5):477–492

Pearce D, Atkinson G, Mourato S (2006) Cost-benefit analysis and the environment: recent developments. Organisation for Economic Co-operation and Development, Paris, France. ISBN 9264010041

Rheinberger CM, Treich N (2017) Attitudes toward catastrophe. Environ Resour Econ 67(3):609–636

Robinson PJ, Botzen WJW (2019) Economic experiments, hypothetical surveys and market data studies of insurance demand against low-probability/high‐impact risks: A systematic review of designs, theoretical insights and determinants of demand. J Econ Surv 33(5):1493–1530

Rovida AN, Locati M, Camassi RD, Lolli B, Gasperini P (2016) CPTI15, the 2015 version of the Parametric Catalogue of Italian Earthquakes. Istituto Nazionale di Geofisica e Vulcanologia

Santagata W, Signorello G (2000) Contingent valuation of a cultural public good and policy design: The case of``Napoli musei aperti’’. J Cult Econ 24(3):181–204

Skidmore M (2001) Risk, natural disasters, and household savings in a life cycle model. Jpn World Econ 13(1):15–34

Slovic P, Fischhoff B, Lichtenstein S, Corrigan B, Combs B (1977) Preferences for insuring against probable small losses: insurance implications. J Risk Insur 44:237–257

Spence R (2004) Risk and regulation: can improved government action reduce the impacts of natural disasters? Build Res Inf 32(5):391–402

Sunstein CR (2005) Laws of fear: Beyond the precautionary principle, vol 6. Cambridge University Press, Cambridge

Sunstein CR (2009) Worst-case scenarios. Harvard University Press, Cambridge

Tian L, Yao P (2015) Preferences for earthquake insurance in rural China: factors influencing individuals’ willingness to pay. Nat Hazards 79(1):93–110

Tversky A, Kahneman D (1992) Advances in prospect theory: Cumulative representation of uncertainty. J Risk Uncertain 5(4):297-323

Vassanadumrongdee S, Matsuoka S (2005) Risk perceptions and value of a statistical life for air pollution and traffic accidents: evidence from Bangkok, Thailand. J Risk Uncertain 30(3):261-287

Viscusi WK (2011) Policy challenges of the heterogeneity of the value of statistical life. Found Trends (R) Microecon 6(2):99–172

Viscusi WK, Aldy JE (2003) The value of a statistical life: a critical review of market estimates throughout the world. J Risk Uncertain 27(1):5–76

Zhou S, Zhai G, Shi Y, Lu Y (2020) Urban seismic risk assessment by integrating direct economic loss and loss of statistical life: an empirical study in Xiamen, China. Int J Environ Res Public Health 17(21):8154

Funding

Open access funding provided by Università degli Studi di Ferrara within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The views expressed in this paper are those of the authors and do not necessarily reflect those of the Ministry of Economy and Finance or the Department of Finance.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Barbieri, N., Mazzanti, M., Montini, A. et al. Risk Attitudes to Catastrophic Events: VSL and WTP for Insurance Against Earthquakes. EconDisCliCha 6, 317–337 (2022). https://doi.org/10.1007/s41885-022-00109-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41885-022-00109-7