Abstract

The paper studies the convergence and growth behavior of 11 Central and Eastern European members states of the European Union between 2000–2019, using a modified development accounting approach based on the neoclassical growth model. The main goal of the exercise is to decompose the still existing development gap relative to Western Europe (Austria) into three components: convergence, productivity, and long-run factors. The latter may include general institutional features such as population growth, or capital market imperfections measured by the capital wedge. The capital wedge is identified by leveraging the neoclassical growth model’s ability to explain the observed behavior of the capital-output ratio. The main conclusions are that for most countries, lower productivity and capital distortions are both important to understand underdevelopment. Economic policy, therefore, should primarily target productivity growth and a free and efficient capital market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic convergence of poorer countries and regions to their richer peers is a core concept in the study of growth and development. Empirical evidence is mixed, but there is broad support for conditional convergence.Footnote 1 This means that (i) countries tend to converge to their own long-run equilibria determined by their institutions and policy environment, and (ii) absolute convergence is more likely to be found among countries with similar institutions.

European countries and regions have been studied extensively in the context of convergence. Assuming that at the very least countries of the European Union share a common institutional environment, poorer members are expected to catch up with the more advanced EU economies. Convergence has indeed been found, although the global financial crisis (GFC) has interrupted the process for the Mediterranean countries of Portugal, Spain and in particular, Greece.Footnote 2

The new Eastern European member states (EEE from now on) are a good laboratory to study convergence behavior.Footnote 3 They were all planned economies before 1990, mostly part of the former COMECON block dominated by the Soviet Union.Footnote 4 After 1990, they all embarked upon building functioning market economies, driven both by economic necessity and a desire to join the European Union. After a deep recession, they have experienced a mostly successful 25 years of strong convergence to Western European countries.Footnote 5 Table 1 shows that relative GDP per capita for each country, compared to Austria, increased significantly between 1995 and 2019. At one extreme, Bulgarian relative development increased by 13 percentage points. At the other extreme, Lithuanian relative GDP per capita has risen by an astonishing 40 percentage points between 1995 and 2019. The main goal of this paper is to identify whether and how this observed convergence process may continue in the future.

The 1990 change of the economic and political regime meant that the EEE can be viewed as fairly clean experiments for the predictions of neoclassical growth theory. Their starting position in the early 1990s can be reasonably approximated as exogenously given, since their earlier institutions were imposed on them externally.Footnote 6 Adopting Western institutions and market economies meant that (full or partial) economic convergence was expected from the beginning.

This paper uses the standard neoclassical growth model with capital accumulation and exogenous technological growth to study the convergence behavior and relative development of the EEE. Differences in GDP per capita in the neoclassical framework can be decomposed into four main components: total factor productivity, capital intensity due to initial conditions, capital intensity in the long-run, and labor input. After deriving the decomposition, I use macroeconomic data to quantify the role each of these factors plays in explaining the relative (under)development of the EEE countries in 2019. The key challenge is to measure the capital stock appropriately, so I provide a detailed description of the methodology I use.

The second challenge is to separate the contributions of temporary capital scarcity (due to economic transition) from long-run determinants of the eventual steady state to which individual countries are converging. Long-run differences in the capital-output ratio are explained by policies and institutions that are difficult to quantify. I use the concept of the capital wedge, which captures these various factors in a reduced form way. I use the growth model developed earlier to simulate the growth paths of the EEE with and without a capital wedge to identify whether the capital wedge is needed to understand observed convergence behavior.

The main results are the following. All EEE countries experienced convergence to Austria in the sample period. There was also strong convergence among the EEE, with initially poorer countries catching up with the initially richer ones. The gap relative to Austria in 2019 is still significant, with ample scope for further catching up. The main reason for lower GDP per capita is production efficiency, followed by long-run differences in the steady state capital-output ratio. Unfinished convergence, conditional on 2019 productivity, plays a minor role for most countries in explaining the GDP per capita gap relative to Austria. Hours worked per person are even less important, with about half the EEE using more labor input per capita than Austria.

The basic calculation may even overstate the role of the convergence factor if persistent capital distortions lower the long-run equilibrium capital-output ratio. Simulations of the neoclassical growth model reveal that the only country where the capital wedge has no explanatory power is Estonia. In all other cases, most or all of the measured convergence factor is likely to be attributed to persistent capital market distortions. Apart from focusing on productivity growth, increasing the efficiency of investment and capital markets should be a priority for economic policymakers.

Starting with the seminal contribution of Solow (1957), there is a large literature that uses the aggregate production function to quantify proximate causes of economic growth and development.Footnote 7 In the context of Eastern European Economics (often, but not always restricted to include only European Union member states), several studies have documented convergence to the European center (Monfort et al., 2013; Próchniak & Witkowski, 2013; Szeles & Marinescu, 2010). Convergence continued after the global financial crisis as well (Åslund, 2018). The literature has not reached a consensus on whether the EEE convergence process will be complete (Papi et al., 2018). There is evidence that EU membership has been important for continued catching up in these countries (Ryszard Rapacki, 2019).

Growth and development accounting exercises for the region include Dombi (2013), who find that until 2007 both capital deepening and productivity growth contributed to convergence, with these two factors still lagging Germany in 2007 significantly. Levenko et al. (2019) provide an update for the post financial crisis period. The main finding is that the strong productivity growth characterizing the region before the GFC came to a halt afterwards, and the recent continued convergence was driven by factor accumulation. The authors also highlight the difficulties in the construction of the capital stock and its impact on growth accounting results. A recent volume (Mátyás, 2022) provides a detailed overview of the region’s economic, social and institutional experience, especially after the global financial crisis and during the recent Covid epidemic.

This paper contributes to the previous literature in two ways. First, apart from measuring the productivity lag with respect to Western Europe (Austria), it uses a decomposition that isolates temporary and long-run factors in explaining differences in the capital-output ratio. This is of first-order importance for policymakers, since if further capital deepening will simply be a feature of the convergence path, there is not much policy can or should do to speed up the process (Gourinchas & Jeanne, 2006). Alternatively, if lower capital intensity is a result of persistent factors, the goal of growth policy should be to alleviate these constraints. In this context, the second main contribution of the paper is to leverage the neoclassical growth model and empirically identify the role of the capital wedge in holding back capital accumulation.

The rest of the paper is organized as follows. Section 2 describes the growth model used in the analysis. Section 3 focuses on measurement, including the data and the construction of the capital stock. Section 4 summarizes the results of the empirical decomposition of relative development, while Sect. 5 uses the growth model to quantify the role of the capital wedge in explaining the observed path of the capital-output ratio. Finally, Sect. 6 concludes.

2 The standard growth model

The model used in the empirical analysis is the standard neoclassical growth model with exogenous labor supply. A single final good is used for consumption and investment. Markets are competitive, both for the final good and for capital and labor, the two factors of production. Utility and production functions satisfy the standard assumptions, with positive marginal utility, positive marginal products, and constant returns to scale in production.

Households solve the following problem:

where \(C_t\) is consumption, \(N_t\) is the size of the population, \(h_t\) is hours worked per person, \(B_t\) is holdings of discount bonds, \(R_t\) is the gross real interest rate, \(W_t\) is the wage rate, and \(\Pi _t\) is dividends received from the representative firm. Hours worked are assumed to be exogenous, but potentially different across countries, capturing various labor market distortions that influence labor supply and demand.

Firms produce using a Cobb–Douglas technology. They hire workers from the representative household, and accumulate physical capital via investment. I assume that final goods cannot be costlessly converted into investment goods. This friction is captured by the relative price of investment goods (in terms of the final good), which is denoted by \(p_{t}.\) I take \(p_{t}\) to be exogenously given for the sake of exposition, although it can be endogenously derived from relative productivities or capital market distortions in a two-sector model, such as in Hsieh and Klenow (2007).

The profit maximization problem is written as

where \(X_t\) is the (global) level of labor-augmenting technology and \(a_t\) stands for a local efficiency wedge, i.e. the distance from the worldwide productivity frontier. I therefore assume that \(X_t\) is common across countries, and productivity differences are picked up by \(a_t \le 1.\) Note that the efficiency wedge is assumed to be bounded as it measures relative productivity.Footnote 8 Also note that since firms are owned by households, profits are converted into utility by the marginal utility of wealth, \(\Lambda _t\) (the Lagrange multiplier in the household problem).

Population and technology grow at the constant and exogenous gross rates \(N_t/N_{t-1}=n\) and \(X_t/X_{t-1}=g,\) respectively. Since the model is not stationary, we introduce normalized variables, such as \(c_t=C_t/\left( X_t N_t\right) ,\) \(i_t=I_t/\left( X_t N_t\right) ,\) \(y_t=Y_t/\left( X_t N_t\right) ,\) \(k_t=K_t/\left( X_t N_t\right)\) and \(w_t=W_t/X_t.\) The model is well-known to be stationary in these normalized variables, with a unique steady state and a saddle path along which from any initial capital stock \(k_0\) the economy converges monotonically to the steady state.Footnote 9

Since the derivation of the equilibrium conditions is well-known, I skip the details. A competitive equilibrium exists, and it is characterized by the following conditions:

These equations can also be used to calculate the steady state, where all normalized variables are constant. I assume that in steady state, \(\bar{b}=0\): this holds by definition in a closed economy, and it is also a natural benchmark in an open economy setting.

Before we turn to the empirical specification, it is useful to link the production function to the capital-output ratio,Footnote 10 denoted by \(\kappa _t = k_t/y_t\):

which implies that

Now we are ready to derive the key equation used for the decomposition of relative development.Footnote 11 GDP per capita, using the production function and Eq. (5), is written as follows:

If we pick a benchmark country (denoted by starred values), and assume it is in steady state, the relative development of country i is given by

The first component on the right-hand side is the relative productivity of country i. The second component is the convergence indicator relative to country i’s own steady state. The third component measures the long-term impact of measurable capital market distortions [see Eq. (2)], captured by the relative price of investment. Finally, the last component controls for differences in labor input. Note that while taking logarithms in Eq. (6) transforms it into an additive specification, it is not necessarily desirable to do so. The reason is that relative development gaps can be large, and the interpretation of the logarithmic ratios as percentage differences for large gaps is misleading. For example, when country i’s GDP per capita is one half of the benchmark country’s, taking logarithms leads to \(\log 0.5 = -0.69\)—which is far from the correct difference \((-50\%).\)

3 Measurement

The main difficulty in the quantification of the decomposition in Eq. (6) is measurement. In particular, measuring the capital stock—and hence the capital-output ratio—is problematic. Estimating the steady state capital-output ratio adds to the complications. In this section, I describe how I propose to circumvent these problems.

3.1 Data

I use Eurostat data for the quantification of development differences. The analysis focuses on the former socialist countries that became members of the European Union between 2004–2013: Bulgaria, Czechia, Croatia, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia and Slovenia. For the benchmark country I use Austria, which has a similar population, economy and history as most countries in the sample. Most data series are available since 1995, but for some countries investment relative prices only start in 2000. Since the COVID epidemic had a large impact on economic activity in 2020, which would distort the analysis of relative development, my main sample period is 2000–2019.

I use the following data series in the analysis:

-

GDP: Chain linked real GDP series in EUR, reference year 2015 (table nama_10_gdp).

-

NGDP: Nominal GDP at market prices in current EUR (table nama_10_gdp).

-

Investment: Chain linked gross fixed capital formation in EUR, reference year 2015 (table nama_10_gdp).

-

GDP price: Price level index for GDP, EU15 = 1 (table prc_ppp_ind).

-

Investment price: Price level index for gross fixed capital formation, EU15 = 1 (table prc_ppp_ind).

-

Hours: Total hours worked, national accounts, total economy (table nama_10_a10_e).

-

Population: Total population on January 1st, domestic concept (table demo_pjan).

-

Capital stock: Net fixed assets in current EUR, total economy, current replacement prices (table nama_10_nfa_st).

3.2 Capital stock

Reliable data on the economic concept of capital stocks is difficult to find. Eurostat reports net fixed assets evaluated at current replacement prices. I use this data as one of two main sources for capital stock estimation. The decomposition presented earlier requires capital-output ratios. To calculate it, I use the ratio of the nominal capital stock divided by the investment price index, and nominal GDP divided by the GDP price index. The price indices are cross-section comparisons of price levels, and come from Eurostat’s purchasing power parity (PPP) statistics. This way I convert capital-output ratios to international prices, which is necessary for cross-country comparisons.

The most common way to calculate capital stocks is the Perpetual Inventory Method (PIM), which is my second approach. This uses the capital accumulation equation from Sect. 2. The method needs an initial value for capital, and a value for the depreciation rate. The latter is relatively easy, as the literature uses standard values between 0.04–0.10. I choose to set \(\delta =0.04,\) which is in line with depreciation rates for these economies reported in the Penn World Table.Footnote 12 For initial capital I use the capital-output ratio calculated directly from Eurostat for 2000 whenever possible. For Croatia the investment price index data only starts in 2003, so I extrapolate the capital output ratio backwards to 2000. The calculation uses the chain-linked fixed investment series, adjusted by the 2015 fixed relative price of investment to GDP. In other words, PIM capital is measured at constant 2015 international prices, while the Eurostat capital stock is calculated with current relative international prices.

Figure 1 plots capital-output ratios using the two alternative measures. It is reassuring that for the majority of countries capital constructed via the PIM is close to the direct measure from Eurostat. Exceptions include Croatia and Poland: for the first, the reported capital stock is much higher than cumulated investment. For Poland, the opposite is true, with the Eurostat measure being unreasonably low in particular. Given these two countries, I will use the PIM capital-output ratio as the baseline.

3.3 Steady state capital and the relative price

The model derived in Sect. 2 allows us to calculate a hypothetical “steady state” capital stock. This is conditional on the relative price of investment goods as observed in the data. In other words, \(\kappa _t\) is defined as the long-run equilibrium capital-output ratio when the relative price of investment is fixed at \(p_t.\)

To calculate this counterfactual using Eq. (2), parameter values must be selected. As above, I set the depreciation rate to \(\delta = 0.04.\) Since the reference country is Austria, I calibrate the long-run growth rate of labor-augmenting productivity to the sample average of Austrian GDP per capita, which yields \(g = 1.0097.\) Similarly, I set the capital elasticity parameter of the production function using Austrian labor share data to \(\alpha = 0.335,\) which is the sample average in Austria. The labor share is calculated the following way:

where COMP is compensation of employees, GVA is gross value added, EMPH is total hours worked by the employed, and EMPEH is total hours worked by employees. This so-called adjusted labor share takes account of the fact that part of mixed income should count towards labor income, and implicitly assumes that the unobserved wages of the self-employed are the same as the observed wages of employees.

In principle the capital elasticity parameter could be calibrated separately to country-specific labor shares. There are two main reasons why I opted for a single, common value. First, the decomposition in Eq. (6) assumes a common \(\alpha ,\) and becomes much less transparent if we allow for country specific values. Second, and more importantly, the labor share is a potentially very imperfect measure of the production function parameter. The equivalence holds only under perfect competition, and assumes that we measure the labor share perfectly. Both assumptions are questionable, especially for emerging economies such as the new EU member states. I therefore use the Austrian value, where measurement error is likely to be smallest, and the resulting value is in line with usual calibrations in the literature.Footnote 13

Finally, the steady state capital calculation requires a value for the discount factor, which I set to \(\beta = 0.965.\) This is somewhat higher than typical values in the literature. This value, however, allows me to match the observed Austrian capital-output ratio with the implied steady state, which is reasonable for an advanced country assumed to be on a balanced growth path. Also, most of the sample period saw low real interest rates, in line with the somewhat higher than usual value of \(\beta\) chosen.

Figure 2 plots the estimated steady state capital-output ratios \((\kappa _t)\). Note that the actual and hypothetical values are very close for Austria, except for the beginning of the sample period. This is only partly due to the calibration, since the choice of a single parameter \((\beta )\) cannot explain the overall good fit between 2005–2019. The figure confirms that the analytical framework is solid, and the theoretical concepts have clear and meaningful empirical counterparts.

For other countries the picture is mixed—I will return to the more detailed analysis of capital-output ratios in the next section. Note that the relative price of capital plays an important role in the results (Fig. 3). In Austria, it was close to 1, although started falling after 2005. In most other countries, however, the relative price of capital goods was much higher throughout the sample (the only exception is Slovenia). In many, but not all cases the investment relative price fell significantly over the period, by as much as 50% for Estonia and Slovakia. This overall fall provided a very strong incentive for increased capital accumulation, which can only partly be seen in investment rates and in the increases in the capital stock.

4 Results

4.1 GDP per capita

To compare GDP per capita across countries and over time, I use chain-linked GDP adjusted by the constant, 2015 cross-country price index of GDP, and divided by the population level. An alternative is to compare living standards using current price levels. The latter method is appropriate when we are only looking at cross-section differences. But if we want to follow economic growth across countries over time, the usage of current PPPs confounds the effect of volume changes with the effect of changes in international relative prices. Countries can appear to have converged when they experience favorable relative price movements, such as terms-of-trade improvements. While these do have an impact on relative living standards, they do not result from improvements in the productive capacity of a country. Since our interest is in output and its determinants, the appropriate choice is to use the fixed PPP measure.

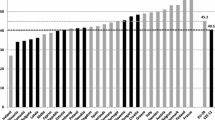

Figure 4 plots the growth experience of the EEE between 2000–2019. In 2000, the richest economy (Slovenia) had a GDP per capita of about 57% of the Austrian level. The poorest country, Bulgaria, only stood at 20% of Austrian living standards. Subsequently, all EEE countries grew significantly faster than Austria, implying absolute convergence over the 2 decades. By 2019, Czechia and Slovenia reached about 70% of Austria’s level of development. Bulgaria was still the poorest, but even it caught up to 40% of the Austrian value.

Note that Austria itself grew in the period, albeit more slowly. Its real GDP per capita increased by a cumulative 20%, or roughly one percentage point per year. Also, there was strong convergence among the EEE as well: countries that started out richer (Czechia, Slovenia) grew slower than initially poorer economies (such as the Baltics or Romania). Moreover, these results are not driven by the decade before the global financial crisis (GFC). Convergence continued after the GFC, between 2012–2019. It is too soon to tell whether the Covid pandemic and the current economic problems have slowed down the catch-up process, but given the still considerable gap between Austria and the EEE, convergence is expected to continue for a while.

4.2 Development accounting

Now we are ready to carry out the decomposition exercise as described by Eq. (6). This is useful for two reasons: first, we can quantify the role of short-run and long-run capital scarcity in explaining relative (under)development. Second, we can calculate relative productivity as a residual, and evaluate its importance in the convergence process. As an additional point, we can also calculate the contribution of hours worked, since different countries utilize their labor force to a differing degree.

Table 2 presents results for 2019. The numbers in the table are relative to Austria, i.e. 0.38 (the first entry) means that Bulgarian GDP per capita in 2019 was 38% of its Austrian counterpart in 2019. The subsequent columns indicate relative levels of each component: hours worked per person, differences in the steady state capital-output ratio, the distance for a country between its actual and steady state capital-output ratios, and total factor productivity. Note that the cell values are the actual ratios, and do not include the relevant exponents [see Eq. (6)]. This means that the contribution of productivity is bigger (by a factor \(1/(1-\alpha ))\), and the contributions of the two capital terms are smaller (by a factor \(\alpha /(1-\alpha ))\) than the ratios reported in the table.

Differences in hours worked play a modest role in explaining relative development. The two extremes are Czechia and Slovakia: for the former, high total hours shrink the gap relative to Austria by 10%, while exactly the opposite is true for the latter. Long-run capital ratios are quite different across the EEE: the Slovenian level is the same as in Austria, while for Bulgaria, the steady state capital-output ratio is significantly lower. This is mostly explained by the high relative price of investment, as shown on Fig. 3.

There is even more variation in the distance of each country from their own steady state. The Polish capital-output ratio appears to be extremely low, even considering the high relative price of investment. Czechia, on the other hand, appears to be very close to its current hypothetical steady state. Notice that while I labeled this term as the convergence factor, there may be another explanation for why the actual capital-output ratio lags behind the implied steady state value. Apart from the observed high relative price of investment, there may be other unobserved distortions that hinder capital investment. The literature calls this the “capital wedge”, which can be introduced into the growth model as a capital tax equivalent.Footnote 14

Is it possible to distinguish the “true” convergence component from an unobserved capital wedge? Yes, as long as the wedge is roughly constant. If the capital-output ratio is below the price-adjusted steady state, the model predicts an unambiguous increase in K/Y. The increase is even more pronounced when (i) the relative price of investment goods is falling, and (ii) relative productivity a is increasing. Both of these conditions hold empirically, as seen on Fig. 3 and later in the next section for productivity. I relegate the details to Sect. 5.

Before moving on to the evolution of productivity, it is worth discussing the 2019 level of relative TFP \((a_t)\), as reported in the last column of Table 2. For most countries, relative TFP varies in the fairly narrow range of 0.75–0.85. Bulgaria appears to be significantly less productive, and Poland significantly more so. The former is not surprising, given that Bulgaria is the poorest EEE country. The case of Poland is more interesting, as its high productivity is mostly due to the very low measured capital-output ratio. Whether Poland is truly an outlier or if its capital stock—or more precisely, investment—is under-reported is an important question for future research.

4.3 Productivity

To calculate the paths of relative productivity for each country, I use the constant PPP adjusted GDP per capita series as discussed above, the capital-output ratio calculated by the PIM, and total hours relative to the population. The calculation uses Eq. (5), which can be rewritten as

Note that since I work with GDP per capita, and not with the efficiency unit variable \(y_t,\) the calculated TFP will also contain the common global component, \(X_t.\) Since this is by assumption the Austrian productivity level, simple visual inspection reveals changes in “convergence” productivity \(a_t.\) Alternatively, it is easy to subtract Austrian TFP growth from the country specific measures, but I do not report the results separately.Footnote 15

Figure 5 shows the results. As already discussed in the previous section, the EEE lag behind Austria even in 2019. For most countries, however, there was strong productivity convergence between 2000–2019. The only exception is Croatia, where productivity basically stagnated over the two decades of analysis. Hungary is another partial outlier, where there was strong TFP growth until 2006, but productivity improvement only resumed after 2016. This may be explained by the very strong increase in hours worked in the 2012–2018 period, although Latvia—where hours also grew in those years—nevertheless shows positive TFP growth in the period. It is an intriguing question whether there is a negative relationship between productivity growth and employment growth, but since the former is exogenous in the current framework, this is a task for future research.

Figure 5 highlights that for most countries convergence has been driven by relative productivity growth. There are still significant gaps relative to Austria, so that further catching-up is possible. As discussed earlier, Poland (and Slovakia) appear to have closed most of the productivity gap already, in their case increasing capital intensity is required (and for Slovakia, increasing hours worked as well). It is important to understand, however, the reasons behind low capital-output ratios. As discussed above, this can be either because of a convergence gap, or because of long-term distortions on capital markets. With empirical paths for productivity and the investment relative price at hand, I now turn to this issue with the help of the modeling framework.

5 Capital distortions

To show how the capital-output ratio should have evolved according to economic incentives, I calibrate and simulate two versions of the theoretical model. The first version is the model presented in Sect. 2. The second version augments the baseline model with a constant capital wedge, which is an unobserved capital market distortion influencing the long-run capital-output ratio. The model is used to shed light on the potential importance of the capital wedge to explain persistent differences in the capital-output ratio not picked up by the relative price of investment.

5.1 The capital wedge

Formally, I rewrite the capital Euler equation as follows:

where \(\tau _k\) is the capital wedge. In principle, it can be time varying, but in the simulations I assume a constant, fix capital wedge. The rest of the model is the same as the baseline version, including the observed paths for relative productivity and the relative price of investment.

To calibrate the capital wedge, I use the following method. In the presence of the wedge, the conditional steady state capital-output ratio is given by

as can be seen from Eq. (7) and where \(\kappa _t\) is the capital-output ratio without the wedge (as defined earlier).

If \(k_t/y_t\) was in steady state each year, the capital wedge would be given simply by

As discussed above, however, this is unlikely, since some of the discrepancy is attributable to convergence dynamics. Eventually, however, we expect \({\tilde{\tau }}_k\) to converge to the long-run capital wedge as economies converge to their respective steady states. Therefore I calculate the constant capital wedge as the 2019 value of \({\tilde{\tau }}_k.\)

Figure 6 shows the calibrated capital wedge. The results are fairly intuitive, with Austria and Czechia showing the lowest distortions, and Poland and Lithuania the highest. Note that these are upper bounds on the true capital wedge, assuming that no convergence gap remains in 2019. In order to check the validity of this assumption, I now turn to the model simulations.

5.2 Solution algorithm

The presentation so far avoided the question of expectations and the information set of agents when they are making investment decisions. When focusing on steady states and production function measurement, this is an innocuous omission.

In the present context, however, expectations about the exogenous processes do influence the trajectory of the capital stock, and are important determinants of investment activity. Note that there are two exogenous processes in the model that are potentially stochastic: the relative price of investment \(p_t\) and relative productivity (the efficiency wedge) \(a_t.\)

There are various assumptions that can be made about expectations formation. First, one can solve the model assuming perfect foresight, i.e. agents fully anticipating future values of the relative price of investment \(p_t\) and relative productivity \(a_t.\) This is highly implausible in the current context, since the two processes are assumed to be exogenous and tend to be quite volatile, which makes their forecast difficult and highly imprecise at best.

Second, one can fit stochastic processes on productivity (typically a sustained increase, see Fig. 5) and the relative price (typically a sustained decrease, see Fig. 3). The natural assumptions would be of stochastic convergence to a long-run steady state, whose values are possibly, but not necessarily equal unity in both cases. The difficulty lies in the empirical identification of the key parameters of the convergence process. If full convergence is not expected (say because of long-run differences in production efficiency), the relatively short time series are not informative enough to estimate both the speed of convergence and the steady state level.

The third approach—which I adopt—assumes that agents have no knowledge about future productivity and the future relative price, and they treat them each period as if they were permanently fixed at the current level. This “naive” assumption is essentially the same as the extended path solution method of stochastic dynamic models (Fair & Taylor, 1983; Gagnon, 1990), when the unknown shocks have no persistence.

The solution algorithm starts with the given endogenous state variable \(k_t,\) and the current values of the two exogenous states, \(a_t\) and \(p_t.\) Then we find the perfect foresight solution path for the capital stock under the assumption that productivity and the relative price remain fixed forever at \(a_t\) and \(p_t.\) This generates a path for the capital stock, from which we retain \(k_{t+1}.\) Next period, the endogenous state is \(k_{t+1},\) and new values \(a_{t+1}\) and \(p_{t+1}\) arrive unexpectedly. We repeat the procedure until the desired number of simulation periods are reached.

5.3 Simulation results

As detailed above, two simulations are run for each country, one without the capital wedge \((\tau _k = 0)\) and one including the capital wedge. In each case, naive expectations are assumed, i.e. agents anticipate no future changes in relative productivity \(a_t\) and the relative price of investment \(p_t.\) I choose parameter values as previously reported. The initial conditions are taken from the data in 2000. Simulations are carried out in Dynare and Matlab.Footnote 16

Figure 7 presents the simulation results, along with the actual path for the capital-output ratio between 2000–2019. Overall, the growth model does a very good job in capturing investment dynamics. In most cases, the version with the capital wedge fits the data better. The main exception is Estonia, where the baseline model explains the data very well, especially after the global financial crisis. In Austria, neither version can capture the sizable increase in the capital-output ratio quantitatively, but they do predict an increase, due to the falling relative price of investment.

The cases of Lithuania and Poland are particularly interesting. These are the countries with the highest predicted capital wedges. Accounting for these additional distortions is crucial to understand the behavior of the capital stock, and the model version with \(\tau _k\) does a great job matching the capital-output ratio. The capital wedge seems to be important also in Bulgaria, Croatia, Romania and Slovakia. In Czechia and Latvia, the wedges are small, so it is difficult to select the appropriate model version. In Hungary, and Slovenia the results are inconclusive, as the capital-output ratio fluctuates significantly in the sample period.

Note that in many cases the capital-output ratio is falling or stagnating between 2000–2019. This may indicate a problem with the initial condition used in the PIM, or rather the capital stock data used for this purpose. Unfortunately there is no way to independently verify whether the capital data in Eurostat captures the true economic value of initial capital. That said, the model is able to match the subsequent dynamics well, either with or without the incorporation of the capital wedge. It is also interesting to point out that the good fit comes from using a constant capital wedge rather than a time-varying one. The parsimonious nature of the exercise strengthens confidence in the growth model’s ability to quantitatively account for investment and capital dynamics in the EEE.

To summarize the findings, and at the risk of some oversimplification, we can group the 11 EEE countries into two main categories. The first group consists of Czechia and Estonia, where capital market distortions are not important. The increase in the capital-output ratio in Estonia seems to have been driven entirely by convergence dynamics. Since Estonian \(k_t/y_t\) is still well below the implied current hypothetical steady state (conditional on the relative price of investment), there is considerable scope for further investment-driven convergence. In Czechia the capital-output ratio has fluctuated around the calibrated steady state throughout the sample period.

The second group consists of the other nine countries. There is more heterogeneity in this group, but by and large their capital markets are subject to distortions, which explains the gap between the actual and steady state capital-output ratios. In these economies increasing capital intensity is not automatic, but requires a lowering of the capital wedge. In addition to increasing productivity, eliminating capital market distortions should be a priority for economic policy in the medium to long run.

6 Conclusion

This paper studied the convergence process of 11 Eastern European Economies over the period of 2000–2019. The main question was to decompose the relative underdevelopment (with respect to Austria) into three main components: productivity, convergence, and long-run factors. The paper found that for most countries, lower productivity is the main reason for the existing GDP per capita gap in 2019. Long-run factors also play a role, with distortions on the capital market—summarized by the capital wedge—lowering the steady state capital-output ratio in most countries (with the exceptions of Estonia and Czechia). Besides the capital wedge, the high relative price of investment goods—likely explained by sectoral productivity differences—is also present in some of the EEE.

The results have important implications for economic policy. First, as hours worked per person are similar across the region and Austria, labor markets are currently not the main constraint on income convergence. This may change, however, given the worsening demographic outlook in the EEE. Second, convergence via capital investment can be a continuing source of growth, but further reforms to make the region attractive to foreign and domestic capital are needed for successful catch-up. Third, and foremost, productivity in most countries is still significantly behind Austria (and Western Europe). The main goal of policy should be to identify new sources of productivity growth, including higher spending on research and development, reforming the public sector, expanding infrastructure, and investing into human capital.

Investigating the possible sources of additional productivity growth should be an important goal for future research, including the role of firm-level policies and the role of intangible capital. For capital markets, the exact distortions behind the measured capital wedges must be identified, ideally using firm-level microdata. While convergence has been strong across the EEE, without additional structural reforms—based on solid empirical evidence—the process is likely to remain incomplete in the future.

Data availability

The paper uses only publicly available data. Sources and data handling steps are provided in the article.

Notes

Conditional convergence among a broad set of countries was documented by the seminal paper of Mankiw et al. (1992).

Convergence among European union countries and regions was found by Cuaresma et al. (2014).

The countries included in the analysis are Czechia, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, Slovenia (joined the EU in 2004), Bulgaria, Romania (joined in 2007) and Croatia (joined in 2013). Malta and Cyprus, which also entered the EU in 2004, have a different historical background, so I omit them from the study.

The three Baltic countries were formally part of the Soviet Union. Croatia and Slovenia, within Yugoslavia, had a similar economic system, but were independent of the Soviet block, and allowed more autonomy in firm and household decisions. While important if one wants a detailed study of the different paths followed by the 11 economies, from now on I do not discuss historical and institutional differences further.

For the reference country I use Austria, which has a similar population, economy and history as most countries in the sample.

Again, the former Yugoslavian countries are partial exceptions, but even Yugoslavia was a strongly centralized state dominated by Serbia.

In principle the efficiency wedge can be above unity, but this possibility is not empirically relevant for the EEE.

This property also requires the exogenous variables \(a_t\) and \(p_t\) to be stationary, which is naturally assumed since these are bounded between zero and one.

This way of writing the production function is borrowed from Hall and Jones (1999).

See for example (Caselli, 2005) who in the context of an extensive development accounting exercise, calibrates the parameter to \(\alpha = 1/3\) based on US time series.

In other words, while relative productivity \(a_t\) is by definition stationary, the figure plots \(a_t X_t,\) which has a unit root.

https://www.mathworks.com/ (Matlab) and https://www.dynare.org/ (Dynare).

References

Åslund, A. (2018). What happened to the economic convergence of central and eastern Europe after the global financial crisis? Comparative Economic Studies, 60, 254–270.

Caselli, F. (2005). Accounting for cross-country income differences. In P. Aghion & S. N. Durlauf (Eds.), Handbook of economic growth, Vol. 1, Chapter 9, pp. 679–741. Elsevier.

Chari, V. V., Kehoe, P. J., & McGrattan, E. R. (2007). Business cycle accounting. Econometrica, 75, 781–836.

Crafts, N., & O’Rourke, K. H. (2014). Chapter 6—Twentieth century growth. In P. Aghion & S. N. Durlauf (Eds.), (Vol. 2, pp. 263–346). Elsevier.

Cuaresma, J. C., Doppelhofer, G., & Feldkircher, M. (2014). The determinants of economic growth in European regions. Regional Studies, 48, 44–67.

Dombi, A. (2013). The sources of economic growth and relative backwardness in the Central Eastern European countries between 1995 and 2007. Post-Communist Economies, 25, 425–447.

Fair, R. C., & Taylor, J. B. (1983). Solution and maximum likelihood estimation of dynamic nonlinear rational expectations models. Econometrica, 51, 1169–1185.

Gagnon, J. (1990). Solving the stochastic growth model by deterministic extended path. Journal of Business & Economic Statistics, 8, 35–36.

Gourinchas, P.-O., & Jeanne, O. (2006). The elusive gains from international financial integration. Review of Economic Studies, 73(3), 715–741.

Gourinchas, P.-O., & Jeanne, O. (2013). Capital flows to developing countries: The allocation puzzle. Review of Economic Studies, 80, 1484–1515.

Hall, R. E., & Jones, C. I. (1999). Why do some countries produce so much more output per worker than others? The Quarterly Journal of Economics, 114, 83–116.

Hsieh, C.-T., & Klenow, P. J. (2007). Relative prices and relative prosperity. American Economic Review, 97, 562–585.

Levenko, N., Oja, K., & Staehr, K. (2019). Total factor productivity growth in Central and Eastern Europe before, during and after the global financial crisis. Post-Communist Economies, 31, 137–160.

Mankiw, N. G., Romer, D., & Weil, D. N. (1992). A contribution to the empirics of economic growth. The Quarterly Journal of Economics, 107, 407–437.

Mátyás, L. (Ed.). (2022). Emerging European economies after the pandemic. Springer.

Monfort, M., Cuestas, J. C., & Ordóñez, J. (2013). Real convergence in Europe: A cluster analysis. Economic Modelling, 33, 689–694.

Papi, L., Stavrev, E., & Tulin, V. (2018). Central, eastern, and southeastern European countries’ convergence: A look at the past and considerations for the future. Comparative Economic Studies, 60, 271–290.

Próchniak, M., & Witkowski, B. (2013). Real beta convergence of transition countries. Eastern European Economics, 51, 6–26.

Ryszard Rapacki, M. P. (2019). EU membership and economic growth: Empirical evidence for the CEE countries. European Journal of Comparative Economics, 16, 3–40.

Solow, R. M. (1957). Technical change and the aggregate production function. The Review of Economics and Statistics, 39, 312–320.

Szeles, M. R., & Marinescu, N. (2010). Real convergence in the CEECs, euro area accession and the role of Romania. European Journal of Comparative Economics, 7, 181–202.

Funding

Open access funding provided by Corvinus University of Budapest. This research was supported by the Hungarian National Research, Development and Innovation Office (NKFIH), Project no. K-143420.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Konya, I. Catching up or getting stuck: convergence in Eastern European economies. Eurasian Econ Rev 13, 237–258 (2023). https://doi.org/10.1007/s40822-023-00230-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-023-00230-2