Abstract

The restructuring process of the electricity industry has driven the competitive environment to such an extent that a reliable supply of good quality and clean energy at a reasonable price as per the demand of the consumer has become a reality. However, such constraints lead to a very complex system with large scale integration of renewable energy (RE) generation throughout the grid in a distributed manner. This situation leads to search for new market models and improved operating mechanisms to run the electricity market. The aim of the work is to propose several market models and an improved operating mechanism for reliable operation of the RE enabled electricity market in India. The above said market models are developed and proposed after thorough understanding of various operations in present Indian electricity market, the status of renewable energy in India especially the growth of both solar and wind energies, various state government policies in the promotion of renewable energy, the demand of different consumers and renewable energy policies in developed countries. The proposed models are also compared in terms of their benefits and limitations to identify their suitability to RE enabled Indian electricity market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

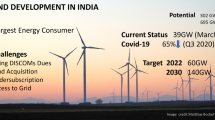

The world is already seeing the consequences of 10 C rise in temperature above pre-industrial levels through more extreme weather, rising sea levels, and diminishing Arctic sea ice among other changes. Now the special report on global warming by the intergovernmental panel for climate change (IPCC) estimates the increase in global warming of 1.5 °C above pre-industrial levels which may further deteriorate the environmental conditions. Significantly de-carbonizing existing energy systems by devoting in renewable energy systems, which mainly includes solar, at a record scale and pace is required to address such effects of global warming [1]. The depletion of conventional energy sources such as fossil fuel is one another factor that promotes renewable energy sources strategically to meet the global electricity demand [2]. In India, the central government and the state governments have put in place various policies and mechanisms to promote solar energy, including financial incentives for certain categories of users.

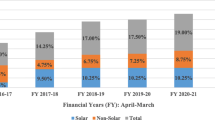

The renewable energy component is increasing every year in the electricity market in India and overseas as well. As of now, the installed capacity of renewable energy is 78.31 GW that comprises 35.63 GW from wind energy, 28.18 GW from solar energy, 9.91 GW from bio and 4.59 GW from small hydro. Further 67.38 GW more capacity of renewable energy is in the process of addition. By 2030, India commits to increase non-fossil based energy resources to 40% of the electricity capacity installed. The government of India has planned to increase solar energy capacity to 100 GW by 2022, out of which 40% has to come from the consumer category in the form of rooftop and similar small scale solar energy systems. To some extent, the ministry of new and renewable energy (MNRE) also enforces renewable energy purchase obligation to bulk consumers. To address critical issues like the uncertainty of renewable energy generation, as assigned by the Govt. of India the power grid corporation of India limited (PGCIL) has initiated the establishment of the renewable energy management centres (REMCs) with the technical assistance of German Govt. at the state level and central level in the year 2016 and actual implementation started since 2017 [3]. To deliver rising demand for electricity in an environmentally friendly way through the promotion of renewable energy, many Indian states came up with many guidelines and policies in recent years. The guidelines for the procurement of power from solar power projects more than 5 MW through long term PPA and the procurement of power from solar power projects below 5 MW capacities at feed in tariff mentioned clearly in the solar policies of the states in India [4].

The entry of RE sources in an already restructured and deregulated electricity market will make it more competitive, dynamic, and add to the complexity of operation and decision making [5]. The increasing penetration of renewable energy may lead to many new issues and challenges such as time scale of operation, price volatility, security and reliability [6]. Although many market models are established for restructured electricity market in international domain, which mostly depend on conventional power generation. However, to handle the obstacles due to renewable energy power generation, new market models are anticipated for present Indian electricity market. This paper presents many market models to handle the situations arising due to increase dominance of RE in Indian electricity market. To develop market models in the scenario of Indian electricity market enabled by renewable energy sources, various policies of MNRE such as renewable energy certificate (REC), RE promotion policies of various Indian states such as power purchase agreement (PPA) and feed in tariff are applied. A new entity called balance responsible parties (BRP) is introduced in second and third models developed in this work to enhance the assistance to market participants for RE enabled Indian electricity market.

Remaining sections are structured as follows. Section 2 describes the evolution of Indian electricity market. Section 3 presents various market models proposed for RE enabled electricity market whereas section 4 analyses and compares all the proposed models. Section 5 describes the proposed operating mechanism of RE enabled electricity market and section 6 discusses the flow of the work using a flow chart. Section 7 presents the conclusion.

Evaluation of Indian Electricity Market

In India before independence, under the provisions of Indian electricity act 1910 private entities used to supply the power in their locality. Indian electricity industry underwent the process of nationalization by virtue of the foresaid act of 1948. This act paved the way for formation of State Electricity Boards (SEBs) dealing with electricity generation, transmission and distribution in States. Subsequently many large power generation projects were established by central govt. to provide power to various states. SEBs became inefficient with time and suffered financially, hence central sector generation and transmission were separated in 1992, but distribution of electricity remained monopoly in the hands of SEBs [7, 8].

Going ahead with restructuring of Indian power sector in 2001, States divided generation, transmission and distribution into separate corporate entities. But power purchase and distribution still remains in the hand of SEBs indicating its monopoly referred to be a single buyer model, which neither benefited sellers nor buyers in order to get competitive market price. In the further transformation process, the independent regulatory bodies have been established at central level and states to rationalize electricity tariff, formulise transport policies regarding subsidies and also to promote efficient and environmentally friendly policies.

The 2003 Electricity Act focused on power supply to all areas, protection of consumer’s interest, rationalizing the power tariff, maintaining fair subsidy schemes, encouraging effective and environmentally sustainable schemes, setting up central electricity authority (CEA), regulatory commissions and setting up of appellate tribunal [7]. It provides open access and encourages privatization as well as competition. Hence, many bulk consumers are turning into producers also, which leads to distributed generation in the power system a lot. Also the solar and wind generation are getting connected to the grid at several locations in distributed manner. The power grid is becoming smart by adding many devices and technologies to manage such changes.

In such a restructured dynamic electricity market where renewable energy power generation, will dominate in future, appropriate market models need to be developed to minimize the electricity price and increase the efficiency of operations.

Proposed Market Models for RE Enabled Indian Electricity Market

Traditional electricity market works with three major restructured models named PoolCo model, bilateral contracts model and hybrid model [9]. A PoolCo model consists of a power exchange (PX) which handles the bids submitted by sellers and buyers by analysing supply and demand of the following day and finalise the optimal price, which is market clearing price (MCP). In bilateral contract model, traders are allowed to negotiate the price without interference of system operators. In this model customers can contact directly to power generating companies. However, the hybrid model incorporates different features in both versions. Here PX may exist and customers are also allowed to contact suppliers directly. This model provides good flexibility to customers and utilities as well.

Single buyer model and Pool market model have been proposed for Malaysia electricity supply industry [10]. Emission trading schemes are introduced to reduce CO2 emission and to promote renewable energy in European countries [11]. To encourage wider adoption of renewable energy, UK implements many schemes for financial support such as feed in tariff and renewable obligation (Energy UK, https://www.energy-uk.org.uk/energy-industry/renewable-generation.html). Transmission expansion planning techniques are provided for enhancing penetrations from renewable energy sources and to deal with the complexity related to integration of smart grid technology and electricity market [12]. The impact of increased wind power penetration to the grid on Iberian electricity market (Spain & Portugal) has been emphasized for having reduced spot prices [13]. The electricity market model for Irish has been proposed, that targets for contribution of wind power to 37% of total power generation by 2020 exploring the curtailment of excess wind power generation and storage options [14]. The impact of variable generation from renewable energy sources on the trading of electricity market and the need to formulate few strategies of demand side management based on grid operating conditions & reliability are emphasized [15].

In India, after the ratification of Electricity Act 2003 and some deregulation policies, restructuring process has been done to introduce competition among various sectors. A suitable power trading model has been proposed for the restructured Indian electricity market [8]. For restructured Indian electricity market, various market models are suggested for the reliable power supply of good quality at competitive price to the consumer [16]. Solar power PV power generation is a boon to a country like India as it is fortunate enough to have sun light throughout the year in many parts of the country. In order to encourage good contribution of solar PV power, some new power trading models are proposed for Indian electricity market [17].

In this paper, market models for RE enabled Indian electricity market are developed and proposed based on rigorous study of renewable energy policies of various countries and different states in India. Also the literature review on existing market models & proposed market models by researchers assist in developing the market models. The market models are proposed in following section for Indian electricity market promoting integration of renewable energy generation in large scale.

Energy Pool Model

This model as shown in Fig. 1 is consisting of solar power plants, wind power plants, IPPs, CGU, SGU, PX, SDU, DISCOM’s, retailers and consumers. PX purchases power from all generating units through online bidding. Then distributing units will purchase the power from pool to supply the power in their respective areas. Being ISO, power pool finalises one MCP by matching the supply and demand curves. This is the simplest structure, not entertaining private entities into the market. Figure 1 projects market operations among participants. This model exhibits monopoly leaving no choice to consumers in selecting the supplier on distribution side. In this model, the DISCOM’s, SDUs and retailers have dedicated consumers represented by C in the Fig. 1. Hence competition at supply side is minimum in this model. This model may be free from congestion except peak demand hours. Perhaps, reliability of the model depends on the performance of the respective distributors. Social obligation may be covered by distribution companies.

Renewable Energy Pool Model

In this model, it is proposed to have separate power trading for renewable energy and non-renewable energy and two power pools as shown in Fig. 2. The Fig. 2 shows solar and wind plants, CGU, SGU and IPP at the top. At the middle, BRP and PX are included. Further, the structure in the Fig. 2 also represents SDU, DISCOM’s, retailers and consumers down side. Conventional generating units submit bids directly to PX and PX finalises MCP by matching the bids. On the other hand, Solar/ wind power plants bid through BRP, an intermediate entity between solar/ wind power plants and consumers. BRP receives a day ahead solar/ wind power forecast from REMC. In case solar/ wind power generation is less, BRP takes the responsibility to fulfil the balance power generation by purchasing power from the PX. In case of excess solar/wind power generation BRP also can submit bids to PX for the sale of power. At distribution level, open access will be given to consumers.

In this model, there will be proper competition because of separate trading for conventional energy and renewable energy. Also this model provides more competition than previous model due to which tariff may be lower and consumers will get benefited. Implementation of this model is easy and operation is less complex, however congestion may occur due to wheeling at distribution level.

Renewable Energy Bilateral Contracts Model with BRP

Figure 3 shows another proposed market model. Along with entities like CGU, SGU, solar/ wind power plants, PX, DISCOM’s, retailers and consumers a new entity called BRP is added in this model to deal with uncertainty of renewable energy [18]. Solar/ wind power plants can go for long term bilateral contracts with distributors/ consumers through BRP by making power purchase agreement (PPA). In case solar/ wind power generation is less, BRP takes the responsibility to fulfil the balance power generation by purchasing power from CGU/SGU. On the other hand, BRP also can submit bids to sell excess power from solar/ wind plants to PX in a day ahead or hour ahead market along with CGU and SGU. Above said bilateral contracts would be supported by the incentives and subsidies of the state governments to promote renewable energy. The consumers in bilateral contracts will be supplied from renewable energy suppliers through BRP.

By matching supply and demand curves, MCP will be finalized in a day ahead market by PX. DISCOM’s and Retailers can purchase power directly from the PX whereas consumer will purchase power from DISCOM’s, retailers.

This model establishes the structure of hybrid model, which enjoys both bilateral contracts and power pool. This model promotes renewable energy and encourages bulk consumers to use renewable energy. In fact, bulk consumers can also fulfil renewable energy purchase obligation by the governments. Compared to above two models, this model is more flexible in establishing either bilateral contracts or power pool. At distribution level, DISCOM’s have dedicated consumers so competition will be less which may increase the electricity price in pool. The reliability of this model depends upon the performance of DISCOM’s and BRP.

Energy Pool Model with Bilateral Contracts of DISCOM’s and RES

In this model as shown in Fig. 4, solar/ wind power plants will have bilateral contracts with DISCOMs and also they can sell excess power to the pool. At the same time DISCOMs in bilateral contracts may purchase the power from pool as and when required in case of power shortage. In this model, solar projects of less than 5 MW are allowed to sell power directly to the pool under guidelines set by the state governments and MNRE. The solar power projects less than 5 MW shall feed into grid based upon feed in tariff (FIT) determined by state electricity commission to the extent power required with in the state [4]. The DISCOMs would establish bilateral contracts with Solar PV or wind power plant owners by making long term PPAs, selected through competitive bidding based upon the guidelines, notified by ministry of power.

This model is also one type of hybrid model for power trading. In this model, bilateral contracts with long term PPA will be signed between solar/ wind power companies and DISCOM’s. Hence DISCOM’s will take care of the uncertainty in renewable energy.

Flexible Market Model with Wheeling at Distribution Level

It is similar to previous model, where DISCOM’s may have bilateral contracts with solar/ wind power plants and also purchase power from pool, however in this model, power wheeling is introduced at distribution level [16]. Open access enables the bulk consumers to buy power from the open market. Instead of buying power from the local utility monopoly, the consumers can choose from many competitive companies. Thus, the suppliers under open access have to incur various charges for using the grid.

The model shown in Fig. 5, has got flexibility in a way that the consumer may choose its distributor, thereby introducing competition at distribution level which may result in lower tariff and better service to the consumer. Utilities are also having the freedom to choose the consumers.

Open Access Model for Bulk Consumers

The various entities of this model along with their market operations are well presented in Fig. 6. Here in this model, the bulk consumers can purchase power from solar/wind power plants. Also, they may purchase either from DISCOMs or the pool. The small consumers also have open access to different distributors, which overcomes monopoly at distribution level as presented in Fig. 6. It allows heavy users with a connected load exceeding 1 MW to buy cheap power from the open market. The open market allows customers to select from a variety of competing power providers, rather than being forced to purchase electricity from the monopoly of local utilities. With open access provision, regular power supply is ensured to Industrial & commercial consumers at competitive rates. Also consumers can meet their renewable purchase obligations.

The power shortage can be effectively reduced by open access as many solar energy/ wind energy companies directly transmit power to some load centres. The open market allows the consumers to purchase power from any company, which increases the competition in the market and makes the price less. Open access may be either Interstate open access or intra state open access.

Flexible Market Model for Consumers and Distributors

Unlike above models, this model as shown in Fig. 7 does not contain any power pool. The DISCOMs/ SDUs may purchase power from CGU/ SGU/ solar/ wind power plants. At distribution level also, the consumer has flexibility to choose the distributor. The distributor will possess distribution licensee for more than one consumer or area. Further, the bulk consumers will be given flexibility to purchase power either from any DISCOM/ SDU or directly from solar/ wind power plants. To make solar/ wind power plants compete with CGU/ SGU the state governments and MNRE are supposed to announce some attractive incentives and subsidies to DISCOM’s/ bulk consumers for purchasing power from solar/ wind power plants. In this multi-buyer or Multi-seller system, one of the major tasks is to have a market based solution with economic efficiency for congestion management. Most of the buyers are interested in purchase power from cheapest generator available. Of course, this leads to overloading of cheaper generators. If congestion occurs, price will be settled area wise. Areas with excess generation will have lower prices and area with excess load will have higher prices [19]. In this model competition is introduced at transmission as well as distribution level.

Comparative Analysis

Seven different market models are proposed for RE enabled Indian electricity market in section 3. They have been compared for various features such as implementation, competition, congestion, tariff and reliability and the highlights are presented in Table 1.

Operating Mechanism

The operating mechanism explains the functioning of electricity market with the coordination of power network. This section proposes operating mechanism of future Indian electricity market with high level of penetration of wind and solar generation as shown in Fig. 8. SLDC forecasts load a day ahead and an hour ahead, REMC forecasts solar power/ wind power generations a day ahead. This forecasting information is further conveyed to RLDC, which analyses ATC and sends the information regarding ATC and forecasting data to PX. At the same time, SLDC and RLDC will be coordinating with REMC for the details of renewable energy. At PX, all generating units will participate in bidding. Then, PX finalises MCP for a day ahead power schedule and sends information to RLDC. Under the supreme control of PGCIL, with the coordination of NLDC, RLDC & SLDC plan and monitor the scheduling/ dispatching of power for a day ahead in the respective state. The steps involved in the operation of the market are shown in Fig. 9 through a flowchart.

This operating mechanism also includes entities like RE generators and Renewable energy certificate (REC). RECs would be issued to RE generators. These RECs are purchased by any consumer in order to meet its renewable purchase obligation [20]. REC will be issued to RE generators by central agency like NLDC. RE generators would submit bids to PX for the remaining power generation excluding RECs.

Discussion

The flow chart mentioned in Fig. 10 presents the step wise process of the work explored in this manuscript.

Conclusion

The increasing demand of clean power with good quality and scalable consumption has put a pressure on power companies to increase the renewable energy integration in to the grid. However, the intermittent nature of solar and wind generation forces the market operators to look for new energy trading models and operating mechanism. Considering various aspects like the growth of RE generation, MNRE policies, state wise targets of RE generation, competition in the market and reliable power supply to the consumers, this paper has proposed seven different market models for RE enabled Indian electricity market and has made a comparative study of all the models. Among all the models, there are both merits and demerits. Every model proposed has its own special feature. The energy pool model resembles conventional trading. The second model proposed deals with uncertainty in renewable energy. The third and fourth models explore on bilateral contracts through different entities. The fifth model introduces wheeling at distribution level. The sixth model prioritises bulk consumers. Being flexible at transmission and distribution the seventh model can provide reliable power supply at competitive price to the consumer. However economic viability of the models has to be analysed. Except the first and the second models, the operation of the remaining proposed market models may demand superior facilities such as string transmission and distribution networks and good technical skills of the power sector. An operating mechanism for future RE enabled Indian electricity market is also proposed based upon the developed models.

Abbreviations

- PGCIL:

-

Power Grid Corporation of India Limited

- ISO:

-

Independent system operator

- SEB:

-

State Electricity Board

- MNRE:

-

Ministry of new renewable Energy

- NLDC:

-

National Load dispatch centre

- SLDC:

-

State Load dispatch centre

- RLDC:

-

Regional Load Dispatch centre

- CTU:

-

Central Transmission Utility

- CERC:

-

Central Electricity Regulatory Commission

- SERC:

-

State Electricity Regulatory Commission

- PX:

-

Power Exchange

- SC:

-

Scheduling Coordinator

- UI:

-

Unscheduled interchange mechanism

- PPA:

-

Power Purchase Agreements

- REMC:

-

Renewable Energy Management Centre

- NTP:

-

National Tariff Policy

- RPO:

-

Renewable Purchase Obligation

- FITs:

-

Feed in Tariffs

- RES:

-

Renewable Energy Sources

- REC:

-

Renewable Energy Certificate

- NAPCC:

-

National Action Plan for Climate Change

- CEA:

-

Central Electricity Authority

- FERC:

-

Federal Energy Regulation Commission

- CFD:

-

Contract for Differences

- ADR:

-

Alternative Dispute Resolution

- BRP:

-

Balance Responsible Parties

- CGU:

-

Central Generating Utility

- SGU:

-

State Generating Utility

- IPP:

-

Independent Power Producer

- SDU:

-

State Distribution Utility

- DISCOM:

-

Distribution Company

- MCP:

-

Market clearing price

References

Tamil Nadu Solar Policy (2019) http://teda.in/wp-content/uploads/2019/02/SOLARPOLICY2019.pdf. Accessed 22-05-2019

Fan X, Sun H, Yuan Z, Li Z, Shi R, Razmjooy N (2020) Multi-objective optimization for the proper selection of the best heat pump technology in a fuel cell-heat pump micro-CHP system. Energy Rep 6:325–335

Renewable Energy Management Centres in India, Power Grid Corporation of India Ltd., 5th June 2017 https://d2oc0ihd6a5bt.cloudfront.net/wp-content/uploads/sites/837/2017/06/Renewable-Energy-Management-Centers-in-India.pdf. Accessed 03-08-2019

Andhra Pradesh Solar Power Policy (2018) https://nredcap.in/PDFs/Pages/AP_Solar_Power_Policy_2018.pdf. Accessed 15-07-2019

Anees AS (2012) Grid Integration of Renewable Energy Sources: Challenges, Issues and Possible Solutions. IEEE 5th India International Conference on Power Electronics (IICPE)

Rambabu M, Nagesh Kumar GV, Sivanagaraju S (2019) Optimal power flow of integrated renewable energy system using a Thyristor controlled series compensator and a Grey-wolf algorithm. Energies 12(11):2215

The Electricity Act (2003) Ministry of law and justice (legislative department) New Delhi, the 2nd June, 2003.Jyaistha 12, 1925 (Saka) http://www.cercind.gov.in/Act-with-amendment.pdf. Accessed 15-07-2019

Bajpai, S. N. Singh (2006) An electric power trading model for Indian electricity market. IEEE Power Engineering Society General Meeting, Montreal, Que., Canada. https://doi.org/10.1109/PES.2006.1709055

Shahidehpour M, Alomoush M (2001) Restructured electrical power systems operation, trading and volatility. Marcel Dkker Inc, New York.Base

Hassan Y, Abdullah MP, Arifis AS, Hussin F, Majid MS (2008) Electricity market models in restructured electricity supply industry. 2nd International Conference on Power & Energy (PECON 2008) Johor Baharu, Malaysia

Rabe M, Streimikiene D, Bilan Y (2019) EU carbon emissions market development and its impact on penetration of renewables in the power sector. Energies 12:2961. https://doi.org/10.3390/en12152961http://www.mdpi.com/journal/energies

Obushevs A, Oleinikova I (2014) Transmission expansion planning considering wholesale electricity market and integration of renewable Generation.11th International Conference on the European Energy Market (EEM14), Krakow, Poland. https://doi.org/10.1109/EEM.2014.6861230

Nuño E, Pereira AJC, Ferreira CMM (2015) Impact of variable renewable energy in the Iberian electricity market. 50th International Universities Power Engineering Conference (UPEC), Stoke on Trent, UK. https://doi.org/10.1109/UPEC.2015.7339826

McKenna EJ, Thomson M (2014) Impact of wind curtailment and storage on the Irish power system 2020 renewable electricity targets: a free open-source electricity system balancing and market(ESBM) model. 3rd Renewable Power Generation Conference (RPG 2014), Naples, Italy. https://doi.org/10.1049/cp.2014.0845

Zareen N, Mustafa MW, Mehmood Q (2014) Optimal Strategies Modelling of Demand Response in Electricity Market for integration of Intermittent Resources. IEEE Conference on Energy Conversion (CENCON), Johor Bahru, Malaysia. https://doi.org/10.1109/CENCON.2014.6967478

Tripathi MM, Pandey AK, Chandra D (2016) Power system restructuring models in the Indian context. Electr J 29:22–27

Kumar N, Tripathi MM (2020) Solar power trading models for restructured electricity market in India. Asian J Water Environ Pollut 17(2):49–54

Bhaskar K, Singh SN (2014) Wind Power Bidding Strategy in a Day-ahead Electricity Market. IEEE PES General Meeting Conference & Exposition

Christie RD, Wangensteen I (1998) The energy market in Norway and Sweden: introduction. Power Engineering Letters, IEEE Power Engineering Review

Soonee SK, Garg M, Prakash S (2010) Renewable Energy Certificate Mechanism in India.16th National Power Systems Conference, 15th–17th December, 2010

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Varanasi, J., Tripathi, M.M. Market Models and Operating Mechanism for Renewable Energy Enabled Indian Electricity Market. Technol Econ Smart Grids Sustain Energy 5, 23 (2020). https://doi.org/10.1007/s40866-020-00097-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s40866-020-00097-1