Abstract

This study estimates optimum corrective fuel taxes for Bangladesh and correlates them with climate change policy. First, we use the European road transport emission model (COPERT IV) to precisely estimate the externalities. Second, using the same model, we also estimate the reduction in greenhouse gas emissions caused by the fuel tax. Finally, we develop a correlation between the fuel tax rate and emissions reduction. Our benchmark calculation of the optimum corrective tax is US$0.94 per gallon for gasoline and US$1.46 per gallon for diesel (in 2016 prices). We find that congestion and accident externalities are the two main fuel tax components for Bangladesh. We also find that the net social welfare gain per year is US$302.11 million and the net revenue gain per year is 3.59% of GDP. The corrective diesel tax reduces fuel consumption by 18.10% and increases fuel efficiency by 12.53%. In the benchmark case, corrective fuel taxes reduce GHG emissions by 5.77%. With the combination of the existing gasoline tax and a diesel tax of US$1.20 per gallon, the country’s greenhouse gas reduction goal can be achieved. Policymakers can use fuel taxes to support climate change policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

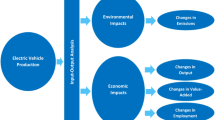

The main purpose of this study is to estimate the “corrective” fuel taxes that can help Bangladesh achieve its intended nationally determined contribution (INDC) to greenhouse gas (GHG) reduction, as a representative middle-income country. Bangladesh has set this goal at a 5% reduction of GHG by the end of 2030, compared with business as usual (BAU) in 2011 [Ministry of Environment and Forests (MoEF) 2015]. “Corrective tax” is a term used in many studies, such as Buchanan (1969), Haughton and Sarkar (1996), and Jacobs and De Mooij (2015), also known as the “Pigouvian tax.” As mentioned in Smith (2017), the tax can be used to correct for externalities or “internalities” in a market. In this study, we analyze the road transport market, known as a major contributor to GHG emissions. The use of gasoline and diesel fuel causes emissions in two ways. First, emissions occur during the combustion of fuel, which is the main source of road transport emissions. Second, evaporation occurs from volatile fuels and lubricants. In this study, we focus on emissions due to combustion. However, the use of motor vehicles generates many negative externalities, including accidents, road damage, air pollution, congestion, and oil dependence (Maibach et al. 2007; Newbery 1990; Parry et al. 2007; Santos et al. 2010). Uddin and Mizunoya (2019) revealed that the construction of expressways can be effective in reducing such external diseconomies. To develop sustainable transport policies, all these external costs need to be measured correctly.

Most fuel tax studies have been done in developed countries. Newbery (2001), Parry and Small (2005), and Sterner (2007) recognized the fuel tax as an ideal instrument to address global warming. Parry and Small (2005) found some people responded to the distance-based externalities of the fuel tax by purchasing more fuel-efficient vehicles, rather than driving less. Addressing these two issues, they derived a formula for an optimum fuel tax based on fuel consumption. Their findings suggest congestion externalities represent the largest component in fuel taxes in the USA and the UK. Antón-Sarabia and Hernández-Trillo (2014) calculated an optimum gasoline tax for Mexico, using five important parameter values, including price elasticity, from Parry and Small (2005). They found accident externality to be the largest component of the fuel tax, followed by distance-related damage, and congestion. Parry and Strand (2012) developed a general approach for estimating motor vehicle externalities; they calculated corrective taxes on gasoline and diesel for Chile, considering only two types of vehicles, namely, cars and trucks. They also used important elasticity values from the USA literature. Moreover, they assumed vehicles’ fuel efficiency might influence the optimum fuel tax calculation. Their model suggests that accident and congestion externalities are the main components of the fuel tax in Chile.

All the above mentioned studies are empirical, and use important elasticity parameters in different geographical locations. Therefore, despite their claims, these models can only partially capture the response to optimum fuel taxes. Additionally, these studies do not address the fuel tax amount that would reduce global pollution to a certain level. To estimate a reduction in global pollution, country-specific emissions regulations, vehicle class, speed, and driving modes need to be considered. Moreover, to the best of our knowledge, no study on corrective fuel tax has been done in Bangladesh.

To address these gaps in the literature, this study sets forth the following four objectives: (i) to estimate the fuel taxes for both gasoline and diesel that would internalize negative road transport externalities considering the current vehicle fleet, emission standards, and driving conditions in Bangladesh; (ii) to estimate the impacts of corrective taxes on welfare gain, revenue collection, fuel consumption, and fuel efficiency; (iii) to estimate the reduction in emissions from on-road vehicles due to corrective fuel taxes; and (iv) to find a set of fuel taxes to achieve the INDC goal.

Using a dataset from Bangladesh, this study estimates corrective fuel taxes that internalize the negative externalities of road vehicles, then correlates such fuel taxes with climate change policy. We use the Parry and Strand (2012) model to derive the corrective fuel tax, and the Microsoft Windows software program COPERT IV to calculate emissions from road transport in Bangladesh, to achieve our objectives. We fully acknowledge that this study neither investigates the impacts of fuel taxes on the fiscal system, nor the interactions between fuel taxes and other taxes. We also restrict our analysis to diesel and gas, since these are the two main fuels used for road transport in Bangladesh.

The rest of our paper is organized as follows. Section 2 presents our analytical framework, including our main models and parameter assessment. Section 3 provides our calculations, results, and a discussion comparing these with previous studies. Section 4 concludes.

2 Analytical framework

2.1 Main models

We follow the model of Parry and Strand (2012) to calculate the corrective fuel tax; however, our methodology is different. The main difference is that we use COPERT IV to simulate emissions from on-road vehicles, while Parry and Strand (2012) used empirical methods. Additionally, we provide estimates for reductions in GHG emissions resulting from different fuel taxes. To calculate road accident externalities, we use country-specific road transport accident (RTA) costs and probabilities of accidents for different vehicles. Parry and Strand (2012), however, extrapolated these from the US literature. Furthermore, we use country specific datasets to estimate elasticity, which are needed to capture the response to fuel taxes. These differences are summarized in Table 1.

2.1.1 Corrective fuel tax model

Since we follow Parry and Strand (2012) to derive the corrective fuel tax, the style and descriptions in this section closely follow their presentation. For detailed descriptions of the model, we refer them. The full expression for the corrective fuel tax is as follows:

where \({t}_{F}^{c}\) is the corrective fuel tax, \({E}^{PF}\) is the marginal global pollution cost, \({E}^{PM}\) is the marginal local pollution cost, \({ E}^{C}\) is the marginal congestion cost, \({E}^{A}\) is the marginal accident cost, \({E}^{D}\) is the marginal road damage cost, \(g\) is the fuel combustion per vehicle kilometer, and \(\beta \) is the proportion of the reduction in fuel consumption that comes from a reduction in distance driven or the vehicle kilometer traveled (VKT) portion of fuel price elasticity (Parry and Small 2005). Parry and Small (2005), Parry and Strand (2012), and Goodwin (1992), define \(\beta \) as the “vehicle miles traveled (VMT) portion of fuel price elasticity” as mile is used as the unit of distance. However, there is essentially no difference between VMT and VKT; hence, we use VKT in this study. Following Parry and Small (2005),

where \({\eta }_{FF}\) is the negative of the fuel demand elasticity, \({\eta }_{MF}\) is the negative of the elasticity of VKT with respect to the consumer fuel price, and \({\eta }_{FF}^{M}\) is the negative of the fuel demand elasticity with VKT held constant. Since we could not find data on elasticity of fuel demand in Bangladesh, we assume \(\beta \) = 0.4 as in Parry and Small (2005). We use \(\beta \) = 0.2–0.6 for sensitivity analysis. In Eq. (1), we do not consider marginal noise cost, as it is difficult to measure in Bangladesh, and we did not find any related studies for the country. To estimate the effects of the corrective fuel tax on kilometers traveled and fuel economy, we use the following functions, as discussed in Parry and Small (2005).

where ° denotes an initial (currently prevailing) value, \({p}_{F}\) denotes the producer price of fuel, \({t}_{F}\) denotes the excise tax on fuel or the fuel tax, and \(M\) denotes the aggregate vehicle kilometers traveled by households.

The welfare gains (\({W}_{F}\)) from raising the fuel tax from an initial level to its corrective level are given by Parry and Strand (2012), as follows:

where \(F\) is aggregate fuel consumption.

2.1.2 COPERT IV model

We use COPERT IV to calculate emissions from road transport in Bangladesh. It is a software program that estimates motor vehicle emissions, including N2O, CO, methane (CH4), Sulphur dioxide (SO2), NOx, VOC, and PM, produced by different vehicle categories, and CO2 emissions based on fuel consumption (Kousoulidou et al. 2010). This model has found growing acceptance among scientists who estimate road emissions regularly (Ntziachristos and Samaras 1998). Moreover, COPERT IV emission factors have been included in the recent 2006 Intergovernmental Panel on Climate Change (IPCC) guidelines. Gkatzoflias et al. (2012) provide a detailed description of the COPERT IV model.

As vehicle emissions vary by individual vehicle size and type; emission control technology; age; vehicle maintenance; fuel use and type; and kilometers driven, each country or region should have specific emission factors. These also depend on driving conditions and environment. Guensler (1993) categorized vehicle emission factors in the USA in terms of vehicle specifications, fuel specifications, vehicle operating conditions, and vehicle operating environment. Similarly, a different road transport emission model (COPERT-based) was developed for European vehicles. The model calculates pollutant emissions and energy consumption within a region or country, using data such as the number of vehicles; year of introduction of regulations; fuel consumption and characteristics; average temperatures of the country; route distribution/driving condition (rural, urban, highway); and average speeds (Burón et al. 2004).

Kholod et al. (2016) suggest using a COPERT model to calculate emissions, especially in countries that have implemented European emission standards. Cai and Xie (2007), Lang et al. (2012), Thambiran and Diab (2011), and many others have used this model to estimate emissions at national and local levels for non-European countries. Since 2005, Bangladesh has adopted European emission standards: Euro I for diesel vehicles and Euro II for gasoline vehicles (Pundir 2012). Since Bangladesh does not have country-specific emission factors, COPERT IV seems suitable for the purpose of our investigation. We use the COPERT algorithm to estimate annual fuel consumption, by capturing fuel specification (Pundir 2012), emission regulation, vehicle information, VKT, speed, and driving share data.

2.2 Parameter assessment and other data

2.2.1 Elasticity of VKT with respect to consumer fuel price

We estimate the corrective fuel tax using an intermediate-run estimate of the elasticity of VKT with respect to consumer fuel price. Since it plays a key role in the corrective fuel tax formulation, we discuss our methodology for the parameter value in detail. It is worth mentioning that although passenger kilometer (PKM) could be another option for buses, cars, and other passenger vehicles, it is not applicable for trucks. Additionally, the PKM database at the national level is not established yet. To calculate the intermediate-run fuel price elasticity of VKT in Bangladesh, we estimate a simple double-log model using country specific data over 8 years (2009–2016). Given the stationary nature of our data, we follow Lin and Zeng (2013). Our model is as follows:

where \(\mathrm{VKT}\) denotes per capita vehicle kilometer (km) traveled by vehicle, \(P\) denotes the real price of fuel, \(I\) denotes per capita real disposable income, \({\beta }_{o}\) is the constant term, \({\beta }_{1}\) is the elasticity of VKT with respect to consumer fuel price, \({\beta }_{2}\) is the elasticity of VKT with respect to income, and \(\epsilon \) is the error term.

Static models like the above are expected to produce intermediate-run elasticity. The interpretation of the coefficients in the above model is not entirely clear. We would expect the price and income elasticities to be as follows:

2.2.2 Marginal local emission cost

Marginal local emission costs are calculated using emission factors and damage costs. Since Bangladesh follows euro standards for emission, COPERT IV can calculate emission factors for different vehicles differentiated by area and road type. In this regard, we consider four categories of roads and highways in Bangladesh: national highways, regional highways, Zila roads (roads connecting district headquarters to the smallest administrative unit called Thana), and rural roads. We assume that our national highways and rural roads are the same as Europe’s motorways and rural roads, respectively.

However, the valuation of damage is highly speculative. The Directorate-General of the European Commission responsible for transport within the European Union (MOVE 2014) provides marginal local emission costs for EU countries (see Appendix Table 14). An important aspect of this damage evaluation is valuation of a life year (VOLY). MOVE (2014) suggested US$57,551 (in 2010 prices) as the mean VOLY for European Union (EU) members. To extrapolate this marginal local emission cost to Bangladesh, we consider differences in the real GDP per capita as shown in Eq. (8).

where \({E}_{i,j,k}^{L,BD}\) is the local emission cost per km in Bangladesh for vehicle class \(i,\) technology \(j\) (Euro I, II, etc.), and driving environment \(k\) (i.e., urban, rural, and highway); \({E}_{i,j,k}^{L,EU}\) is the local emission cost per km in the EU for \(i,j,\) and \(k\); \({I}_{BD}\) is the real GDP per capita in Bangladesh (US$); \({I}_{EU}\) is the real GDP per capita in the EU (US$); and \({\eta }_{I}\) is the elasticity of VOLY with respect to income.

From the World Bank (2019a), \({I}_{BD}/{I}_{EU}\) is (US$3869/US$43,976 =) 0.088. The empirical literature on the income elasticity of VOLY (\({\eta }_{I}\)) is conflicting, with estimates varying between about 0.5 and 1.5 (Parry and Strand, 2012). This suggests a plausible range for Bangladesh of US$1652 to US$18,779, with a benchmark value of US$5571 when \({\eta }_{I}\)=1 (all in 2016 prices). We use this range for our sensitivity analysis.

To get the marginal local emission cost, we multiply the unit marginal local cost by number of vehicles and kilometers traveled under the same condition; then, we divide the product by total VKT, as shown in Eq. (9).

where \({E}^{PM}\) is the marginal local emission cost, \({v}_{i,j}\) is the number of vehicles of vehicle class \(i\) and technology \(j\), \(\mathrm{and} {m}_{i,j,k}\) is the kilometers traveled by vehicle class \(i\) and technology \(j\) under condition \(k\).

2.2.3 Marginal global pollution cost

Global warming costs are highly speculative due to the long period involved; uncertainties about atmospheric dynamics; and inability to forecast adaptive technologies (Parry and Small 2005). The key step here is the valuation of the cost of CO2. MOVE (2014) suggests the carbon price to be US$120 (in 2010 prices) with a range of US$65–US$225 at a 3% discount rate. We extrapolate this carbon price in Eq. (10). Using \({I}_{BD}/{I}_{EU}\)= 0.088 and \({\eta }_{I}\)=1, our benchmark CO2 price is US$11.62 for Bangladesh with a range from US$6.29 to US$21.78 (all in 2016 prices). Again, we use this range for our sensitivity analysis.

where \({C}_{f, GHG}^{BD}\) is the climate change cost of fuel type \(f\) for Bangladesh (US$), and \({C}_{f,GHG}^{EU}\) is the climate change cost of fuel type \(f\) for EU (US$) (see Appendix Table 15).

Marginal global pollution cost is estimated in Eq. (11). We multiply total fuel consumption by the unit climate change cost of that fuel, then divide the product by aggregate kilometer traveled under that fuel. Note that we import total fuel consumption from the COPERT IV software using the vehicle database, emission standard, and fuel specification, as the government database of fuel consumption for the road sector does not separate fuel consumption by other sectors.

where \({E}^{PF}\) is the marginal global pollution cost, and \({F}_{f}\) is the aggregate fuel consumption of fuel type \(f\) in liters.

2.2.4 Marginal congestion cost

Each vehicle creates a marginal congestion cost for other road users due to its road usage, which depends on the marginal delay and value of travel time (VOT). We use VOT data from Uddin (2017), who studied VOT for different vehicles in Bangladesh (see Table 4 and Sect. 2.2.8 for details). An approximation for the marginal delay can be inferred from data on average delay. We obtain the average delay due to congestion by comparing the inverse of average speed and desired speed of a vehicle. Using the “Bureau of Public Roads” formula, Parry and Strand (2012) found the marginal delay to be four times the average delay. Since a nationwide congestion study does not exist, we assume that 30% of urban mileage and 20% of highway mileage face congestion, and there is no congestion on rural roads. To calculate marginal congestion cost, we multiply the marginal delay by kilometers traveled in congestion and by the VOT. Then, we divide the product by total VKT of the respective vehicles, as given in Eq. (12).

where \({E}^{C}\) is the marginal congestion cost; \({T}_{i,j,k}^{MD}\) is the marginal delay per vehicle km for \(i,j,\) and \(k;\) \({M}_{i,j,k}^{\mathrm{congestion}}\) is the kilometers traveled in congestion for \(i\) and \(k\); and \({ VOT}_{i,k}\) is the value of travel time for \(i\) and \(k\).

2.2.5 Marginal accident cost

Marginal accident cost depends on types of accidents, number of accidents, and RTA costs. However, we take a different approach to calculate marginal accident cost. We assume that each vehicle has a probability of accident when it is driven on a road and poses an accident threat to others. This probability can be seen as equivalent to past accident rates of that vehicle type. In Bangladesh, a high level of underreporting is believed to exist at all levels of accident statistics, possibly due to the Government’s limited capacity to track post-accident deaths. Furthermore, some accidents are not reported to avoid legal proceedings. To overcome this challenge, we consider fatal accidents to be 24,954 (World Health Organization 2018), and serious, simple, and property damage only (PDO) accidents to be 1954, 109, and 2566, respectively (Bangladesh Bureau of Statistics 2018). We assume that non-reported accidents have no effect on our results. The Power and Participation Research Centre (2014) identified buses as the dominant vehicle category (38.1%) among accident perpetrators, followed by trucks (30.4%), motorcycles (12%), cars (6%), jeeps (4.5%), and others (9%) in 2012. Paul et al. (2008) studied RTA costs for Bangladesh using the gross output method. We update their RTA costs, assuming 6% inflation (Table 2).

We can calculate the marginal accident cost by multiplying the number of accident types with the RTA cost, then dividing the product by total VKT. Then, we distribute the total marginal cost to each vehicle type by their probability of accident. We summarize this in Eq. (13).

where \({E}^{A}\) denotes the marginal accident cost, \({P}_{i}\) is the probability of an accident involving vehicle class \(i\), \({N}_{l}\) is number of accidents of type \(l\) (i.e., fatal, serious, simple, PDO), and \({C}_{l}^{a}\) is the cost of the road traffic accident of type l.

2.2.6 Marginal road damage cost

The road damage cost, which is the cost of repairing the damage caused by the passage of vehicles is borne by the highway agencies. However, other drivers also bear the cost in the form of extra vehicle operating costs imposed by this damage (Santos et al. 2010). Newbery (1988) suggests that, under certain conditions, the average cost of repair could be equal to the cost of marginal road damage. Empirical studies in transportation engineering suggest that road damage caused by a vehicle increases according to the fourth power of the axle load. Thus, most of the damage is caused by heavy duty vehicles on thin roads (Newbery 1990). We estimate marginal road damage cost for heavy duty vehicles using Eq. (14).

where \({E}^{D}\) is the marginal road damage cost, \({C}_{m}\) is the annual maintenance expenditure in US$, and \({ M}_{HDV}\) is the annual kilometer traveled by heavy-duty vehicles.

2.2.7 Producer price of fuel (\({{{p}}}_{{{F}}}\)) and initial tax rate (\({{{t}}}_{{{F}}}^{{{o}}})\)

As Bangladesh is not an oil producing country, it imports oil to meet domestic demand. Thus, the price in international markets affects oil imports. However, the domestic oil market is regulated by the government to protect consumers from sudden price changes. Therefore, the government accepts a huge loss each year when the price in the international markets increases. We assume the world average oil price as the producer price of fuel. Subtracting the producer price from the local fuel price, we obtain an initial tax rate (Table 3).

2.2.8 Other data

Our main data source for our major variables is Uddin (2017). We also use the Bangladesh Road Transport Authority (BRTA) database for on-road vehicle statistics from the Bangladesh Bureau of Statistics (2018). The BRTA has divided motorized vehicles into 20 classes. However, it does not keep annals according to fuel use. Therefore, we use the Roads and Highways Department (RHD) database to classify vehicles according to the types of fuel used. RHD classifies vehicles into 11 classes, which differs from the BRTA classification. In fact, BRTA defines heavy trucks as trucks that carry more than 7.5 tons of payload, while the RHD classifies heavy trucks as trucks that have three or more axles. Due to this difference in definition, BRTA-classified heavy truck numbers can include many of the RHD-classified medium trucks that have two axles, but carry more than 7.5 tons payload. Uddin (2017) shows that about 47% of BRTA-classified trucks are classified as heavy trucks by RHD, 16% as medium trucks, and less than 2% as articulated trucks. We assume the 2% articulated trucks are included in the heavy trucks, and the remaining 35% are small trucks (Appendix Table 12).

Since Bangladesh does not have country-specific emission factors, our vehicle classifications should align with the vehicles referenced in the IPCC guidelines. Therefore, we compare RHD and BRTA vehicle classifications with those of Eggleston and Walsh (1998) to create a combined vehicle classification and unique database that conforms with COPERT (see Appendix Table 13). We assume the closest match in the COPERT classification when analogous vehicles are not found. For example, we assume the COPERT class PC mini (1.4–2 l) for the Auto Rickshaw, the Tempo, and the Human Hauler.

Uddin (2017) surveyed VKT, average travel speed of vehicles, and VOT on national highways (see Table 4). As data on individual vehicle kilometers traveled are difficult to establish, we assume driving shares are distributed as 40%, 30%, and 30% on urban, rural, and national highways, respectively. From our industry experience, we assume the desired safe speed on highways to be 50 km/h. In contrast, the traffic on urban roads in Bangladesh is mixed in nature and moves in a group. The speed of the slowest vehicle slows down the average speed of the group. Additionally, numerous intersections at frequent intervals, poor road conditions, side friction of non-motorized vehicles, a manual signaling system, and illegal encroachments of roadsides slow down vehicle speed. At times, traffic slows to walking speed in large cities. Therefore, we assume an average speed of 20 km/h and a desired speed of 30 km/h for urban traffic during congestion.

The VOT is captured by the concept that the time spent traveling could be used for an alternative activity. If we assign a monetary value to this alternative activity, we can estimate the VOT. Hence, its unit value is US$ per hour (US$/h). Both average wage and revealed preference methods are used for the VOT calculation. We use both VOT calculations for our sensitivity analysis. Moreover, an average of both is used for the benchmark calculation of the corrective tax. As we could find no study on travel time on urban roads, we assume that VOT is the same on highways.

3 Results and discussion

3.1 Benchmark parameter values and COPERT IV analysis

We calculate each component of the corrective fuel tax before we calculate the corrective gasoline and diesel taxes and analyze their impacts. According to Eq. (1), our corrective fuel tax has five components; each component depends on one or two parameters and assumptions. Therefore, we arrive at a range of values for each parameter. For example, Eq. (8) has two parameters, namely, local emission cost per km and elasticity of VOLY with respect to income. Both parameters have a range of values. It is difficult to achieve a certain value of the corrective fuel tax component if the parameters change. Therefore, we use the mean (average) values of the parameters so that we can reach a certain value for a component of the corrective fuel tax. We summarize the results of the benchmark parameter values in Table 5.

For other parameters, using the COPERT IV model calculation, we arrive at an initial fuel consumption (\({{{F}}}_{{{f}}}\)) for gasoline of 2,303,519 tons and for diesel 7,842,565 tons. The total initial VKT for gasoline and diesel are 48,874.22 million km and 34,838.34 million km, respectively. Dividing both figures, we arrive at initial fuel efficiency (\(1/{{{g}}}^{{{o}}}\)) for gasoline of 15.86 km/l and for diesel 3.75 km/l.

3.2 Elasticity of VKT with respect to consumer fuel price (\({{{\beta}}}_{1}\))

The elasticity of VKT of fuel price is probably the most important component of the corrective fuel tax; its estimation is crucial for policymaking. We believe that we are the first to estimate elasticity of VKT with respect to consumer fuel price for Bangladesh. Earlier, McRae (1994) estimated price elasticity of gasoline demand (− 0.35) for Bangladesh using a dataset with the period 1973–1987. However, to the best of our knowledge, no study has been done on the elasticity of VKT in Bangladesh. Our regression analysis shows that VKT elasticity for gasoline and diesel is − 0.26 and − 0.19, respectively (see Table 6). This means that a 1% increase in fuel price is associated with a 0.26% and a 0.19% decrease in annual VKT for gasoline and diesel vehicles, respectively. Most results are statistically significant at the 5% level. Goodwin (1992) found short-run VMT elasticity of -0.16 and long-run VMT elasticity of − 0.33. Graham and Glaister (2002) also found similar results. Goodwin et al. (2004) reviewed the literature on elasticities published as of 1990. Their findings suggest that VMT elasticity is − 0.31 for a static model. In contrast, Lin and Zeng (2013) found a larger value, which they attributed to the poor quality of VKT data for China. Our findings differ from the previous literature, falling in the intermediate range. We think this variation is due to the sensitivity of the estimates to different aspects of the model’s structure. These aspects might be selection of dependent variables, nature of data, period of analysis, geographic location, and estimation techniques, among others. Our VKT elasticity for gasoline is greater than that for diesel. One possible reason is that diesel is more inelastic because it is used mainly for public transportation vehicles and commercial trucks. Therefore, drivers are not very responsive to changes in diesel price; thus, leading to a higher inelasticity for VKT.

3.3 Result of corrective fuel tax calculation

3.3.1 Gasoline tax

Applying the benchmark parameter values for gasoline to Eq. (1), we obtain the corrective gasoline tax. Our benchmark corrective gasoline tax is US$0.94 per gallon (see Table 7) with congestion accounting for (\({E}^{C}\cdot 100/{t}_{F}^{C}\) =) 54.07%, traffic accidents (\({E}^{A}\cdot 100/{t}_{F}^{C}\) =) 33.59%, global warming (\({E}^{PF}\cdot 100/{t}_{F}^{C}\) =) 11.04%, and local tailpipe emissions (\({E}^{PM}\cdot 100/{t}_{F}^{C}\) =) 1.29%. Our benchmark estimate is lower than that of Parry and Small (2005), even after we update their results to 2016 prices (see Table 8). This seems reasonable given the lower valuations of a life year and travel time for Bangladesh compared with the USA and the UK. However, we note that the percentage of the accident component in the corrective tax is about 33.59% for Bangladesh, which is higher than that in the USA (32%) and the UK (20%). Our explanation is that accident externalities are much higher for Bangladesh than for the USA and the UK. Although the nationwide congestion in Bangladesh might not be similar to that in the big cities in the USA and the UK, frequent intersections, side friction, non-motorized traffic, manual signaling, and, above all, illegal encroachments on roadways significantly reduce travel speed. For this reason, the share of the congestion component is higher in the case of Bangladesh.

3.3.2 Diesel tax

Applying the benchmark parameter values for diesel to Eq. (1), we obtain the corrective diesel tax. Our benchmark corrective diesel tax is US$1.46 per gallon (see Table 7). Our benchmark calculation implies that the corrective diesel tax should be higher than the corrective gasoline tax, which is contrary to most situations in the OECD countries as depicted in Fig. 1. We argue that a low tax on diesel could act as an incentive for diesel users, and gasoline users might switch to diesel. Mayeres and Proost (2001) found that lower taxes on diesel than gasoline were inefficient because diesel emitted more pollutants than gasoline. A study by Harrington and Mcconnell (2003) found that the use of diesel-fueled vehicles increased in Europe due to a lower tax on diesel than gasoline, which supports our argument. However, our corrective diesel tax is higher than that in the USA, Canada, Chile, and New Zealand, as Bangladesh diesel vehicles have lower fuel economies and emit more emissions per kilometer than those in the abovementioned countries. For this reason, our corrective diesel tax seems reasonable.

Source: International Energy Agency (2019)

Excise tax on fuel in selected OECD countries.

Unlike gasoline, road damage contributes (\({E}^{D}\cdot 100/{t}_{F}^{C}\) =) 11.39% (US$0.17 per gallon) to the diesel tax. Other externalities are higher than for the gasoline tax. However, the share of the congestion externality in the total corrective tax is lower for diesel (\({E}^{C}\cdot 100/{t}_{F}^{C}\) = 37.67%) than gasoline (54.26%). This can be explained by the fact that gasoline-powered private vehicles carry fewer passengers than public buses, which are the main cause of congestion in the big cities in Bangladesh. In this context, our finding implies that the tax could reduce congestion in the absence of a congestion charge or any measure specifically designed to address congestion. Notably, accident and congestion externalities reflect equal shares in the corrective diesel tax.

Our corrective diesel tax is much smaller than that of Parry and Strand (2012) for Chile (US$2.09 per gallon). Although we follow the same model, our methodology is different. Assumptions in value of life and price of carbon, differences in income, accident statistics, and road maintenance expenditures might cause the dissimilarity in the corrective diesel taxes in the two countries. However, we think our use of on-road vehicular data, appropriate vehicle kilometers traveled, driving conditions, country-specific emission standards, and elasticity values make our estimate more precise than that of Parry and Strand (2012).

3.4 Impacts of tax reform on social welfare and government revenue

Using Eq. (6) in our benchmark case, the welfare gain for gasoline is US$11.48 million. However, our corrective tax for gasoline is less than the currently prevailing excise tax. Therefore, the corrective tax decreases the welfare gain by the same amount and fuel efficiency by 2.71%. It also increases gasoline demand by 4.93%. However, by raising the excise tax to the corrective diesel tax level, the welfare gain becomes US$313.59 million. At present, we show a loss in welfare of US$70.87 million due to the fuel subsidy. Therefore, our net social welfare gain would be (US$313.59–US$11.48) US$302.11 million. In addition, raising the excise tax to the corrective tax also increases fuel efficiency by 12.53%. In the long run, diesel consumption decreases by 18.10%.

By implementing the corrective gasoline tax, gasoline demand increases by 4.93%. Therefore, the government loses revenue from two perspectives. First, revenue from existing sales decrease by 814.08 million gallons of gasoline (from the COPERT calculation), which amounts to US$252.37 million. Second, the government must pay for the increased demand for gasoline at the world market price. This amounts to US$120.00 million. Therefore, the total loss from the reduction in price is (US$252.37 + US$120.00) US$372.37 million. However, the increase in the diesel price has several benefits. First, the government does not have to pay the subsidy for future fuel consumption of 2008.04 million gallons (current consumption is 2451.82 million gallons from the COPERT calculation and the current subsidy is US$367.77 million), which amounts to US$301.21 million. Second, the government can increase revenue by US$2931.74 million by selling diesel. Finally, with the price increase, the demand for diesel drops by 18.10%, which means the government can import less diesel than before, saving US$1477.79 million. Thus, the total gain would be (US$301.21 + US$2931.74 + US$1477.79) US$4710.74 million. The net gain would be (US$4710.74-US$372.37) US$4338.37 million. The GDP of Bangladesh for fiscal year (FY) 2016–2017 is US$120,797.76 million (Bangladesh Bureau of Statistics 2018) at a constant price. Therefore, our net gain from the corrective fuel tax is 3.59% of GDP. So, corrective fuel tax like the carbon tax could be an effective way to promote economic development (Zou et al. 2014). The government can use this revenue to finance road maintenance (Act No. XXVIII, 2013), which will improve fuel efficiency, speed, and reduce road damage costs.

3.5 Sensitivity analysis

Considering the uncertainty surrounding the benchmark calculation, we conduct a sensitive analysis, by varying seven of the most relevant parameters, one at a time. We follow MOVE (2014) for the intervals of the first two parameters, Uddin (2017) for the alternative value of travel time, and Parry and Small (2005) for the intervals for the rest of the parameters (see Table 9).

The results are most sensitive to the VKT portion of fuel price elasticity. Using β = 0.6 causes the corrective gasoline and diesel tax increase to rise to US$1.40/gal and US$1.90/gal, respectively. However, using β = 0.2 decreases the corrective gasoline and diesel tax by US$0.48/gal and US$0.66/gal, respectively. The results are also sensitive to traffic congestion. An increase in congestion by 50% results in an increase in the corrective gasoline and diesel taxes by 29.79% and 14.38%, respectively. However, under a low traffic congestion scenario, the corrective gasoline and diesel taxes fall by 28.72% and 26.03%, respectively.

The results are also sensitive to VOLY. As discussed earlier, for Bangladesh, VOLY could be anywhere between US$1652 and US$18,779. Using the higher VOLY increases the corrective gasoline and diesel taxes by 24.47% and 17.81%, respectively. Using the lower VOLY, decreases the corrective gasoline and diesel taxes by 4.25% and 3.42%, respectively.

Using a higher value for global warming damages ($21.77 per ton of CO2 instead of $11.62 per ton) increases the corrective gasoline tax and diesel tax by 14.28% and 16.30%, respectively. Increasing and decreasing accident externalities by up to 50% causes the corrective fuel taxes to vary by up to 20% (approximately). In the remaining cases shown in Table 8, alternative parameter assumptions do not change corrective fuel taxes dramatically. For example, changing road damage by 50% and using the average wage method, or the revealed preference method, causes the corrective tax to vary by about 10%.

In sum, a wide range of outcomes is possible under alternative parameter scenarios. To show the likelihood of different outcomes for the ranges of our parameters, we perform a simple Monte Carlo simulation. First, we set the maximum and minimum for all externalities. Second, we draw each of the above parameters randomly and independently 1000 times from selected distributions and, third, for each draw, we calculate the corrective fuel tax. Finally, we take the average of all the corrective fuel taxes.

Table 10 shows the simulation results. The probability that the corrective gasoline tax is less than the $0.94/gal is 0.38, and the probability that it is below $1.20/gal is 1. For diesel, the probability that the corrective diesel tax is less than the $1.46/gal is 0.57, and the probability that it is below $1.50/gal is 0.74.

3.6 Corrective fuel taxes for INDC goal

The main pollutants from combustion activities that have an effect at the local level are nitrogen oxides, VOCs, NMVOCs, carbon monoxide, and particulate matter. CO2, nitrogen monoxides, and methane have impacts at a global level. Calculations from our COPERT IV model show that total emissions of PM2.5 from the road transport sector is 13,527.09 tons (see Appendix Table 17), of which, 39.75% of the pollution occurs on urban roads, followed by 36.18% on rural roads, and 24.07% on highways. Diesel vehicles are mainly responsible for PM2.5 (Fig. 2), emitting 86% of the total pollution, while gasoline vehicles are responsible for only 14%. Among the diesel vehicles, mini buses, heavy trucks, and large buses are responsible for 22.51%, 18.89%, and 16.66% of the total emissions, respectively. The contribution from jeeps is 11%, while other vehicles contribute less than 10%. Among gasoline vehicles, motorcycles contribute 93% of total emissions. In total, buses emit 50% of total emissions, while heavy duty trucks, motorcycles, passenger cars, and light commercial vehicles emit 26.96%, 12.61%, 7.86%, and 2.42% of total emissions, respectively.

Total emissions of PM10 are 14,777.15 tons (see Appendix Table 18). Like PM2.5, diesel vehicles emit the largest portion (85%) of total PM10. Motorcycles and private cars, have an 88% and 12% share in pollution contribution, respectively. Among all the vehicle classes, buses are responsible for 49.36% of total PM10, followed by heavy duty trucks at 26.64%, motorcycles at 12.77%, passenger cars at 8.71%, and light commercial vehicles at 2.51%. Individual assessment suggests that mini buses and heavy trucks bear the responsibility for 22.09% and 18.37% of these emissions, respectively.

Diesel vehicles emit 98% of total NOx. Among them, buses contribute 63.67% (145,370.95 tons) of NOx, which is more than twice the emissions from heavy duty vehicles (HDVs) (28.16%). Individually, mini buses emit 29.29%, and heavy trucks and large buses emit almost 20%. Passenger cars and light car vehicles (LCVs) contribute 5.67% and 1.78%, respectively (Appendix Table 19).

The total VOC emissions are 119,797.5 tons (Appendix Table 20). Urban, rural, and highway shares are 41.54%, 36.04%, and 22.42%, respectively. Gasoline vehicles are the primary emitters of VOC (83%). Motorcycles alone contribute 80.55% (96,494.85 tons), which is the highest of all vehicles. Among the diesel vehicles, mini buses are responsible for 4.63% of total VOC. Motorcycles and buses are still major contributors of NMVOC. Motorcycles are responsible for 81.92%, whereas buses emit 10.16% (Appendix Table 21).

CO was the second highest emitted pollutant, at 449,528.04 tons (Appendix Table 22). Gasoline vehicles are the main source of CO (86%), of which, 97% comes from motorcycles. Mini buses contribute 3.83%, followed by private cars at 2.79%. Heavy trucks and large buses each contribute 2.68%.

CO2 is the highest emitted pollutant; 31.94 million tons are emitted from fuel combustion (Appendix Table 23). Gasoline vehicles emit 22.60%, while diesel vehicles are the major contributors at 77.40%. Among the gasoline vehicles, motorcycles are the major emitter of CO2. Among the five vehicle classes, buses emit 14.47 million tons, representing 45.31% of total emissions, of which, large buses contribute 14.14%, followed by minibuses at 20.77%, and microbuses at 22.93%. Among other vehicles, HDVs, passenger cars, and motorcycles contribute 20.92%, 17.45%, and 13.68%, respectively. Heavy trucks and private cars are the top contributors within their respective vehicle classes.

With a 55% share, diesel vehicles are the main contributor of N2O (Appendix Table 24). Of this, heavy trucks contributed 20%, large buses 19%, minibuses 16%, and jeeps 12%. Among gasoline vehicles, the shares of motorcycles and private cars are 53% and 47%, respectively. Major pollution occurs on urban roads (54.59%), while rural and highways contribute 24.61% and 20.80%, respectively.

Total emissions of CH4 are 3406.18 tons (Appendix Table 25). Most of the CH4 emissions occur on urban roads (63.30%). Whereas, CH4 emissions from rural roads and highways are very low (19.48% and 17.22%, respectively). Diesel vehicles make up 57% of total CH4 pollution, while gasoline vehicles make up 43%. Among the five vehicle classes, motorcycles are responsible for 33.82% of total emissions. Buses and HDVs contribute 32.36% and motorcycles 20.44% of emissions. After motorcycles, the next highest emitters are heavy trucks (13.26%).

As our corrective gasoline tax (US$0.94 per gallon) is lower than the initial tax rate (US$1.25 per gallon), a reduction in tax might increase VKT. Therefore, it is not practical to lower the existing tax. Hence, we fix the gasoline tax at US$1.25 per gallon and change the diesel tax rate to US$1.46 per gallon. We measure the response in Eq. (4) and estimate the emissions using COPERT IV. Compared with BAU, this combination of taxes reduces NOx by 7.31%, PM2.5 by 6.44%, PM10 by 6.38%, CO2 by 5.77%, N2O by 4.13%, and CH4 by 4.22% (see Figs. 3, 4, 5). Using the global warming potential (GWP) given by Forster et al. (2007) (CO2 = 1, CH4 = 25, and N2O = 298), we find that corrective fuel taxes reduce GHG emissions by 5.77% (1.85 Million tons of equivalent CO2). Similarly, we calculate emissions at US$0.96, US$1.25, US$1.35, and US$1.50 per gallon (see Table 11). Applying the GWP factors, we find that GHG emission reductions are 4.27%, 5.18%, 5.48%, and 5.86%, respectively. We plot the percentage in GHG emission reduction against the corrective diesel tax (see Fig. 6). From this relationship, we can calculate the fuel taxes: US$1.25 per gallon of gasoline and US$1.20 per gallon of diesel reduce GHG emissions by 5%, which is Bangladesh’s INDC goal.

4 Conclusion

This research presents a methodology for estimating corrective fuel taxes to meet INDC goal for a developing country. It also illustrates methodology for compiling estimates of parameters required to assess corrective fuel taxes for a country which does not have any previous study and uses different vehicle fleets, emission standards, and driving conditions. Though we use Bangladesh as a case study, our methodology can be useful to set the corrective fuel taxes to achieve INDC goal.

This study estimates elasticity of VKT with respect to consumer fuel price while calculating corrective fuel taxes. Previous literatures on corrective fuel tax purports this parameter from the study of other developed countries. But the responses of tax hike is not the same for all geographical locations and time. Hence, we suggest it should be calculated for each country.

We emphasize that this study does not investigate the fiscal impact of fuel tax, particularly the impact on the labor market, and does not investigate the distributional impact of the fuel tax. Although part of the fuel tax revenue could be redistributed back to citizens through an alternate taxation system (Zou et al. 2014), we recommend that fuel tax revenues be used to fund the “road maintenance fund” in Bangladesh to derive maximum welfare gain. Our study suggests that congestion and accident externalities are two major components of fuel tax in Bangladesh. Thus, we recommend that the major share of the road maintenance fund be used to improve existing road conditions, traffic management, and road safety. Note that we should not confuse fuel tax with toll fees collected for new roads or expressways. The former includes road damage cost, while the latter includes capital investment and operation cost, which is not a fuel tax. They also differ based on their objectives: fuel taxes are aimed at curbing externalities while toll fees are aimed at maximizing profits and reimbursing investment cost. Therefore, in this study, we only support the improvement of existing road conditions by utilizing fuel tax revenue.

Our findings open a new window for policymakers to reduce GHG emissions from road transport and to maximize social welfare gains. In this study, our focus has been on emissions from fuel combustion. In future research, emissions from lubricants could also be included. A lifecycle analysis of fuels and lubricants could have further policy implications. However, despite some caveats, our methodology can be applied in other countries to achieve INDC goals.

References

Act No. XXVIII. Board of Road Maintenance Fund Act (2013) Bangladesh: Bangladesh Gazette.https://rthd.portal.gov.bd/sites/default/files/files/rthd.portal.gov.bd/law/58355a88_e2f8_453e_89be_c5a192409eaf/4.

.pdf

.pdfAntón-Sarabia A, Hernández-Trillo F (2014) Optimal gasoline tax in developing, oil-producing countries: the case of Mexico. Energy Policy 67:564–571. https://doi.org/10.1016/j.enpol.2013.11.058

Bangladesh Bureau of Statistics (2018) Statistical Year Book 2017, 37th edn. Statistics and Informatics Division, Ministry of Planning

Buchanan J (1969) External diseconomies, corrective taxes, and market structure. Am Econ Rev 59(1):174–177

Burón JM, López JM, Aparicio F, Martín MÁ, García A (2004) Estimation of road transportation emissions in Spain from 1988 to 1999 using COPERT III program. Atmos Environ 38(5):715–724

Cai H, Xie SD (2007) Estimation of vehicular emission inventories in China from 1980 to 2005. Atmos Environ 41(39):8963–8979

Eggleston S, Walsh M (1998) Emissions: energy, road transport. In: Ngara T, Miwa K, Buendia L, Tanabe K, Pipatti R (eds) Good practice guidance and uncertainty management in national greenhouse gas inventories. Intergovernmental Panel on Climate Change, Japan. https://www.ipcc-nggip.iges.or.jp/public/gp/bgp/2_3_Road_Transport.pdf

Forster P, Ramaswamy V, Artaxo P, Berntsen T, Betts R, Fahey DW, Van Dorland R (2007) Changes in atmospheric constituents and in radiative forcing. In: Climate change 2007: the physical science basis. Cambridge University Press, Cambridge and New York, pp 129–234. https://www.ipcc.ch/pdf/assessment-report/ar4/wg1/ar4-wg1-chapter2.pdf

Gkatzoflias D, Kouridis C, Ntziachristos L, Samaras Z (2012) Copert 4. Computer program to calculate emissions from road transport. User manual (Version 9.0)

Goodwin PB (1992) A review of demand elasticities with special reference to short and long run effects of pricee changes. J Transp Econ Policy 26(2):155–169

Goodwin P, Dargay J, Hanly M (2004) Elasticities of road traffic and fuel consumption with respect to price and income: a review. Trans Rev 24(3):275–292. https://doi.org/10.1080/0144164042000181725

Graham DJ, Glaister S (2002) The demand for automobile fuel. J Trans Econ Policy 36(1):1–26

Guensler R (1993) Vehicle emission rates and average vehicle operating speeds. University of California, Institute of Transportation Studies, California

Harrington W, Mcconnell V (2003) Motor vehicles and the environment. Resources for the Future, Washington, DC. https://www.rff.org

Haughton J, Sarkar S (1996) Gasoline tax as a corrective tax: estimates for the United States, 1970–1991. Energy J 17(2):103–126

International Energy Agency (2019) World energy prices 2019. Retrieved 29 June 2019. https://www.iea.org/statistics/prices/

Jacobs B, De Mooij RA (2015) Pigou meets Mirrlees: on the irrelevance of taxdistortions for the second-best Pigouvian tax. J Environ Econ Manag 71:90–108

Kholod N, Evans M, Gusev E, Yu S, Malyshev V, Tretyakova S, Barinov A (2016) A methodology for calculating transport emissions in cities with limited traffic data: case study of diesel particulates and black carbon emissions in Murmansk. Sci Total Environ 547:305–313

Kousoulidou M, Ntziachristos L, Gkeivanidis S, Samaras Z, Franco V, Dilara P (2010) Validation of the COPERT road emission inventory model with real-use data. In: US EPA 19th Annual International Emission Inventory Conference, vol 40. Emissions Inventories—Informing Emerging Issues

Lang J, Cheng S, Wei W, Zhou Y, Wei X, Chen D (2012) A study on the trends of vehicular emissions in the Beijing-Tianjin-Hebei (BTH) region, China. Atmos Environ 62:605–614. https://doi.org/10.1016/j.atmosenv.2012.09.006

Lin CYC, Zeng J (2013) The elasticity of demand for gasoline in China. Energy Policy 59(90):189–197

Local Government Engineering Depatment (2017) Annual Report of LGED. Dhaka

Maibach M, Schreyer C, Sutter D, van Essen HP, Boon BH, Smokers R, Schroten A, Doll C, Pawlowska B, Bak M (2007) Internalisation Measures and Policies for All external Cost of Transport (IMPACT). CE-Delft, Delft, Netherlands. https://ec.europa.eu/transport/sites/transport/files/themes/sustainable/doc/2008_costs_handbook.pdf

Mayeres I, Proost S (2001) Should diesel cars in Europe be discouraged?Regional Science and Urban Economics, vol 31. www.elsevier.nl/locate/econbase

McRae R (1994) Gasoline demand in developing Asian countries. Energy J 15(1):143–155

Ministry of Environment and Forests (2015) Intended Nationally Determined Contributions (INDC), Dhaka

MOVE D (2014) Update of the Handbook on External Costs of Transport. Report for the European Commission

Newbery DM (1988) Road damage externalities and road user charges. Econometrica 56(2):295–316

Newbery DM (1990) Pricing and congestion: economic principles relevant to pricing roads. Oxf Rev Econ Policy 6(2):22–38

Newbery DM (2001) Harmonizing energy Taxes in the EU. In: In conference Tax Policy in the European Union, pp 17–19. Ministry of Finance, The Hague

Ntziachristos L, Samaras Z (1998) COPERT III: Computer programme to calculate emissions from road transport, vol 49, pp 1–86. https://edz.bib.uni-mannheim.de/daten/edz-bn/eua/00/tech49.pdf

Parry IWH, Small KA (2005) Does Britain or the United States have the right gasoline tax? Am Econ Rev 95(4):1276–1289

Parry I, Strand J (2012) International fuel tax assessment: an application to Chile. Environ Dev Econ 17(2):127–144

Parry IWH, Walls M, Harrington W (2007) Automobile externalities and policies. J Econ Lit XLV:373–399

Paul S, Hoque MM, Mahmud SMS (2008) The cost of road traffic accidents in Bangladesh. In: 10th Pacific Regional Science Conference Organization (PRSCO) Summer Institute. Accident Research Institute (ARI), Dhaka

Power and Participation Research Centre (2014) Road Safety in Bangladesh: Ground Realities and Action Imperatives. https://www.brac.net/images/reports/Research report_Road Safety in Bangladesh-Ground Realities and Action Imperatives.pdf

Pundir BP (2012) Revisions of vehicular emission standards for Bangladesh. Dhaka. http://case.doe.gov.bd/file_zone/feedback/Revisions of Vehicular Emission Standards for Bangladesh.pdf

Road Transport and Highways Division (2018) Annual Report 2017–2018, Dhaka

Santos G, Behrendt H, Maconi L, Shirvani T, Teytelboym A (2010) Part I: externalities and economic policies in road transport. Res Transp Econ 28(1):2–45. https://doi.org/10.1016/j.retrec.2009.11.002

Smith K (2017) Corective Taxes, Institute for Fiscal Studies United Kingdom. https://www.ifs.org.uk/uploads/Presentations/Public%2520Economics%2520Lectures/K%2520Smith%2520060117.pdf

Sterner T (2007) Fuel taxes: an important instrument for climate policy. Energy Policy 35(6):3194–3202. https://doi.org/10.1016/j.enpol.2006.10.025

Thambiran T, Diab RD (2011) Air pollution and climate change co-benefit opportunities in the road transportation sector in Durban, South Africa. Atmos Environ 45(16):2683–2689. https://doi.org/10.1016/j.atmosenv.2011.02.059

Trading Economics (2019) Bangladesh disposable personal income. Retrieved 29 June 2019. https://tradingeconomics.com/bangladesh/disposable-personal-income

Uddin SR (2017) Review of existing road user cost estimation procedure used in RHD and update the same under BRRL during the year 2016–2017, Dhaka. https://rhd.portal.gov.bd/sites/default/files/files/rhd.portal.gov.bd/page/f2d0af0d_cfed_4bce_a16f_22eef21ef0c0/Draft_Final_RUC_27_03_18.pdf

Uddin MZ, Mizunoya T (2019) An economic analysis of the proposed Dhaka-Chittagong Expressway in Bangladesh with the viewpoint of GHG emission reduction. Asia Pac J Reg Sci. https://doi.org/10.1007/s41685-019-00136-5

World Bank (2019a) GDP per capita PPP. Retrieved 29 June 2019. https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD

World Bank (2019b) Population data. Retrieved 29 June 2019. https://data.worldbank.org/indicator/SP.POP.TOTL?locations=BD

World Bank (2019c) Pump price for gasoline and diesel (US$/litre) | Data. Retrieved 29 June 2019. https://data.worldbank.org/indicator/EP.PMP.SGAS.CD?end=2016&locations=BD&start=2016&view=bar

World Health Organization (2018) Global Status Report on Road Safety 2018. Geneva. https://doi.org/10.1590/s1809-98232013000400007

Zou Y, Song J, Mizunoya T, Yabar H, Higano Y (2014) Research on environmental tax to affect the economic development and GHG mitigation in Beijing, China. App Mech Mater 522:1871–1878. https://doi.org/10.4028/www.scientific.net/AMM.522-524.1871

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

See Appendix Tables 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Kamruzzaman, M.H., Mizunoya, T. Quantitative analysis of optimum corrective fuel tax for road vehicles in Bangladesh: achieving the greenhouse gas reduction goal. Asia-Pac J Reg Sci 5, 91–124 (2021). https://doi.org/10.1007/s41685-020-00173-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-020-00173-5

.pdf

.pdf